Ford Motor Company. Pexels Image.

This article presents the vehicle sales breakdown by segment of Ford Motor Company (NYSE: F). Ford Motor’s operating segments consist of three major divisions: Ford Blue, Ford Model e, and Ford Pro. The explanation of these business segments is available in the definition section.

Moreover, the vehicle sales presented in this article are based on Ford’s vehicle wholesale. Vehicle wholesale may differ from retail sales. The explanation of Ford’s vehicle wholesale is available here: vehicle wholesale.

Let’s look at the details.

Investors looking for Ford Motor’s other sales statistics may find more information on these pages:

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Consolidated Sales

A1. Global Sales

Results By Segment

B1. Sales From Ford Blue, Ford Model e, And Ford Pro

B2. Sales From Ford Blue, Ford Model e, And Ford Pro In Percentage

Growth Rates

C1. Sales Growth Of Ford Blue, Ford Model e, And Ford Pro

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Vehicle Wholesale: In the context of automobile companies, wholesale refers to the sale of vehicles in bulk quantities to dealerships or other businesses rather than to individual consumers.

Wholesale transactions typically involve the manufacturer or a distributor selling a large number of vehicles to an intermediary, such as a car dealership, which then sells these vehicles to end consumers. This process allows automobile manufacturers to distribute their products efficiently across various markets.

Here are a few key points about wholesale in the automobile industry:

1. Bulk Sales: Manufacturers sell large quantities of vehicles to dealerships or fleet operators.

2. Dealerships: The vehicles are then sold by dealerships to individual consumers.

3. Fleet Sales: Some wholesale transactions involve selling to businesses that require a large number of vehicles, such as rental car companies or corporate fleets.

4. Inventory Management: Wholesale helps manufacturers manage production and inventory levels by moving large volumes of vehicles at once.

Ford’s vehicle wholesale presented in this article excludes those from unconsolidated affiliates.

Unconsolidated Affiliates: Unconsolidated affiliates in automobile companies are entities in which the parent company holds a significant but not controlling interest, typically less than 50%.

These affiliates operate independently and their financial statements are not fully integrated into the parent company’s consolidated financial statements. Instead, they are reported as investments on the parent company’s balance sheet.

Key points about unconsolidated affiliates:

1. Ownership: The parent company has a significant stake (usually between 20% and 50%) but does not have full control.

2. Financial Reporting: The parent company uses the equity method to account for its investment, recognizing its share of the affiliate’s profits or losses.

3. Independence: Unconsolidated affiliates maintain their own legal and financial identity, separate from the parent company.

Ford’s sales of vehicles from unconsolidated affiliates totaled about 694,000 units in 2021, 560,000 units in 2022, and 545 units in 2023, according to the 2023 annual report.

Ford Blue: The Ford Blue segment focuses on iconic gas and hybrid vehicles. It aims to drive growth and profitability by leveraging Ford’s strong brand heritage and improving operational efficiencies.

This segment is dedicated to building out Ford’s traditional internal combustion engine (ICE) vehicles while relentlessly attacking costs, simplifying operations, and enhancing quality.

Ford Blue also produces and sells service parts, accessories, and digital services to retail customers. Iconic gas and hybrid vehicles developed under Ford Blue include the F-150, Bronco, and Mustang.

Ford Model e: The Ford Model e segment is dedicated to the development and production of electric vehicles (EVs) and digital capabilities. This segment focuses on innovation and the advancement of electric vehicle technology, aiming to provide cutting-edge EVs that cater to the growing demand for sustainable and eco-friendly transportation.

Apart from EVs, Ford Model e also designs and creates digital vehicle technologies, including embedded software and all of Ford’s electric architecture. Ford Model e operates in North America, Europe, and China.

Ford Pro: Ford Pro is responsible for the sale of Ford and Lincoln ICE, hybrid, and electric vehicles, service parts, accessories, and services to commercial, government, and rental customers.

Ford Pro focuses on fleet sales to customers with large orders, such as those from commercial sectors, government, and rental companies.

Ford Pro’s vehicles sold in North America include the Super Duty and the Transit range of vans. In Europe, Ford Pro’s flagship vehicles include the Ranger. Ford Pro operates primarily in North America and Europe.

Global Sales

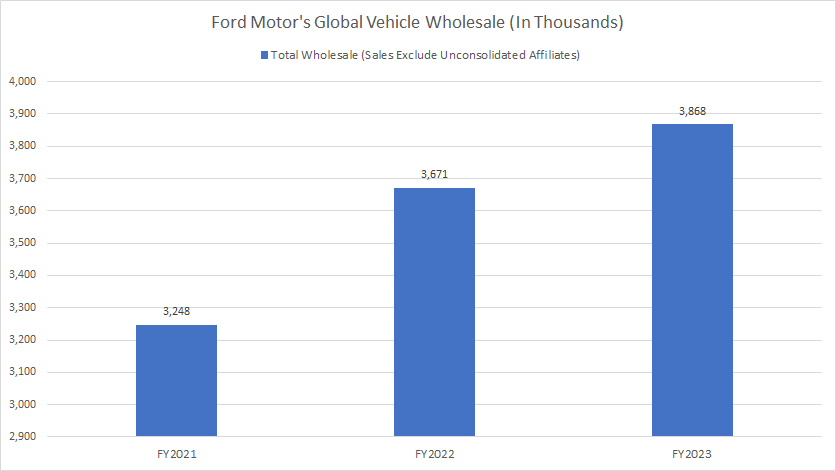

Ford-global-sales

(click image to expand)

