Marlboro. Pixabay Image.

This article presents Philip Morris International (PMI)’s cigarette sales volume by brand name.

In this article, you will find out about the company’s top 10 cigarette brands by sales volume.

That said, only PMI’s cigarette sales volume is presented here.

As a result, the data in the following charts do not include the sales volume of HTUs or Heated Tobacco Units which are different from cigarettes and are only used in PMI’s proprietary IQOS blade.

Readers who are interested in Philip Morris International’s HTUs sales volume can find the information in this article – Philip Morris Cigarette And Heated Tobacco Sales Volume.

All told, let’s head out to the following topics!

PMI’s Largest Cigarette Brands By Sales Volume

Consolidated Metrics

A1. Top Cigarette Brands By Sales Volume

A2. Top Cigarette Sales Volume By Percentage

Individual Cigarette Brands By Sales Volume

B1. Marlboro

B2. L&M

B3. Chesterfield

B4. Philip Morris

B5. Parliament

B6. Sampoerna A

B7. Dji Sam Soe

B8. Bond Street

B9. Lark

Summary And Reference

C1. Conclusion

C2. References and Credits

C3. Disclosure

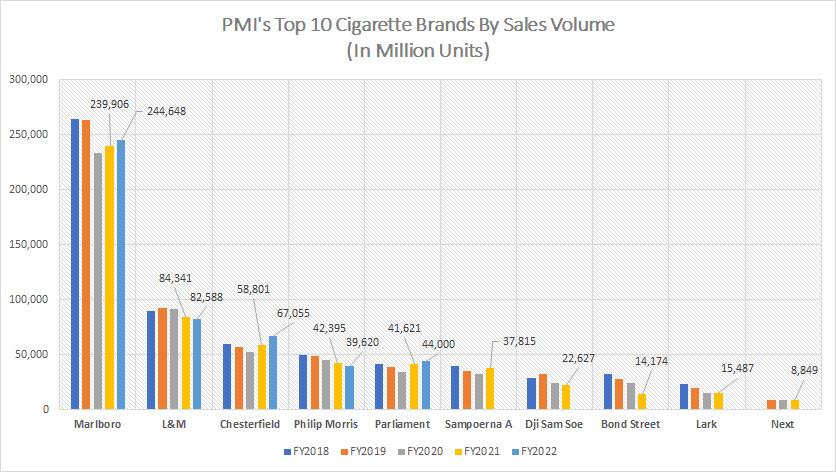

Top 10 Cigarette Brands By Sales Volume

Top 10 cigarette brands by sales volume (click to enlarge)

Let’s first look at Philip Morris International’s top 10 cigarette brands by sales volume which are shown in the chart above for the period from fiscal 2018 to 2022.

As seen, Marlboro had been PMI’s number 1 cigarette brand by sales volume between fiscal 2018 and 2022.

In fiscal 2022 alone, Marlboro cigarette sales clocked 245 billion units, a rise of 2% over 2021.

Despite selling more than 200 billion sticks, Marlboro cigarette sales had been on a decline and for the first time since 2020, the figure had dropped below the 250 billion sticks threshold.

A trend worth pointing out is the huge gap that exists between Marlboro and other brand names.

For example, Philip Morris’ Marlboro cigarette shipment volume in 2022 was nearly 200% higher than that of its closest counterpart.

Therefore, we can say that Marlboro is making up the bulk of Philip Morris’ total cigarette volume.

On the other hand, the second-highest cigarette brand by sales volume goes to L&M or Liggett & Myers at 83 billion units reported in fiscal 2022.

L&M cigarette sales had been strong in the past 5 years and this brand had consecutively stayed in the second spot after Marlboro since 2018.

Similarly, L&M cigarette sales also have been on a decline since 2018 and reached a record low as of 2022.

Chesterfield comes in as 3rd spot in terms of the highest cigarette brand by sales volume, with roughly 67 billion sticks being sold in fiscal 2022.

While the sale volume of other brand names has deteriorated, it has not been the case for Chesterfield.

As seen, Chesterfield’s sales volume has been going strong after hitting a bottom in 2020 and was at a record high as of 2022.

The brand names that occupied the 4th and 5th highest sales volume are Philip Morris and Parliament, respectively.

