General Motors. Pixabay Image

This article presents the global and regional vehicle sales and market share of General Motors Company (NYSE: GM).

The vehicle sales statistics covered here are based on GM’s total vehicle sales data, which includes the company’s retail volumes, fleet sales, and vehicles used by dealers in their businesses, according to its latest annual report.

The difference between GM’s total vehicle sales and wholesale is that the total vehicle sales do not correlate directly to the revenue it recognizes in a given period. In contrast, vehicle wholesales correlate with the revenue it recognises in the income statements.

Investors interested in GM’s vehicle wholesale may find more information on this page: General Motors wholesale by country and region.

Let’s take a look.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. General Motors Business Strategy

O3. How Does General Motors Distribute Its Vehicles

Consolidated Sales

A1. Worldwide Vehicle Sales

A2. Growth Rates Of Worldwide Vehicle Sales

Consolidated Market Share

A3. Worldwide Market Share

A4. Market Share Excluding Europe

Sales By Region

B1. North America, Asia Pacific & MEA, And South America Vehicle Sales

B2. Europe Vehicle Sales

B3. North America, Asia Pacific & MEA, And South America Vehicle Sales In Percentage

B4. North America, Asia Pacific & MEA, And South America Vehicle Sales Growth Rates

Market Share By Region

B5. North America, Asia Pacific & MEA, And South America Market Share

B6. Europe Market Share

Sales By Country

C1. U.S., China And Brazil Vehicle Sales

C2. U.S., China And Brazil Vehicle Sales In Percentage

C3. U.K. And Germany Vehicle Sales

Market Share By Country

C4. U.S., China And Brazil Market Share

C5. U.K. And Germany Market Share

Growth Rates By Country

D1. U.S. Vehicle Sales Growth Rates

D2. China Vehicle Sales Growth Rates

D3. South America Vehicle Sales Growth Rates

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Total Vehicle Sales: General Motors defines its total vehicle sales as:

(1) retail sales (i.e., sales to consumers who purchase new vehicles from dealers or distributors);

(2) fleet sales (i.e., sales to large and small businesses, governments and daily rental car companies); and

(3) certain vehicles used by dealers in their business.

Total vehicle sales data for periods presented prior to 2022 reflect courtesy transportation vehicles used by U.S. dealers in their business. Beginning in 2022, GM stopped including such dealership courtesy transportation vehicles in total vehicle sales until such time as those vehicles were sold to the end customer.

Total vehicle sales data includes all sales by joint ventures on a total vehicle basis, not based on our percentage ownership interest in the joint venture. Certain joint venture agreements in China allow for the contractual right to report vehicle sales of non-GM trademarked vehicles by those joint ventures, which are included in the total vehicle sales it reports for China.

While total vehicle sales data does not correlate directly to the revenue it recognizes during a particular period, GM believes it is indicative of the underlying demand for its vehicles.

Total vehicle sales data represents management’s good faith estimate based on sales reported by dealers, distributors and joint ventures; commercially available data sources such as registration and insurance data; and internal estimates and forecasts when other data is unavailable.

Market Share: General Motors defines its market share as the ratio of GM’s total vehicle sales to industry volume. The equation is as follow:

Market share = Total vehicle sales / Industry Volume

General Motors Business Strategy

General Motors’ business strategy focuses on innovation, sustainability, and customer satisfaction. The company aims to be a leader in the automotive industry by developing and producing high-quality vehicles that meet customers’ evolving needs and preferences.

GM’s strategy also involves investing in new technologies, such as electric and autonomous vehicles, and collaborating with other companies to advance the industry.

Additionally, the company is committed to reducing its environmental footprint by implementing sustainable practices throughout its operations.

Overall, GM’s business strategy focuses on delivering value to its customers while driving long-term growth and profitability.

How Does General Motors Distribute Its Vehicles

General Motors distributes its vehicles through a network of dealerships located throughout the United States and around the world.

These dealerships are independently owned and operated, but they work closely with General Motors to ensure that customers have access to the latest models and technologies.

This article, GM competitive advantage , provides extensive coverage of General Motors’ network of dealerships.

General Motors also sells its vehicles online through its website, allowing customers to research, customize, and purchase vehicles from the comfort of their homes.

Additionally, General Motors offers leasing and financing options to help customers get behind the wheel of their dream car.

