Cannabis Products. Flickr Image

Altria Group, Inc., or Altria (NYSE: MO), runs a highly profitable business.

The company’s extraordinary profitability can be seen from its margins.

In this article, we will explore the company’s profitability from several margins, including the gross profit margin, operating profit margin, and net profit margin. These are GAAP margins.

Apart from the GAAP margins, we also examine some of Altria’s non-GAAP margins, such as the OCI and adjusted OCI margins.

We also explore Altria’s profitability by product segments and dive into the company’s two most profitable product segments: smokeable products and oral tobacco products.

Let’s get started!

Please use the table of contents to navigate this page.

Table Of Contents

Overview And Definitions

- Operating Company Income (OCI)

- Adjusted Operating Company Income (OCI)

- Smokeable Products Segment

- Oral Tobacco Products Segment

- Wine Products Segment

O2. Why Is Altria’s Profit Margin So Good?

O3. Altria Business Overview

Consolidated GAAP Margins

A1. Gross Profit Margin

A2. Operating Profit Margin

A3. Net Profit Margin

Consolidated Non-GAAP Margins

B1. Operating Companies Income (OCI) Margin

Margins By Product Segment

C1. Smokeable Products Margin

C2. Oral Tobacco Products Margin

C3. Wine Products Margin

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Operating Company Income (OCI): Altria defines the OCI as operating income before general corporate expenses and amortization of intangibles.

The OCI is a non-GAAP measure created by the management to evaluate the performance of and allocate resources to business segments.

Altria’s management believes that non-GAAP financial measures provide additional insight into underlying business trends and results and provide a more meaningful comparison of year-over-year results.

Altria’s management uses non-GAAP financial measures for planning, forecasting, and evaluating business and financial performance, including allocating resources and evaluating results relative to employee compensation targets.

Adjusted Operating Company Income (OCI): The adjusted OCI is similar to the non-adjusted OCI in which both are non-GAAP measures.

However, the adjusted OCI is further adjusted to exclude certain income and expense items, which the management considers as special, non-recurring, unusual, infrequent, etc.

These special or sometimes one-time income or expense items are hard to predict and can distort underlying business trends and results.

Similar to the non-adjusted OCI, Altria management uses the adjusted OCI to evaluate the performance of and allocate resources to business segments.

Smokeable Products Segment: Altria’s smokeable products segment includes cigarettes, cigars, and pipe tobacco.

This segment is the largest revenue generator for the company and consists of the most popular brands, such as Marlboro, Black & Mild, and Copenhagen. The segment is highly competitive, but Altria’s strong brand image and diversified product portfolio have helped it maintain its market share and profitability over the years.

Despite increased regulatory pressure and declining smoking rates, the smokeable products segment contributes significantly to Altria’s overall revenue and earnings.

Oral Tobacco Products Segment: Altria’s oral tobacco products segment includes smokeless tobacco products, such as snus, moist snuff, and chewing tobacco.

This segment is a smaller revenue generator than its smokeable products segment. However, Altria’s diversified product portfolio and strong distribution network have helped it maintain its market share and profitability in this segment.

Despite declining usage rates, the oral tobacco products segment remains an important contributor to Altria’s overall revenue and earnings.

Wine Products Segment: Altria completely divested its wine product segment in 2021, possibly due to the unprofitable nature of the wine business, especially during the COVID disruptions.

Therefore, Altria’s main product segments include only the smokeable, smokeless, and financial services. Altria’s core business currently focuses on smokeable and smokeless tobacco products.

Why Is Altria’s Profit Margin So Good?

Altria attains incredible profit margins because of the following reasons:

1. Strong Brand Image: Altria has a strong brand image in the market, which helps it charge premium prices for its products. As a result, the company enjoys higher profit margins than its competitors.

2. Cost Optimization: Altria has a robust cost optimization strategy that helps it keep its operational costs low. This allows the company to generate higher profits despite low sales volumes.

3. Diversified Product Portfolio: Altria has a diversified product portfolio, which includes cigarettes, cigars, and smokeless tobacco products. This helps the company to generate revenue from multiple sources and reduces its dependence on any single product.

