Property. Pexels Image.

This article provides a detailed breakdown of Berkshire Hathaway’s insurance premiums written, categorized by regions and countries, including the United States, Asia Pacific, Western Europe, and others.

For a definition of insurance premiums written and earned, you may visit this section: insurance premiums written and earned.

Let’s take a look!

Investors looking for other statistics of Berkshire Hathaway may find more resources on these pages:

- Berkshire Hathaway insurance vs non-insurance revenue,

- Berkshire Hathaway insurance revenue by subsidiary, and

- Berkshire Hathaway profit margin by business segment

.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Berkshire Hathaway Earn Its Insurance Revenue?

Insurance Premiums Written By Region And Country

A1. United States, Asia Pacific, Western Europe, And Other

Insurance Premiums Written As A Percentage Of Total

A2. United States, Asia Pacific, Western Europe, And Other

Growth Rates Of Insurance Premiums Written

A3. United States, Asia Pacific, Western Europe, And Other

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Insurance Premiums Written And Earned: The terms “insurance premiums earned” and “insurance premiums written” refer to different aspects of an insurance company’s revenue:

Written Premium: This is the total amount of premium income that an insurance company records when it issues new policies during a specific period. It represents the sales of new insurance contracts, regardless of whether the coverage period has elapsed. For example, if an insurance company sells 1,000 new policies at $1,000 each, the written premium for that period would be $1 million.

Earned Premium: This is the portion of the written premium that the insurance company has actually earned by providing coverage over a specific period. It reflects the amount of premium that corresponds to the time the insurer has been on risk for the policyholder. For instance, if a policyholder pays a $1,000 annual premium, the earned premium for six months would be $500, as the insurer has provided coverage for half the policy term.

In summary, written premiums represent the total potential revenue from new policies sold, while earned premiums represent the actual revenue recognized for the coverage provided during a specific period.

How Does Berkshire Hathaway Earn Its Insurance Revenue?

Berkshire Hathaway earns its insurance revenue through two primary sources:

1. Insurance Underwriting

This involves evaluating the risks associated with insuring individuals, properties, or entities and determining the terms and conditions of the insurance policies. Berkshire Hathaway’s insurance subsidiaries, such as GEICO and Berkshire Hathaway Reinsurance Group, generate revenue by collecting premiums from policyholders.

2. Investment Income

Berkshire Hathaway also earns revenue from investments made with the premiums collected. The company invests these funds in a diverse portfolio of stocks, bonds, and other assets, generating additional income through interest, dividends, and capital gains.

These two sources combined contribute to Berkshire Hathaway’s substantial insurance revenue, making it one of the largest insurance companies in the world.

A comprehensive statistics of Berkshire’s insurance underwriting revenue and investment income is available on this page: Berkshire insurance underwriting revenue and investment income.

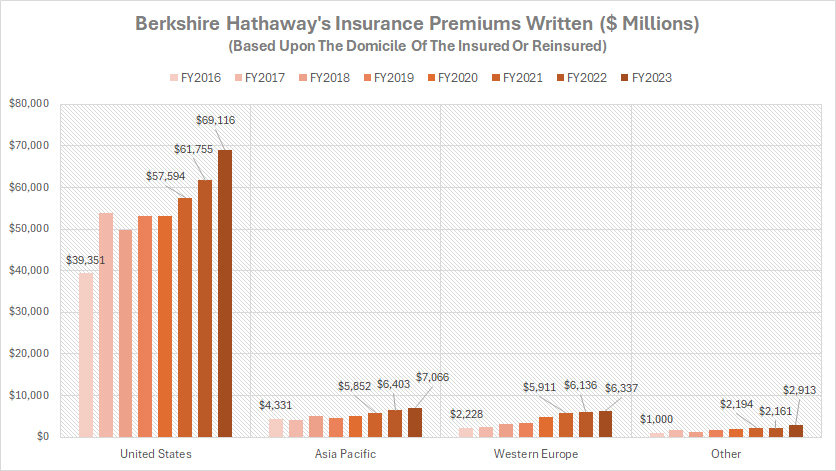

United States, Asia Pacific, Western Europe, And Other

berkshire-insurance-premiums-written

(click image to expand)

You can find the definitions of Berkshire’s insurance premiums written and earned here: insurance premiums written and earned.

