Ford truck. Pexels Image.

This article presents Ford Motor Company’s vehicle sales by type. Ford’s vehicle sales are categorized into three major types: electric vehicles (EVs), hybrid vehicles, and internal combustion engine (ICE) vehicles.

Please note that the sales data presented here represents only U.S. sales. In addition, we also look at two types of sales data: vehicle wholesales and retail sales. Let’s delve into the details.

Investors looking for other statistics of Ford Motor may find more resources on these pages:

- Ford sales and market share by region,

- Ford global vehicle sales by segment, and

- Ford profit margin breakdown – automotive, Ford Credit, etc..

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why Has Ford Motor Been Selling Only a Modest Number of Electric and Hybrid Cars?

U.S. Vehicle Wholesales

A1. EV, Hybrid, And ICE Vehicles Wholesales

A2. Percentage Of EV, Hybrid, And ICE Vehicles Wholesales

U.S. Vehicle Retail Sales

B1. EV, Hybrid, And ICE Vehicles Retail Sales

B2. Percentage Of EV, Hybrid, And ICE Vehicles Retail Sales

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Vehicle Wholesale: In the context of automobile companies, wholesale refers to the sale of vehicles in bulk quantities to dealerships or other businesses rather than to individual consumers.

Wholesale transactions typically involve the manufacturer or a distributor selling a large number of vehicles to an intermediary, such as a car dealership, which then sells these vehicles to end consumers. This process allows automobile manufacturers to distribute their products efficiently across various markets.

Here are a few key points about wholesale in the automobile industry:

1. Bulk Sales: Manufacturers sell large quantities of vehicles to dealerships or fleet operators.

2. Dealerships: The vehicles are then sold by dealerships to individual consumers.

3. Fleet Sales: Some wholesale transactions involve selling to businesses that require a large number of vehicles, such as rental car companies or corporate fleets.

4. Inventory Management: Wholesale helps manufacturers manage production and inventory levels by moving large volumes of vehicles at once.

Ford’s vehicle wholesale presented in this article includes those from unconsolidated affiliates.

Vehicle Retail Sales: Vehicle retail sales refer to the number of vehicles sold directly to consumers through retail channels, such as dealerships.

This metric typically includes sales of new and used cars, trucks, and other types of vehicles. Vehicle retail sales provide insight into consumer demand and purchasing behavior in the automotive market.

Key points to consider about vehicle retail sales:

1. New vs. Used Vehicles: Retail sales can encompass both new and used vehicles sold to individual customers.

2. Dealerships: The sales typically occur through authorized dealerships, which serve as the primary retail outlets for car manufacturers.

3. Consumer Demand: Retail sales figures help gauge consumer demand and market trends within the automotive industry.

4. Exclusions: These figures generally exclude fleet sales (e.g., sales to rental car companies, government agencies, and corporate fleets) and wholesale transactions.

Understanding vehicle retail sales is crucial for manufacturers, dealerships, and market analysts to assess the health and trends of the automotive market.

Unconsolidated Affiliates: Unconsolidated affiliates in automobile companies are entities in which the parent company holds a significant but not controlling interest, typically less than 50%.

These affiliates operate independently and their financial statements are not fully integrated into the parent company’s consolidated financial statements. Instead, they are reported as investments on the parent company’s balance sheet.

Key points about unconsolidated affiliates:

1. Ownership: The parent company has a significant stake (usually between 20% and 50%) but does not have full control.

2. Financial Reporting: The parent company uses the equity method to account for its investment, recognizing its share of the affiliate’s profits or losses.

3. Independence: Unconsolidated affiliates maintain their own legal and financial identity, separate from the parent company.

Ford’s sales of vehicles from unconsolidated affiliates totaled about 694,000 units in 2021, 560,000 units in 2022, and 545 units in 2023, according to the 2023 annual report.

Why Has Ford Motor Been Selling Only a Modest Number of Electric and Hybrid Cars?

Ford Motor Company has been increasing its focus on electric and hybrid vehicles, but there are a few reasons why their sales numbers in these categories might still be modest compared to traditional internal combustion engine (ICE) vehicles:

1. Late Entry: Ford started getting serious about electric vehicles (EVs) only around fiscal year 2020. This means they are still catching up to early entrants like Tesla, which have had a significant head start.

2. Market Competition: The EV market is highly competitive, with many established players and new entrants. Ford faces stiff competition from other automakers who have been in the EV space for longer.

3. Consumer Awareness and Adoption: While interest in EVs and hybrids is growing, consumer adoption is still in the early stages. Many consumers are still transitioning from traditional ICE vehicles to EVs and hybrids.

4. Infrastructure: The availability of charging infrastructure is still a limiting factor for many potential EV buyers. Although this is improving, it can still be a barrier to higher sales.

5. Product Lineup: Ford’s EV and hybrid lineup, while growing, is still relatively limited compared to their extensive range of ICE vehicles. As they expand their offerings, sales in these categories are likely to increase.

6. Technological Advancements and Costs: The development and production of EVs and hybrids involve significant investment in new technologies and manufacturing processes. This can affect pricing and profitability, making it challenging for automakers like Ford Motor to scale up quickly.

