Fresh foods. Pexels Images.

This article presents Walmart’s profitability and profit margin by segment. Walmart’s operating segments consist of three primary units: Walmart U.S., Walmart International, and Sam’s Club U.S.

Let’s take a look!

For other key statistics of Walmart, you may find more resources on these pages:

Revenue

- Walmart revenue by country: U.S. and International,

- Walmart revenue breakdown: net sales and membership & other income,

- Walmart revenue by segment: U.S., International, and Sam’s Club

Other Revenue Streams

Profit Margin

- Walmart vs Costco: profit margin comparison

Other Statistics

- Capital expenditures breakdown analysis,

- financial health,

- comparable sales,

- revenue per store

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What drives the significant profit contribution from Walmart U.S. segment?

Profit By Segment

A1. Gross Profit From Walmart U.S., International, and Sam’s Club

A2. Operating Income From Walmart U.S., International, and Sam’s Club

Profit Margin By Segment

B1. Gross Margin From Walmart U.S., International, and Sam’s Club

B2. Operating Margin From Walmart U.S., International, and Sam’s Club

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Net Sales: Walmart’s net sales refer to the total revenue generated by the company through its retail and eCommerce operations after deducting returns, discounts, and allowances.

This figure excludes membership income and represents the core income from selling goods and services across its segments, including Walmart U.S., Walmart International, and Sam’s Club.

Net sales are a critical metric used to assess the company’s financial performance and operational effectiveness.

Walmart U.S.: Walmart U.S. stands as the company’s largest segment, operating 4,605 stores across the United States, spanning all 50 states, Washington D.C., and Puerto Rico.

As a leading mass merchandiser of consumer products, Walmart U.S. serves customers under the “Walmart” and “Walmart Neighborhood Market” brands, as well as through its digital platform, walmart.com.

With a focus on convenience and integration, Walmart U.S. delivers a seamless omni-channel shopping experience by blending its physical retail locations with eCommerce services.

Nearly all stores offer same-day pickup and delivery options, including features like express delivery within 90 minutes, in-home delivery, and digital pharmacy services.

The Walmart+ membership program enhances this omni-channel approach, offering benefits such as unlimited free shipping with no minimum purchase, unlimited delivery from stores, fuel discounts, mobile Scan & Go capabilities, and exclusive perks for members.

Strategically, Walmart U.S. operates within three core merchandise categories: Grocery, General merchandise, and Health and wellness.

Walmart International: Walmart International ranks as the company’s second largest segment, operating 5,566 stores across 18 countries outside of the United States.

The segment functions through wholly-owned subsidiaries in Canada, Chile, China, and Africa (covering nations such as Botswana, Lesotho, Malawi, Mozambique, Namibia, South Africa, Eswatini, and Zambia), alongside majority-owned subsidiaries in India, and in Mexico and Central America (including Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua).

Walmart International spans diverse formats under two main categories: retail and wholesale. These include supercenters, supermarkets, warehouse clubs like the membership-only Sam’s Club, cash-and-carry stores, and robust eCommerce offerings via websites and mobile apps like walmart.com.mx, walmart.ca, flipkart.com, PhonePe, and others.

The division’s strategy revolves around “bringing Walmart to the world and the world to Walmart.” This means leveraging its global network and localized expertise to deliver affordable products and services, helping millions of customers and members save money and live better daily.

A seamless omni-channel shopping experience is a cornerstone of Walmart International’s approach, integrating physical retail stores with eCommerce. This includes pickup and delivery services across most markets, with same-day delivery as a prominent feature.

Marketplace expansions also play a significant role, opening doors to enhanced fulfillment and advertising services. Walmart International’s merchandising strategy mirrors the breadth and depth of Walmart U.S., ensuring customers access a wide variety of products.

Sam’s Club U.S.: Sam’s Club U.S. operates as a membership-only warehouse club with 600 locations across 44 states in the U.S. and Puerto Rico, alongside its online platform, samsclub.com.

Committed to offering a fast and seamless omni-channel experience, Sam’s Club U.S. integrates physical clubs with eCommerce solutions.

