Altria Group. Flickr Image.

Altria Group (NYSE:MO) is a cash dividend-paying company.

It has been paying cash dividends continuously since 1989, according to the company’s dividend information page.

Therefore, Altria has been a dividend-paying stock for over 30 years as of 2023.

In fact, Altria has increased its dividend rates year over year without fail in the past ten years.

Therefore, Altria is a strong dividend payer committed to returning shareholders as much cash as possible.

Aside from paying a reasonable cash dividend, Altria also buys back its common stocks at more than USD 1 billion annually on average.

While Altria temporarily suspended its stock buyback in fiscal 2020, the company resumed its stock buyback in fiscal 1Q 2021.

In fiscal 2022 alone, Altria spent nearly $2 billion on stock buyback and more than $6 billion on cash dividends.

Therefore, Altria has a firm capital return policy for shareholders.

In this article, we will look at factors that favor Altria’s dividend policy, including those that have enabled the company to pay and raise dividends continuously.

Apart from the favorable factors, we also look at unfavorable ones that may harm the dividends and make the dividends unsafe.

Without further delay, let’s sit back and explore the table of contents below!

Table Of Contents

Favorable Factors

A1. Rising Revenue

A2. Highly Profitable Company

A3. Expanding Margins

A4. Postive Cash Flow And Low Capital Expenditures

A5. Solid Capital Returns

A6. Manageable Debt Payments

A7. Comfortable Interest Coverage

Unfavorable Factors

B1. Declining Shipment Volume

B2. Still A Cigarette Company

B3. High Payout Ratio

B4. An Overstretched Cash Flow

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Rising Revenue

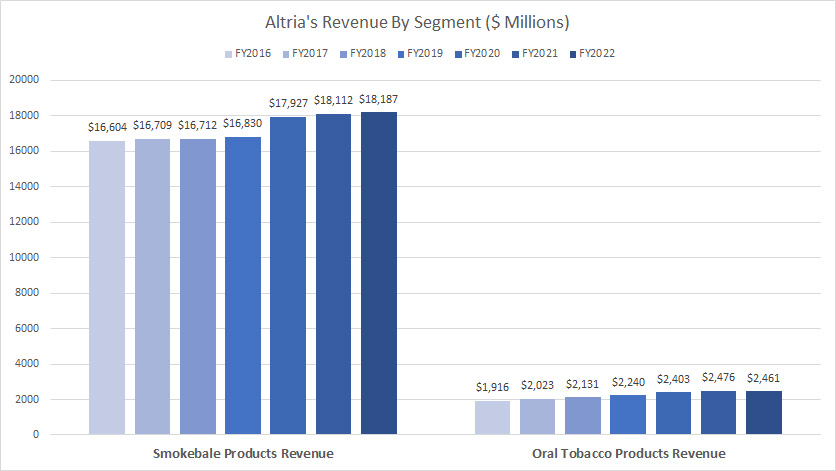

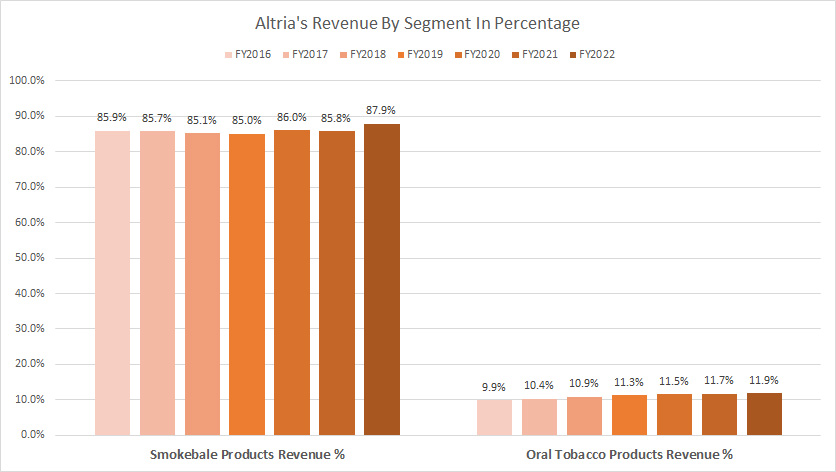

Altria revenue by segment

(click image to enlarge)

While revenue may not necessarily translate to profitability and, thus, cash dividends, it is good to see that Altria has been able to grow its revenue.

