Wholesaler. Pexels Images.

This article explores Costco’s revenue breakdown by stream. Costco derives its revenue from two sources: net sales and membership fees.

You may find more information about Costco’s net sales and membership fees here: net sales and membership fees.

Let’s look at the revenue breakdown!

Investors interested in Costco’s other key statistics may find more resources on these pages:

Revenue By Product

Revenue By Region

Other Revenue Streams

Profit Margin

- Costco profit margin by segment, and

- Costco profit margin vs Walmart.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How does Costco make money?

Revenue Breakdown

A1. Revenue From Net Sales And Membership Fees

Revenue Share

A2. Percentage Of Revenue From Net Sales And Membership Fees

Revenue Growth

A3. YoY Growth Rates Of Revenue From Net Sales And Membership Fees

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions Of Segments

To help readers understand the content better, the following terms and glossaries have been provided.

Net Sales: Costco’s net sales refer to the total revenue generated from the sale of goods and services, excluding any returns, allowances, and discounts. This figure represents the company’s core business performance and is a key indicator of its financial health and growth.

Membership Fees: Costco’s membership fees are annual charges that customers pay to access Costco’s warehouses and purchase products at discounted prices.

These fees help the company maintain a loyal customer base and provide a steady stream of revenue. There are typically two types of memberships:

- Gold Star Membership: This is the standard membership available to individual consumers. It provides access to all Costco locations worldwide and offers various member benefits. The fee for this membership is usually around $60 per year.

- Executive Membership: This membership offers additional benefits, including an annual 2% reward on qualified purchases, which can offset the membership fee. Executive members also receive exclusive discounts and access to special services. The fee for this membership is typically around $120 per year.

These membership fees are a significant part of Costco’s business model, contributing to its overall profitability and helping to keep product prices low for members.

How does Costco make money?

Costco’s business model is quite robust, allowing it to generate revenue from several key channels:

- Membership Fees: An essential part of Costco’s revenue comes from annual membership fees. Members pay to access Costco’s warehouses and benefit from discounted prices. This not only generates a steady income but also fosters customer loyalty.

- Ancillary Services: Costco offers additional services such as gas stations, pharmacies, optical centers, and food courts. These services add convenience for members and contribute extra revenue.

- E-commerce: Besides physical stores, Costco’s online sales are growing. The e-commerce platform allows customers to shop conveniently from home, especially in areas without nearby warehouses.

- Private Label Products: Costco’s private label, Kirkland Signature, is a significant contributor to its revenue. These products are known for their quality and competitive prices, encouraging customers to choose them over national brands.

- Bulk Sales and High Turnover: Costco focuses on selling products in bulk, which increases the average transaction size. The high turnover rate ensures fresh inventory and efficient use of warehouse space.

By leveraging these diverse revenue streams, Costco ensures its position as a leading wholesale retailer.

Revenue From Net Sales And Membership Fees

costco-revenue-breakdown

(click image to expand)

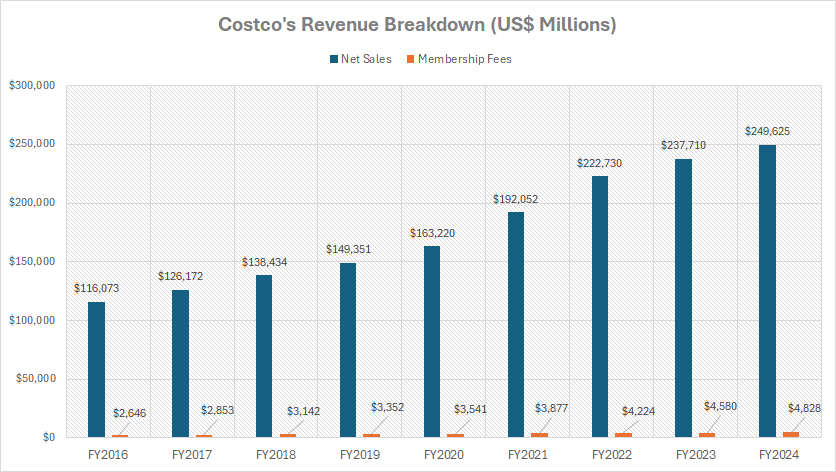

Costco’s revenue streams consist of net sales and membership fees. The definitions of these revenue sources are available here: net sales and membership fees.

