Grocery shopping. Pexels Images.

This article presents Walmart’s revenue distribution by country and region. Walmart categorizes its revenue into two primary segments: the United States and the international region.

Let’s take a look!

For other key statistics of Walmart, you may find more resources on these pages:

Revenue

- Revenue breakdown: net sales and membership & other income,

- Revenue by segment: U.S., International, and Sam’s Club

Other Revenue Streams

Profit Margin

- Profit margin breakdown: U.S., International, and Sam’s Club,

- Walmart vs Costco: profit margin comparison

Other Statistics

- Capital expenditures breakdown,

- Comparable sales by calendar period,

- revenue per store

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is Walmart’s revenue concentrated heavily in the U.S.?

Revenue By Country/Region

A1. Revenue From The U.S. and International Region

A2. Percentage Of Revenue From The U.S. and International Region

Revenue Growth

B1. YoY Growth Rates Of Revenue From The U.S. And International Region

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Walmart U.S. Operations: Walmart U.S. operations refer to the segment of Walmart’s business that focuses on retail activities within the United States.

This includes the operation of Walmart’s supercenters, discount stores, neighborhood markets, and e-commerce platforms.

The U.S. segment is Walmart’s largest revenue generator, driven by its extensive network of stores and its focus on providing a wide range of products at competitive prices.

Walmart Non-U.S. Operations: Walmart’s Non-U.S. operations, also known as Walmart International, encompass the company’s retail activities outside the United States.

This segment operates in 18 countries, including markets like Mexico, Canada, China, and Chile. Walmart International focuses on tailoring its business strategies to local markets while leveraging Walmart’s global expertise. It operates nearly 5,400 retail units and employs approximately 550,000 associates worldwide.

The company also engages in strategic partnerships and equity investments to strengthen its presence in various regions. For example, Walmart holds stakes in businesses like Seiyu in Japan and Asda in the United Kingdom.

Why is Walmart’s revenue concentrated heavily in the U.S.?

Walmart’s revenue is heavily concentrated in the U.S. due to several key factors:

-

Established Market Dominance: Walmart has a long history in the U.S., where it was founded in 1962. Over decades, it has built a vast network of over 5,000 stores, making it a household name and a dominant player in the U.S. retail market.

-

Proximity to Customers: Approximately 90% of the U.S. population lives within 10 miles of a Walmart store, ensuring easy access and convenience for American shoppers.

-

Economies of Scale: Walmart’s scale in the U.S. allows it to negotiate better terms with suppliers, optimize logistics, and maintain its “Everyday Low Prices” strategy, which resonates strongly with American consumers.

-

Challenges in International Markets: While Walmart has expanded globally, its international operations face challenges such as cultural differences, regulatory hurdles, and competition from local retailers. These factors have limited its ability to replicate its U.S. success abroad.

-

E-commerce Growth in the U.S.: Walmart has also invested heavily in its U.S. e-commerce platform, which has seen significant growth, particularly in grocery delivery and pickup services.

These factors have collectively contributed to Walmart’s significant revenue growth in North America.

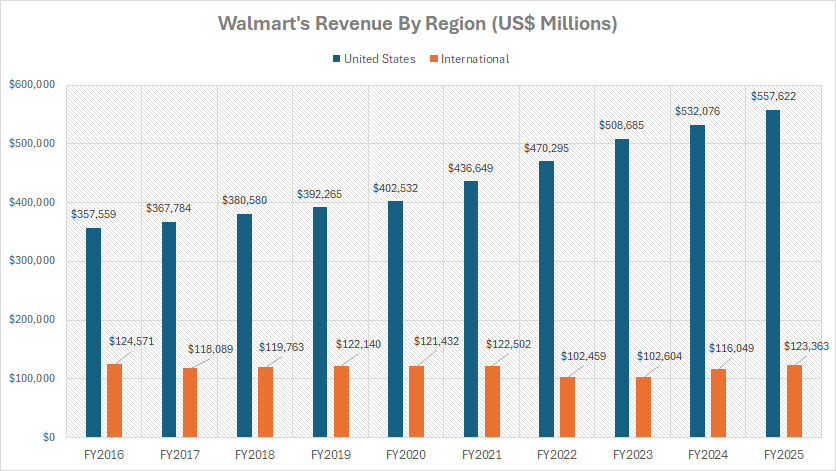

Revenue From The U.S. and International Region

Walmart-revenue-by-region

(click image to expand)

Walmart’s revenue by region/country consists of the U.S. and International regions. The definitions of the company’s U.S. and International segments are available here: U.S. Operations and Non-U.S. Operations.

