Going veggie. Source: Flickr Image

The debt portion of a company is often a hot topic of discussion.

The reason is that debt can bring a company to its knee if there is too much of it.

It is no exception for Beyond Meat (NASDAQ:BYND).

As an investor myself, I am often interested to find out how a company is doing with debt and equity.

That said, I have created this article to explore Beyond Meat’s debt.

Apart from debt, we also will look at the company’s cash and near-cash assets which include cash equivalents and receivables.

Debt leverage ratios such as debt-to-equity and debt-to-asset ratios are other important metrics that we will find out.

Finally, we will briefly look at the company’s interest expenses and compared them with operating income.

The ratio of operating income to interest expenses provides us with the interest coverage ratio.

Let’s get started with the following topics!

Table Of Contents

Consolidated Results

A1. Total Debt

A2. Total Cash

A3. Net Debt

Leverage Ratios

B1. Debt To Equity Ratio

B2. Debt To Asset Ratio

B3. Debt To Sales Ratio (Debt Margin)

Debt Expenses And Coverage Ratios

C1. Operating Income And Debt Expenses

C2. Interest Coverage Ratio

Debt Schedule

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

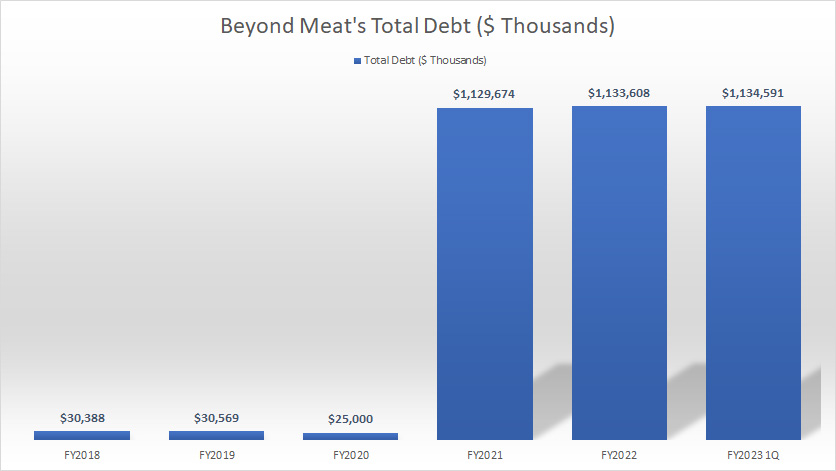

Beyond Meat’s Total Debt

Beyond Meat’s total debt

(click image to enlarge)

As of 1Q 2023, Beyond Meat’s total debt outstanding came in at $1.1 billion USD.

This figure was roughly in line with that reported in the prior quarter in 2022 and also did not change much compared to the figure reported in fiscal 2021, indicating that the company’s total debt has remained the same since 2021.

Prior to fiscal 2021, Beyond Meat had literally no debt.

However, in fiscal 2021, Beyond Meat’s total debt surged significantly to more than $1 billion, driven primarily by the company’s issuance of a Convertible Senior Notes which is expected to be due in 2027.

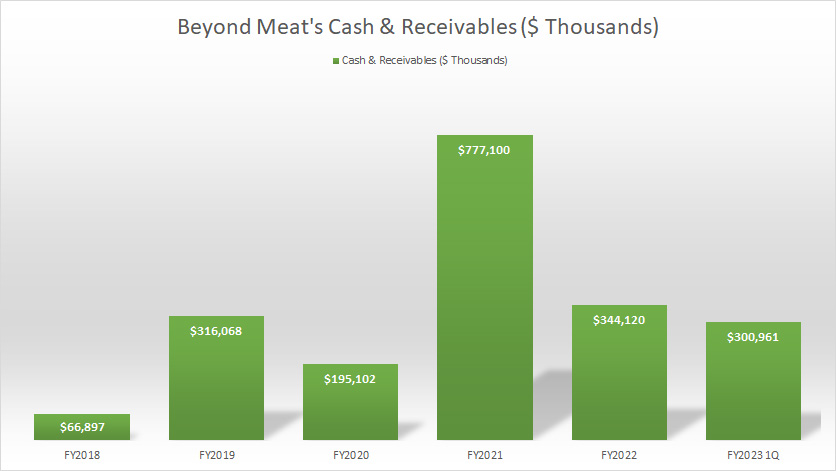

Beyond Meat’s Total Cash

Beyond Meat cash and receivables

(click image to enlarge)

