Nio House. Source: Flickr

Nio Inc. (NYSE:NIO), an automobile company headquartered in China, designs, develops, and co-manufactures smart premium electric vehicles.

Apart from the EVs, Nio also has its own proprietary autonomous driving technologies.

It is also one of the largest EV players in China with a market capitalization of around $25 billion USD as of August 2023.

Nio’s primary revenue source is the sales of electric vehicles in addition to a small portion coming from the sales of batteries as well as services.

While Nio has gone public for nearly 6 years after completing its IPO in Sept 2018, the company has never declared or paid any cash dividends.

The following excerpt extracted from Nio’s 2022 annual report explains the company’s dividend policy:

-

Dividend Policy

We do not have any present plan to pay any cash dividends on our ordinary shares in the foreseeable future. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business.If we pay any dividends on our ordinary shares, we will pay those dividends which are payable in respect of the ordinary shares underlying our ADSs to the depositary, as the registered holder of such ordinary shares, and the depositary then will pay such amounts to our ADS holders in proportion to the ordinary shares underlying the ADSs held by such ADS holders, subject to the terms of the deposit agreements, including the fees and expenses payable thereunder.

Cash dividends on our ordinary shares, if any, will be paid in U.S. dollars.

Therefore, Nio is a non-dividend-paying stock that does not declare any cash dividend to shareholders who hold the company’s ADS or American Depository Shares.

This article explores the factors that Nio does not pay cash dividends.

Let’s go take a look.

Table Of Contents

Factors That Do Not Support A Dividend

A1. Slowing Vehicle Sales

A2. Slowing Revenue Growth

A3. Poor Gross Margin

A4. Unprofitable Operations

A5. Poor Cash Flow

A6. Growing Debt Levels

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

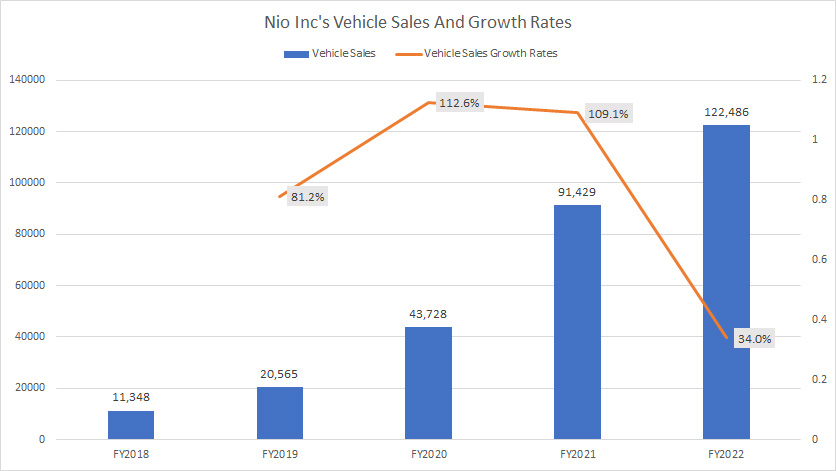

Slowing Vehicle Sales

nio-inc-vehicle-sales-and-growth-rates

(click image to expand)

The first factor that Nio may not pay cash dividends has to do with its slowing vehicle sales.

While Nio’s vehicle sales seemed like going through the roof in fiscal 2022, the sales growth came in at only 34% year-over-year, the lowest rate that had ever been recorded over the past 4 years.

Prior to 2022, Nio managed to ship its vehicles at a growth rate of more than 100% year-on-year.

However, this figure has declined to only 34% as of fiscal 2022.

The slowing vehicle sales will push back not just the potential dividends but also any sort of capital returns to shareholders.

