Gas price. Pexels Images.

This article covers Costco’s gasoline sales revenue. Costco derives a significant portion of its net sales from gasoline revenue.

For your information, Costco’s net sales refer specifically to revenue from merchandise sales, excluding any income derived from membership fees, as presented in this article: Costco revenue breakdown: net sales and membership.

Let’s look at the details.

Investors interested in Costco’s other key statistics may find more resources on these pages:

- Costco revenue by country: U.S., Canada, and International,

- Costco revenue segments: foods, non-foods, fresh foods, etc., and

- Costco profit margin vs Walmart.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why does Costco sell gasoline?

Gas Stations Numbers

A1. Number Of Gas Stations Worlwide

Percentage Of Gasoline Revenue

A2. Gasoline Sales As A Percentage Of Total Net Sales

Gasoline Revenue

Growth Rates

A4. Gas Stations Growth

A5. Gasoline Revenue Growth

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Warehouse Ancillary: Costco operates its ancillary businesses within or next to its warehouses to provide expanded products and services, encouraging members to shop more frequently. These businesses include gas stations, pharmacy, optical dispensing centers, food courts, hearing-aid centers, and tire installation.

Gasoline Sales: Costco’s gasoline sales represent the revenue generated from fuel sold at Costco’s gas stations. These stations are typically located at or near Costco warehouses and are exclusively accessible to Costco members (with rare exceptions in certain regions).

Gasoline sales align with Costco’s core business strategy by offering fuel at competitive, often below-market prices to attract and retain members, increase foot traffic, and support overall membership value.

Gasoline sales are a significant revenue stream for Costco, but they are classified separately from membership fees in its financial reporting. This focus on discounted fuel strengthens member loyalty and helps Costco maintain its reputation as a high-value retailer.

Why does Costco sell gasoline?

Costco sells gasoline primarily as a way to attract and retain members while boosting overall sales. Here’s why:

- Value for Members: Gasoline is a high-demand commodity, and offering it at a competitive price provides an additional incentive for members to choose Costco over other retailers.

- Increased Foot Traffic: By offering gasoline, Costco encourages members to visit their locations. While there, members are more likely to shop for other merchandise, increasing overall sales.

- Member Loyalty: Providing discounted gasoline reinforces the value of a Costco membership, encouraging renewals and fostering long-term loyalty.

- Low Overheads: Costco’s business model relies on efficiency and low-cost operations. This allows them to offer gasoline at lower prices, aligning with their strategy of delivering value to members.

It’s all about creating a win-win situation where members save on fuel, and Costco strengthens its membership-driven business model. Smart move, wouldn’t you say?

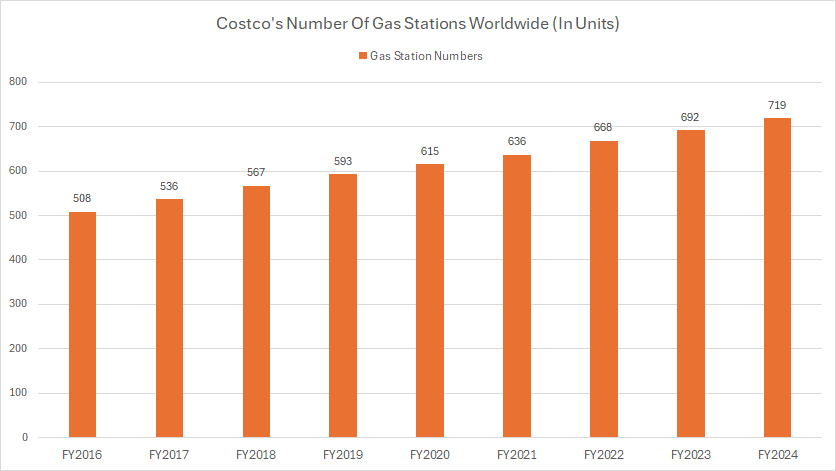

Number Of Gas Stations Worlwide

Costco-number-of-gas-stations-worldwide

(click image to expand)

Costco’s gasoline business falls under the Warehouse Ancillary segment. You may find more information about Costco’s warehouse ancillary business here: warehouse ancillary.

By the close of fiscal year 2024, Costco operated an impressive 719 gas stations worldwide. This marked a 4% increase from the 692 locations recorded at the end of fiscal year 2023.

This steady expansion highlights Costco’s commitment to broadening its reach and providing its members with greater accessibility to their competitively priced fuel services.

Taking a longer-term view, Costco’s growth in gas station locations has been remarkable. Since fiscal year 2016, when the company had 508 gas stations, the total number of locations has surged by over 40%.

This significant expansion underscores the strategic importance of fuel offerings in Costco’s business model, contributing not only to revenue growth but also to enhanced member satisfaction and loyalty by offering added convenience across more regions.