In terms of liquidity, Beyond Meat’s cash or near-cash assets totaled slightly over $300 million as of 1Q 2023.

This figure has been on a decline since 2021, indicating the dwindling cash position of the company.

Since 2021, Beyond Meat’s cash or near-cash assets had more than halved, due primarily to the company’s negative operating cash flow reported in most fiscal years.

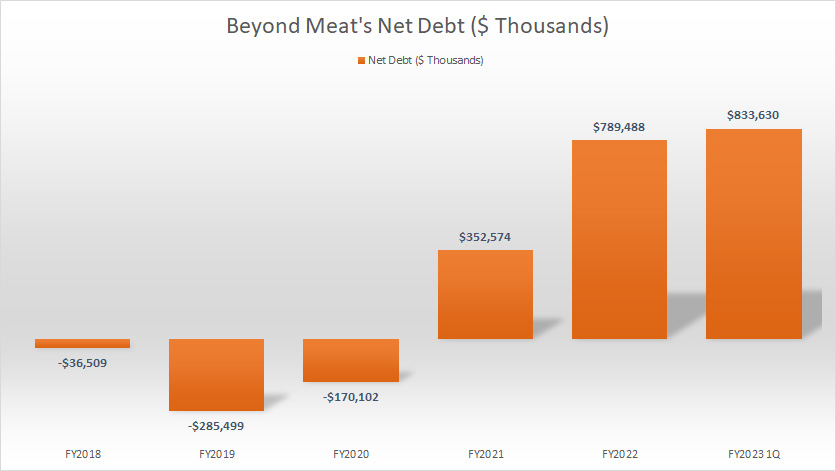

Beyond Meat’s Net Debt

Beyond Meat’s net debt

(click image to enlarge)

Even after taking into consideration Beyond Meat’s cash and near-cash assets, the company still owes a massive $834 million of debt as of fiscal Q1 2023.

The worse part is that Beyond Meat’s net debt has been on the rise since fiscal 2021, indicating the dwindling cash and near-cash assets of the company.

Prior to fiscal 2021, Beyond Meat carried more cash than debt, and hence, the negative net debt figures.

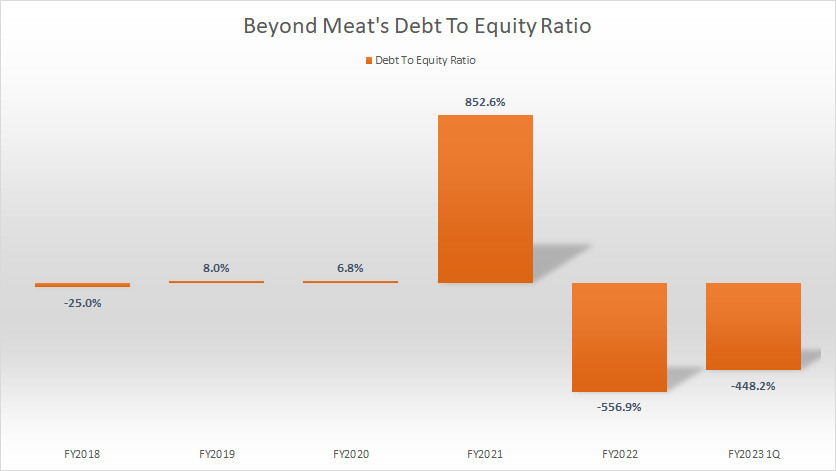

Beyond Meat’s Debt To Equity Ratio

Beyond Meat’s debt to equity ratio

(click image to enlarge)

Beyond Meat’s leverage surged significantly in fiscal 2021 to more than 800% for the debt-to-equity ratio.