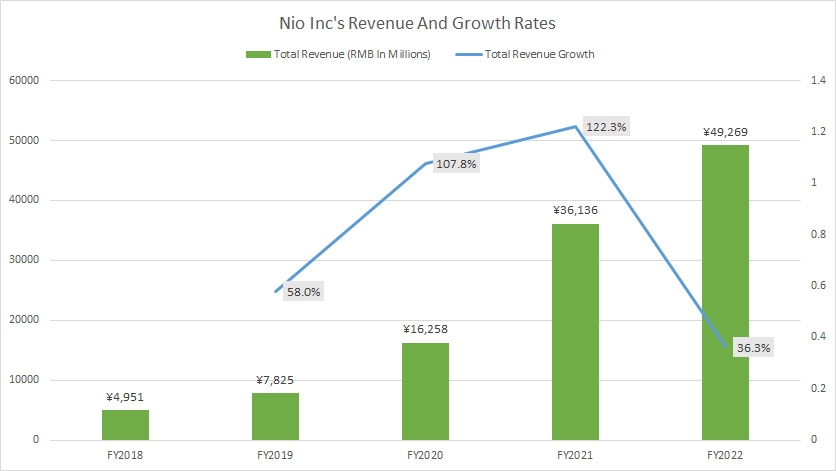

Slowing Revenue Growth

nio-inc-total-revenue-and-growth-rates

(click image to expand)

Similarly, Nio’s revenue growth also has declined significantly and reached only 36% as of fiscal 2022, primarily driven by the decline in vehicle volume which we saw earlier.

Unlike the revenue growth which totaled more than 100% prior to 2022, Nio’s latest revenue growth of 36% was the lowest since 2019.

Therefore, Nio’s slowing revenue growth is a major hold-up on the potential cash dividends that the company may declare.

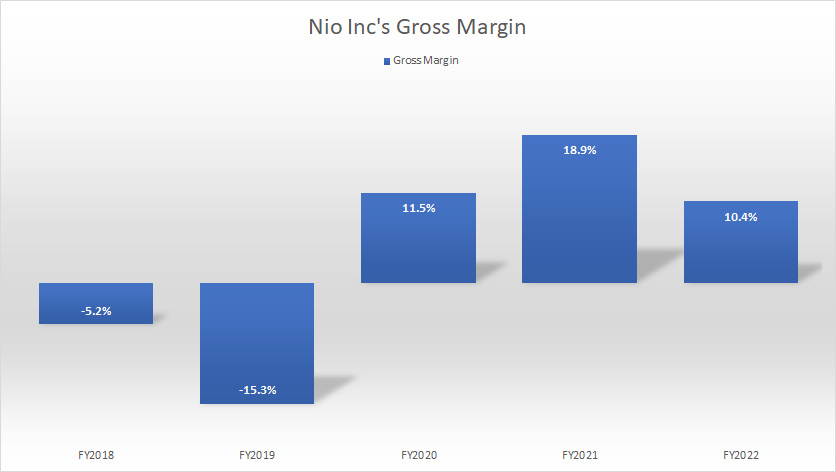

Poor Gross Margin

nio-inc-gross-margin

(click image to expand)

Another factor that has held up Nio’s potential cash dividends is the company’s poor margin.

As shown in the chart above, Nio’s gross margin totaled only 10% in fiscal 2022 and was a major decline over 2021.

A lower margin means lower profitability.

In Nio’s case, the company may even be having losses after accounting for other expenses such as operating costs, interest expenses, etc.

As a result, the case of a dividend from Nio Inc looks pretty slim when the company makes less money.

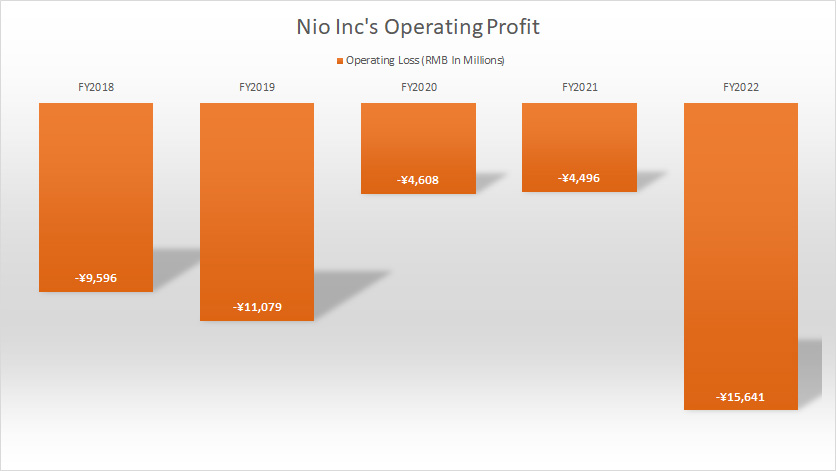

Unprofitable Operations

nio-inc-operating-profit

(click image to expand)

Nio is not only poor in margins but also unprofitable.

As shown in the plot above, Nio had been having unprofitable operations over the past 5 years.

