Capital market. Pexels Images.

This article presents Walmart’s capital expenditures breakdown by segment.

Walmart allocates its capital expenditures into two primary units: U.S. segment (include both Walmart U.S. and Sam’s Club U.S.) and International.

Let’s take a look!

For other key statistics of Walmart, you may find more resources on these pages:

Revenue

- Revenue by country: U.S. and International,

- Revenue breakdown: net sales and membership & other income,

- Revenue by segment: U.S., International, and Sam’s Club

Other Revenue Streams

Profit Margin

- Profit margin breakdown: U.S., International, and Sam’s Club,

- Walmart vs Costco: profit margin comparison

Other Statistics

- Same store sales by calendar period,

- Financial health,

- revenue per store

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What drives the significant growth in Walmart’s capital expenditures?

Consolidated Results

A1. Total Capital Expenditures

Results By Region

B1. Capital Expenditures for U.S. and International

B2. Percentage Of Capital Expenditures for U.S. and International

U.S. Only Results

C1. Capital Expenditures Breakdown for U.S.

C2. Percentage Of Capital Expenditures Breakdown for U.S.

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Capital Expenditures: Capital expenditures, often abbreviated as CapEx, refer to the funds a company uses to acquire, upgrade, or maintain long-term physical assets.

These assets can include property, buildings, equipment, or technology that are essential for the company’s operations or growth.

Unlike operating expenses, which cover day-to-day costs, capital expenditures are investments aimed at enhancing the company’s future capabilities or efficiency.

For example, purchasing new machinery for a factory or constructing a new office building would be considered capital expenditures.

Walmart U.S.: Walmart U.S. stands as the company’s largest segment, operating 4,605 stores across the United States, spanning all 50 states, Washington D.C., and Puerto Rico.

As a leading mass merchandiser of consumer products, Walmart U.S. serves customers under the “Walmart” and “Walmart Neighborhood Market” brands, as well as through its digital platform, walmart.com.

With a focus on convenience and integration, Walmart U.S. delivers a seamless omni-channel shopping experience by blending its physical retail locations with eCommerce services.

Nearly all stores offer same-day pickup and delivery options, including features like express delivery within 90 minutes, in-home delivery, and digital pharmacy services.

The Walmart+ membership program enhances this omni-channel approach, offering benefits such as unlimited free shipping with no minimum purchase, unlimited delivery from stores, fuel discounts, mobile Scan & Go capabilities, and exclusive perks for members.

Strategically, Walmart U.S. operates within three core merchandise categories: Grocery, General merchandise, and Health and wellness.

Walmart International: Walmart International ranks as the company’s second largest segment, operating 5,566 stores across 18 countries outside of the United States.

The segment functions through wholly-owned subsidiaries in Canada, Chile, China, and Africa (covering nations such as Botswana, Lesotho, Malawi, Mozambique, Namibia, South Africa, Eswatini, and Zambia), alongside majority-owned subsidiaries in India, and in Mexico and Central America (including Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua).

Walmart International spans diverse formats under two main categories: retail and wholesale. These include supercenters, supermarkets, warehouse clubs like the membership-only Sam’s Club, cash-and-carry stores, and robust eCommerce offerings via websites and mobile apps like walmart.com.mx, walmart.ca, flipkart.com, PhonePe, and others.

The division’s strategy revolves around “bringing Walmart to the world and the world to Walmart.” This means leveraging its global network and localized expertise to deliver affordable products and services, helping millions of customers and members save money and live better daily.

A seamless omni-channel shopping experience is a cornerstone of Walmart International’s approach, integrating physical retail stores with eCommerce. This includes pickup and delivery services across most markets, with same-day delivery as a prominent feature.

Marketplace expansions also play a significant role, opening doors to enhanced fulfillment and advertising services. Walmart International’s merchandising strategy mirrors the breadth and depth of Walmart U.S., ensuring customers access a wide variety of products.

Sam’s Club U.S.: Sam’s Club U.S. operates as a membership-only warehouse club with 600 locations across 44 states in the U.S. and Puerto Rico, alongside its online platform, samsclub.com.

Committed to offering a fast and seamless omni-channel experience, Sam’s Club U.S. integrates physical clubs with eCommerce solutions.

Members enjoy convenient services such as curbside pickup for contact-free shopping, the Scan & Go mobile checkout for skipping lines, and the innovative Just Go feature, introduced in fiscal 2025, which enables frictionless exits.

The club provides merchandise across four key categories: Grocery, General merchandise, Health and wellness, and Fuel.