Berkshire Hathaway generates the majority of its insurance premiums written from the United States, as illustrated in the graph above.

Over the past three years, Berkshire Hathaway’s insurance premiums written from the United States have grown from $57.6 billion to $69.1 billion, reflecting a 20% increase. Since fiscal year 2016, this growth has been even more impressive, with premiums rising by 75%, from $39.4 billion to $69.1 billion over eight years. As of fiscal year 2023, Berkshire Hathaway’s U.S. insurance premiums written reached $69.1 billion, the highest figure recorded in the past eight years.

In the Asia Pacific region, Berkshire Hathaway generated approximately $7.1 billion in insurance premiums written in fiscal year 2023. Over the past three years, these premiums have grown from $5.9 billion to $7.1 billion, marking a 20% increase. Since fiscal year 2016, Berkshire has seen even more substantial growth, with premiums rising by 65%, from $4.3 billion in 2016 to $7.1 billion in 2023.

Western Europe represents Berkshire Hathaway’s third-largest source of insurance premiums written, with total premiums reaching $6.3 billion in fiscal year 2023. Over the past three years, Berkshire’s insurance premiums written in Western Europe have increased by 7%, rising from $5.9 billion in 2021 to $6.3 billion in 2023. On a longer-term basis, Berkshire has seen even more impressive growth in the Western Europe region, with insurance premiums nearly tripling since fiscal year 2016.

Berkshire Hathaway’s insurance premiums written in other regions and countries totaled $2.9 billion as of fiscal year 2023, the highest level ever reported in eight years.

Berkshire Hathaway’s strong market presence in the United States is driven by several factors. A notable one is the company’s well-established brands, such as GEICO, which have consistently enjoyed high levels of consumer trust and recognition in the U.S.

Additionally, the highly regulated U.S. insurance market has provided a stable and predictable environment for insurers like Berkshire Hathaway to operate and grow. Furthermore, the company has built a large and loyal customer base in the U.S., which contributes significantly to its premium volume compared to other countries and regions.

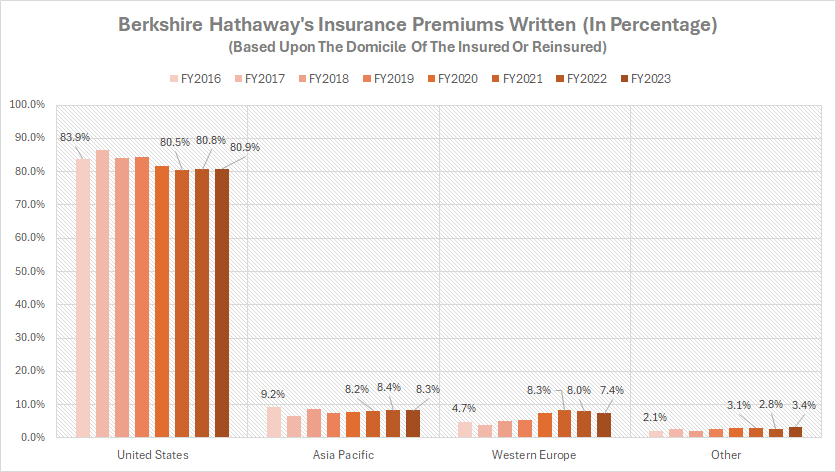

United States, Asia Pacific, Western Europe, And Other

berkshire-insurance-premiums-written-in-percentage

(click image to expand)

You can find the definitions of Berkshire’s insurance premiums written and earned here: insurance premiums written and earned.

