Get the sample spreadsheet here to find out how the tool works.

(Please provide a valid email as the download link will be sent to your email.)

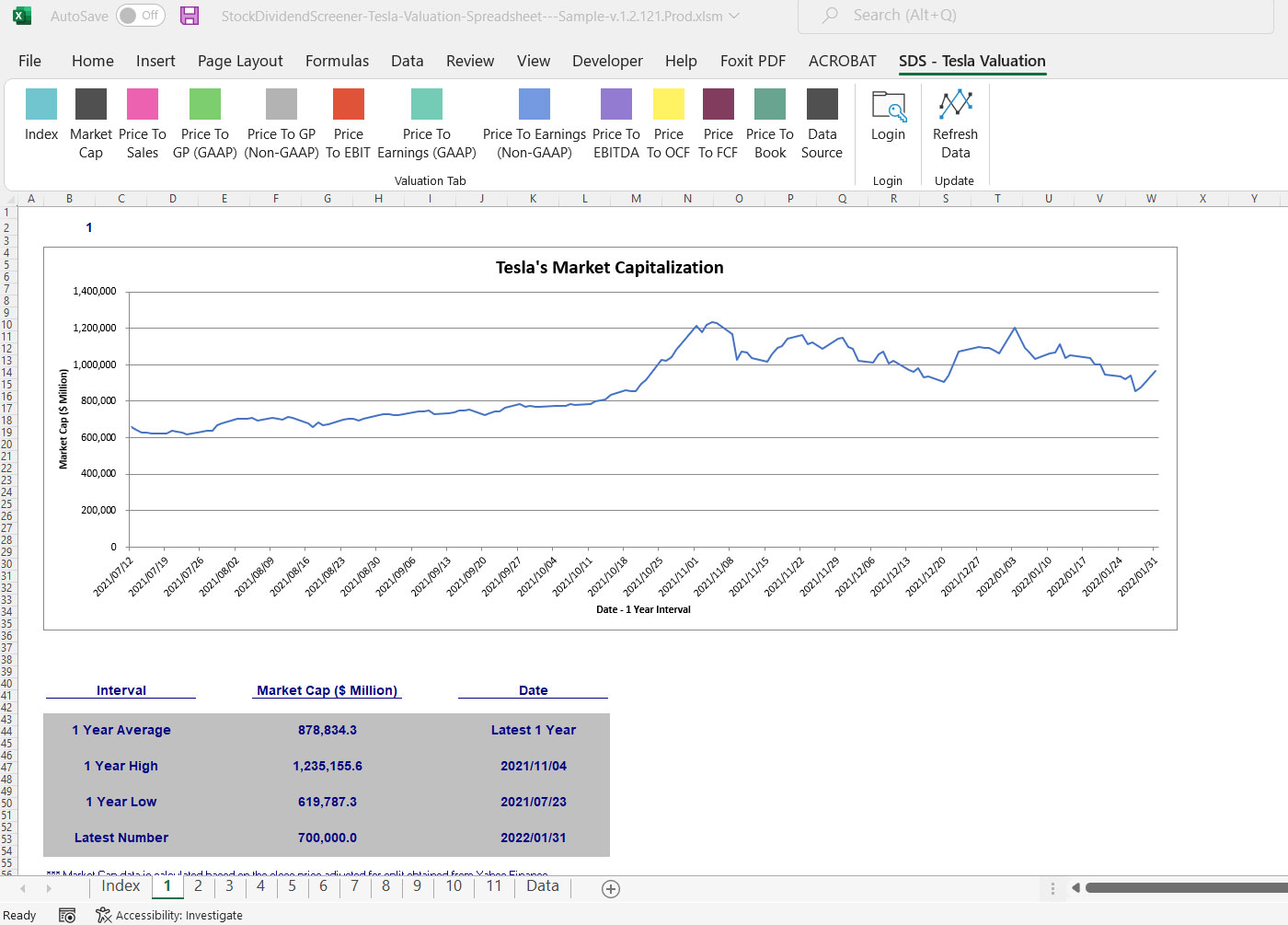

SDS - Tesla Valuation Spreadsheet Sample

Register here to get the StockDividendScreener - Tesla Valuation Spreadsheet sample.

Try it out to get a feel of how the Tesla Valuation spreadsheet works.

Read Here About The Requirements

- You need to have Microsoft Excel (Version 2007 and onward) installed on your PC to use this spreadsheet.

- The Excel spreadsheet has ONLY been tested on Windows. NOT sure if the Mac version will work.

- The Tesla Valuation Excel Spreadsheet requires an internet connection to work.

- Also, you need to enable Macro (a set of automation) in the Excel spreadsheet as it relies on Macro to fetch stock prices and fundamental data over the internet.

- Please provide a valid email as the download link will be sent to your email.

- For any inquiries, you can send an email to support@stockdividendscreener.com.