Members enjoy convenient services such as curbside pickup for contact-free shopping, the Scan & Go mobile checkout for skipping lines, and the innovative Just Go feature, introduced in fiscal 2025, which enables frictionless exits.

The club provides merchandise across four key categories: Grocery, General merchandise, Health and wellness, and Fuel.

Memberships come with added value, including a spouse/household card at no extra cost. Club members benefit from free curbside pickup for orders of $50 or more, while Plus members enjoy additional perks such as complimentary delivery-from-club, free shipping on $50+ orders, exclusive discounts, convenience features, and early access to shopping before regular hours.

Beginning in fiscal 2023, Sam’s Club U.S. launched a rewards program allowing members to earn Sam’s Cash on purchases, which can be redeemed for cash, used for future purchases, or applied toward membership fees.

Omni-Channel: Omni-channel refers to a strategy in commerce and customer engagement that provides a seamless and integrated experience across all channels, whether they are online, offline, or hybrid. It’s about making every interaction — from browsing products online to visiting a physical store—feel connected and consistent.

For example:

-

In retail, omni-channel could mean a customer can browse products online, reserve an item on a mobile app, and pick it up in-store, all while receiving consistent information and support.

-

In customer service, omni-channel ensures that whether a customer contacts a company via email, chat, phone, or social media, their inquiries and interactions are unified across these platforms.

The key idea is to break down silos between channels and prioritize the customer’s convenience. Businesses that adopt omni-channel approaches often see improved customer satisfaction and loyalty.

What drives the significant profit contribution from Walmart U.S. segment?

The Walmart U.S. segment significantly contributes to the company’s profitability due to several key factors:

-

Scale and Market Penetration: Walmart U.S. operates over 4,600 stores across the country, ensuring that 90% of the U.S. population lives within 10 miles of a Walmart store. This extensive reach allows Walmart to dominate the retail market.

-

Omni-Channel Strategy: The integration of physical stores with e-commerce platforms, such as Walmart.com, enhances customer convenience. Services like same-day pickup, express delivery, and Walmart+ memberships drive both in-store and online sales.

-

Diverse Product Categories: Walmart U.S. focuses on three core merchandise categories — grocery, general merchandise, and health and wellness. Grocery sales, in particular, are a major revenue driver.

-

Cost Leadership: Walmart’s ability to offer low prices through efficient supply chain management and economies of scale attracts a broad customer base, boosting sales and profitability.

-

Membership and Advertising Income: Programs like Walmart+ and the growth of Walmart Connect’s advertising business contribute additional revenue streams.

Although Walmart’s U.S. segment remains the primary driver of its profits, the company has actively sought to expand its sales and enhance profitability in international markets.

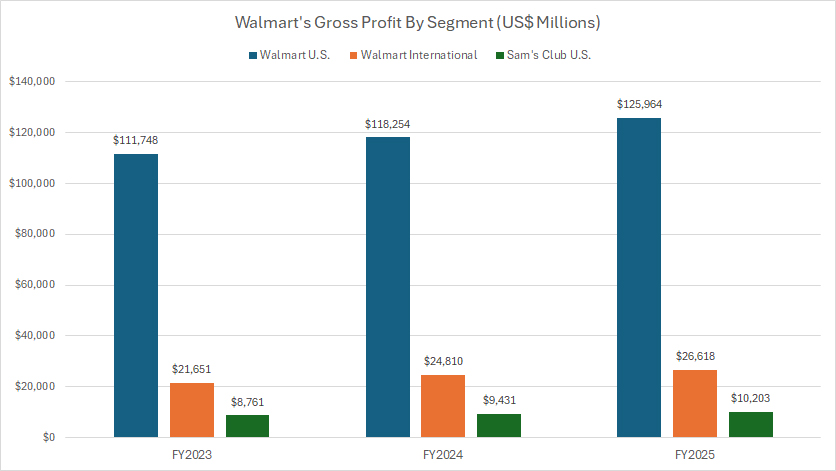

Gross Profit From Walmart U.S., International, and Sam’s Club

Walmart-gross-profit-by-segment

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

Walmart’s profit margin by segment is measured with respect to its net sales. For more information about Walmart’s net sales, you may refer to this section: Walmart’s net sales.