As a percentage of the total premiums written, Berkshire Hathaway’s insurance premiums written from the United States accounted for 81% of the total in fiscal year 2023, the largest among all countries compared. This ratio has remained relatively steady over the past three years but is slightly lower than the 84% recorded in 2016.

On the other hand, in fiscal year 2023, the premiums written in the Asia Pacific region formed just 8.3% of the total. Western Europe accounted for an even smaller percentage, only 7.4% in fiscal year 2023.

On a long-term basis, the percentage of Berkshire Hathaway’s insurance premiums written from the Asia Pacific region has declined from 9.2% to 8.3% over the past eight years. Meanwhile, the Western Europe region has experienced significant growth, with its share rising from 4.7% in 2016 to 7.4% as of 2023.

A notable trend is that, although insurance premiums from the United States have significantly risen over the past eight years, the percentage relative to the total has remained relatively constant during this period. This is because the insurance premiums written from other countries and regions have also grown at roughly the same rates or slightly faster than those in the U.S.

Nevertheless, the United States has been the dominant source of insurance premiums for Berkshire Hathaway, while the Asia Pacific and Western Europe regions contribute a much smaller portion.

Overall, Berkshire Hathaway’s long-standing and well-established presence in the U.S. insurance market has made it a major player in the industry.

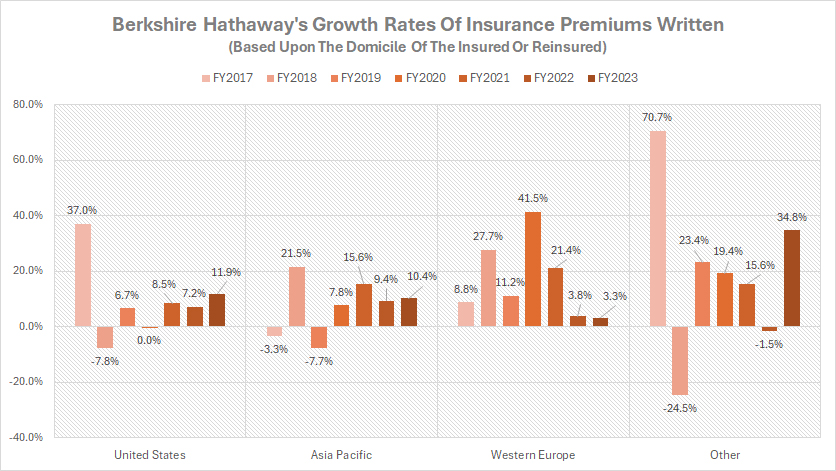

United States, Asia Pacific, Western Europe, And Other

berkshire-growth-rates-of-insurance-premiums-written

(click image to expand)

You can find the definitions of Berkshire’s insurance premiums written and earned here: insurance premiums written and earned.

Berkshire Hathaway’s premiums written from the Asia Pacific have shown much higher growth compared to those from the U.S. and Western Europe. Over the past three years, the premiums growth in the Asia Pacific has averaged 12% annually.

In contrast, Berkshire Hathaway’s premiums growth in the United States has averaged 9% per annum over the same period, while the growth in Western Europe has been 10%.

In fiscal year 2023, Berkshire Hathaway experienced a notable premiums growth of 12% in the U.S. In the same year, the Asia Pacific region recorded a growth rate of 10%. However, premiums growth in Western Europe dropped to only 3.3% in fiscal year 2023.

Summary

Overall, the United States has been the primary source of insurance premiums for Berkshire Hathaway, with significant contributions from the Asia Pacific and Western Europe regions. Despite the rapid growth in these regions, the U.S. continues to account for the majority of the company’s premiums.

Credits And References

1. All financial data presented in this article was obtained and referenced from Berkshire Hathaway’s annual reports published in the company’s investor relation page: Berkshire’s Reports.

2. Pexels Images.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link to this article from any website so that more articles like this one can be created in the future.

Thank you!