Smoke free. Pexels Image.

This article presents Philip Morris International (PMI)’s profit margin breakdown by segment. PMI’s operating segments consist of five major units: Europe, SSEA, CIS & MEA, EA, AU & PMI DF, Americas, and Wellness & Healthcare.

The definition of PMI’s operating segments are available here: PMI’s operating segments.

Let’s take a look.

For other key statistics of Philip Morris International, you may find more resources on these pages:

Revenue Breakdown

- PMI revenue by product category: combustible and smoke-free, and

- PMI revenue by segment: Europe, Asia Pacific, and America

Sales Breakdown

Market Share

Other Statistics

- PMI vs Altria: profit margin comparison, and

- PMI financial health: total debt, payment due, and cash

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is Philip Morris International generating impressive profit margin?

Gross Profit

A1. Gross Profit By Segment

A2. Gross Margin By Segment

Operating Profit

B1. Operating Profit By Segment

B2. Operating Margin By Segment

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Europe Region: Europe Region is headquartered in Lausanne, Switzerland, and covers all the European Union countries, Switzerland, the United Kingdom, and also Ukraine, Moldova and Southeast Europe.

SSEA, CIS & MEA: South and Southeast Asia, Commonwealth of Independent States, Middle East and Africa Region (“SSEA, CIS & MEA”) is headquartered in Dubai, United Arab Emirates.

It covers South and Southeast Asia, the African continent, the Middle East, Turkey, as well as Israel, Central Asia, Caucasus and Russia.

EA, CIS & PMI DF: East Asia, Australia, and PMI Duty Free Region (“EA, AU & PMI DF”) is headquartered in Hong Kong, and includes the consolidation of PMI’s international duty free business with East Asia & Australia.

Americas: Americas Region is headquartered in Stamford, Connecticut, and covers the United States, Canada and Latin America.

Swedish Match: In 2022, PMI acquired Swedish Match AB, a market leader in oral nicotine delivery with a significant presence in the United States market.

The Swedish Match acquisition is a key milestone in PMI’s transformation into a smoke-free company. Swedish Match has a leading nicotine pouch franchise in the U.S. under the ZYN brand name.

The Swedish Match product portfolio complements PMI’s existing portfolio, permitting the company to combine a leading oral nicotine product with the leading heat-not-burn product.

By joining forces with Swedish Match, PMI expects to accelerate the achievement of its joint smoke-free ambitions, switching more adults who would otherwise continue to smoke cigarettes to better alternatives faster than either company could achieve separately.

Wellness And Healthcare: In the third quarter of 2021, PMI acquired Fertin Pharma A/S, Vectura Group plc. and OtiTopic, Inc.

On March 31, 2022, PMI launched a new Wellness and Healthcare business, Vectura Fertin Pharma, consolidating these entities. The operating results of this business are reported in the Wellness and Healthcare segment.

The business operations of PMI’s Wellness and Healthcare segment are managed and evaluated separately from the geographical segments.

Why is Philip Morris International generating impressive profit margin?

Philip Morris International (PMI) has been achieving impressive profit margins due to several strategic factors:

-

Shift to Smoke-Free Products: PMI has been actively transitioning its portfolio towards smoke-free alternatives like IQOS, which have higher profit margins compared to traditional cigarettes. This shift aligns with global trends and regulatory pressures.

-

Geographical Diversification: PMI operates across diverse regions, including Europe, Asia, and the Americas, which helps mitigate risks and capitalize on varying market dynamics.

-

Operational Efficiency: The company has been optimizing its supply chain and production processes, reducing costs while maintaining product quality.

-

Strong Brand Positioning: PMI’s established brands and innovative products have allowed it to maintain pricing power, contributing to robust margins.

-

Acquisitions and Expansions: Strategic acquisitions, such as Swedish Match, have bolstered PMI’s presence in the oral nicotine market, further enhancing profitability.

PMI’s ability to adapt to changing consumer preferences and regulatory environments has been key to its impressive profit margins.

