This article analyzes and reviews the Public Global Select Fund (PGSF).

For your information, the PGSF is a unit trust fund managed by Public Mutual Berhad Malaysia.

The fund invests primarily in equities or stocks of companies on a global basis.

Apart from equities, the fund also invests in collective investment funds such as ETFs and other equity funds managed locally and abroad, but the number is small.

Let’s look at more details starting with the table of contents below.

Enjoy!

Table Of Contents

Overview

A1. Fund Summary

Performance

B1. Annual Total Return

B2. Average Annual Return

B3. Capital And Income Growth

B4. Other Performance Data

Distribution And Income Received

C1. Cash Distribution And Unit Split

C2. Income And Yield

Asset Allocation

D1. Asset Allocation – Equities

D2. Asset Allocation – Collective Investments

D3. Asset Allocation – Cumulative

Liquidity

Top Holdings

F1. Top 10 Equities – Global

F2. Top 10 Collective Investments – Global

Correlation With Benchmark

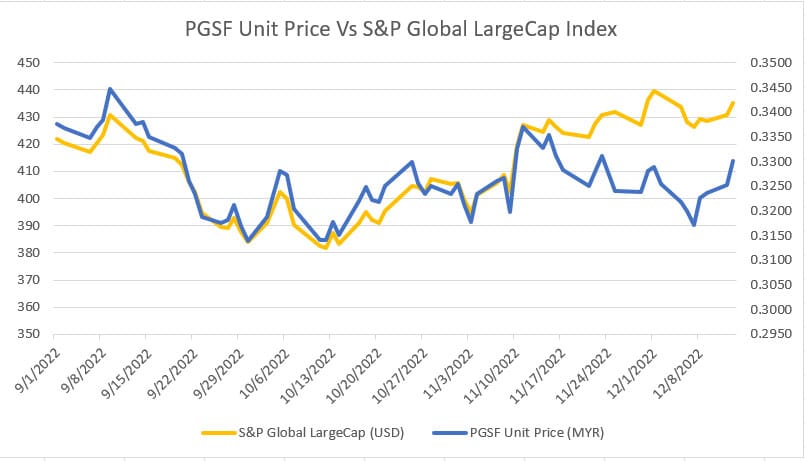

G1. Unit Price Vs Benchmark

G2. Positive Correlation With Benchmark

G3. Negative Correlation With Benchmark

Conclusion And Reference

S1. Review Summary

– S11. Advantages

– S12. Disadvantages

S2. References and Credits

S3. Disclosure

Fund Summary

The following summary is obtained from the annual report for the financial year ended 31 May 2023, unless stated otherwise.

Category

Equity

Investment Objective

To seek long-term capital appreciation by investing in equities and collective investment schemes in domestic and global markets.

Launch Date

28 Sep 2006

Distribution Policy

Incidental

Risk Level

Very High – 5 (on a scale of 1 – 5)

3-Year Volatility

High – 14.4 By Lipper Analytics

Size

MYR3.1 billion (USD682 million based on an exchange rate of USD1 = MYR4.5) as of 30 August 2023.

Expenses

1.78% Of Fund NAV On Average From 2020 To 2023

Shariah Compliant

No

Sales Charge

Up To 5%

Performance

Annual Total Return

Annual total return for the financial year ended 31 May

| Years | PGSF Annualized Return (%) | Benchmark (%) |

|---|---|---|

| 2023 | 6.10 | 5.42 |

| 2022 | -4.74 | -2.63 |

| 2021 | 30.27 | 29.31 |

| 2020 | 17.97 | 7.27 |

| 2019 | 1.73 | 2.06 |

| 2018 | 2.83 | 2.17 |

The Public Global Select Fund (PGSF), which holds equity and collective investment funds, ie. ETF registered an annual total return of +6.10% for the financial year ended 31 May 2023.

The performance of the fund in 2023 was slightly better than the benchmark’s return of +5.42%.

By slicing the return number, the PGSF’s equity portfolio contributed a return of +8.90% while its money market portfolio contributed a return of +2.84% in fiscal 2023.

The PGSF had an equity exposure of 87.55% while the money market portfolio’s exposure averaged 12.45% in fiscal 2023, thereby generating an attributed return of 7.79% for the equity portion while that of the money market came in at 0.35%.

Adjusted for an expense ratio of 2.04%, the total return of the unit trust fund topped +6.10% for the financial year 2023.