The surge in leverage in fiscal 2021 was due primarily to the issuance of long-term debt in the same year.

However, going into fiscal 2022 and 2023, Beyond Meat shareholders’ equity became negative when the company incurred significant net losses in both fiscal years.

In other words, Beyond Meat carried more liabilities than assets when the shareholders’ equity became negative.

As of 1Q 2023, Beyond Meat’s debt-to-equity ratio measured at -448%, due mainly to the negative equity of the company.

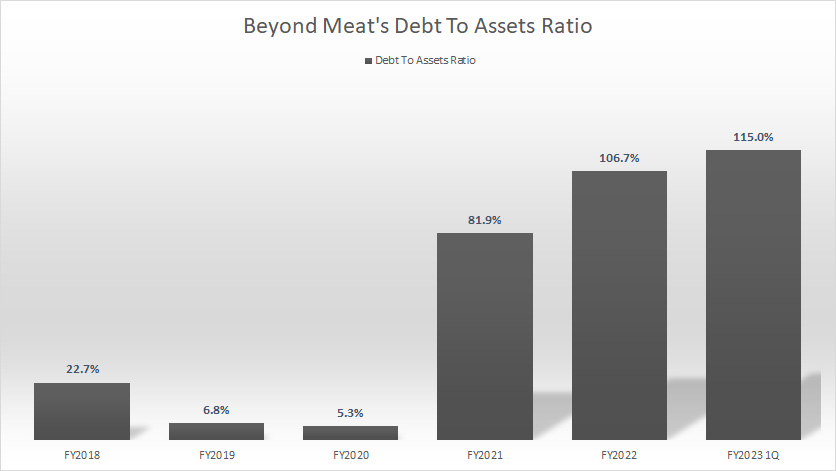

Beyond Meat’s Debt To Asset Ratio

Beyond Meat’s debt to assets ratio

(click image to enlarge)

The debt-to-asset ratio reflects Beyond Meat’s capital structure, also known as the debt structure.

In Beyond Meat’s case, its capital structure was 115% debt as of fiscal 1Q 2023, suggesting that the company’s total debt exceeded its total assets.

The worse part is that Beyond Meat’s debt-to-asset ratio has been on the rise and reached a record high as of 2023.

For your information, Beyond Meat’s debt-to-asset ratio surged only in fiscal 2021, driven by the huge indebtedness taken on in the same year.

Prior to fiscal 2021, Beyond Meat’s debt-to-assets ratio averaged less than 10% when the company carried literally no debt in that period.

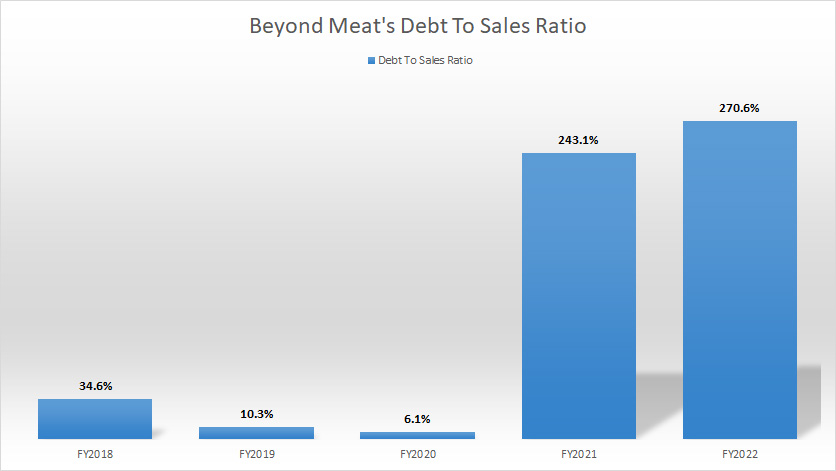

Beyond Meat’s Debt To Sales Ratio (Debt Margin)

Beyond Meat debt to sales ratio

(click image to enlarge)

Beyond Meat’s debt margin hovered more than 270% as of 2022, a significantly massive figure compared to the numbers reported prior to 2021.

