Cryptocurrency trading. Pexels image.

This article presents the revenue distribution of Coinbase Global, Inc. (NASDAQ: COIN) across various countries and regions. While the United States remains the primary source of Coinbase’s revenue, a substantial portion is also generated from its international operations.

Let’s look at the details.

For other key statistics of Coinbase Global, you may find more information on these pages:

- Coinbase employee numbers and revenue per employee,

- Coinbase trading volume breakdown: retail and institutional, and

- Coinbase revenue by segment: transaction and subscription.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is Coinbase getting the majority of its revenue from the United States?

Results By Country

C1. Revenue From The U.S. And International

C2. Percentage Of Revenue From The U.S. And International

Revenue Growth

C3. YoY Growth Rates Of Revenue From The U.S. And International

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Revenue By Country: Coinbase defines the revenue broken down by geography based on the domiciles of the customer or other counterparty, according to the annual reports.

Why is Coinbase getting the majority of its revenue from the United States?

Coinbase’s dominance in the U.S. market stems from several interconnected factors:

- Regulatory Clarity: The U.S. has established clearer cryptocurrency regulations compared to many other regions, providing a stable environment for Coinbase to operate and attract both retail and institutional investors.

- Institutional Partnerships: Coinbase has built strong relationships with U.S.-based institutional clients, such as hedge funds and asset managers, who contribute significantly to its trading volume.

- High Adoption Rates: The U.S. has a large and active cryptocurrency user base, driven by a tech-savvy population and increasing interest in digital assets as an investment class.

- First-Mover Advantage: As one of the earliest cryptocurrency exchanges in the U.S., Coinbase has established itself as a trusted and reliable platform, benefiting from brand loyalty.

- Product Offerings: Coinbase provides a wide range of services tailored to U.S. customers, including staking, advanced trading tools, and seamless fiat-to-crypto transactions.

However, Coinbase is actively working to expand its international presence. For example, it has launched operations in countries like Canada and Brazil, obtained licenses in regions such as Spain and Singapore, and introduced its International Exchange to cater to institutional clients outside the U.S.

Revenue From The U.S. And International

coinbase-revenue-by-country

(click image to expand)

The definition of Coinbase’s revenue by country is available here: revenue by country.

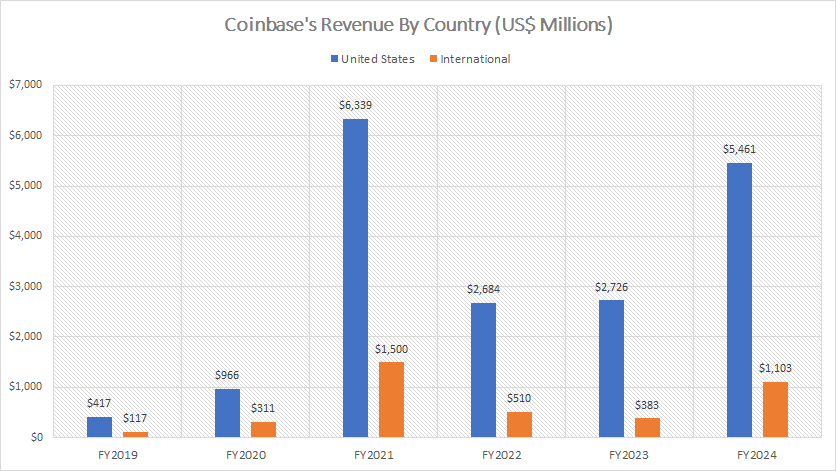

The majority of Coinbase’s revenue originates from the United States, with the remainder coming from various international markets, as illustrated in the chart above.

In fiscal year 2024, Coinbase’s revenue from the U.S. reached an impressive $5.5 billion, showcasing a substantial recovery compared to the $2.7 billion recorded in 2023. This significant growth reflects strong market conditions and increased trading activity among U.S.-based customers. However, despite this recovery, the 2024 figure still falls short of the historical high of $6.3 billion achieved in fiscal year 2021, highlighting room for further growth in its domestic market.

Similarly, Coinbase’s international revenue experienced notable growth post-pandemic. In fiscal year 2024, international revenue surged to $1.1 billion, more than triple the $383 million reported in 2023. This increase signals a rebound in global cryptocurrency adoption and Coinbase’s efforts to expand its presence in international markets. Nonetheless, the 2024 international revenue figure remains below the historical high of $1.5 billion recorded in fiscal year 2021, suggesting that Coinbase’s global business still has opportunities to regain its prior momentum.

These trends highlight the dual recovery trajectories of Coinbase’s domestic and international revenue streams. While the U.S. continues to serve as the cornerstone of Coinbase’s revenue base, the growth in international markets underscores the company’s potential to capitalize on the expanding global cryptocurrency ecosystem. This could be further supported by strategic initiatives such as market entry into key international regions and the enhancement of localized services for non-U.S. customers.

Percentage Of Revenue From The U.S. And International

coinbase-revenue-by-country-in-percentage

(click image to expand)

The definition of Coinbase’s revenue by country is available here: revenue by country.