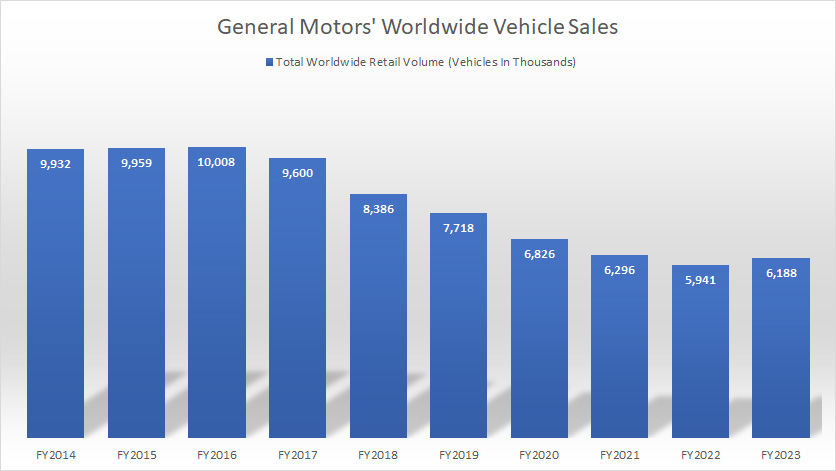

Worldwide Vehicle Sales

general-motors-worldwide-vehicle-sales

(click image to expand)

The definition of GM’s vehicle sales is available here: total vehicle sales.

General Motors reported worldwide or global vehicle sales of 6.2 million units in fiscal 2023, up 4% over 2022 but 2% lower from 2021. It is the first increase the company has experienced since 2017.

Since fiscal 2017, GM’s global vehicle sales have declined by 35%. On average, GM sold 6.1 million vehicles globally between 2021 and 2023.

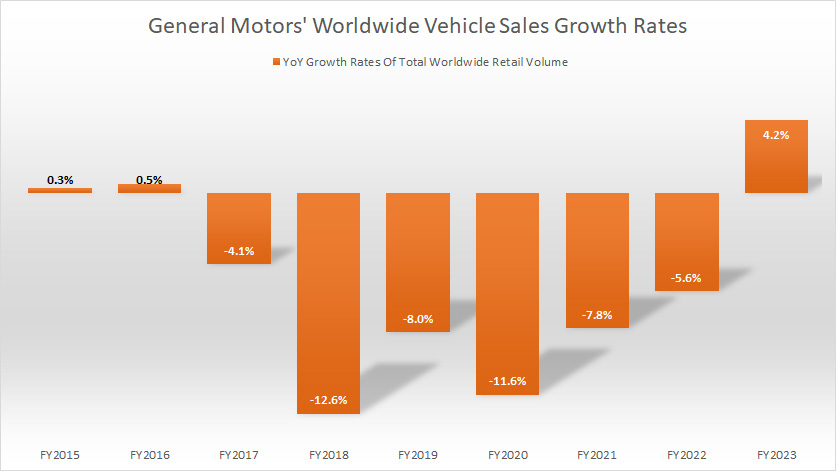

Growth Rates Of Worldwide Vehicle Sales

general-motors-worldwide-vehicle-sales-growth-rates

(click image to expand)

The growth rate plot above shows that GM hardly has any growth in global or worldwide vehicle sales.

In most fiscal years, GM’s worldwide vehicle sales were in decline except in 2023. In 2023, GM experienced its first sales increase of 4.2% over seven years.

On average, GM’s global or worldwide vehicle sales decreased by 3.1% between 2021 and 2023.

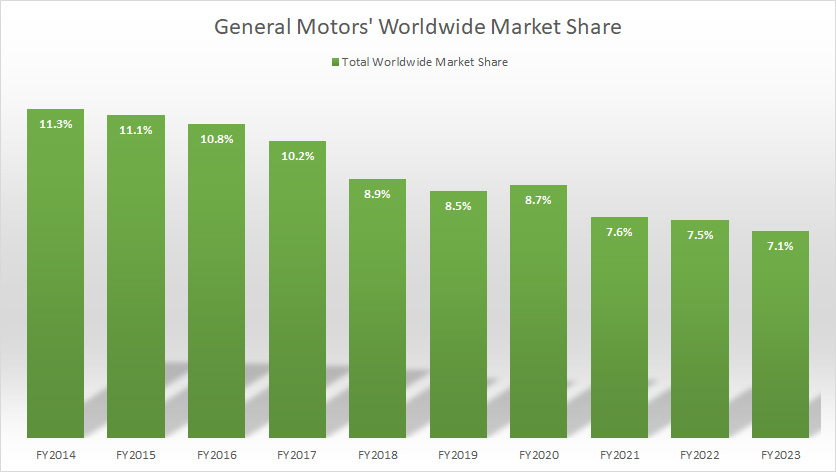

Worldwide Market Share

general-motors-worldwide-market-share

(click image to expand)

The definition of GM’s market share is available here: market share.

GM claimed to have a global market share of 7.1%, 7.5%, and 7.6% for fiscal years 2023, 2022, and 2021, respectively.

Although global market share has stabilized in recent years, the figure has been cut by nearly half since fiscal 2014.

On average, GM’s worldwide market share landed at 7.4% between 2021 and 2023.

