Social media apps. Flickr Image.

Facebook (NASDAQ: META), Snapchat (NYSE: SNAP), Twitter and Pinterest (NYSE: PINS) use the average revenue per user or ARPU to measure their business performance. Precisely, the ARPU measures how well the businesses monetize from their user base.

Each social media platform defines the ARPU differently. The difference makes comparing Facebook, Snap, Twitter and Pinterest a bit tricky.

Despite that, we still compare the ARPUs of Facebook, Pinterest, Twitter and Snapchat. This article tries to group the social media platforms with similar ARPU definitions as best as it can and then does a comparison.

Investors interested in the comparison of Monthly Active Users (MAUs) and Daily Active Users (DAUs) of the respective social media platforms may find more information on these pages: Pinterest MAU Vs Facebook and Snap And Twitter DAU Vs Facebook.

Let’s take a look!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Global ARPU

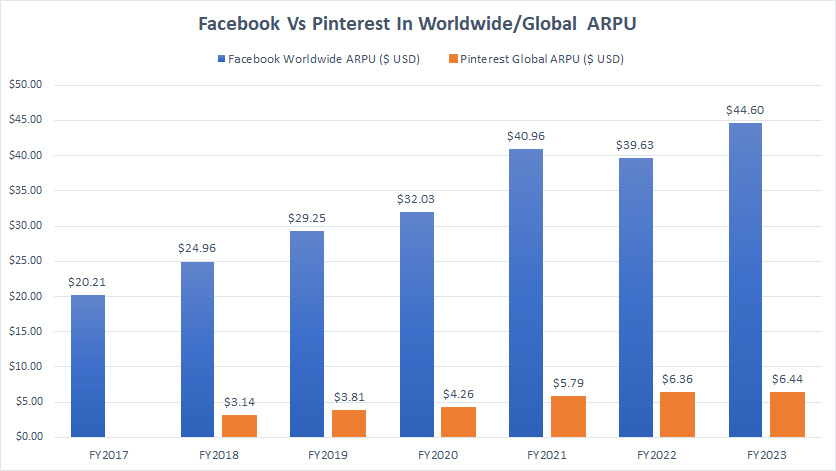

A1. Facebook Vs Pinterest In Worldwide or Global ARPU

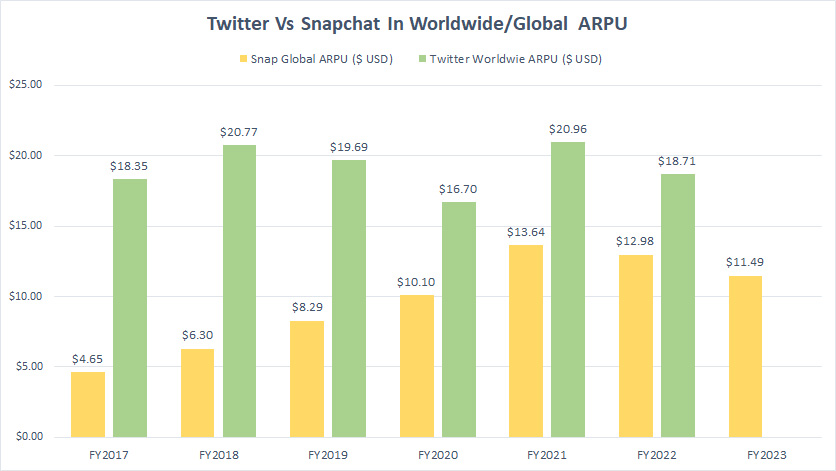

A2. Twitter Vs Snapchat In Worldwide or Global ARPU

North America

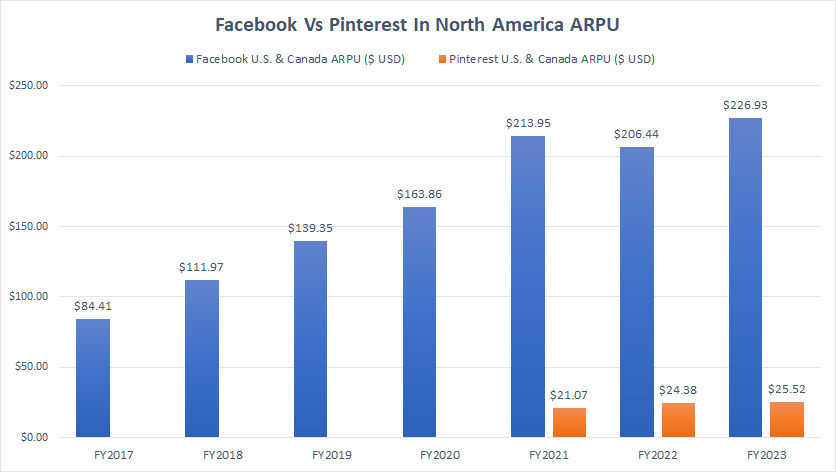

B1. Facebook Vs Pinterest In North America ARPU

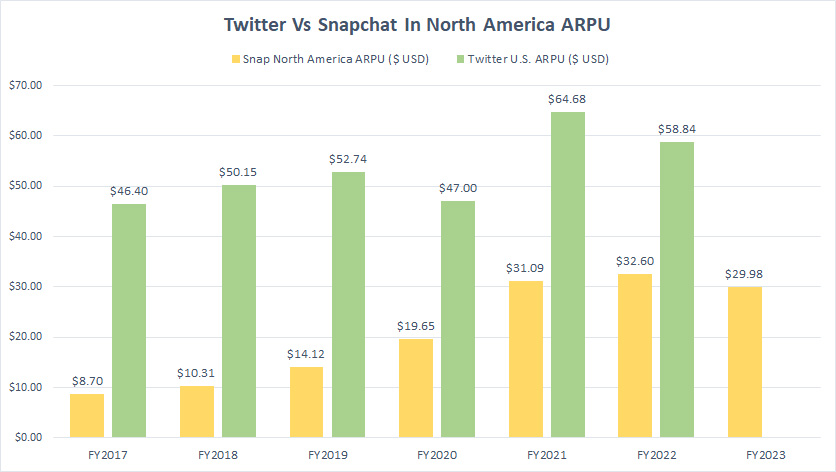

B2. Twitter Vs Snapchat In North America ARPU

Europe

C1. Europe ARPU

Asia Pacific

Rest Of World

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Facebook ARPU: Facebook defines its ARPU as total revenue in given geography during a given quarter, divided by the average of the number of MAUs in the geography at the beginning and end of the quarter.

