Clean room. Pexels Images.

This article explores the research and development (R&D) spending of TSMC and Samsung Electronics.

TSMC operates as a pure-play foundry, meaning it manufactures semiconductors for other companies. Notably, TSMC produces chips for clients such as Apple, AMD, and Nvidia. Unlike some of its competitors, TSMC does not design its own chips, focusing instead on the manufacturing process to ensure the highest quality for its customers.

Samsung, on the other hand, has a more diversified business model. It operates a foundry business similar to TSMC but also designs and manufactures its own semiconductor products. Additionally, Samsung is involved in various other segments, including consumer electronics, IT & mobile communications, and device solutions.

Despite their different business models, both companies are at the forefront of semiconductor technology, investing heavily in research and development to stay ahead in the industry. They have pioneered advanced manufacturing processes, such as 7nm, 5nm, and 3nm nodes.

In this article, we delve into the R&D expenditures of both firms, comparing how each company allocates resources to maintain its technological edge and leadership in the semiconductor industry.

Investors looking for key statistics of TSMC and Samsung may find more resources on these pages:

- TSMC vs Samsung: profit margin comparison,

- TSMC vs Intel: r&d budget comparison, and

- TSMC revenue by product: sales of wafer and other products.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Who Is Winning The R&D Race?

R&D Spending

A1. TSMC vs Samsung: R&D Spending

R&D Growth

B1. TSMC vs Samsung: R&D Growth Rates

R&D Spending To Revenue

C1. TSMC vs Samsung: R&D To Revenue Ratio

R&D Spending To Gross Profit

D1. TSMC vs Samsung: R&D To Gross Profit Ratio

R&D Spending To OPEX

E1. TSMC vs Samsung: R&D To Operating Expenses Ratio

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Currency Conversion: TSMC and Samsung presented their financial results in their native currencies, specifically the New Taiwan Dollar (TWD) for TSMC and the Korean Won (KRW) for Samsung.

The respective companies handled the conversion of these currencies to US dollars at the time of their earnings presentations, rather than the editors.

R&D To Revenue Ratio: The R&D to revenue ratio is a financial metric measuring the proportion of a company’s revenue that is spent on research and development (R&D).

It is calculated by dividing the total R&D expenditures by the total revenue, usually expressed as a percentage. This ratio helps investors and analysts understand how much a company is investing in innovation and future growth relative to its sales.

The formula for the R&D to revenue ratio is:

\[\text{R&D to Revenue Ratio} = \left( \frac{\text{R&D Expenditures}}{\text{Total Revenue}} \right) \times 100\%\]

A higher R&D to revenue ratio indicates a stronger commitment to innovation and development, which can be crucial for long-term growth and competitiveness.

R&D To Gross Profit Ratio: The R&D to gross profit ratio is a financial metric measuring the proportion of a company’s gross profit that is spent on research and development (R&D).

This ratio helps investors and analysts evaluate how much of a company’s gross profit is being reinvested into innovation and future growth.

The formula for the R&D to gross profit ratio is:

\[\text{R&D to Gross Profit Ratio} = \left( \frac{\text{R&D Expenditures}}{\text{Gross Profit}} \right) \times 100\%\]

A higher R&D to gross profit ratio indicates a greater investment in innovation relative to the company’s profitability, which can be a sign of a commitment to long-term growth and competitiveness.

R&D To Operating Expenses Ratio: The R&D to operating expenses ratio is a financial metric measuring the proportion of a company’s operating expenses that are spent on research and development (R&D).

This ratio helps evaluate how much of the company’s total expenses are dedicated to innovation and future growth efforts.

The formula for the R&D to operating expenses ratio is:

\[\text{R&D to Operating Expenses Ratio} = \left( \frac{\text{R&D Expenditures}}{\text{Total Operating Expenses}} \right) \times 100\%\]

A higher R&D to operating expenses ratio indicates a greater commitment to innovation relative to the company’s overall spending, which can be a positive indicator of future growth potential. Comparing this ratio with industry peers can provide additional insights into a company’s investment in research and development.

Who Is Winning The R&D Race?

The race for research and development (R&D) in the semiconductor industry is fiercely competitive, with both TSMC (Taiwan Semiconductor Manufacturing Company) and Samsung Electronics making significant strides.

TSMC has consistently invested heavily in R&D to maintain its technological edge, focusing on advanced manufacturing processes such as 3nm and 2nm nodes. This aggressive pursuit of cutting-edge technology has positioned TSMC as a leader in the semiconductor industry, allowing it to pioneer several advancements, including the 7nm FinFET and 5nm processes essential for high-performance and energy-efficient chips.