According to the 2023 annual report, the better performance of the fund compared to the benchmark was primarily attributed to the fund’s equity portfolio whose investments within the technology and financial sectors outperformed the broader market during the financial year under review.

Average Annual Return

Average annual return for the following years ended 31 May 2023

| Years | PGSF Average Return (%) | Benchmark Average Return (%) |

|---|---|---|

| 1 Year | 6.10 | 5.42 |

| 3 Years | 10.54 | 10.89 |

| 5 Years | 11.60 | 9.06 |

| 10 Years | 16.60 | 14.87 |

| Since Commencement | 10.00 | 7.97 |

The performance of the Public Global Select Fund beats its benchmark index hands down, particularly on a long-term basis.

For example, the PGSF’s average annualized return for 3 years was 10.54% compared to 10.89% for its benchmark.

For longer-term such as 5 years and 10 years, the Public Global Select Fund recorded average annualized returns of 11.6% and 16.6%, respectively, which were way better than its benchmark’s returns of 9.06% and 14.87% for the same periods.

Since its commencement in 2006, the average annualized return of the PGSF boosted by 10% compared to only 7.97% for its benchmark.

In short, the PGSF performs much better on a long-term basis and certainly beats inflation by a wide margin.

Capital And Income Growth

Capital And Income Growth

| As at 31 May | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Capital Growth (%) | 6.73 | -3.56 | 31.32 | -0.65 |

| Income Growth (%) | -0.59 | -1.22 | -0.80 | -0.52 |

Another performance metric to keep an eye on is the capital and income growth of the fund.

The PGSF boosts decent capital growth, which averaged about 8.5% between fiscal 2020 and 2023, as presented in the table above.

However, the PGSF lacks income growth. On average, income payable to the fund has declined by -0.78% over the past four years.

The poor performance of the income aspect of the fund may be forgivable as the fund’s objective is not to provide income but to seek capital appreciation.

Other Performance Data

Other performance data for the financial year ended 31 May.

Unit Prices (MYR) => prices quoted are ex-distribution

| As at 31 May | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Highest NAV per unit for the year | 0.3743 | 0.4641 | 0.4657 | 0.3801 |

| Lowest NAV per unit for the year | 0.3129 | 0.3754 | 0.3480 | 0.2878 |

Net Asset Value (NAV) and Units In Circulation (UIC) as at the end of the financial year

| As at 31 May | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total NAV (MYR’000) | 2,854,306 | 2,136,584 | 1,653,324 | 1,041,700 |

| UIC (in ’000) | 7,645,075 | 6,068,280 | 4,026,549 | 2,940,012 |

| NAV per unit (MYR) | 0.3734 | 0.3521 | 0.4106 | 0.3543 |

Total Expense Ratio

| As at 31 May | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Total Expense Ratio (%) | 1.78 | 1.79 | 1.77 | 1.77 |

A lower ratio is preferable as it indicates lower expenses.

Portfolio Turnover Ratio

| As at 31 May | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Portfolio Turnover Ratio (time) | 0.90 | 1.02 | 1.30 | 0.82 |

A lower ratio is preferable as it indicates lower trading activities and thus, lower expenses and more money for unit holders.

An important feature to look at when buying a unit trust fund such as The Public Global Select Fund (PGSF) is to look at the size of the fund, ie. the NAV or net asset value of the fund.

On a long-term basis, the NAV of the fund should always be on the rise and we are seeing this important feature in the PGSF.

Since fiscal 2020, the PGSF’s NAV has nearly tripled.

The NAV per unit may not be an accurate indicator of the performance of the fund due to cash distribution and/or unit split which can significantly affect the value of the NAV per unit.

Cash Distribution And Unit Split

| Declaration Date | |||||

|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | 2019 | |

| 05-31 | 05-31 | 05-31 | 05-29 | 05-31 | |

| Net Distribution Per Unit (Cent In MYR) | – | 4.00 | 5.00 | 2.00 | 0.50 |

| Yield (%) | – | 8.6 – 10.7 | 10.7 – 14.4 | 5.3 – 6.9 | – |

| Distribution In Cash Amount (MYR In Millions) | – | 242.7 | 201.3 | – | – |

| Unit Split | – | – | – | – | – |

The Public Global Select Fund (PGSF) did not declare any cash distribution in fiscal 2023.

However, the fund declared a cash distribution of MYR0.04 per unit in 2022, giving a massive yield of between 8.6% to 10.7% based on the lowest and highest NAV value of MYR0.3754 and MYR0.4641, respectively, reported in the financial year 2022.