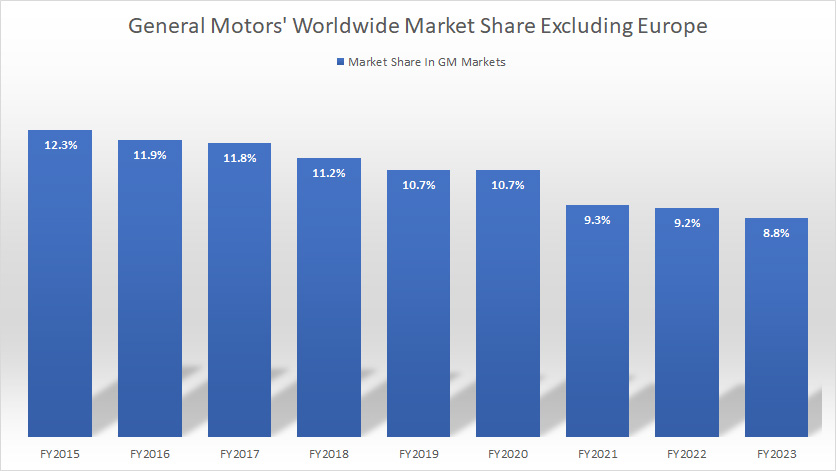

Market Share Excluding Europe

general-motors-worldwide-market-share-excluding-europe

(click image to expand)

The definition of GM’s market share is available here: market share.

In Europe, GM has had a significant presence for many years, with various brands such as Opel, Vauxhall, and Chevrolet being sold across different countries. However, in recent years, General Motors has scaled back its operations in Europe, selling off some of its brands and reducing its manufacturing footprint.

In 2023, it sold only 2,000 vehicles in Europe.

That said, GM’s worldwide market share, excluding Europe, reached 8.8%, 9.2%, and 9.3% for fiscal years 2023, 2022, and 2021, respectively.

Although GM’s market share, excluding Europe, has stabilized in recent years, the figures have continued to decrease, as shown in the chart above. Since 2014, GM’s worldwide market share, excluding Europe, has reduced by nearly four percentage points.

On average, GM’s worldwide market share, excluding Europe, was 9.1% between 2021 and 2023.

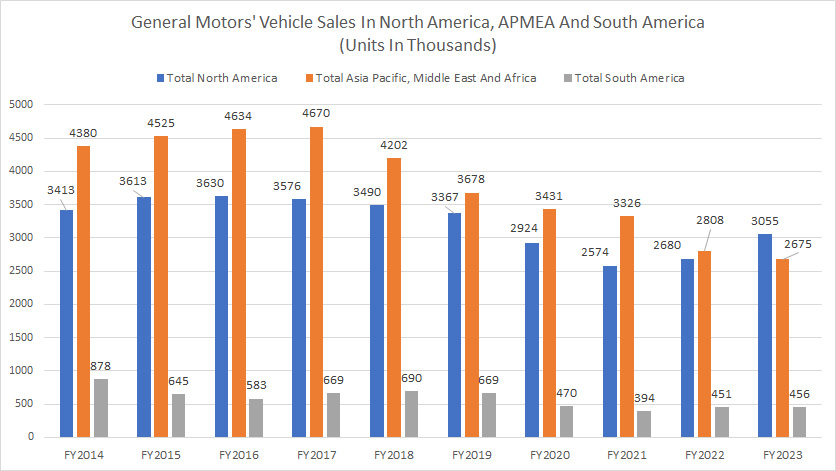

North America, Asia Pacific & MEA, And South America Vehicle Sales

general-motors-vehicle-sales-by-region

(click image to expand)

The definition of GM’s vehicle sales is available here: total vehicle sales.

In 2023, GM’s vehicle sales in North America surpassed the figure in the Asia Pacific & MEA for the first time in ten years, reaching 3.1 million, representing a rise of 14% over 2022. On the other hand, GM’s vehicle sales in the Asia Pacific & MEA totaled 2.7 million units in 2023, down 5% over 2022.

A noticeable trend is that GM’s vehicle sales in North America have significantly increased post-COVID periods, while the Asia Pacific & MEA has continued to decrease.

GM’s vehicle sales in South America have also increased post-pandemic, reaching 456,000 units as of 2023.

Another significant trend is that GM has sold fewer vehicles in recent years than historical highs.

Between 2021 and 2023, GM sold an average of 2.8 million vehicles annually in North America and 2.9 million in Asia Pacific & MEA.

