Supermarket. Pexels Image.

To evaluate the financial health of Costco Wholesale Corporation (COST), it is essential to start by examining its debt, as excessive debt is a common factor leading to bankruptcy for many companies.

Following this, we will assess whether the company has sufficient financial resources to meet its upcoming debt obligations. Let’s look at the details.

Investors looking for other key statistics of Costco may find more resources on these pages:

- Costco revenue streams: merchandise sales and membership fees,

- Costco revenue by country: U.S., Canada, and International, and

- Costco total gas stations worldwide and gasoline revenue.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Debt

A1. Total Debt

A2. Debt Breakdown

Leases

A3. Lease Liabilities

A4. Total Debt + Lease Liabilities

Debt Due, Liquidity, And Credit Rating

D1. Debt And Lease Payment Due

D2. Liquidity

D3. Credit Rating

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Lease Liabilities: Lease liabilities represent a company’s obligation to make future lease payments under leasing agreements. They arise when a company leases an asset, such as real estate, equipment, or vehicles, for a specific period. These liabilities are typically calculated based on the present value of the unpaid lease payments, discounted using the company’s borrowing rate or a similar rate.

Lease liabilities are reported on the balance sheet as part of the company’s financial obligations, and they are associated with the corresponding right-of-use asset, which reflects the benefit of using the leased asset over time. Accounting standards like IFRS 16 and ASC 842 require companies to recognize lease liabilities for most lease agreements, improving transparency in financial reporting.

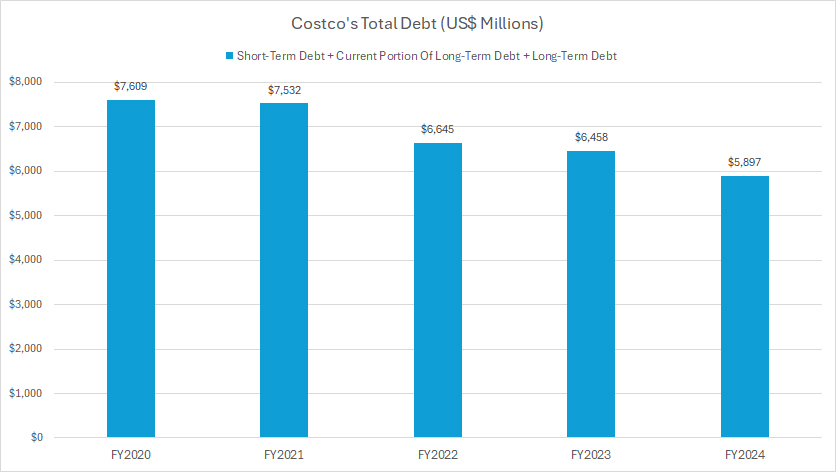

Total Debt

Costco-total-debt

(click image to expand)

In terms of debt figure, Costco’s total debt reached $5.9 billion as of the end of fiscal year 2024, down 9% from $6.5 billion reported a year ago.

An impressive trend is that Costco’s total debt has significantly declined over the last five years, falling from $7.6 billion in 2020 to a record low of $5.9 billion in the latest result, marking a decrease of 22% in four years.

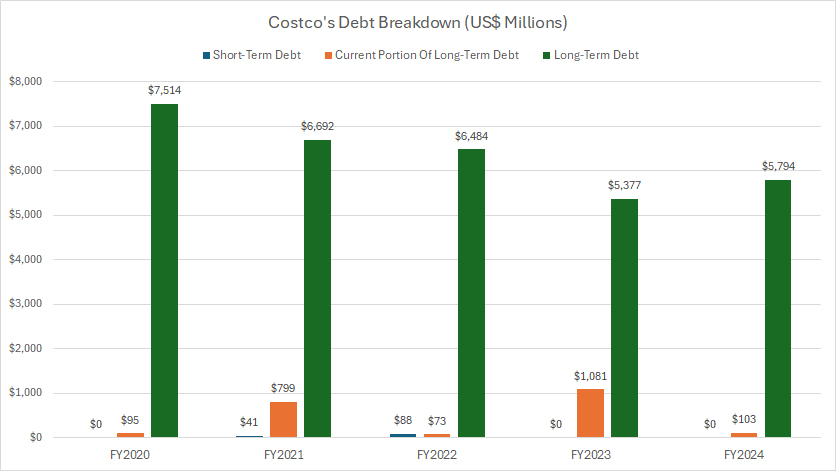

Debt Breakdown

Costco-debt-breakdown

(click image to expand)

Costco’s total debt consists of short-term borrowings, current portion of long-term debt, and long-term debt. Costco’s short-term borrowings have been insignificant, as presented in the chart above.