4. Efficient Supply Chain Management: Altria has an efficient supply chain management system, which allows it to procure raw materials and deliver finished products at a low cost. This helps the company to maintain its profit margins even when the input costs are high.

5. Strong Distribution Network: Altria has a strong distribution network that allows it to reach a large customer base. This helps the company to generate higher sales and maintain its profit margins.

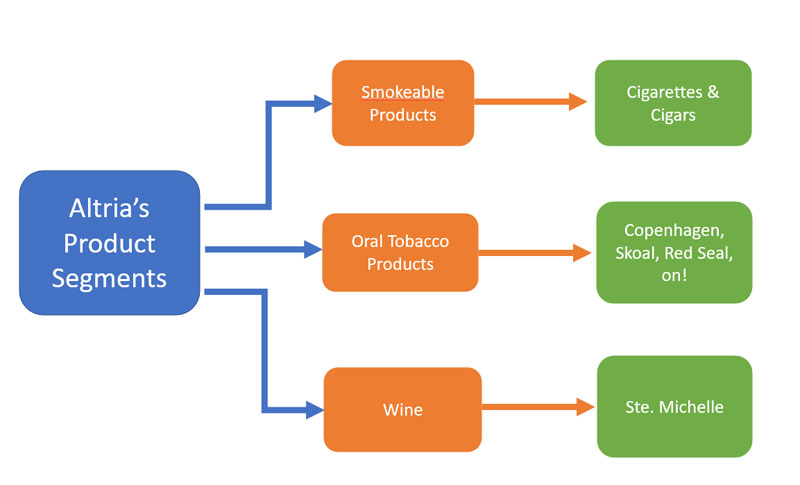

Altria Business Overview

Altria product segments

(click image to expand)

Altria operates on three product segments, and they are:

2. Oral tobacco products, and

3. Wine.

Altria’s largest product segment is the smokeable or combustible product, and it gets its revenue or sales from cigarettes and cigars.

Some famous brand names under the cigarette and cigar products are the popular Marlboro and Black & Mild.

The 2nd major product segment is Altria’s oral tobacco or non-combustible product segment, and its revenue source comes from selling smokeless tobacco products.

The brand names under Altria’s oral tobacco product segment range from Copenhagen, Skoal, on!, Red Seal, etc.

Altria’s smallest product segment is the wine category.

Ste. Michelle is the holding company under Altria’s wine sector, and it produces and markets premium wines sold under various labels, including Chateau Ste. Michelle, 14 Hands, and Stag’s Leap Wine Cellars.

However, Altria completely divested its wine business in 2021, possibly due to the wine segment’s low margin and low profitability.

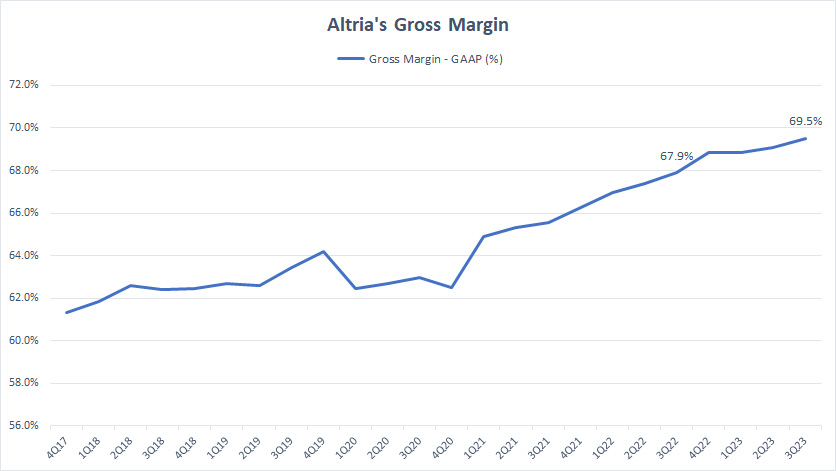

Gross Profit Margin

Altria gross margin

(click image to expand)

Altria generates an extraordinary gross profit margin, as depicted in the plot above.

As seen, Altria’s gross profit margin is close to 70%, and it is still rising.