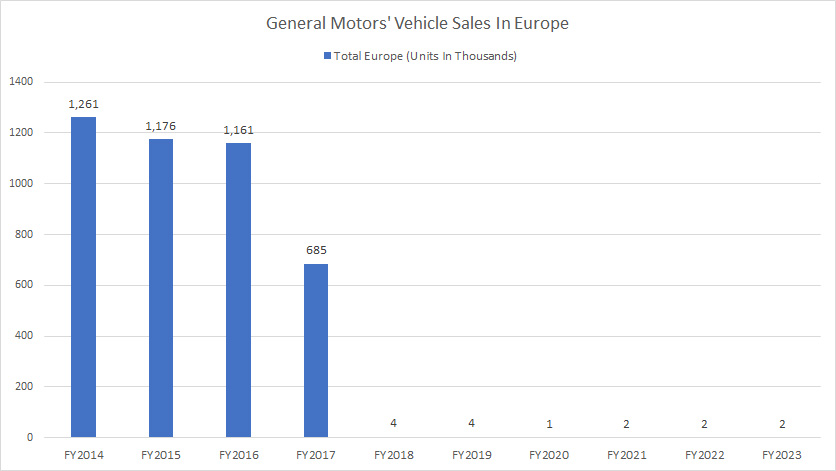

Europe Vehicle Sales

general-motors-vehicle-sales-in-europe

(click image to expand)

GM sold just 685,000 vehicles in Europe in fiscal 2017 before selling most of its European subsidiaries and exiting the market.

As of 2023, GM had only about two thousand vehicle sales in Europe annually, probably imported through third parties and agents.

Prior to 2017, GM used to sell over one million cars in Europe, making this region one of the company’s largest markets for its vehicles.

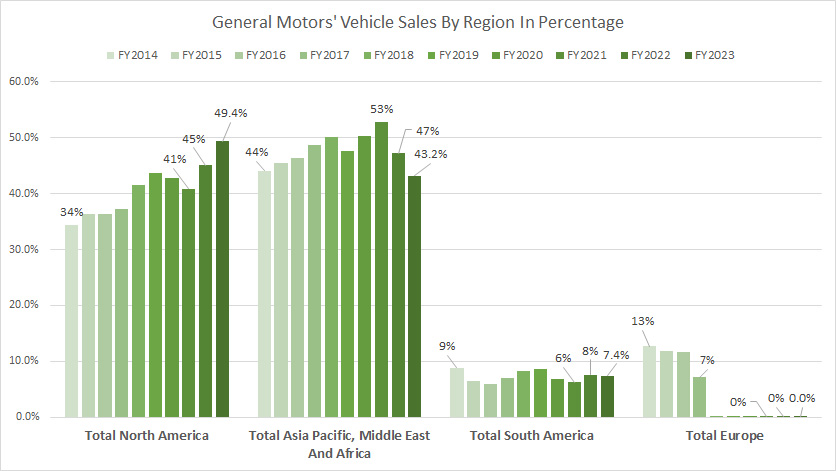

North America, Asia Pacific & MEA, And South America Vehicle Sales In Percentage

general-motors-vehicle-sales-by-region-in-percentage

(click image to expand)

In fiscal 2023, GM’s sales in North America accounted for almost 50% of its total vehicle volume. The Asia Pacific & MEA region accounted for 43.2%.

GM’s South America made up just 7.4% of the company’s total vehicle volume in fiscal 2023, the lowest among all regions under comparison.

A trend worth noting is the growing contribution of the North American region since 2014. On the other hand, the contribution from the Asia Pacific & MEA region has decreased considerably after reaching its peak at 53% in 2021. The contribution from South America has remained relatively unchanged.

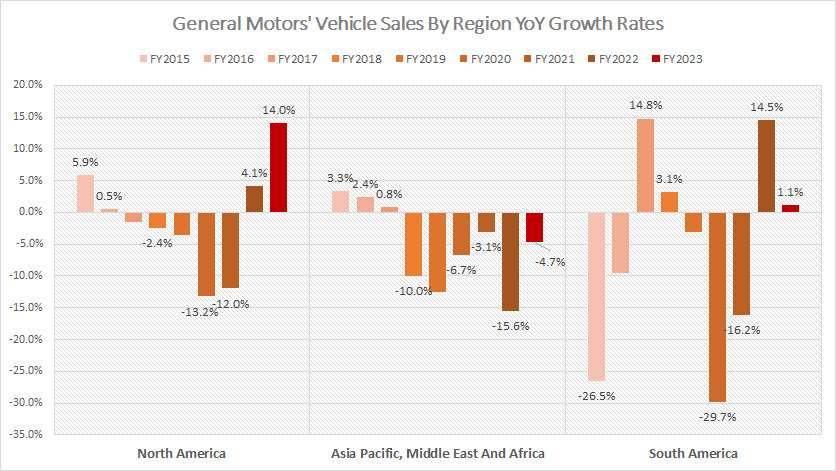

North America, Asia Pacific & MEA, And South America Vehicle Sales Growth Rates

general-motors-vehicle-sales-by-region-growth-rates

(click image to expand)

GM hardly had any growth in terms of vehicle sales in most regions.

