Microchips. Pexels Images.

ARM Holdings is a British multinational semiconductor and software design company. It is renowned for its ARM architecture, a family of Reduced Instruction Set Computing (RISC) architectures for computer processors.

ARM doesn’t manufacture chips; instead, it licenses its intellectual property (IP) to other companies, who then incorporate ARM’s designs into their products.

This business model has made ARM’s architecture prevalent in a wide range of products, from smartphones and tablets to a growing number of embedded systems and Internet of Things (IoT) devices.

ARM’s energy-efficient processor designs are particularly well-suited for applications where power consumption is critical.

This article looks at ARM’s revenue breakdown by segment. For your information, ARM derives its revenue from only 2 segments, which are licensing and royalty.

Let’s look further!

For other key statistics of ARM Holdings, you may find more resources on these pages:

Revenue

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Is ARM Growing So Fast?

Consolidated Results

A1. Total Revenue

Revenue By Segment

B1. License And Royalty Revenue

B2. License And Royalty Revenue In Percentage

Revenue Growth

C1. YoY Growth Rates Of License And Royalty Revenue

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

License And Other Revenue: License and other revenue include revenue from licensing, software development tools, design services, training, support, and all other fees that do not constitute royalty revenue.

ARM Holdings generates its license revenue by allowing other companies to use its intellectual property, specifically its ARM architecture for processors, in exchange for a fee.

Instead of manufacturing and selling chips, ARM licenses its chip designs and related technology to semiconductor companies that incorporate these designs into their products.

The licensing revenue comes in two primary forms: upfront licensing fees when a company agrees to use ARM’s technology and royalties based on the number of units sold that incorporate ARM’s designs.

Licensing fees are typically one-time payments when a company agrees to use ARM’s technology.

Royalty Revenue: ARM Holdings’ royalty revenue is generated from the sales of products that incorporate ARM’s intellectual property, specifically its ARM architecture for processors.

Companies that license ARM’s technology agree to pay royalties based on the number of units sold, including ARM’s designs. This means that after an initial licensing agreement, ARM continues to earn income from every product sold by its licensees that uses ARM’s chip designs.

As mentioned, licensing fees are typically one-time payments. In contrast, royalty payments are ongoing and paid on each unit sold, including ARM’s designs.

This revenue model leverages the widespread adoption of ARM’s architecture across various electronic devices, such as smartphones, tablets, and embedded systems, allowing ARM to benefit financially from the extensive use of its technology in the market.

As a result, ARM will have a continuous revenue stream as long as its IPs are embedded in its customers’ products.

How Is ARM Holdings Growing So Fast?

ARM Holdings’ rapid growth can be attributed to several key factors:

-

Licensing Model: ARM’s unique business model, which licenses its intellectual property rather than manufacturing chips, has allowed for widespread adoption of its technology. By licensing its ARM architecture to many semiconductor companies, ARM has enabled its designs to be used in various products. This approach minimizes its operational risks and investments in manufacturing facilities while maximizing its reach and influence in the semiconductor industry.

-

Energy-Efficient Design: The ARM architecture is known for being highly energy-efficient, which makes it particularly appealing for mobile and embedded applications where power consumption is a critical consideration. In an era where battery life is a significant factor for consumer electronics like smartphones, tablets, and IoT devices, ARM’s energy-efficient processors are in high demand.

-

Wide Adoption Across Industries: ARM’s technology is not limited to just one electronics market segment. Its architectures are used in various products, from consumer electronics like smartphones and tablets to embedded systems and IoT devices. This diversity in application areas ensures a steady and growing demand for ARM’s intellectual property.

-

Royalty Revenue Model: ARM’s revenue model, which includes upfront licensing fees and royalties on each unit sold containing its technology, ensures a continuous income stream. As the adoption of ARM architecture expands and more units are sold, ARM benefits financially from both initial agreements and the ongoing sale of products by its licensees.

