Altria’s logo. Source: Flickr

When it comes to cigarettes, you may not know Altria (NYSE:MO), but you certainly have heard of Marlboro.

For your information, Marlboro is one of the world’s most well-known cigarette brands owned by Philip Morris USA and Philip Morris International.

The company that owns Philip Morris USA, the maker of Marlboro cigarettes, is Altria (NYSE:MO). Additionally, Altria also owns John Middleton, the maker of the popular Black & Mild cigar.

Altria’s revenue excluding excise duty for cigarettes and cigars alone totaled $18 billion in fiscal 2023, the largest among all product segments, and accounted for 88% of the company’s total revenue, according to this article – Altria revenue by product segment and profit margin.

On top of that, the smokeable product segment, as Altria calls it, produced more than $10 billion in operating income for the company in 2023, also the largest by product category, according to the same page.

Therefore, Altria’s sales of cigarettes and cigars contribute to the majority of the revenue and profit of the company.

In this article, we cover only the statistics of Altria’s smokeable product segment which include the revenue figures, sales volumes, and market share.

Let’s look at the numbers!

Investors interested in Altria’s smokeless product segment may find more resources on this page – Altria smokeless product sales and market share.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Altria Expand Its Cigarette Sales And Market Share?

Consolidated Revenue

A1. Smokeable Product Revenue

A2. YoY Growth Rates Of Smokeable Product Revenue

Consolidated Sales Volume

B1. Smokeable Products Sales Volumes

B2. YoY Growth Rates Of Smokeable Products Sales Volumes

Cigarette Sales Volume

C1. Total Cigarette Sales Volumes

C2. Percentage Of Cigarette Sales To Smokeable Product Volume

Marlboro Sales

C3. Marlboro Sales Volumes

C4. Percentage Of Marlboro Sales To Total Cigarette Volume

Cigarette Market Share

C5. Cigarette And Marlboro Market Share

Cigar Sales Volume

D1. Total Cigar Sales Volumes

D2. Percentage Of Cigar Sales To Smokeable Product Volume

Black & Mild Sales

D3. Black & Mild Sales Volumes

D4. Percentage Of Black & Mild Sales To Total Cigar Volume

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Smokeable Product Segment: Altria’s smokeable product segment primarily consists of the manufacturing and sales of cigarettes, cigars, and pipe tobacco.

This segment is managed under Altria Group, Inc., one of the largest tobacco companies in the world. The company’s most recognized and leading brand within the smokeable product category is Marlboro, which holds a significant position in the U.S. cigarette market.

Apart from cigarettes, Altria also invests in smokeless tobacco products and e-cigarettes, aiming to diversify its portfolio in response to shifting consumer preferences towards reduced-risk products.

However, the smokeable product segment remains a cornerstone of Altria’s business operations, generating the majority of the company’s revenue.

Retail Share: In the context of a specific product, retail share refers to the percentage of sales or volume that the product holds within a particular retail market or category.

This metric significantly indicates the product’s market position, competitiveness, and appeal to consumers within retail environments. It’s calculated by dividing the product’s sales by the total sales of all similar products in the same category, then multiplying by 100 to get a percentage.

Retail share offers insights into the product’s performance, helps understand consumer preferences, and aids in strategic decision-making for marketing, distribution, and product development.

According to Altria, its retail share results for cigarettes are based on data from Circana, Inc. and Circana Group, L.P. (“Circana”), as well as, Management Science Associates, Inc.

Circana is a newly formed company reflecting the recent merger of IRI and NPD Group, Inc. Circana maintains a blended retail service that uses a sample of stores and certain wholesale shipments to project market share and depict share trends.

This service tracks sales in the food, drug, mass merchandisers, convenience, military, dollar store and club trade classes. For other trade classes selling cigarettes, retail share is based on shipments from wholesalers to retailers through the Store Tracking Analytical Reporting System (“STARS”), as provided by Management Science Associates, Inc.

This service is not designed to capture sales through other channels, including the internet, direct mail and some illicitly tax-advantaged outlets. It is the standard practice of retail services to periodically refresh their retail scan services, which could restate retail share results that were previously released in these services.

How Does Altria Expand Its Cigarette Sales And Market Share?

