Crypto rocket. Pixabay image.

This article presents the number of verified users and monthly transacting users (MTU) of Coinbase Global, Inc., (NASDAQ: COIN).

Coinbase uses the verified users and monthly transacting users as part of its key business metrics to evaluate business performance, identify trends, and make strategic decisions, according to the company’s annual report.

Investors interested in Coinbase’s crypto investment and bitcoin holdings may find more information on this page – Coinbase crypto investment and bitcoin holdings.

Let’s look at Coinbase’s verified users and MTU numbers.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Coinbase Boost Its Transacting Users?

Verified User Results

A1. Verified Users By Year

A2. Verified Users By Quarter

A3. Verified Users Growth Rates

Monthly Transacting User (MTU) Results

B1. MTU By Year

B2. Annual Average MTU

B3. MTU By Quarter

B4. MTU Growth Rates

MTU Vs Verified Users

C1. Ratio Of MTU To Verified Users

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Verified Users: Coinbase defines verified users as all consumers, institutions, and developers that have registered an account on its platform and confirmed either their email address or phone number, or that have established an account with a username on its non-custodial wallet application, as of the date of measurement, according to the 2022 annual report.

However, the number of verified users is not without weaknesses. Firstly, verified users do not necessarily mean paying customers but the probability is higher as these customers have demonstrated an interest in Coinbase’s platform or direct intent to transact with crypto assets. Therefore, a growing verified user number may or may not translate to more revenue.

Secondly, according to Coinbase, the verified user numbers may overstate the number of unique customers who have registered an account on its platform. The reason is that a customer may register for, and use, multiple accounts with different email addresses, phone numbers, or usernames.

Monthly Transacting Users: The Monthly Transacting User (MTU) is defined as a consumer who transacts one or more products on Coinbase’s platform at least once during the rolling 28-day period ending on the date of measurement, according to the company’s annual report.

There are two types of MTU presented in Coinbase’s earnings releases: quarterly and annual MTU numbers.

According to Coinbase, MTU is an important statistic because it represents the transacting base of consumers who drive potential revenue-generating transactions on the company’s platform.

Therefore, the higher the MTU figures, there is a high probability of more revenue. Again, the MTU metric is not without weaknesses.

In this aspect, the MTU may overstate the number of unique consumers due to differences in product architecture or user behavior.

How Does Coinbase Boost Its Transacting Users?

Coinbase, a leading cryptocurrency exchange platform, employs various strategies to increase its monthly transacting users, focusing on enhancing user experience, security, and market presence. Here are some of the key strategies:

1. **User-Friendly Platform**: By constantly improving its user interface and making the platform more intuitive, Coinbase attracts seasoned traders and newcomers to the cryptocurrency world. Simplifying the buying, selling, and trading processes encourages more frequent transactions.

2. **Security Enhancements**: Security is paramount in the crypto space. Coinbase invests heavily in state-of-the-art security measures to protect user funds and personal information. This commitment to security builds trust and encourages users to transact more frequently.

3. **Educational Resources**: Coinbase provides a wealth of educational materials on its platform through Coinbase Learn, aiming to demystify cryptocurrency for the average user and provide insights into emerging trends. Educated users are more likely to engage in transactions.

4. **Cryptocurrency Variety**: By regularly adding new cryptocurrencies to its platform, Coinbase caters to varied interests within the crypto community. This diversity attracts a broader user base and encourages existing users to explore new transaction opportunities.

5. **Marketing and Partnerships**: Strategic marketing campaigns and partnerships help Coinbase reach new audiences. Collaboration with popular brands or personalities in the crypto space can drive sign-ups and transactions.

6. **Mobile App Accessibility**: With the increasing use of smartphones for financial transactions, Coinbase ensures its mobile app is robust, feature-rich, and user-friendly. This accessibility boosts the frequency of transactions among users who prefer mobile platforms.

7. **Reward Programs and Incentives**: Coinbase occasionally offers reward programs, such as earning crypto for learning about new currencies or cashback in crypto for using their Coinbase Card. These incentives encourage users to engage more with the platform.

8. **Regulatory Compliance**: By actively working to comply with global financial regulations, Coinbase builds a reputation of reliability and safety. This regulatory compliance attracts users who are cautious about the legality and security of their investments.

9. **Customer Support**: Investing in responsive and helpful customer support ensures that users’ issues are resolved quickly, maintaining a positive user experience and encouraging continued use of the platform.

By focusing on these areas, Coinbase aims to create a favorable environment that attracts new users and retains existing ones, encouraging them to transact more frequently on the platform.