Since 2017, Altria’s gross profit margin has risen from 62% to 70% in the latest quarter, suggesting the incredible pricing power the company has for the tobacco market.

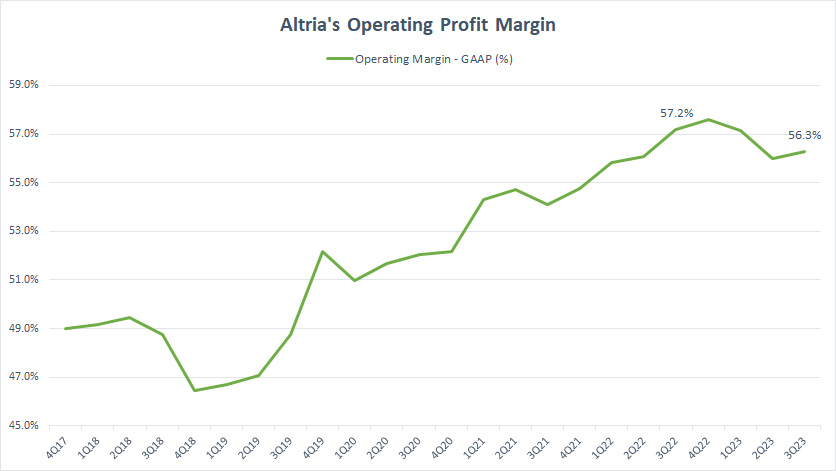

Operating Profit Margin

Altria operating margin

(click image to expand)

Apart from having a massive moat over the tobacco market, Altria operates super efficiently, as depicted in the chart above.

As seen, Altria’s operating profit margin is closing in at 60% and is still on the rise.

As of 3Q 2023, Altria’s operating profit margin reached 56.3%, down slightly from a year ago but up significantly from 2017.

Altria’s highly efficient operations have enabled the company to increase its dividend every year.

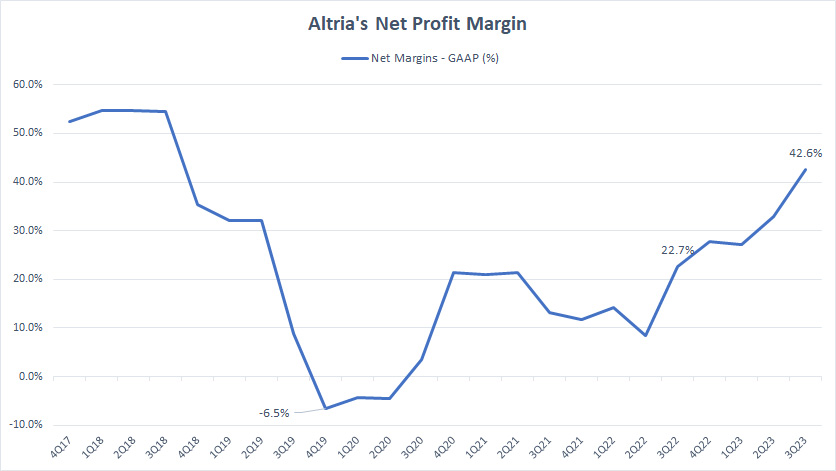

Net Profit Margin

Altria net profit margin

(click image to expand)

Altria also generates an extraordinary net profit margin, which has exceeded 40% as of 3Q 2023, as presented in the chart above.

Although Altria is a highly profitable company, its profitability is not immune to sudden drops, as in 2020.

As seen, Altria incurred a significant loss in 2020, as evidenced by the company’s net profit margin falling below the profitability level.

For your information, Altria’s negative net margin in 2020 was driven by the loss of investment in JUUL and Cronos.