PMI’s smallest cigarette brand by sales volume was Next, clocking in at a sales volume of only 9 billion cigarettes in fiscal 2021.

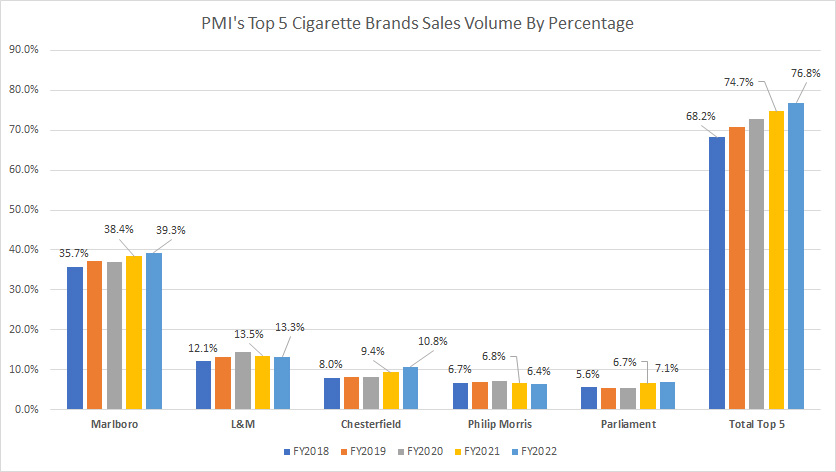

Top Cigarette Sales Volume By Percentage

Cigarette sales volume by percentage (click to enlarge)

The chart above shows only the top 5 cigarette brands of Philip Morris International as the company has stopped breaking down the sales volume of some brand names for fiscal 2022.

That said, Philip Morris’ Marlboro tops the chart at 39% of sales volume as of 2022, the highest among all cigarette brand names.

While the absolute sales volume has been falling, the percentage of Marlboro cigarette sales has been on a rise, illustrating the growing importance of Marlboro in contributing to the total cigarette sales volume for Philip Morris.

L&M or Liggett & Myers cigarette occupies the second spot with a contribution of 13% of sales to the total cigarette volume in 2022.

Chesterfield came in at 11% in 2022, slightly below that of L&M but was significantly higher than the 7% ratio of Parliament reported in 2022.

Philip Morris cigarette was in fifth place, with a cigarette sales volume of only 6% reported in 2022.

The total top 5 cigarette brand names represent 77% of Philip Morris’ total cigarette volume in 2022, indicating that the top 5 cigarette brand names alone were making up the majority of the company’s cigarette volume.

More importantly, this ratio also has been on a rise, growing from 68% in 2018 to the massive 77% result as of 2022, illustrating the growing concentration of sales volume of these brand names.

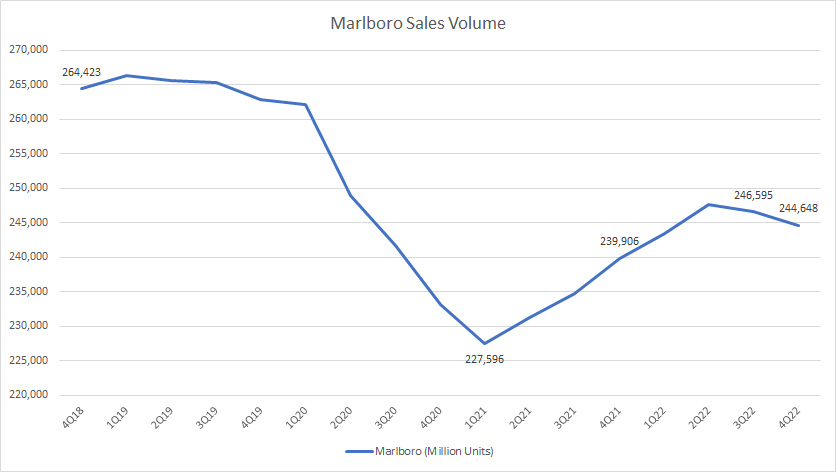

Marlboro Sales Volume

Marlboro sales volume (click to enlarge)

Marlboro is one of the top brands of cigarettes marketed and sold by Philip Morris International around the world.

Moreover, it is also one of the best-known cigarette brands in the world.