More importantly, Altria’s revenue has risen considerably in the company’s two major segments: the smokeable products and oral tobacco products.

As displayed in the chart above, Altria has grown its smokeable products revenue by 10% since 2016 and a massive 28% for the oral tobacco products revenue in the same period.

As of 2022, Altria’s smokeable product revenue reached a record figure of US$18.2B, while the oral tobacco product revenue hit US$2.5B, also a record figure in the past seven years.

A noteworthy trend is that Altria can still achieve meaningful revenue growth despite declining cigarette sales.

Again, the rising revenue may not necessarily mean a safe dividend.

However, a stable and solid cash dividend is more likely when a company can raise prices and generate long-term revenue growth.

Highly Profitable Company

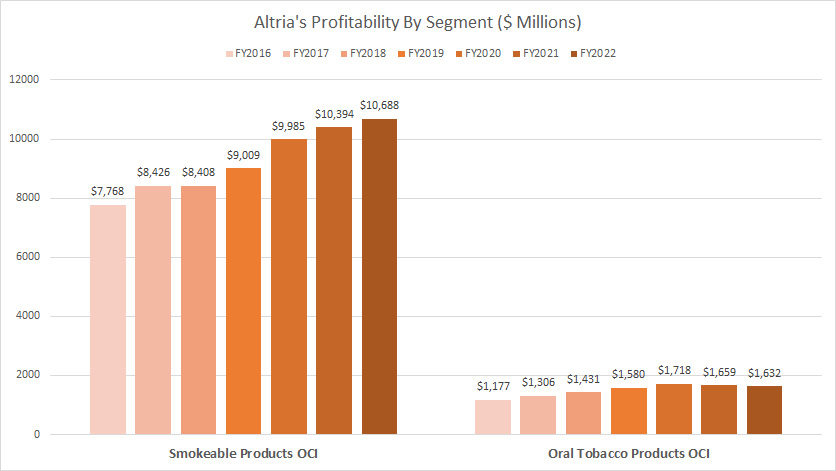

Altria profitability by segment

(click image to enlarge)

Profitability is perhaps one of the most important factors determining a company’s ability to pay cash dividends.

Fortunately, Altria is not just a profitable company but also a highly profitable one.

As seen in the chart above, Altria’s smokeable and oral tobacco segments have been very profitable, with annual operating income exceeding $10 billion and $1.6 billion, respectively.

Additionally, the profitability of these business segments is consistent and rising, indicating a positive trend and stability in their financial performance.

For example, Altria’s smokeable product OCI has risen by a whopping 37%, while that of oral tobacco products has risen even more, by 39% since 2016.

Therefore, Altria’s case for safe and stable dividends is even stronger with consistent and rising profits from its primary business operations.

Expanding Margins

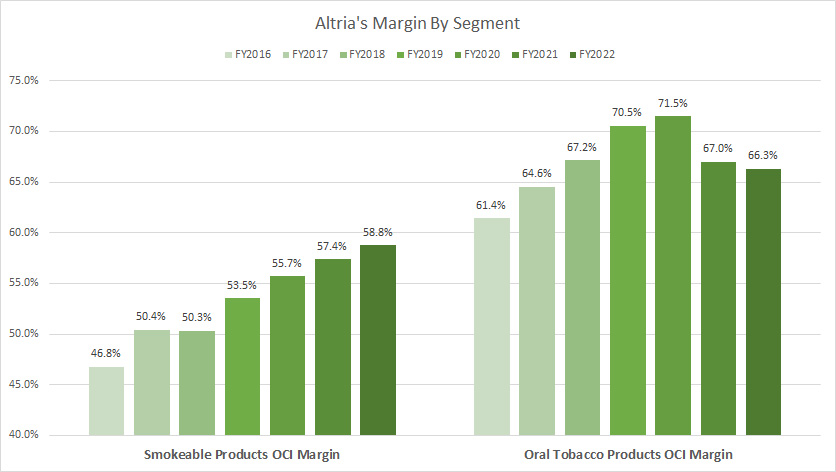

Altria margin by segment

(click image to enlarge)

expenses and amortization of intangibles.

Altria’s expanding margins in both the smokeable product and oral tobacco product segments make the company a solid dividend payer.

The increasing margins indicate that the company earns more profit for the same revenue.

In other words, Altria becomes more profitable when margins rise.