The explanation of Ford’s vehicle wholesale is available here: vehicle wholesale. Ford’s wholesale presented excludes those from unconsolidated affiliates. Refer to this section for Ford’s sales data from unconsolidated affiliates: unconsolidated affiliates.

Ford’s global sales reached 3.9 million vehicles in fiscal year 2023, up 5% from 2022 and over 20% from 2021. Ford’s vehicle wholesale has significantly recovered in the post-pandemic period, primarily driven by improvements in supply chains.

The easing of supply chain disruptions that hampered production and inventory levels in late 2021 and early 2022 has allowed Ford to ramp up production and meet demand.

Apart from improving supply chains, Ford’s recovering vehicle sales have also been driven by a strong economic recovery in the post-pandemic period. As economies around the world recover from the pandemic, consumer confidence and spending have increased, leading to higher vehicle sales.

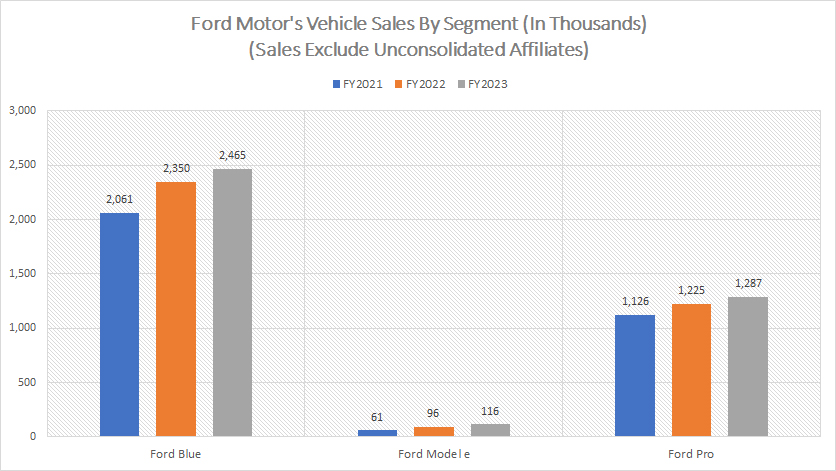

Sales From Ford Blue, Ford Model e, And Ford Pro

Ford-sales-breakdown-by-segment

(click image to expand)

The explanation of Ford’s vehicle wholesale is available here: vehicle wholesale. Ford’s wholesale presented excludes those from unconsolidated affiliates. Refer to this section for Ford’s sales data from unconsolidated affiliates: unconsolidated affiliates.

You can find the definition of Ford Blue, Ford Model e, and Ford Pro here: Ford Blue, Ford Model e, and Ford Pro.

Ford Blue delivered 2.5 million vehicles in fiscal year 2023, a 5% increase over 2022, making it the largest segment among all of Ford’s divisions.

On the other hand, Ford Model-e shipped just 116,000 vehicles in fiscal year 2023, which was only about 4% of Ford Blue’s volume. However, the sales growth of Ford Model-e was significantly higher, with a notable 21% year-over-year increase, compared to Ford Blue.

Ford Pro’s sales landed at 1.3 million vehicles in fiscal 2023, up 5% over 2022. Ford Pro focuses on fleet sales to customers with large orders, such as those from commercial sectors, government, and rental companies. Therefore, it has a significant sales volume.

However, Ford Pro’s sales volumes are still relatively small compared to those from Ford Blue. In fiscal year 2023, Ford Pro’s sales volume represented only half of Ford Blue’s vehicle volume.

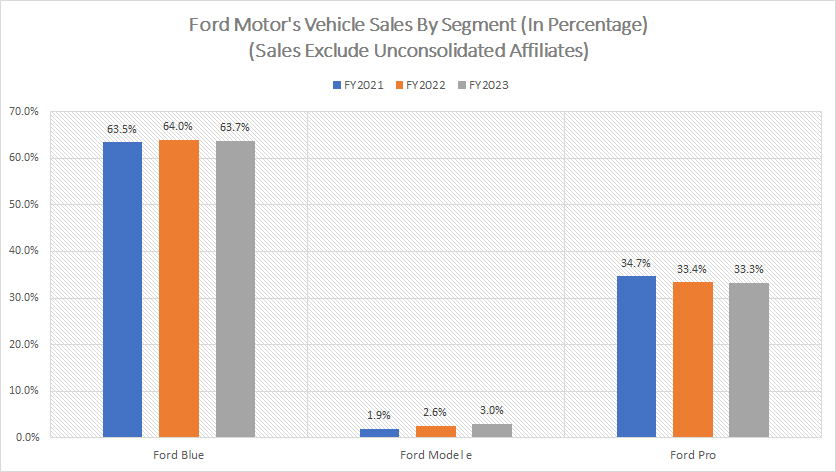

Sales From Ford Blue, Ford Model e, And Ford Pro In Percentage

Ford-sales-breakdown-by-segment-in-percentage

(click image to expand)

The explanation of Ford’s vehicle wholesale is available here: vehicle wholesale. Ford’s wholesale presented excludes those from unconsolidated affiliates. Refer to this section for Ford’s sales data from unconsolidated affiliates: unconsolidated affiliates.

