Philip Morris International. Source: Flickr

Philip Morris International (PMI) is traditionally a cigarette company.

However, the company is currently transitioning to a smoke-free future by having a non-combustible product, the IQOS.

Despite being primarily a cigarette company, PMI is a Wall Street darling due to its hefty dividend yield which currently hovers at more than 5%.

For your information, PMI has been a dividend-paying stock since 2008 and has not suspended a single dividend payout during all these years, even during the height of the COVID-19 pandemic in 2020.

The best thing is that PMI even raised the cash dividend by 3% in 2020 and a similar rate in 2021.

In 2022, Philip Morris International is expected to increase the cash dividend again by a similar rate, which is 3%, and the dividend rate is expected to come in at a hefty $5.04 USD per share.

The question is should you buy PMI stock now considering the massive 5% yield?

If you had decided to plunge your money into the stock, will the dividend be safe, and can the company sustain the payout?

These are the most asked questions about Philip Morris International’s dividends.

In this article, we will find out how safe PMI’s dividend is and whether the company can afford the dividend payout for the rest of fiscal 2022.

Let’s dive in!

PMI’s Cash Dividend Topics

1. Trailing Dividend Yield

2. Trailing And Forward Dividend

3. Cash Payment For Dividends

4. 2022 Outlook

5. Payout Ratio With Respect To Earnings

6. Payout Ratio With Respect To Operating Income

7. Forward Dividend Yield

8. Summary

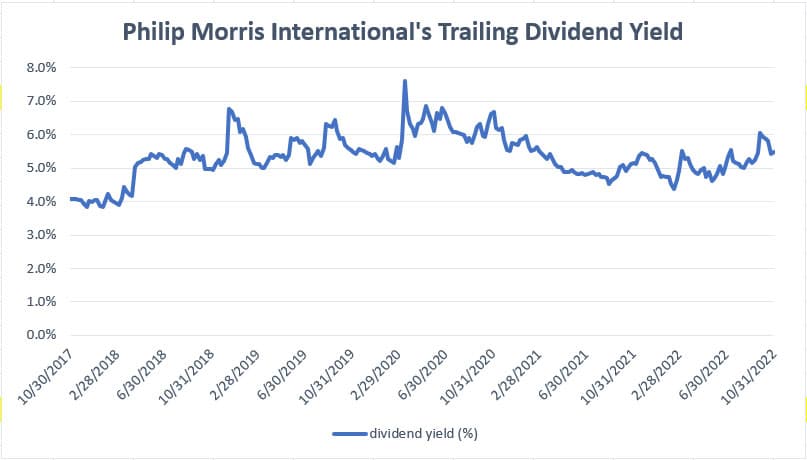

PMI’s Trailing Dividend Yield

PMI’s dividend yield

Let’s first look at Philip Morris International’s historical dividend yield as shown in the chart above for the period from 2017 to 2022.

On average, PMI’s dividend yield hovered around 5% for the last 5 years.

During the onset of the COVID-19 pandemic, PMI’s dividend yield soared above 6% in most of 2020, thanks to the plummeting stock prices as well as the dividend raise.

However, PMI’s dividend yield came down slightly to around 5% in 2021, driven primarily by the rising stock prices after intense buying in 2020.

In 2022, PMI’s dividend yield rose again when stock prices declined, thanks to the rising interest rates.

As of October 2022, PMI’s dividend yield was driven close to 6% on the back of a trailing dividend rate of $5 USD per share.

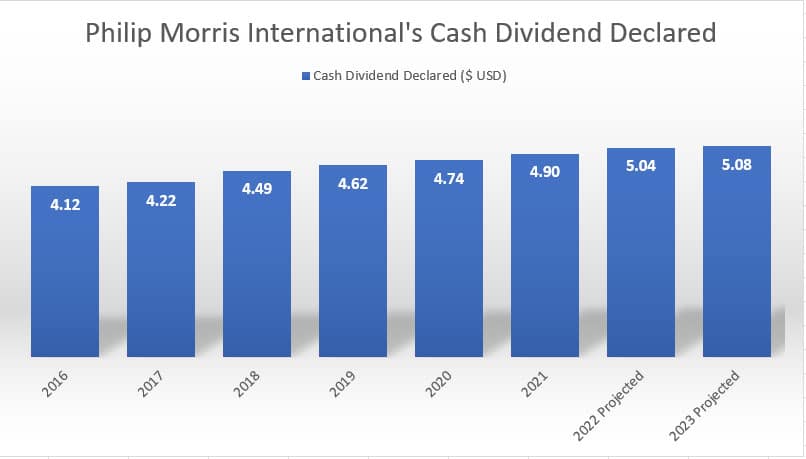

PMI’s Dividend History

PMI’s dividend declared

The chart above shows Philip Morris International’s yearly historical dividend payments that dated back to 2016.