Verified Users By Year

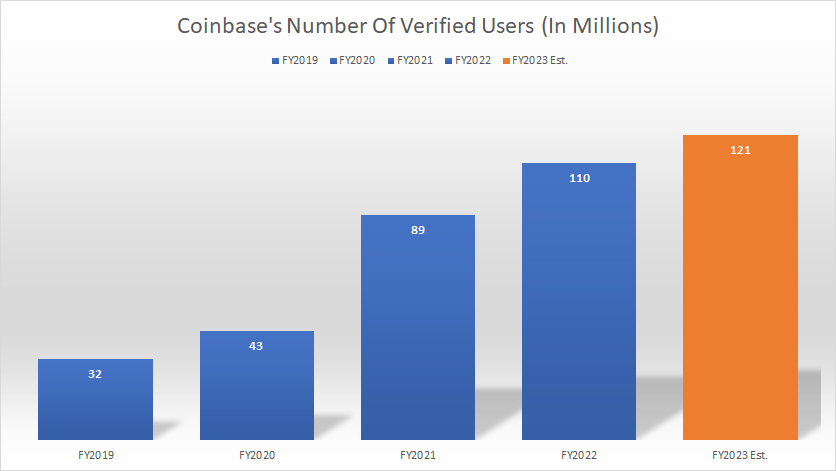

Coinbase-number-of-verified-users

(click image to expand)

The definition of Coinbase’s verified users is available here: verified users. Coinbase has stopped presenting the verified users results starting in 2023, citing inaccuracy of the metric in measuring business performance.

That said, Coinbase’s verified users reached 110 million in fiscal year 2022, representing a rise of 24% over 2021. Since 2019, the number of verified users has more than tripled and represents an incredible success for the company.

If Coinbase’s verified users were to grow conservatively at 10%, it might have reached 121 million users by the end of fiscal 2023.

Verified Users By Quarter

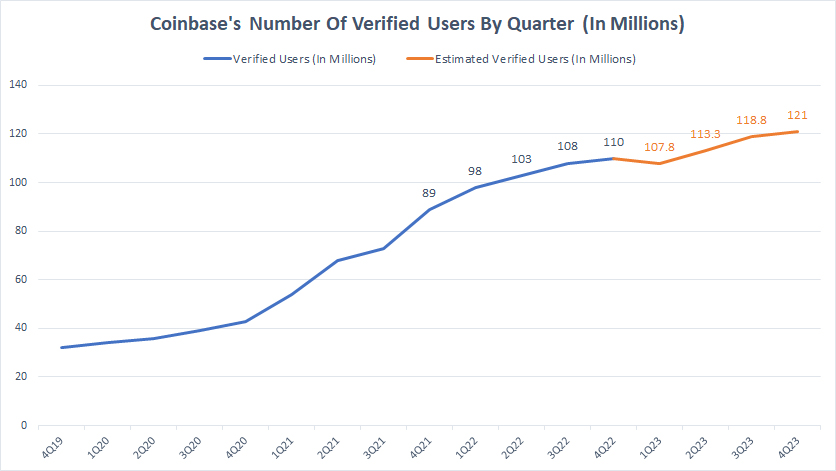

Coinbase-number-of-verified-users-by-quarter

(click image to expand)

The definition of Coinbase’s verified users is available here: verified users. Coinbase has stopped presenting the verified users results starting in 2023, citing inaccuracy of the metric in measuring business performance.

The quarterly plot depicts the steady rise of Coinbase’s verified users since fiscal 2019. Coinbase reported verified users of 103 million, 108 million, and 110 million in fiscal 2Q 2022, 3Q 2022, and 4Q 2022, respectively.

In fiscal 2023, Coinbase stopped presenting the quarterly verified user data, citing that the data do not track user activities leading to revenue generation and, as a result, are not indicative of the company’s business performance, including with respect to revenue and operating results.

Although Coinbase has stopped presenting the verified user data, we can make an assumption. For example, if Coinbase’s verified users were to grow YoY at 10% in each quarter in 2023, it would have reached 108 million, 113 million, 119 million, and 121 million in fiscal 1Q, 2Q, 3Q, and 4Q 2023, respectively.

