Ford Mustang. Pexels Image.

This article details the vehicle retail sales of Ford Motor Company, categorized by country, including the U.S., China, Canada, United Kingdom, Germany, and more.

Additionally, we provide an overview of Ford’s vehicle retail sales categorized by region, including North America, Europe, South America, and ASEAN.

For other sales statistics of Ford Motor, you may find more information on these pages:

- Ford global sales and worldwide market share,

- Ford sales by vehicle type – electric, hybrid, and internal combustion, and

- Ford SUV sales by model – Explorer, Escape, Bronco, etc..

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why are Ford Motor’s vehicle sales in China on the decline?

United States

China, Canada, U.K., And Germany

A2. Sales In China, Canada, U.K., And Germany

Türkiye, Italy, Australia, And France

A3. Sales In Türkiye, Italy, Australia, And France

Mexico, Brazil, Argentina, And India

A4. Sales In Mexico, Brazil, Argentina, And India

North America, Europe 20, South America, And ASEAN

B1. Sales In North America, Europe 20, South America, And ASEAN

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Vehicle Retail Sales: Vehicle retail sales refer to the number of vehicles sold directly to consumers through retail channels, such as dealerships.

Ford Motor defines its retail vehicle sales as sales primarily by dealers, sales to the government, and leases to Ford management, and is based, in part, on estimated vehicle registrations; includes medium and heavy trucks.

This metric typically includes sales of new and used cars, trucks, and other types of vehicles. Vehicle retail sales provide insight into consumer demand and purchasing behavior in the automotive market.

Understanding vehicle retail sales is crucial for manufacturers, dealerships, and market analysts to assess the health and trends of the automotive market.

Europe 20: Europe 20 markets are United Kingdom, Germany, France, Italy, Spain, Austria, Belgium, Czech Republic, Denmark, Finland, Greece, Hungary, Ireland, the Netherlands, Norway, Poland, Portugal, Romania, Sweden, and Switzerland.

Europe 20 excludes Russia and Turkey.

China Sales: China includes Taiwan. Ford’s sales in China include Ford brand and JMC brand vehicles produced and sold by the company’s unconsolidated affiliates.

Unconsolidated Affiliates: Unconsolidated affiliates are companies in which a parent company holds a significant, but not a controlling, interest.

Typically, this means the parent company owns between 20% and 50% of the affiliate’s voting shares. Because the parent company does not have full control over the affiliate’s operations, the financial results of unconsolidated affiliates are not fully included in the parent company’s consolidated financial statements.

Instead, the parent company accounts for its investment in unconsolidated affiliates using the equity method. This means the parent company’s share of the affiliate’s profits or losses is reported as a single line item in the parent company’s income statement, and the investment is adjusted accordingly on the balance sheet.

Why are Ford Motor’s vehicle sales in China on the decline?

Ford Motor’s vehicle sales in China have been on the decline due to several factors:

- Rise of Local EV Brands: The Chinese market has seen a significant surge in electric vehicle (EV) demand, with local brands like BYD, Geely, and Li Auto offering more affordable and advanced options compared to foreign automakers.

- Consumer Preferences: Chinese consumers have shown a strong preference for smaller vehicles, such as sedans and compact cars, which are less profitable for Ford compared to larger vehicles like trucks and SUVs.

- Joint Venture Challenges: Ford’s joint ventures with local Chinese automakers have faced complexities and inefficiencies, impacting overall sales performance.

- Government Subsidies: The Chinese government has heavily subsidized local EV production, making it difficult for foreign automakers to compete on price and market share.

- Economic Factors: General economic conditions and fluctuations in consumer spending in China have also played a role in the decline of Ford’s vehicle sales.

These factors combined have led to a challenging environment for Ford in the Chinese market, prompting the company to reevaluate its strategy and focus on exporting locally produced vehicles to other markets to offset losses in China.