Walmart derives the vast majority of its revenue from the U.S. market, reflecting its dominant position in the American retail landscape. In fiscal year 2025, Walmart’s U.S. operations generated an impressive $557.6 billion, accounting for a substantial portion of the company’s total revenue.

Conversely, the international segment contributed only $123.4 billion, which is a mere 22% of the U.S. revenue. This stark disparity highlights the centrality of the U.S. market to Walmart’s overall financial success.

In fiscal year 2024, a similar revenue distribution was observed. Walmart’s U.S. operations reported $532.1 billion in revenue, while the international division earned $116.0 billion. This demonstrates a consistent trend of domestic growth outpacing international performance.

A notable insight is that Walmart has seen significant revenue growth in its U.S. operations over the past decade, driven by strong store expansion, an optimized supply chain, and increasing e-commerce adoption.

From fiscal year 2016 to fiscal year 2025, Walmart’s U.S. revenue surged from $357.6 billion to $557.6 billion, marking a 56% growth over nine years. This sustained growth underscores the resilience and scalability of Walmart’s business model in its home market.

In contrast, Walmart’s international revenue has remained relatively stagnant. Over the same period, international revenue hovered around $124 billion, reflecting only marginal changes.

This stagnation underscores the persistent challenges Walmart faces in global markets, such as adapting to diverse consumer behaviors, navigating regulatory complexities, and competing with strong local players. These issues have hindered its ability to replicate the success of its U.S. operations abroad.

This disparity between U.S. and international growth highlights the strategic importance of the U.S. market for Walmart, while also pointing to the potential need for renewed strategies to unlock growth in its international operations.

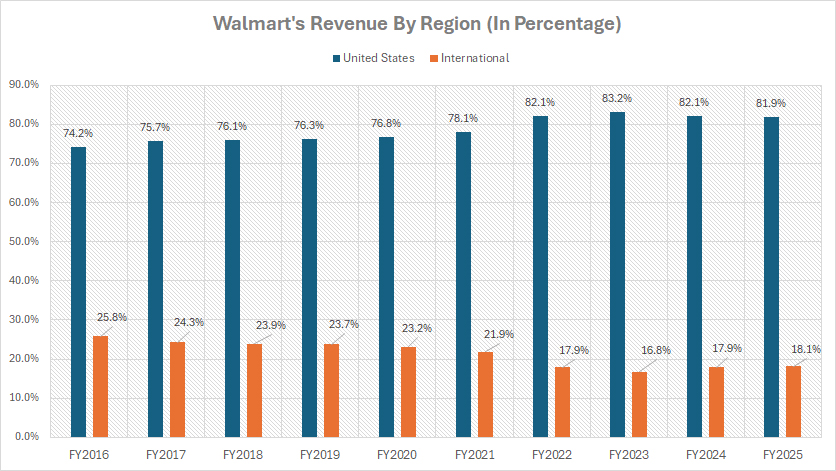

Percentage Of Revenue From The U.S. and International Region

Walmart-revenue-by-region-in-percentage

(click image to expand)

Walmart’s revenue by region/country consists of the U.S. and International regions. The definitions of the company’s U.S. and International segments are available here: U.S. Operations and Non-U.S. Operations.

In fiscal year 2025, Walmart’s U.S. operations contributed a remarkable 82% of the company’s total revenue, reflecting its dominance in the domestic retail market. This marks a significant increase compared to the 74% share recorded in 2016.

This growth underscores the robust expansion of Walmart’s U.S. business, driven by factors such as the rise of e-commerce, improved in-store experiences, and the broad adoption of its grocery pickup and delivery services.

