Rivian R1T. Image By Rivian

Rivian Automotive (NASDAQ: RIVN) is an automobile company specializing in designing, developing, and manufacturing electric vehicles.

Rivian produces and sells only two vehicle types to customers in the consumer market: electric trucks and utility vehicles. On the other hand, Rivian produces and sells electric vans to customers in the commercial market segment.

This article explores the revenue, profitability, and margin of Rivian Automotive. We will check into several statistics, which include the breakdown of Rivian’s revenue, profit per vehicle, cash flow, etc.

Let’s get started!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Business Model And Strategy

O3. What Does Rivian Do?

O4. How Does Rivian Make Money?

Consolidated Revenue

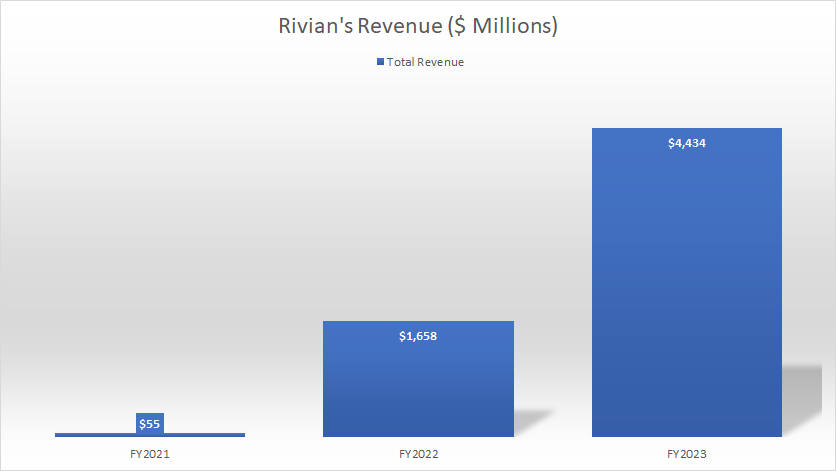

B1. Revenue By Year

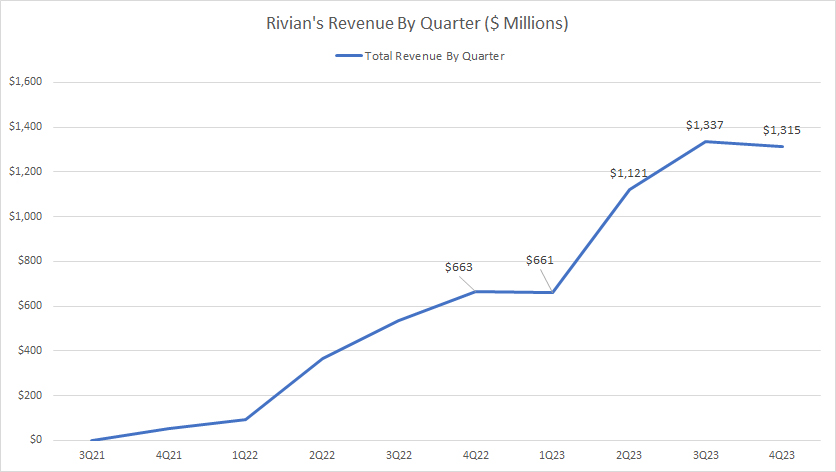

B2. Revenue By Quarter

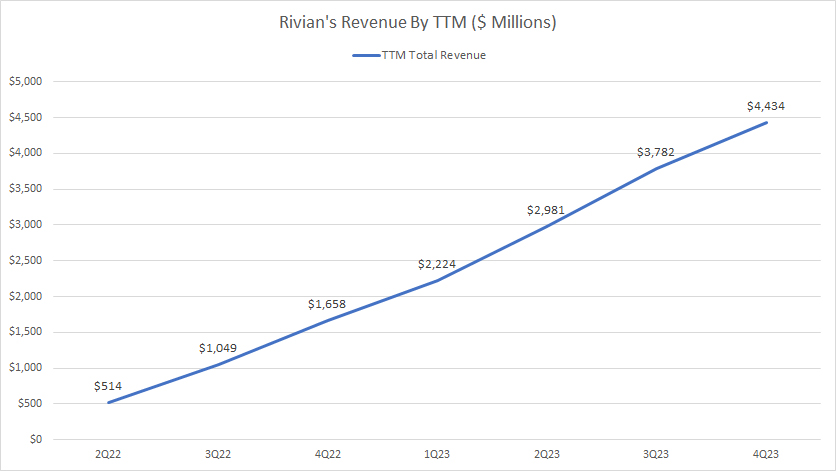

B3. Revenue By TTM

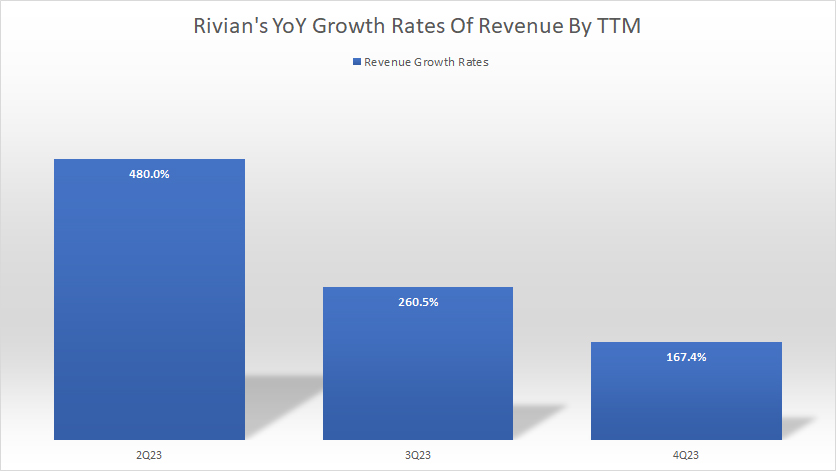

B4. YoY Growth Rates Of Revenue By TTM

Revenue From Other Sources

C1. Revenue From Amazon

C2. Revenue From Amazon In Percentage

C3. Revenue From Sales Of Regulatory Credits

C4. Revenue From Sales Of Regulatory Credits In Percentage

Consolidated Profit

D1. Gross Profit

D2. Operating Profit

D3. Adjusted EBITDA

Profit Per Car Statistics

E1. Profit Per Vehicle By Year

E2. Profit Per Vehicle By Quarter

Margins

F1. Gross Margin

Cash Flow

G1. Net Cash From Operations

G2. Free Cash Flow

Conclusion And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Regulatory Credits: Regulatory credits are a form of government incentive for organisations to engage in certain practices that align with public policy goals, such as reducing emissions, producing renewable energy, or manufacturing electric vehicles.

These credits can often be sold or traded, allowing companies that exceed regulatory requirements to monetize their excess actions, while companies not meeting the standards can purchase credits to comply with regulations. This system incentivizes businesses to adopt environmentally friendly practices and technologies beyond the minimum standards set by regulations.