To increase its cigarette sales and market share, a company like Altria, one of the largest tobacco companies, might employ various strategies, focusing on innovation, marketing, and adaptability to changing market dynamics and regulatory environments. Here are several approaches:

1. **Product Innovation and Diversification**: Developing new products or enhancing existing ones to meet consumers’ evolving preferences. This could include introducing cigarettes with different flavors, nicotine levels, or reduced-harm tobacco products. Altria has also diversified into non-combustible products like e-cigarettes and heated tobacco products to capture a broader market.

2. **Brand Management and Marketing**: Effective branding and marketing are key. This could involve targeted advertising campaigns, promotional offers, and loyalty programs to retain existing customers and attract new ones. While there are significant regulations around cigarette advertising, companies find ways to effectively market their products within those constraints.

3. **Distribution Channels**: Expanding and optimizing distribution channels to ensure product availability in various retail outlets, including convenience stores, supermarkets, and specialized tobacco shops. Streamlining the distribution process can also lower costs and improve market penetration.

4. **Pricing Strategies**: Implementing competitive pricing strategies to appeal to a broader demographic. This might include offering products at different prices to cater to premium and budget-conscious consumers.

5. **Regulatory Navigation**: Proactively managing regulatory challenges by engaging with policymakers, complying with regulations, and advocating for favorable policies. Understanding and adapting to the regulatory landscape can help mitigate risks and seize opportunities.

6. **Consumer Engagement**: Foster strong relationships with consumers through customer service, social media, and community engagement. This can help build brand loyalty and encourage word-of-mouth promotion.

7. **Research and Development**: Investing in research and development to continuously innovate and improve product offerings. This also includes efforts to develop products that may be perceived as less harmful, which could appeal to health-conscious consumers.

8. **Global Expansion**: Exploring opportunities in emerging markets where there might be less stringent regulations and a growing demand for tobacco products.

It’s important to note that tobacco companies like Altria operate in a highly regulated environment due to the health risks associated with tobacco use. In response to growing health concerns and regulatory pressures, such companies are increasingly focusing on developing and promoting reduced-risk products as part of their growth strategy.

Smokeable Product Revenue

Altria smokeable product revenue

(click image to expand)

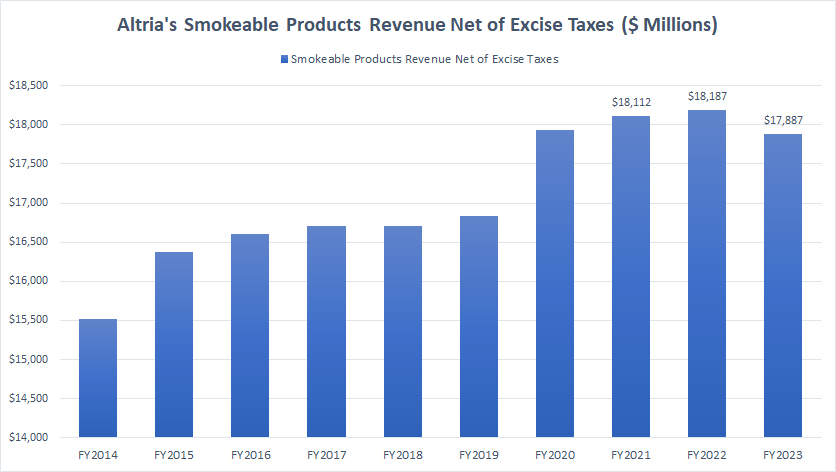

Altria’s smokeable product revenue is generated primarily from the sales of cigarettes and cigars. Since fiscal year 2014, Altria’s smokeable product revenue has significantly risen, reaching $17.9 billion as of the end of fiscal year 2023. Between 2015 and 2023, Altria’s smokeable product revenue has increased by 15%.

Altria’s latest revenue figure accounted for 88% of the company’s total net revenue excluding excise taxes, according to this article – Altria revenue breakdown by segment.

A particular trend worth mentioning is the significant rise of the smokeable product revenue in 2020 over the prior year.

For example, the figure rose by about 6.5% to nearly $18 billion in fiscal 2020, the biggest growth since 2014 and this happened during the height of the COVID-19 pandemic.

