Grilling plant-based meat. Flickr Image.

Beyond Meat is a company specializing in creating plant-based meat that closely mimic the taste, texture, and nutritional profile of real meat.

Founded in 2009 by Ethan Brown, Beyond Meat has quickly become one of the leading companies in the plant-based food industry, offering a wide variety of products that include burgers, sausages, ground beef, and chicken strips.

The company’s mission is to provide consumers with a more sustainable and ethical alternative to traditional animal-based products while promoting healthier eating habits and reducing the environmental impact of meat production.

The company literally manufactures meat right out of its factories, but with plant-based protein instead of animal-based meat.

The success of Beyond Meat’s breakthrough innovation and the variety of products has positioned the company to compete directly in the $1.4 trillion global meat industry.

That said, this article explores Beyond Meat’s revenue and briefly looks into the company’s different business channels and their respective sales. In addition, Beyond Meat’s revenue by geographical region will be examined.

Also, we will delve into the company’s profitability and margins and talk about the outlook given by the company.

Let’s read on!

Please use the table of contents to navigate this page.

Table Of Contents

Overview And Definitions

- Net Revenues

- Adjusted EBITDA

- U.S. Retail

- U.S. Foodservice

- International Retail

- International Foodservice

O2. Beyond Meat Revenue Streams

O3. Beyond Meat Business Model

Consolidated Results

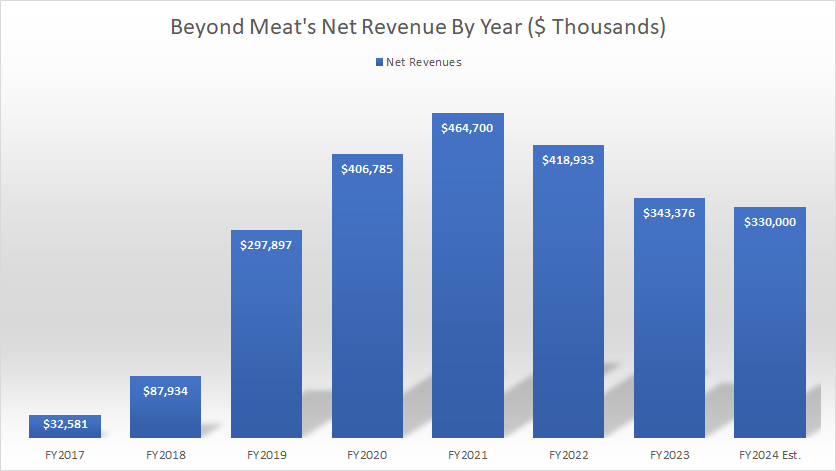

A1. Revenue By Year

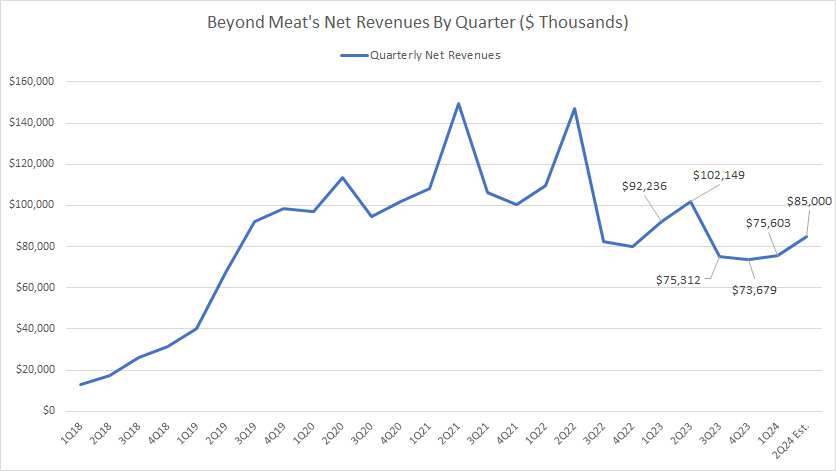

A2. Revenue By Quarter

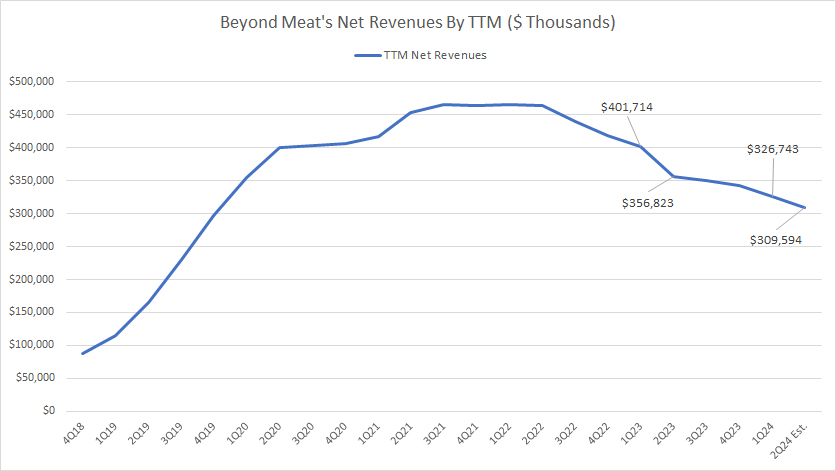

A3. Revenue By TTM

Revenue Growth

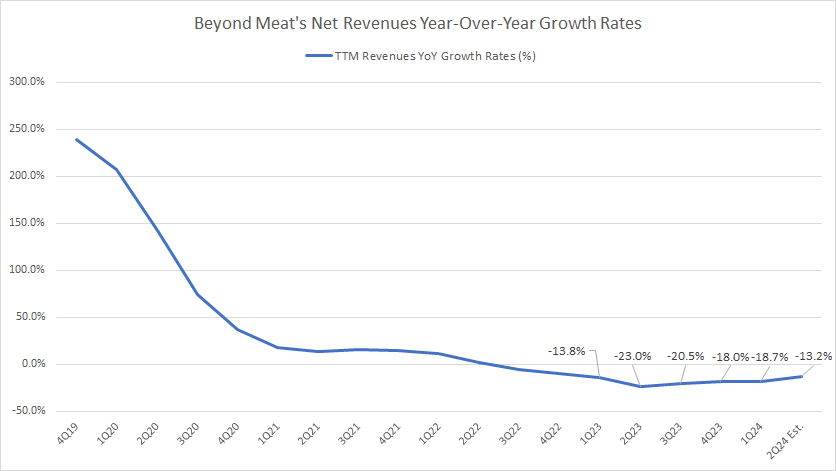

B1. Revenue Year-On-Year Growth Rates

Profit And Margins

C1. Gross Profit, Operating Profit, And Adjusted EBITDA

C2. Gross Margin, Operating Margin, And Adjusted EBITDA Margin

Revenue By Segment

D1. Retail And Foodservice Revenue