That said, on a TTM basis, we can clearly see that Marlboro shipment volume has been on a decline as shown in the chart above.

However, there seems to be a rebound in sales volume for Marlboro after hitting the bottom in 1Q 2021.

For example, after selling 228 billion sticks in 2Q 2021, the lowest sales volume that has ever been reported in the past 5 years, Marlboro cigarette sales volume has been soaring and the figure continues to rise as of Q4 2022.

As of fiscal 2022 4Q, Marlboro sales total 245 billion units, down 1% from the prior quarter but up 2% from a year ago, and this figure was one of the best records since 2021.

Therefore, it’s not the end of the world for Marlboro cigarette sales despite the downtrend all these years.

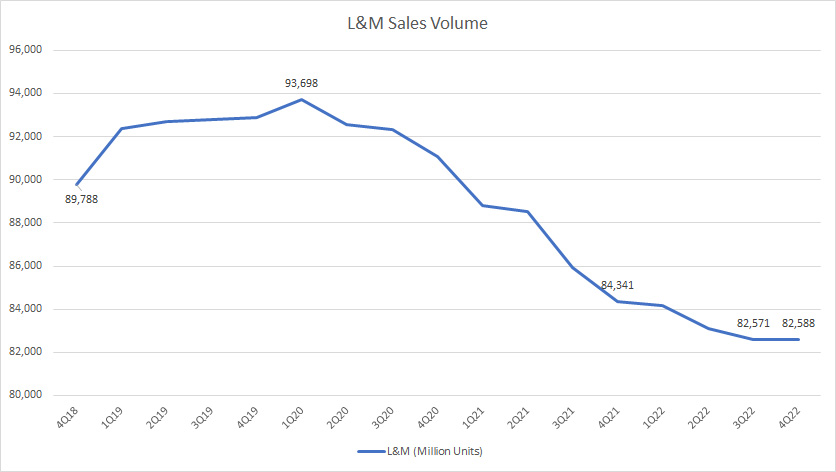

L&M Sales Volume

L&M sales volume (click to enlarge)

Philip Morris International’s L&M is also another top cigarette brand name that is marketed and sold worldwide.

In terms of sales volume, the L&M figure has been on a decline since fiscal 2018 as seen in the chart above.

Contrary to the sales volume of Marlboro, there has been no rebound in the shipment volume of L&M.

As shown in the chart, L&M shipment volume has been hammered badly, especially during the post-pandemic periods.

As of Q4 2022, L&M’s sales volume totaled only 83 billion units on a TTM basis, down 2% from a year ago, and was roughly in line with that of the prior quarter.

Unlike the sales recovery seen in Marlboro, L&M cigarette sales seem to be getting worse since fiscal 2021.

The 4Q 2022 result was the lowest ever reported for L&M shipment volume.

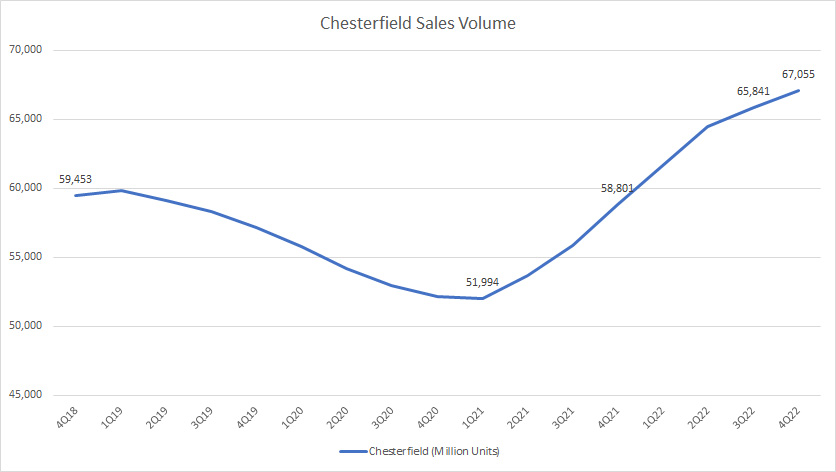

Chesterfield Sales Volume

Chesterfield sales volume (click to enlarge)

Chesterfield is a brand of cigarette marketed and sold by Philip Morris International throughout the world in dozens of countries.