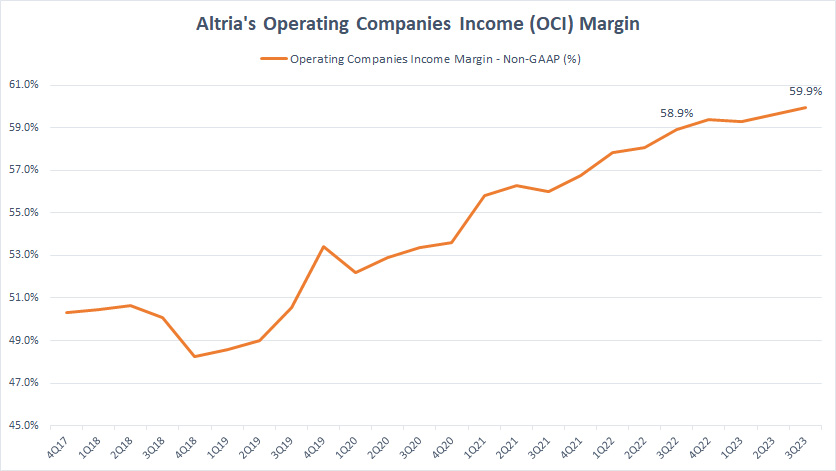

Operating Companies Income (OCI) Margin

Altria OCI margin

(click image to expand)

Similar to the GAAP operating margin, Altria’s non-GAAP OCI margin also depicts the company’s incredible operating efficiency.

As seen in the chart above, Altria’s OCI margin has significantly risen from 50% in 2017 to 60% as of 2023, suggesting the company’s improving operating efficiency.

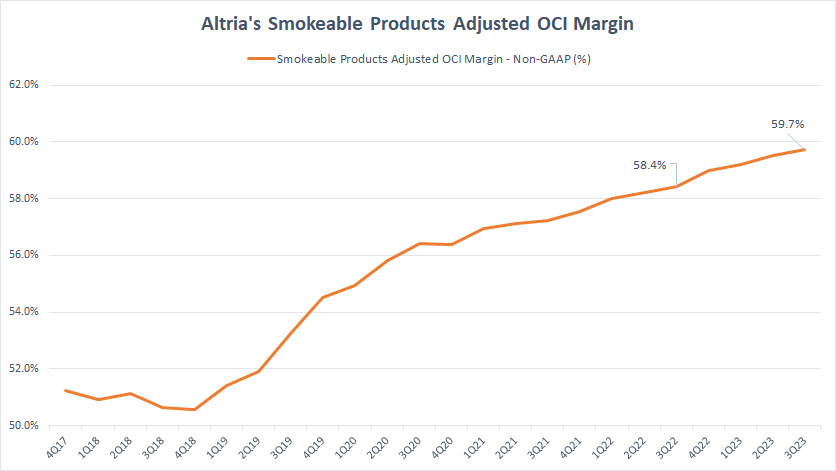

Smokeable Products Margin

Altria smokeable product margin

(click image to expand)

Altria’s smokeable or combustible products segment is the company’s largest segment that generates the most revenue.

Apart from having the most revenue, the smokeable products segment is also one of the most profitable segments.

As seen in the chart above, Altria’s smokeable products segment has an adjusted OCI margin that reaches 60%.

More importantly, the result has significantly risen from 50% in 2017 to the latest figure of 60%, indicating the improving profitability and operating efficiency of the combustible products segment.

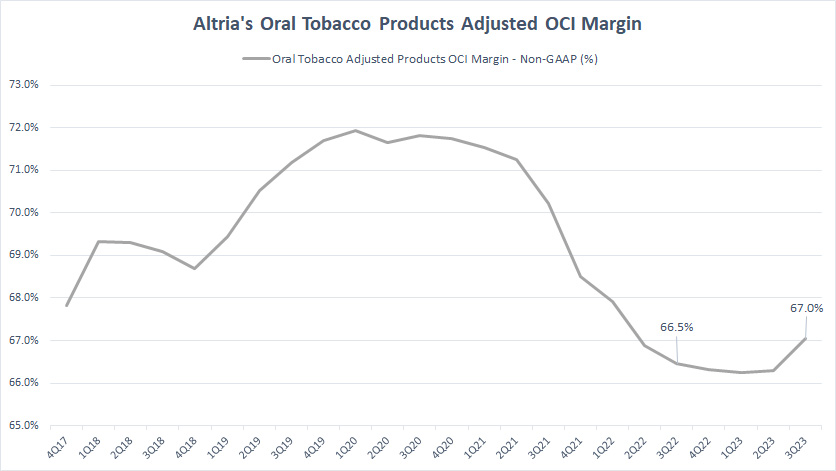

Oral Tobacco Products Margin

Altria oral tobacco product margin

(click image to expand)

Although Altria’s oral tobacco products segment contributes significantly less revenue, it is the most profitable segment with an adjusted OCI margin topping 70%, as shown in the chart above.