You can find the definition of Ford Blue, Ford Model e, and Ford Pro here: Ford Blue, Ford Model e, and Ford Pro.

Ford Blue leads all divisions in terms of vehicle volume share, as depicted in the chart above. In fiscal year 2023, Ford Blue’s wholesale of 2.5 million units accounted for 64% of Ford’s worldwide volume, the highest among all segments. Over the last three years, Ford Blue’s share of global vehicle volume has been consistently around 64%, reflecting steady performance since fiscal year 2021.

Ford Pro, primarily focused on fleet sales for commercial customers, contributed 33% of sales in fiscal year 2023. Ford Pro’s volume share has averaged 34% in the past three years, demonstrating relative stability since 2021.

Ford Model e, which has the smallest wholesale volume among Ford’s segments, comprised 3% of the global vehicle volume in fiscal year 2023, an increase from 2% in 2021.

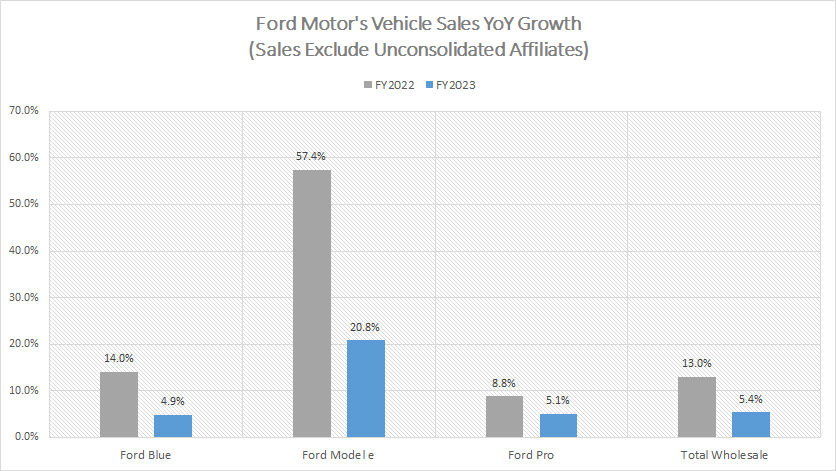

Sales Growth Of Ford Blue, Ford Model e, And Ford Pro

Ford-sales-yoy-growth-rates

(click image to expand)

The explanation of Ford’s vehicle wholesale is available here: vehicle wholesale. Ford’s wholesale presented excludes those from unconsolidated affiliates. Refer to this section for Ford’s sales data from unconsolidated affiliates: unconsolidated affiliates.

You can find the definition of Ford Blue, Ford Model e, and Ford Pro here: Ford Blue, Ford Model e, and Ford Pro.

Ford Model-e has led all segments in vehicle sales growth since fiscal year 2022, with an average growth rate of 39% over the last two years. In fiscal year 2023, its worldwide volume climbed by 21% year-over-year.

On the other hand, Ford Blue saw a modest 5% year-on-year increase in wholesale volume in fiscal year 2023, while Ford Pro’s sales grew by 5%.

On average, Ford Blue has experienced 10% annual sales growth since 2022, compared to Ford Pro’s 7% average annual growth rate.

Conclusion

In summary, Ford Motor’s global sales have been performing quite well since fiscal year 2021.

Ford Blue delivered 2.5 million vehicles in fiscal year 2023, representing 64% of global vehicle volume and achieving an average annual sales growth of 10% since 20222. This marks the segment best performance since 2021.

On the other hand, Ford Pro contributed 33% of sales, primarily through fleet sales for commercial customers, with a sales volume representing half of Ford Blue’s and an average annual growth rate of 7% since 2022.

Ford Model-e shipped 116,000 vehicles, making up 3% of global vehicle volume but experiencing the highest growth rate at 39% annually since 2022 and 21% year-over-year in 2023.

Overall, Ford Motor’s worldwide sales growth has been driven by strong performance across all vehicle segments, including gas, hybrid, and electric lines. The F-Series continues its legacy as the best-selling truck in America for the 47th consecutive year.

References and Credits

1. All vehicle sales data presented in this article were obtained and referenced from Ford’s annual reports published in the company’s investors relation page: Ford’s Investor Relation.

2. Pexels Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and providing a link to it from any website so that more articles like this can be created.

Thank you!