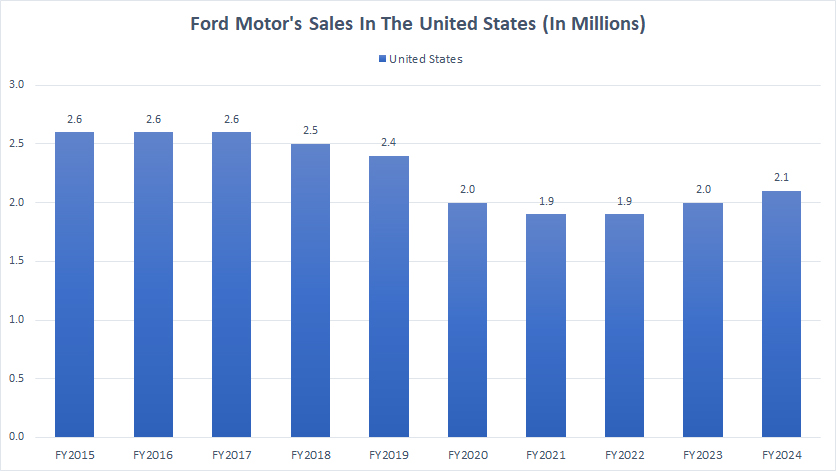

Sales In The U.S.

ford-retail-sales-in-the-US

(click image to expand)

The explanation of Ford’s vehicle retail sales is available here: vehicle retail sales.

Ford Motor’s U.S. retail sales reached 2.1 million vehicles in fiscal year 2024, a modest increase from the 2.0 million vehicles sold in fiscal year 2023.

After hitting a low point in fiscal year 2021 with sales at 2.0 million vehicles, Ford’s U.S. vehicle sales have rebounded significantly, achieving record levels by fiscal year 2024.

This recovery has been driven by several factors, including the introduction of new models, a renewed focus on electric vehicles (EVs), and a strong marketing push to regain consumer confidence and market share.

Despite the noticeable recovery over the past three years, Ford’s U.S. vehicle sales are still below their historical highs. For instance, between fiscal years 2015 and 2017, Ford’s U.S. sales consistently exceeded 2.6 million vehicles annually.

This indicates that while the recent growth is promising, there is still a considerable gap to bridge to return to those peak levels.

The company’s efforts to innovate and adapt to changing market dynamics, such as increasing the production of electric and hybrid vehicles and enhancing their digital sales platforms, are expected to play a crucial role in driving future growth.

Additionally, the ongoing economic recovery and improvements in supply chain management are likely to further support Ford’s efforts to increase its market presence and sales volume in the U.S. in the coming years.

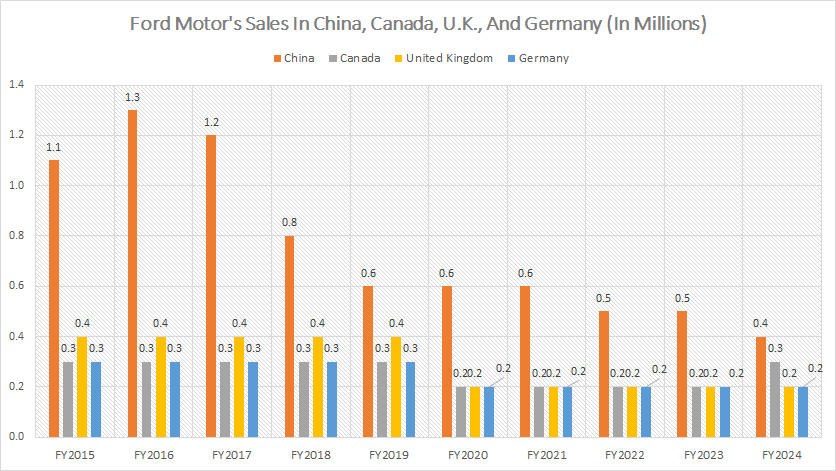

Sales In China, Canada, U.K., And Germany

ford-retail-sales-in-China-Canada-UK-and-Germany

(click image to expand)

The explanation of Ford’s vehicle retail sales is available here: vehicle retail sales. You can find the definition of Ford’s China sales here: China sales.

