Charging a Tesla Model S. Flickr Image.

Tesla’s revenue streams consist of multiple sources, including the automotive and energy sector.

Tesla also gets its revenue from services, which is derived from sales of used vehicles, parts, warranty, insurance, and repairs.

One revenue stream that we have often overlooked is the automotive leasing revenue.

While automotive leasing comprises only 3% of the company’s total revenue, the profitability and gross margin may surprise you.

Let’s take a look.

Please use the table of contents to navigate this page.

Table Of Contents

Overview And Definitions

O2. Automotive Leasing Business

O3. Leased Vehicle Deliveries

Revenue Numbers

A1. Automotive Leasing Revenue By Year

A2. Automotive Leasing Revenue By Quarter

A3. Automotive Leasing Revenue By TTM

A4. Leasing Revenue Per Car

Revenue Growth Rates

B1. Growth Rates Of Automotive Leasing Revenue

As A Percentage Of Total And Automotive Revenue

C1. Automotive Leasing To Total Revenue Ratio

C2. Automotive Leasing To Automotive Revenue Ratio

Gross Margin

D1. Automotive Leasing Gross Margin

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Automotive Leasing Revenue: Tesla’s automotive leasing revenue refers to the amount of money earned by Tesla through its leasing program for its electric vehicles.

This revenue includes the monthly lease payments made by customers and any fees associated with the lease. Tesla offers leasing options for many models, allowing customers to drive their electric vehicles without purchasing them outright.

Leasing Revenue Per Car: Tesla’s automotive leasing revenue per vehicle is calculated as:

Automotive Leasing Revenue Per Car = Automotive Leasing Revenue / Car Deliveries Subject To Leasing

Automotive Leasing Business

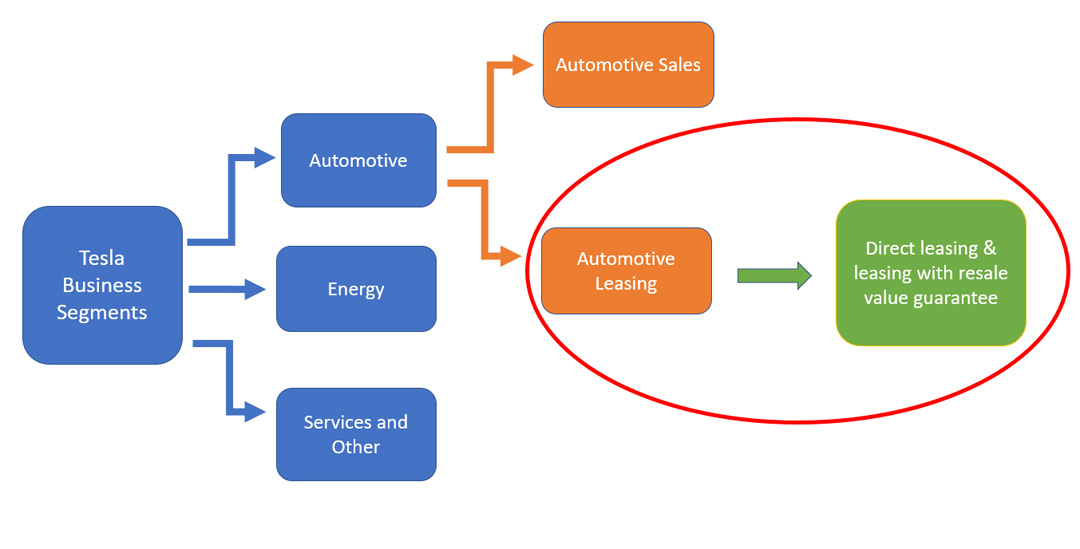

Tesla’s automotive leasing sector is clearly illustrated in the following diagram:

Tesla automotive leasing business

(click image to expand)

Tesla’s automotive leasing business falls under the automotive sector and is in the same hierarchy as the automotive sales.

Tesla’s automotive leasing gets its revenue from 2 leasing methods, and they are

(2) leasing with a resale value guarantee.

