Driving on a highway. Pexels image.

Stellantis is a multinational automotive manufacturing corporation that resulted from the merger of the Italian-American conglomerate Fiat Chrysler Automobiles (FCA) and the French PSA Group in January 2021. With its global headquarters in Amsterdam, Netherlands, Stellantis has established a significant international presence, positioning itself as one of the world’s leading automakers.

The company operates approximately 400 manufacturing facilities and R&D centers around the world, showcasing its extensive reach in the automotive industry. Stellantis’ global presence spans several key markets across North America, Europe, Latin America, Asia, Africa, and the Middle East.

This article covers Stellantis’ revenue streams, profit and profit margin by segment. The company operates on six reportable segments: five regional vehicle segments (North America, Enlarged Europe, Middle East & Africa, South America and China and India & Asia Pacific) and Maserati, the automaker’s global luxury brand segment.

According to the 2023 annual report, Stellantis’ five regional vehicle reportable segments deal with the design, engineering, development, manufacturing, distribution and sale of passenger cars, light commercial vehicles and related parts and services in specific geographic areas.

For instance, the North America segment focuses primarily on the U.S., Canada, and Mexico, while the Enlarged Europe segment deals extensively with countries of the European Union and the United Kingdom. The Middle East & Africa segment mainly attends to Turkey, Morocco, Egypt and Algeria. The South America segment includes Central America and the Caribbean islands, while the China and India & Asia Pacific segment focuses on Asia and Pacific countries.

Stellantis’ global luxury brand reportable segment, Maserati, deals with the design, engineering, development, manufacturing, worldwide distribution and sale of luxury vehicles under the Maserati brand.

Let’s look at the revenue streams numbers!

Investors interested in Stellantis’ consolidated revenue, profit, and margin may find more resources on this page – Stellantis revenue breakdown, profit and margin.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- North America

- Enlarged Europe

- Middle East & Africa

- South America

- China and India & Asia Pacific

- Maserati

- Other Activities

- Adjusted Operating Income

O2. Stellantis Business Strategy

Revenue By Segment

A1. Revenue In North America, Europe, MEA, South America, Asia, And Maserati

A2. Percentage Of Revenue In North America, Europe, MEA, South America, Asia, And Maserati

Profit By Segment

B1. Profit In North America, Europe, MEA, South America, Asia, And Maserati

B2. Percentage Of Profit In North America, Europe, MEA, South America, Asia, And Maserati

Profit Margin By Segment

C1. Profit Margin In North America, Europe, MEA, South America, Asia, And Maserati

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

North America: Stellantis’ North American operations involve manufacturing, distributing and selling vehicles in the United States, Canada and Mexico, primarily under the Jeep, Ram, Dodge, Chrysler, Fiat and Alfa Romeo brands. Manufacturing plants are located in the US, Canada and Mexico.

Enlarged Europe: Stellantis’ European operations involve manufacturing, distributing and selling vehicles in Europe (which includes the 27 members of the European Union, the United Kingdom (“UK”) and the members of the European Free Trade Association).

Stellantis’ mainstream European brands include Citroën, Fiat, Opel, Peugeot, Vauxhall, and premium brands Alfa Romeo, DS and Lancia. Manufacturing plants are in France, Italy, Spain, Germany, the UK, Poland, Portugal, Serbia and Slovakia.

Middle East & Africa: Stellantis’ MEA operations involve manufacturing, distributing and selling vehicles primarily in Turkey, Algeria and Morocco under the Peugeot, Citroën, Opel, Fiat and Jeep brands.

Manufacturing plants are located in Morocco, Algeria and Turkey through a joint venture with Tofas-Turk Otomobil Fabrikasi A.S. (“Tofas”).

South America: Stellantis’ South American operations involve manufacturing, distributing and selling vehicles in South and Central America, primarily under the Fiat, Jeep, Peugeot and Citroën brands, with the largest focus of its business in Brazil and Argentina.

Manufacturing plants are located in the main markets of Brazil and Argentina.

China and India & Asia Pacific: Stellantis’ China and India & Asia Pacific operations involves manufacturing, distributing and selling vehicles in the Asia Pacific region (mostly in China, Japan, India, Australia and South Korea) carried out in the region through both subsidiaries and joint ventures, primarily under the Jeep, Peugeot, Citroën, Fiat, DS and Alfa Romeo brands.

Manufacturing plants are located in India and Malaysia through joint operation with India Fiat India Automobiles Private Limited (“FIAPL JV”) and wholly owned subsidiary Stellantis Gurun (Malaysia).

