Chat GPT. Pexels Images.

This article examines the profitability and profit margins of Palantir Technologies and Nvidia Corporation.

We will explore various metrics, such as gross profit, operating profit, pre-tax profit, and net profit, to offer a detailed analysis of each company’s financial performance.

Let’s take a look!

Investors looking for other statistics of Palantir and Nvidia may find more resources on these pages:

- Palantir vs Nvidia: R&D budget comparison,

- Nvidia revenue by country: U.S., Taiwan, China, and Europe, and

- Palantir profit breakdown by segment.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is Nvidia having much better profit margin than Palantir?

Profitability

A1. Palantir vs Nvidia: Gross And Operating Profit

A2. Palantir vs Nvidia: Pre-Tax And Net Profit

Profit Margins

B1. Palantir vs Nvidia: Gross And Operating Profit Margins

B2. Palantir vs Nvidia: Pre-Tax And Net Profit Margins

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Gross Profit: Gross profit is the amount a company earns after subtracting the costs associated with producing and selling its products or providing its services. It’s a key indicator of a company’s financial health and efficiency in managing production costs.

Here’s the formula:

\[\text{Gross Profit} = \text{Revenue – Cost of Goods Sold (COGS)} \]

Gross profit helps to measure a company’s ability to generate profit from its core business operations, excluding indirect costs like administration and marketing expenses.

Operating Profit: Operating profit, also known as operating income or operating earnings, represents the profit a company makes from its core business operations, excluding any income from investments, interest, and taxes.

It’s a crucial measure of a company’s operational efficiency and profitability. Here’s the formula for calculating operating profit:

\[\text{Operating Profit} = \text{Gross Profit – Operating Expenses} \]

Operating expenses include costs such as salaries, rent, utilities, and depreciation. Operating profit provides insight into how well a company is managing its core business activities and controlling its operating costs.

Pre-Tax Profit: Pre-tax profit, also known as pre-tax income or earnings before tax (EBT), represents the profit a company makes before accounting for income taxes.

It’s a measure of a company’s profitability that excludes tax expenses, providing insight into the company’s financial performance before tax obligations are considered.

Here’s the formula for calculating pre-tax profit:

\[\text{Pre-tax Profit} = \text{Operating Profit + Other Income – Other Expenses} \]

Other income may include items like interest earnings, and other expenses might include interest expenses or non-operating costs.

Net Profit: Net profit, also known as net income or net earnings, is the amount of profit a company has left after all expenses have been deducted from total revenue.

These expenses include the cost of goods sold (COGS), operating expenses, interest, taxes, and any other expenses. Net profit is a key indicator of a company’s overall profitability.

Here’s the formula for calculating net profit:

\[\text{Net Profit} = \text{Total Revenue – Total Expenses} \]

Net profit provides a clear picture of a company’s financial health, showing how much profit it actually retains after covering all its costs. It’s often used by investors and analysts to assess a company’s performance and profitability.

Why is Nvidia having much better profit margin than Palantir?

Nvidia’s profit margin is significantly higher than Palantir’s due to several key factors:

- Product Demand and Market Position: Nvidia’s advanced AI chips and GPUs are in high demand, especially in the data center and AI markets. This strong demand allows Nvidia to command higher prices and maintain robust profit margins.

- Economies of Scale: Nvidia’s large-scale production and extensive customer base enable it to achieve economies of scale, reducing per-unit costs and boosting profit margins.

- Revenue and Profit Growth: Nvidia’s revenue and profit have grown substantially, with the company reporting a net profit margin of 56% as of Jan 26, 2025. In contrast, Palantir’s net profit margin is much lower, at 16% as of Dec 31, 2024.

- Product Mix: Nvidia’s product mix, which includes high-margin AI chips and GPUs, contributes to its higher profit margins. Palantir, on the other hand, primarily offers software solutions, which typically have lower profit margins compared to hardware.

- Operational Efficiency: Nvidia’s operational efficiency and cost management strategies further enhance its profitability. The company has successfully ramped up production of its Blackwell AI supercomputers, achieving billions in sales.

In summary, Nvidia’s strong market position, economies of scale, revenue growth, product mix, and operational efficiency all contribute to its superior profit margins compared to Palantir.