Adjusted EBITDA: Adjusted EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric that enhances the traditional EBITDA measure by adjusting for specific items that are unique or non-recurring.

These adjustments are made to provide a clearer view of a company’s operational performance and cash flow generation capability by excluding irregularities and potential distortions. Factors often adjusted for include one-time expenses, non-cash items, stock-based compensation, and any gains or losses associated with asset sales, among others.

This makes Adjusted EBITDA a valuable tool for investors and analysts looking to compare the core profitability of companies without the noise of non-operational financial activities and one-off events.

According to Rivian, its adjusted EBITDA is defined as net loss before interest expense (income), net, provision for income taxes, depreciation and amortization, stock-based compensation, and other (expense) income, net.

Business Model And Strategy

Rivian uses a direct-to-customer business model to allow the company to manage all sales, deliveries, service operations, and resales in-house without relying on a franchise dealership network or other third parties.

Rivian believes this strategy will allow it to deliver uncompromised experiences well beyond what is available through the standard franchise dealership model.

What Does Rivian Do?

Rivian Automotive, Inc. is an American electric vehicle (EV) manufacturer and automotive technology company founded in 2009. The company focuses on developing and producing electric vehicles, including trucks and SUVs, designed for both on-road and off-road adventures.

Rivian’s mission is centered around sustainability and innovation, aiming to reduce the carbon footprint of the automotive industry by providing electric vehicles that do not compromise on performance, utility, or features.

Their flagship vehicles include the R1T, an all-electric pickup truck, and the R1S, an all-electric SUV. Both models are known for their impressive range, powerful electric motors, and advanced autonomous driving features.