Despite these challenges, Ford is making significant progress with models like the Mustang Mach-E and the F-150 Lightning, which are gaining traction in the market. As the company continues to innovate and expand its offerings, their presence in the electric and hybrid vehicle market is expected to grow.

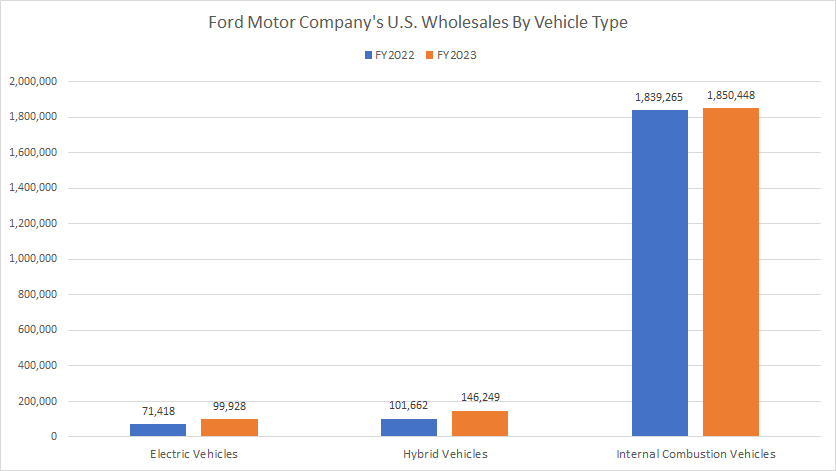

EV, Hybrid, And ICE Vehicles Wholesales

Ford-us-wholesales-of-vehicles-by-type

(click image to expand)

The explanation of Ford’s vehicle wholesale is available here: vehicle wholesale. Ford’s wholesale presented include those from unconsolidated affiliates. Refer to this section for Ford’s sales data from unconsolidated affiliates: unconsolidated affiliates.

The majority of Ford’s U.S. vehicle wholesales came from internal combustion engine (ICE) vehicles, as shown in the graph above. In fiscal year 2023, Ford’s U.S. wholesales of ICE vehicles amounted to 1.85 million units, slightly increasing from 1.84 million units in fiscal year 2022.

In contrast, Ford’s U.S. vehicle wholesales of electric and hybrid vehicles accounted for only a fraction of the total U.S. volumes. In fiscal year 2023, Ford sold 100,000 electric vehicles and 146,200 hybrid vehicles in the U.S. However, these figures represent a significant increase from fiscal year 2022.

As shown in the chart above, Ford’s U.S. wholesales of electric vehicles and hybrid cars in fiscal year 2022 were 71,400 units and 101,700 units, respectively. Therefore, in fiscal year 2023, Ford’s U.S. wholesales of electric vehicles and hybrid cars increased by 40% and 44%, respectively, compared to the previous fiscal year.

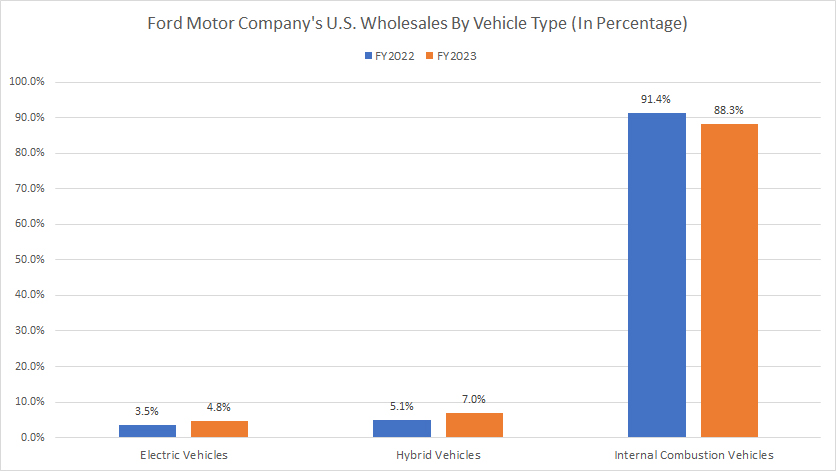

Percentage Of EV, Hybrid, And ICE Vehicles Wholesales

Ford-us-wholesales-of-vehicles-by-type-in-percentage

(click image to expand)

The explanation of Ford’s vehicle wholesale is available here: vehicle wholesale. Ford’s wholesale presented include those from unconsolidated affiliates. Refer to this section for Ford’s sales data from unconsolidated affiliates: unconsolidated affiliates.

In fiscal year 2023, Ford’s U.S. wholesales of internal combustion engine (ICE) vehicles accounted for 88% of the total U.S. volumes, down slightly from 91% in the previous year.

In contrast, the share of Ford’s U.S. wholesales of electric and hybrid vehicles increased modestly in fiscal year 2023 compared to 2022. Ford’s U.S. electric vehicle wholesales represented 4.8% of the total U.S. volumes in fiscal year 2023, up from 3.5% in the previous year.

