Crypto asset. Pixabay image.

This article presents the consolidated revenue and revenue breakdown of Coinbase Global, Inc. (NASDAQ: COIN). For your information, Coinbase’s revenue segments consist of two major streams: transaction and subscription & services.

Let’s take a look!

For other key statistics of Coinbase Global, you may find more resources on these pages:

Transaction Revenue

Subscription & Services Revenue

Revenue By Region

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Coinbase Make Money

Consolidated Revenue

A1. Total Revenue

Revenue By Segment

B1. Revenue From Transaction and Subscription & Services

B2. Percentage Of Revenue From Transaction and Subscription & Services

Revenue Growth

C1. YoY Growth Rates Of Revenue From Transaction and Subscription & Services

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Transaction: Coinbase’s transaction revenue primarily comes from fees charged on cryptocurrency trades conducted on its platform.

These fees apply to both buying and selling transactions and vary based on factors such as the transaction amount, payment method, and user type (e.g., retail or institutional).

Retail users are charged fees for buying, selling, and converting cryptocurrencies, while institutional clients incur fees for trading and related services. Bitcoin and Ethereum are the major cryptocurrencies contributing to Coinbase’s transaction revenue.

Subscription and Services: Coinbase’s subscription and services revenue comes from various non-transactional sources, including:

-

Stablecoin Revenue: This is primarily derived from interest earned on reserves backing stablecoins like USDC (USD Coin). The revenue depends on factors such as USDC’s market capitalization and prevailing interest rates.

-

Blockchain Rewards: Coinbase earns fees by facilitating staking services, where users participate in blockchain networks to earn rewards. Coinbase pools user assets, manages the technical aspects, and retains a portion of the rewards.

-

Custodial Fees: These are fees charged for securely holding and managing cryptocurrency assets on behalf of institutional clients.

-

Interest Income: Coinbase generates interest from lending activities and other financial services.

-

Other Services: This includes revenue from additional offerings like analytics and developer tools.

This segment is a strategic move to diversify Coinbase’s income beyond trading fees.

Crypto Assets Sales: According to Coinbase, crypto asset sales are periodic sales of the company’s own crypto assets.

The purpose of these sales is to fulfill customer accommodation transactions for orders that do not meet the minimum trade size for execution on Coinbase’s platform OR to maintain customers’ trade execution and processing times during unanticipated system disruptions.

For your information, Coinbase has custody and control of these crypto assets before the sale to the customer and records revenue at the point in time when the sale is processed.

How Does Coinbase Make Money

Coinbase generates its revenue primarily from two sources: transaction fees and subscription/services revenue. Transaction fees are generated from trading on Coinbase’s platforms, which refer to the company’s website and app. The transaction revenue is highly dependent on the price and quantity of assets being traded, and it’s recognized as soon as the transaction is completed.

Subscription and service revenue consists of several sources, including blockchain rewards, custodial fees, and interest income. Blockchain rewards are earned by participating in activities on the blockchain, while custodial fees are made by securing customer crypto assets in dedicated cold storage.

Coinbase also earns interest income on fiat money under a revenue-sharing agreement with the issuer of USD Coin (USDC) and on loans issued to consumers and institutional users. Additionally, Coinbase makes money off customer custodial funds and cash held at certain third-party banks that provide interest.

Total Revenue

Coinbase-total-revenue

(click image to expand)

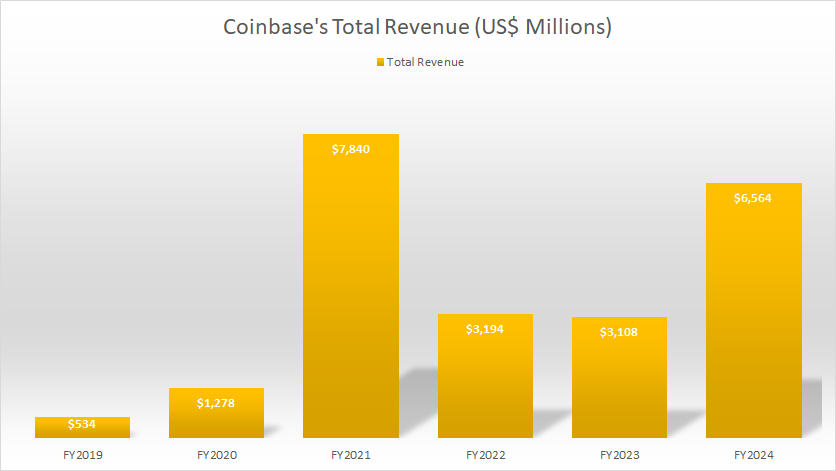

On a consolidated basis, Coinbase reported total revenue of $6.6 billion in fiscal year 2024, marking a dramatic rebound from $3.1 billion in 2023. This represents more than a twofold increase year-over-year, reflecting substantial growth in the platform’s operations.

However, despite this impressive recovery, 2024 revenue still lagged behind the $7.8 billion peak achieved in 2021, showcasing the lingering impact of the crypto market’s cyclical dynamics.