At this ratio, Beyond Meat’s total debt amounted to nearly 3X of its yearly revenue.

Prior to fiscal 2021, you can see that the company’s debt margin averaged less than 20%.

Therefore, Beyond Meat’s debt leverage had significantly surged after taking on a huge chunk of debt since fiscal 2021.

The surge in the company’s debt margin should ring a warning sign to shareholders.

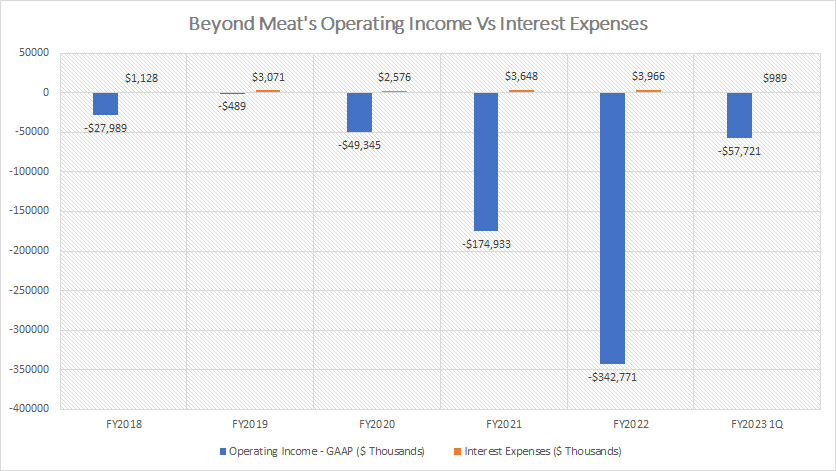

Beyond Meat’s Operating Income And Debt Expenses

Beyond Meat operating income vs interest expense

(click image to enlarge)

Beyond Meat had not been able to make an operating profit over the past 6 years and the unprofitable trend will most likely remain so in the foreseeable future.

The worse part is that the operating loss had worsened over the years and totaled a record high of -$343 million as of 2022.

Since Beyond Meat had not been able to make an operating profit, it had been unable to cover its debt expenses with its own money as shown in the chart above.

As a result, Beyond Meat had to resort to external cash injection to pay for all expenses, including the interest charges.

Also, Beyond Meat’s interest expenses have been on the rise and totaled a record high of nearly $4 million per year as of 2022, driven primarily by the company’s growing indebtedness.

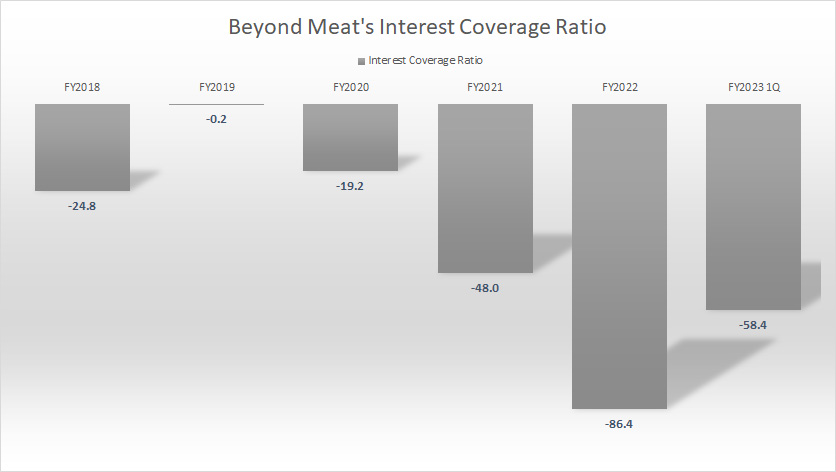

Beyond Meat’s Interest Coverage Ratio

Beyond Meat interest coverage ratio

(click image to enlarge)

As mentioned in prior discussions, Beyond Meat had not been able to make any operating profit so far and therefore, the interest coverage ratio had been negative.