The majority of Costco’s total debt came from the long-term indebtedness. As of the end of fiscal year 2024, Costco’s long-term debt amounted to $5.8 billion, while the current portion of the long-term debt stood at only $103 million in the same period.

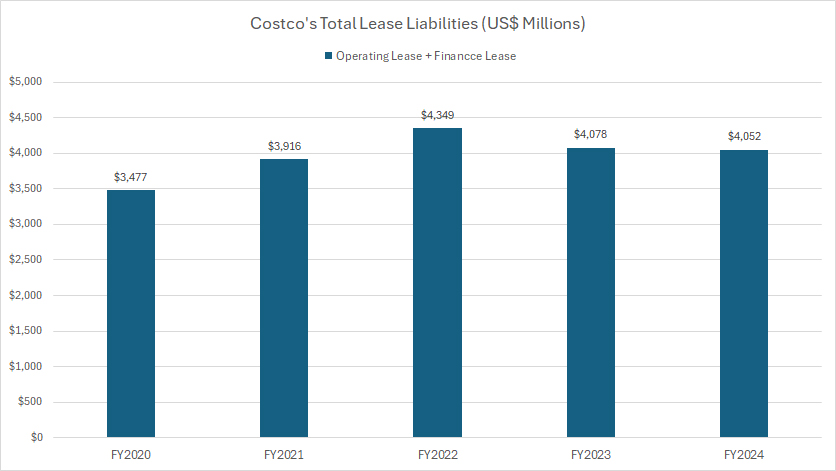

Lease Liabilities

Costco-lease-liabilities

(click image to expand)

The definition of Costco’s lease liabilities is available here: lease liabilities.

Costco carried significant amount of lease liabilities, as shown in the above graph. As of the end of fiscal year 2024, Costco had $4.1 billion of total lease liabilities, which consist of operating and finance leases.

This figure has significantly increased over the past five years, rising from $3.5 billion in 2020 to $4.1 billion in the latest result, marking an increase of 17% in four years.

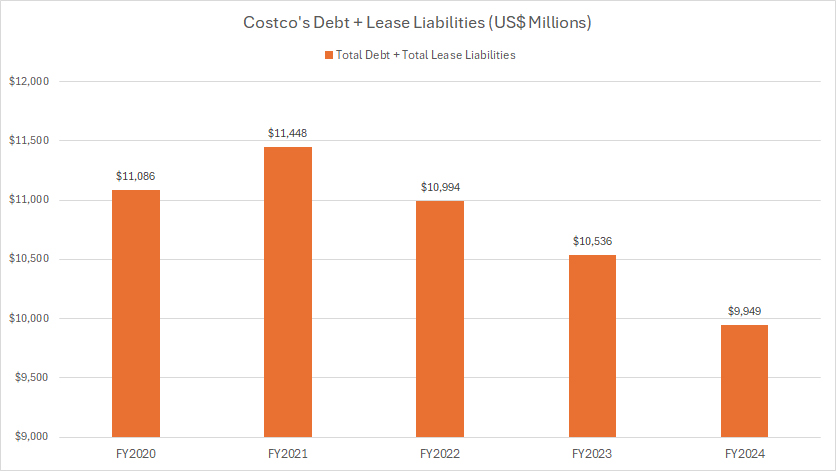

Total Debt + Lease Liabilities

Costco-debt-and-lease-liabilities

(click image to expand)

The definition of Costco’s lease liabilities is available here: lease liabilities.