-

Innovation and Development: ARM continually invests in research and development to enhance its architectures and introduce new technologies. This commitment to innovation ensures that ARM remains at the forefront of semiconductor design, meeting the evolving needs of the industry and maintaining its competitive edge.

These strategic factors combined have propelled ARM Holdings to grow rapidly and secure its position as a dominant force in the global semiconductor industry.

Total Revenue

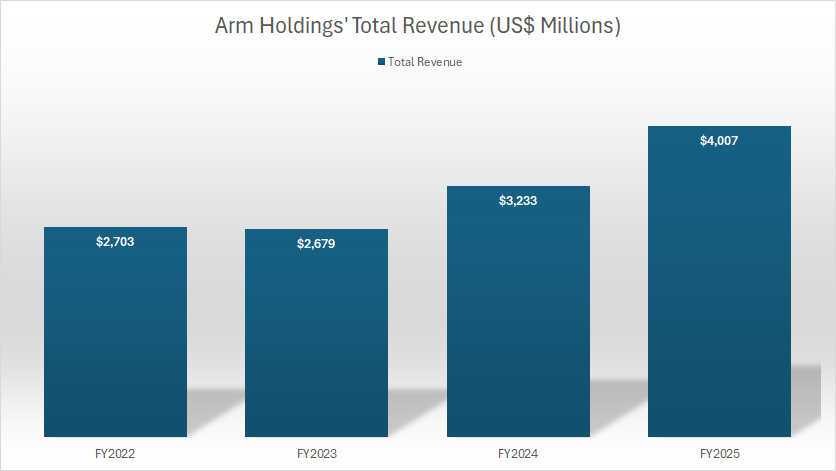

arm-holdings-total-revenue

(click image to expand)

ARM’s substantial revenue growth has been largely fueled by the expansion of its licensing revenue.

This increase stems from several factors, including a surge in new licensing agreements, additional revenue from prior contractual arrangements, and the renewal of existing licenses as customers seek access to the latest iterations of ARM’s technology IP.

These elements collectively reinforce ARM’s strong market presence and sustained financial momentum.

The following table shows more detailed revenue results:

Total Revenue in FY2025:

| Segment | Revenue (US$ Millions) |

|---|---|

| Consolidated | $4,007 |

3-Year Trend from FY2022 to FY2025:

| Segment | Revenue (US$ Millions) | % Changes |

|---|---|---|

| Consolidated | $2,703 – $4,007 | +48.2% |

License and Royalty Revenue

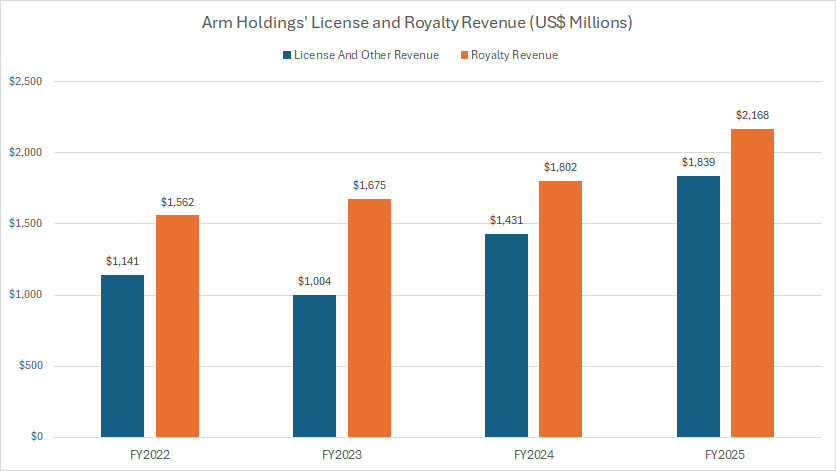

arm-holdings-license-and-royalty-revenue

(click image to expand)

The definition of ARM’s license and royalty revenue is available here: license revenue and royalty revenue.