While Facebook’s ARPU includes all sources of revenue, the number of MAUs used in this calculation only includes users of Facebook and Messenger, according to the company’s financial reports.

While the share of revenue from users who are not also Facebook or Messenger MAUs has grown over time, Meta estimates that revenue from users who are Facebook or Messenger MAUs represents the substantial majority of its total revenue.

Snap ARPU: Snap defines its ARPU as quarterly revenue divided by the average DAUs.

Snap assesses the health of its business by measuring DAUs and ARPU because it believes that these metrics are important for both management and investors to understand engagement and monitor the performance of our platform.

Pinterest ARPU: Pinterest defines its ARPU as total revenue in a given geography during a period divided by the average of the number of MAUs (Monthly Active Users) in that geography during the period.

Pinterest calculates the average MAUs based on the average number of MAUs measured on the last day of the current period and the last day before the beginning of the current period.

Twitter ARPU: Twitter’s ARPU is defined as the total advertising revenue in a given geography during a period divided by the average monetizable Daily Active Usage or Users (mDAU).

Twitter defines its mDAU as people, organizations, or other accounts who logged in or were otherwise authenticated and accessed Twitter on any given day through twitter.com, Twitter applications that are able to show ads, or paid Twitter products, including subscriptions, according to the 2021 annual report.