As the chart above shows, Altria’s smokeable segment has an OCI margin above 59%. However, the oral tobacco segment is even more profitable, with an OCI margin exceeding 60%.

Again, Altria’s exceptional margins make a consistent and safe dividend highly probable.

Positive Cash Flow And Low Capital Expenditures

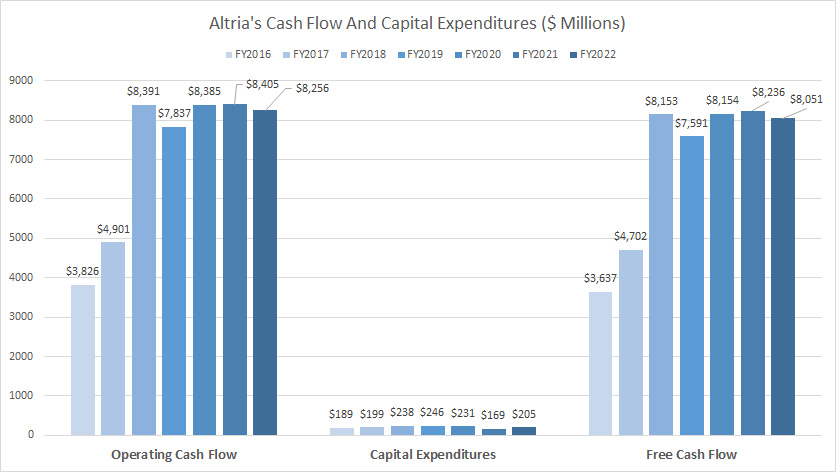

Altria cash flow and capital expenditures

(click image to enlarge)

A discussion of dividends would be incomplete without considering cash flow, as dividends are sourced directly from cash.

That said, Altria consistently generates impressive cash flow, providing shareholders with peace of mind.

As shown in the chart above, Altria’s net cash from operations tops more than $8 billion annually.

Of that $8 billion, Altria managed to squeeze as much as 98% of free cash flow, a result made possible by the company’s low capital expenditures.

The free cash flow is essential as they are used for debt repayments, business expansion, capital returns, etc.

The huge amount of free cash flow has enabled Altria to pay cash dividends and consistently raise the rates every year.

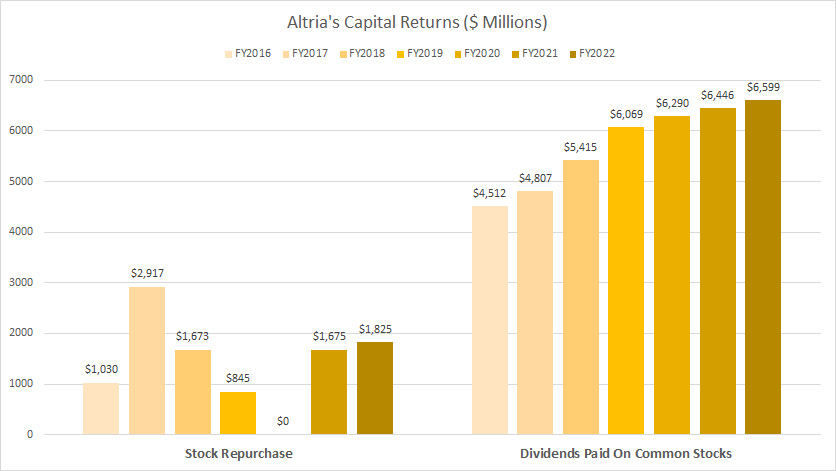

Solid Capital Returns

Altria capital returns

(click image to enlarge)

Altria has a solid capital return policy for shareholders.

The company’s growing dividend payout every year is an even more impressive practice.

As the chart above shows, Altria’s cash dividend payout has increased by 46% since fiscal 2016, topping a massive figure of $6.6 billion as of 2022, up significantly from the $4.5 billion reported in 2016.

Altria not only pays dividends but also has spent an average of $1.4 billion annually since 2016 to buy back its shares.

For your information, Altria’s board members just approved a new $1 billion share repurchase program in 1Q 2023. The stock repurchase is expected to be completed by December 31, 2023, according to the company 1Q 2023 10-Q report.

Again, Altria’s sound and secure dividend payment is a result of its consistent capital return policy for shareholders.