D2. Retail And Foodservice Revenue In Percentage

D3. Retail And Foodservice Revenue YoY Growth Rates

Revenue By Region

E1. U.S. And International Revenue

E2. U.S. And International Revenue In Percentage

E3. U.S. And International Revenue YoY Growth Rates

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Net Revenues: According to Beyond Meat, it routinely offers sales discounts and promotions through various programs to customers and consumers. These programs include rebates, temporary on-shelf price reductions, off-invoice discounts, retailer advertisements, product coupons and other trade activities.

It anticipates that over time it will need to continue to offer more trade and promotion discounts to both retail and foodservice customers, to drive increased consumer trials and in response to changing consumer and customer behavior and increased competition and pressure on the plant-based meat category.

The expense associated with these discounts and promotions is estimated and recorded as a reduction in total gross revenues in order to arrive at reported net revenues.

Adjusted EBITDA: Beyond Meat defines the adjusted EBITDA as net loss/income adjusted to exclude, when applicable, income tax expense, interest expense, depreciation and amortization expense, restructuring expenses, share-based compensation expense, and Other, net, including interest income and foreign currency transaction gains and losses, according to its earnings releases.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric commonly used to evaluate a company’s operating profitability by calculating its earnings before accounting for non-operating expenses such as interest payments, taxes, depreciation, and amortization.

EBITDA is often used to measure a company’s overall financial performance because it provides a clearer picture of its ability to generate cash flow from its core operations.

U.S. Retail: Beyond Meat defines its U.S. retail sales as net revenues from retail sales to the U.S. market and, sales to TPP, its joint venture with PepsiCo, Inc.