As seen in the plot above, GM reported negative sales growth in most regions, with some numbers logging double-digit declines.

However, GM did much better in fiscal 2023, with sales growth coming to 14% in North America while South America grew by 1.1%.

GM’s sales growth in the Asia Pacific & MEA regions has performed the worst. GM has reported no sales growth in most fiscal years in the Asia Pacific & MEA region.

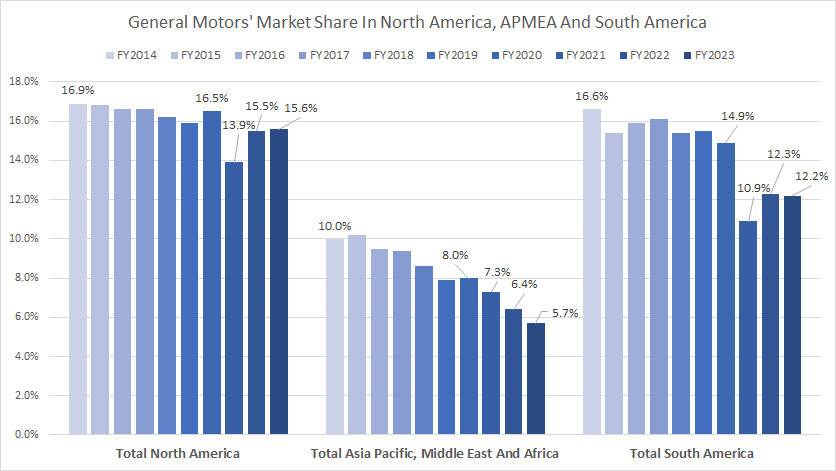

North America, Asia Pacific & MEA, And South America Market Share

general-motors-market-share-by-region

(click image to expand)

The definition of GM’s market share is available here: market share.

General Motors (GM) had a market share of 15.6% in North America in the fiscal year 2023, which was an improvement from 13.9% in 2021 and consistent with 2022.

In the Asia Pacific, Middle East and Africa regions, GM’s market share decreased by one percentage point to 5.7% in fiscal 2023 compared to the previous year.

In South America, GM’s market share remained unchanged at 12.2% in fiscal 2023, matching the 2022 result and increasing by one percentage point from 2021.

A significant trend over the years has been the continuous decline in GM’s market share in the Asia Pacific and MEA region. Since 2014, GM’s market share in this region has been reduced by almost half, reaching an all-time low in 2023.

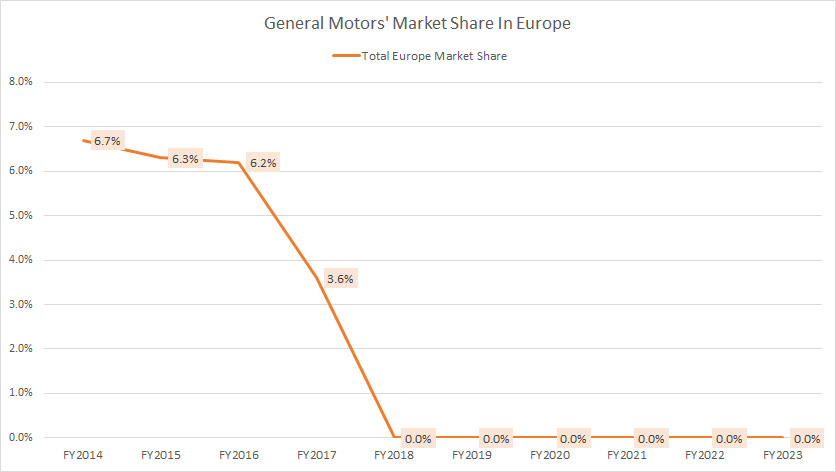

Europe Market Share

general-motors-market-share-in-europe

(click image to expand)

GM’s market share in Europe declined from over 6% before 2017 to 3.6% in 2017 and to 0% since 2018.

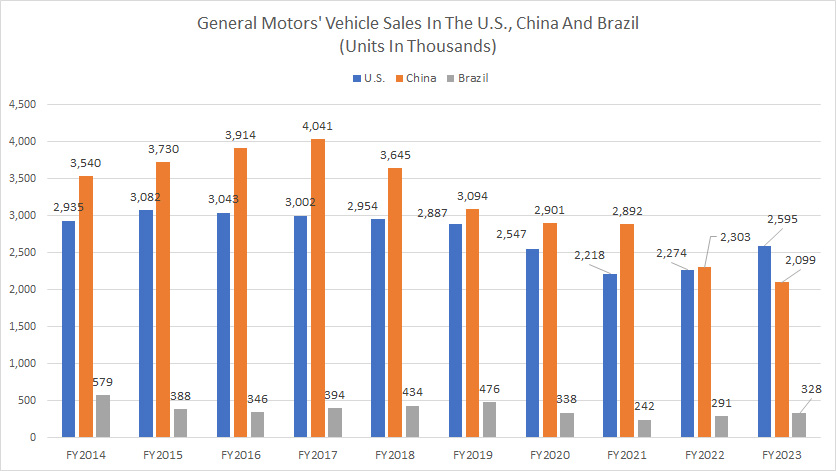

U.S., China And Brazil Vehicle Sales

general-motors-vehicle-sales-by-country

(click image to expand)

The definition of GM’s vehicle sales is available here: total vehicle sales.