Rivian also works on developing an expansive charging network and has been involved in projects related to adventure and exploration, emphasizing the outdoor lifestyle that their vehicles support.

How Does Rivian Make Money?

Rivian produces and markets its vehicles in two market segments: consumer and commercial. Rivian offers the R1T, an electric pickup truck, and the R1S, a seven-seater all-electric SUV for the consumer market. Therefore, Rivian gets its revenue from the sales of the R1T and R1S under the consumer segment.

Apart from the sales of vehicles, Rivian also generates revenue by providing various services to customers in the consumer market, including digitally enabled financing, telematics-based insurance, proactive vehicle service (maintenance and repair), software services, and charging solutions. According to Rivian, these services will generate long-term brand loyalty while creating a recurring revenue stream for each vehicle across its lifecycle.

In addition to the consumer segment, Rivian also earns revenue from the commercial sector. Under the commercial sector, Rivian generates revenue from the sales of electric delivery vans (EDV).

The available models for electric delivery vans are the EDV-700, a 700-cubic-foot EDV designed for last-mile delivery, and the EDV-500, a narrower and shorter version of the EDV-700. According to the 2022 annual report, Amazon was Rivian’s first commercial customer.

In addition to the sales of the EDV, Rivian also makes money by prodiving a range of services under the commercial market segment. These services include subscribing to the company’s proprietary and end-to-end centralized fleet management platform, FleetOS.

Users can do various things within the FleetOS, including getting real-time data on vehicle distribution, service, telematics, software services, charging, connectivity management, Driver+, and lifecycle management.

Over time, FleetOS is expected to support additional features such as financing, insurance, driver safety and coaching, smart charging and routing, remote diagnostics, 360° collision reports, and vehicle resale.

Revenue By Year

Rivian-revenue-by-year

(click image to expand)

Rivian earned US$1.7 billion and US$4.4 billion in annual revenue in fiscal years 2022 and 2023, respectively. The 2023 result represents a YoY growth of 167% over 2022.

The significant increase in revenue in 2023 was primarily due to the increase in vehicle sales which reached 50 thousand units as of 2023, more than twice the number in 2022.

Investors interested in Rivian’s vehicle production and deliveries may find more resources on this page – Rivian vehicle production and sales.

Revenue By Quarter

Rivian-revenue-by-quarter

(click image to expand)

Rivian earned US$1.1 billion, US1.3 billion, and US$1.3 billion in quarterly revenue in 2Q, 3Q, and 4Q 2023, respectively. The 4Q 2023 quarterly result represents a growth of 98% from a year ago.

A notable trend is the significant quarterly revenue increase in fiscal 2023 over the periods in 2022, implying a soaring demand for the company’s electric vehicles.

Revenue By TTM

Rivian-revenue-by-ttm

(click image to expand)

The revenue growth of Rivian seems remarkable in the graph for the trailing twelve months (TTM) shown above. As of 4Q 2023, Rivian’s revenue for the trailing twelve months stood at $4.4 billion, which indicates a 167% year-over-year increase. Furthermore, Rivian’s TTM revenue for 1Q, 2Q, and 3Q 2023 was $2.2 billion, $3.0 billion, and $3.8 billion, respectively.

The rising TTM revenue over the periods depicted in the chart underscores the fact that Rivian is a formidable player in the electric vehicle (EV) space that should not be ignored.

YoY Growth Rates Of Revenue By TTM

Rivian-growth-rates-of-revenue-by-ttm

(click image to expand)

Rivian achieved a staggering 480% and 260.5% revenue increase in 2Q and 3Q of 2023, respectively. However, this ratio decreased to 167.4% in 4Q 2023, the lowest in 2023.

Although revenue growth has significantly slowed in the latest quarter, it is still impressive at over 100%. These spetacular results are a testament to the company’s success and rapid expansion in the EV market.