U.S. Foodservice: Beyond Meat defines its U.S. foodservice sales as net revenues from restaurant and foodservice sales to the U.S. market.

International Retail: Beyond Meat defines its international retail sales as net revenues from retail sales to international markets, including Canada.

International Foodservice: Beyond Meat defines its international foodservice sales as net revenues from restaurant and foodservice sales to international markets, including Canada.

Beyond Meat Revenue Streams

Beyond Meat generates revenue through several streams focusing on selling its diverse product lineup. These revenue streams include:

1. **Retail Sales**: Beyond Meat sells its products in supermarkets, grocery stores, and other retail outlets. This category includes frozen and refrigerated plant-based meat products, such as burgers, sausages, and ground meat alternatives. Retail sales constitute a significant portion of the company’s revenue, making its products accessible to consumers who want to cook at home.

2. **Food Service Sales**: Beyond Meat partners with restaurants, fast food chains, and other food service establishments to offer plant-based meat products on their menus. This stream includes sales to both large national chains and independent local operators. The company’s ability to penetrate the food service sector allows it to tap into the dining-out market, potentially increasing its product adoption and brand recognition.

3. **International Sales**: Beyond Meat has expanded its presence in international markets, including Europe, Asia, and Canada. International sales contribute to the company’s revenue streams by offering its products through retail and food service channels in these regions. The expansion into global markets is a strategic move to capitalize on the growing international demand for plant-based foods.

4. **Product Diversification**: Beyond Meat continuously innovates and expands its product range to include new plant-based meat alternatives. By diversifying its product lineup, the company can cater to a broader range of consumer preferences and dietary requirements, potentially opening up new revenue streams. New product launches and updates to existing products can drive sales growth both in existing markets and as the company enters new markets.

Overall, Beyond Meat’s revenue streams are primarily driven by the sale of its plant-based meat products across various channels and markets. The company focuses on expanding its presence in the retail and food service sectors globally. The company’s product innovation and international expansion strategy plays a crucial role in its ability to generate revenue and achieve growth.

Beyond Meat Business Model

Beyond Meat’s business model is a prime example of innovation and sustainability in the food industry. The company has successfully disrupted the traditional meat market by creating plant-based meat products that look, cook, and taste like their animal-based counterparts.

Beyond Meat’s flagship product, the Beyond Burger, has become a household name and has helped the company establish a strong foothold in the industry.

The company’s business model is centered around producing and selling its plant-based meat products at a premium price, typically higher than traditional meat-based products. This pricing strategy has allowed the company to generate high margins and reinvest in research and development to improve its products continually.

Beyond Meat’s proprietary technology and advanced ingredient sourcing have helped the company create plant-based meat products that are indistinguishable from traditional meat products. The company’s innovative marketing campaigns have also played a crucial role in creating awareness and driving product demand.

Beyond Meat’s partnerships with restaurants like Dunkin’ and McDonald’s, which offer Beyond Meat products on their menus, have helped the company expand its reach and generate additional revenue streams.

The company’s licensing agreements with various food service providers have also enabled it to penetrate new markets and increase its market share.

Overall, Beyond Meat’s business model is an excellent example of how a company can disrupt a traditional market by using innovation, technology, and sustainability.

The company’s mission to create delicious, nutritious, and sustainable plant-based meat products has resonated well with consumers. It has helped the company become one of the fastest-growing food companies in the world.

Revenue By Year

Beyond-Meat-revenue-by-year

(click image to expand)

The definition of Beyond Meat’s net revenue is available here: net revenues. In simple terms, Beyond Meat’s net revenues are sales net of discounts, promotions, and rebates.

Accordingly, Beyond Meat’s net revenue has significantly decreased since fiscal year 2021 when it reached its peak figure at nearly %465 million.

As of fiscal year 2023, Beyond Meat’s net revenues declined to $343 million, down $75 million or 18% over 2022 and $121 million or 26% over 2021.

Beyond Meat expects its net revenue to further decline by another 5% to reach $330 million midpoint at the end of the fiscal year 2024, according to the company’s 1Q24 earnings release.

Although Beyond Meat has suffered serious setbacks since 2021 due to various issues, including the pandemic, supply chain disruptions, rising cost of raw material, and growing competition, the opportunities ahead are massive.

