Bell peppers. Pexels Images.

This article presents Walmart’s revenue breakdown by category. Walmart’s revenue categories consist of only two primary units: Net Sales and Membership Fee And Other Income.

Let’s take a look!

Investors interested in Walmart’s other key statistics may find more resources on these pages:

- Walmart revenue by segment: U.S., International, and Sam’s Club,

- Walmart revenue by country: U.S. and International, and

- Walmart vs Costco: profit margin comparison.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What is driving the significant growth in Walmart’s net sales revenue?

Revenue Breakdown

A1. Revenue From Net Sales and Membership and Other Income

A2. Percentage Of Revenue From Net Sales and Membership and Other Income

Revenue Growth

B1. YoY Growth Rates Of Revenue From Net Sales and Membership and Other Income

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Net Sales: Walmart’s net sales refer to the total revenue generated by the company through its retail and eCommerce operations after deducting returns, discounts, and allowances.

This figure excludes membership income and represents the core income from selling goods and services across its segments, including Walmart U.S., Walmart International, and Sam’s Club.

Net sales are a critical metric used to assess the company’s financial performance and operational effectiveness.

Membership Fees and Other Income: Walmart’s Membership Fees and Other Income primarily refer to revenue streams outside of its core retail operations. These include:

-

Membership Fees:

-

Walmart’s membership fee revenues are revenues associated with the company’s various membership offerings for customers and members across each reportable segment, such as Walmart U.S., Walmart International, and Sam’s Club U.S.

-

-

Other Income:

-

Includes revenue from services such as rental and tenant income, recycling income and gift card breakage income.

-

These revenue streams provide Walmart with additional income sources, enhancing its overall profitability and diversifying its business model.

What is driving the significant growth in Walmart’s net sales revenue?

Walmart’s significant growth in net sales revenue is driven by several key factors:

-

eCommerce Expansion: Walmart has seen remarkable growth in its eCommerce segment, with global eCommerce sales surging significantly in recent periods. This growth is fueled by store-fulfilled pickup and delivery services, as well as the expansion of its marketplace, which includes third-party sellers.

-

Advertising Revenue: Walmart Connect, the company’s advertising business, has grown by leaps and bounds, reflecting the increasing importance of digital advertising tied to Walmart’s eCommerce and retail ecosystem.

-

Inventory Management: Walmart has effectively managed its inventory, reducing global inventory levels while maintaining healthy in-stock levels. This ensures product availability without overstocking.

-

Grocery Segment Strength: Sustained consumer spending in essential categories like groceries has been a major contributor to revenue growth.

-

International Operations: Walmart’s international markets, particularly in regions like India and Mexico, have shown strong performance, supported by initiatives like Flipkart’s success during its Big Billion Days event.

-

Omnichannel Strategy: Walmart’s ability to integrate physical stores with digital platforms has positioned it as a leader in both traditional and online retail spaces.

These factors collectively highlight Walmart’s adaptability and strategic focus in navigating a rapidly changing retail landscape.

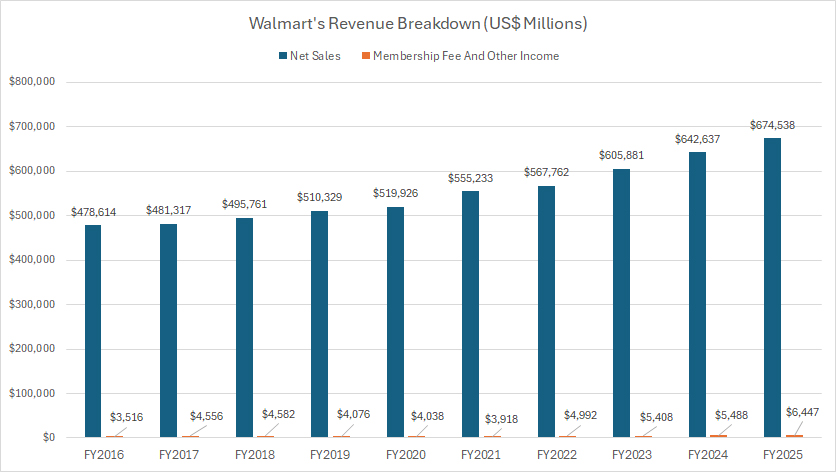

Revenue From Net Sales and Membership and Other Income

Walmart-revenue-breakdown

(click image to expand)

Walmart’s revenue streams consist of net sales and membership and other income. For more information about these streams, you may refer to this section: net sales and membership fee and other income.

Walmart’s revenue is predominantly generated through its net sales, as highlighted in the chart above.

In fiscal year 2025, Walmart achieved a record-breaking $674.5 billion in net sales revenue, representing a 5% increase compared to the $642.6 billion reported for fiscal year 2024. This growth underscores the company’s ability to consistently expand its retail footprint and sustain customer demand across its key markets.

Taking a broader perspective, spanning fiscal years 2016 to 2025, Walmart’s net sales revenue has grown by more than 40%. The company reported $478.6 billion in net sales revenue in fiscal year 2016, which has since surged to the remarkable $674.5 billion achieved in fiscal year 2025.

This long-term growth reflects Walmart’s strategic investments in areas such as eCommerce expansion, international operations, and enhanced omnichannel capabilities.

By comparison, Walmart’s membership fees and other income amounted to a more modest $6.4 billion in fiscal year 2025. Despite its smaller share of total revenue, this category has exhibited significant growth, increasing by over 80% since fiscal year 2016, when it stood at $3.5 billion.

The rise in membership fees and other income can be attributed to factors such as the growing popularity of Sam’s Club memberships and Walmart Connect’s success in digital advertising.

Overall, while net sales remain the primary revenue driver, Walmart’s steady expansion of ancillary income streams highlights its diversification efforts and resilience in adapting to a dynamic retail landscape.