Among ARM’s two primary revenue streams, licensing revenue saw the most substantial growth in FY2025, rising 28.5% year-over-year, compared to a 21% increase in royalty revenue.

Despite this, royalty income has historically outpaced licensing revenue and may hold greater strategic significance for ARM. Royalty payments provide a continuous and scalable revenue source, ensuring long-term financial stability beyond the initial licensing agreements.

Once a company adopts ARM’s technology, every subsequent product it manufactures that integrates ARM’s designs incurs royalty fees.

Given the massive global production of electronics, these cumulative royalty payments can expand significantly over time, potentially surpassing the initial licensing fees and reinforcing ARM’s business model.

The following table shows more detailed revenue results:

Revenue By Segment in FY2025:

| Segment | Revenue (US$ Millions) |

|---|---|

| License and Other | $1,839 |

| Royalty Revenue | $2,168 |

3-Year Trend from FY2022 to FY2025:

| Segment | Revenue (US$ Millions) | % Changes |

|---|---|---|

| License and Other | $1,141 – $1,839 | +61.2% |

| Royalty Revenue | $1,562 – $2,168 | +38.8% |

License and Royalty Revenue In Percentage

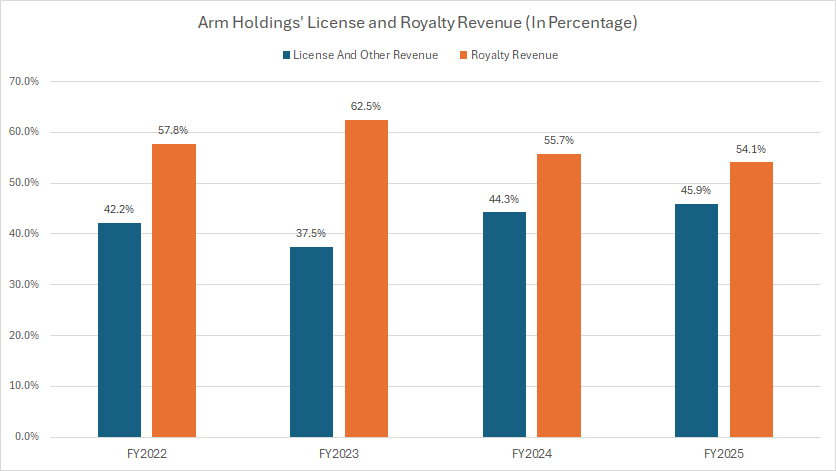

arm-holdings-license-and-royalty-revenue-in-percentage

(click image to expand)

The definition of ARM’s license and royalty revenue is available here: license revenue and royalty revenue.

ARM Holdings’ royalty revenue accounts for a much significant portion of its total revenue. The ratio reached 54.1% in fiscal year 2025 versus 55.7% in fiscal year 2024.

On the other hand, ARM’s license revenue made up 45.9% of its total revenue in fiscal year 2025 compared to 44.3% in fiscal year 2023.

The following table shows more detailed revenue results:

Revenue Share in FY2025:

| Segment | Revenue Share (%) |

|---|---|

| License and Other | 45.9% |

| Royalty Revenue | 54.1% |

3-Year Trend from FY2022 to FY2025:

| Segment | Revenue Share (%) | % Point Changes |

|---|---|---|

| License and Other | 42.2% – 45.9% | +3.7% |

| Royalty Revenue | 57.8% – 54.1% | -3.7% |

YoY Growth Rates of License and Royalty Revenue

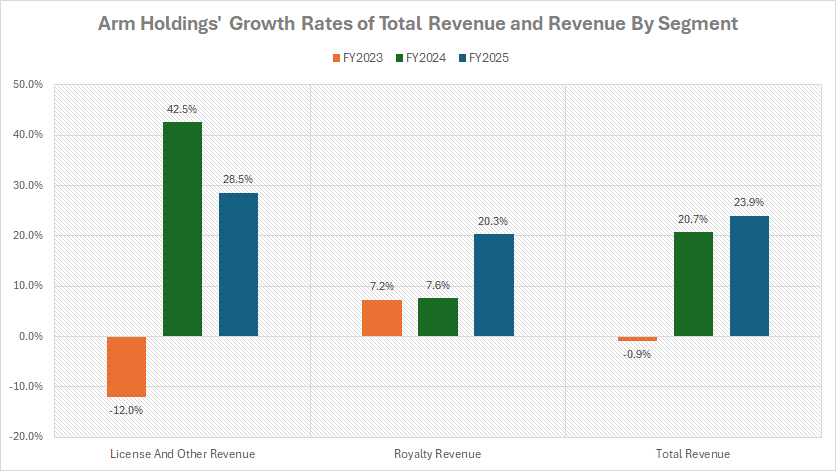

arm-holdings-growth-rates-of-license-and-royalty-revenue

(click image to expand)

The definition of ARM’s license and royalty revenue is available here: license revenue and royalty revenue.

A notable trend is the significantly higher growth rate of ARM’s licensing revenue compared to its royalty revenue.

The following table shows more detailed revenue results:

Revenue Growth By Segment in FY2025:

| Segment | YoY Revenue Growth (%) |

|---|---|

| License and Other | 28.5% |

| Royalty | 20.3% |

| Consolidated | 23.9 |

3-Year Average from FY2023 to FY2025:

| Segment | YoY Revenue Growth (%) |

|---|---|

| License and Other | 19.7% |

| Royalty | 11.7% |

| Consolidated | 14.6% |

Insight

ARM Holdings has demonstrated remarkable financial performance in FY2025, driven by strong growth in both licensing and royalty revenue streams. The company’s unique business model—licensing its intellectual property rather than manufacturing chips—has enabled it to scale efficiently while maintaining high profitability. This approach has allowed ARM to expand its presence across multiple industries, including mobile computing, cloud infrastructure, and automotive technology.

A key driver of ARM’s revenue growth has been the increasing adoption of its Armv9 architecture and Compute Subsystems (CSS), which have gained traction among major technology firms. The surge in licensing revenue, which grew by 28.5% year-over-year, reflects heightened demand for ARM’s chip designs, particularly in AI-driven computing and custom silicon solutions. Meanwhile, royalty revenue also saw a significant increase of 21%, fueled by the widespread deployment of ARM-based processors in consumer electronics and enterprise applications.

ARM’s financial results for FY2025 further highlight its momentum, with total revenue reaching $4 billion, marking a 24% year-over-year increase. The company achieved record royalty revenue of $2.2 billion, up 20%, and record licensing revenue of $1.8 billion, reflecting a 28.5% growth. This strong performance underscores ARM’s ability to capitalize on the growing demand for energy-efficient and high-performance computing solutions.

Despite its success, ARM faces challenges related to geopolitical uncertainties and macroeconomic factors. The company’s reliance on a limited number of key customers for a significant portion of its revenue presents a potential risk, as shifts in demand or regulatory changes could impact its financial stability. Additionally, ARM must navigate the complexities of semiconductor export regulations, particularly in markets like China, where trade restrictions could affect its growth trajectory.

Looking ahead, ARM’s strategic focus on AI infrastructure, hyperscaler deployments, and sovereign silicon initiatives positions it well for sustained expansion. The company’s commitment to research and development ensures that its chip architectures remain at the forefront of technological innovation, reinforcing its competitive advantage in the semiconductor industry. As ARM continues to evolve, its ability to balance licensing growth with stable royalty streams will be crucial in maintaining its leadership position in the global market.

References and Credits

1. All financial figures presented were obtained and referenced from ARM’s quarterly and annual reports published on the company’s investor relations page: ARM Financial Reports.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.