Similarly, Samsung Electronics allocates substantial resources to R&D, particularly in memory chips and advanced nodes. Samsung’s investment in gate-all-around (GAA) technology for 3nm chips exemplifies its commitment to innovation. The company’s significant progress in semiconductor technology, particularly in memory and logic chips, has made it a formidable competitor in the industry. Samsung’s 3nm GAA technology promises improved performance and power efficiency over traditional FinFET designs, highlighting its focus on technological advancements.

Both TSMC and Samsung are capitalizing on the growing demand for generative AI chips and data center build-outs, segments expected to drive significant growth in the semiconductor industry. Their extensive R&D efforts ensure they remain competitive in the rapidly evolving market, maintaining strong global market presence and key partnerships. TSMC and Samsung’s ongoing commitment to innovation underscores their competitiveness and critical role in driving the industry’s advancements.

Declaring a definitive winner in the R&D race is challenging as both companies are leading the charge with substantial investments and technological advancements. TSMC’s focus on cutting-edge manufacturing processes and Samsung’s progress in memory and logic chips positions both companies at the forefront of semiconductor innovation. Their respective strategies and substantial R&D efforts will continue to shape the future of the semiconductor industry.

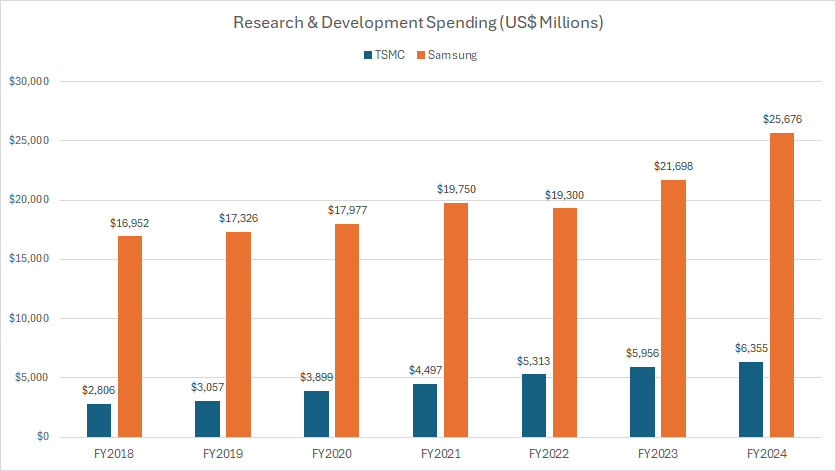

TSMC vs Samsung: R&D Spending

tsmc-vs-samsung-in-research-and-development

(click image to expand)

TSMC and Samsung report their financial results in their native currencies. The conversion of these currencies to USD was carried out by the respective companies, rather than the editors.

As presented in the accompanying chart, Samsung’s research and development (R&D) spending has consistently surpassed that of TSMC across all periods. In the latest fiscal year 2024, Samsung invested an impressive $25.7 billion in R&D, approximately four times higher than TSMC’s expenditure of $6.4 billion during the same period.

From fiscal year 2018 to 2024, Samsung’s R&D expenditure has grown by a remarkable 50%, equating to an increase of nearly $9 billion. It rose from $17 billion in 2018 to the latest figure of $25.7 billion in 2024. Over the past three years alone, Samsung’s R&D investment surged from $19.3 billion to $25.7 billion, marking a significant 33% growth.

Despite Samsung’s significantly higher investment in research and development compared to TSMC, TSMC’s R&D expenditure has grown at a much faster pace. Since fiscal year 2018, TSMC’s R&D spending has surged by an impressive 128%, rising from $2.8 billion to $6.4 billion over six years. This means that TSMC’s R&D spending has grown at nearly three times the rate of Samsung’s growth from fiscal year 2018 to 2024.

However, when examining the past three years from fiscal year 2022 to 2024, TSMC’s R&D spending growth rate has been lower than Samsung’s. During this period, TSMC’s R&D expenditure increased by only 19%, adding an extra $1 billion, whereas Samsung’s R&D investment soared by 33%, adding an additional $6 billion.

Overall, while Samsung’s absolute R&D spending remains substantially higher, TSMC’s rapid growth in R&D expenditure demonstrates its commitment to catching up and pushing the boundaries of semiconductor innovation. This dynamic between the two industry giants underscores the competitive landscape of the semiconductor sector and the relentless pursuit of technological advancements by both companies.

Understanding these investment trends offers valuable insights into how each company prioritizes and allocates resources to maintain their competitive edge in the market.

