XPeng P7. Source: Flickr

Apart from Tesla, other strong players in the electric vehicle (EV) space include Chinese companies such as Nio (NYSE:NIO), Xpeng (NYSE:XPEV) and Li Auto (NASDAQ:LI).

Among the Chinese EV players, Li Auto was the largest with a market cap of $20 billion as of Jun 2024. On the other hand, Xpeng was the smallest with a market cap of just $7 billion during the same period.

Nio’s market cap was slightly larger than Xpeng at around $10 billion. Year to date in 2024, most Chinese EV stocks had been badly beaten down. As such, their respective market cap was only a fraction of Tesla’s.

For your information, Tesla’s market cap was valued at more than $500 billion as of Jun 2024.

While most Chinese EV stocks have been beaten down, that does not necessarily mean that they will not rise again in the foreseeable future and they probably will, given their popularity in the EV space.

In this article, we will compare the margins of these EV players, including that of Tesla and Chinese EV companies, to see how they have been doing with respect to each other.

The margins that we are going to look at include the gross margin, vehicle margin, operating, and net profit margins. By the way, these are all GAAP measures and are comparable.

Let’s get started!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Can The Chinese EV Makers Win The Electric Vehicle Race?

Margins Comparison

A1. Gross Margin

A2. Vehicle Margin

A3. Operating Profit Margin

A4. Net Profit Margin

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Vehicle Margin: Automobile companies’ vehicle margin refers to the difference between the cost of manufacturing and selling a vehicle and its retail price. It’s a critical metric automobile companies use to measure profitability on each vehicle sold.

This margin can be expressed in absolute terms or as a percentage of the vehicle’s selling price. The vehicle margin takes into account direct costs such as materials, labor, and manufacturing overhead. It also might include additional costs like transportation, marketing, and research and development allocated per vehicle.

Higher vehicle margins generally indicate better profitability and financial health for automobile companies, enabling them to invest in new technologies, designs, and market expansion.

Can The Chinese EV Makers Win The Electric Vehicle Race?

Chinese EV makers have a significant opportunity to excel in the global electric vehicle (EV) race, primarily due to strong government support, substantial investment in research and development (R&D), and a rapidly growing domestic market.

Here are several factors that could position Chinese EV manufacturers at the forefront of the global EV market:

1. **Government Support:** The Chinese government has been very supportive of the EV industry, implementing policies to promote EV adoption such as subsidies for EV buyers, investment in charging infrastructure, and regulations favoring electric vehicles. This strong government backing creates a favorable environment for Chinese EV makers to grow and innovate.

2. **Large Domestic Market:** China is the largest automotive market in the world, with the highest number of EV sales globally. This massive domestic market gives Chinese EV manufacturers a significant advantage, as they can scale up their operations and reduce costs more efficiently than competitors in smaller markets.

3. **Technological Innovation:** Chinese EV makers have been rapid in their R&D efforts, focusing on innovations in battery technology, autonomous driving, and vehicle manufacturing processes. Companies like NIO, BYD, and XPeng have made notable advancements, including developments in battery swap technology and self-driving capabilities.

4. **Global Expansion:** Some Chinese EV manufacturers are already looking beyond the domestic market and starting to expand globally. For example, BYD and NIO are exploring or have entered markets in Europe, the Middle East, and other regions. As these companies establish a global presence, they could capture significant shares of the international EV market.

5. **Supply Chain Dominance:** China controls a substantial portion of the global supply chain for critical EV components, especially rare earth elements and batteries. This supply chain dominance can give Chinese EV makers a competitive edge in terms of production efficiency and cost control.

However, winning the global EV race will not be without challenges. Chinese EV makers must navigate issues such as domestic and international competition, the need for continuous innovation, and potential trade barriers or political tensions. Additionally, as global auto manufacturers accelerate their EV initiatives, the competition becomes more intense.

In conclusion, while there are challenges ahead, Chinese EV manufacturers are well-positioned to play a leading role in the global shift towards electric vehicles, leveraging their technological advancements, government support, and domestic market scale. Their success on the international stage will depend on how effectively they can innovate, scale, and navigate global market dynamics.