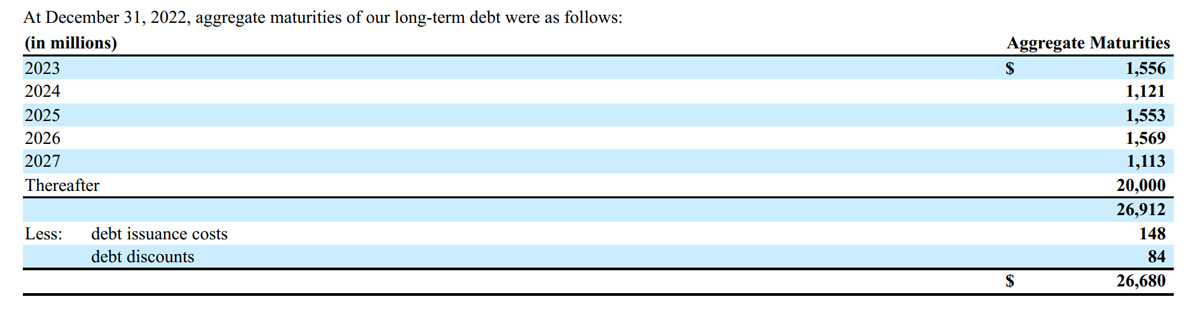

Manageable Debt Payments

Altria debt maturities

(click image to enlarge)

Altria carries quite a significant amount of debt according to this article – Altria Debt, Cash Assets And Payments Due Date.

As of 1Q 2023, Altria’s debt levels amounted to $25 billion, a considerable prominent figure compared to the historical average.

While the debt figure may be huge, Altria can handle the debt repayments.

As shown in the snapshot above, between 2023 and 2027, Altria’s debt will come in at $1.4 billion on average every year in the next five years.

Despite the seemingly gigantic debt figure, Altria’s cash and cash equivalents alone should easily cover the amount.

Altria’s cash equivalents & restricted cash

| Fiscal Year | Cash In Millions |

|---|---|

| 2016 | $4,569 |

| 2017 | $1,314 |

| 2018 | $1,433 |

| 2019 | $2,160 |

| 2020 | $5,006 |

| 2021 | $4,594 |

| 2022 | $4,091 |

| 2023 1Q | $3,974 |

| 2023 2Q | $923 |

| 2023 3Q | $1,581 |

| — | — |

| Average | $3,000 |

As shown in the table above, Altria’s cash on hand averaged $3 billion, and it boasted $1.6 billion as of 3Q 2023.

Therefore, Altria’s debt should not threaten its generous dividend policy.

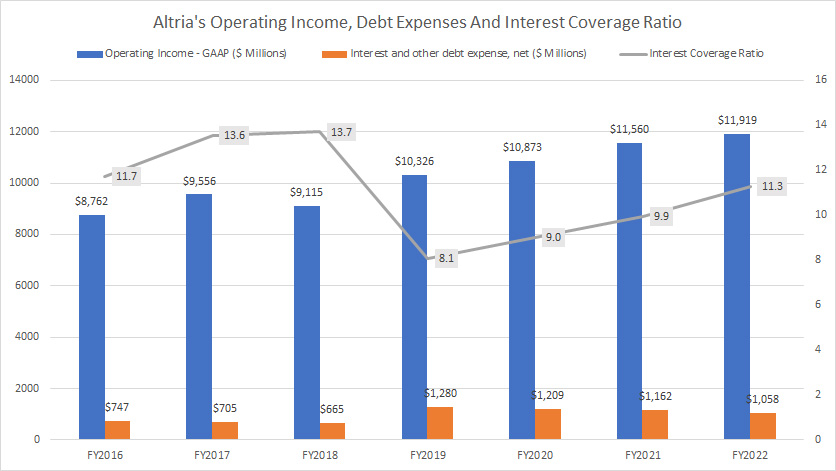

Comfortable Interest Coverage

Altria operating income, debt expenses, and interest coverage ratio

(click image to enlarge)

Apart from being able to repay its debt, Altria can also service its debt.

The chart above shows that Altria’s operating income is far more significant than the interest and other debt expenses.

In fact, Altria’s interest coverage ratio, measured by dividing the operating income by interest and debt expenses, is many times over the interest and debt expenses.

Therefore, Altria should have no problem servicing its debt.

Again, Altria’s debt and interest payments do not hinder the company’s dividend policy.