TSMC vs Samsung: R&D Growth Rates

tsmc-vs-samsung-in-research-and-development-growth

(click image to expand)

TSMC and Samsung report their financial results in their native currencies. The conversion of these currencies to USD was carried out by the respective companies, rather than the editors.

In terms of research and development (R&D) growth, TSMC has historically maintained a competitive edge over Samsung, as evidenced by the accompanying chart.

However, this dynamic has seen significant shifts over the recent periods from fiscal year 2023 to 2024, with Samsung making substantial strides in ramping up its R&D spending. In fact, Samsung’s YoY growth rates have either matched or surpassed those of TSMC during this period, signaling an intense rivalry in innovation.

For instance, in fiscal year 2024, Samsung achieved an impressive annual R&D growth rate of 18%, which starkly contrasts with TSMC’s more modest growth rate of 7% for the same period. This remarkable increase underscores Samsung’s renewed focus and investment in cutting-edge technologies and R&D initiatives.

Moreover, in fiscal year 2023, Samsung’s R&D YoY growth rate was recorded at 12%, nearly on par with TSMC’s 12.4%. This alignment reflects a competitive push from Samsung to enhance its R&D capabilities and maintain a technological edge.

However, the landscape looked different in fiscal year 2022, where TSMC showcased its superior R&D growth with an impressive rate of 18%, while Samsung faced a decline, registering an R&D growth rate of -2.3%. This disparity highlights the volatile nature of R&D investments and the varying strategies employed by both companies.

When we examine the average R&D growth over a more recent period from fiscal years 2022 to 2024, TSMC’s annual growth rate averaged at 12%, whereas Samsung’s growth rate was comparatively lower at 10%. This average further illustrates TSMC’s consistent commitment to R&D excellence.

Extending our view to a longer term, from fiscal years 2018 to 2024, TSMC’s R&D growth has consistently outperformed Samsung’s in each fiscal year, with the notable exception of fiscal year 2024. This long-term perspective emphasizes TSMC’s sustained investment in R&D and its strategic prioritization of innovation.

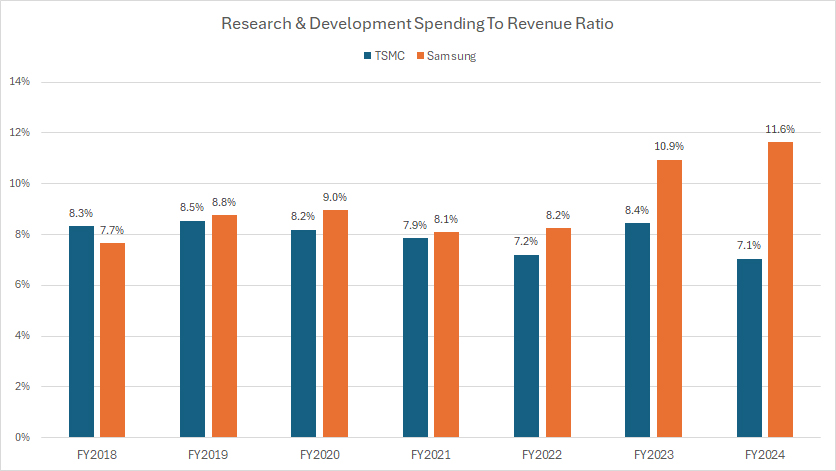

TSMC vs Samsung: R&D To Revenue Ratio

tsmc-vs-samsung-in-research-and-development-to-revenue-ratio

(click image to expand)

You can find the definition of the R&D to revenue ratio here: R&D To Revenue Ratio.

TSMC and Samsung report their financial results in their native currencies. The conversion of these currencies to USD was carried out by the respective companies, rather than the editors.

When evaluating research and development (R&D) spending relative to revenue, both TSMC and Samsung have historically allocated a nearly equal proportion of their revenue towards R&D. This commitment underscores their dedication to fostering innovation and technological advancement. However, in recent years, Samsung’s R&D to revenue ratio has surged, significantly outpacing that of TSMC.

For instance, in fiscal year 2024, TSMC’s R&D spending accounted for only 7% of its total revenue, whereas Samsung’s ratio was significantly higher, amounting to a substantial 12% of its total revenue for the same period. This marked increase highlights Samsung’s intensified focus on R&D investments aimed at securing a competitive edge in the market.

Similarly, in fiscal year 2023, Samsung’s R&D to revenue ratio was recorded at 11%, substantially exceeding TSMC’s ratio of 8%. This trend signals a strategic shift by Samsung towards bolstering its R&D endeavors to drive innovation and maintain technological leadership.