Direct leasing is where Tesla gets more of its leasing revenue.

On the other hand, leasing with a resale guarantee is similar to direct leasing but comes with a guarantee that Tesla will buy back the vehicle at the end of the leased terms.

However, the company has done less leasing with a resale value guarantee.

In addition, I believe leasing with a resale value guarantee is only available in North America.

Leased Vehicle Deliveries

Tesla deliveries attributed to leasing sales

| As at 31 Dec | |||||||

|---|---|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 Estimate | |

| Total Deliveries | 245,506 | 367,656 | 499,647 | 936,222 | 1,313,851 | 1,808,581 | 2,700,000 |

| Of Which Subject To Lease Accounting | 11,034 | 25,439 | 34,470 | 60,912 | 47,582 | 71,353 | 82,056 |

| % Of Leased Vehicles To Total Deliveries | 4.5% | 6.9% | 6.9% | 6.5% | 3.6% | 3.9% | 3.0% |

Since fiscal 2018, Tesla’s number of vehicles delivered subject to leasing revenue has been on the rise, growing from 11,000 units reported in 2018 to 71,000 units as of 2023, a rise of over 500% for the past six years.

Tesla’s leased vehicle deliveries for fiscal 2024 are estimated at 82,000 units, a rise of 15% over 2023 or 3% of the total sales in 2024.

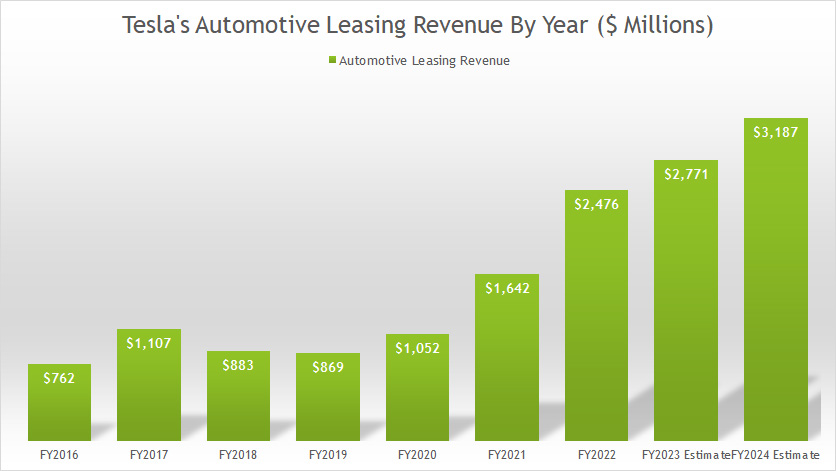

Automotive Leasing Revenue By Year

Tesla-automotive-leasing-revenue-by-year

(click image to expand)

Tesla earned US$2.5 billion in automtotive leasing revenue in fiscal 2022, up 56% over 2021.

Tesla’s automotive leasing revenue is estimated at US$2.8 billion and US$3.2 billion for fiscal 2023 and 2024, respectively, based on the leased vehicle deliveries that we saw earlier.

The revenue projection is calculated using the average leasing revenue per car of roughly US$39,000 for the last four quarters.

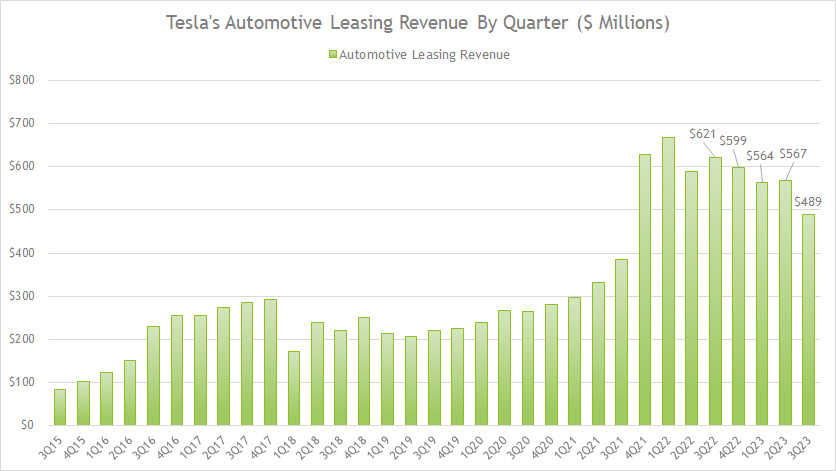

Automotive Leasing Revenue By Quarter

Tesla’s quarterly automotive leasing revenue

(click image to expand)