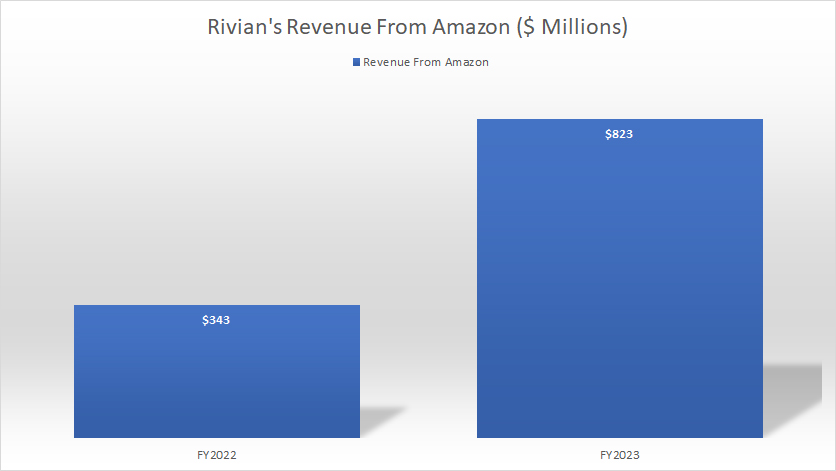

Revenue From Amazon

Rivian-revenue-from-Amazon

(click image to expand)

Amazon is Rivian’s first commercial segment customer. According to Rivian’s 2022 annual report, Amazon has placed an initial order of 100,000 EDVs, subject to modification.

Rivian earned US$343 million and US$823 million in revenue from Amazon in fiscal years 2022 and 2023, respectively, mainly from selling EDVs to Amazon. Rivian’s 2023 revenue from Amazon was more than double from 2022.

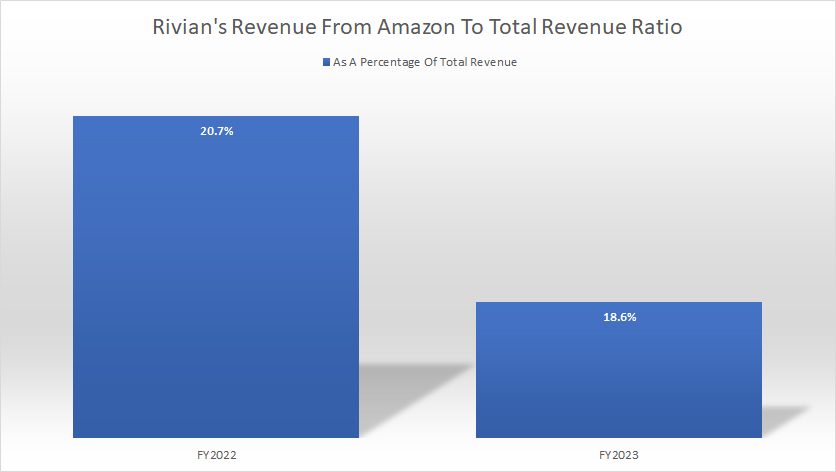

Revenue From Amazon In Percentage

Rivian-revenue-from-Amazon-in-percentage

(click image to expand)

Rivian’s revenue from Amazon represents roughly 20.7% of its total revenue in fiscal 2022. This ratio decreased to 18.6% in 2023. On average, Rivian’s revenue contribution from Amazon measured 20% between 2022 and 2023.

Due to the significant portion of revenue from Amazon, Rivian’s business, prospects, financial condition, results of operations, and cash flows could be materially and adversely affected if Amazon purchases significantly fewer vehicles from Rivian.

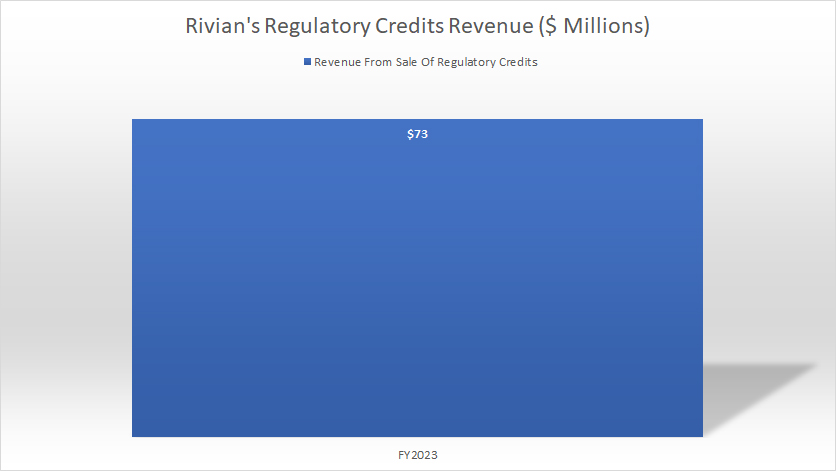

Revenue From Sales Of Regulatory Credits

Rivian-revenue-from-sales-of-regulatory-credits

(click image to expand)

The definition of Rivian’s regulatory credits is available here: regulatory credits.