The reason for the considerable rise was due to the increase in smoking rates during the pandemic. For instance, the pandemic brought about significant amounts of stress and anxiety among people. For some, smoking is a coping mechanism to manage stress, leading to increased consumption of tobacco products.

Nevertheless, Altria’s smokeable product revenue has remained flat at $18 billion after the pandemic since 2020.

YoY Growth Rates Of Smokeable Product Revenue

altria-yoy-growth-rates-of-smokeable-product-revenue-by-year

(click image to expand)

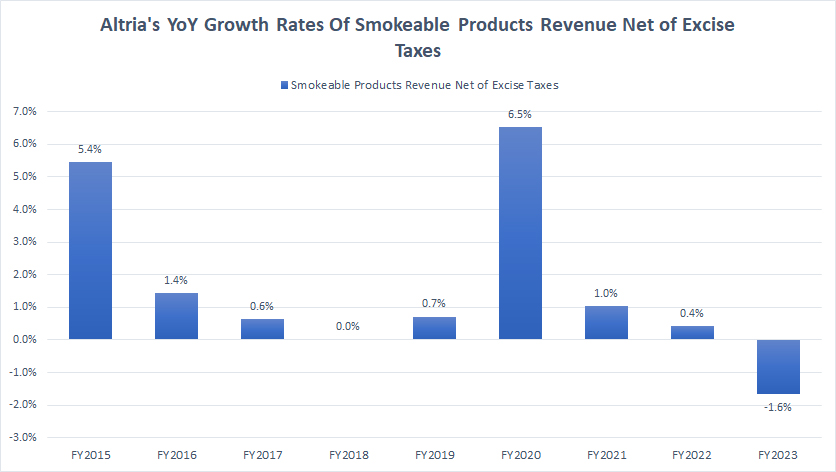

Altria’s smokeable product revenue grew significantly higher during the height of the COVID-19 pandemic in fiscal year 2020, notably at 6.5%, the highest growth rate ever measured over the last nine years, as depicted in the chart above.

Subsequently, the growth of Altria’s smokable product revenue has remained relatively muted. On average, Altria’s smokable product revenue has grown by 0.0% annually after the pandemic between 2021 and 2023.

Smokeable Product Sales Volumes

Altria smokeable product sales volume by year

(click image to expand)

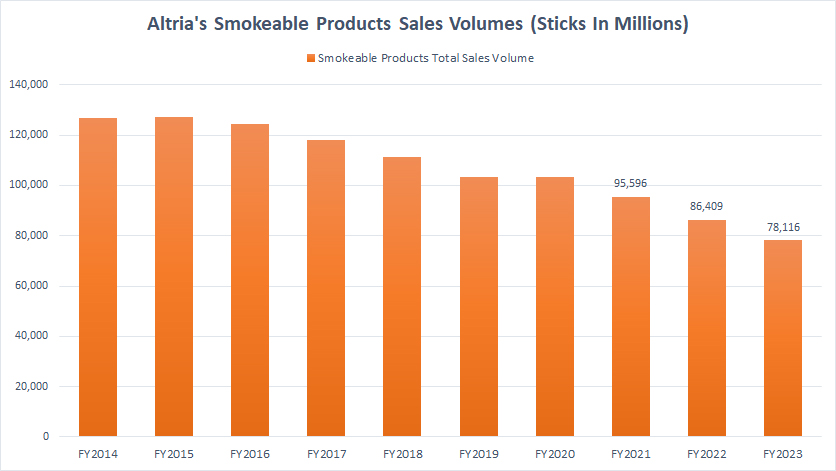

Altria’s smokeable product sales volumes consist of the combined shipment volumes of cigarettes and cigars.

While the smokeable product revenue has significantly risen over the past nine years which we saw earlier, it has been the opposite for shipment volumes.

As seen in the chart above, Altria’s smokeable product shipment volumes have steadily declined during the same period.

In fiscal year 2023, sales volume in this segment reached only 78 billion sticks, the lowest level ever recorded.

In terms of growth rate, Altria’s smokeable product sales volume has declined by 38% since fiscal year 2014, down from nearly 130 billion sticks in 2014 to just 78 billion sticks as of 2023.