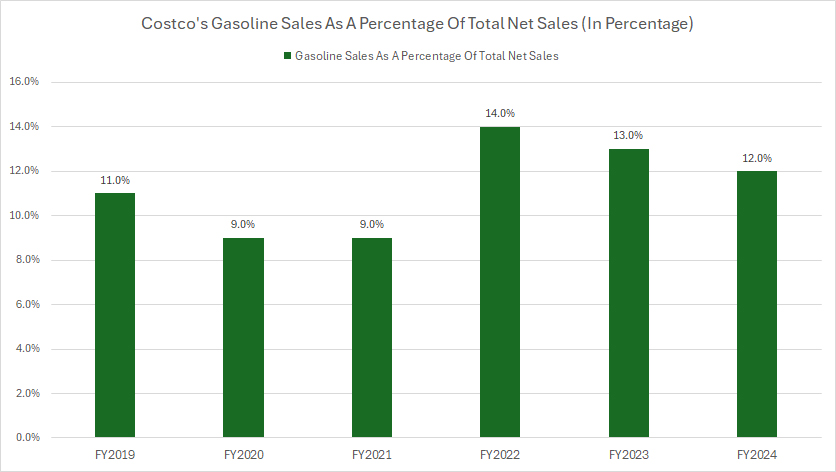

Gasoline Sales As A Percentage Of Total Net Sales

Costco-gasoline-sales-to-total-net-sales

(click image to expand)

Costco’s gasoline business falls under the Warehouse Ancillary segment. You may find more information about Costco’s warehouse ancillary business here: warehouse ancillary.

Costco’s gasoline business accounted for approximately 12% of the company’s total net sales in fiscal year 2024. This represents a modest decline from the 13% contribution reported in fiscal year 2023.

The gasoline business contribution reached its highest level at 14% in fiscal year 2022, reflecting peak demand and elevated fuel prices during that period. By contrast, between fiscal years 2020 and 2021, the contribution from gasoline sales dipped to a low of 9%, reflecting softer market conditions at the time.

Over the long term, from fiscal year 2019 to 2024, the gasoline segment’s share of Costco’s total net sales has shown relative stability. Starting at 11% in 2019, it rose slightly to 12% by 2024, maintaining an average contribution of roughly 11% over this period.

This steady performance highlights the strategic importance of Costco’s gasoline operations, which continue to play a key role in driving member value and enhancing overall revenue.

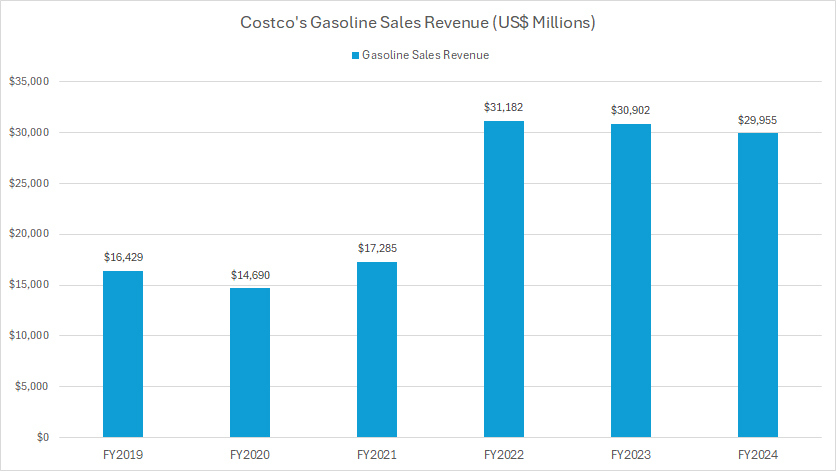

Gasoline Sales Revenue

Costco-gasoline-sales-revenue

(click image to expand)

Costco’s gasoline business falls under the Warehouse Ancillary segment. You may find more information about Costco’s warehouse ancillary business here: warehouse ancillary.

From a revenue standpoint, Costco’s gasoline business generated nearly $30 billion in fiscal year 2024, showing a slight decline from the $30.9 billion reported in 2023. The segment reached its all-time high of $31.2 billion in fiscal year 2022, reflecting peak demand and potentially elevated fuel prices during that period.

Looking at earlier years, between fiscal 2019 and 2021, Costco’s gasoline sales revenue averaged only $16.1 billion annually. This represents some of the lowest revenue levels for the gasoline segment, likely due to softer market conditions or lower fuel prices.

Over the longer term, from fiscal year 2019 to fiscal year 2024, Costco’s gasoline business has demonstrated significant growth. Revenues rose from $16.4 billion in 2019 to $30 billion in the most recent fiscal year, nearly doubling over this six-year period.

This impressive increase underscores the importance of the gasoline business as a key revenue driver for Costco, aligning with its strategy of delivering value to members while boosting overall sales.