Rivian earned just US$73 million in revenue from sales of regulatory credits in fiscal year 2023.

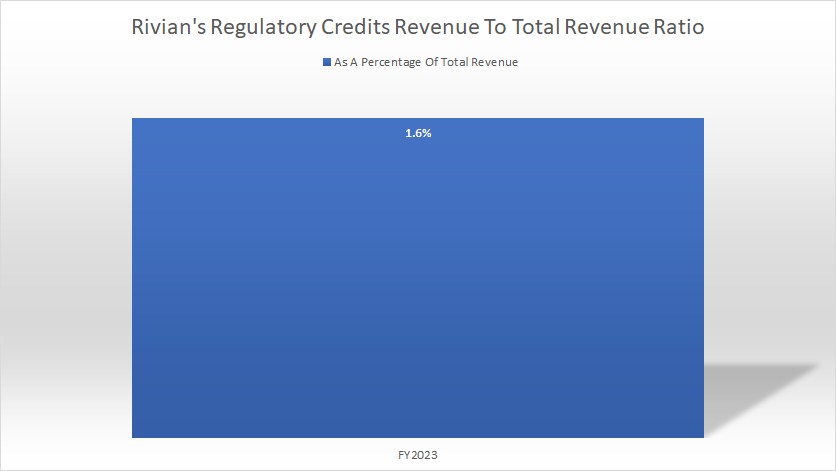

Revenue From Sales Of Regulatory Credits In Percentage

Rivian-percentage-of-revenue-from-sales-of-regulatory-credits

(click image to expand)

The definition of Rivian’s regulatory credits is available here: regulatory credits.

Rivian’s US$73 million from sales of regulatory credits in 2023 represents a percentage of just 1.6% of total revenue.

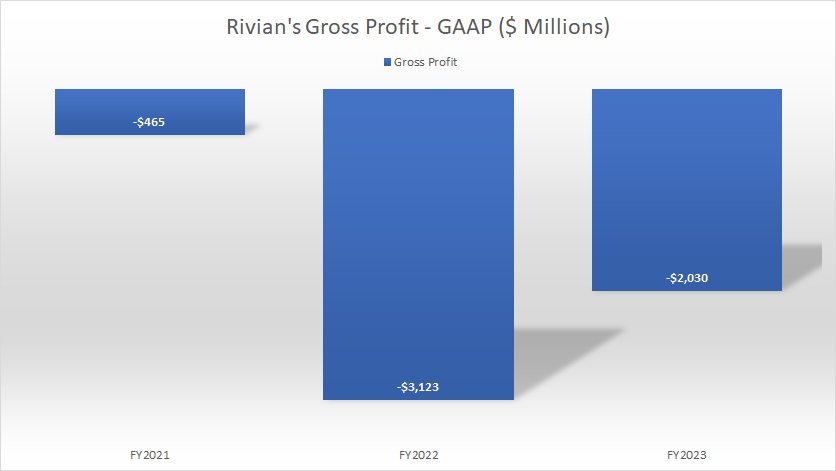

Gross Profit

Rivian-gross-profit

(click image to expand)

Rivian was still unprofitable as of 2023 from the perspective of gross profit. The electric automaker made a gross loss of US$2 billion in fiscal year 2023. However, Rivian’s loss has significantly narrowed between 2022 and 2023, from US$3.1 billion to US$2 billion.