Costco primarily generates its revenue from net sales, with membership fees contributing only a small portion. The data in the chart above reflects this disparity clearly.

In fiscal year 2024, Costco’s net sales revenue reached a staggering $249.6 billion, marking a roughly 5% increase from the $237.7 billion reported in fiscal year 2023. This consistent growth highlights the company’s robust market presence and effective sales strategies.

Looking back, in fiscal year 2022, Costco reported net sales revenue of $222.7 billion, which was a significant 16% jump from the $192.1 billion in fiscal year 2021. Such substantial growth over consecutive years underscores the strength of Costco’s business model and its ability to attract and retain customers.

Since fiscal year 2016, Costco’s net sales revenue has more than doubled, soaring from $116.1 billion to an impressive $249.6 billion by fiscal year 2024. This trajectory showcases the company’s steady expansion and the increasing consumer demand for its products and services.

Conversely, Costco’s membership fees revenue, while substantial, is much lower compared to net sales. In fiscal year 2024, membership fees amounted to $4.8 billion, representing a 5% rise from the $4.6 billion earned in fiscal year 2023.

Despite its relatively smaller size, the membership fees segment has also experienced remarkable growth over the past nine years. In fiscal year 2016, Costco earned $2.6 billion from membership fees. By fiscal year 2024, this figure had increased by 85% to reach $4.8 billion. This growth highlights the effectiveness of Costco’s membership model, which encourages customer loyalty and provides a steady revenue stream.

Essentially, Costco’s financial performance demonstrates a strong upward trajectory in both net sales and membership fees revenue, reinforcing its position as a major player in the retail industry.

Percentage Of Revenue From Net Sales And Membership Fees

costco-revenue-breakdown-in-percentage

(click image to expand)

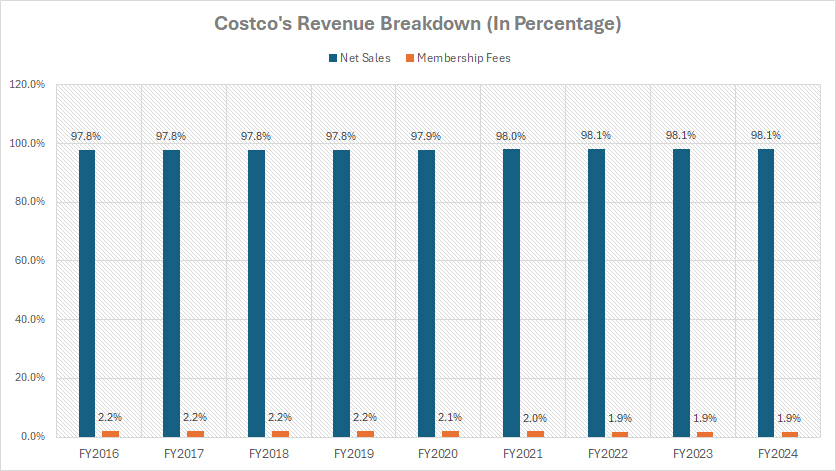

Costco’s revenue streams consist of net sales and membership fees. The definitions of these revenue sources are available here: net sales and membership fees.

In most fiscal years, Costco’s net sales revenue has consistently accounted for a significant majority of the company’s total revenue. Specifically, in fiscal year 2024, this ratio stood at 98.1%, mirroring the ratios seen in fiscal years 2023 and 2022. This highlights the predominant role that net sales revenue plays in Costco’s overall financial performance.

When examining the long-term trends from fiscal year 2016 to 2024, the revenue share of Costco’s net sales has shown a modest increase, rising from 97.8% to 98.1%. This upward trajectory underscores the robust and growing contribution of net sales to the company’s total revenue, even as Costco consistently adjusts its membership fees.

Conversely, the revenue share of Costco’s membership fees remains relatively small. In fiscal year 2024, membership fees comprised just 1.9% of total revenue. Remarkably, Costco has maintained this ratio for the last three years, from fiscal year 2022 to 2024.

