U.S. flag with dollar bills. Pexels Images.

This article explores Costco’s profitability and profit margins across different regions worldwide. The company primarily derives its profits from three key areas: the United States, Canada, and its other international operations.

The United States serves as Costco’s largest contributor to profitability, with Canada ranking second. The remainder of its profits is attributed to international markets outside of these two countries.

Keep in mind that the reported profitability and profit margins represent consolidated results, encompassing both the merchandise sales and membership fee segments. Together, these two streams drive Costco’s overall financial performance.

Let’s look at the details!

Investors interested in Costco’s other key statistics may find more resources on these pages:

- Costco revenue by country: U.S., Canada, and International,

- Costco revenue segments: foods, non-foods, fresh foods, etc., and

- Costco number of gas stations worldwide and gasoline revenue.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is Costco having significantly low profit margins?

Profit By Country

A1. Operating Profit From The U.S.

A2. Operating Profit From Canada and Other International Operations

Percentage Of Profit

B1. Percentage Of Operating Profit By Country

Profit Margin

C1. Operating Profit Margin By Country

Profit Growth

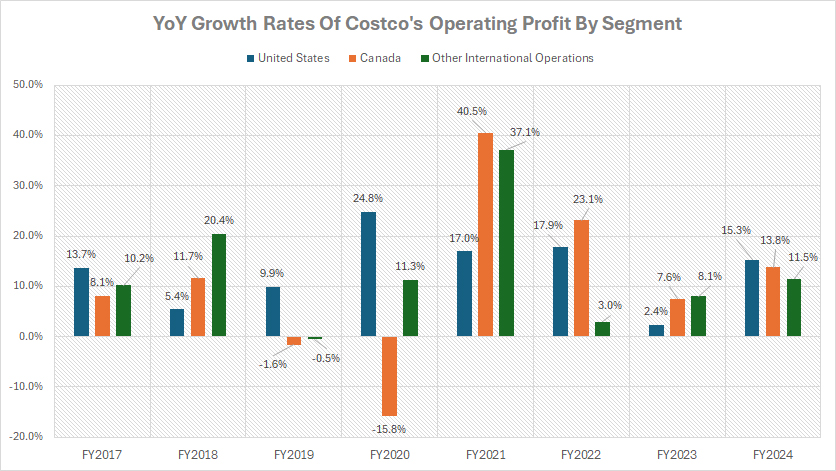

D1. YoY Growth Rates Of Operating Profit By Country

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Reportable Segments: Costco primarily operates membership warehouses through its wholly owned subsidiaries located in the U.S., Canada, Mexico, Japan, the U.K., Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

The management organizes reportable segments based on operational decisions and financial performance assessments, which take into account geographic locations.

Why is Costco having significantly low profit margins?

Costco’s low profit margins are a result of its unique business strategy, which prioritizes customer savings over maximizing profits. Here are the key reasons:

- Low Markup Policy: Costco enforces strict pricing guidelines, especially for its private-label Kirkland Signature products, which are capped at a 15% markup. This ensures affordability for customers but limits profit margins.

- Bulk Purchasing: By buying products in large quantities, Costco secures better deals from suppliers. However, this bulk-buying model also means lower per-unit profits.

- Limited Product Variety: Unlike traditional retailers that stock tens of thousands of items, Costco offers a curated selection of around 4,000 products. This streamlines operations and reduces costs but also limits revenue opportunities.

- Membership Model: Costco relies heavily on its membership fees for profitability. While this model supports its low-price strategy, it means the company operates with thinner margins on actual product sales.

- Minimal Marketing and Store Design Costs: Costco keeps expenses low by avoiding elaborate marketing campaigns and maintaining a no-frills store layout. While this helps pass savings to customers, it also contributes to lower profit margins.

This approach has made Costco a favorite among value-conscious shoppers, even if it means sacrificing higher profit margins.