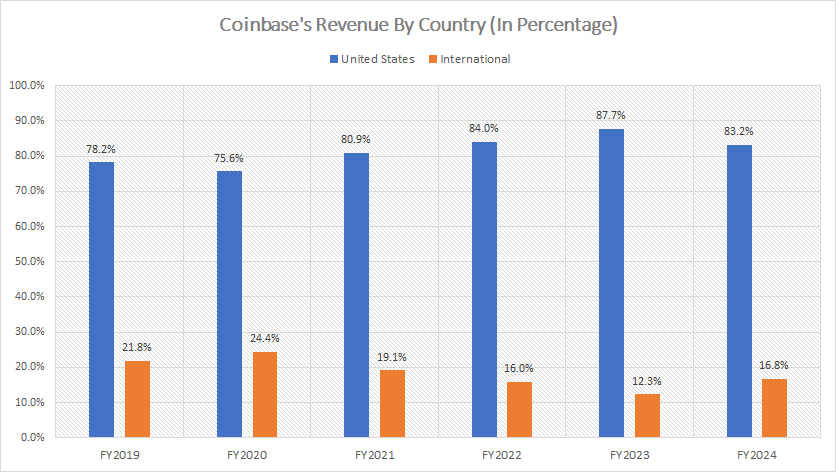

Coinbase’s financial performance in fiscal year 2024 highlights an evolving revenue distribution between its domestic and international operations. The company reported that its U.S. revenue constituted approximately 83% of its total revenue for the year.

This marked a slight decline from the 88% recorded in fiscal year 2023, despite a robust increase in absolute revenue during the same period. The decrease in the U.S. revenue share suggests that international markets contributed more significantly to overall growth.

Correspondingly, Coinbase’s international revenue accounted for 17% of the total in 2024, reflecting an increase from the 12% reported in 2023. This upward trend indicates a growing diversification of the company’s revenue base, with international operations playing a more prominent role in driving Coinbase’s financial success.

Examining the revenue composition over a longer horizon, from fiscal year 2019 through 2024, there has been a modest shift in the company’s geographic revenue distribution. During this six-year period, Coinbase’s U.S. revenue share experienced a slight rise, growing from 78% in 2019 to 83% in 2024.

Conversely, the international revenue share declined from 22% in 2019 to 17% in 2024. This broader trend underscores the enduring dominance of the U.S. market in Coinbase’s operations, although international markets have exhibited notable growth in recent years. Such shifts provide valuable insights into the strategic balance Coinbase is striking between its domestic stronghold and expanding global reach.

YoY Growth Rates Of Revenue From The U.S. And International

coinbase-revenue-by-country-yoy-growth-rates

(click image to expand)

The definition of Coinbase’s revenue by country is available here: revenue by country.

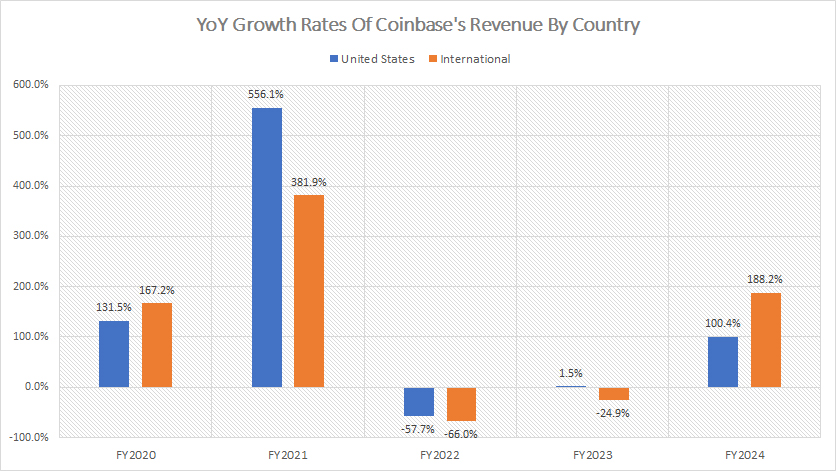

From 2019 to 2024, Coinbase’s revenue growth trajectory highlights a volatile yet dynamic journey, culminating in a remarkable rebound in 2024. In that fiscal year, the company’s U.S. revenue demonstrated an impressive resurgence, skyrocketing by 100%. Notably, Coinbase’s international markets outpaced this growth significantly, achieving an extraordinary expansion rate of 188%. These figures underscore the growing impact and potential of Coinbase’s international operations as a key driver of its financial recovery and future prospects.

In stark contrast, financial years 2023 and 2022 were marked by notable downturns, with revenue growth experiencing average double-digit declines. These periods of contraction stand out as significant challenges in Coinbase’s financial narrative, reflective of broader market volatility and shifts in the cryptocurrency sector.

Despite these occasional setbacks, Coinbase’s earlier years were characterized by extraordinary revenue growth, fueled by the initial wave of cryptocurrency adoption. Fiscal year 2021 stands as a particularly remarkable milestone, with Coinbase achieving phenomenal growth rates. U.S. revenue surged by an astounding 556%, while the international segment posted an equally striking 382% increase. These explosive figures highlight the pivotal role of early market momentum in Coinbase’s rapid expansion.

The momentum was already evident in fiscal year 2020, which saw both U.S. and international markets enjoying robust revenue growth rates exceeding 100% year-over-year. This period reflects the early enthusiasm and widespread adoption of cryptocurrencies, which significantly bolstered Coinbase’s financial performance and positioned the company as a leading player in the cryptocurrency exchange ecosystem.

Through this period, Coinbase’s revenue journey captures the essence of the cryptocurrency market’s highs and lows, revealing its capacity to recover and adapt in the face of challenges while continuing to capitalize on growth opportunities in both domestic and international markets.

Conclusion

Overall, Coinbase’s financial performance underscores the critical balance between sustaining its stronghold in the U.S. market and leveraging growth opportunities in international markets. While the U.S. market remains a bedrock for the company, the faster growth in international revenue in years like 2024 signals the potential for global diversification. Strategic investments in international expansion could enable Coinbase to mitigate the effects of market volatility and capture a broader share of the growing cryptocurrency ecosystem.

Credits and References

1. All financial figures presented were obtained and referenced from Coinbase Global, Inc.’s annual reports published on the company’s investor relations page: Coinbase Investor Relations.

2. Pixabay images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.