Between 2015 and 2022, the PGSF unit trust fund had consecutively declared cash distributions without fail, according to Public Mutual.

Therefore, it was the first time the fund failed to declare a cash distribution in 2023.

The yield of the PGSF unit trust had been quite substantial in the past.

For example, in 2022, the yield was between 8.6% and 10.7% on the back of a cash distribution that totaled MYR0.04 or MYR4.0 cents per unit.

The yield was even better in 2021, reportedly between 10.7% and 14.4% on the back of a cash distribution of MYR0.05 or MYR5.0 cents per unit.

Also, the Public Global Select Fund (PGSF) unit trust had not initiated a unit split from 2018 to 2023.

Income And Yield

| As at 31 May (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Interest Income | 6,255 | 2,578 | 1,111 |

| Distribution Income | 8,716 | 5,848 | 5,324 |

| Dividend Income | 14,596 | 9,098 | 8,072 |

| Total Income | 29,567 | 17,524 | 14,507 |

| Average NAV | 2,495,445 | 1,894,954 | – |

| Average Yield % | 1.2 | 0.9 | – |

The Public Global Select Fund receives various sources of income such as interest income, distribution income, and dividend income.

In fiscal 2023, the PGSF earned a record figure of MYR29.6 million in total income compared to MYR17.5 million reported in fiscal 2022, representing a rise of 69% year-on-year.

As a result, the income yield for the financial year 2023 averaged 1.2%, which was marginally higher than the 0.9% yield measured in the prior year.

The modest income yield of the fund is not unexpected as the main objective of the fund is to seek long-term capital appreciation rather than providing income.

Asset Allocation – Equities

| As at 31 May (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| Malaysia | ||||

| Financial | 0.1 | 0.2 | 0.2 | 0.2 |

| Australia | ||||

| Consumer Non-Cyclical | 1.6 | – | 3.4 | – |

| China | ||||

| Consumer Non-Cyclical | – | 1.7 | – | – |

| Germany | ||||

| Consumer Cyclical | – | 0.8 | – | – |

| Hong Kong | ||||

| Communications | – | 4.5 | – | – |

| Consumer Cyclical | – | 0.9 | – | – |

| Financial | – | 2.9 | – | – |

| Sub Total | – | 8.3 | – | – |

| Indonesia | ||||

| Financial | 1.2 | – | – | – |

| Korea | ||||

| Communications | – | 1.7 | – | – |

| Consumer Non-Cyclical | – | 0.3 | – | – |

| Sub Total | – | 2.0 | – | – |

| Netherlands | ||||

| Technology | – | – | 2.7 | 1.7 |

| Singapore | ||||

| Consumer Cyclical | 0.2 | – | – | – |

| Financial | 0.6 | – | – | – |

| Industrial | 2.2 | – | – | – |

| Sub Total | 3.1 | – | – | – |

| Thailand | ||||

| Consumer Cyclical | – | 2.9 | – | |

| United States | ||||

| Communications | 11.6 | 11.9 | 12.2 | 9.2 |

| Consumer Cyclical | 3.2 | 3.9 | 7.7 | 7.0 |

| Consumer Non-Cyclical | 5.5 | 7.6 | 10.7 | 4.7 |

| Financial | 8.6 | 8.7 | 6.9 | 8.8 |

| Industrial | – | 1.9 | 4.9 | 3.1 |

| Technology | 33.6 | 19.3 | 29.1 | 19.3 |

| Sub Total | 62.5 | 53.3 | 71.5 | 52.1 |

| TOTAL EQUITY SECURITIES | 68.5 | 66.3 | 80.7 | 54.0 |

In fiscal 2023, the Public Global Select Fund (PGSF) exited its equity positions in most countries but also initiated several new positions in countries such as Australia, Indonesia, and Singapore.

In addition, the unit trust fund significantly grew its position in the technology sector in the United States in fiscal 2023.

As shown in the table, the PGSF increased its holding in the U.S. technology sector to a massive 33.6% as of the end of the financial year 2023 from 2022, possibly betting on a favorable upside in the technology sector in the U.S.

The Public Global Select Fund’s portfolio of U.S. equities topped 62.5% of NAV as of fiscal 2023, the largest among its holdings in any country.

It is undeniable that the PGSF has been betting on U.S. equities and the results seem to have paid off for the fund.