Memberships come with added value, including a spouse/household card at no extra cost. Club members benefit from free curbside pickup for orders of $50 or more, while Plus members enjoy additional perks such as complimentary delivery-from-club, free shipping on $50+ orders, exclusive discounts, convenience features, and early access to shopping before regular hours.

Beginning in fiscal 2023, Sam’s Club U.S. launched a rewards program allowing members to earn Sam’s Cash on purchases, which can be redeemed for cash, used for future purchases, or applied toward membership fees.

Omni-Channel: Omni-channel refers to a strategy in commerce and customer engagement that provides a seamless and integrated experience across all channels, whether they are online, offline, or hybrid. It’s about making every interaction — from browsing products online to visiting a physical store—feel connected and consistent.

For example:

-

In retail, omni-channel could mean a customer can browse products online, reserve an item on a mobile app, and pick it up in-store, all while receiving consistent information and support.

-

In customer service, omni-channel ensures that whether a customer contacts a company via email, chat, phone, or social media, their inquiries and interactions are unified across these platforms.

The key idea is to break down silos between channels and prioritize the customer’s convenience. Businesses that adopt omni-channel approaches often see improved customer satisfaction and loyalty.

What drives the significant growth in Walmart’s capital expenditures?

Walmart’s significant growth in capital expenditures is driven by several strategic initiatives:

-

Expansion of E-commerce and Technology: Walmart has been heavily investing in its e-commerce platforms and digital infrastructure to compete with online retail giants. This includes enhancing its website, mobile apps, and fulfillment centers to improve customer experience and operational efficiency.

-

Store Modernization: The company is upgrading its physical stores to align with modern retail trends. This includes remodeling stores, integrating technology for seamless shopping experiences, and improving energy efficiency.

-

Supply Chain Enhancements: Walmart is focusing on strengthening its supply chain by building new distribution centers, automating processes, and adopting advanced technologies to ensure faster and more efficient delivery.

-

Sustainability Initiatives: Investments in renewable energy, waste reduction, and sustainable practices are part of Walmart’s commitment to environmental responsibility.

These factors collectively contribute to the growth in Walmart’s capital expenditures, reflecting its efforts to adapt to changing consumer preferences and market dynamics.

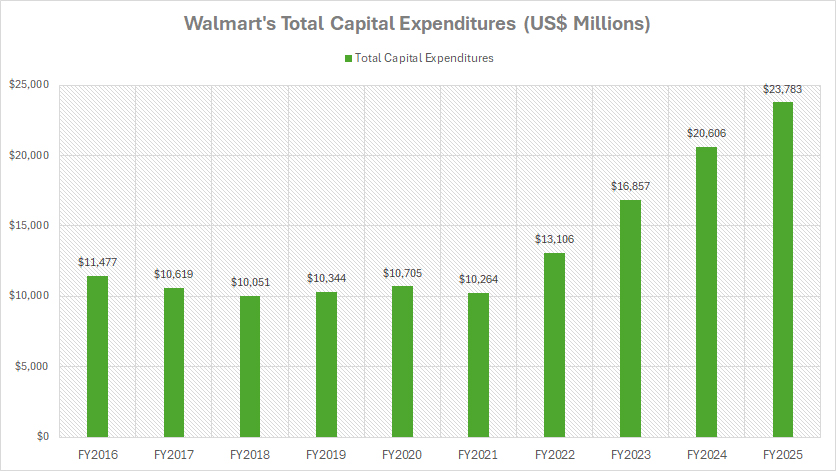

Total Capital Expenditures

walmart-total-capital-expenditures

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

For the definition of Walmart’s capital expenditures, you may refer to this section: Capital Expenditures.

Walmart’s global capital expenditures surged to an impressive $23.8 billion in fiscal year 2025, marking a record high over the past decade and a 16% increase compared to the $20.6 billion reported in 2024.

Since fiscal year 2016, the company’s capital expenditures have more than doubled, climbing from $11.5 billion to the current $23.8 billion.

Notably, Walmart’s spending remained relatively stable between fiscal years 2016 and 2021 but began to escalate significantly in fiscal year 2022, rising sharply from $10.3 billion in 2021 to $23.8 billion in the latest results.

The rapid post-pandemic increase in capital expenditures reflects Walmart’s efforts to remain competitive in a rapidly changing retail landscape and meet the demands of a tech-savvy and environmentally conscious consumer base.