General Motors had higher sales in China than in the United States in previous years. However, in 2022, the sales figures in both countries were at the same level.

The following year, in 2023, GM’s sales in the US surpassed those in China, as depicted in the chart above. In fiscal year 2023, GM reported selling 2.6 million vehicles in the US, while the number in China was 2.1 million, which is approximately 20% lower.

GM’s sales in Brazil totaled only 328 thousand vehicles as of fiscal 2023, the smallest among the three countries under comparison.

A significant trend is the considerable increase in sales in the U.S. in post-COVID periods. On the other hand, GM’s sales in China have been on the decline.

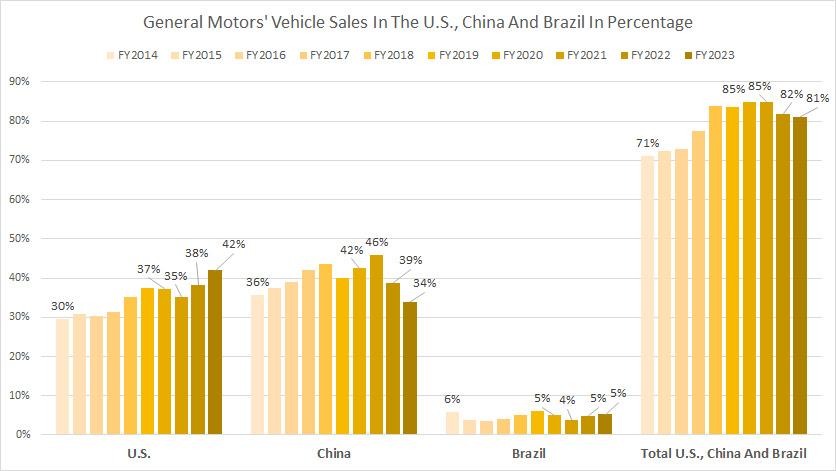

U.S., China And Brazil Vehicle Sales In Percentage

general-motors-vehicle-sales-by-country-in-percentage

(click image to expand)

General Motors sales in the United States, China, and Brazil account for over 80% of the company’s overall volume. This ratio increased to 81% in fiscal year 2023. Since fiscal year 2014, the sales contribution from these three countries has significantly risen.

Notably, the sales contribution from China and Brazil has remained relatively constant over the past nine years. In contrast, GM’s sales contribution in the United States has sharply increased from 30% to 42% since fiscal year 2014.

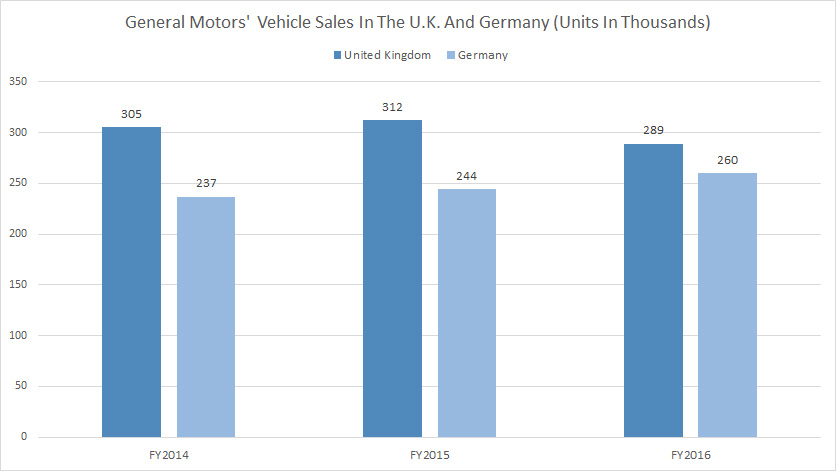

U.K. And Germany Vehicle Sales

general-motors-vehicle-sales-in-the-uk-and-germany

(click image to expand)

General Motors sold around 300,000 vehicles in the UK and 260,000 units in Germany before it exited these markets. These were the latest sales figures for GM in these countries.