Asset Allocation – Collective Investments

| As at 31 May (% of NAV) | ||||

|---|---|---|---|---|

| 2023 | 2022 | 2021 | 2020 | |

| COLLECTIVE INVESTMENT FUNDS | ||||

| France | ||||

| Funds | 3.0 | 3.6 | 1.8 | 5.7 |

| Germany | ||||

| Funds | 11.3 | 11.8 | 12.1 | 10.7 |

| Japan | ||||

| Funds | 6.2 | 6.7 | 5.4 | 6.2 |

| United States | ||||

| Funds | – | – | 1.5 | 15.5 |

| COLLECTIVE INVESTMENT SCHEMES | ||||

| Funds | 3.8 | 3.3 | 4.1 | 4.8 |

| TOTAL COLLECTIVE INVESTMENTS | 24.3 | 25.4 | 24.9 | 42.9 |

| Deposit With Financial Institutions | 4.9 | 18.8 | 3.4 | 6.7 |

| Other Assets & Liabilities | 2.3 | -10.5 | -9.0 | -3.6 |

Collective investments are investments in ETFs, equity funds, mutual funds, etc.

The Public Global Select Fund (PGSF)’s portfolio of this type of investment remained relatively unchanged in fiscal 2023 compared to that of fiscal 2022.

However, the unit trust’s collective investments have changed dramatically between 2020 and 2023.

For example, the PGSF’s holdings of collective investments have reduced by almost half since fiscal 2020, given that the percentage of NAV has declined from 42.9% to 24.3%.

Additionally, the PGSF’s deposits with financial institutions also dramatically declined in fiscal 2023 to only 4.9% from 18.8% reported in 2022.

Asset Allocation – Cumulative

Change In Portfolio Exposures

| As at 31 May | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Investment Type | |||

| Equity and equity-related securities | 92.8 | 82.3 | 94.1 |

| Money market | 7.2 | 17.7 | 5.9 |

Adjusted for other assets and liabilities, the Public Global Select Fund (PGSF)’s equity exposure increased to 92.8% as of the financial year 2023 compared to 82.3% reported in 2022.

At the same time, the unit trust’s money market exposure declined to 7.2% from 17.7%.

Perhaps, the PGSF was seeing equity as a more favorable bet in 2023 and beyond.

Cash And Deposits

| As at 31 May (MYR’000) | |||

|---|---|---|---|

| 2023 | 2022 | 2021 | |

| Deposits And Cash | |||

| Deposits With Financial Institutions | 138,920 | 401,880 | 56,332 |

| Cash At Banks | 80,338 | 68,024 | 66,799 |

| Total Deposit And Cash | 219,258 | 469,904 | 123,131 |

| Total Net Assets | |||

| Net Asset Value (“NAV”) | 2,854,306 | 2,136,584 | 1,653,324 |

| Ratio Of Liquid Assets To NAV (%) | 7.7 | 22.0 | 7.4 |

The Public Global Select Fund (PGSF) held a total of deposits and cash of as much as MYR219 million as of the financial year 2023.

This figure has significantly declined from the MYR470 million of deposits and cash held as of fiscal 2022.

Again, the PGSF may be expecting a favorable equity market in 2023 with the reduced cash position.

Top 10 Equities – Global

| As at 31 May 2023 | |||

|---|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Equity Securities | Related Sectors | ||

| Microsoft Corp | Technology | 204,506 | 7.2 |

| Apple Inc | Technology | 204,414 | 7.2 |

| Alphabet Inc – Class A | Communications/Technology | 141,700 | 5.0 |

| Accenture plc | Technology | 91,729 | 3.2 |

| S&P Global Inc | Consumer, Non-cyclical | 84,748 | 3.0 |

| Mastercard Incorporated | Financial | 84,192 | 3.0 |

| Amazon.com, Inc | Communications/Technology | 83,435 | 2.9 |

| Visa Inc | Financial | 76,471 | 2.7 |

| ServiceNow, Inc | Technology | 75,392 | 2.6 |

| Crowdstrike Holdings, Inc | Technology | 73,868 | 2.6 |

| Total | – | 1,120,455 | 39.4 |

The table above shows the top 10 equity holdings of the Public Global Select Fund (PGSF).

Both Microsoft and Apple Inc occupied the top spots at 7.2% of NAV or MYR204 million each as of 31 May 2023.

At 5.0% of NAV or MYR142 million, Alphabet Inc claimed the second spot as one of the top equity positions within the unit trust.