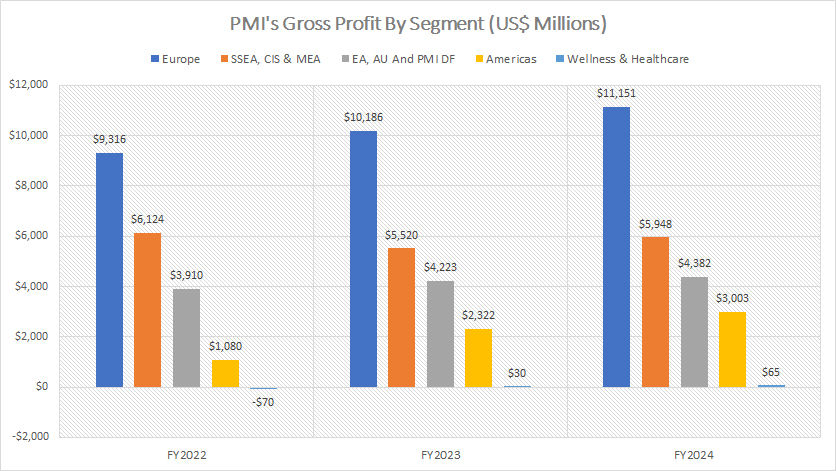

Gross Profit By Segment

PMI-gross-profit-by-segment

(click image to expand)

In January 2023, PMI rearranged its operations in four geographical segments, down from the previous six. The definitions of PMI’s four new geographical segments are available here: Europe Region, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas.

PMI also created two new segments in 2023 to speed its transition into a smoke-free company. The two new segments were Swedish Match and Wellness and Healthcare. The definitions of PMI’s two new segments are available here: Swedish Match and Wellness And Healthcare.

However, in fiscal year 2024, PMI merged the Swedish Match segment into the four geographical segments, with previous periods being recast. The Wellness And Healthcare segment remained unchanged.

Philip Morris International (PMI) demonstrates remarkable financial performance, generating its highest gross profit from Europe among all compared regions.

In fiscal year 2024, PMI reported a gross profit from Europe of $11.2 billion, reflecting an impressive year-over-year growth of $1 billion compared to the $10.2 billion reported in 2023. This upward trajectory continues from 2022, when gross profit in Europe reached $9.3 billion, highlighting consistent growth in PMI’s largest market.

Europe’s prominence is driven by robust demand for PMI’s smoke-free products, particularly IQOS, which has established a strong foothold in key countries.

The SSEA, CIS & MEA segment emerged as the second-highest profit contributor, generating $5.9 billion in gross profit during fiscal year 2024. This represents an increase of $400 million from the $5.5 billion reported in 2023. However, this region’s performance peaked at $6.1 billion in 2022, reflecting both challenges and opportunities across these diverse markets.

The EA, AU, and PMI DF region contributed $4.4 billion to PMI’s gross profit in fiscal year 2024, making it the third-largest profit generator. This segment also saw growth compared to the previous year, when it reported $4.2 billion in 2023.

PMI’s efforts to expand the footprint of smoke-free products and enhance market penetration in these regions have supported this sustained performance.

The Americas region contributed $3 billion to PMI’s gross profit in fiscal year 2024. While it remains one of the smaller contributors overall, its growth trajectory is noteworthy. The gross profit has tripled from $1 billion in 2022, making the Americas PMI’s fastest-growing division.

This growth reflects increasing adoption of smoke-free products like IQOS and ZYN across the Americas, coupled with strategic investments in distribution and marketing.

PMI’s Wellness & Healthcare segment generated $65 million in gross profit in 2024, more than doubling the $30 million reported in 2023. This marks a significant turnaround from fiscal year 2022, when the segment experienced a loss of $70 million.

PMI’s expansion into wellness and healthcare underscores its commitment to diversifying its portfolio, albeit as a smaller contributor compared to its other divisions.

Overall, PMI’s diversified global presence and strategic emphasis on smoke-free products have been pivotal in driving its robust gross profit performance across regions.