As of 1Q 2023, the company’s interest coverage ratio totaled -58.4, suggesting that the company had not been able to cover the interest expense with its operating income.

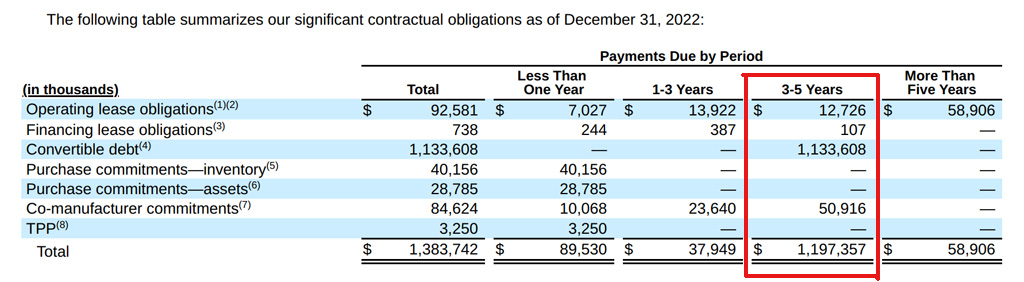

Beyond Meat’s Debt Payments Due

Beyond Meat debt schedule

(click image to enlarge)

An analysis of Beyond Meat’s debt and leverage will not be conclusive without a discussion of the corresponding debt due date.

As shown in the snapshot above, Beyond Meat’s payments due include not only its debt such as leases and convertible debt but also purchase commitments as well as other commitments.

In Beyond Meat’s case, its long-term debt will be due within 3 to 5 years as shown in the snapshot above and the total amount is going to be $1.1 billion.

In other words, Beyond Meat will have to settle its long-term debt somewhere between 2025 and 2027.

However, based on the latest cash position, Beyond Meat will be unable to pay off this amount as its cash and near-cash assets totaled only $300 million as of 1Q 2023.

Therefore, Beyond Meat will most likely take on more debt or issue equity in the foreseeable future to raise cash.

However, in the near term such as within 1 to 3 years, Beyond Meat should have no problem covering all payments due as the amount totals only $140 million.

Therefore, Beyond Meat should be able to easily satisfy all debt commitments in the near term.

Conclusion

In summary, Beyond Meat was highly indebted and leveraged as of fiscal Q1 2023 based on the company’s ratios such as debt-to-equity, debt-to-asset, and debt margin.

Moreover, Beyond Meat also had been unable to cover its debt expenses with its operating profit as the company had been unprofitable and had to rely on external cash injections such as debt and equity to pay for all expenses.

However, Beyond Meat’s long-term debt will only be due somewhere between 2024 and 2027.

In the near term, the company will still be able to cover its debt commitments as the company held more than $300 million of cash and near-cash assets as of 1Q 2023.

In the longer term, Beyond Meat will be unable to settle the $1.1 billion debt payment.

Beyond Meat will most likely need to borrow more or issue equity to settle the debt obligations at that time.

Also, Beyond Meat’s cash and near-cash assets had been dwindling fast and will run out sooner at the current burn rate.

Therefore, Beyond Meat may have to issue more debt or equity sooner than the expected 3 to 5-year period.

References and Credits

1. All financial figures in this article were obtained and referenced from Beyond Meat’s financial statements, SEC filings, earnings reports, etc, which are available in Beyond Meat Investor Relations.

2. All images in this article are used under creative commons license and sourced from the following websites: Jon Fisher and Steve Jurvetson.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!