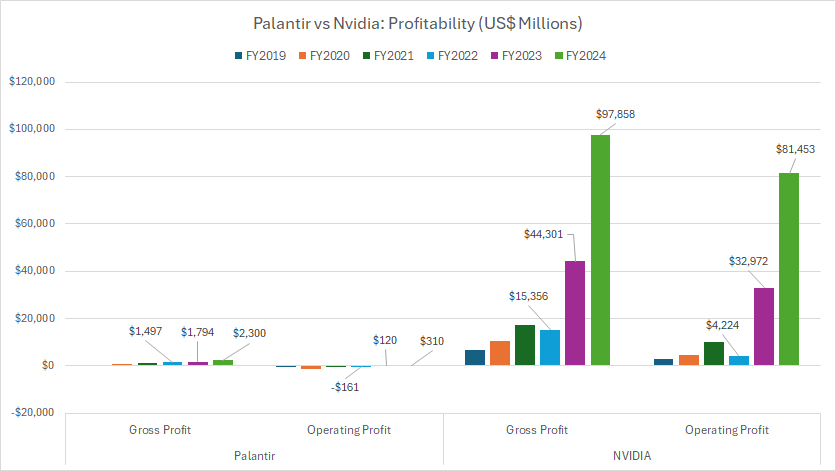

Palantir vs Nvidia: Gross And Operating Profit

palantir-vs-nvidia-gross-and-operating-profits

(click image to expand)

You can find the definitions of gross and operating profit here: gross profit and operating profit.

The graph above clearly illustrates that Nvidia’s profitability significantly surpasses that of Palantir in all fiscal years. Nvidia consistently achieves higher gross and operating profits, reflecting its superior financial performance and efficiency in generating income compared to Palantir.

For instance, in fiscal year 2024, Nvidia achieved gross profits of $98 billion and operating profits of $81 billion. In stark contrast, Palantir’s performance was more modest, with gross profits of $2.3 billion and operating profits of $310 million. These substantial differences highlight Nvidia’s superior profitability compared to Palantir.

Similarly, Nvidia’s performance in other fiscal years also significantly outpaced Palantir. For example, in fiscal year 2023, Nvidia achieved a gross profit of $44 billion and an operating profit of $33 billion, compared to Palantir’s gross profit of only $1.8 billion and operating profit of $120 million. These figures underscore Nvidia’s strong profitability relative to Palantir, even in a less stellar year.

It’s important to note that Palantir has only become profitable in terms of operating profit since fiscal year 2023. Prior to this, Palantir consistently faced operating losses, which further accentuates Nvidia’s superior financial performance over an extended period.

In summary, Nvidia’s higher gross and operating profits across multiple fiscal years demonstrate its robust financial health and efficiency in generating income, making it significantly more profitable than Palantir.

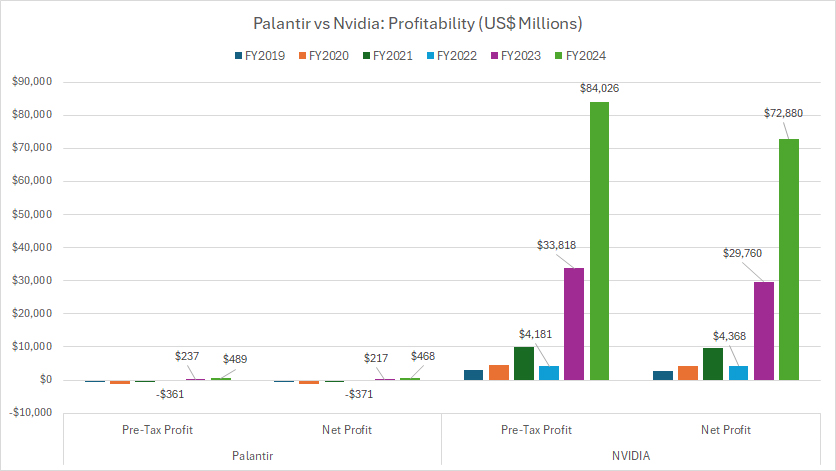

Palantir vs Nvidia: Pre-Tax And Net Profit

palantir-vs-nvidia-pretax-and-net-profits

(click image to expand)

You can find the definitions of pre-tax and net profit here: pre-tax profit and net profit.

In terms of pre-tax and net profitability, Nvidia consistently outperforms Palantir by a substantial margin, as illustrated in the chart above. This stark difference highlights Nvidia’s superior financial performance and exceptional efficiency in generating profits compared to Palantir.

