Tesla Gigafactory Nevada

This article presents the revenue per car, profit per car, and vehicle margin of major automakers that are based primarily in the U.S. and globally.

Let’s look at the details!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Revenue

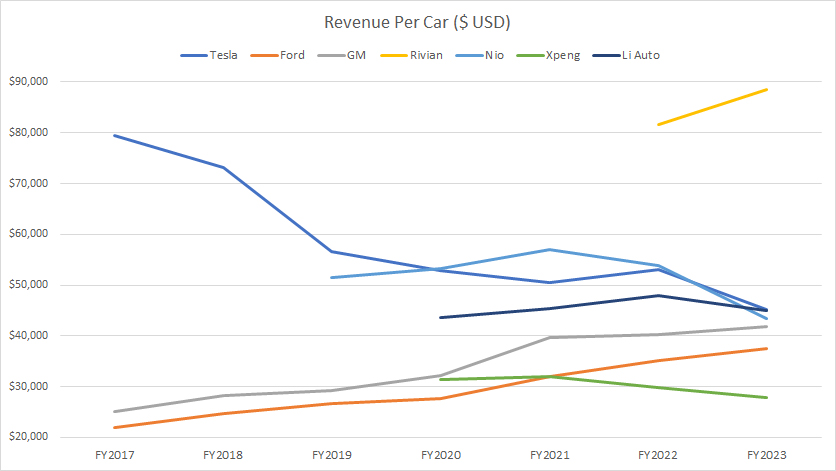

A1. Revenue Per Car

Profit

Margin

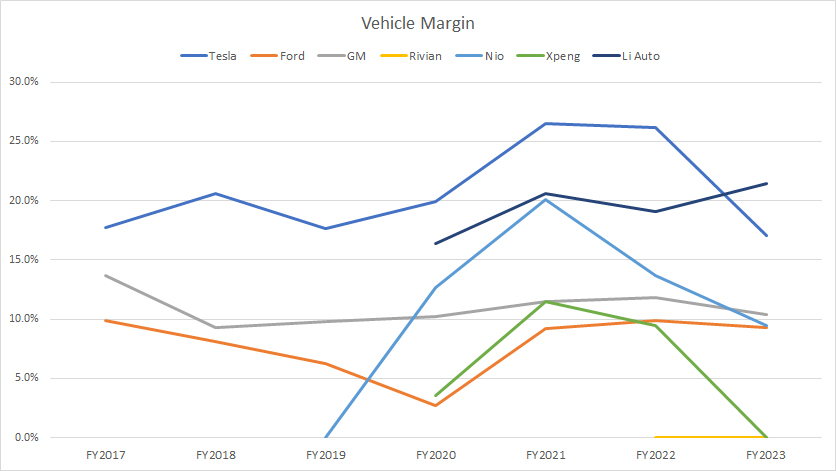

A3. Vehicle Margin

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Revenue Per Car: Revenue per car refers to the average amount of revenue that a company earns from the sale of each individual vehicle.

It is calculated by dividing the total revenue generated from vehicle sales by the total number of vehicles sold. Here’s the formula:

\[ Revenue\ Per\ Car = \frac{Vehicle\ Sales\ Revenue}{Number\ Of\ Vehicles\ Sold} \]

This metric is useful for assessing the profitability and pricing strategy of an automobile company. Higher revenue per car can indicate successful pricing strategies, higher-end or premium vehicle sales, or effective upselling of additional features and options.

Profit Per Vehicle: Profit per vehicle refers to the average amount of profit that a company earns from the sale of each individual vehicle.

It is calculated by subtracting the total costs associated with producing and selling the vehicles from the total revenue generated from those sales, and then dividing the result by the number of vehicles sold. Here’s the formula:

\[ Profit\ Per\ Vehicle = \frac{Vehicle\ Sales\ Revenue – Costs\ Of\ Vehicle\ Sales\ Revenue}{Vehicle\ Sales} \]

This metric is important for assessing the profitability and efficiency of an automobile company. Higher profit per vehicle indicates that the company is effectively managing its costs and/or successfully pricing its vehicles to maximize profit.

Vehicle Margin: Vehicle margin refers to the difference between the selling price of a vehicle and the cost associated with producing and selling that vehicle. It is a measure of profitability for automobile companies and can be expressed in two main ways:

1. Gross Vehicle Margin: This margin takes into account the cost of goods sold (COGS) from the revenue generated from the sale of the vehicle. It is calculated by dividing the gross profit per vehicle by the revenue per vehicle and multiplying by 100 to get a percentage. The formula is:

\[ Gross\ Vehicle\ Margin = \frac{Gross\ Profit\ Per\ Vehicle}{Revenuer\ Per\ Vehicle} \times 100\% \]

2. Operating Vehicle Margin: This margin takes into account the operating expenses in addition to the COGS. It’s calculated by dividing the operating profit per vehicle by the revenue per vehicle and multiplying by 100 to get a percentage. The formula is:

\[ Operating\ Vehicle\ Margin = \frac{Operating\ Profit\ Per\ Vehicle}{Revenuer\ Per\ Vehicle} \times 100\% \]

Vehicle margin helps assess how efficiently a company is producing and selling its vehicles and is a key indicator of financial health and competitive positioning within the automotive industry.