Gross Margin

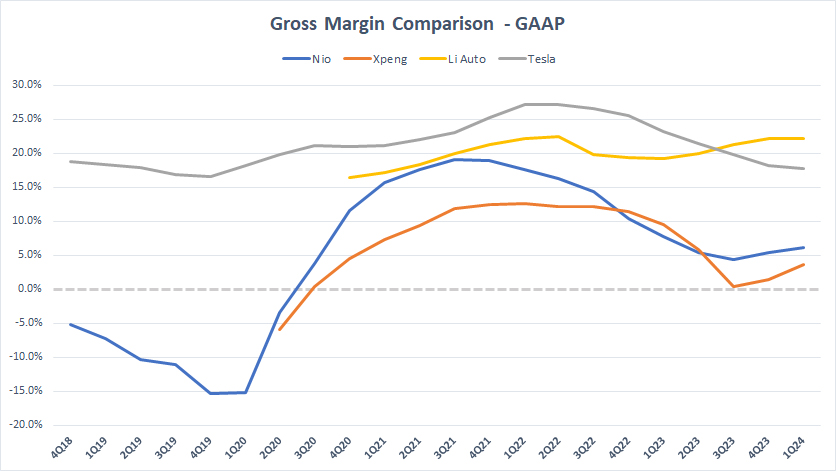

Tesla, Li Auto, Nio and Xpeng’s gross margin

(click image to enlarge)

Let’s first look at the gross margins of all EV companies which are shown in the chart above. For your information, the gross margin is a profitability metric that measures the markup of a product. Therefore, the higher the gross margin, the more profitable the product is.

As seen in the chart above, Tesla’s gross margin used to beat all Chinese EV makers under comparison. However, it has slowly declined in recent periods and has plummeted below 20% since 3Q23.

Since 2023, Li Auto’s gross margin has slowly surpassed that of Tesla, and has become the most profitable EV maker among all companies under comparison, as depicted in the chart above.

As of 1Q 2024, Li Auto’s gross margin topped roughly 22%, while Tesla’s gross margin hovered around 18%.

At the bottom of the ranking were Nio Inc. and Xpeng. The gross margin of both EV makers have significantly plummeted in recent periods, highlighting the decrease in profitability of both companies. As of 1Q 2024, their gross margins hovered just 5%.

Vehicle Margin

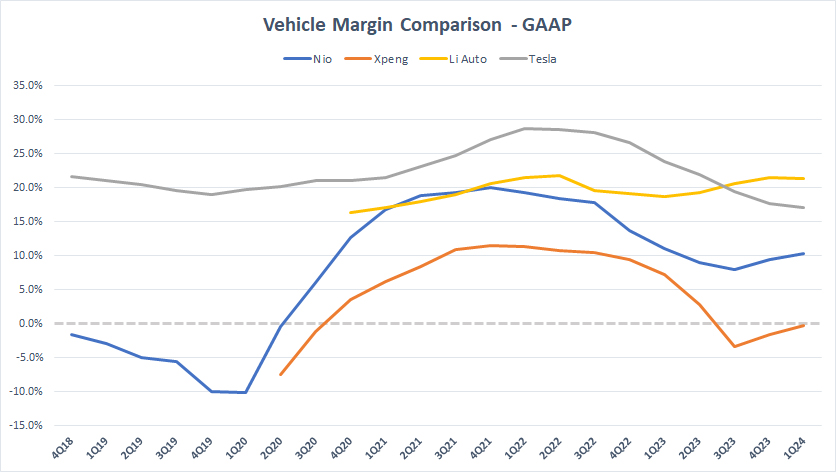

Tesla, Li Auto, Nio and Xpeng’s vehicle margin

(click image to enlarge)

The definition of automobile companies’ vehicle margin is available here: vehicle margin. In terms of vehicle margin, Tesla used to beat all Chinese EV makers hands down. However, its vehicle margin has significantly decreased in recent periods, as illustrated in the chart above. It plummeted below 20% in 3Q23 for the first time in more than five years. Since then, it has remained below 20%.

On the other hand, Li Auto’s vehicle margin has remained firm and has soared above 20% since 3Q23. Since then, it has overtaken Tesla’s vehicle margin and has remained as the top EV maker with the highest vehicle margin.

At over 20% of vehicle margin, Li Auto’s profit per car is way ahead of other automaker, even beating Tesla’s profit per vehicle by a wide margin.

For other Chinese EV automakers such as Nio and Xpeng, their vehicle margins have been mediocre. For example, Nio’s vehicle margin hovered just 10% as of 1Q 2024, while Xpeng’s vehicle margin barely stayed above 0%.