Accenture plc, a cloud solution provider, came in at 3.2% of NAV or MYR92 million as of the end of the financial year 2023.

The top 3 equity holdings of the PGSF alone made up roughly 19% of the fund’s NAV or MYR550 million.

These are mega-cap blue-chip companies located in the U.S. which are technology-related.

Similarly, of all the top 10 equities, a majority of them are in the technology sectors and are above USD 100 billion in market capitalization.

Therefore, the Public Global Select Fund (PGSF) invests primarily in stable and large U.S. companies.

In addition, the top 10 equity holdings of the PGSF made up roughly 39% of its NAV or MYR1.1 billion as of May 31, 2023, and in my opinion, was quite significant.

The PGSF’s concentrated portfolio in U.S. equities results in the fund depending heavily on the U.S. economy and the American stock market.

Top 10 Collective Investments – Global

| As at 31 May 2023 | |||

|---|---|---|---|

| Fair Value (MYR’000) | Percent Of NAV (%) | ||

| Collective Investments | Related Country | ||

| MSCI Europe Index UCITS ETF | Germany | 170,701 | 6.0 |

| iShares Core MSCI Europe UCITS ETF | Germany | 153,190 | 5.2 |

| SPDR MSCI Europe UCITS ETF | France | 84,678 | 3.0 |

| iFreeETF TOPIX | Japan | 60,099 | 2.1 |

| NEXT FUNDS TOPIX ETF | Japan | 59,439 | 2.1 |

| Nikko Exchange Traded Index Fund | Japan | 58,725 | 2.0 |

| Sub Total | 586,832 | 20.4 | |

| Public Islamic Asia Tactical Allocation Fund | Malaysia | 38,262 | 1.3 |

| Public Asia Ittikal Fund | Malaysia | 36,094 | 1.3 |

| Public Islamic Global Equity Fund | Malaysia | 25,079 | 0.9 |

| Public e-Islamic Sustainable Millennial Fund | Malaysia | 9,144 | 0.3 |

| Sub Total | 108,579 | 3.8 | |

| TOTAL COLLECTIVE INVESTMENTS | – | 695,411 | 24.2 |

The collective investments are divided into 2 categories which are ETFs and unit trusts.

However, the majority of the collective investments fall into ETFs as shown in the table above.

The rest are invested in Malaysian unit trusts, ie. Public Islamic Asia Tactical Allocation Fund.

As of the end of fiscal 2023, the Public Global Select Fund (PGSF)’s collective investments contributed a total of MYR695 million or 24.2% of NAV within its portfolio.

Keep in mind that the ETF and unit trust holdings within the PGSF’s portfolio also are diversified investments that are spread out among equities.

These collective investments make the Public Global Select Fund (PGSF) partially less risky and less volatile.

Unit Price Vs Benchmark

PGSF Unit Price Vs S&P Global LargeCap

(click image to expand)

The benchmark for the Public Global Select Fund (PGSF) is the S&P Global LargeCap Index but it carries only a weight of up to 90%, according to the 2023 annual report.

The remaining 10% of the benchmark comes from the 1-Month Kuala Lumpur Interbank Offered Rate (KLIBOR).

That being said, this correlation was performed back in 2022 over 3 months.

Although carrying only a weight of up to 90%, the correlation between PGSF and S&P Global LargeCap Index can still be done and I am curious to see how the results will turn out.

The results above show that the unit price of the Public Global Select Fund (PGSF) nearly follows the volatility of the S&P Global LargeCap index.

Therefore, the unit trust index correlates quite closely with the S&P Global LargeCap index.

Positive Correlation With Benchmark

Positive Correlation

| Positive Correlation | |||

|---|---|---|---|

| S&P Global LargeCap Index Changes | PGSF Unit Price Changes In MYR | Rise Ratio | |

| Date | |||

| 12/13/2022 | 4.65000 | 0.00480 | 0.001032 |

| 12/12/2022 | 2.02000 | 0.00160 | 0.000792 |

| 12/08/2022 | 2.88000 | 0.00550 | 0.001910 |

| 12/01/2022 | 3.07000 | 0.00100 | 0.000326 |

| 11/30/2022 | 9.33000 | 0.00410 | 0.000439 |

| 11/25/2022 | 1.16000 | -0.00710 | -0.006121 |

| 11/23/2022 | 3.49000 | 0.00330 | 0.000946 |

| Average | – | – | 0.000582 |

The table above shows the correlation between the S&P Global LargeCap index and the PGSF unit prices in a positive direction.