Walmart derives the largest share of its gross profit from the U.S. segment, as illustrated in the chart. In fiscal year 2025, Walmart U.S. reported gross profit of $126.0 billion, approximately $2 billion higher than the $118.3 billion recorded in 2024.

In comparison, Walmart International’s gross profit in fiscal year 2025 amounted to just $26.6 billion, representing only about 20% of the gross profit generated by the U.S. segment.

Sam’s Club U.S. contributes the least to Walmart’s gross profit. For fiscal year 2025, this segment recorded gross profit of only $10.2 billion.

Notably, gross profit across all segments has experienced significant growth over the last three fiscal years, from 2023 to 2025.

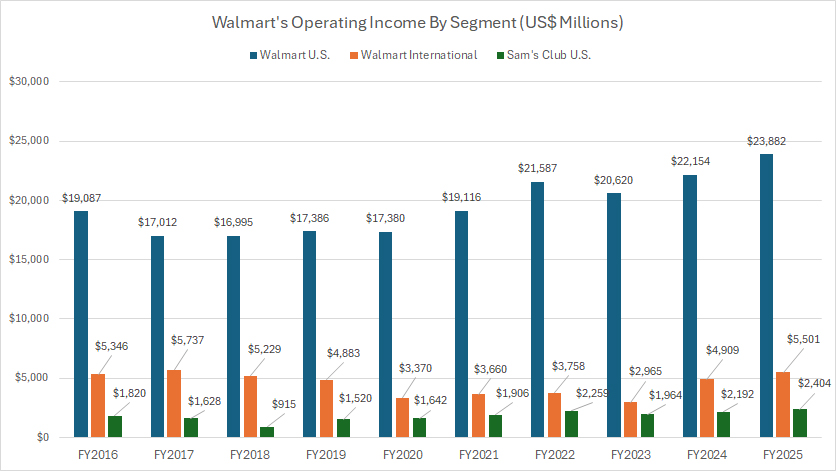

Operating Income From Walmart U.S., International, and Sam’s Club

Walmart-operating-income-by-segment

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

Walmart’s profit margin by segment is measured with respect to its net sales. For more information about Walmart’s net sales, you may refer to this section: Walmart’s net sales.

Walmart U.S. contributes the largest portion of the company’s operating income, reaching $23.9 billion in fiscal year 2025. This represents an increase of $1.5 billion compared to the $22.2 billion reported in 2024.

Over the longer term, spanning fiscal years 2016 to 2025, Walmart U.S. has achieved a 25% growth in operating income, underscoring its steady expansion and profitability.

In contrast, Walmart International recorded $5.5 billion in operating income for fiscal year 2025. Sam’s Club U.S., the smallest contributor among the company’s segments, generated $2.4 billion in operating income during the same period.

Walmart International’s operating income has remained flat over the past decade, influenced by various factors such as currency fluctuations and challenging market conditions.

Conversely, Sam’s Club U.S. saw its operating income rise from $1.8 billion to $2.4 billion between fiscal years 2016 and 2025.