On a longer-term basis, the revenue share of Costco’s membership fees has experienced a slight decline, decreasing from 2.2% in fiscal year 2016 to 1.9% as of fiscal year 2024. Despite this decrease, the overall revenue from membership fees has increased, reflecting the company’s ability to attract and retain a substantial number of members, thereby providing a steady revenue stream.

These trends highlight the enduring importance of net sales revenue in Costco’s financial structure while also recognizing the critical, albeit smaller, role that membership fees play in supporting the company’s operations and growth. Overall, Costco’s financial data vividly illustrate its strategic focus on maximizing net sales revenue while maintaining a strong membership base.

YoY Growth Rates Of Revenue From Net Sales And Membership Fees

costco-yoy-growth-rates-of-revenue-breakdown

(click image to expand)

Costco’s revenue streams consist of net sales and membership fees. The definitions of these revenue sources are available here: net sales and membership fees.

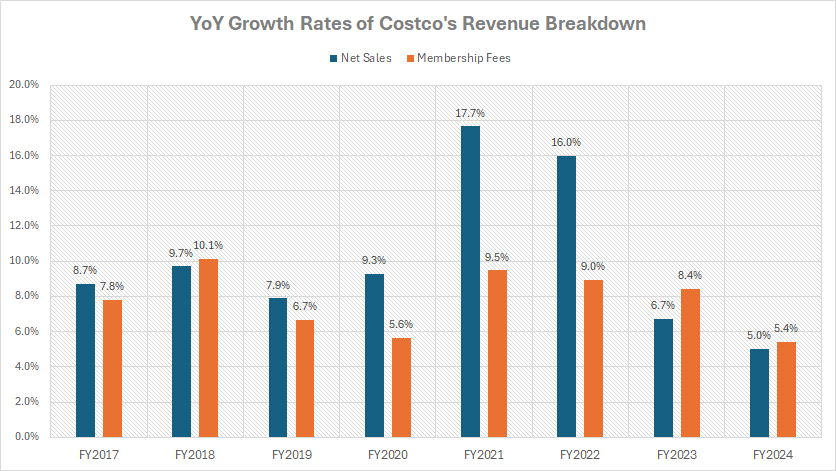

On average, Costco’s net sales revenue has achieved slightly better growth rates compared to its membership fees revenue. This is largely attributed to several exceptional growth periods for net sales revenue. For instance, Costco’s net sales revenue experienced a massive 18% growth in fiscal year 2021 and a notable 16% growth in fiscal year 2022. During the same periods, Costco’s membership fees revenue growth was comparatively modest at 9.5% and 9%, respectively.

Over the past five years, from fiscal year 2020 to 2024, the average annual growth rate of Costco’s net sales revenue amounted to 11%, whereas membership fees revenue grew at an average annual rate of 8%. This comparison underscores the stronger performance of net sales in driving overall revenue growth for the company.

However, while net sales revenue has historically generated exceptional growth, its growth rate has significantly slowed over the last three years. In fiscal year 2024, Costco reported its slowest growth in net sales revenue, with an increase of only 5%, compared to 6.7% in fiscal year 2023 and 16% in fiscal year 2022. This deceleration in growth may indicate a maturing market or increasing competition.

Similarly, Costco’s growth in membership fees has also decelerated in recent periods. In fiscal year 2024, the year-over-year (YoY) growth rate for membership fees was 5.4%, marking a record low not seen over the past nine years. Despite the slowdown, membership fees remain a vital revenue stream, contributing to the company’s stability and customer loyalty.

Overall, while Costco’s net sales revenue has demonstrated stronger growth historically, the recent slowdown in both net sales and membership fees revenue growth signals the importance of strategic adjustments to maintain momentum in the competitive retail landscape. The company may need to explore new avenues for revenue generation and enhance its value proposition to sustain its impressive growth trajectory

Conclusion

Overall, Costco’s financial performance relies heavily on net sales revenue, which has shown strong growth historically but has slowed recently. Membership fees, while smaller in contribution, provide a steady revenue stream and reflect customer loyalty.

The recent deceleration in growth for both net sales and membership fees suggests that Costco may need to explore new strategies and innovations to sustain its impressive growth trajectory in the competitive retail landscape.

References and Credits

1. All financial figures presented were obtained and referenced from Costco’s annual reports published on the company’s investor relations page: Costco Investor Relations.

2. Pexels Images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.