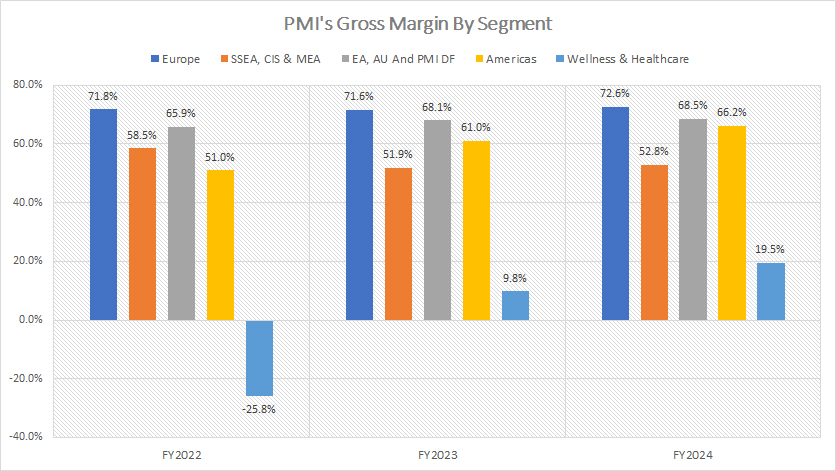

Gross Margin By Segment

PMI-gross-margin-by-segment

(click image to expand)

In January 2023, PMI rearranged its operations in four geographical segments, down from the previous six. The definitions of PMI’s four new geographical segments are available here: Europe Region, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas.

PMI also created two new segments in 2023 to speed its transition into a smoke-free company. The two new segments were Swedish Match and Wellness and Healthcare. The definitions of PMI’s two new segments are available here: Swedish Match and Wellness And Healthcare.

However, in fiscal year 2024, PMI merged the Swedish Match segment into the four geographical segments, with previous periods being recast. The Wellness And Healthcare segment remained unchanged.

From a profitability standpoint, Philip Morris International (PMI) has achieved remarkable gross margins across its regional segments, with Europe leading the way. In fiscal year 2024, PMI’s Europe segment posted a gross margin of 73%, marking a modest yet significant increase from 72% in 2023.

Europe remains PMI’s most profitable region, underpinned by a strong demand for its smoke-free products and the company’s ability to maintain premium pricing amidst economic challenges. The consistent improvement in gross margin reflects PMI’s operational efficiency and strategic focus on sustaining profitability in this key market.

Despite producing the second-highest gross profit, the SSEA, CIS & MEA segment lags behind in gross margin performance compared to other divisions. In 2024, this region reported a gross margin of 53%, far below the 69% and 66% achieved by the EA, AU & PMI DF and Americas segments, respectively.

This decline has been part of a downward trend, as the segment’s gross margin has dropped from 59% in 2022, indicating challenges such as cost pressures, geopolitical risks, and regulatory complexities impacting overall profitability.

In sharp contrast, the EA, AU & PMI DF segment has successfully sustained its gross margin at 68% since 2022, demonstrating stability and resilience in these markets. Similarly, the Americas region has shown remarkable growth in profitability, with its gross margin climbing from 51% in 2022 to 66% in 2024.

This improvement is driven by PMI’s increasing penetration of smoke-free products like IQOS and ZYN, alongside effective cost management strategies and optimized distribution channels.

PMI’s Wellness & Healthcare segment, while still a smaller contributor, has made notable strides in profitability. Its gross margin doubled from 10% in 2023 to 20% in 2024, signaling progress in the company’s diversification efforts. This division remains an area of growth potential, as PMI continues to refine its offerings and strengthen its presence in health-focused markets.

Overall, PMI’s ability to navigate challenges and focus on high-margin products, efficient operations, and targeted investments has contributed to its robust profitability across regions.