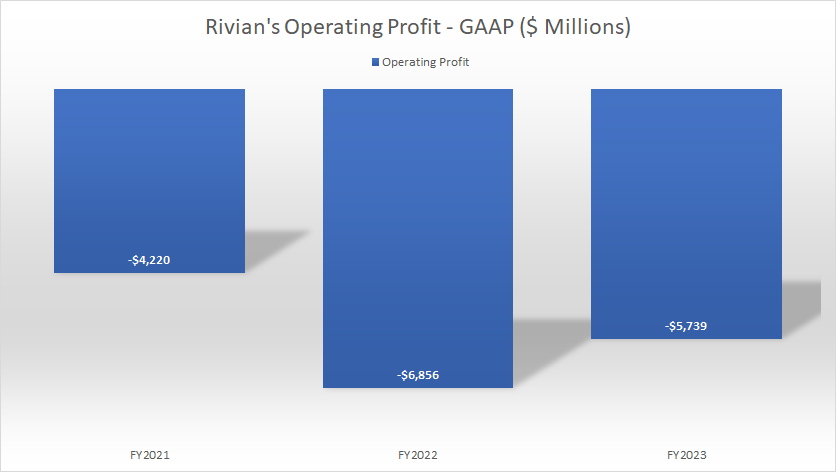

Operating Profit

Rivian-operating-profit

(click image to expand)

Rivian has incurred an even bigger loss in operating profit. The company’s operating loss in 2023 totaled US$5.7 billion. However, Rivian has considerably reduced its operating loss since 2022, from -US$6.9 billion to -US$5.7 billion, down more than US$1 billion.

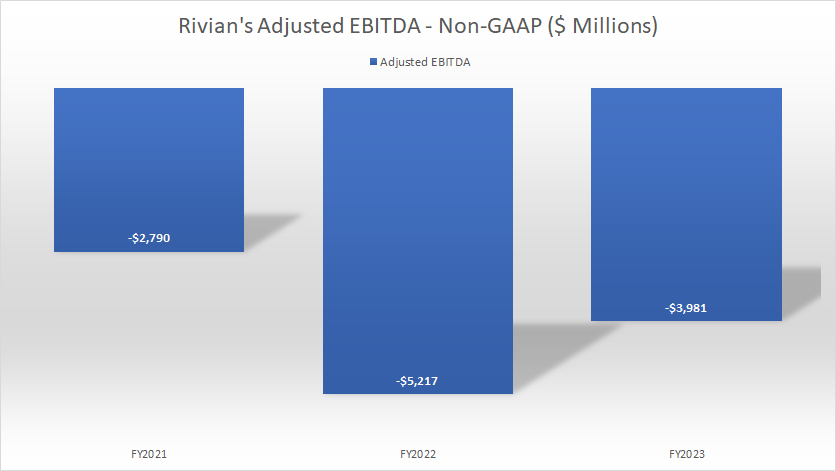

Adjusted EBITDA

Rivian-adjusted-EBITDA

(click image to expand)

The definition of Rivian’s adjusted EBITDA is available here: adjusted EBITDA.

Rivian has experienced a similar loss in the adjusted EBITDA as its gross profit and operating income. As shown in the chart, Rivian’s loss in adjusted EBITDA reached nearly US$4 billion in fiscal 2023, down by over US$1 billion from fiscal 2022.

Rivian’s loss in adjusted EBITDA has considerably reduced from fiscal 2022 to 2023, down by over US$1 billion.

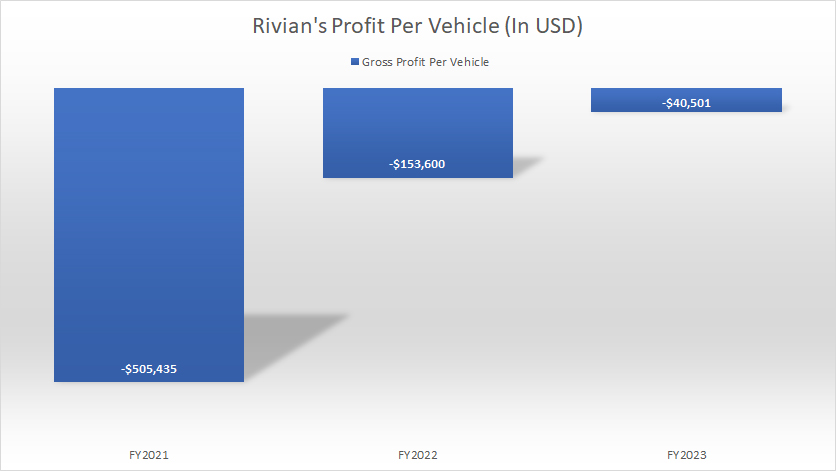

Profit Per Vehicle By Year

Rivian-profit-per-vehicle-by-year

(click image to expand)

Rivian’s loss per vehicle has significantly narrowed over time. Rivian has reduced its loss per vehicle from US$505,400 in 2021 to US$40,500 in 2023, representing a significant reduction over the last three years.