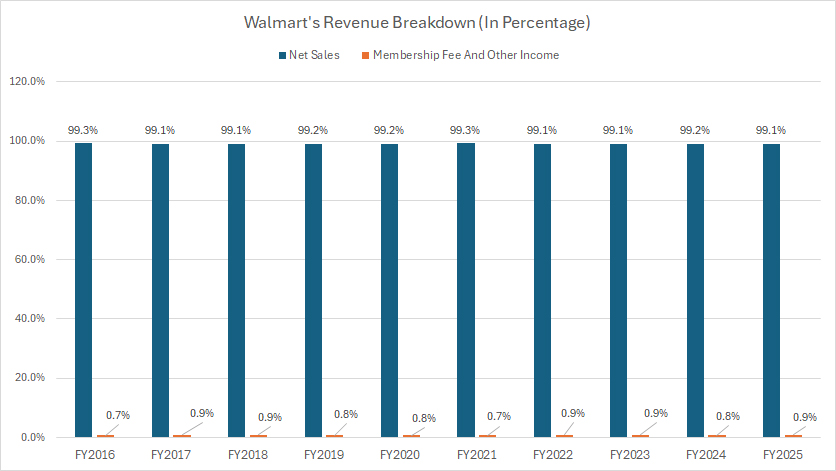

Percentage Of Revenue From Net Sales and Membership and Other Income

Walmart-revenue-breakdown-in-percentage

(click image to expand)

Walmart’s revenue streams consist of net sales and membership and other income. For more information about these streams, you may refer to this section: net sales and membership fee and other income.

In fiscal year 2025, Walmart’s net sales revenue constituted an impressive 99% of the company’s total revenue, a proportion that has remained unwavering since fiscal year 2016.

This consistency underscores the central role of Walmart’s retail operations and eCommerce platforms in driving its overall financial performance. The dominance of net sales highlights the company’s ability to sustain robust consumer demand across its vast range of products and services, both domestically and internationally.

Conversely, Walmart’s membership fee and other income accounted for less than 1% of its total revenue in fiscal year 2025. Since fiscal year 2016, Walmart has significantly expanded its membership income. However, this growth has not shifted its proportion relative to total revenue, reflecting the sheer scale of net sales as the dominant driver.

Looking ahead, while the ratio of net sales to total revenue is likely to remain stable, the consistent growth in membership fees and other income represents a promising opportunity for Walmart to further diversify its revenue base.

As the company continues to innovate in areas such as digital services and value-added memberships, this segment could play an increasingly important role in supporting Walmart’s broader financial strategy.

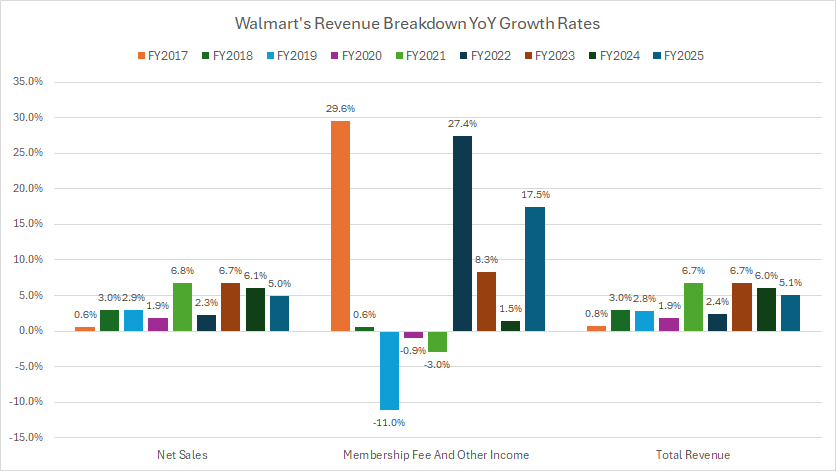

YoY Growth Rates Of Revenue From Net Sales and Membership and Other Income

Walmart-revenue-breakdown-yoy-growth-rates

(click image to expand)

Walmart’s revenue streams consist of net sales and membership and other income. For more information about these streams, you may refer to this section: net sales and membership fee and other income.

From a growth rate perspective, Walmart’s net sales revenue has demonstrated remarkable consistency over the past five fiscal years, spanning 2021 to 2025. During this period, the company’s average year-over-year (YoY) growth rate for net sales was 5%.

Also, this revenue stream has never experienced a dip over the past decade, as shown in the accompanying graph.

In contrast, Walmart’s membership fee and other income experienced considerable volatility in annual growth rates. While the average YoY growth for this segment was notably higher at 10%, the fluctuations highlight the varying contributions of income streams like memberships and other income.

For Walmart’s consolidated results, the average YoY growth rate for total revenue aligns with the consistent performance of net sales, standing at 5%.

This outcome reflects the predominant influence of net sales on the company’s overall revenue growth while emphasizing the supplementary role of membership fees and other income as expanding but less predictable contributors.

Walmart’s ability to achieve balanced growth across both net sales and ancillary income streams demonstrates its adaptability and resilience in a rapidly evolving retail landscape.

While net sales continue to anchor the company’s financial performance, the rising importance of other income segments provides opportunities for diversification and innovation in its business model.

Insight

Walmart has been expanding its net sales revenue while steadily growing ancillary income streams. Net sales remain the dominant revenue driver, demonstrating Walmart’s consistent execution across retail and eCommerce operations.

Meanwhile, the growth in membership fees and other income highlights opportunities for diversification, providing resilience and adaptability in an evolving retail landscape.

References and Credits

1. All financial figures presented were obtained and referenced from Walmart’s annual reports published on the company’s investor relations page: Walmart Investor Relations.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.