Verified Users Growth Rates

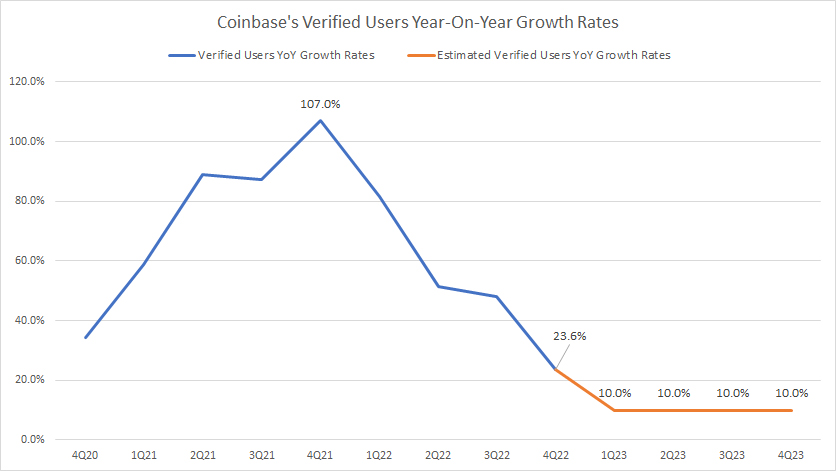

Coinbase-growth-rates-of-verified-users

(click image to expand)

The definition of Coinbase’s verified users is available here: verified users. Coinbase has stopped presenting the verified users results starting in 2023, citing inaccuracy of the metric in measuring business performance.

As presented in the plot above, Coinbase’s verified user growth has considerably slowed in post-pandemic periods since fiscal 2022. As of 4Q 2022, Coinbase’s verified user growth measured just 23.6%, a much lower figure than the 107% reported a year ago.

Coinbase experienced a record surge in verified user growth of 107% during fiscal year 4Q 2021. However, since the fourth quarter of 2021, the growth rate for verified users has been declining. Despite this trend, Coinbase was still able to achieve a respectable verified user growth rate of 23.6% in fiscal year 4Q 2022.

Considering that the verified user growth rates have been declining, the growth rates in 2023 may go even lower. We may assume that the verified user growth to be conservatively at 10% in 2023.

MTU By Year

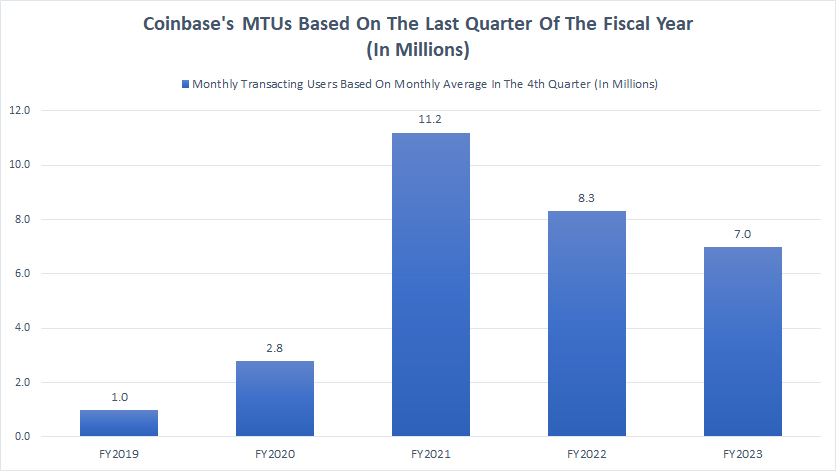

Coinbase-MTU-based-on-the-last-quarter

(click image to expand)

MTU by year is the MTU figure based on the last quarter result of the fiscal year. The definition of Coinbase’s MTU is available here: monthly transacting users.

An alternative measure of Coinbase’s MTU is based on the annual average. This version of MTU is presented in the next section: MTU based on annual average.

That said, Coinbase had experienced an incredible surge in MTU in the earlier years. For example, Coinbase’s monthly transacting users had surged from 1.0 million users in fiscal year 2019 to 11.2 million users in 2021, a rise of over 1000% in just three years.

However, Coinbase’s MTU has considerably decreased in post-COVID periods. For example, Coinbase’s monthly transacting users have decreased from 11.2 million users in 2021 to 7.0 million users in 2023, a drop of 37.5% over the last three years.

On a long-term basis, Coinbase’s MTU result is still favorable because it represents an increase of 600% from 2019.