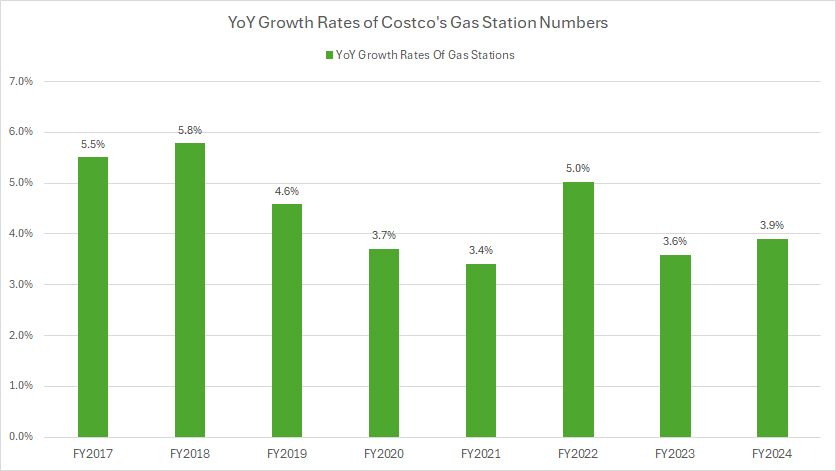

Gas Stations Growth

Costco-gas-stations-growth-rates

(click image to expand)

Costco’s gasoline business falls under the Warehouse Ancillary segment. You may find more information about Costco’s warehouse ancillary business here: warehouse ancillary.

One notable trend in Costco’s global network of gas stations is its uninterrupted growth over the past eight years. From fiscal year 2017 to 2024, the number of Costco gas stations worldwide has consistently increased each year, without a single decline during this period.

This steadfast expansion underscores Costco’s strategic focus on growing its fuel business as part of its broader mission to deliver value and convenience to its members.

Over this eight-year span, the average annual growth rate of Costco’s gas stations has been an impressive 4%. This steady pace of expansion reflects not only the company’s commitment to maintaining consistent growth but also its ability to identify and capitalize on new opportunities in both existing and emerging markets.

This growth trajectory is indicative of Costco’s broader operational strategy, where fuel services play a critical role in driving member loyalty and increasing foot traffic to their warehouses.

By consistently adding new locations, Costco has reinforced its position as a leader in providing competitively priced gasoline to its members, while simultaneously boosting its overall business performance.

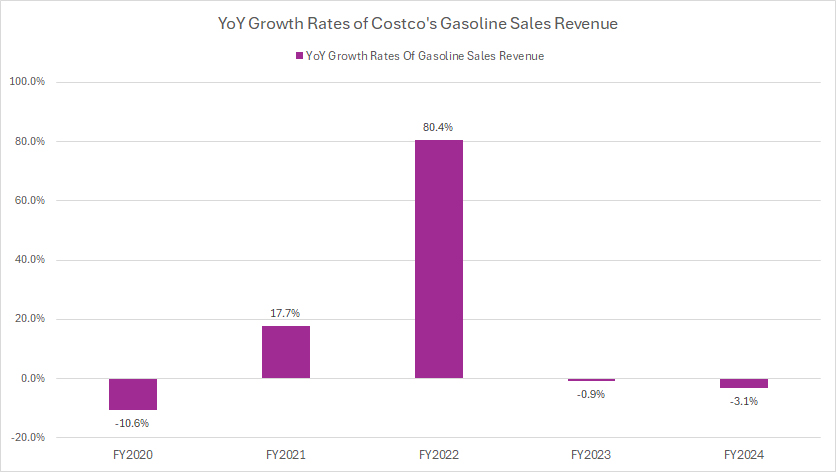

Gasoline Revenue Growth

Costco-gasoline-sales-revenue-growth-rates

(click image to expand)

Costco’s gasoline business falls under the Warehouse Ancillary segment. You may find more information about Costco’s warehouse ancillary business here: warehouse ancillary.

The growth trajectory of Costco’s gasoline sales revenue has been notably dynamic, reflecting significant fluctuations year over year. In fiscal year 2024, gasoline sales experienced a modest decline of 3%, following flat growth in fiscal year 2023.

These recent results contrast sharply with the impressive surge seen in fiscal year 2022, when gasoline revenue skyrocketed by 80%, driven by elevated fuel prices and heightened demand. This substantial growth in 2022 marked a significant leap from the 18% increase recorded in fiscal year 2021.

However, not all years were as positive — in fiscal year 2020, the gasoline segment suffered a notable decline of 11%, reflecting challenging market conditions during that period.

From a long-term perspective, Costco’s gasoline business has demonstrated remarkable growth despite these year-to-year fluctuations. Between fiscal years 2020 and 2024, the segment achieved an average annual growth rate of 17%, a testament to its strategic importance within Costco’s overall business model.

This consistent upward trend underscores the company’s ability to adapt to market dynamics and leverage its competitive pricing and membership-driven model to sustain growth over time. Costco’s gasoline operations remain a key contributor to its revenue, providing added value to members while supporting the company’s long-term financial performance.

Conclusion

In summary, Costco’s gasoline business is a cornerstone of its broader strategy, driving both financial performance and member loyalty. Its sustained growth in stations and revenue underscores Costco’s ability to adapt to market dynamics while reinforcing its reputation as a high-value retailer.

References and Credits

1. All financial figures presented were obtained and referenced from Costco’s annual reports published on the company’s investor relations page: Costco Investor Relations.

2. Pexels Images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.