Operating Profit Margin

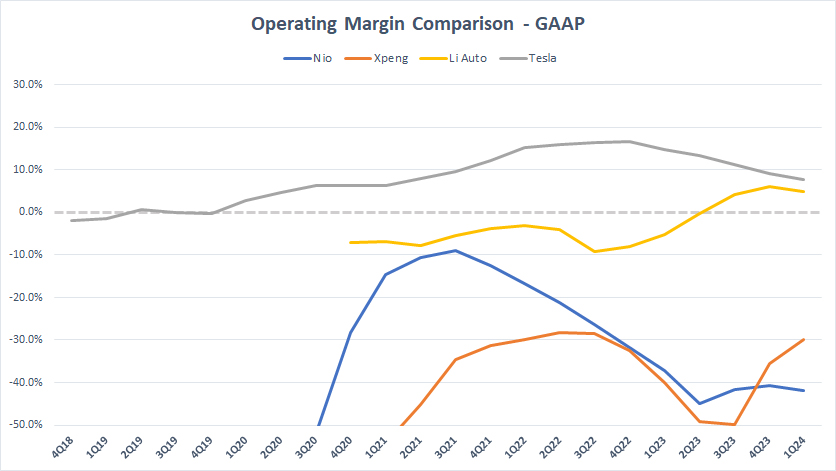

Tesla, Li Auto, Nio and Xpeng’s operating margin

(click image to enlarge)

The operating margin takes into account the operating costs in addition to the costs of revenue but before taxes and interest expenses.

The operating costs of all EV companies in discussions include research and development as well as SG&A expenses.

Research and development expenses are big with EV companies and can take up as much as 50% or even more of the total operating costs.

That said, the operating profit margin shown in the chart measures primarily the operating strength of the respective EV companies.

Of all the EV companies presented, Tesla appears to have the highest operating profit margin. However, its operating profit margin has slightly dipped in recent periods, and has marginally stayed above Li Auto’s operating profit margin.

On the flipped side, Li Auto’s operating profit margins has soared above 0% in recent periods, hovering around 5% as of 1Q 2024, only slightly below Tesla’s operating profit margin of 8%. I believe it is just a matter of time when Li Auto’s operating profit margin overtakes Tesla.

At the same time, Nio and Xpeng had negative operating profit margins, making these automakers bearing deep losses.

Net Profit Margin

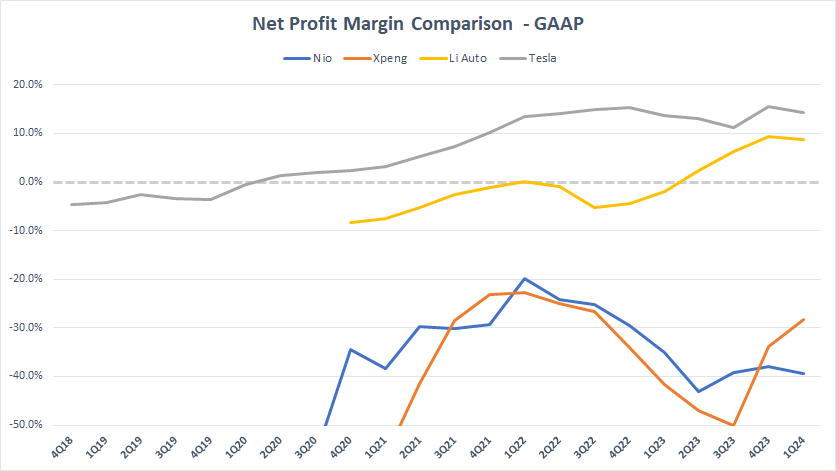

Tesla, Li Auto, Nio and Xpeng’s net profit margin

(click image to enlarge)

The net profit margin shows the bottom line of all EV companies after accounting for all costs and expenses of doing business and this includes taxes and interest expenses.

Again, Tesla is the only EV company that has managed to generate positive net profit margins according to the chart. However, Li Auto has been able to make it into the profitability rank recently when its margin increases.

As seen in the chart, Li Auto’s profitability has been soaring, with its net profit margin closing in at 10% as of 1Q 2024. Its profitability is getting closer to Tesla and may even outpace the American EV maker soon.

In contrast, Nio and Xpeng have been making big losses all these years. Their net profit margins were still way below the profitability thresholds. They have much work to do.

Conclusion

In conclusion, with the price wars unfolding recently, most automakers in China have seen their margins shrinking, and this include Tesla.

However, Tesla still leads the profitability race by a wide margins despite experiencing a decrease in profitability in recent periods. On the other hand, most Chinese EV players such as Nio and Xpeng are still reeling from losses.

However, Li Auto has been fast catching up recently. Its profit margin has come close to Tesla and may even outrun the American EV maker soon. In fact, Li Auto has already beaten up Tesla in gross margin and vehicle margin since fiscal year 2023.

Therefore, Tesla, watch out!

References and Credits

1. All financial figures presented in this article were obtained and referenced from the companies’ respective financial statements, SEC filings, investor update letters, earnings reports, etc, which can be obtained from the following links:

a) Tesla Investor Relations

b) NIO Investor Relations

c) Xpeng Investor Relations

d) Li Auto Investors Overview

2. Featured images in this article are used under creative commons license and sourced from the following websites: XPeng P7 and NIO ES6.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!

Excellent work