Tesla earned automotive leasing revenue of US$489 million, US$567 million, and US$564 million in 3Q, 2Q, and 1Q 2023, respectively.

Tesla’s quarterly automotive leasing revenue of US$489 million in 3Q 2023 represents a decline of 21% from last year.

A noteworthy trend is that Tesla’s automotive leasing revenue appears to be on a decrease after recording a peak figure of nearly US$700 million in 2022.

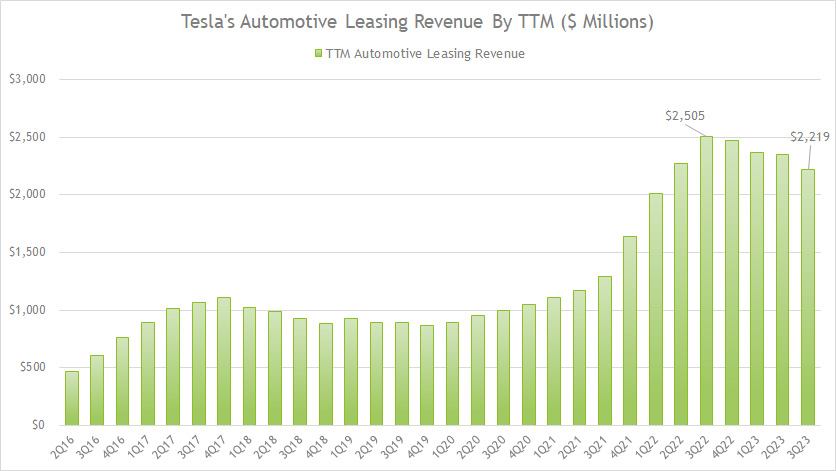

Automotive Leasing Revenue By TTM

Tesla’s TTM automotive leasing revenue

(click image to expand)

Tesla’s automotive leasing revenue reached US$2.2 billion on a TTM basis as of 3Q 2023, down 12% from last year.

Tesla’s TTM automotive leasing revenue seems to decrease after recording a peak figure of US$2.5 billion in 2022.

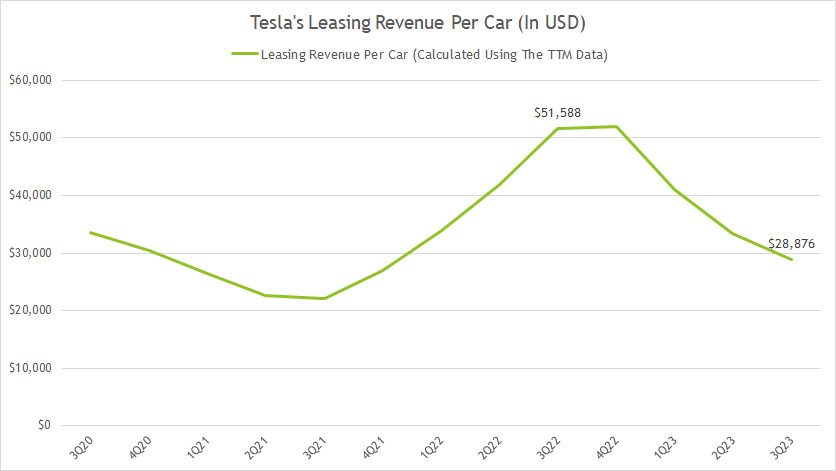

Leasing Revenue Per Car

Tesla-leasing-revenue-per-car

(click image to expand)

Tesla earned about US$28,876 in leasing revenue per vehicle delivered as of 3Q 2023, down significantly from the US$51,588 measured a year ago.