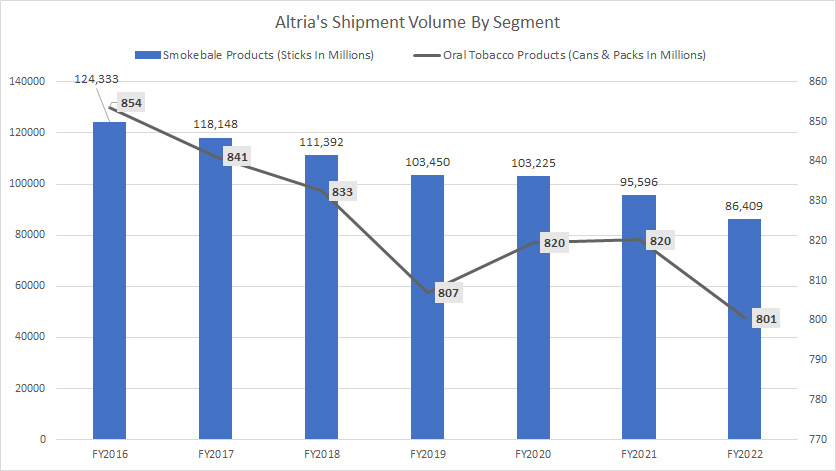

Declining Shipment Volume

Altria shipment volume by segment

(click image to enlarge)

Altria’s declining shipment volume is unfavorable to the company’s dividend policy.

Over the years, its shipment volumes in both the smokeable product and oral tobacco product segments have consistently declined.

As seen in the chart above, Altria’s shipment volumes reached record lows as of fiscal 2022 for both the smokeable product and oral tobacco product segments.

Fewer shipment volume means less money and possibly smaller dividends.

Altria has been raising prices to compensate for the lost shipment volumes.

However, raising prices indefinitely may not solve the company’s declining shipment volumes.

Therefore, Altria’s declining shipment volumes may threaten its consistent dividend payments.

Altria Is Still A Cigarette Company

Altria revenue by segment in percentage

(click image to enlarge)

As of 2022, despite efforts to divest from its legacy cigarette business, Altria remained primarily a cigarette company.

As seen in the chart above, Altria’s smokeable product still accounted for the lion’s share of the company’s sales, at 88% as of 2022.

For your information, Altria’s smokeable product segment consists primarily of cigarettes and cigars.

The contribution of revenue from other segments has barely progressed over the years.

In fact, Altria has attempted to divest into other areas such as cannabinoids, e-cigarettes, and alcohol; however, none of them have managed to impact the company’s financials significantly.

On the contrary, Altria has suffered considerable losses in some of these divestments.

Thus, Altria continues to depend heavily on its traditional cigarette segment to drive growth and profitability.

Altria needs a new growth engine as its legacy business declines.

If Altria continues to rely on its traditional cigarette business, its dividends may suffer the same fate.

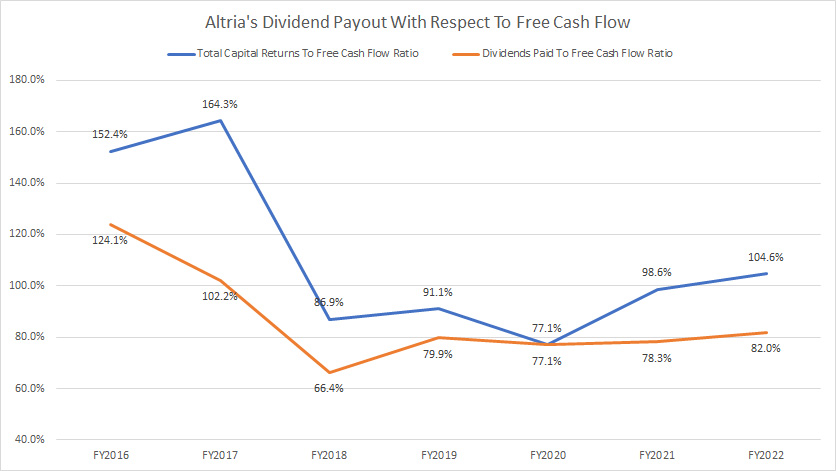

High Payout Ratio

Altria dividend payout ratio

(click image to enlarge)

Altria has consistently increased its dividend rates for years without any failures.

However, this practice may not be sustainable in the long run, considering the high dividend payout ratio, as displayed in the chart above.