In China, Stellantis had a joint venture with GAC Fiat Chrysler Automobiles Co (“GAC-Stellantis JV”) until production ceased in January 2022. GAC JV filed for bankruptcy in November 2022.

Stellantis’ Citroën and Peugeot branded vehicles are manufactured in China by Dongfeng Peugeot Citroën Automobiles (“DPCA”) under various license agreements.

Maserati: Stellantis’ Maserati operations involve designing, engineering, developing, manufacturing, worldwide distributions and selling luxury vehicles under the Maserati brand. Design, engineering and manufacturing plants are located in Italy.

Other Activities: According to the 2023 annual report, other activities includes the results of Stellantis’ industrial automation systems design and production business, pre-owned car business, cast iron components business, mobility businesses, software and data businesses, and other investments, including Archer, the automaker’s financial services activities, as well as the activities and businesses that are not operating segments under IFRS 8.

Adjusted Operating Income: Adjusted operating income is a non-GAAP and non-IFRS measure used by Stellantis’ chief operating decision maker to assess performance, allocate resources to the company’s operating segments and to view operating trends, perform analytical comparisons and benchmark performance between periods and among the segments.

Adjusted operating income/(loss) exclusions include restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of Stellantis’ ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit).

Stellantis Business Strategy

Stellantis, formed from the merger of Fiat Chrysler Automobiles (FCA) and PSA Group in January 2021, has articulated a global business strategy that reflects its position as one of the world’s leading automakers. This strategy is centered around several key pillars:

1. **Electrification and Sustainability**: Stellantis has committed to becoming a leader in electrification, aiming to transition its vehicle lineup to electric and hybrid models to meet global demands for cleaner transportation. The company plans to offer electric versions of most of its models by 2025 and aims for a significant portion of its sales in major markets to be electric vehicles (EVs) by 2030.

2. **Global Market Expansion**: While Stellantis has a strong presence in Europe and North America, it aims to strengthen its position in these markets and expand its footprint in emerging markets such as China, Africa, and South America. This involves leveraging its diverse brand portfolio to cater to varying market needs and consumer preferences.

3. **Innovation and Technology**: Investing in research and development to drive innovation in areas such as autonomous driving, connectivity, and digital services is a core part of Stellantis’ strategy. The company seeks to enhance the driving experience and improve vehicle safety through advanced technologies.

4. **Operational Efficiency**: Stellantis aims to achieve cost efficiencies through economies of scale, platform sharing, and optimizing its manufacturing footprint. The merger is expected to result in significant cost savings, which can be reinvested in product development and innovation.

5. **Brand Strategy**: With a diverse portfolio of 14 brands, Stellantis plans to position each brand to target specific market segments without overlap, ensuring each brand has a distinct identity and value proposition.

6. **Customer Focus**: A key strategic priority is to place customers at the center of its business model, offering high-quality vehicles and services that meet evolving consumer needs and preferences. This includes enhancing the digital customer experience and exploring new business models, such as mobility services.

7. **Sustainability and Corporate Responsibility**: Stellantis is committed to environmental sustainability and social responsibility, aiming to reduce its carbon footprint, improve the sustainability of its supply chain, and ensure ethical business practices across its operations.

By executing this strategy, Stellantis aims to navigate the rapidly changing automotive industry, capitalize on new opportunities, and create value for its stakeholders.

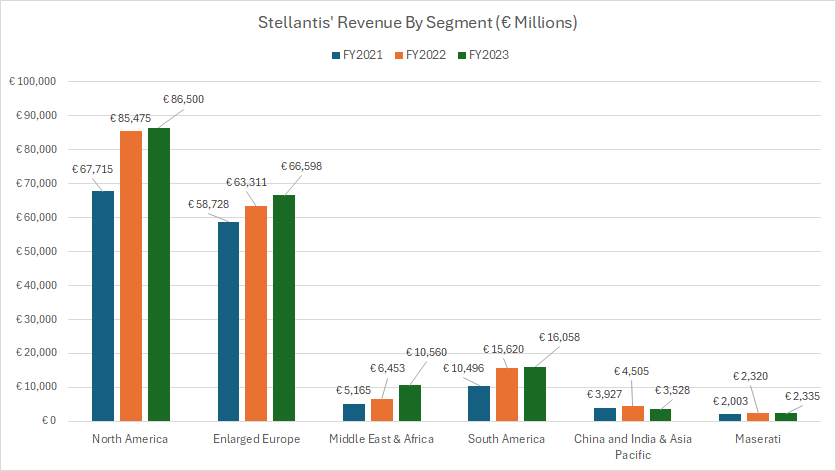

Revenue In North America, Europe, MEA, South America, Asia, And Maserati

Stellantis-revenue-by-segment

(click image to expand)

The definitions of Stellantis’ segments are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, Maserati, and Other Activities.