Despite the narrowing loss, Rivian has never turned a profit per vehicle since 2021. In other words, Rivian has continued to incur a loss for every vehicle the automaker delivers.

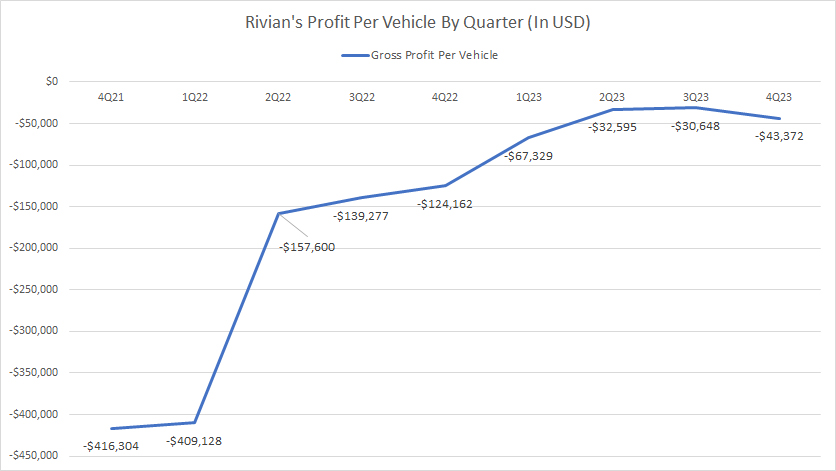

Profit Per Vehicle By Quarter

Rivian-profit-per-vehicle-by-quarter

(click image to expand)

Rivian has continued to incur a significant loss per vehicle sold. As of 2023, its loss per vehicle averaged US$43,500 in each quarter. This figure was down considerably from the average loss of US$207,500 per quarter in 2022.

Rivian’s rising vehicle shipment in 2023 helped to narrow the loss per vehicle. Rivian’s vehicle shipment in 2023 was more than double the figure in 2022.

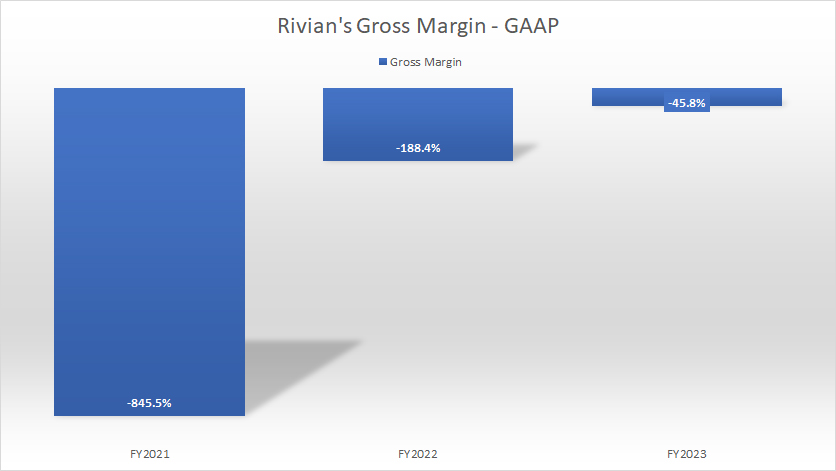

Gross Margin

Rivian-gross-margin

(click image to expand)

As Rivian has never turned a profit, its gross margin has continued to remain negative. As of 2023, Rivian’s gross margin reached -45.8%, a considerable improvement from the -188.4% in 2022.

Since 2021, Rivian’s negative gross margin has significantly narrowed, down from -845% in 2021 to -46% in 2023.

Rivian has expected to continue being unprofitable despite forecasting a significant increase in vehicle sales in 2024. Therefore, Rivian’s negative gross margin will likely persist through the end of 2024. However, the company expects to generate a positive gross margin by the 4th quarter of 2024.

The following quotes were extracted from Rivian’s 2024 shareholder letter.