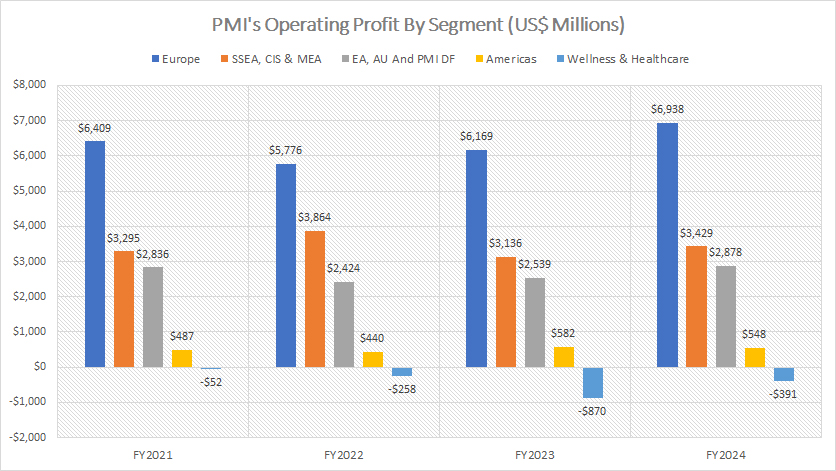

Operating Profit By Segment

PMI-operating-profit-by-segment

(click image to expand)

In January 2023, PMI rearranged its operations in four geographical segments, down from the previous six. The definitions of PMI’s four new geographical segments are available here: Europe Region, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas.

PMI also created two new segments in 2023 to speed its transition into a smoke-free company. The two new segments were Swedish Match and Wellness and Healthcare. The definitions of PMI’s two new segments are available here: Swedish Match and Wellness And Healthcare.

However, in fiscal year 2024, PMI merged the Swedish Match segment into the four geographical segments, with previous periods being recast. The Wellness And Healthcare segment remained unchanged.

Philip Morris International (PMI) showcases diverse financial performance across its regional segments, with Europe leading as the highest contributor to operating profit.

In fiscal year 2024, the Europe segment recorded an impressive $6.9 billion in operating profit, marking a significant increase of $700 million from $6.2 billion in 2023. This growth reflects the continued strength of PMI’s smoke-free product portfolio in the region, driven by products like IQOS, along with effective pricing strategies and operational efficiencies.

However, historical performance shows some fluctuation, as Europe’s operating profit had decreased to $5.8 billion in 2022, compared to its previous peak of $6.4 billion in 2021. Such a rebound in 2024 highlights the resilience and market leadership PMI commands in the region.

The SSEA, CIS & MEA segment ranks as PMI’s second-largest contributor to operating profit, delivering $3.4 billion in fiscal year 2024, up $300 million from $3.1 billion in 2023. Despite this growth, the region’s operating profit remains below its high of $3.9 billion in 2022.

The decline since 2022 suggests ongoing challenges in some markets, likely due to macroeconomic and regulatory headwinds. Nonetheless, the 2024 recovery reflects the segment’s potential, buoyed by diversification across emerging markets.

The EA, AU, and PMI DF region emerged as PMI’s third-largest operating profit generator, contributing $2.9 billion in fiscal year 2024, a remarkable increase from $2.5 billion in 2023. However, this performance remains relatively unchanged compared to $2.8 billion reported in 2021, indicating a steady yet gradual growth pattern. The region’s profitability is underpinned by stable market demand and effective integration of smoke-free products.

The Americas segment, while trailing behind in total operating profit, reported $548 million in fiscal year 2024. Although this contribution is among the smallest, the Americas have exhibited potential for rapid growth, driven by the increasing popularity of smoke-free products like IQOS and ZYN. However, its relatively modest performance compared to other regions suggests ongoing expansion efforts are still maturing.

On the other hand, PMI’s Wellness & Healthcare division continues to report operating losses. In fiscal year 2024, the segment incurred a loss of $391 million, a marked improvement compared to the $870 million loss in 2023, but still highlighting challenges in achieving profitability.

Since 2021, the division has consistently reported operating losses, starting with a $21 million loss that year. This persistent trend underscores the segment’s current struggles as it navigates its early stages of development and investment.

Overall, PMI’s strategic emphasis on its core markets and innovation in smoke-free product segments have driven robust growth in operating profits across its leading regions. The contrasting performance in less mature divisions like Wellness & Healthcare reflects both challenges and opportunities as the company continues to diversify its portfolio.