Altria has a very high dividend payout ratio with respect to free cash flow, somewhere north of 70%.

The figure reached more than 80% as of 2022.

The ratio becomes even higher when considering the cash spent on share buybacks.

In fiscal 2022, Altria’s total capital return exceeded its free cash flow, thereby causing the payout ratio to exceed 100%, as summarized in this article – Altria Free Cash Flow Vs Capital Returns.

Unless Altria can drastically boost its free cash flow, the continuous growth of the dividend rates may become unsustainable in the future.

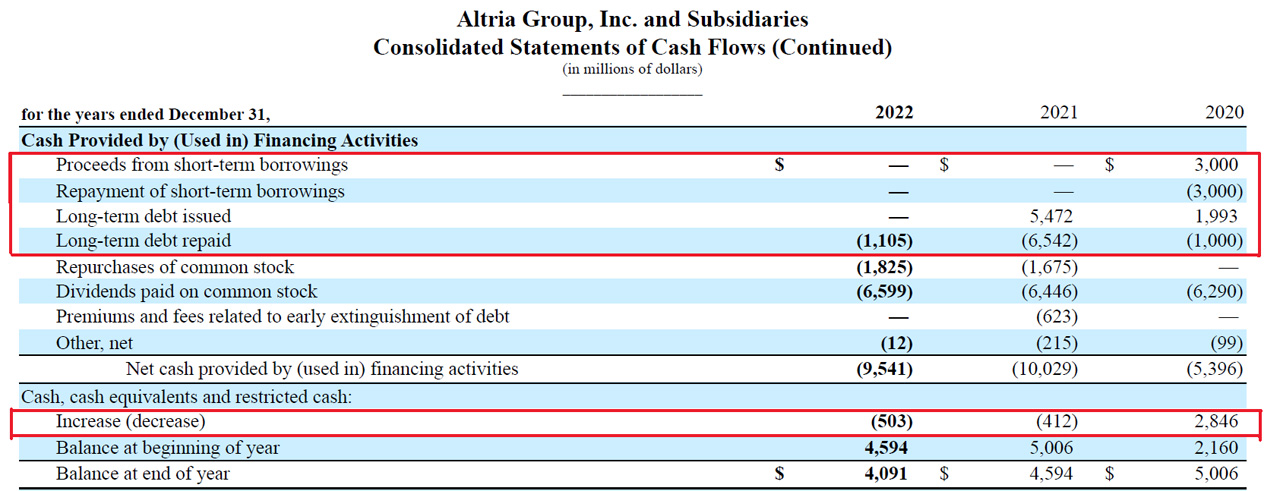

An Overstretched Cash Flow

Altria debt repayment and capital return

(click image to enlarge)

Is Altria cash flow overstretched?

Based on the cash flow statements presented above, it appears to be so.

The highlighted box at the top shows Altria’s debt borrowings and repayments, while the highlighted box at the bottom shows Altria’s changes in cash balance.

As the snapshot shows, Altria’s cash balance increases when it borrows more and stops buying back its stocks, meaning more cash comes in.

On the other hand, Altria’s cash balance decreases when it repays debt, buys back stocks, and pays dividends.

Therefore, Altria must choose between reducing share buybacks, cutting dividends, or increasing borrowing to boost cash reserves.

If Altria pays dividends and buys back its stocks, there will not be enough cash for debt repayment and vice versa.

In this case, Altria must go to the capital market to obtain funds to refinance its debt.

Simply put, Altria will exceed its cash flow capacity if it chooses to return cash to shareholders and repay its debt at the same time.

Summary

Altria is a highly profitable company that has consistently provided its shareholders with a stable and solid cash dividend despite declining cigarette sales.

However, the declining shipment volumes in Altria’s legacy cigarette business may threaten its consistent dividend payments.

Therefore, Altria needs a new growth engine, as its legacy business may fail to sustain its dividend growth in the long run.

Overall, Altria’s capital return policy, sound financial health, and consistent dividend payments make it an attractive investment option for dividend-seeking investors.

Please leave your comments below.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Altria’s quarterly and annual filings, earnings reports, presentations, investor updates, etc., which can be obtained throuygh the company’s official website – Altria Investor Relations.

2. Featured images in this article are used under a Creative Commons license and sourced from the following websites – Ivan Radic.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link back to this article from any website so that more articles like this can be created in the future.

Thank you!