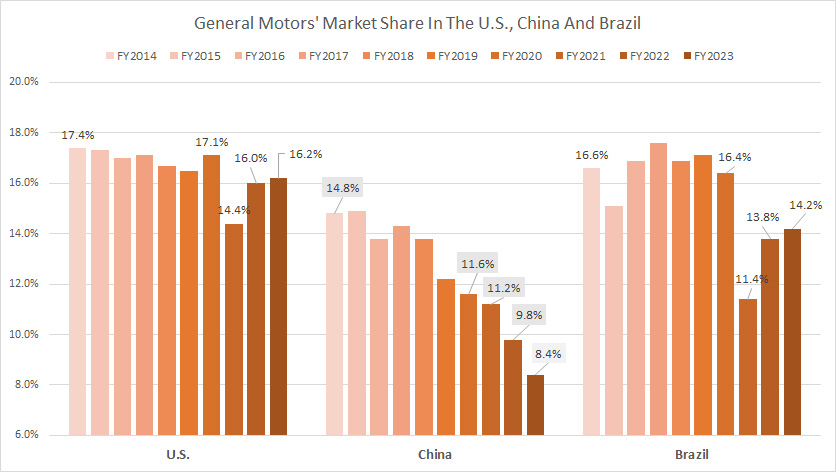

U.S., China And Brazil Market Share

general-motors-market-share-by-country

(click image to expand)

The definition of GM’s market share is available here: market share.

According to the latest fiscal report, GM’s market share in the US has reached a new high since 2021, surpassing all other countries at 16.2% as of 2023. Although the figure remained unchanged from the previous year, it significantly increased from 14.4% in 2021.

GM’s U.S. market share averaged 15.5% between 2021 and 2023.

On the other hand, GM’s market share in China and Brazil stood at 8.4% and 14.2%, respectively, in fiscal 2023.

Unfortunately, GM is facing a considerable struggle in China, as its market share has been declining since fiscal 2014, with no signs of recovery. In 2023, it reached an all-time low of 8.4%.

GM’s market share in China and Brazil averaged 9.8% and 13.1% between 2021 and 2023.

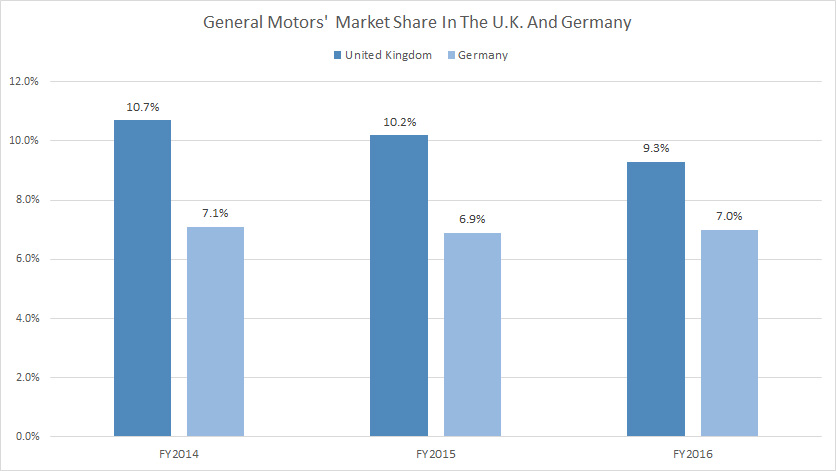

U.K. And Germany Market Share

general-motors-market-share-in-the-uk-and-germany

(click image to expand)

General Motors had a market share of 9% in the United Kingdom in fiscal 2016 and 10% in fiscal 2015.

In Germany, the company had a market share of approximately 7% in fiscal 2016 and 2017.

These are the most recent market share data available before General Motors exited the European market in 2017.

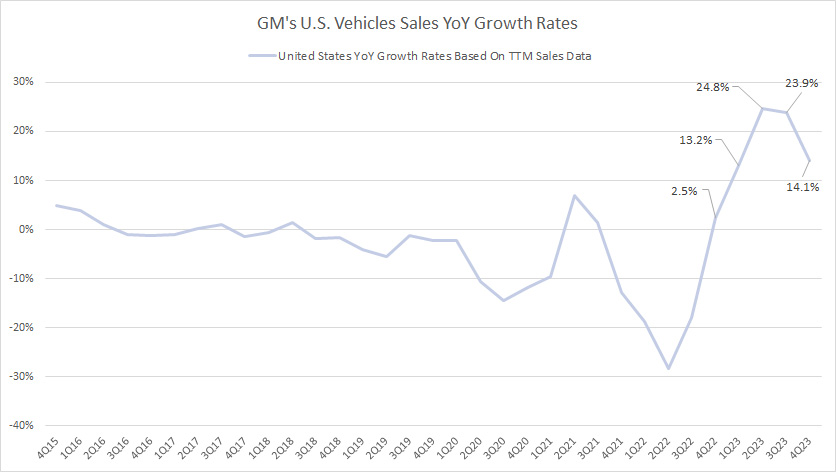

U.S. Vehicle Sales Growth Rates

general-motors-vehicle-sales-in-the-US-growth-rates

(click image to expand)

The YoY growth rate plot above clearly depicts the sharp recovery in GM’s U.S. vehicle sales in post-pandemic periods.