According to the data from Fitch Solutions‘ macro research, the meat industry is the largest category in the food sector, generating an estimated sales of approximately $270 billion in the U.S. or $1.4 trillion globally in 2017 alone.

With total sales of slightly over $300 million in 2023, Beyond Meat captured less than 1% market share in the U.S. and the global meat industry.

Therefore, Beyond Meat’s growth story may not end here as there are plenty of opportunities ahead for the company, considering that the world is slowly becoming more environmentally and health-conscious, especially in the U.S.

In this context, the growing awareness of the negativities associated with eating animal-based products, including climate change and diseases, will only help to bolster Beyond Meat’s expansion into the protein industry.

Revenue By Quarter

Beyond-Meat-revenue-by-quarter

(click image to expand)

The definition of Beyond Meat’s net revenue is available here: net revenues.

Beyond Meat earned $75.6 million in quarterly net revenues in fiscal Q1 2024, down 18% from a year ago. It expects its net revenue to reach at least $85 million in the next quarter, according to the company’s 1Q24 earnings release.

On average, Beyond Meat has earned $84 million in quarterly net revenues between 1Q 2023 and 1Q 2024.

Revenue By TTM

Beyond-Meat-revenue-by-ttm

(click image to expand)

The definition of Beyond Meat’s net revenue is available here: net revenues.

Beyond Meat’s days of significant revenue growth is probably over, as depicted in the TTM chart above.

As seen, Beyond Meat’s TTM net revenues have been going downhill in post-poandemic time, reaching a record low of $326.7 million as of 1Q 2024, down 19% from a year ago.

Based on the revenue outlook provided in the 1Q24 earnings release, Beyond Meat’s TTM net revenues may reach $309.6 million, roughly 13% lower from a year ago.

Revenue Year-On-Year Growth Rates

Beyond-Meat-revenue-YoY-growth-rates

(click image to expand)

Beyond Meat’s revenue year-over-year growth rates have significantly slowed, as illustrated in the chart above.

They have reversed from growth to a decline. For example, the growth rates were nearly 250% in 2019. However, they have remained in double-digits decline since 2023.

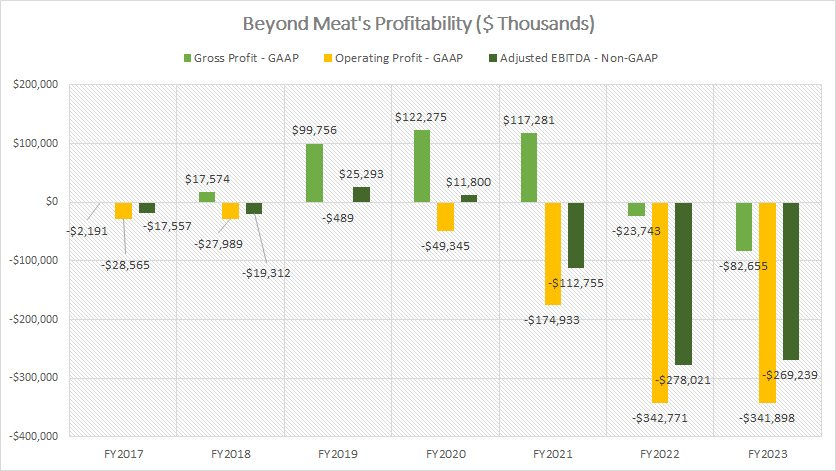

Gross Profit, Operating Profit, And Adjusted EBITDA

Beyond Meat Profitability

(click image to expand)

The definition of Beyond Meat’s adjusted EBITDA is available here: adjusted EBITDA.

As shown in the chart above, Beyond Meat’s profitability has significantly declined in post-pandemic periods.

In fact, Beyond Meat has never turned a profit. The only profit that it has made is in gross profit. However, its gross profit also has been in the red since 2022.

As of 2023, Beyond Meat generated a gross loss of $83 million, a much worse figure than the loss of $24 million in the prior year.

Also, Beyond Meat’s operating loss tumbled to $342 million in fiscal year 2023, while the adjusted EBITDA reached -$269 million.

For your information, Beyond Meat has been having a deteriorating cash on hand due to its poor cash flow generation.