While Chesterfield’s shipment volume declined initially, it significantly bounced back during the post-pandemic period as shown in the chart above.

For example, after reaching the bottom at 52 billion sticks in 1Q 2021, Chesterfield cigarette volume has since been soaring, and topped 67 billion sticks as of Q4 2022 on a TTM basis, a record high for this brand.

The Q4 2022 result represents a rise of 1% over the prior quarter or 14% over Q4 2021.

Therefore, we are seeing a significant recovery in PMI”s Chesterfield sales volume in a post-pandemic world.

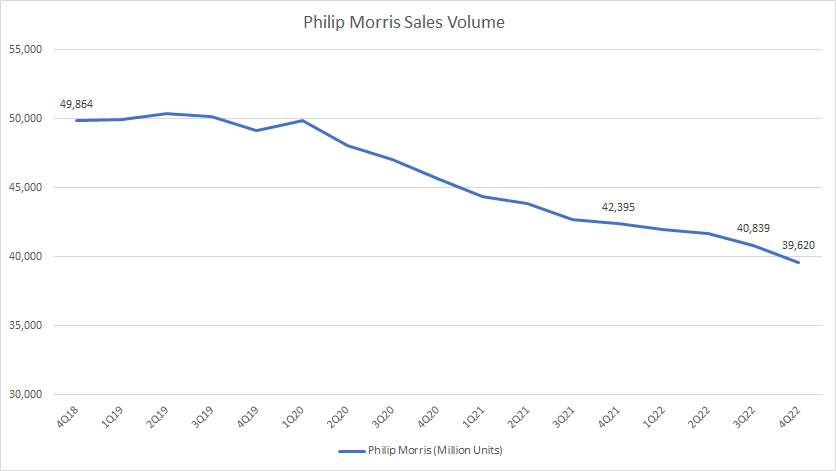

Philip Morris Sales Volume

Philip Morris sales volume (click to enlarge)

Philip Morris is marketed and sold mainly in America but the brand has steadily gained popularity internationally.

According to the chart, Philip Morris’ sales volume has been going downhill and looks to be setting an even worse result in the foreseeable future considering the downtrend of the plot.

As of fiscal 4Q 2022, PMI sold only 40 billion sticks of Philip Morris on a TTM basis, down 7% from a year ago.

While we have witnessed a recovery in sales volume in a number of brand names such as Marlboro and Chesterfield, it is not the case for Philip Morris cigarettes.

Therefore, Philip Morris’s sales volume continued to dive in the post-pandemic period, and the brand has not been doing so well since 2021.

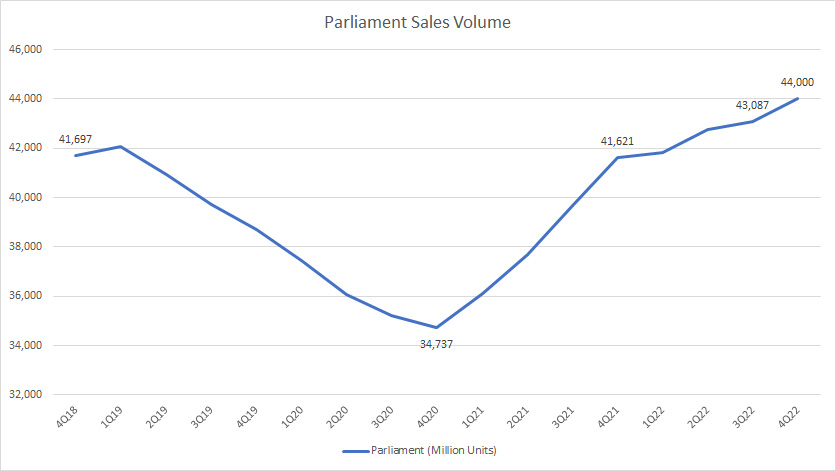

Parliament Sales Volume

Parliament sales volume (click to enlarge)

Parliament is another brand of cigarette marketed and sold by Philip Morris International throughout the world.

Similar to some of its counterparts, Parliament cigarette sales volume has been on a turnaround after hitting the bottom in 4Q 2020.

As of fiscal Q4 2022, Parliament’s sales volume totaled 44 billion units on a TTM basis, a record quarter in fiscal 2022.