Stellantis’ North America segment has been the company’s largest revenue source, generating over €86.5 billion in fiscal year 2023, slightly up from €85.5 billion in 2022.

The Enlarged Europe captured the second place, with revenue clocking in at €58.7 billion, €63.3 billion, and €66.6 billion in fiscal years 2021, 2022, and 2023, respectively.

The South America segment came in third, while the Middle East And Africa segment claimed the fourth place. Both segments produced €16.1 billion and €10.6 billion in revenue in fiscal year 2023, respectively.

The China and India & Asia Pacific segment generates one of the smallest amount of revenue, totaling just €3.9 billion, €4.5 billion, and €3.5 billion in fiscal years 2021, 2022, and 2023, respectively.

Stellantis’s Maserati segment earned €2.0 billion, €2.3 billion and €2.3 billion in fiscal years 2021, 2022, and 2023, respectively.

Most segments have seen their revenue rising since 2021. However, revenue has remained flat for the China and India & Asia Pacific and Maserati segments over the last three years.

Stellantis’ Middle East And Africa segment has been the best performing division in the past three years, with revenue climbing by over 100% since 2021. The South America division also has done quite well. Between 2021 and 2023, the revenue from this segment has grown by over 50%, from €10.5 billion to €16.1 billion.

Stellantis’ North America segment also has performed impressively. Between 2021 and 2023, the revenue in this division was up 28%, from €67.7 billion to €86.5 billion.

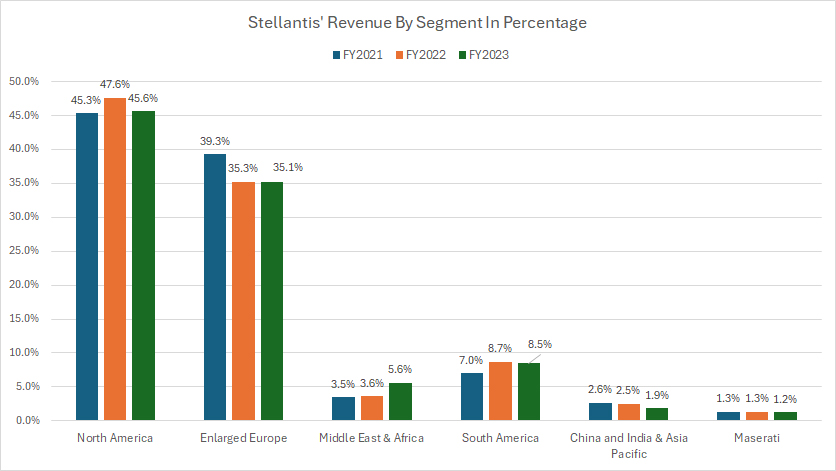

Percentage Of Revenue In North America, Europe, MEA, South America, Asia, And Maserati

Stellantis-percentage-of-revenue-by-segment

(click image to expand)

The definitions of Stellantis’ segments are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, Maserati, and Other Activities.

Stellantis’ North America segment contributes the majority of revenue to the company. In fiscal year 2023, the revenue contribution from this division reached 45.6%, slightly down from the 47.6% reported in 2022.

The revenue contribution from Enlarged Europe reached 35.1% in 2023, making this division the second-largest revenue source to Stellantis. However, the percentage in 2023 has considerably decreased from 39.3% measured in 2021.

The revenue contribution from the Middle East & Africa and South America segments have slightly climbed since 2021, reaching 5.6% and 8.5%, respectively, in fiscal year 2023. These regions are the only segments that have seen their revenue contribution increasing in the last three years.

On the other hand, the China and India & Asia Pacific region contributed just 1.9% of revenue in fiscal year 2023, while Maserati generated 1.2% in the same period. These segments have produced the least amount of revenue to Stellantis since 2021.