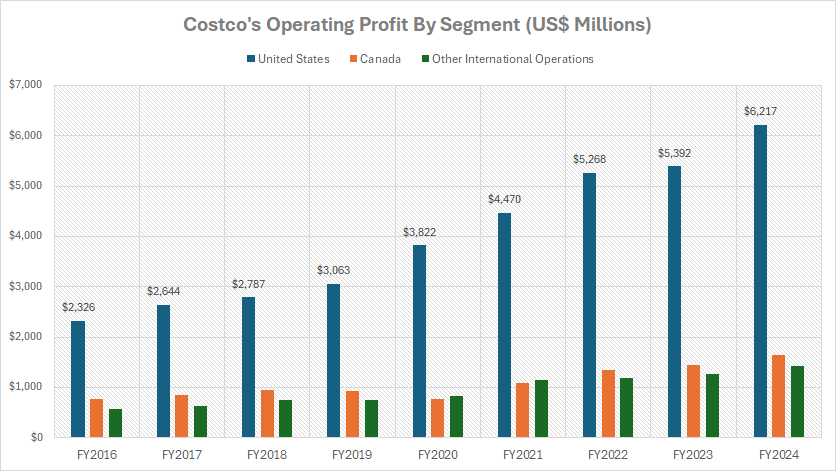

Operating Profit From The U.S.

Costco-operating-profit-breakdown-by-segment-united-states

(click image to expand)

Costco’s reportable segments consist of the U.S., Canada, and Other International regions. The definitions of the company’s reportable segments are available here: reportable segments.

Costco’s profit from the U.S. reached an unprecedented $6.2 billion as of fiscal year 2024, cementing the United States’ position as the retailer’s largest profit-generating region by a substantial margin.

This figure represents a remarkable 15% year-on-year increase compared to the $5.4 billion reported in fiscal year 2023. Such growth underscores Costco’s sustained expansion and profitability within its domestic market.

Over the longer term, Costco’s U.S. operating profit has demonstrated exponential growth. Since 2016, it has nearly tripled, climbing from $2.3 billion to $6.2 billion in less than a decade.

This surge reflects the success of Costco’s operational model, which emphasizes membership-driven revenue, efficient operations, and a curated product selection that resonates strongly with U.S. consumers.

Given the scale and dominance of its U.S. operations, the profits from other regions, including Canada and international markets, are comparatively smaller.

While these regions contribute positively to Costco’s overall financial health, their impact is overshadowed by the sheer magnitude of profitability achieved within the U.S. market. Nevertheless, these regions provide additional avenues for growth as Costco continues to expand its global footprint.

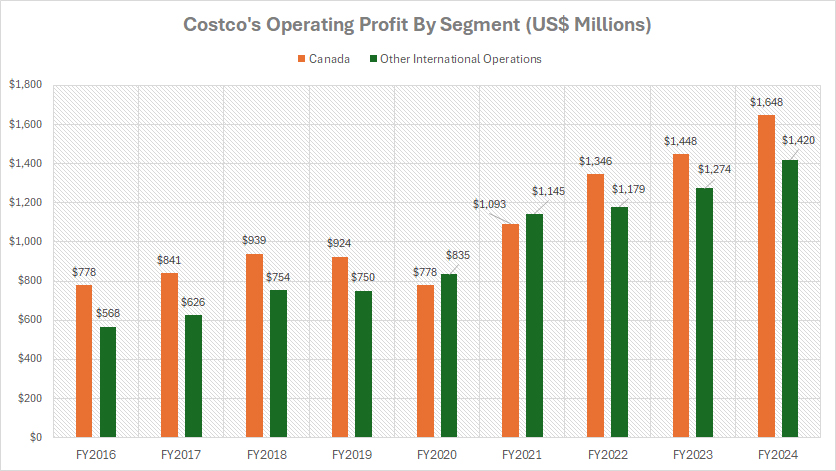

Operating Profit From Canada and Other International Operations

Costco-operating-profit-breakdown-by-segment-canada-and-international

(click image to expand)

Costco’s reportable segments consist of the U.S., Canada, and Other International regions. The definitions of the company’s reportable segments are available here: reportable segments.

Costco reported $1.6 billion in operating profit from its Canadian operations in fiscal year 2024, while profits from its other international markets reached $1.4 billion in the same period. These figures, though significantly lower than the U.S. profit of $6.2 billion, highlight the importance of these regions as growing contributors to Costco’s global business.

Despite the disparity, Costco’s profitability from Canada and other international markets has demonstrated remarkable growth over the years. From fiscal year 2016 to 2024, operating profit in Canada more than doubled, surging from $778 million to $1.6 billion.

This impressive performance underscores the strength of Costco’s business model in the Canadian market, characterized by growing membership loyalty and effective cost management.

Similarly, Costco’s operating profit from other international regions experienced an even more dramatic rise, nearly tripling during the same timeframe. It grew from $568 million in fiscal year 2016 to $1.4 billion in 2024. This growth reflects Costco’s successful expansion into new markets, along with its ability to adapt its offerings to meet the diverse needs of international customers.