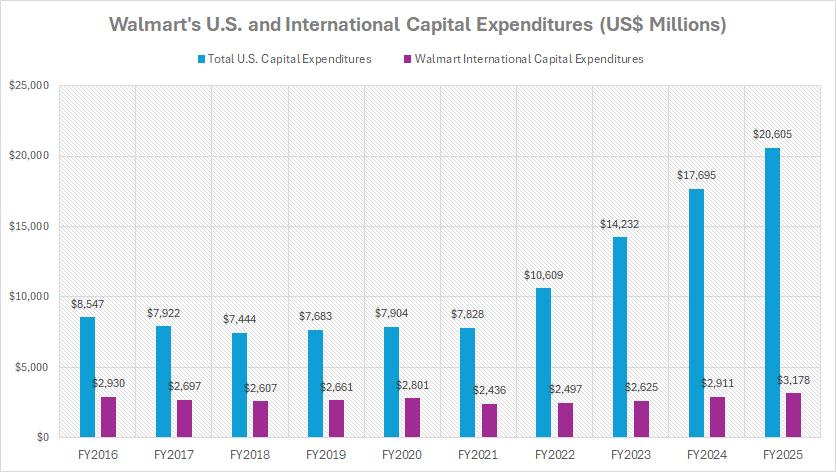

Capital Expenditures for U.S. and International Segments

walmart-U.S.-and-international-capital-expenditures

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

For the definition of Walmart’s capital expenditures, you may refer to this section: Capital Expenditures.

Walmart allocates a substantial portion of its capital expenditures to its U.S. segment, which reached $20.6 billion in fiscal year 2025. This represents an impressive increase of over 140% since fiscal year 2016, when the figure stood at $8.5 billion.

Conversely, Walmart’s International segment reported capital expenditures of just $3.2 billion for the same period.

Over the past decade, the company’s spending on its International segment has remained relatively stable, growing marginally from $2.9 billion in fiscal year 2016 to $3.2 billion in 2025 — a modest rise of only 10%, in stark contrast to the U.S. segment’s over 140% growth.

The limited growth in capital expenditures for Walmart’s International segment is likely influenced by currency fluctuations, particularly the impact of a strong U.S. dollar during these years.

This highlights the disparity in investment priorities between domestic and international operations.

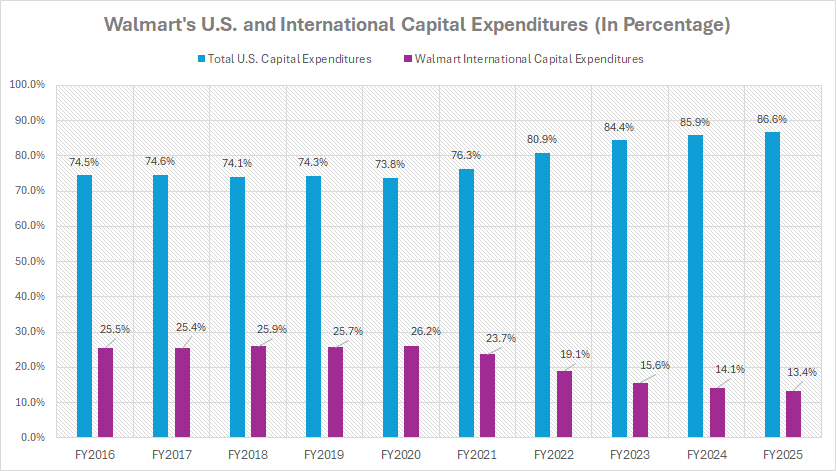

Percentage Of Capital Expenditures for U.S. and International Segments

walmart-U.S.-and-international-capital-expenditures-in-percentage

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

For the definition of Walmart’s capital expenditures, you may refer to this section: Capital Expenditures.

In percentage terms, Walmart’s capital allocation for the U.S. market reached approximately 87% of its total expenditures in fiscal year 2025, marking a notable rise from the 74.5% recorded in 2016.

Meanwhile, the company’s capital allocation for the International market accounted for just 13% of the total in fiscal year 2025, reflecting a decline from 25.5% reported a decade earlier.

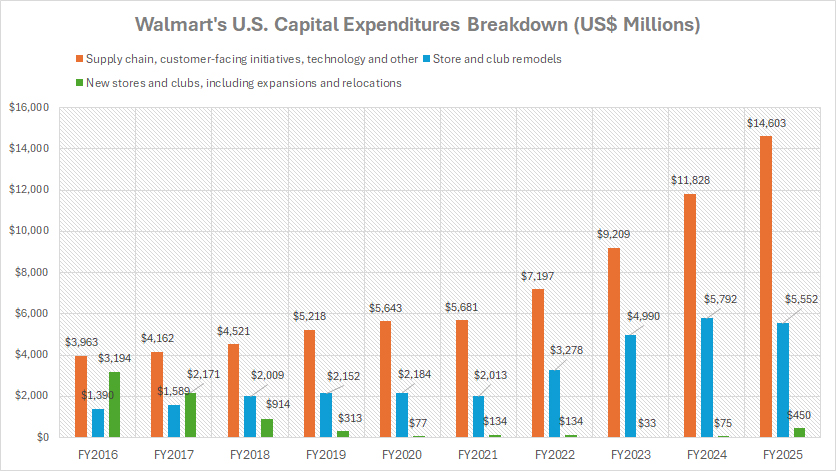

Capital Expenditures Breakdown for U.S. Market

walmart-U.S.-capital-expenditures-breakdown

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

For the definition of Walmart’s capital expenditures, you may refer to this section: Capital Expenditures.