Twitter’s average mDAU for a period represents the number of mDAU on each day of such period divided by the number of days for such period.

Facebook Vs Pinterest In Worldwide or Global Average Revenue Per User

Facebook vs Pinterest in worldwide/global ARPU

The graph above compares the ARPU of Facebook and Pinterest due to their similar ARPU definitions. You can find the ARPU definitions of Facebook and Pinterest here: Facebook ARPU and Pinterest ARPU.

At first look, Facebook’s worldwide ARPU exceeds Pinterest’s by approximately seven times. Since fiscal 2017, Facebook’s ARPU has risen by 120%, from $20.21 in 2017 to $44.60 as of 2023. On the other hand, Pinterest’s global ARPU has climbed 105% from $3.14 in 2018 to $6.44 in 2023.

Compared to Pinterest, Facebook is a more mature social media platform with a broader range of monetization channels. Moreover, Facebook’s user base is much larger than Pinterest’s. That probably explains Facebook’s relatively higher ARPU.

Twitter Vs Snapchat In Worldwide or Global Average Revenue Per User

Twitter vs Snapchat in worldwide/global ARPU

The graph above compares the ARPU of Snap and Twitter to their similar ARPU definitions. You can find the ARPU definitions of Snap and Twitter here: Snap ARPU and Twitter ARPU.

Twitter has a much higher global ARPU than Snap’s. A noticeable trend is that Twitter produces consistent average revenue per user in most fiscal years. Between 2020 and 2022, Twitter’s worldwide ARPU averaged $18.79, while Snap’s figure came to $12.24 during the same period.

In fiscal 2023, Snap’s global ARPU of $11.49 was 11% lower than the 2022 result. Twitter’s worldwide ARPU of $18.71 in 2022 was 10% lower than the 2021 result.

Facebook Vs Pinterest In North America Average Revenue Per User

Facebook vs Pinterest in North America ARPU

The graph above compares the ARPU of Facebook and Pinterest due to their similar ARPU definitions. You can find the ARPU definitions of Facebook and Pinterest here: Facebook ARPU and Pinterest ARPU.

Facebook’s U.S. and Canada ARPU averaged $215.77 between 2021 and 2023, while Pinterest’s figure landed at $23.66 for the same period. Facebook’s U.S. and Canada ARPU is roughly nine times higher than Pinterest’s figure.

In fiscal 2023, Facebook earned $226.93 in average revenue per user in North America. On the other hand, Pinterest made only $25.52 in average revenue per user in the North American region in the same period.

A noticeable trend is the considerable increase in the ARPU of both social media platforms over the last three years. For example, Facebook’s ARPU in the U.S. and Canada has increased by 6% since 2021, while Pinterest’s results in the same countries have jumped 21% during the same period.

Twitter Vs Snapchat In North America Average Revenue Per User

Snapchat vs Twitter in North America ARPU

The graph above compares the ARPU of Snap and Twitter to their similar ARPU definitions. You can find the ARPU definitions of Snap and Twitter here: Snap ARPU and Twitter ARPU.

Twitter’s U.S. ARPU is much higher than Snapchat’s North America result. Twitter earned $56.84 in average revenue per user in the U.S. between 2020 and 2022. On the other hand, Snap made $31.22 in average revenue per user in North America between 2021 and 2023. The average revenue per user (ARPU) of Twitter in the United States is approximately twice the ARPU of Snapchat.

As of fiscal 2023, Snap’s ARPU of $29.98 in North America was roughly 8% lower than the 2022 result.