For your information, Philip Morris International has not missed a single dividend payment since becoming a publicly-traded company in 2008.

The best thing is that PMI’s cash dividend has been on an increase year-over-year as seen in the chart above and stood at a massive $4.90 USD per share in 2021.

In 2022, PMI is expected to pay out as much as $5.04 USD per share in cash dividends, representing a rise of about 3% from 2021.

On a quarterly basis, PMI’s dividend in the 4th quarter of 2022 will be $1.27 USD per share.

Going forward, if PMI were to maintain its quarterly dividend payment of $1.27 USD per share, the annual rate will be as much as $5.08 USD per share in fiscal 2023.

Therefore, if you were to buy PMI’s stock today, you will get at least $5.08 in cash dividend per share in 2023.

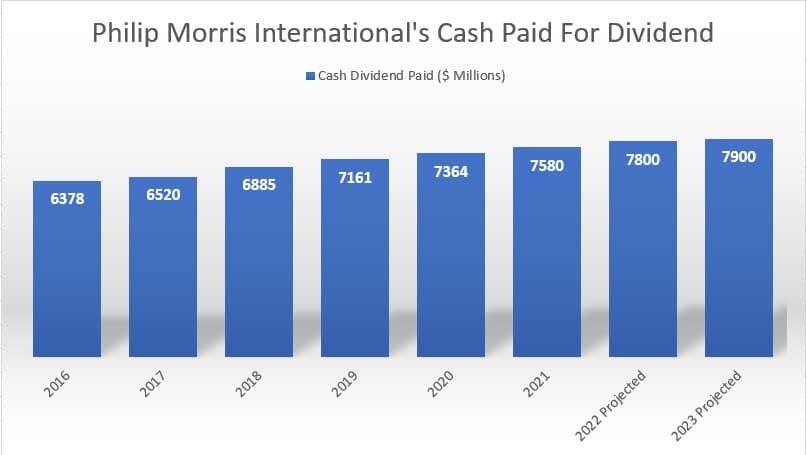

PMI’s Cash Payment For Dividends

PMI’s cash paid for dividend

In terms of cash payment for dividends, Philip Morris International paid about $6 billion in cash for dividend payments on a yearly basis.

As seen in the chart above, PMI’s cash paid for dividends has been on a rise and came in at a massive $7.6 billion in 2021.

In 2022, PMI will pay out nearly $8 billion of cash ((PMI has about 1.55 billion in shares outstanding as of 3Q 2022) just for the dividend.

That is a massive amount and is roughly 4X that of Ford’s dividend paid.

Mind you, this amount has not even included the cash returned to shareholders in the form of a stock buyback.

Going into 2023, the cash payment for dividends is expected to rise further to $7.9 billion per year.

The question is can Philip Morris International afford this massive amount of cash payment for dividends?

Read on to find out.