-

2024 Outlook

Over the course of fiscal year 2024, we are focused on

• Driving towards profitability: Drive down cost and achieve modest gross profit in the fourth quarter

2024 Guidance

Vehicles Produced 57,000

Adj. EBITDA $(2,700) million

Capital Expenditures $1,750 million

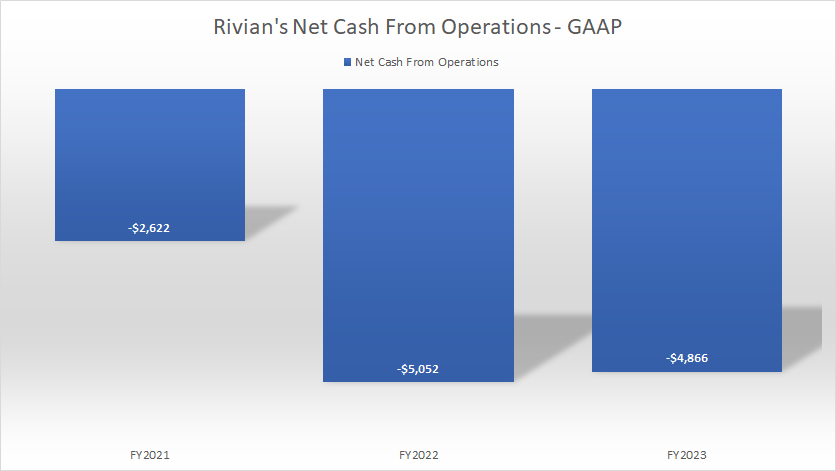

Net Cash From Operations

Rivian-net-cash-from-operations

(click image to expand)

Apart from being unprofitable, Rivian also consumes a significant amount of cash. The primary concern is that Rivian’s cash flow consumption may worsen over time, as shown in the chart above.

As of 2023, Rivian’s net cash from operations measured at -US$4.9 billion, only down marginally from 2022. Therefore, Rivian’s cash flow consumption has not had any significant improvement since 2021 and has continued to consume massive amount of operating cash flow.

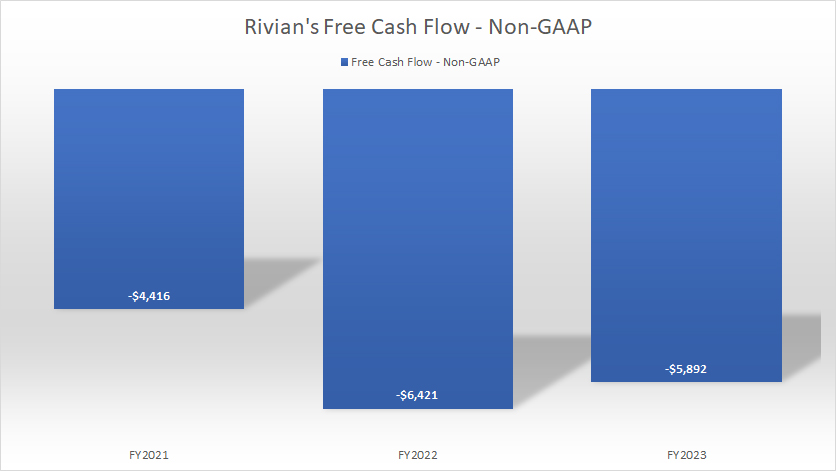

Free Cash Flow

Rivian-free-cash-flow

(click image to expand)

Rivian’s free cash flow equals net cash from operations less capital expenditures. Similarly, Rivian’s free cash flow has not improved much since 2021. In fact, it has worsened over time, as shown in the chart above.

As of 2023, Rivian consumed US$5.9 billion of free cash flow, roughly 40% higher than the figure in 2021 but sligthly lower than in 2022.

Conclusion

Despite the surging revenue and car delivery, Rivian Automotive has yet to turn a profit. In addition, Rivian also consumes tonnes of cash.

However, loss per vehicle has significantly reduced over time, and may soon be able to make a profit per vehicle. This profit per vehicle is measured from the perspective of gross profit. In terms of operating profit, Rivian will likely continue to incur significant losses per vehicle.

In the meantime, Rivian’s unprofitability will likely continue into the end of 2024.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Rivian Automotive, Inc.’s quarterly and annual reports, SEC filings, earnings releases, shareholders letters, etc., which are available in Rivian Investor Relations.

2. Images were obtained from Rivian R1T.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link back to this article from any website so that more articles like this can be created in the future.

Thank you!