Walmart’s largest capital investments in the U.S. market are directed toward enhancing supply chain infrastructure, customer-facing initiatives, technology, and other areas, with expenditures reaching $14.6 billion in fiscal year 2025 — a substantial increase from the $4 billion reported a decade ago.

The second-largest category of capital expenditures in the U.S. is store and club remodels, for which Walmart allocated $5.6 billion in fiscal year 2025. This category has become a key focus within the company’s domestic investment strategy.

Meanwhile, the smallest category is new store and club expansion and relocations, which totaled just $450 million in fiscal year 2025.

Historically, this category held greater prominence, with expenditures reaching $3.2 billion a decade ago. However, spending on new expansions steadily declined over the years, hitting a historic low of $33 million in fiscal year 2023, before recovering to $450 million in the latest figures.

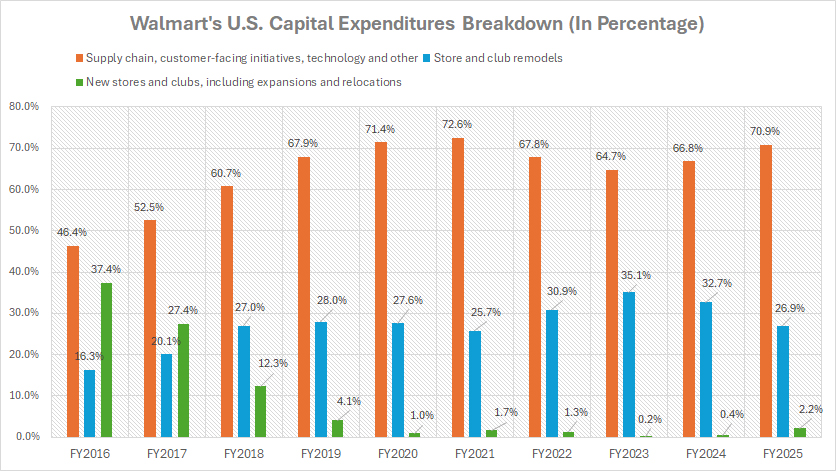

Percentage Of Capital Expenditures Breakdown for U.S. Market

walmart-U.S.-capital-expenditures-breakdown-in-percentage

(click image to expand)

Walmart’s operating segments consist of Walmart U.S., Walmart International and Sam’s Club U.S. The definitions of these segments are available here: Walmart U.S., Walmart International, and Sam’s Club U.S.

For the definition of Walmart’s capital expenditures, you may refer to this section: Capital Expenditures.

Walmart’s largest capital investments in the U.S. market focus on enhancing supply chain infrastructure, customer-facing initiatives, technology, and other areas.

These investments accounted for 71% of the company’s total expenditures in fiscal year 2025 — a significant increase from the 46% recorded a decade ago.

The second-largest category of capital expenditures within the U.S. was store and club remodels, which comprised 27% of the total in fiscal year 2025. This area has emerged as a key priority in Walmart’s domestic investment strategy.

On the other hand, the smallest category was new store and club expansions and relocations, representing just 2% of total expenditures in fiscal year 2025.

Historically, this category played a more prominent role, accounting for 37% of capital expenditures a decade ago.

However, investment in new expansions steadily declined over time, reaching an all-time low of 0.2% in fiscal year 2023, before rebounding to 2.2% in the most recent figures.

Insight

Walmart’s capital expenditures reflect a strategic pivot toward strengthening its domestic market through modernization, technology integration, and supply chain enhancements.

While international investments remain steady, the growing focus on U.S. operations aligns with Walmart’s goal to adapt to evolving retail trends and customer demands.

The reduction in new store expansions indicates a shift from aggressive physical growth to optimizing existing infrastructure. Overall, these expenditures reveal Walmart’s efforts to balance innovation with operational efficiency for sustained growth.

References and Credits

1. All financial figures presented were obtained and referenced from Walmart’s annual reports published on the company’s investor relations page: Walmart Investor Relations.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.