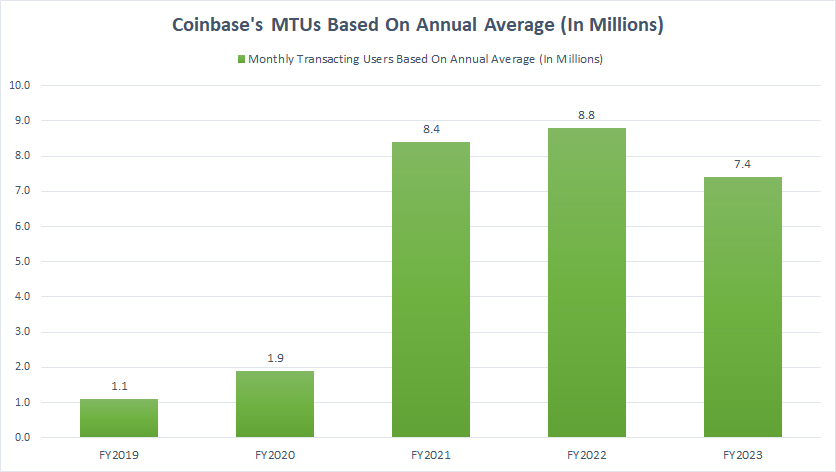

Annual Average MTU

Coinbase-MTU-based-on-annual-average

(click image to expand)

Contrary to the previous MTU result, the annual average MTU is defined as the average of the MTU for the whole fiscal year. The definition of Coinbase’s MTU is available here: monthly transacting users.

Therefore, the annual average MTU may represent a more consistent result. That said, Coinbase’s annual average MTU has remained relatively strong in post-COVID periods. For example, Coinbase’s annual average MTU reached 7.4 million users in fiscal year 2023, down 16% over 2022 or 12% over 2021.

Instead of a decrease of 37.5% from 2021 which we saw in prior MTU results, the annual average results depicts a more gradual decrease. In this aspect, the annual average results show that Coinbase’s MTU has been on a much stronger footing in post-COVID periods compared to prior MTU results.

You can see that Coinbase’s MTU has increased from 8.4 million users in 2021 to 8.8 million users in 2022. This result is in contrast with what we saw in the previous section.

On a long-term basis, Coinbase’s monthly transacting users has grown by over 600%, which is consistent with what we saw previously.

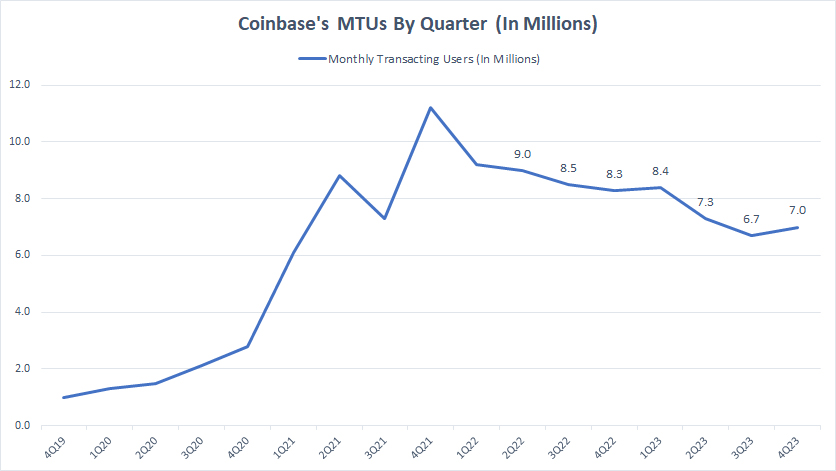

MTU By Quarter

Coinbase-MTU-by-quarter

(click image to expand)

The definition of Coinbase’s MTU is available here: monthly transacting users.

Coinbase’s quarterly monthly transacting users have been on a gradual decrease in post-COVID periods, as shown in the chart above. During pre-COVID time, Coinbase’s quarterly MTUs had considerably surged, notably from less than 2.0 million users in 4Q19 to over 11.0 million users in 4Q21.

In post-COVID time, Coinbase’s MTUs have slowly decreased, reaching 7.0 million users as of 4Q23. Coinbase’s 7.0 million monthly transacting users reported in 4Q23 is still an incredible result despite significantly lower than prior highs.

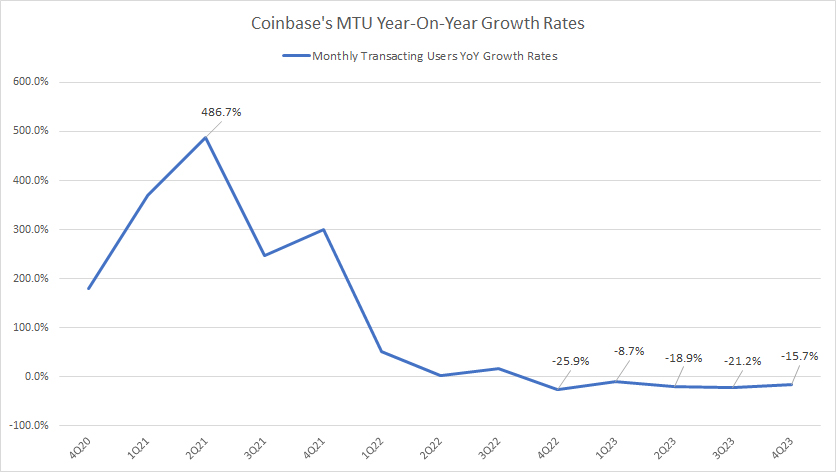

MTU Growth Rates

Coinbase-MTU-growth-rates

(click image to expand)