YoY Growth Rates Of Smokeable Product Sales Volumes

altria-yoy-growth-rates-of-smokeable-product-shipment-volumes-by-year

(click image to expand)

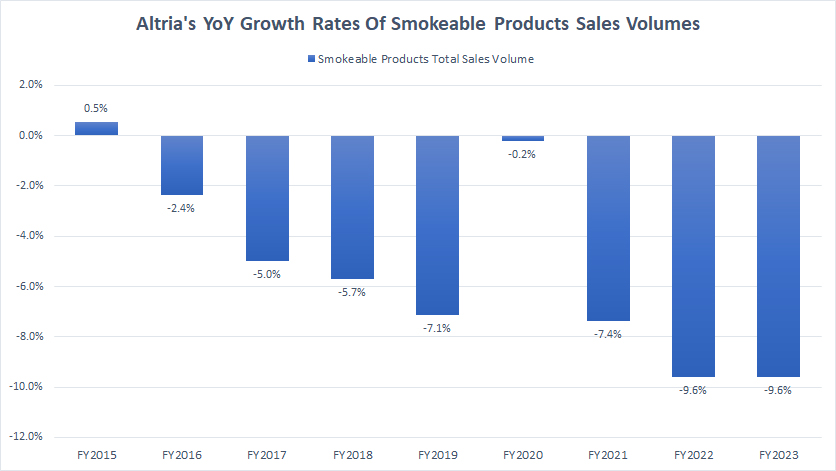

You can see from the growth rate chart above that the growth of Altria’s sales volume under the smokeable product segment has hardly recorded a positive number.

In most fiscal years, Altria’s sales volume under the smokeable product segment has been in a decline.

On average, the growth of Altria’s sales within the smokeable product segment has measured -9% annually over the last three years.

A noticeable trend is that the decrease in sales was among the smallest during the height of the COVID-19 pandemic in fiscal year 2020, notably at -0.2%.

With lockdowns and social distancing measures in place during the pandemic, many individuals found themselves with more discretionary time.

The lack of usual social activities or the transition to working from home for some meant that there were more opportunities for smoking, and thereby the slowest decline in sales for tobacco products such as cigarettes and cigars.

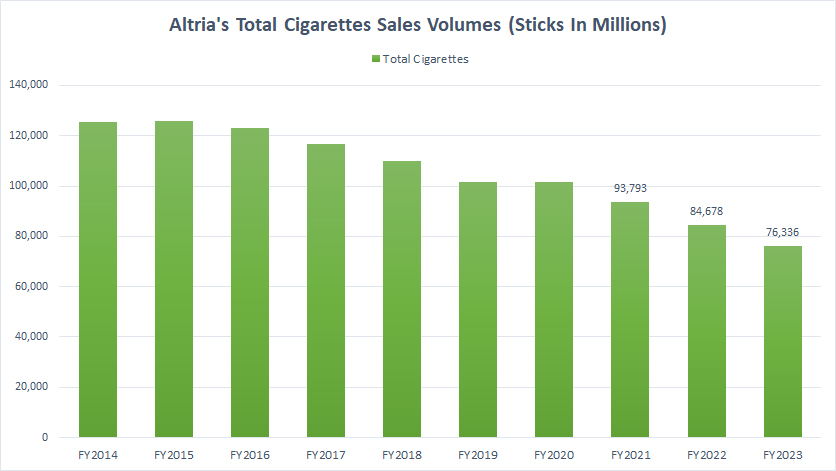

Total Cigarette Sales Volumes

Altria cigarette sales volume by year

(click image to expand)

Altria’s sales volumes within the smokeable product segment can be broken down into two categories: cigarettes and cigars.

This section shows only Altria’s cigarette shipment volumes between FY2014 and FY2024.

Altria’s total cigarette sales have been declining, as depicted in the chart above. Since fiscal year 2014, Altria’s cigarette sales have decreased by 40%, down from 125 billion sticks in 2014 to just 76 billion sticks as of 2023.

As of fiscal year 2023, Altria’s total cigarette shipment volumes reached only 76 billion sticks, the lowest level ever recorded.

