Revenue growth. Pixabay Image.

This article presents Philip Morris International (PMI)’s revenue breakdown by product category. PMI’s product category consists of two major units: combustible tobacco products and smoke-free products.

Let’s take a look.

For other key statistics of Philip Morris International, you may find more resources on these pages:

Revenue Breakdown

Sales Breakdown

Market Share

- Worldwide market share: cigarette and HTU,

- Combined market share of cigarette and HTU by country,

- Market share of HTU by country,

- Market share for Marlboro and other cigarette brands

Profit Margin

Other Statistics

- Philip Morris vs Altria: profit margin comparison,

- Financial health: total debt, payment due, and cash

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Philip Morris International Business Model

O3. How Does Philip Morris International Generate Revenue

Results By Product Category

A1. Revenue By Product Category

A2. Percentage Of Revenue By Product Category

Revenue Growth

B1. Revenue By Product Category YoY Growth Rates

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Combustible Tobacco Products: Combustible tobacco products is the term PMI uses to refer to cigarettes and other tobacco products that are combusted.

Smoke-Free Products: Smoke-free products (“SFPs”) is the term refers to all of PMI’s products that are not combustible tobacco products, such as heat-not-burn, e-vapor, and oral nicotine. In addition, SFPs include wellness and healthcare products, as well as consumer accessories such as lighters and matches.

Philip Morris International Business Model

Philip Morris International is a leading tobacco company in over 180 countries. The company’s business model revolves around producing and selling tobacco products, primarily cigarettes, under its various brand names, such as Marlboro, Chesterfield, and L&M.

PMI’s business strategy is focused on innovation and sustainability. It invests heavily in research and development to create new products that meet the evolving needs of consumers. The company is also committed to reducing the environmental impact of its operations and promoting sustainable practices throughout its supply chain.

In recent years, PMI has been actively pursuing a smoke-free future by investing in alternative nicotine delivery systems such as heated tobacco products and e-cigarettes. The company aims to replace cigarettes with less harmful alternatives and ultimately phase out traditional tobacco products.

Overall, PMI’s business model is characterized by a strong focus on innovation, sustainability, and adapting to changing consumer preferences and regulatory environments.

How Does Philip Morris International Generate Revenue

Philip Morris International (PMI) generates revenue primarily through the sale of tobacco products, including cigarettes, heated tobacco products, and smoke-free alternatives such as e-cigarettes.

PMI is one of the largest tobacco companies in the world, with a presence in over 180 countries. The company’s portfolio of brands includes Marlboro, Parliament, Virginia Slims, and many others.

In addition to selling tobacco products, PMI also generates revenue through licensing agreements and other business ventures. Despite increasing regulations and declining smoking rates in many parts of the world, PMI remains a profitable company with a strong global presence.

Revenue By Product Category

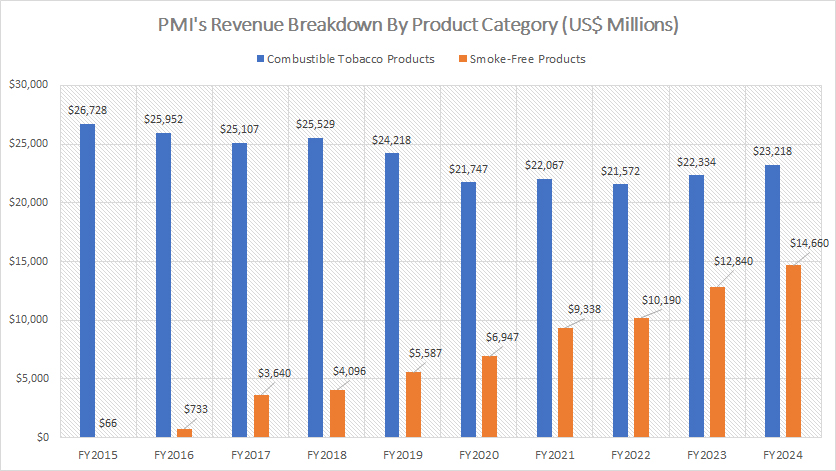

PMI’s revenue by product category (click to enlarge)

The definitions of PMI’s combustible tobacco and smoke-free products are available here: combustible tobacco products and smoke-free products.

Philip Morris International (PMI) generates its revenue from two primary categories of tobacco products: combustible products, which include traditional cigarettes, and non-combustible products, such as its innovative IQOS line of smoke-free devices.

Over the past decade, PMI has experienced a significant shift in its revenue composition. The company has seen a notable decline in revenue from combustible products, while its income from non-combustible products has expanded remarkably, underscoring a strategic transition toward a smoke-free future.