While the U.S. remains Costco’s dominant profit center, the strong upward trajectory of its Canadian and international operations positions these regions as vital drivers of future growth.

As Costco continues to expand its global footprint, these markets are likely to play an increasingly significant role in its overall profitability.

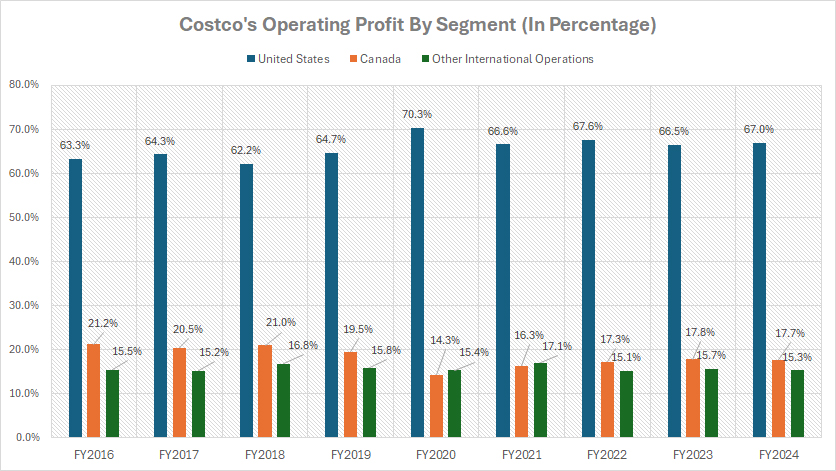

Percentage Of Operating Profit By Country

Costco-operating-profit-breakdown-by-segment-in-percentage

(click image to expand)

Costco’s reportable segments consist of the U.S., Canada, and Other International regions. The definitions of the company’s reportable segments are available here: reportable segments.

From a percentage standpoint, Costco’s operating profit derived from its U.S. operations accounted for approximately 67% of the company’s total operating income in fiscal year 2024. This ratio has remained relatively stable in recent years, underscoring the enduring significance of the U.S. market as the company’s primary profit driver.

On a longer-term basis, the contribution from the U.S. has steadily increased, rising by four percentage points from 63% in fiscal year 2016 to 67% in fiscal year 2024. This growth highlights the continued expansion and strong profitability of Costco’s domestic operations.

In contrast, Costco’s Canadian segment has experienced a gradual decline in its share of operating income over the same period. Between fiscal year 2016 and 2024, the percentage of operating income from Canada fell by three percentage points, dropping from 21% to 18%. This relative decrease reflects slower growth in profitability from the Canadian market compared to the U.S.

Meanwhile, Costco’s other international markets have remained a consistent contributor, representing slightly more than 15% of the total operating income throughout the period.

Despite not experiencing a significant shift in their proportional contribution, these markets continue to play a vital role in diversifying Costco’s geographic revenue base. Their steady performance suggests opportunities for sustained profitability as Costco further develops its global presence.

These shifts in regional profit contributions emphasize the growing dominance of the U.S. market while highlighting the importance of maintaining balanced growth across Canada and international operations to support the company’s long-term global strategy.

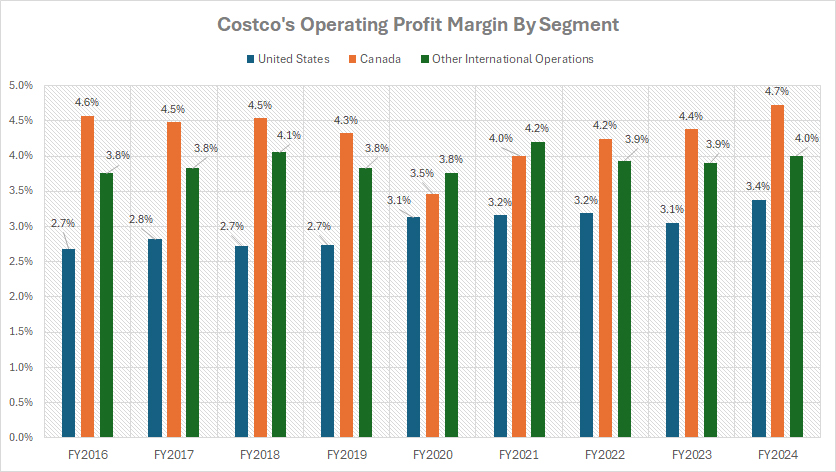

Operating Profit Margin By Country

Costco-operating-profit-margin-by-segment

(click image to expand)

Costco’s reportable segments consist of the U.S., Canada, and Other International regions. The definitions of the company’s reportable segments are available here: reportable segments.