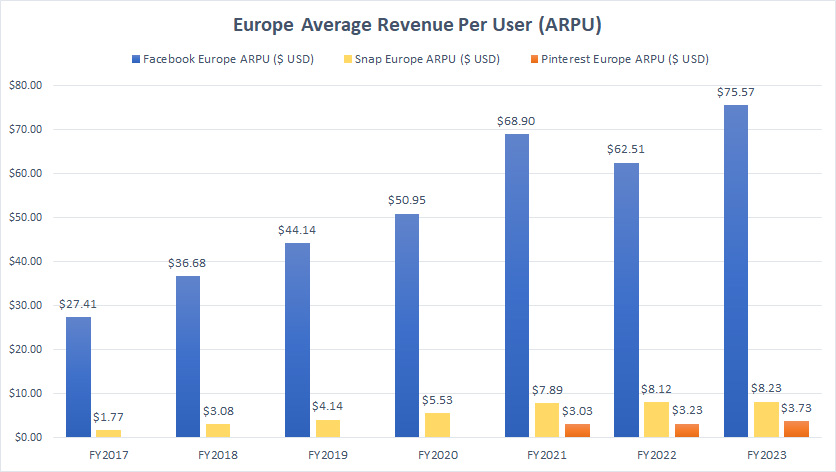

Europe Average Revenue Per User

Europe ARPU

Facebook, Pinterest and Snap’s Europe ARPU numbers may not be comparable on an apple-to-apple basis due to the difference in ARPU definitions. You can find the ARPU definitions of Facebook, Pinterest, and Snap here: Facebook ARPU, Pinterest ARPU, and Snap ARPU.

Facebook generates a significantly higher average revenue per user (ARPU) in Europe than Pinterest and Snapchat. In fiscal 2023, Facebook’s Europe ARPU landed at a record figure of $75.57, up 21% over 2022. Between 2021 and 2023, Facebook’s average revenue per user in Europe totaled $69.00.

On the other hand, over the last three years, Snap’s and Pinterest’s ARPUs in Europe were much lower, averaging only $8.08 and $3.33, respectively.

In fiscal year 2023, Snapchat generated an average revenue of $8.23 per user in Europe, while Pinterest earned $3.73 per user. Both social media platforms saw significant growth in revenue per user in 2023 compared to 2022.

Twitter does not break down its ARPU in Europe.

A significant trend is that Europe is the second-most lucrative region after North America for most social media platforms.

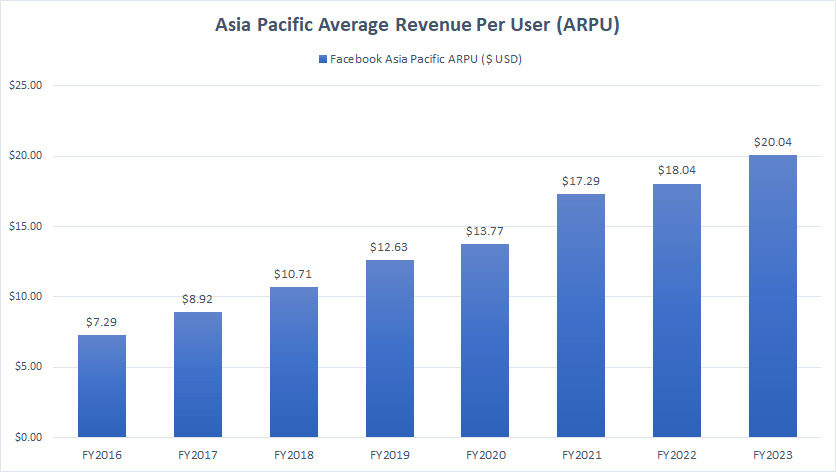

Asia Pacific Average Revenue Per User

Asia Pacific ARPU

Facebook’s average revenue per user in the Asia Pacific reached a record high of $20.04 in fiscal 2023, up about 10% over 2022. Since 2016, Facebook’s ARPU has significantly increased. Facebook earned only $7.29 in revenue per user in fiscal 2016. This figure has risen to $20.04 as of 2023, up nearly threefold.

Although Facebook’s revenue per user in the Asia Pacific has improved significantly, it is still only a quarter of Europe’s and a tenth of North America’s. Therefore, the Asia Pacific region represents one of Facebook’s largest but the least monetized regions. It is probably so for Snapchat and Pinterest.