For example, in fiscal year 2024, Nvidia’s pre-tax profit skyrocketed to an extraordinary $84 billion, a figure that dwarfs Palantir’s $489 million. Similarly, Nvidia reported an astounding net profit of $74 billion for the same year, vastly surpassing Palantir’s $468 million. These striking disparities demonstrate Nvidia’s financial dominance and operational effectiveness.

The trend remains consistent in fiscal year 2023. Nvidia achieved a pre-tax profit of $34 billion, compared to Palantir’s more modest $237 million. Additionally, Nvidia’s net profit for fiscal year 2023 reached an impressive $30 billion, far exceeding Palantir’s $217 million during the same period. These figures further underline Nvidia’s ability to maintain high profitability, even in earlier fiscal years.

Moreover, Nvidia’s financial outperformance isn’t limited to these specific fiscal years; it represents a broader pattern of dominance. Palantir, by contrast, only recently reached profitability in terms of operating profit, beginning in fiscal year 2023. Before this point, the company struggled with persistent operating losses, which have limited its capacity to generate comparable pre-tax and net profits.

Overall, Nvidia’s consistently higher pre-tax and net profits across multiple fiscal years showcase its robust financial health, effective cost management, and strong market position, reaffirming its clear superiority over Palantir in terms of profitability.

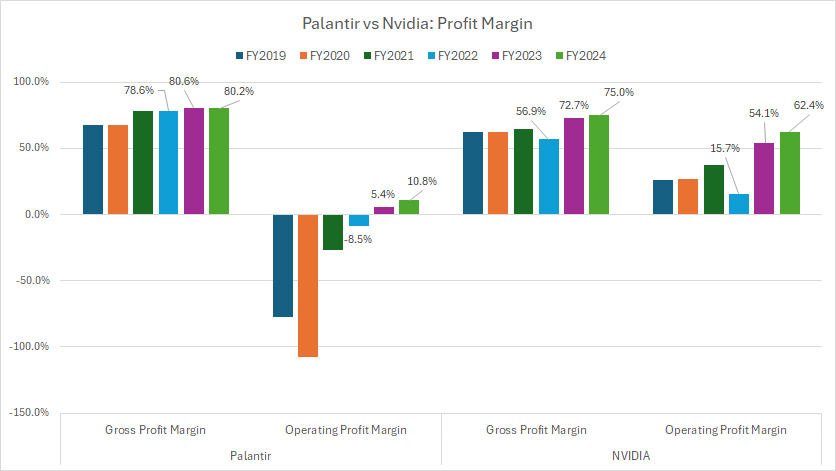

Palantir vs Nvidia: Gross And Operating Profit Margins

palantir-vs-nvidia-gross-and-operating-profit-margins

(click image to expand)

You can find the definitions of gross and operating profit here: gross profit and operating profit.

Although Palantir’s overall profitability is significantly lower than Nvidia’s, its profit margins, particularly gross margins, are quite competitive and have even surpassed Nvidia’s in certain periods, as highlighted in the chart above.

For instance, in fiscal year 2024, Palantir achieved an impressive gross margin of 80%, clearly exceeding Nvidia’s 75% gross margin. Similarly, in fiscal year 2023, Palantir continued to outperform, with an 81% gross margin compared to Nvidia’s 73%.

This trend was also observed in fiscal year 2022, where Palantir’s gross margin of 79% significantly outpaced Nvidia’s 57%. These numbers indicate Palantir’s ability to effectively manage the cost of goods sold relative to its revenues, even though its overall profitability lags behind.

However, Nvidia demonstrates superior performance in terms of operating efficiency, as reflected in its substantially higher operating profit margins. In fiscal year 2024, Nvidia reported an operating profit margin of 62%, a remarkable figure that dwarfs Palantir’s 11%.

Similarly, in fiscal year 2023, Nvidia’s operating profit margin stood at an impressive 54%, far surpassing Palantir’s modest 5%. The disparity is even more pronounced in fiscal year 2022, when Palantir suffered an operating loss, with its operating profit margin plunging to -9%, while Nvidia maintained a solid 16% operating profit margin.

These contrasting figures underscore the difference in the two companies’ financial strategies and operational efficiencies. While Palantir excels in maintaining high gross margins, indicating efficient cost control at the production level, Nvidia’s ability to translate its revenues into robust operating profits highlights its overall financial strength and operational prowess.