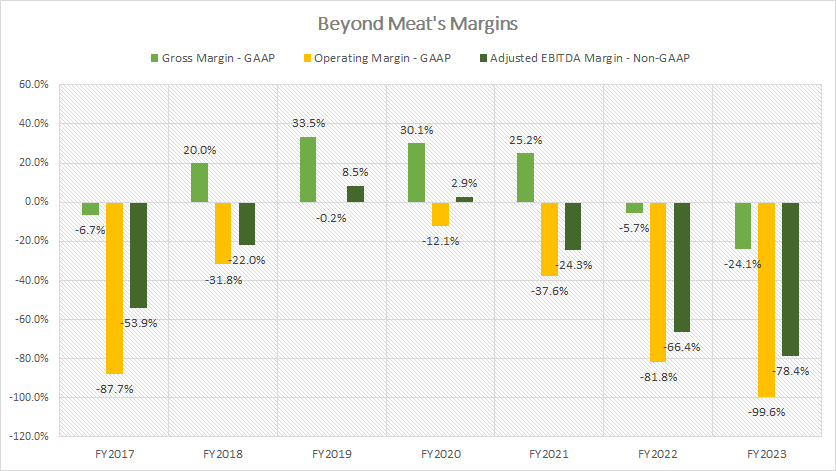

Gross Margin, Operating Margin, And Adjusted EBITDA Margin

Beyond Meat Margins

(click image to expand)

The definition of Beyond Meat’s adjusted EBITDA is available here: adjusted EBITDA.

Beyond Meat’s gross margin was seen tumbling to -24% in fiscal year 2023, a consecutive loss since 2022.

Similarly, Beyond Meat’s operating margin worsened to -100% in fiscal year 2023, compared to -82% in the previous year. Beyond Meat’s adjusted EBITDA margin also deteriorated to -78% in fiscal year 2023 from -66% in 2022.

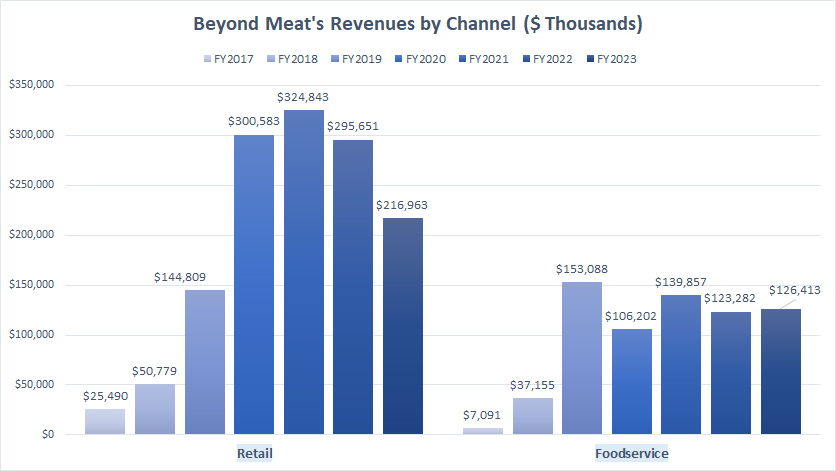

Retail And Foodservice Revenue

Beyond-Meat-revenue-by-segment

(click image to expand)

Beyond Meat operates in two distribution channels: retail and foodservice. The definitions of Beyond Meat’s retail and foodservice distribution channels are available here: U.S. Retail, U.S. Foodservice, International Retail, and International Foodservice.

As illustrated in the chart, Beyond Meat’s net revenues generated from the company’s retail channel has been much larger than the foodservice channel, at nearly 3X in fiscal year 2022 and 2X in fiscal year 2023.

As of Q1 2024, Beyond Meat had approximately 130,000 retail and foodservice outlets in the U.S. and internationally.

Of the 130,000 retail and foodservice outlets, approximately 70,000 were located in the United States. That leaves approximately 60,000 retail and foodservice outlets outside the U.S. or internationally.

In fiscal year 2023, Beyond Meat earned $217 million in retail sales versus $126 million in foodservice sales. Beyond Meat’s retail sales of $217 million in 2023 was a significant decrease from the $325 million in 2021 – down 33% in two years.

The same goes for the company’s foodservice revenue of $126 million in 2023, about 10% lower than the $140 million in 2021.