With lease liabilities included, Costco’s total debt amounted to a staggering figure of nearly $10 billion by the end of fiscal year 2024.

The good news is that this total debt figure has significantly reduced over the past five years, primarily driven by the reduction in long-term debt.

At its peak, Costco’s total debt, inclusive of lease liabilities, reached a whopping $11.4 billion in fiscal year 2021.

Debt And Lease Payment Due

Costco’s debt and lease payments data are obtained from the 2024 annual report dated 1 Sept 2024.

| Debt And Lease Payments | Amount Due (US$ Billions) | ||||

|---|---|---|---|---|---|

| 2025 | 2026 | 2027 | 2028 | 2029 | |

| Long-Term Debt | $0.1 | $0.1 | $2.3 | $0.0 | $3.3 |

| Future Minimum Lease Payments | $0.5 | $0.4 | $0.4 | $0.3 | $0.3 |

| Total | $0.6 | $0.5 | $2.7 | $0.3 | $3.6 |

We only look at Costco’s debt and lease payments. For other contractual payments such as purchase obligations and dividend payments, we will ignore them in this discussion as we focus only on the company’s indebtedness.

That said, Costco’s cash requirement for debt due, inclusive of lease payments, in calendar year 2025 amounted to only $0.6 billion, and the toal amount due in calendar year 2026 stood at just $0.5 billion per the 2024 annual report dated 1 Sept 2024.

Costco had big amount due only in calendar year 2027, which was estimated at $2.7 billion. Another one was in 2029, totaling $3.6 billion. These large payments are the results of the long-term debt portion due in that specific periods.

Over the next five years from calendar year 2025 to 2029, the total amount due stood at roughly $7.7 billion. Therefore, does Costco have the financial means to meet the cash requirement, which is a result of debt obligation? Let’s read further.

Liquidity

Total liquidity as of 1 Sept 2024.

| Liquidity | US$ Billions | |

|---|---|---|

| Committed Capacity | Available Capacity For 2025 And Onward | |

| Cash & Cash Equivalents + Short-Term Investments | – | $11.1 |

| Bank Credit Facilities | $1.2 | $1.2 |

| Letter Of Credit | $0.2 | $0.0 |

| Operating Cash Flow | – | $9.9 (estimated) |

| Total | – | $22.2 |

Costco’s financial health can be assessed through its ability to meet debt obligations. For 2025, the company’s total financial commitment, including cash payments due, was estimated at $0.6 billion. The critical question is whether Costco has the necessary liquidity to cover this obligation.

As of September 1, 2024, Costco’s total liquidity, which includes cash flow from operations, was estimated at $22.2 billion, as depicted in the accompanying table. This demonstrates that the company had more than sufficient funds to fulfill its $0.6 billion payment due in 2025.

In fact, Costco’s liquidity was robust enough to cover all outstanding debt obligations, including lease payments, through calendar year 2029.

Notably, Costco’s cash and cash equivalents, combined with short-term investments, amounted to $11.1 billion as of September 1, 2024. This alone was ample to meet the company’s debt obligations for the next five years, extending through 2029.

Based on the financial results as of September 1, 2024, Costco’s financial health appeared to be in excellent condition, showcasing its ability to manage debt obligations effectively while maintaining substantial liquidity reserves.

Credit Rating

Costco’s credit ratings as of 1 Sept 2024.

| Rating Institutions | Types Of Indebtedness | Outlook | |

|---|---|---|---|

| Long-Term Debt | Short-Term Debt | ||

| Standard & Poor’s | N.A. | N.A. | N.A. |

| Moody’s | N.A. | N.A. | N.A. |

| Fitch | N.A. | N.A. | N.A. |

As of September 1, 2024, Costco had not disclosed any credit ratings for its debt in its 2024 annual reports.

Conclusion

Overall, Costco’s financial health, as outlined, presents a picture of stability, strategic foresight, and operational strength, making it well-prepared to tackle upcoming challenges and seize new opportunities.

References and Credits

1. All financial figures presented were obtained and referenced from Costco’s annual reports published on the company’s investor relations page: Costco Investor Relations.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.