On average, Tesla’s automotive leasing revenue per car amounted to US$38,838 for the previous four quarters.

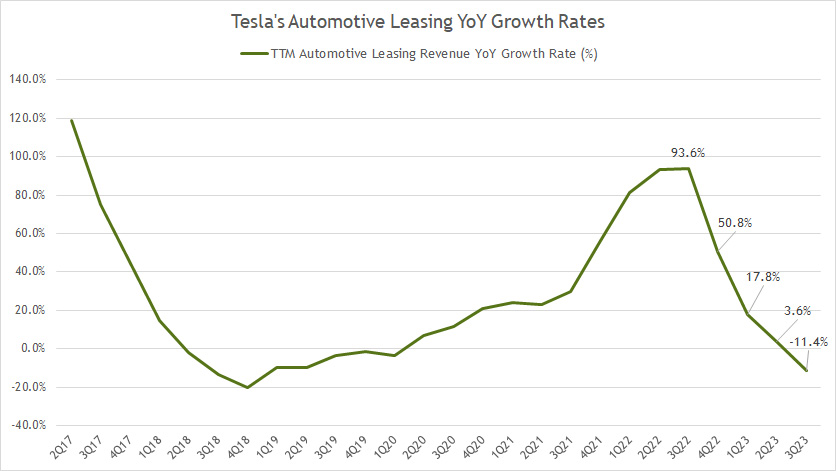

Growth Rates Of Automotive Leasing Revenue

Tesla’s automotive leasing revenue YoY growth rates

(click image to expand)

Tesla has experienced a significant automotive leasing revenue decrease since 3Q 2022 after achieving a peak YoY growth rate of 93.6%.

As of 2023 3Q, Tesla’s automotive leasing revenue declined by 11.4% year-over-year compared to an increase of 93.6% a year ago.

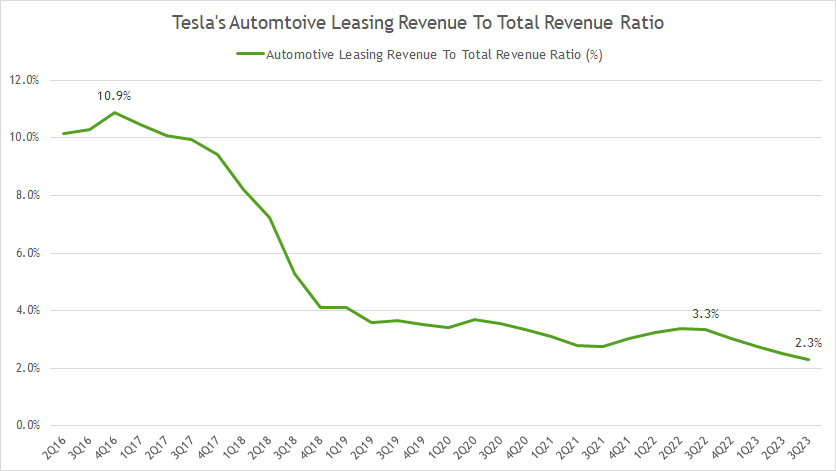

Automotive Leasing To Total Revenue Ratio

Tesla’s automotive leasing to total revenue ratio

(click image to expand)

Tesla’s automotive leasing revenue represents only 2.3% of its revenue in fiscal 3Q 2023.

This ratio has significantly declined since 2016, from over 10% to the latest figure of 2.3%.

The decreasing ratio indicates that Tesla’s automotive leasing revenue has grown much slower than other revenue segments.