Prior to fiscal year 2023, both companies maintained a relatively equal proportion of R&D spending to revenue, averaging around 8% for each company. This equilibrium illustrated their steady commitment to innovation while effectively managing revenue growth. The consistency in R&D investment during these years underscores the critical role that innovation plays in their overall strategic direction.

However, the recent divergence in their R&D to revenue ratios indicates a more aggressive approach by Samsung in recent years. Samsung’s heightened R&D expenditure relative to revenue not only reflects its ambition to outpace competitors but also signals its strategic investments in emerging technologies and new product development.

In summary, while both TSMC and Samsung have consistently demonstrated a strong commitment to R&D, the recent surge in Samsung’s R&D to revenue ratio points to a more aggressive stance in its pursuit of technological advancement and market leadership.

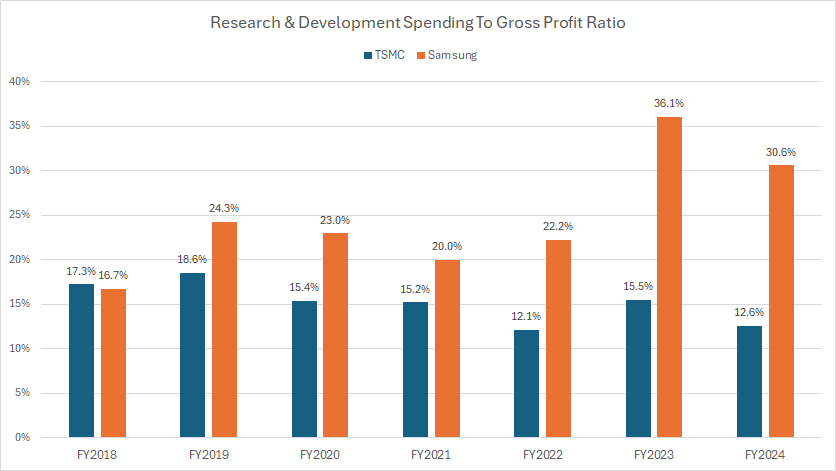

TSMC vs Samsung: R&D To Gross Profit Ratio

tsmc-vs-samsung-in-research-and-development-to-gross-profit-ratio

(click image to expand)

You can find the definition of the R&D to gross profit ratio here: R&D To Gross Profit Ratio.

TSMC and Samsung report their financial results in their native currencies. The conversion of these currencies to USD was carried out by the respective companies, rather than the editors.

Samsung’s R&D expenditure has significantly impacted its gross profit margin, especially when compared to TSMC. As illustrated in the accompanying chart, in fiscal year 2024, Samsung’s R&D spending consumed a staggering 30.6% of its gross profit, whereas TSMC’s ratio was much lower at 12.6%. This substantial difference underscores the heavy financial burden that R&D costs have placed on Samsung’s profitability.

Interestingly, Samsung’s ratio of R&D to gross profit was notably lower in fiscal year 2024 compared to fiscal year 2023. In fiscal year 2023, Samsung’s R&D to gross profit ratio surged to a massive 36%, while TSMC’s ratio was comparatively modest at around 15.5%. This significant fluctuation highlights the variability in Samsung’s R&D investment strategy and its impact on profitability.

On average, from fiscal year 2022 to 2024, Samsung allocated approximately 30% of its gross profit to research and development, while TSMC’s ratio averaged only 13%. This stark contrast indicates the considerable toll that Samsung’s R&D expenditures have taken on its profitability.

Despite the impact on profitability, Samsung’s high R&D to gross profit ratio reflects its aggressive approach to investing in innovation and new technologies. While this strategy may place a short-term strain on profitability, it is aimed at securing long-term growth and maintaining a competitive edge in the market.

Examining the broader context, the divergence in R&D spending ratios between Samsung and TSMC reveals differing strategic priorities and approaches to balancing innovation with profitability. Samsung’s higher ratio suggests a willingness to endure short-term financial pressures for the sake of long-term technological advancements, whereas TSMC’s more conservative ratio indicates a balanced approach to R&D investments and profitability.