In comparison, Coinbase’s revenue for fiscal year 2023 stood at $3.1 billion, a slight dip from the $3.2 billion recorded in 2022. This decline over two years underscored the challenges the company faced, such as reduced trading volumes and muted investor sentiment during a prolonged downturn in the cryptocurrency market.

The rebound in 2024, therefore, highlights a remarkable turnaround, likely driven by a combination of improved market conditions, increased trading activity, and potential diversification efforts into subscription and service revenues.

Such a significant jump from 2023 to 2024 not only signals resilience but also positions Coinbase to reclaim momentum in a competitive and evolving industry. This trend will undoubtedly be critical to monitor as the company continues to navigate market fluctuations and expand its revenue streams.

Revenue From Transaction and Subscription & Services

Coinbase-revenue-breakdown

(click image to expand)

The definition of Coinbase’s transaction and subscription and services revenue is available here: transaction and subscription & services.

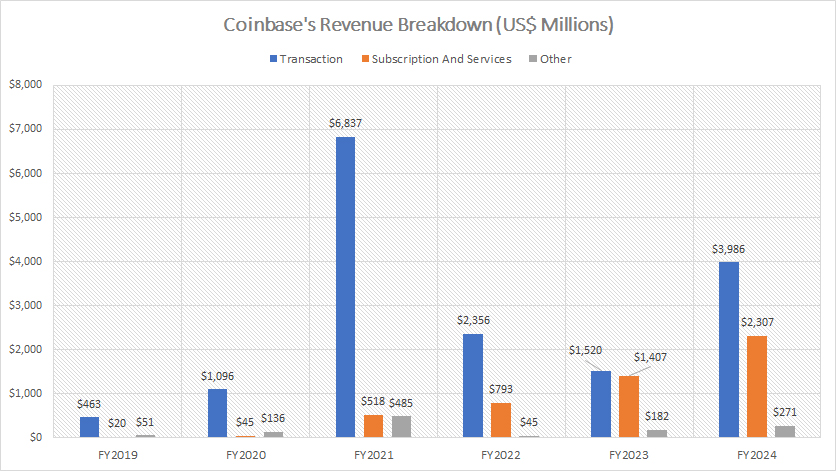

Coinbase continues to derive the bulk of its revenue from transactions, underscoring the platform’s strong reliance on trading activity. However, as illustrated in the accompanying chart, subscription and services revenue — though historically smaller — has grown significantly and is now approaching parity with transaction revenue. This shift highlights Coinbase’s evolving business model as it seeks to diversify income streams beyond trading fees.

In fiscal year 2024, Coinbase’s transaction revenue stood at $4 billion. While this represents a notable recovery from the lows of $1.5 billion in 2023 and $2.4 billion in 2022, it remains well below the peak of $6.8 billion achieved in 2021.

The sharp fluctuations in transaction revenue underscore the platform’s exposure to market volatility and the cyclical nature of cryptocurrency trading activity.

In contrast, Coinbase’s subscription and services revenue has shown consistent growth across fiscal years, steadily climbing since 2019 without any significant downturn. In 2024, this revenue segment reached a record $2.3 billion, marking a remarkable 60% increase compared to $1.4 billion in 2023.

This upward trajectory reflects the growing adoption of Coinbase’s ancillary services, such as blockchain rewards, custodial fees, and interest income derived from stablecoins and lending activities.

Meanwhile, the “Other” revenue stream remains a minor contributor, amounting to just $271 million in 2024. This category’s negligible share further emphasizes the importance of transactions and subscriptions in driving the company’s revenue.

Coinbase’s ongoing efforts to expand its subscription and services portfolio signal a strategic move towards revenue stability and diversification. This trend will be pivotal as the company navigates the unpredictable dynamics of the cryptocurrency market.

Percentage Of Revenue From Transaction and Subscription & Services

Coinbase-revenue-breakdown-in-percentage

(click image to expand)

The definition of Coinbase’s transaction and subscription and services revenue is available here: transaction and subscription & services.

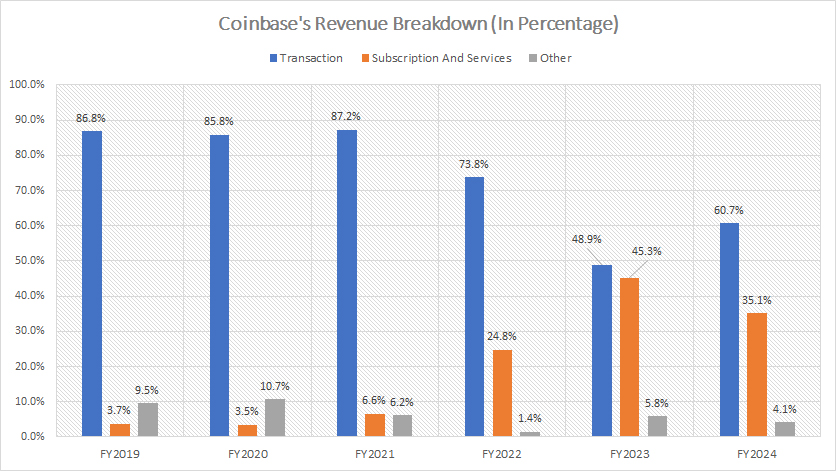

As illustrated in the chart above, Coinbase’s transaction segment remains the primary driver of revenue, contributing approximately 61% of total revenue in fiscal year 2024. This underscores the platform’s ongoing reliance on trading activities as the backbone of its financial performance.