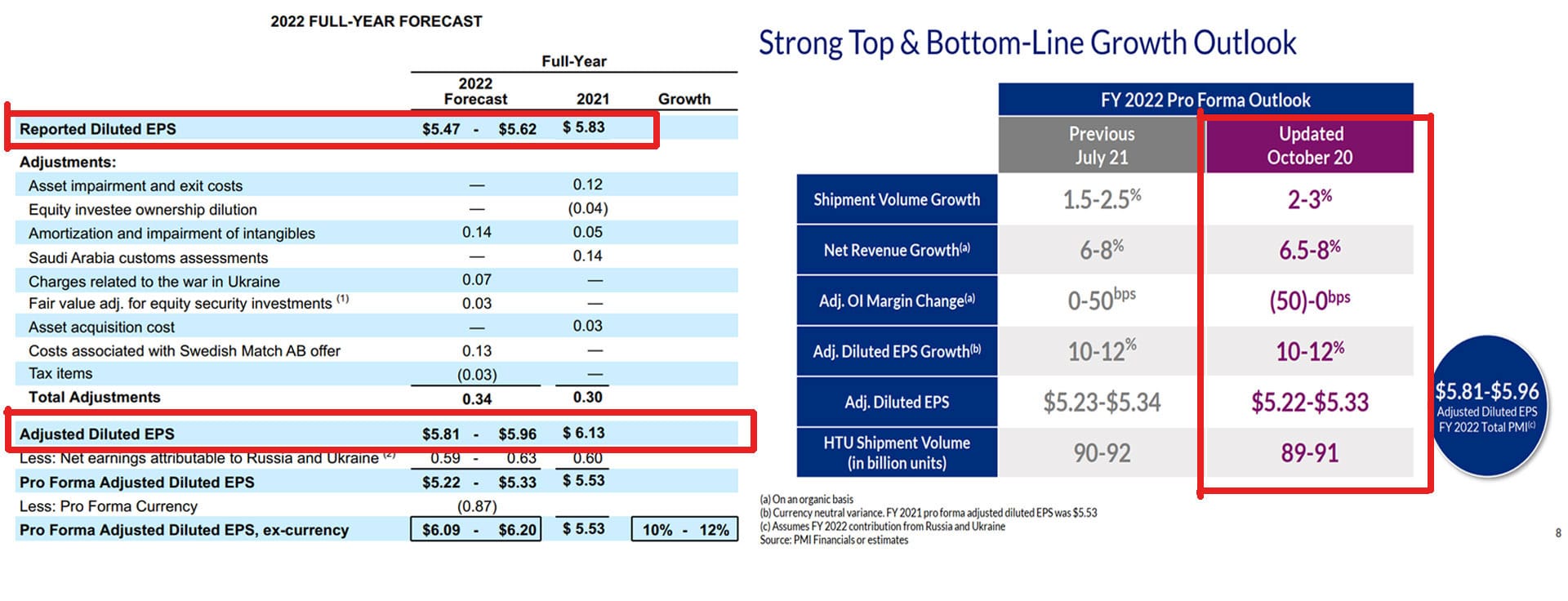

PMI’s FY2022 Outlook

PMI’s 2022 Outlook

Philip Morris International’s cash dividend safety in fiscal 2022 depends largely on the company’s projected profits.

As shown in the snapshot above, PMI’s earnings or the reported EPS are estimated to come in between $5.47 and $5.62 USD per share, a slightly lower figure compared to that of FY2021.

Similarly, PMI’s adjusted diluted EPS is expected to come in between $5.81 and $5.96 USD per share for fiscal 2022, also a slightly lower figure compared to that of FY2021.

On the other hand, PMI’s net revenue is expected to grow slightly between 6.5% and 8% while the operating income margin will be nearly unchanged or dip slightly.

Will all this information on hand, how do they translate to a safe or a reliable cash dividend?

That’s what we are going to find out in the next discussion.

Payout Ratio With Respect To Earnings

| Fiscal Year | Cash Dividend Declared ($ USD) | Reported Diluted EPS ($ USD) | Adjusted Diluted EPS ($ USD) | Payout Ratio wrt Reported Diluted EPS | Payout Ratio wrt Adjusted Diluted EPS |

|---|---|---|---|---|---|

| 2016 | $4.12 | $4.48 | $4.48 | 92% | 92% |

| 2017 | $4.22 | $3.87 | $4.71 | 109% | 90% |

| 2018 | $4.49 | $5.08 | $5.10 | 88% | 88% |

| 2019 | $4.62 | $4.62 | $5.20 | 100% | 89% |

| 2020 | $4.74 | $5.17 | $5.18 | 92% | 91.5% |

| 2021 | $4.90 | $5.83 | $6.07 | 84% | 81% |

| 2022 Projected | $5.04 | $5.47 – $5.62 | $5.67 – $5.82 | 90% – 92% | 86% – 89% |

| 2023 Projected | $5.08 | $5.47 – $5.62 | $5.67 – $5.82 | 90% – 93% | 87% – 90% |

The chart above shows PMI’s dividend payout ratio with respect to (wrt) adjusted EPS and reported EPS for fiscal 2022 and fiscal 2023 as well as prior fiscal years.

Figures for FY2022 and FY2023 are projected numbers while figures for prior fiscal years are historical numbers.

According to the chart, PMI’s projected dividend payout ratio for FY2022 is expected to be in line with the historical figures, even for the worst-case scenario.

For example, PMI is expected to pay out as much as $5.04 USD per share in cash dividends for 2022.

Going into 2023, PMI’s dividend will be at least $5.08 USD per share if the company were to maintain a quarterly payout of $1.27 USD per share.

This figure will be the minimum that PMI will pay out assuming that there is no increment in the quarterly dividends in 2023.