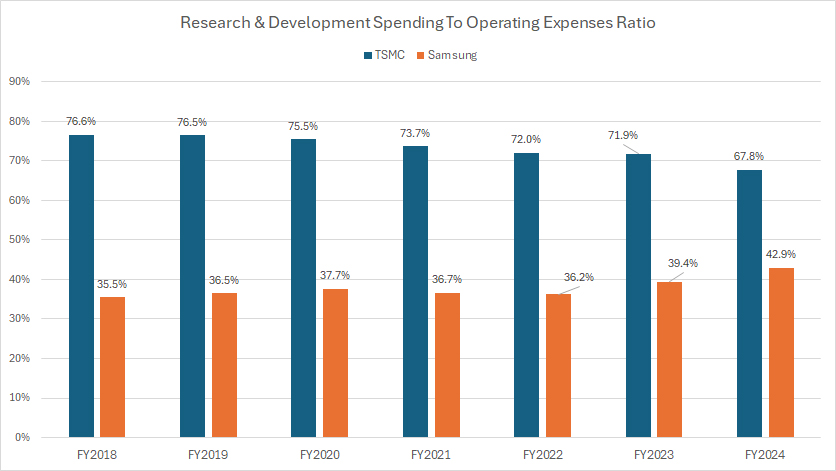

TSMC vs Samsung: R&D To Operating Expenses Ratio

XXXXX

(click image to expand)

You can find the definition of the R&D to OPEX ratio here: R&D To Operating Expenses Ratio.

TSMC and Samsung report their financial results in their native currencies. The conversion of these currencies to USD was carried out by the respective companies, rather than the editors.

From the perspective of operating expenses (OPEX), we can observe that TSMC allocates a significant portion of its OPEX towards research and development (R&D) spending. In fiscal year 2024, TSMC’s ratio of R&D to OPEX was an impressive 68%, while Samsung’s ratio was more modest at 43%. This substantial difference underscores TSMC’s strong focus on R&D investments, highlighting its commitment to innovation and technological advancement.

Historically, TSMC has directed an even higher proportion of its OPEX towards R&D. For perspective, from fiscal year 2018 to 2020, TSMC’s ratio of R&D to OPEX consistently exceeded 75%, compared to Samsung’s ratio of around 36% during the same period. This disparity further illustrates TSMC’s long-standing emphasis on prioritizing R&D within its overall expenditure framework.

However, looking at the more recent periods from fiscal year 2022 to 2024, TSMC’s R&D to OPEX ratio has slightly decreased, averaging around 71%. While this represents a reduction from earlier years, it still remains significantly higher than Samsung’s average ratio of 40% during the same period. This sustained focus on R&D spending by TSMC reflects its strategic priority to maintain a competitive edge in the semiconductor industry through continuous innovation.

On the other hand, Samsung’s R&D to OPEX ratio, while lower than TSMC’s, has also demonstrated a consistent commitment to R&D investments. The steady increase in Samsung’s ratio, reaching 43% in fiscal year 2024, indicates a strategic shift towards enhancing its R&D efforts to better compete with industry leaders like TSMC.

Compared to TSMC, Samsung’s ratio of R&D to OPEX remains notably lower, suggesting that the company has other strategic priorities that have diverted a significant portion of its operating expenses away from R&D investments. This allocation of resources indicates a more diversified focus for Samsung, possibly targeting other areas such as marketing, production expansion, or other operational initiatives.

In contrast, TSMC appears to maintain a more concentrated focus on R&D from the perspective of OPEX, dedicating a substantial portion of its operating budget to fuel innovation and technological progress.

In summary, TSMC’s consistently high ratio of R&D to OPEX highlights a focused and robust investment in research and development, which has been a key driver of its technological advancements and market leadership.

Conversely, Samsung’s relatively lower ratio indicates that it may have other strategic priorities that divert resources away from R&D, reflecting a more diversified approach to its operational and growth strategies.

Conclusion

When comparing the absolute values of R&D spending, it’s evident that Samsung’s R&D expenditure is significantly higher than that of TSMC. In fiscal year 2024, Samsung’s R&D spending was more than four times higher than TSMC’s.

This disparity reflects Samsung’s broader scope of operations and its strategic focus on multiple technology sectors. On the other hand, TSMC, as a pure-play foundry, focuses its R&D efforts primarily on semiconductor manufacturing processes, allowing it to allocate its R&D resources more efficiently towards enhancing its core competencies.

While TSMC has historically led in R&D growth and spending, Samsung has made significant strides in recent years, particularly in terms of R&D spending relative to revenue and gross profit.

Meanwhile, TSMC continues to allocate a substantial portion of its operating expenses towards R&D, reflecting a more focused approach towards innovation and technological advancement. In this aspect, Samsung’s R&D budget with respect to OPEX is much lower than TSMC.

Overall, Samsung’s increasing R&D expenditures in absolute term indicate a strategic shift towards enhancing its R&D efforts to better compete with industry leaders like TSMC.

References and Credits

1. All financial figures presented in this article were obtained and referenced from TSMC’s annual reports published on the company’s investors relations page: TSMC Investor Relations.

2. Pexels Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!