Year-over-year, Parliament cigarette volume grew 6% and the Q4 2022 result has even surpassed that of the pre-pandemic periods.

Therefore, we are seeing a significant recovery in Parliament’s cigarette volume in a post-pandemic world.

Sampoerna-A Sales Volume

Sampoerna A sales volume (click to enlarge)

I can only manage to get the data up to 2Q 2022 as PMI has stopped publishing the quarterly cigarette sales volume for Sampoerna A.

That said, Sampoerna A is a brand of cigarette marketed and sold mainly in Indonesia by Philip Morris International.

According to the chart above, Sampoerna A’s cigarette sales volume was deeply impacted by the COVID-19 restriction in fiscal 2020, with sales tumbling to multiple new lows at roughly 33 billion units in some of the quarters.

However, sales volume for Sampoerna A posed a significant comeback since fiscal 2021, starting in the 2nd quarter.

As of fiscal Q2 2022, PMI managed to ship 39 billion units of Sampoerna A on a TTM basis, representing a rise of 13% year on year.

Therefore, Sampoerna A cigarette volume has been on a turnaround during the post-pandemic periods.

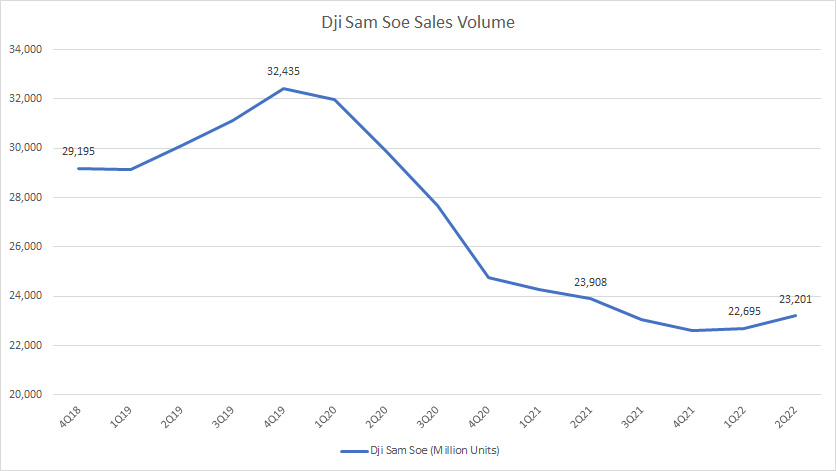

Dji Sam Soe Sales Volume

Dji Sam Soe sales volume (click to enlarge)

Another popular brand of cigarettes being marketed and sold by Philip Morris International in Indonesia is Dji Sam Soe.

Similarly, I can only manage to get the data up to 2Q 2022 as PMI has stopped breaking down the sales volume in 2022 for this brand.

Unlike Sampoerna-A whose sales volume has been rising, Dji Sam Soe’s shipment volume has been on a decline since fiscal 2020, reaching a record low of only 23 billion sticks as of fiscal 2Q 2022 on a TTM basis.

The 2Q 2022 TTM result was roughly in line with the result from a year ago but has tumbled badly by nearly 30% from the record high of 32.4 billion sticks reported in Q4 2019.

By the end of fiscal 2022, Dji Sam Soe’s sales volume may have recovered slightly considering the rising volume reported in 2Q 2022.

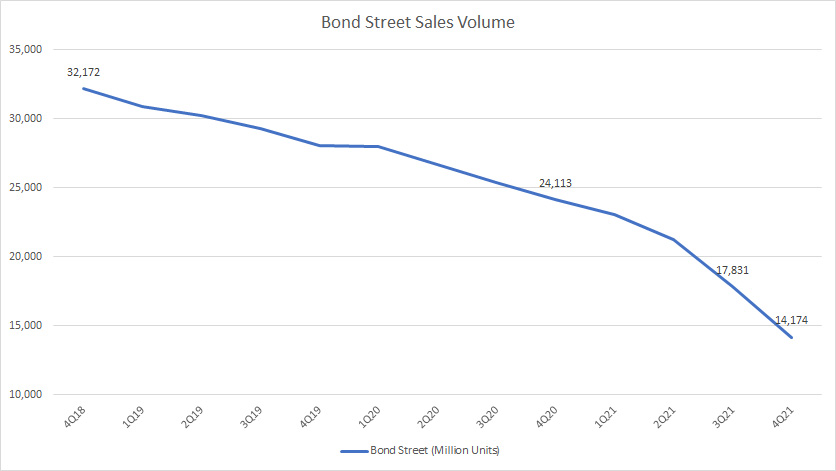

Bond Street Sales Volume

Bond Street sales volume (click to enlarge)

Bond Street was sold mainly outside of the U.S. by Philip Morris International.