The unprofitable nature of Nio’s operations is not expected to improve in the foreseeable future and may even get worse.

In fiscal 2022, Nio’s operating loss totaled RMB15.6 billion, the worst figure that the company has ever reported since 2018.

As a result, it is not possible for Nio to declare a dividend now if it wanted to because it has never made a profit.

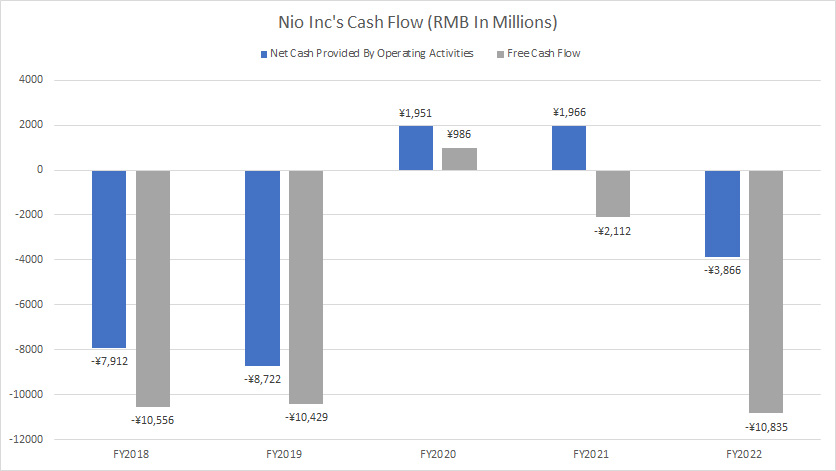

Poor Cash Flow

nio-inc-cash-flow

(click image to expand)

Apart from being unprofitable, Nio also is having very poor cash flow.

Of all the fiscal years shown in the chart, Nio had positive operating cash flow in only 2 fiscal years.

Far from over, Nio’s free cash flow was even worse.

After accounting for capital expenditures, Nio burns more cash than it produces.

Therefore, the cash dividend is totally out of the question for Nio Inc when it has been burning more cash than it can produce.

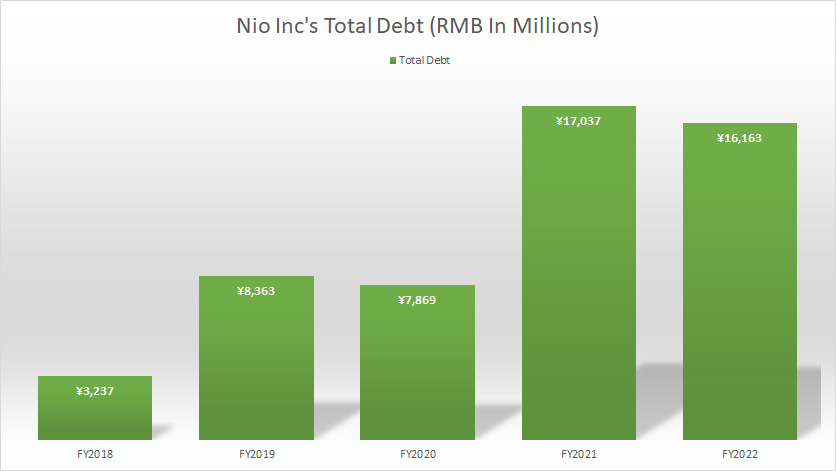

Growing Debt Levels

nio-inc-debt-levels

(click image to expand)

As Nio Inc is unprofitable and has poor cash flow, the company relies on debt to sustain its operations.

As seen in the plot above, Nio’s total debt keeps piling up over the years.

As of fiscal 2022, Nio had one of the highest debt levels in the company’s history, topping RMB16 billion.

Nio’s growing debt level is another factor that prevents the company from declaring any cash dividends.

Conclusion

In summary, why doesn’t Nio Inc’s stock pay dividends?

The obvious reason is that the company has neither a profit nor the necessary cash flow to pay a dividend.

The company does not even generate sufficient cash to support its own operations, let alone a dividend.

All in all, Nio Inc, simply does not have the financial means to declare a dividend now.

Credits and References

1. All financial figures presented in this article were obtained and referenced from Nio Inc.’s SEC filings, earnings reports, financial statements, news releases, etc, which are available in Nio’s Financial Results.

2. Featured images in this article are used under creative commons license and sourced from the following websites: Nio House and Chips.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!