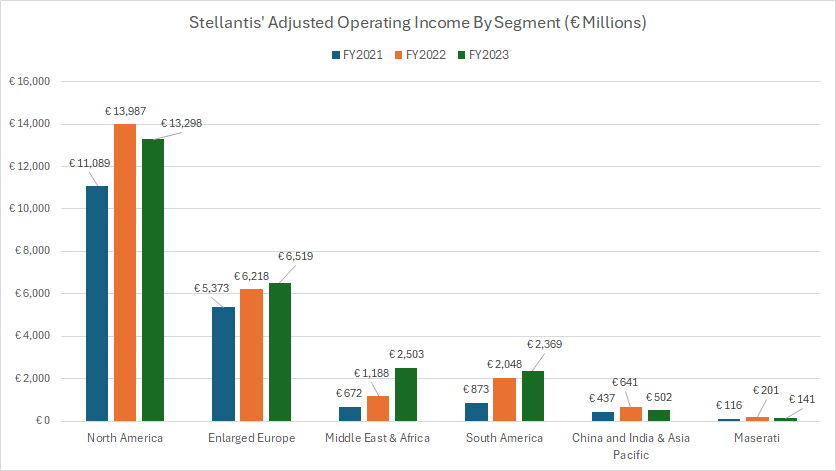

Profit In North America, Europe, MEA, South America, Asia, And Maserati

Stellantis-profit-by-segment

(click image to expand)

The definitions of Stellantis’ segments are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, Maserati, and Other Activities.

Stellantis’ adjusted operating income is a non-GAAP and non-IFRS measure. Its definition is available here: adjusted operating income.

Stellantis’ North America segment generates the most profit for the company. In fiscal year 2023, the adjusted operating income produced by this segment reached €13.3 billion, far outpacing the profit streams of the rest of the segments. This division also has seen its adjusted operating income rising considerably since 2021. In fiscal 2022, the adjusted operating income of the North America segment was a stunning €14 billion, the biggest this division has seen over the last three years.

Stellantis’ Enlarged Europe produces the second-highest profit for the company. In fiscal 2023, the Enlarged Europe segment earned €6.5 billion in adjusted operating income, a significant rise over the €5.4 billion in 2021.

The Middle East And Africa and South America divisions generates roughly the same level of profits. For example, the adjusted operating income for both segments topped €2.5 billion and €2.4 billion, respectively, in fiscal year 2023.

Stellantis’ China and India & Asia Pacific is one of the segments with the least profit. In fiscal 2023, this region produced just €502 million in adjusted opearating income.

Similarly, Maserati also is one of the smallest segments. Its adjusted operating income clocked just €141 million in fiscal year 2023.

Among all regions, the profits of the Middle East And Africa and South America divisions have risen the most. Since 2021, the adjusted operating income of both segments have increased by a minimum of threefold.

The profits of the North America and Europe divisions also have significantly climbed. In contrast, the profit of China and India & Asia Pacific has remained relatively flat over the last three years.

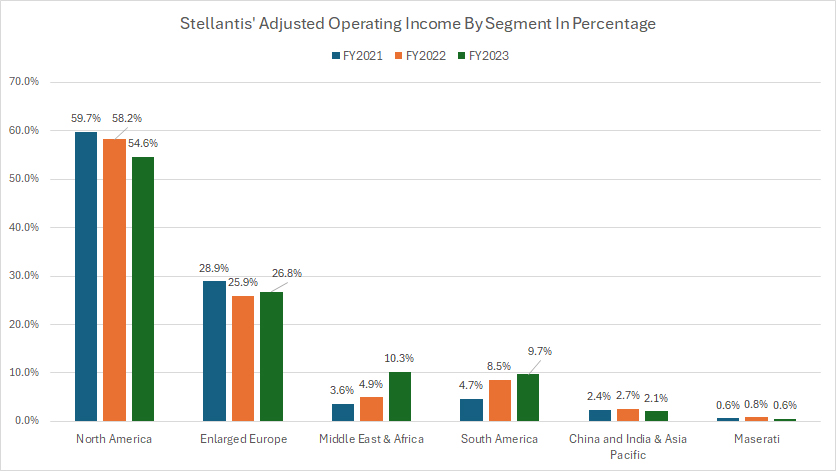

Percentage Of Profit In North America, Europe, MEA, South America, Asia, And Maserati

Stellantis-percentage-of-profit-by-segment

(click image to expand)

The definitions of Stellantis’ segments are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, Maserati, and Other Activities.

Stellantis’ adjusted operating income is a non-GAAP and non-IFRS measure. Its definition is available here: adjusted operating income.