Nvidia’s higher operating margins consistently demonstrate its dominance in turning revenue into actual operating profit, reinforcing its position as a financially superior company over Palantir across the board.

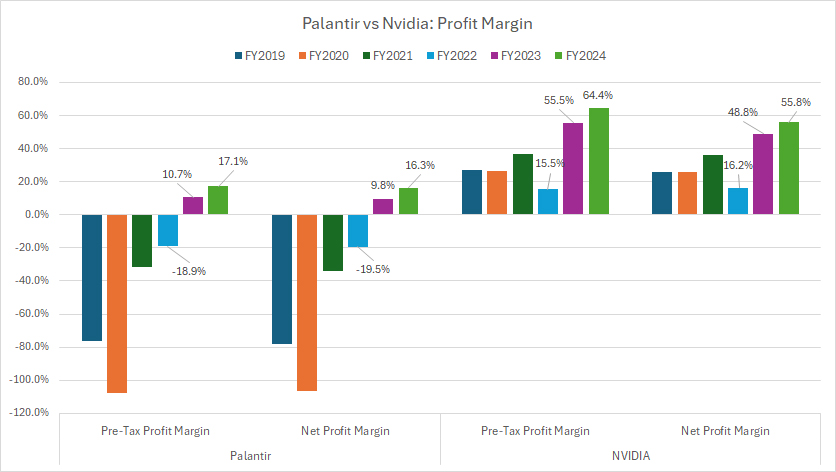

Palantir vs Nvidia: Pre-Tax And Net Profit Margins

palantir-vs-nvidia-pretax-and-net-profit-margins

(click image to expand)

You can find the definitions of pre-tax and net profit here: pre-tax profit and net profit.

When it comes to pre-tax and net profit margins, Nvidia has consistently outperformed Palantir by a substantial margin, as evidenced by the accompanying chart. This performance underscores Nvidia’s exceptional financial efficiency and its ability to translate revenues into significant profits.

In fiscal year 2024, Nvidia’s pre-tax margin soared to an impressive 64%, far outstripping Palantir’s more modest 17%. Similarly, Nvidia’s net profit margin reached a remarkable 56%, sharply exceeding Palantir’s 16% net margin. These figures highlight Nvidia’s robust profitability and operational excellence.

The same pattern is evident in fiscal year 2023. Nvidia achieved pre-tax and net profit margins of 56% and 49%, respectively, showcasing its strong profitability even during earlier periods. In stark contrast, Palantir’s results for the same year were significantly lower, with a pre-tax margin of just 11% and a net profit margin of 10%.

The gap between the two companies’ profitability becomes even more pronounced when looking at fiscal year 2022. During this period, Palantir faced financial challenges, reporting a pre-tax loss with a margin of -19% and a net profit margin of -20%, reflecting ongoing struggles with profitability. Meanwhile, Nvidia demonstrated its financial strength, delivering pre-tax and net profit margins of 16% each, firmly solidifying its dominance in profitability.

In summary, Nvidia’s consistently superior pre-tax and net profit margins underscore its exceptional ability to manage costs, optimize operations, and generate substantial shareholder value. Palantir’s financial performance, while improving in recent years, remains a significant distance behind Nvidia’s industry-leading profitability.

Conclusion

In summary, Nvidia’s superior profitability and margins, particularly in operating, pre-tax, and net metrics, highlight its strong market position, operational efficiency, and ability to capitalize on high-demand products like GPUs and AI chips.

While Palantir lags in overall profitability, its high gross margins indicate effective cost control at the production level. However, its lower operating and net margins suggest challenges in scaling profitability beyond gross revenue.

Nvidia benefits from economies of scale and high-margin hardware products, while Palantir’s software-focused model, though efficient in gross margin terms, struggles to achieve comparable profitability at the operating and net levels.

In summary, Nvidia’s financial performance and margins consistently outpace Palantir’s, reflecting its dominance in the tech industry. Palantir, while improving, remains in a different league in terms of profitability and operational efficiency.

References and Credits

1. All financial figures presented were obtained and referenced from Palantir’s and Nvidia’s annual reports published on the respective investors relation pages: Palantir Investor Relations and Nvidia Investor Relations.

2. Pexels Images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.