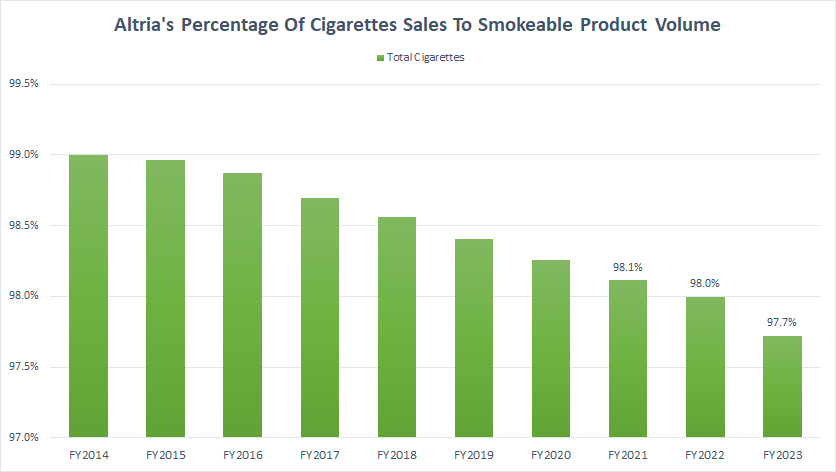

Percentage Of Cigarette Sales To Smokeable Product Volume

Altria percentage of cigarette sales to smokeable segment total volume

(click image to expand)

Altria’s cigarette sales volume has formed the biggest percentage within the smokeable product segment. As shown in the chart, Altria’s total cigarette sales contributed 97.7% of sales to the total volume within the smokeable product segment as of 2023.

However, this ratio has been on a steady decline since 2014. The ratio was much higher at 99% back in 2014.

Since 2014, the percentage has declined by more than 1 percentage point during the 10-year period. What has declined in one product segment is a gain in another product segment.

Altria’s percentage decline in cigarette sales volume is replaced by the gain in the percentage of cigar sales which we will see in later discussions.

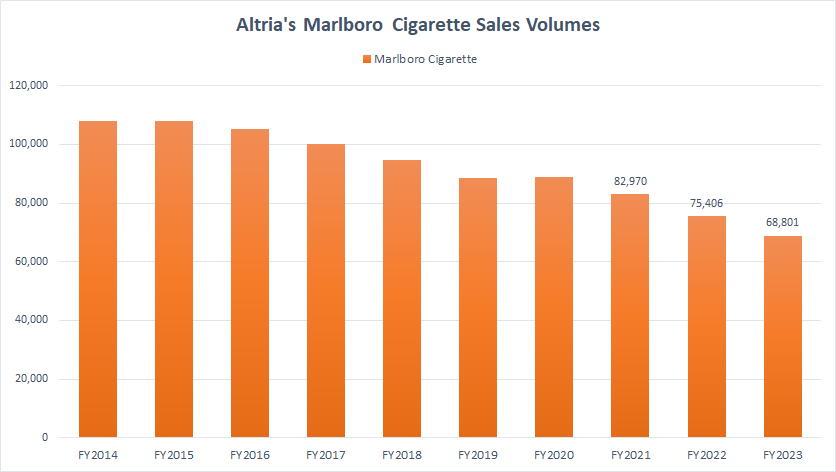

Marlboro Sales Volumes

Altria Marlboro sales volume by year

(click image to expand)

Marlboro is Altria’s most popular product by sales volume within the smokeable product segment.

In addition, Marlboro also is the most popular product by sales volume within the cigarette segment. Altria’s Marlboro cigarette sales outpace all other cigarette brand names by a massive margin.

Despite the popularity of Marlboro, Altria’s Marlboro sales in the U.S. have been declining, as shown in the chart above.

For your information, Altria has the right to sell the Marlboro cigarette only within the U.S. as the right to ship Marlboro internationally is owned by Philip Morris International.

That said, Altria’s Marlboro sales in the U.S. totaled just 69 billion sticks as of 2023, a decline of 36% from the 108 billion sticks in 2014.

Since 2014, Altria’s Marlboro sales have decreased by more than 30% over the last ten years or 4% annually on average.