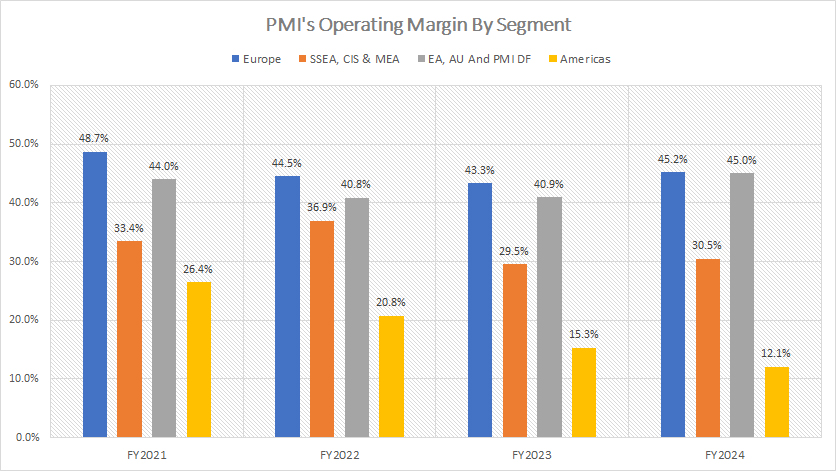

Operating Margin By Segment

PMI-operating-margin-by-segment

(click image to expand)

In January 2023, PMI rearranged its operations in four geographical segments, down from the previous six. The definitions of PMI’s four new geographical segments are available here: Europe Region, SSEA, CIS & MEA, EA, AU & PMI DF, and Americas.

PMI also created two new segments in 2023 to speed its transition into a smoke-free company. The two new segments were Swedish Match and Wellness and Healthcare. The definitions of PMI’s two new segments are available here: Swedish Match and Wellness And Healthcare.

However, in fiscal year 2024, PMI merged the Swedish Match segment into the four geographical segments, with previous periods being recast. The Wellness And Healthcare segment remained unchanged.

From an operating margin perspective, both Europe and the EA, AU & PMI DF segments have demonstrated comparable levels of profitability, showcasing their pivotal role in Philip Morris International’s (PMI) financial success.

In fiscal year 2024, the Europe division reported an impressive operating margin of 45%, consistent with the EA, AU & PMI DF segment, which also achieved a 45% margin. This parity highlights PMI’s ability to effectively balance costs and revenues in two of its most significant markets.

Europe’s high profitability is supported by strong demand for smoke-free products such as IQOS, while the EA, AU & PMI DF segment benefits from stable market performance and streamlined operations.

However, the SSEA, CIS & MEA segment, despite generating one of PMI’s highest operating profits, reported a significantly lower operating margin of 31% in 2024. This disparity suggests that while the segment contributes substantially to PMI’s overall profit, it faces higher costs or operational inefficiencies.

The decline in operating margin from 33% in 2021 to 31% in 2024 illustrates persistent challenges, including geopolitical and regulatory complexities that continue to weigh on profitability in the region.

The Americas division has consistently struggled with profitability compared to other regions. Its operating margin has plummeted from 26% in 2021 to a record low of 12% in 2024, marking it as one of PMI’s least profitable segments.

This sharp decline reflects challenges such as competitive pressures, higher operating costs, and slower adoption of smoke-free products compared to more established markets. The Americas’ underperformance highlights the region’s ongoing hurdles in transitioning to PMI’s new product strategy.

Despite these challenges, PMI has continued to focus on diversification and innovation, striving to stabilize and improve margins in less profitable regions while maintaining robust profitability in its flagship divisions.

Insight

Essentially, Europe remains Philip Morris International’s most profitable region across all metrics, driven by strong smoke-free product demand and operational efficiency.

The Americas segment, though improving in gross profit, faces significant challenges in operational costs, reflected in its declining margins.

The SSEA, CIS & MEA region contributes heavily to gross and operating profits but struggles with declining margins due to regional complexities.

While the EA, AU & PMI DF segment may not exhibit the explosive growth seen in other regions like the Americas, its consistent profitability, high margins, and stability make it a key pillar of PMI’s global operations.

Wellness & Healthcare shows progress in gross profit and margins but remains in the investment phase, consistently operating at a loss.

References and Credits

1. All financial numbers presented were obtained and referenced from PMI’s quarterly and annual reports published on the company’s investor relations page: PMI’s Reports And Filings.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.