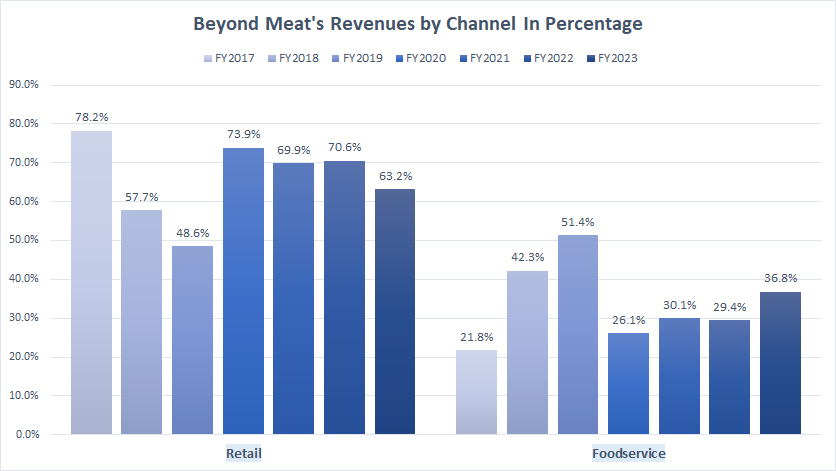

Retail And Foodservice Revenue In Percentage

Beyond-Meat-revenue-by-segment-in-percentage

(click image to expand)

Beyond Meat operates in two distribution channels: retail and foodservice. The definitions of Beyond Meat’s retail and foodservice distribution channels are available here: U.S. Retail, U.S. Foodservice, International Retail, and International Foodservice.

Beyond Meat’s retail sales have contributed an average of 68% of sales to net revenues between 2021 and 2023, while foodservice sales have represented an average of 32% during the same period. The latest ratios were 63% and 37% for retail and foddservice, respectively.

Although the foodservice’s sales have remained firm over the last several years, the retail channel still contributes a significant portion of sales to Beyond Meat’s net revenues, making the retail segment the company’s primary revenue source.

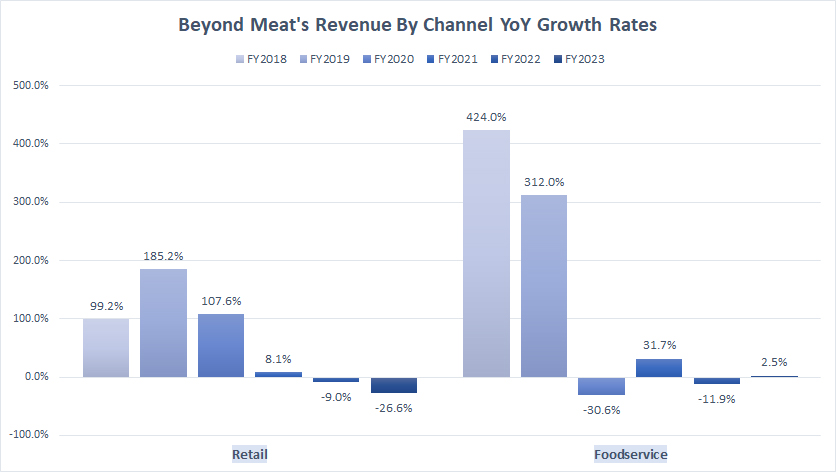

Retail And Foodservice Revenue YoY Growth Rates

Beyond-Meat-revenue-by-segment-growth-rates

(click image to expand)

Beyond Meat operates in two distribution channels: retail and foodservice. The definitions of Beyond Meat’s retail and foodservice distribution channels are available here: U.S. Retail, U.S. Foodservice, International Retail, and International Foodservice.

Beyond Meat’s revenue growth in the retail channel was slightly lower than the foodservice channel in recent years. On average, the retail segment has registered a growth rate of -9% annually between 2021 and 2023, while the foodservice segment has measured 7.5% annually.