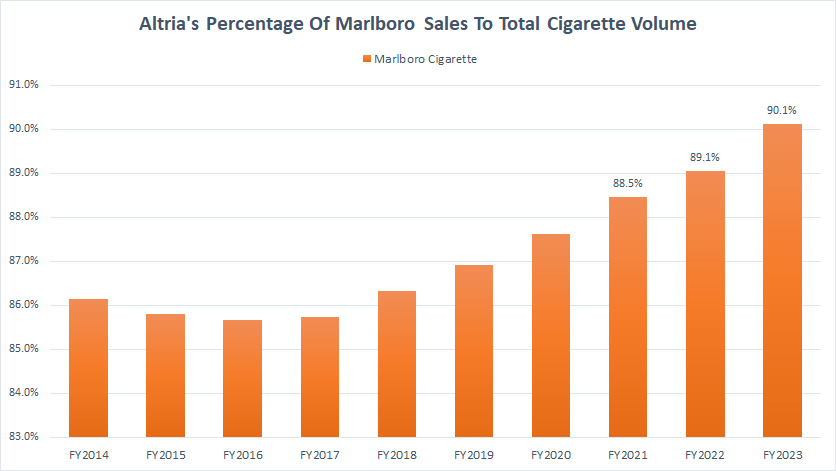

Percentage Of Marlboro Sales To Total Cigarette Volume

Altria percentage of Marlboro sales to cigarette total volume

(click image to expand)

Altria’s Marlboro has contributed the biggest sales percentage to the company within the cigarette segment. As seen, Altria’s Marlboro sales volume made up 90% of the total cigarette volume as of 2023. The ratio has been on the rise too.

In fiscal year 2014, Altria’s sales of Marlboro cigarettes contributed just 86% of volume to the total cigarette volume. However, this figure has risen to 90% as of 2023 despite the declining sales figures all these years.

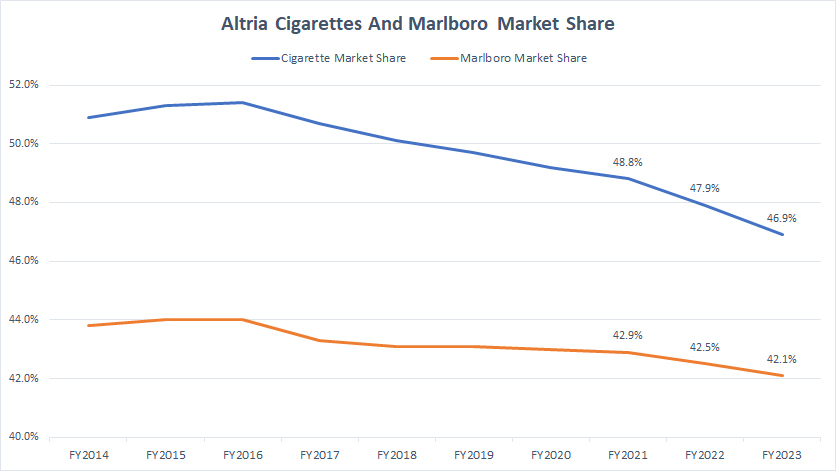

Cigarettes And Marlboro Market Share

Altria cigarette and Marlboro market share

(click image to expand)

The definition of Altria’s market share is available here: market share. According to Altria, the market share or retail share results for cigarettes are measured based on the following assumption:

-

Retail share results for cigarettes are based on data from IRI/Management Science Associates, Inc., a tracking service that uses a sample of stores and certain wholesale shipments to project market share and depicts share trends.

This service tracks sales in the food, drug, mass merchandisers, convenience, military, dollar store, and club trade classes.

For other trade classes selling cigarettes, the retail share is based on shipments from wholesalers to retailers through the Store Tracking Analytical Reporting System (“STARS”).

Also, the market share data presented refer to sales volume conducted in only the U.S.

That said, Altria’s market share for cigarettes and Marlboro in the U.S. has been declining over the last several years.

Accordingly, Altria’s market share for cigarette in the U.S. has plunged from 51% in fiscal 2014 to 46.9% as of fiscal 2023.

A similar trend occurs for Marlboro’s market share whose number has plunged from 44% in fiscal 2014 to 42.1% as of 2023.