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.000582.

At this ratio, a 1-point index increment in the S&P Global LargeCap index will result in an MYR0.000582 increase in the PGSF unit price.

For a 10-point index increment, the PGSF unit trust fund will increase by MYR0.00582 or MYR0.6 cents on average.

Negative Correlation With Benchmark

Negative Correlation

| Negative Correlation | |||

|---|---|---|---|

| S&P Global LargeCap Index Changes | PGSF Unit Price Changes In MYR | Fall Ratio | |

| Date | |||

| 12/09/2022 | -0.59000 | 0.00110 | -0.001864 |

| 12/07/2022 | -1.92000 | -0.00290 | 0.001510 |

| 12/06/2022 | -5.36000 | -0.00180 | 0.000336 |

| 12/05/2022 | -4.39000 | -0.00360 | 0.000820 |

| 12/02/2022 | -1.48000 | -0.00360 | 0.002432 |

| 11/29/2022 | -4.84000 | -0.00010 | 0.000021 |

| 11/21/2022 | -1.49000 | -0.00330 | 0.002215 |

| Average | – | – | 0.001269 |

The table above shows the correlation between the S&P Global LargeCap index and PGSF unit prices in a negative direction.

Based on the 90-day data between Sept and Dec 2022, the average ratio came in at 0.001269.

The average ratio indicates that when the S&P Global LargeCap index falls by 1 index point, the PGSF unit price will fall by about MYR0.001269 on average.

From a 10-point perspective, the PGSF unit price will fall by about MYR0.01269 or MYR1.3 cents on average.

Since the falling ratio is twice as large as the rising ratio, the Public Global Select Fund (PGSF) unit price will be more sensitive to an index drop than an index rise.

As a result, the PGSF unit trust will have a unit price drop more than a unit price rise when the S&P Global LargeCap index moves.

Review Summary

Advantages (Results Were Up To 31 May 2023)

1. The majority of equities held by the fund are U.S. large-cap counters and some of them pay dividends to the fund. The amount of dividends earned in fiscal 2023 totaled MYR15 million, a record figure in the past 3 years.

2. In addition to equities, The Public Global Select Fund (PGSF) also held collective investments and the exposure was 24% of NAV as of the end of fiscal 2023. These collective investments make the unit trust less risky and volatile.

3. The Public Global Select Fund (PGSF) offers exceptional performance to unit holders. For 3 years, the PGSF returned an average of 10.54% per annum while the 5-year return came in at 11.6% per annum on average. Since its commencement in 2006, the unit trust returned an average of 10% per annum. And it beats its benchmark hands down.

4. The PGSF should be a safe investment considering that the portfolio primarily consists of equities of mega-cap U.S. companies, ETFs, and unit trusts.

5. Although the fund does not intend to provide income consistently, it does declare a cash distribution incidentally. More importantly, the yield was quite good in the past as seen in one of the tables above.

6. The PGSF has significantly grown in size since fiscal 2020, notably at nearly 3X the value 3 years ago. In fiscal 2020, the fund was worth roughly MYR1 billion. However, it was worth MYR2.9 billion as of 31 May 2023. In addition, units in circulation also have considerably increased, implying a drive of fresh cash into the fund.

Disadvantages (Results Were Up To 31 May 2023)

1. The Public Global Select Fund (PGSF)’s objective is not to provide income but to seek long-term capital appreciation. Therefore, the fund does not intend to distribute cash consistently. The PGSF failed to declare a cash distribution in fiscal 2023. Income seekers will probably be disappointed.

2. The Public Global Select Fund (PGSF) counts on the growth of the U.S. economy as the fund’s exposure to American equity was as much as 62.5% of NAV as of 2023. If the U.S. economy is negatively impacted, the fund may follow suit.

3. The correlation of the fund with the S&P LargeCap Index shows that the fund was more sensitive to a market decline than a rise. In this aspect, the volatility of the PGSF may be much greater during a market downturn.

References and Credits

1. All financial information in this article was obtained and referenced from the following links:

a) Public Mutual Unit Trust Fund

b) S&P Global LargeCap index

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor advice to purchase a security. The Public Global Select Fund (PGSF) is not in any way sponsored, endorsed, sold, or promoted by StockDividendScreener.com.

Therefore, StockDividendScreener.com shall not be liable (whether in negligence or otherwise) to any person for any error in this article.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!