However, the revenue share from transactions has shown a noticeable downward trend over the past six years, decreasing from 87% in 2019 to 61% in 2024. This decline reflects the company’s strategic efforts to diversify its income streams.

Interestingly, fiscal year 2024 marked a significant rebound in the transaction segment’s revenue share, climbing from 49% in 2023 to 61% in the latest result. This resurgence points to renewed trading activity driven by improved market sentiment and heightened interest in cryptocurrency investments.

On the other hand, Coinbase’s subscription and services revenue has demonstrated remarkable growth, capturing 35% of total revenue in 2024 — an extraordinary leap from just 4% in 2019. This segment reached its peak revenue share in fiscal year 2023, accounting for 45%, before declining to 35% in 2024.

The drop in percentage is largely attributed to the surge in transaction revenue during 2024, though the absolute growth in subscription and services revenue remains significant. The consistent expansion of this segment highlights Coinbase’s success in diversifying beyond trading fees, with products such as blockchain rewards, custodial services, stablecoin interest, and analytics tools.

Meanwhile, other revenue streams remain minor contributors, further solidifying the dominance of transactions and subscriptions in Coinbase’s revenue composition. This balance between the segments showcases the company’s ability to adapt to evolving market conditions while exploring sustainable growth avenues.

YoY Growth Rates Of Revenue From Transaction and Subscription & Services

Coinbase-revenue-breakdown-yoy-growth-rates

(click image to expand)

The definition of Coinbase’s transaction and subscription and services revenue is available here: transaction and subscription & services.

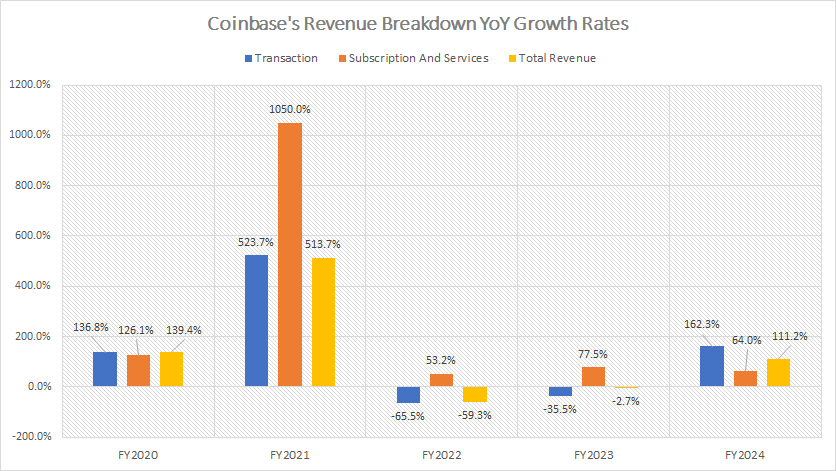

Coinbase experienced robust revenue growth across all segments in fiscal year 2024, marking a significant recovery after previous years of market turbulence. As depicted in the graph above, total revenue surged by an impressive 111% compared to 2023, reaching $6.6 billion.

Transaction revenue, the company’s primary income driver, grew dramatically by 162%, reflecting a resurgence in cryptocurrency trading activity and improved market conditions. Similarly, subscription and services revenue climbed by a substantial 64% in the same period, demonstrating the continued strength and diversification of Coinbase’s business model.

One notable trend is the consistent and uninterrupted growth in subscription and services revenue over the past five years, from 2020 to 2024. This segment has remained resilient, even during challenging periods for the broader cryptocurrency market.

For instance, while transaction revenue plummeted by 66% in 2022 and further declined by 36% in 2023 due to reduced trading volumes, subscription and services revenue displayed robust year-over-year growth, rising by 53% in 2022 and an even more impressive 78% in 2023.

The steady rise in subscription and services revenue highlights Coinbase’s success in expanding beyond its reliance on trading fees. Key contributors include blockchain rewards, custodial fees, and stablecoin-related income. This diversification not only provides a buffer against market volatility but also positions Coinbase for sustained long-term growth.

The fiscal year 2024 results underscore Coinbase’s adaptability and ability to capitalize on renewed market opportunities while maintaining steady growth in ancillary revenue streams.

Insight

Overall, Coinbase’s fiscal year 2024 results underscore its adaptability in responding to market shifts while strategically diversifying its revenue streams.

The dual growth approach — leveraging transaction revenue during market booms and relying on subscription services for stability — positions the company as a resilient leader in the cryptocurrency industry.

This balanced strategy not only mitigates risks from market volatility but also enhances its long-term growth potential.

Credits and References

1. All financial figures presented were obtained and referenced from Coinbase Global, Inc.’s annual reports published on the company’s investor relations page: Coinbase Investor Relations.

2. Pixabay images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.