We can expect Facebook to grow its average revenue per user in the Asia Pacific further, given the size of the population and the relatively low ARPU in this region.

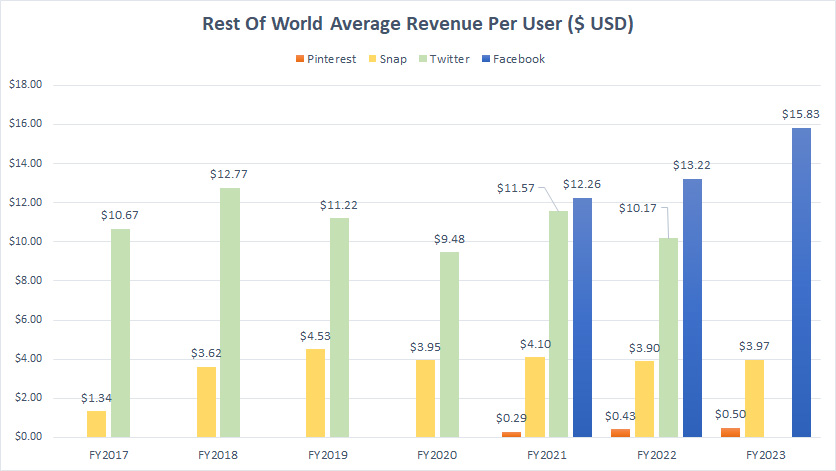

Rest Of World Average Revenue Per User

rest-of-world ARPU

Facebook, Pinterest, Twitter, and Snap’s Rest Of World ARPU numbers may not be comparable on an apple-to-apple basis due to the difference in ARPU definitions. You can find the ARPU definitions of Facebook, Pinterest, Twitter, and Snap here: Facebook ARPU, Pinterest ARPU, Twitter ARPU, and Snap ARPU.

Nevertheless, we can still look at the ARPU comparison for reference purposes.

Facebook tops the chart at $15.83 in ARPU in fiscal 2023, the highest among all social media platforms in comparison, despite having Europe and the Asia Pacific regions excluded in ARPU measurement.

Twitter’s Rest Of World ARPU topped $10.17 in 2022, the second highest after Facebook. Snap earned $3.97 in average revenue per user in Rest Of World, while Pinterest’s latest result reached $0.50.

Pinterest’s Rest Of World ARPU is significantly lower than the results of other social media platforms. On the other hand, Facebook’s ARPU in Rest Of World has risen by nearly 30% in three years.

Conclusion

North America, particularly the United States, is the most profitable market for Facebook, Pinterest, Twitter, and Snap. The average revenue per user (ARPU) in this region is the highest despite the online advertising market in North America being large and mature. The social media companies are experiencing incredible revenue growth in this region.

Europe is the second most lucrative market for Facebook, Pinterest, and Snapchat, contributing the second highest ARPU to these companies.

Facebook has the lowest ARPU in the Asia Pacific compared to other regions and countries. Despite the size of the population in the Asia Pacific, it is still under-explored and untapped by most social media companies like Facebook, Snap, Twitter, and Pinterest.

Although Facebook has the largest ARPU figures, smaller players like Snap and Pinterest are experiencing significant growth in ARPU numbers in all regions of the world.

References and Credits

1. Financial figures for all companies discussed above were obtained and referenced from their respective financial statements, which can be obtained from the following links:

a) Facebook Investor Relations

b) Snap Investor Relations

c) Pinterest Investor Relations

d) Twitter Investor Relations

2. Featured images in this article are used under Creative Common Licenses and obtained from Wall Boat and ijclark.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and providing a link to it from any website to create more articles like this.

Thank you!

It is remarkable that these mega platforms can continue to grow at very healthy rates. I created a new platform, dedicated to helping people settle a difference of opinion in a fun, entertaining and safe environment. I’m very excited to see that the market is still growing, and there is room for competition, or in my case niche platforms offering something new.