In terms of projected earnings, PMI’s reported EPS and adjusted EPS are expected to be in the range as shown in the table above, which are slightly lower than the FY2021 figures.

Despite the lower projected figures, PMI’s dividend payout ratios are still in line with the historical figures, even for the worst-case scenario.

The same can be said about the 2023 dividend payment where the payout ratios are also expected to be within the range of the historical figures.

The assumption here is that PMI will be able to maintain its earnings in 2023 and the amounts are the same as that of 2022.

In short, PMI can afford the upcoming dividend payment, and management will be comfortable paying out the projected dividend for FY2022 and FY2023 as earnings are more than enough to cover the said dividends.

Payout Ratio With Respect To Adjusted Operating Income

| Fiscal Year | Cash Dividend Paid ($ Billions) | Adjusted Operating Income ($ Billions) | Payout Ratio wrt Adjusted Operating Income |

|---|---|---|---|

| 2016 | $6.4 | $10.8 | 59% |

| 2017 | $6.5 | $11.6 | 56% |

| 2018 | $6.9 | $11.4 | 60.5% |

| 2019 | $7.2 | $11.8 | 61% |

| 2020 | $7.4 | $11.7 | 63% |

| 2021 | $7.6 | $13.5 | 56% |

| 2022 Projected | $7.8 | $13.9 – $14.1 | 54% – 56% |

| 2023 Projected | $7.9 | $13.9 – $14.1 | 56% – 57% |

In terms of adjusted operating income, the projected figures for FY2022 and FY2023 are well enough to cover the upcoming dividend payment as seen in the table above.

In the worst case scenario where as much as $7.8 billion of cash will be paid in 2022, the dividend payout ratio will only come to about 56%, which is well below the historical figures.

Similarly, PMI’s dividend payout ratio will come to only about 57% on the back of a $7.9 billion cash payout in 2023, which is well below the historical ratios.

The assumption here is that Philip Morris International can maintain its adjusted operating income in 2023 and the amount is the same as that of 2022.

If Philip Morris International could afford the payout ratio in prior years, then the company should have no problem affording the same payout ratio in FY2022 and FY2023.

Again, PMI management will be comfortable with the upcoming dividend payment and will most likely declare a quarterly amount of at least $1.27 in the 4th quarter of 2022.

Therefore, the trailing dividend on an annual basis will be as much as $5.04 USD per share.

Going into 2023, PMI’s dividend will come to $5.08 per share in the worst-case scenario in which no dividend increment will happen.

PMI’s Forward Dividend Yield

| Fiscal Year | PMI’s Stock Price ($ USD) | Dividend Declared Per Common Share ($ USD) | Forward Dividend Yield (%) |

|---|---|---|---|

| FY2023 Projected | $90 | $5.08 | 5.6% |

We have seen that Philip Morris International can definitely afford a cash dividend of $5.04 USD per share in fiscal 2022 and a minimum of $5.08 USD per share in fiscal 2023.

Therefore, if you bought PMI’s stock today at $around 90 USD per share, the respective dividend yield will come to about 5.6% as shown in the table above.

Keep in mind that the said dividend yield is most likely the minimum yield that you will get as PMI is expected to pay a much higher dividend rate in 2023.

That said, your forward dividend yield will most likely come close to 6% in 2023 for a stock price of $90 USD per share.

In short, if you buy PMI’s stock today at $90 USD per share today, and PMI declares quarterly cash dividends that will amount to a sum of $5.08 USD per share in 2023, your forward dividend yield will come to a minimum of 5.6%.

Summary

In summary, the analysis of Philip Morris International’s cash dividend for fiscal 2022 and 2023 shows that the firm can not only sustain the dividend payment but also increase the payout to at least $5.08 USD per share in 2023.

Despite the lower projected earnings in 2022, PMI’s adjusted operating income will come in slightly better in 2022 compared to 2021.

For this reason, PMI should have no problem maintaining and even increasing the cash dividend in 2022 and 2023.

The caveat here is that PMI can make the same earnings and adjusted operating income in 2022 and 2023, respectively.

References and Credits

1. All financial figures in this article were obtained and referenced from PMI’s quarterly and annual financial reports which are available in the following link: PMI’s Financials and Filings.

2. Featured images in this article are used under the creative commons license and sourced from the following websites: < an Image by Žarko Lazarević from Pixabay and Image by Christo Anestev from Pixabay.

Other Top Statistics

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!