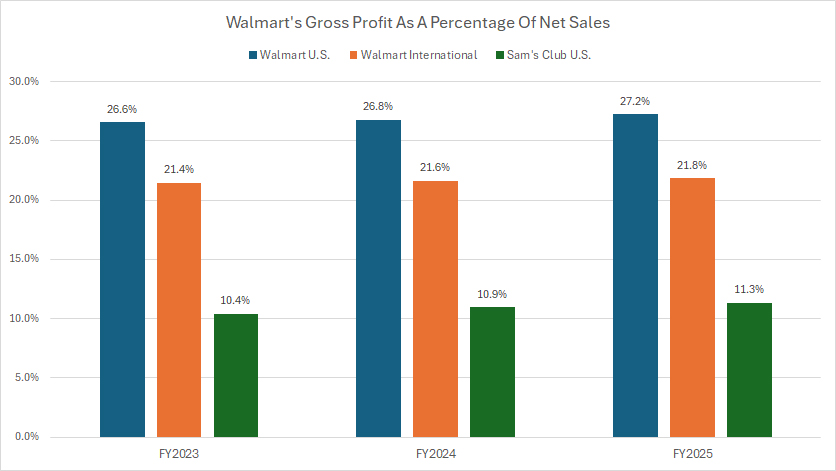

Gross Margin From Walmart U.S., International, and Sam’s Club

Walmart-gross-margin-by-segment

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

Walmart’s profit margin by segment is measured with respect to its net sales. For more information about Walmart’s net sales, you may refer to this section: Walmart’s net sales.

With respect to net sales, Walmart U.S. achieves the highest profitability among all segments, consistently maintaining a ratio of 27% in fiscal year 2025. This margin has remained stable over the past three years.

Walmart International follows with a gross profit margin of 22% in fiscal year 2025, the second highest after the U.S. segment. Similarly, this ratio has shown consistency from fiscal years 2023 to 2025.

In contrast, Sam’s Club U.S. reports the lowest gross margin relative to net sales, totaling just 11% in fiscal year 2025.

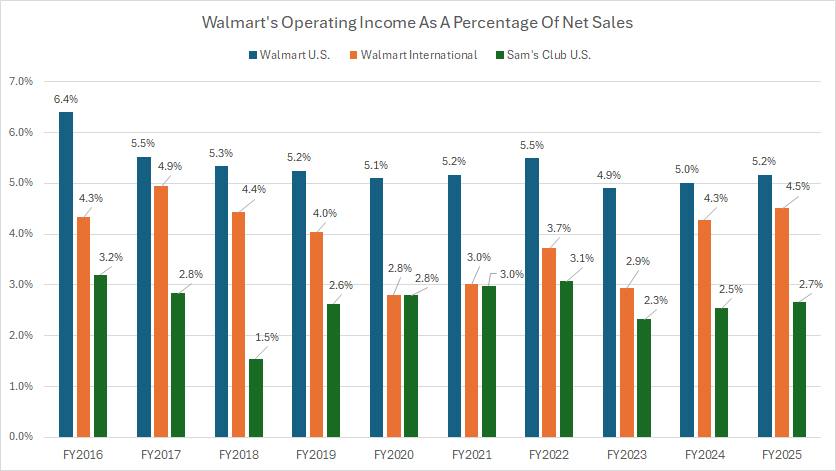

Operating Margin From Walmart U.S., International, and Sam’s Club

Walmart-operating-margin-by-segment

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

Walmart’s profit margin by segment is measured with respect to its net sales. For more information about Walmart’s net sales, you may refer to this section: Walmart’s net sales.

Walmart U.S. achieved an operating profit equivalent to 5% of net sales in fiscal year 2025, marking the highest operating margin among all segments. Over the past five years, the segment has maintained an average operating margin of 5%.

Walmart International reported a slightly lower operating margin relative to net sales, standing at 4.5% in fiscal year 2025. From fiscal years 2021 to 2025, the segment’s average operating margin was 4%.

Sam’s Club U.S. recorded the lowest operating margin, amounting to only 2.7% in fiscal year 2025. Over the five-year period spanning fiscal years 2021 to 2025, its average operating margin stood at 3%.

Insight

Walmart U.S. consistently generates the highest gross profit and operating income among all segments, reflecting its unmatched scale, market penetration, and robust omni-channel strategy.

In contrast, Walmart International operates with a slightly lower gross margin of 22% and an operating margin of 4.5%.

Sam’s Club U.S., known for its membership-based warehouse model, delivers the lowest gross margin and operating margin, at 11% and 2.7% respectively in fiscal year 2025. This reflects the cost structure and competitive pricing typical of its business model.

Essentially, Walmart’s ability to maintain consistent profit margins across all segments while continuing to achieve overall growth in gross profit and operating income. This balance highlights the company’s operational resilience and strategic focus.

References and Credits

1. All financial figures presented were obtained and referenced from Walmart’s annual reports published on the company’s investor relations page: Walmart Investor Relations.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.