Conversely, Walmart’s international segment accounted for only 18% of total revenue in fiscal year 2025, showing a notable decline from the 26% share it held in 2016. This drop highlights the persistent challenges Walmart faces in expanding its global footprint, including adapting to diverse cultural and consumer preferences, navigating regulatory frameworks, and competing with well-established local retailers in international markets.

These shifts in revenue distribution over the years emphasize Walmart’s increasing reliance on its U.S. operations to drive growth. While the company has made strategic moves to enhance its international presence, such as forming partnerships and investing in promising markets, the results have not been sufficient to offset the waning contribution of its international operations to the overall revenue mix.

This trend underscores the importance of the U.S. market as Walmart’s primary revenue engine, while also raising questions about its long-term strategy for international expansion.

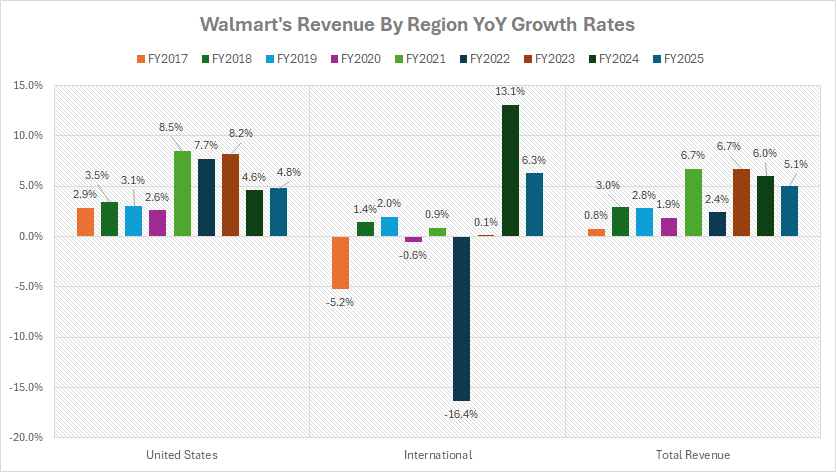

YoY Growth Rates Of Revenue From The U.S. And International Region

Walmart-revenue-by-region-yoy-growth-rates

(click image to expand)

Walmart’s revenue by region/country consists of the U.S. and International regions. The definitions of the company’s U.S. and International segments are available here: U.S. Operations and Non-U.S. Operations.

The chart above highlights a striking trend in Walmart’s revenue dynamics over the past nine fiscal years, spanning 2016 to 2025. Walmart’s U.S. segment has shown remarkable consistency, never experiencing a dip in revenue growth during this period.

This sustained upward trajectory underscores the strength and resilience of Walmart’s domestic business model. From fiscal year 2021 to 2025, Walmart’s U.S. revenue growth averaged an impressive 7% annually, reflecting steady expansion fueled by its strong physical and e-commerce presence.

In contrast, Walmart’s International segment has faced significant volatility during the same nine-year period. For instance, international revenue suffered a dramatic 16% decline in fiscal year 2022, driven by factors such as unfavorable exchange rates, economic disruptions, and competitive pressures in key markets.

However, fiscal year 2024 marked a rebound, with international revenue increasing by 13%, showcasing the uneven nature of growth across global markets. This variability highlights the challenges Walmart faces in navigating diverse economic and regulatory environments abroad.

On average, revenue growth for the international segment from fiscal year 2021 to 2025 was a modest 1% annually, revealing the need for more consistent strategies in overseas markets.

When analyzing consolidated revenue, which combines the performance of both U.S. and international operations, Walmart achieved an average annual growth rate of 5% between fiscal year 2021 and 2025. This metric captures the overall stability of Walmart’s revenue performance, largely driven by robust growth in its U.S. operations.

These trends underline the growing reliance on the U.S. market as Walmart’s primary revenue driver, while also pointing to the substantial challenges it faces in achieving steady international growth.

Insight

Walmart’s dependence on the U.S. market highlights its robust domestic strategy, but also underscores the need to address challenges in its international segment to achieve balanced global growth. Cultural, regulatory, and competitive factors continue to impact its performance outside the U.S.

References and Credits

1. All financial figures presented were obtained and referenced from Walmart’s annual reports published on the company’s investor relations page: Walmart Investor Relations.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.