Revenue Per Car

revenue-per-car-comparison

(click image to expand)

The revenue per vehicle presented in the chart above is evaluated based on the vehicle sales revenue excluding non-automotive segments such as regulatory credits, energy, leasing, services, etc. The calculation of revenue per vehicle is available here: revenue per car.

Among all automobile compnies, Rivian Automotive has the highest revenue per car, totaling over $80,000, as shown in the chart above. The EV maker’s revenue per vehicle climbed to nearly $90,000 in fiscal year 2023.

On the other hand, General Motors, Ford Motor, and Xpeng have one of the lowest revenue per vehicle, which averages less than $40,000. For example, General Motors produced slightly over $40,000 in revenue per car in fiscal year 2023, while Ford Motor’s revenue per car came in at about $38,000.

Xpeng’s revenue per vehicle totaled less than $30,000 in fiscal year 2023, the lowest among all automobile companies being compared.

The revenue per vehicle for Tesla, Nio and Li Auto averages around $45,000. A significant trend is that Tesla’s revenue per vehicle has tumbled from $80,000 in 2017 to around $45,000 as of 2023.

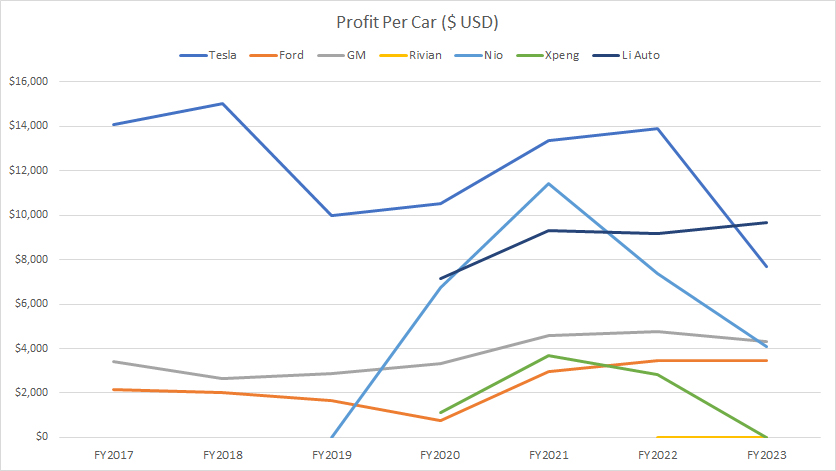

Profit Per Vehicle

profit-per-car-comparison

(click image to expand)

The profit per vehicle presented in the chart above is evaluated based on the gross vehicle profit. The calculation of profit per vehicle is available here: profit per vehicle.

Although Rivian Automotive generates the highest revenue per car, its profit per car is nil. In other words, Rivian does not make any profit out of its vehicle despite having the highest revenue per car. The reason is that Rivian is still in its infancy and hasn’t been able to mass-produced its vehicles.

The automakers that produce the highest profit per car go to Tesla and Li Auto, as depicted in the chart above. In fact, Li Auto overtook Tesla in 2023 in terms of profit per vehicle.

As seen in the chart above, Tesla’s profit per car in fiscal year 2023 tumbled to $8,000 from $14,000 a year ago, while Li Auto’s profit per car remained at roughly $10,000. Li Auto has made consistent profit per vehicle over the last several years. On the other hand, Tesla’s profit per vehicle has varied significantly in the last several years.

Automobile companies that produce the least profit per car are Xpeng, Ford Motor, and General Motors. In fiscal year 2023, Xpeng’s profit per car went to zero from above $2,000 a year ago.

The profit per vehicle for Ford Motor and General Motors hovered around $4,000 in fiscal year 2023, which was roughtly the same as Nio’s. Nio’s profit per car also has significantly declined over the last several years. It went from nearly $12,000 in 2021 to just $4,000 as of 2023.

Vehicle Margin

vehicle-margin-comparison

(click image to expand)

The vehicle margin presented in the chart above is evaluated based on the gross vehicle margin. The calculation of vehicle margin is available here: vehicle margin.

Tesla and Li Auto produce some of the highest vehicle margins, as shown in the chart above. In fact, Li Auto surpassed Tesla in fiscal year 2023 in terms of vehicle margin. Li Auto’s vehicle margin climbed above 20% as of 2023, far exceeding Tesla’s 17% vehicle margin.

Xpeng and Rivian Automotive did not produce any vehicle profit. Therefore, their vehicle margins were zero.

The vehicle margins of Nio, Ford Motor, and General Motors hovered around 10% in fiscal year 2023, which were way below Tesla and Li Auto.

In short, Tesla and Li Auto are some of the most profitable automakers.

Conclusion

In summary, Rivian Automotive generates the highest revenue per vehicle but makes no profit per car.

On the other hand, Tesla and Li Auto are some of the most profitable automobile companies, with profit per vehicle ranging from $8,000 to $14,000. These EV manufacturers also achieve some of the highest vehicle margins, ranging from 15% to 26%.

References and Credits

1. All financial figures in this article were obtained and referenced from the companies’ respective annual reports which are available in the following links:

a. Rivian Investor Relations

b. Ford Motor Investor Relations

c. GM Investor Relations

d. Tesla Investor Relations

e. Nio Inc. Investor Relations

f. Xpeng Investor Relations

g. Li Auto Investor Relations

2. Images were obtained from Tesla 4Q 2022 Update Letter.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!