Both market share numbers reported in 2023 represent new lows in over ten years.

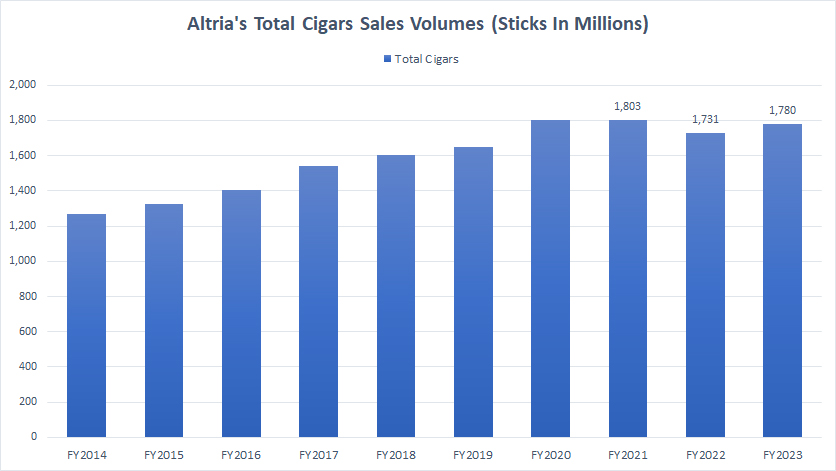

Total Cigar Sales Volumes

Altria cigar sales volume by year

(click image to expand)

Aside from cigarettes, Altria also ships cigars within the smokeable product segment. However, Altria’s cigar sales volume is much smaller than that of cigarettes.

In fiscal 2023, Altria shipped only 1.8 billion sticks of cigars in the entire year, a much smaller number compared to cigarettes.

A trend worth mentioning is the increasing sales volume of Altria’s cigars over the years. As seen, Altria’s cigar sales volume has been steadily rising since fiscal year 2014.

The growth of Altria’s cigar sales is contrary to its cigarette volume which has been declining, as shown in prior discussions.

Since 2014, Altria’s total cigar sales have increased by 40% during the 10-year period or roughly 4.4% annually on average.

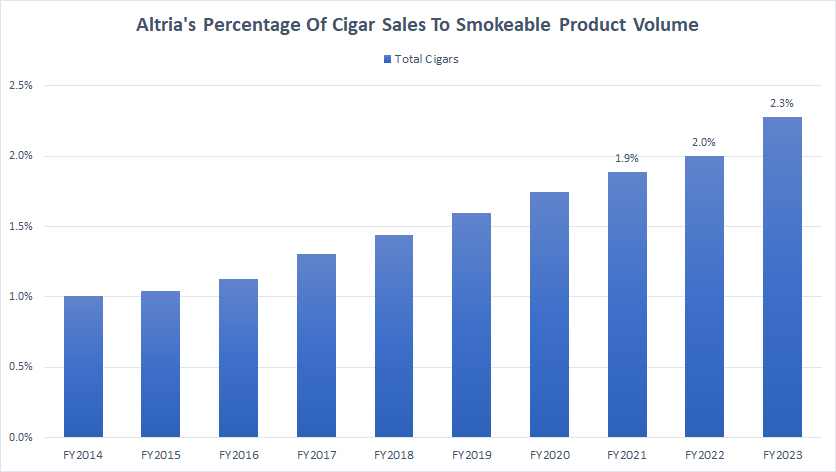

Percentage Of Cigar Sales To Smokeable Product Volume

Altria percentage of cigar sales to smokeable segment total volume

(click image to expand)

Although Altria’s cigar sales have been increasing, they have made up only a tiny portion of the total volume. As of 2023, the contribution from cigar reached just 2.3% of the total volume within the smokeable product segment.

Despite the growing percentage points over the years, Altria’s cigar volume is far from that of cigarettes.