Similarly, Ford’s U.S. hybrid vehicle wholesales made up 7.0% of the total U.S. volumes in fiscal year 2023, rising from 5.1% in the previous year.

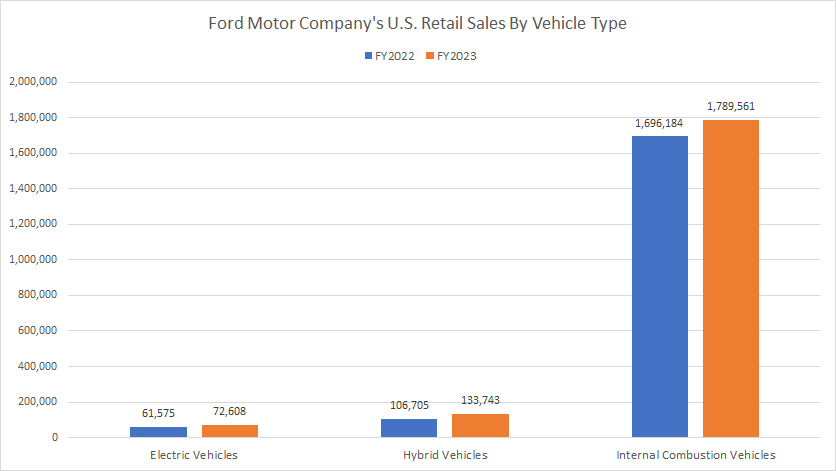

EV, Hybrid, And ICE Vehicles Retail Sales

Ford-us-retail-sales-of-vehicles-by-type

(click image to expand)

The explanation of Ford’s vehicle retail sales is available here: vehicle retail sales.

Ford’s U.S. vehicle retail sales have closely mirrored their wholesale numbers, as shown in the graph above. This similarity highlights the alignment between the number of vehicles sold to dealerships and those ultimately purchased by consumers.

In this aspect, the majority of Ford’s U.S. vehicle retail sales were primarily from internal combustion engine (ICE) vehicles. On the other hand, only a fraction of Ford Motor’s U.S. retail sales were represented by electric vehicles and hybrid vehicles, as shown in the chart above.

For example, Ford’s retail volume of electric vehicles in the U.S. totaled only 72,600 units in fiscal year 2023, up 18% over fiscal year 2022. Similarly, Ford sold just 133,700 hybrid cars in the U.S. on a retail basis in fiscal year 2023, up 25% over fiscal year 2022.

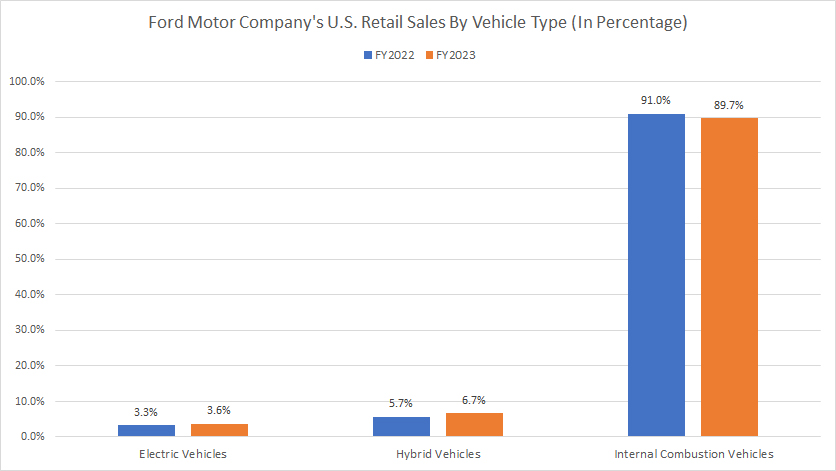

Percentage Of EV, Hybrid, And ICE Vehicles Retail Sales

Ford-us-retail-sales-of-vehicles-by-type-in-percentage

(click image to expand)

The explanation of Ford’s vehicle retail sales is available here: vehicle retail sales.

In fiscal year 2023, Ford Motor’s U.S. retail sales of internal combustion engine (ICE) vehicles represented 90% of the total U.S. volume, down slightly from 91% in fiscal year 2022.

On the flipped side, Ford Motor’s U.S. retail deliveries of electric and hybrid vehicles accounted for 3.6% and 6.7% of the total U.S. volume in fiscal year 2023, respectively. These figures increased from 3.3% and 5.7% in fiscal year 2022.

Conclusion

Ford Motor Company has seen modest growth in the sales of electric and hybrid vehicles, both in wholesale and retail segments. While ICE vehicles still make up the majority of their U.S. sales, the proportion of EV and hybrid sales has been gradually increasing. This trend reflects Ford’s ongoing efforts to expand its presence in the electric and hybrid vehicle markets.

References and Credits

1. All vehicle sales data presented in this article were obtained and referenced from Ford’s annual reports published in the company’s investor relation page: Ford’s Investor Relation.

2. Pexels Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and providing a link to it from any website so that more articles like this can be created.

Thank you!