The chart above shows that Stellantis’ North America segment generated over half of the company’s profit. The percentages of the adjusted operating income in this region clocked in at 59.7%, 58.2%, and 54.6% in fiscal years 2021, 2022, and 2023, respectively.

Europe has been Stellantis’ second-largest profit source since 2021. The percentage of the adjusted operating income in this region came in at 28.9%, 25.9%, and 26.8%, respectively.

The Middle East And Africa and South America segments both generate about the same portion of profit. The percentage of the adjusted operating income was 10% in fiscal year 2023 for both regions.

The profit contribution from China and India & Asia Pacific clocked just 2.1% in fiscal year 2023, while Maserati contributed 0.6% of the adjusted operating income in the same period, the lowest among all segments.

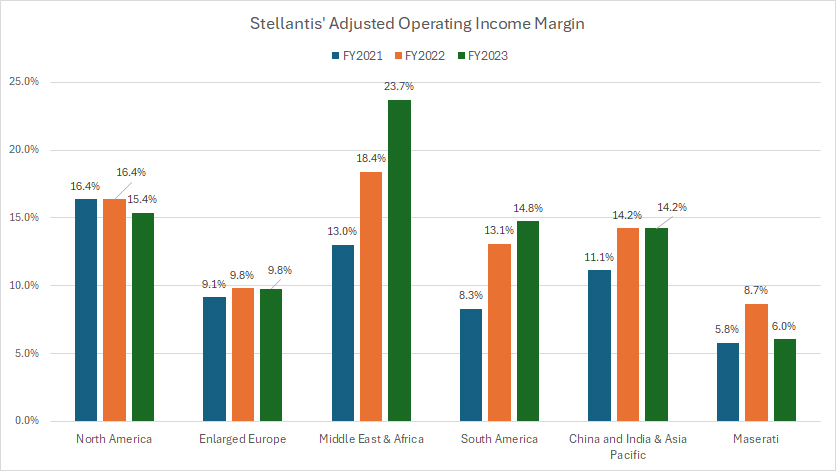

Profit Margin In North America, Europe, MEA, South America, Asia, And Maserati

Stellantis-profit-margin-by-segment

(click image to expand)

The definitions of Stellantis’ segments are available here: North America, Enlarged Europe, Middle East & Africa, South America, China and India & Asia Pacific, Maserati, and Other Activities.

Stellantis’ adjusted operating income is a non-GAAP and non-IFRS measure. Its definition is available here: adjusted operating income.

Although the North America segment generates the majority of revenue and profit, it is not the most profitable. The profit margin of this region averaged 16% for the last three years, slightly behind that of the Middle East And Africa segment, which averaged 18.4%. The adjusted operating income margin for the Middle East And Africa segment has significantly increased since 2021, reaching 23.7% as of 2023.

It is a surprise that Stellantis’ Enlarged Europe segment has one of the lowest profit margins among all regions. The adjusted operating income margin for the European segment clocked just 9.8% in fiscal year 2023, which was slightly above Maserati’s 6.0% margin. Unfortunately, the profit margin of Enlarged Europe segment has remained relatively flat since 2021.

On the other hand, the profit margin of the Middle East And Africa segment has nearly doubled over the last three years, while the South America division has climbed nearly seven percentage points, reaching 14.8% as of 2023, the third-highest in 2023 among all segments.

Even the China and India & Asia Pacific segment generates better profit margin than Enlarged Europe. In fiscal 2023, the adjusted operating income margin of Stellantis’ Asia Pacific operation topped a stunning 14.2%, only trailed the North America segment by a small margin.

Conclusion

Stellantis’ North America and Enlarged Europe have generated the majority of revenue and profit for the company over the last three years. The revenue contribution from the North America segment reached 45.6% in 2023, while the share of the adjusted operating income reached 54.6% in the same period. The Enlarged Europe saw its revenue contribution at 35.1%, while the profit contribution topped 26.8% in fiscal year 2023. Therefore, the North America segment has a much larger impact on Stellantis because it generates a significant portion of profit although the revenue share is less than half.

Stellantis’ Middle East And Africa division captured the top spot as the most profitable region. Its adjusted operating income was among the highest in 2023, topping 23.7%, while that of the North America segment landed at just 15.4% in the same period.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Stellantis’ quarterly and annual reports, SEC filings, investor presentations, press releases, earnings results, etc., which are available in Stellantis Investor Relation.

2. Pexels images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to it from any website so that more articles like this can be created.

Thank you!