Similarly, I can only manage to get the data up to 4Q 2021 as PMI has stopped breaking down the sales volume in 2022 for this brand.

As of fiscal Q4 2021, PMI shipped only 14 billion cigarettes of Bond Street, a record low, and was down as much as 41% from the same quarter a year ago.

Bond Street was probably the only cigarette brand under Philip Morris that recorded a sales volume decline of as much as 40% in the last 3 years.

While the sales volumes of other cigarette brands have either remained flat or recovered, the sales volumes of Bond Street have continued to dive badly, even in a post-pandemic world, illustrating how severely this cigarette brand has been impacted by the war in Ukraine.

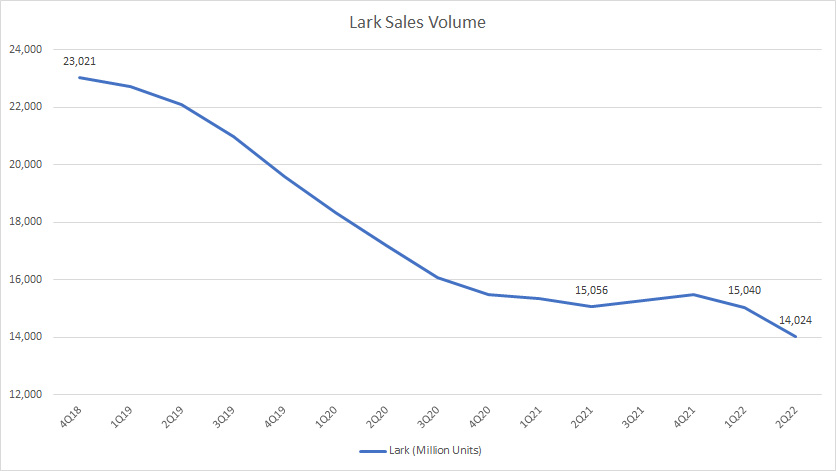

Lark Sales Volume

Lark sales volume (click to enlarge)

Lark is marketed and sold in the U.S. and also internationally.

Again, the sales volume is up to only 2Q 2022 as PMI has stopped presenting the standalone sales data starting in 2022.

That said, Lark is one of the smallest brands of cigarettes by sales volume at less than 20 billion units.

As of fiscal 2Q 2022, PMI shipped roughly 14 billion units of Lark on a TTM basis, down 7% year-on-year.

Also, Lark’s shipment volume has been on a decline but the downtrend may have slowed down considerably in recent quarters.

Conclusion

Of all Philip Morris International’s top cigarette brands, only 4 out of 9 were seen recovering in a post-pandemic world.

And these were Marlboro, Chesterfield, Parliament, and Sampoerna A.

The rest of PMI’s cigarette brands had either stayed flat or got worse in fiscal 2022 compared to 2021 in terms of sales volume.

While some of PMI’s cigarette brands have significantly recovered post-COVID period, they were still below their historical highs, putting the recovery in doubt.

Therefore, it’s no surprise to see that Philip Morris International’s total cigarette sales had reached a record low as of fiscal 2022.

References and Credits

1. All cigarette sales numbers in this article were obtained and referenced from PMI’s quarterly and annual filings which are available in Philip Morris International’s Reports And Filings.

2. Featured images in this article are obtained free and are used without any attribution from the following links: Pixabay

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!

Useful Statistics For Your Reference

- How does AB InBev’s Asia Pacific beer sales volume look?

- Tesla vs General Motors in automotive gross margin

- Tata Motors commercial vehicle and passenger car sales figures

- 3D Systems’ cash position – free cash flow and net cash from operating activities

- A look at Ford’s automotive gross margin and profitability

hello , Iam coming from Rwanda I want ask how can get contract between us me Agronomist I have project of tobacco cultivation

tell:0785652236