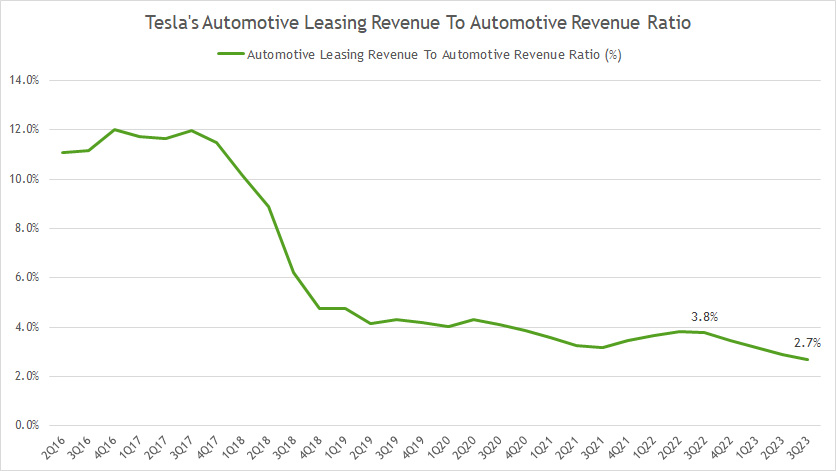

Automotive Leasing To Automotive Revenue Ratio

Tesla-automotive-leasing-revenue-to-automotive-revenue-ratio

(click image to expand)

Within the automotive segment, Tesla’s automotive leasing revenue represents about 2.7% of its automotive revenue as of fiscal 3Q 2023.

Again, the ratio has significantly declined since 2016, from over 12% to the latest figure of 2.7%.

The decreasing ratio indicates that Tesla’s automotive leasing revenue has grown at much slower rates than other automotive revenue segments, including car sales revenue and carbon credits.

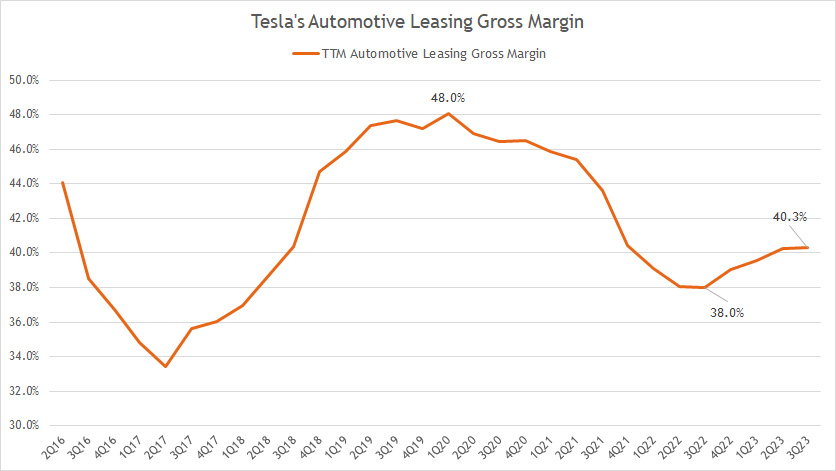

Automotive Leasing Gross Margin

Tesla’s automotive leasing gross margin

(click image to expand)

Tesla’s automotive leasing gross margin topped 40.3% as of 3Q 2023, up slightly from 38% a year ago.

Tesla’s automotive leasing gross margin averaged around 42% in the past. The latest figure was in line with the historical average, indicating that the profitability of the company’s automotive leasing business has remained relatively stable.

Conclusion

Tesla’s automotive leasing business is essential to the company’s growth, although its contribution was only 2% of total revenue.

While automotive leasing revenue is small relative to other revenue segments, it has been one of Tesla’s most profitable business segments, as the gross margin crosses 40% on average.

The gross margin has been the highest among all the company’s business sectors.

Tesla needs to expand its lines of products to boost its leasing revenue, considering that only legacy products are available for leasing.

To this end, Tesla’s Model Y can drive the leasing revenue higher and boost the margin in this sector.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Tesla’s quarterly and annual reports, SEC filings, investor presentations, press releases, update letters, etc., which are available in Tesla SEC Filings.

2. Featured image was used under Creative Common Licenses and obtained from Yasunari Goto and Jeff Cooper.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!