In fiscal year 2024, PMI reported $23.2 billion in revenue from combustible products, marking a $1 billion increase from the $22.3 billion recorded in 2023. Despite this incremental growth, the overall trend for traditional cigarettes remains stagnant over the longer term, highlighting the challenges faced by the combustible product segment amidst changing consumer preferences and regulatory pressures.

Conversely, PMI’s smoke-free portfolio, particularly products such as IQOS, has demonstrated exceptional growth. In fiscal year 2024, the company achieved $14.7 billion in revenue from smoke-free products, representing a 15% year-over-year increase from $12.8 billion in 2023.

This substantial growth underscores the rising global demand for alternative products that align with PMI’s vision of reducing harm and addressing evolving market dynamics.

To illustrate the magnitude of PMI’s success in the smoke-free category, consider its trajectory over the past decade. A mere ten years ago, the company’s revenue from smoke-free products was less than $100 million — a fraction of its overall earnings. By fiscal year 2024, this figure had surged to $14.7 billion, reflecting exponential growth and a successful pivot toward innovative product offerings.

On the other hand, PMI’s net revenue from combustible products was $26.7 billion in fiscal year 2015. While the revenue from this category has remained relatively stable, hovering around the same level in 2024, the stagnation juxtaposed with the explosive growth of smoke-free products highlights the company’s ability to adapt to shifting consumer trends.

This achievement signals PMI’s strategic commitment to evolving its business model and responding to market demands for reduced-risk products, paving the way for sustained long-term growth in the smoke-free segment.

PMI’s transition from reliance on traditional tobacco products to a diversified portfolio of smoke-free options demonstrates the company’s forward-looking approach in redefining its industry presence.

This pivot not only underscores the company’s ability to innovate and capitalize on emerging trends but also positions it as a leader in promoting alternatives to conventional cigarettes—a critical factor as societal attitudes and regulatory landscapes evolve globally.

Percentage Of Revenue By Product Category

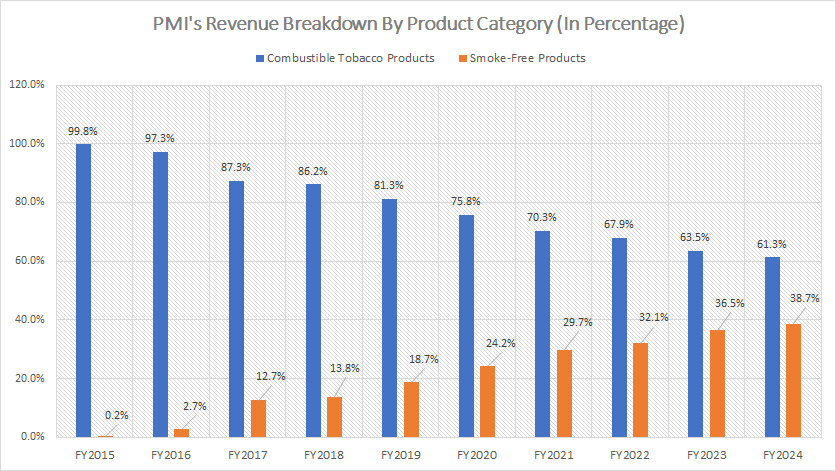

PMI’s percentage of revenue by product category (click to enlarge)

The definitions of PMI’s combustible tobacco and smoke-free products are available here: combustible tobacco products and smoke-free products.

Philip Morris International (PMI) has undergone a remarkable transformation in its revenue composition over the past decade. The contribution of combustible tobacco products to PMI’s overall revenue has steadily declined, reaching a historic low of 61.3% in fiscal year 2024. This is a significant drop from nearly 100% in fiscal year 2015, reflecting the company’s strategic shift away from traditional cigarette products.

Conversely, PMI’s smoke-free product category has seen exponential growth in its revenue contribution. By fiscal year 2024, smoke-free products accounted for 38.7% of PMI’s total revenue, a dramatic leap from 0% in fiscal year 2015. This shift underscores the company’s success in developing and scaling innovative alternatives like IQOS, which cater to changing consumer preferences and growing demand for reduced-risk products.

The exponential growth in PMI’s smoke-free revenue contribution highlights the company’s determination to fulfill its ambition of becoming a predominantly smoke-free organization. From generating no revenue in the smoke-free segment just a decade ago to achieving nearly 40% of its total income in 2024, PMI’s progress is a testament to its vision and adaptability.