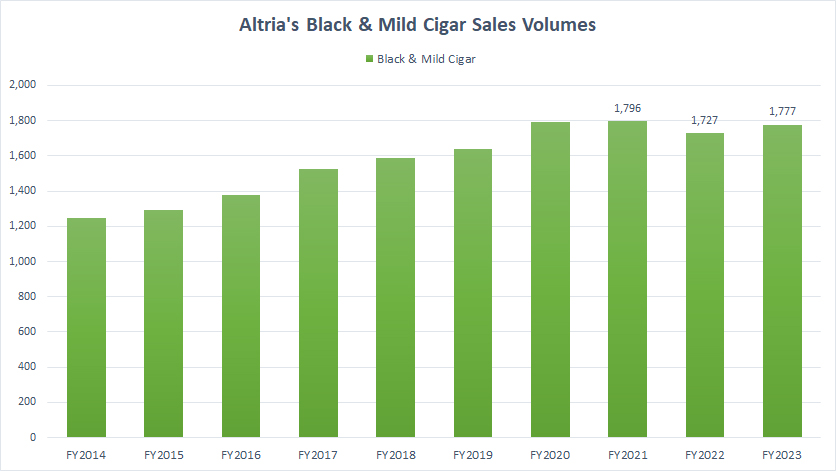

Black & Mild Sales Volumes

Altria Black & Mild sales volume by year

(click image to expand)

Black & Mild is one of Altria’s popular cigar brand names and the sales volume from this brand alone makes up nearly the entire volume of the company’s cigar sales.

While cigar sales volume has been steadily going higher, the figure is far smaller compared to that of cigarettes.

As shown in the chart above, Altria recorded a sales volume of only 1.8 billion sticks in 2023 for the Black & Mild cigar.

This figure has risen by 43% since 2014 or roughly 5% annually on average over the last ten years. In this aspect, Altria’s Black & Mild sales volume has increased from 1.2 billion sticks in 2014 to 1.8 billion sticks as of 2023.

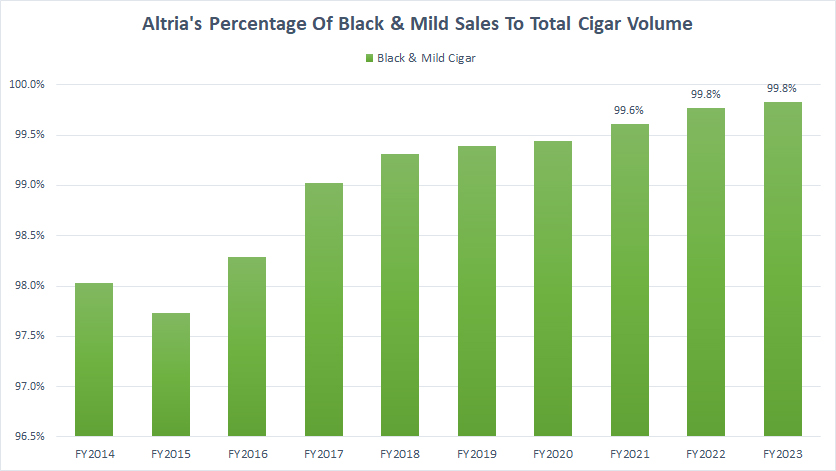

Percentage Of Black & Mild Sales To Total Cigar Volume

Altria percentage of Black & Mild sales to cigar total volume

(click image to expand)

Altria’s Black & Mild cigars comprise nearly 100% of the total cigar volume. As of 2023, this figure reached 99.8% and has risen from 98% recorded in 2014.

In other words, Altria’s total cigar volume is entirely made up of just one brand, which is Black & Mild.

Summary

In summary, Altria’s sales volume for cigarettes, Marlboro in particular, has steadily been declining over the last decade.

A similar downtrend is seen in Altria’s market share for cigarettes.

While cigarette sales volume has declined, the revenue has increased, illustrating that Altria has raised the price of cigarettes all these years to make up for the decrease in volume.

On the other hand, Altria’s cigar sales volume has been on the increase.

Despite the rise in cigar sales volume, it made up only 2% of the total smokeable product volume compared to 98% for cigarettes.

Therefore, Altria is still pretty much a cigarette company.

References and Credits

1. All data presented in this article were referenced and obtained from Altria’s earnings reports, SEC filings, quarterly and annual statements, webcast, investor presentations, etc., which are available in Altria SEC Filings.

2. Featured images in this article are used under creative commons license and sourced from the following websites: flickr.com/volver-avanzar and Ivan Radic.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

Also, the content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!