Coinbase’s MTU YoY growth rates have significantly decreased in post-COVID periods. For example, the growth rates have decreased from nearly 500% in 2021 to -15.7% as of 4Q 2023.

The negative figures represents negative growth rates. Therefore, Coinbase’s monthly transacting users have actually been declining in recent quarters.

Before 2022, Coinbase’s MTU growth rates had been mostly in triple digits. The result has completely reversed in recent years.

Keep in mind that the MTU has a profound impact on Coinbase’s revenue as the metric is closely correlated to the company’s revenue-generating capability.

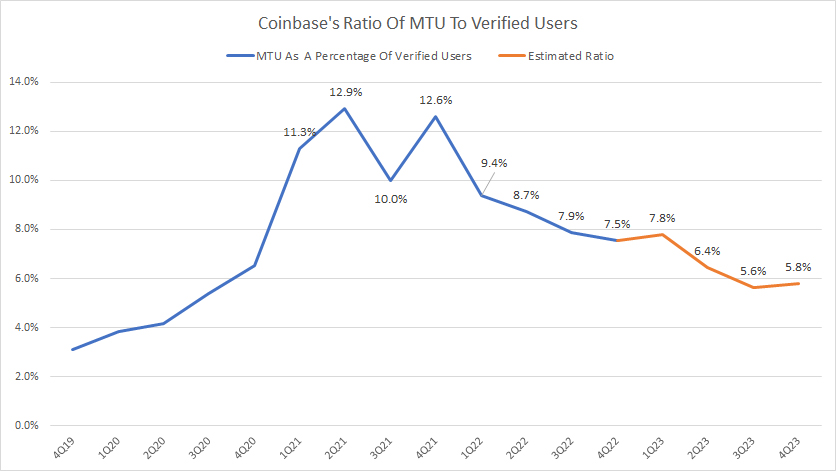

Ratio Of MTU To Verified Users

Coinbase-ratio-of-MTU-to-verified-users

(click image to expand)

This ratio measures the percentage of verified users that get translated to transacting users. The ratio beyond 4Q22 is an estimate because the verified user data provided by Coinbase is up to only 4Q 2022.

That said, the plot shows that Coinbase reached a peak ratio of more than 10% somewhere during 2021. Since then, Coinbase’s ratio of MTU to verified users has been on the decline and totaled only 7.5% as of 4Q 2022.

The actual data in the plot above ended on 4Q 2022 as Coinbase has stopped publishing the verified user’s data since 1Q 2023. If Coinbase’s verified users in 2023 were to grow at 10% YoY which we saw in prior discussion, the ratio would go even lower, as shown in the plot above.

As of 4Q 2023, Coinbase’s estimated ratio of transacting users to verified users would probably be just 5.8%. The average ratio for 2023 may reach 6.4%. Therefore, fewer and fewer verified users get translated to transacting users.

Before 2023, the average ratio was about 8.4% for the four quarters ended on 2022. In other words, only about 8.4% of Coinbase’s verified users were translated to transacting users in 2022.

In short, a decreasing ratio does not look good for Coinbase because fewer verified users are being translated to transacting users. Keep in mind that the transacting user is one of the primary factors driving Coinbase’s revenue growth.

Conclusion

As Coinbase’s transacting users have declined in post-pandemic periods, its revenue also has followed the same pattern, as depicted in this article: how does Coinbase make money.

Although Coinbase’s verified users have increased, its transacting users have decreased, implying a contrasting trend.

Only about 8% of Coinbase’s verified users got translated to transacting users in fiscal 2022. This ratio is much lower than the 10% measured in 2021. The ratio is estimated to go even lower in 2023.

The decreasing ratio does not bode well for Coinbase and shareholders.

Credits and References

1. All financial figures presented in this article were obtained and referenced from Coinbase Global, Inc.’s SEC filings, earnings reports, financial statements, news releases, shareholder presentations, quarterly and annual statements, etc., which are available in Coinbase Investor Relations.

2. Pixabay images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!