As of 4Q 2023, GM’s vehicle sales growth in the U.S. topped 14.1% compared to 2.5% a year ago.

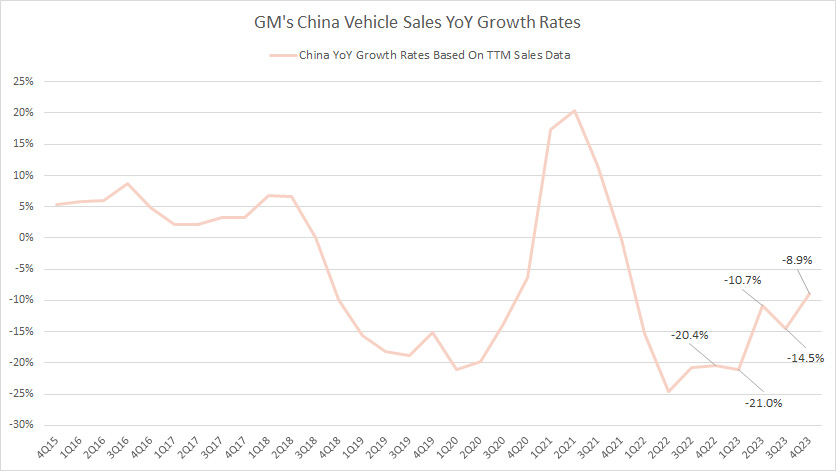

China Vehicle Sales Growth Rates

general-motors-vehicle-sales-in-china-growth-rates

(click image to expand)

The plot above displays the year-over-year growth rate of GM’s vehicle sales in China. It indicates that sales have declined after the pandemic, with most periods experiencing a double-digit drop.

However, between fiscal 2020 and 2021, GM’s vehicle sales in China rose during the pandemic. As of fiscal 4Q 2023, the growth rate of GM’s vehicle sales in China was -8.9%, which is an improvement from -20.4% the previous year.

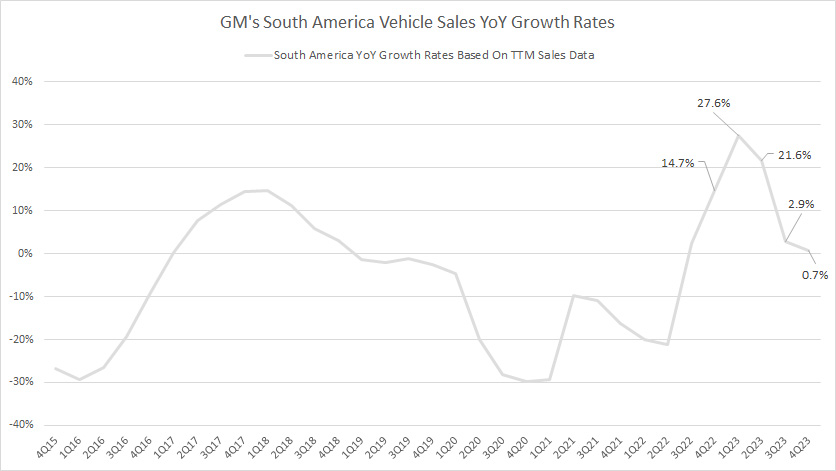

South America Vehicle Sales Growth Rates

general-motors-vehicle-sales-in-south-america-growth-rates

(click image to expand)

GM’s sales growth in South America has sharply recovered in post-pandemic periods. The average growth rate came at 13.2% over the last four quarters.

As of 4Q 2023, GM’s sales growth in South America topped 0.7%, a considerable decrease from 14.7% measured a year ago.

Conclusion

In fiscal year 2023, GM reported its first global sales growth, largely driven by North and South America.

However, the sales in China were still on the decline. In the same year, GM’s sales in North America exceeded those in China for the first time since 2014.

After the pandemic, GM’s market share in North and South America has bounced back, while it has continued to decrease in China.

Credits and References

1. All sales and market share figures presented in this article were obtained and referenced from General Motors’ earning releases, shareholders letter, presentation, SEC filings, quarterly and annual reports, etc., which are available in GM Sec Filings.

2. Featured images in this article are used under Creative Commons license and sourced from the following websites: GM Europe.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and providing a link to it from any website to create more articles like this.

Thank you!

Thanks for these great graphs and analysis! America is losing and in retreat on every front, it seems!