This shift also signifies a broader industry trend as companies respond to regulatory pressures, public health advocacy, and evolving societal attitudes toward smoking. PMI’s strategic pivot not only aligns with these external factors but positions the company as a leader in the development and commercialization of reduced-risk products. As the revenue share from smoke-free products continues to grow, PMI’s goal of transitioning to a smoke-free future is rapidly taking shape.

This transformation places PMI in a unique position to address global smoking-related challenges while tapping into lucrative new markets for innovative tobacco alternatives. The company’s ability to balance declining combustible product revenues with rapid expansion in the smoke-free segment showcases its resilience and forward-thinking approach in navigating an evolving industry landscape.

PMI’s revenue trends signal a promising trajectory toward redefining its business model and delivering on its commitment to innovation and sustainability.

Revenue By Product Category YoY Growth Rates

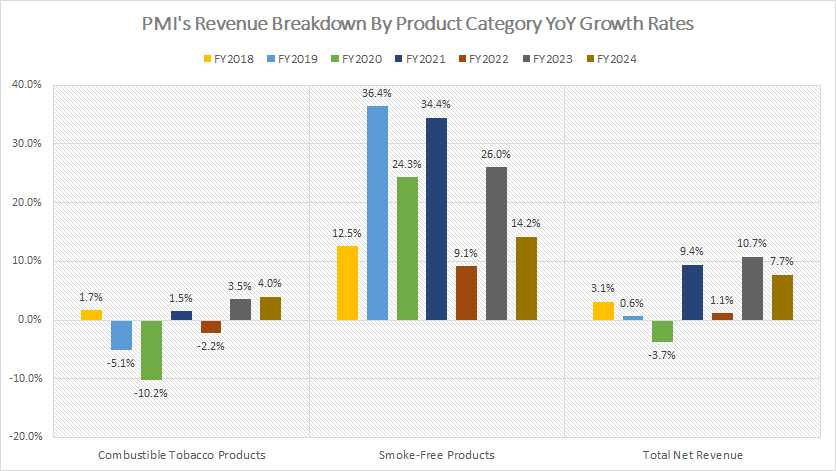

philip-morris-international-revenue-by-product-category-yoy-growth-rates

(click image to expand)

The definitions of PMI’s combustible tobacco and smoke-free products are available here: combustible tobacco products and smoke-free products.

The chart above vividly highlights the striking disparity in growth rates between Philip Morris International’s (PMI) smoke-free product segment and its combustible product category. This visual representation underscores the transformative momentum that the smoke-free segment has achieved over recent years.

From fiscal year 2020 to 2024, PMI’s smoke-free product category exhibited impressive annual average growth rates of 22%, driven by increasing consumer demand for innovative alternatives such as IQOS. This robust growth reflects PMI’s strategic pivot toward reduced-risk products, aligning with its vision of building a smoke-free future.

In stark contrast, the combustible product category has experienced a decline in performance. Over the same timeframe, the combustible segment registered an average annual growth rate of -1%. This negative trajectory highlights the broader industry challenges and shifting consumer preferences away from traditional cigarettes, as well as the impact of regulatory measures targeting combustible tobacco products.

The consolidated net revenue for PMI demonstrates steady growth, with an annual average increase of 5% from fiscal year 2020 to 2024. This expansion can be attributed primarily to the remarkable performance of the smoke-free product segment, which has become the key driver of PMI’s overall revenue growth.

By focusing on the development, marketing, and scaling of smoke-free solutions, PMI has successfully mitigated the stagnation of its traditional tobacco portfolio.

This significant disparity in growth rates underscores PMI’s strategic resilience and adaptability in navigating an evolving tobacco industry landscape. The shift in focus toward smoke-free products not only aligns with global health initiatives but also positions PMI as a leader in innovation and sustainability.

The company’s ability to leverage the exponential growth of its smoke-free segment while managing the challenges associated with combustible products exemplifies its commitment to transforming the future of tobacco. As smoke-free products continue to gain traction, PMI’s consolidated growth trajectory signals its readiness to redefine industry norms and advance its ambitious goal of a smoke-free world.

Insight

PMI’s pivot toward smoke-free products aligns with global trends, regulatory pressures, and shifting consumer preferences for reduced-risk alternatives. The company’s success in scaling its smoke-free portfolio positions it as a leader in the tobacco industry, with a clear focus on achieving its goal of becoming a predominantly smoke-free organization. The exponential growth of the smoke-free segment not only contributes significantly to consolidated revenue but also signals PMI’s adaptability and commitment to innovation.

References and Credits

1. All financial numbers presented were obtained and referenced from PMI’s quarterly and annual reports published on the company’s investor relations page: PMI’s Reports And Filings.

2. Pixabay Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.