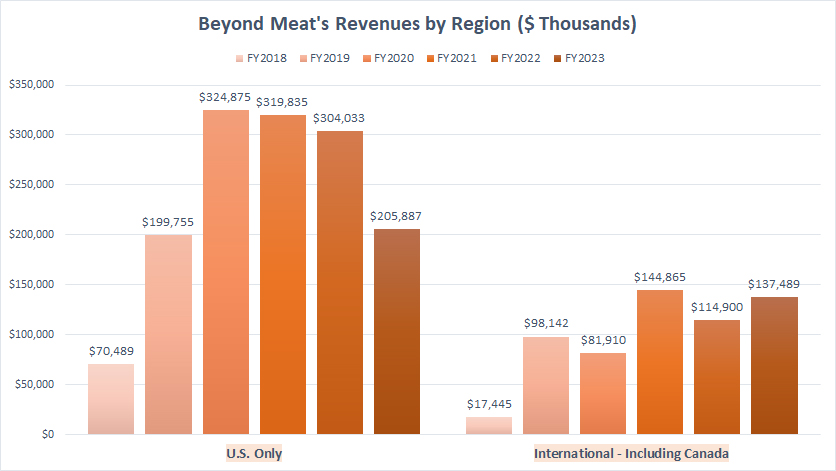

U.S. And International Revenue

Beyond-Meat-revenue-by-region

(click image to expand)

Beyond Meat breaks down its revenue into two regions: U.S. and International. The definitions of Beyond Meat’s retail and foodservice revenue by region are available here: U.S. Retail, U.S. Foodservice, International Retail, and International Foodservice.

As depicted in the chart above, Beyond Meat’s U.S. revenue is much higher than its International region, at nearly 2X the figure in 2023. In fiscal 2023, Beyond Meat’s U.S. revenue reached $206 million versus $137 million in International revenue. Therefore, Beyond Meat generates the majority of its net revenue from the U.S.

While the U.S. revenue has experienced incredible growth between 2018 and 2020, it has begun to slow since 2020 when it topped $325 million, the highest level ever reported.

On the other hand, Beyond Meat’s International revenue has remained relatively solid even during the post-COVID periods. In fact, Beyond Meat’s International revenue increased by 20% in 2023 compared to a decrease of 32% for its U.S. sales.

U.S. And International Revenue In Percentage

Beyond-Meat-revenue-by-region-in-percentage

(click image to expand)

Beyond Meat breaks down its revenue into two regions: U.S. and International. The definitions of Beyond Meat’s retail and foodservice revenue by region are available here: U.S. Retail, U.S. Foodservice, International Retail, and International Foodservice.

Beyond Meat’s U.S. revenue has contributed an average of 67% of sales to net revenues versus 33% for its International segment between 2021 and 2023. These ratios reached 60% and 40% as of fiscal year 2023.

Beyond Meat’s U.S. revenue contribution has significantly declined since 2018, down from 80% in 2018 to 60% as of 2023. On the other hand, its International revenue contribution has increased from 20% in 2018 to 40% as of 2023.

Therefore, Beyond Meat is increasingly getting a bigger portion of its sales from the International segment.

U.S. And International Revenue YoY Growth Rates

Beyond-Meat-revenue-by-region-growth-rates

(click image to expand)

Beyond Meat breaks down its revenue into two regions: U.S. and International. The definitions of Beyond Meat’s retail and foodservice revenue by region are available here: U.S. Retail, U.S. Foodservice, International Retail, and International Foodservice.

Beyond Meat’s International revenue has grown at a much faster rate than its U.S. region. On average, the net revenue from International region has grown at an average growth rate of 25% annually between 2021 and 2023 versus the average growth rate of -13% annually for its U.S. segment.

The latest growth rates were -32% and 20% for the U.S. and International segments, respectively.

Conclusion

While Beyond Meat had experienced phenomenal growth in the U.S. and international regions in the past, it has been having setback in recent years. This scenario also applies to Beyond Meat’s retail and foodservice channels, whose revenue has declined considerably since 2022.

Moreover, Beyond Meat has never turned a profit and its margins has been awful. Despite the setback, according to its CEO, Beyond Meat has continued to invest and expand for the long term.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Beyond Meat’s quarterly and annual reports, SEC filings, investor slides, press releases, etc., which are available in Beyond Meat SEC filings.

2. Featured images in this article are used under Creative Commons licenses and sourced from the following websites: Helen Alfvegren and Christoph Scholz.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!

Please let me know if you’re looking for a author for your weblog.

You have some really good articles and I think I would be

a good asset. If you ever want to take some of the load off, I’d

love to write some content for your blog in exchange for a

link back to mine. Please shoot me an e-mail if interested.

Kudos!

My web blog … Deloras