Altria’s oral tobacco products segment was an even more profitable segment in the past when the adjusted OCI margin exceeded 70%.

In post-pandemic periods, the adjusted OCI margin of Altria’s oral tobacco products segment has slightly declined compared to its historical highs.

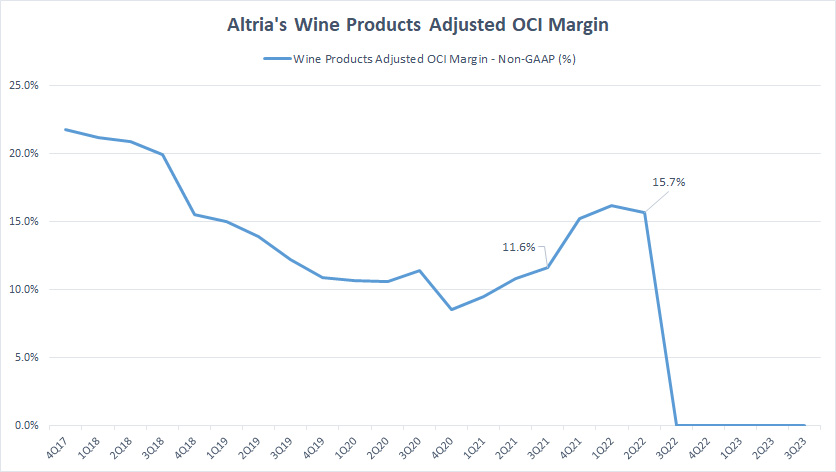

Wine Products Margin

Altria wine product margin

(click image to expand)

Altria’s wine product segment produces the lowest margin among all businesses of the company.

As shown in the chart, the adjusted OCI margin of Altria’s wine segment came in at slightly over 15% as of 2022.

For your information, Altria’s wine business was divested in 2021, possibly due to this segment’s low margin and low profitability.

The low margin and low profitability of Altria’s wine products segment were particularly obvious during COVID-19, as the adjusted OCI margin had tumbled to record lows between 2020 and 2021.

Therefore, it was no surprise that Altria disposed of this business segment during the pandemic.

Summary

Altria, a leading tobacco company, has maintained a strong margin and profitability over the years. The company’s operating margin has consistently remained above 40% since 2017, indicating its ability to generate significant profits.

In terms of profitability, Altria has delivered consistent earnings growth to its shareholders. The company’s adjusted net earnings have increased from US$3.39 per share in 2017 to US$4.84 per share as of 2022, which is a testament to the company’s strong financial performance.

One of the key drivers of Altria’s margin and profitability is its ability to price its products effectively. The company has been able to increase prices on its tobacco products in response to declining demand, which has helped to offset the impact of declining volumes.

Additionally, Altria has reduced its costs through various initiatives, such as supply chain optimization and cost-cutting measures.

Another factor contributing to Altria’s margin and profitability is its diversification strategy.

The company has expanded into adjacent markets, such as wine and beer, which has helped mitigate the impact of declining tobacco volumes. Altria has also made significant investments in the emerging cannabis industry, which could provide a new source of growth in the future.

Overall, Altria’s margin and profitability are a result of its ability to manage costs effectively, increase prices on its products, and diversify its revenue streams.

While the tobacco industry faces significant headwinds, Altria’s strong financial performance suggests that the company is well-positioned to navigate these challenges and deliver value to its shareholders.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Altria’s quarterly and annual reports, SEC filings, event presentations, press releases, etc., which are available in Altria Earnings Releases.

2. Featured images are used under Creative Common Licenses and are obtained from Elsa Olofsson and Patrick Harris.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!