Costco operates with an exceptionally low-margin business model, as demonstrated by its consistently modest operating profit margins across all regions, including its largest market, the U.S.

As reflected in fiscal year 2024, Costco’s operating profit margin in the U.S. — its most profitable region — stood at just 3.4%. Over the past five years, the U.S. has averaged an operating profit margin of only 3.2%, highlighting the slim margins that characterize its domestic operations.

This figure underscores Costco’s strategy of prioritizing volume-driven sales and competitive pricing over higher per-unit profitability.

In contrast, Costco achieves significantly higher operating profit margins in its Canadian operations. In fiscal year 2024, the Canadian region recorded an impressive operating profit margin of 4.7%, far exceeding that of the U.S.

Over the past five years, Costco’s average operating profit margin in Canada was approximately 4.2%, demonstrating a more profitable structure in this market. This improved margin reflects Costco’s ability to maintain cost efficiencies while capitalizing on strong customer loyalty and high membership retention rates in Canada.

Similarly, Costco’s international markets outside of North America generate comparatively strong profit margins. From fiscal year 2020 to 2024, the company’s other international operations achieved an average operating profit margin of 4.0%, on par with Canadian levels and notably above those in the U.S.

In fiscal year 2024, the operating profit margin for these international markets stood at 4.0%, aligning with the five-year average. This consistency highlights the effectiveness of Costco’s global operations, as the company continues to adapt and thrive in diverse regional markets.

Although the U.S. remains Costco’s largest profit generator, its lower margins compared to Canada and international markets emphasize the challenges of maintaining profitability in a highly competitive domestic retail landscape.

Costco’s ability to achieve better margins abroad underscores the importance of its international expansion as a vital component of its growth strategy. These regions, with their stronger profitability metrics, offer valuable diversification and underscore the company’s resilience and scalability on a global scale.

YoY Growth Rates Of Operating Profit By Country

Costco-operating-profit-growth

(click image to expand)

Costco’s reportable segments consist of the U.S., Canada, and Other International regions. The definitions of the company’s reportable segments are available here: reportable segments.

In fiscal year 2024, Costco demonstrated robust operating profit growth across all regions, showcasing its ability to recover and capitalize on market opportunities. The U.S. market saw a strong 15% increase in operating profit, solidifying its position as the company’s largest profit generator.

Canada followed closely with a 14% growth rate, while international operations posted a commendable 11.5% increase, further emphasizing Costco’s global potential.

These figures represent a significant improvement over fiscal year 2023, when operating profit growth was notably subdued. During that year, the U.S. recorded a modest growth rate of 2.4%, Canada saw 7.6%, and international markets achieved 8.1%. The comparison highlights Costco’s strategic resilience and its ability to navigate varying economic and operational challenges.

Costco’s strongest operating profit growth occurred in fiscal year 2021, a year of exceptional financial performance for the company. During this period, the U.S. market posted an impressive 17% growth, reflecting heightened consumer spending and increased membership engagement.

Meanwhile, Canada experienced an extraordinary surge of 40.5%, showcasing rapid gains in profitability driven by operational efficiencies and strong sales volumes. International markets also performed remarkably well, delivering a robust 37% growth rate, demonstrating Costco’s success in adapting its model to diverse global markets.

The varying growth patterns across regions underscore Costco’s ability to leverage its strengths while addressing unique regional dynamics.

Its consistent performance in the U.S. serves as a stable anchor, while the impressive growth in Canada and international markets highlights emerging opportunities and the company’s capacity to expand its global footprint.

With a strong track record and a clear upward trajectory, Costco continues to fortify its position as a leader in the retail industry.

Conclusion

Essentially, Costco’s ability to generate strong growth despite its low-margin strategy reflects the success of its volume-based, membership-driven model.

While the U.S. remains a critical profit hub, the higher margins and rapid growth in Canada and international markets indicate that these regions are vital for future profitability and diversification.

As Costco continues its global expansion, these markets will likely play a pivotal role in balancing its overall financial strategy and offsetting the limitations of its domestic operations.

References and Credits

1. All financial figures presented were obtained and referenced from Costco’s annual reports published on the company’s investor relations page: Costco Investor Relations.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.