Ford’s vehicle sales in China have seen a marked decline since fiscal year 2015, plummeting to just 0.4 million units by fiscal year 2024. This represents a significant drop of over 60% from their peak sales.

In fiscal year 2016, Ford’s vehicle sales in China reached their zenith, with retail volumes peaking at 1.3 million units. However, this success was short-lived. From 2017 onwards, sales started to decline steadily, reflecting various challenges and market dynamics.

A major reason driving the decline in Ford’s China retail sales is the rise of local competitors. The rapid growth and innovation of domestic Chinese automakers, such as Geely, BYD, and NIO, have intensified competition, making it harder for foreign brands like Ford to maintain their market share.

In addition to challenges in China, Ford has also experienced significant declines in vehicle sales in Canada, the United Kingdom, and Germany, reaching record lows as of fiscal year 2024, as illustrated in the accompanying graph.

Ford’s vehicle sales in Canada have seen a substantial decrease. In fiscal year 2015, Ford sold 0.3 million vehicles in Canada, but by fiscal year 2020, this number had dropped to only 0.2 million vehicles. This decline reflects a 33% reduction in six years.

From fiscal year 2020 to 2023, Ford’s vehicle sales in Canada remained steady at approximately 0.2 million units. However, in fiscal year 2024, Ford experienced a significant recovery, with sales rebounding to 0.3 million vehicles.

The situation in the United Kingdom has been even more pronounced. Ford’s vehicle sales in the UK have halved over the last ten years, falling from 0.4 million units in fiscal year 2015 to just 0.2 million units by fiscal year 2024. This 50% reduction highlights the significant challenges Ford faces in maintaining its market share in the UK.

Ford has faced a similar downward trend in Germany. Vehicle sales in this key European market have declined from 0.3 million units in fiscal year 2015 to 0.2 million units in fiscal year 2024. This represents a 33% decrease over the period.

Several key factors are contributing to the decline in Ford’s sales in Canada, the UK, and Germany. One significant factor is the changing consumer preferences. In these regions, consumers have increasingly favored electric and hybrid vehicles, where local and European manufacturers have already established strong footholds.

Moreover, there has been a notable increase in competition. The automotive markets in Canada, the UK, and Germany have become highly competitive, with numerous brands vying for market share. This intensifying competition has made it challenging for Ford to maintain its previous sales levels.

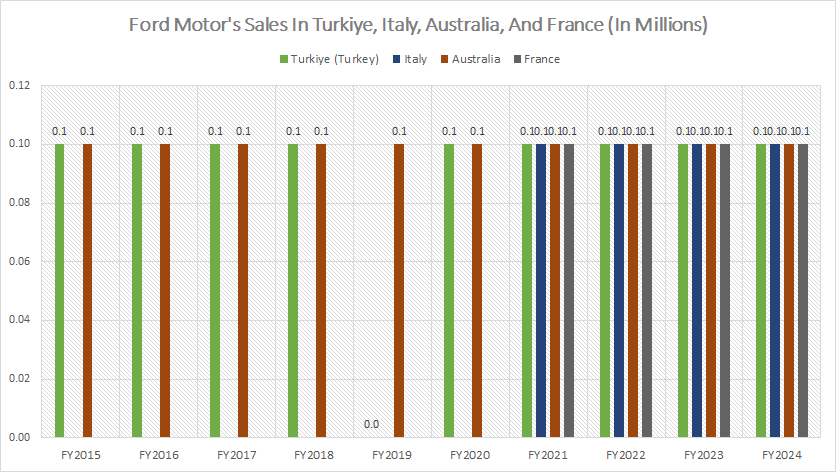

Sales In Türkiye, Italy, Australia, And France

ford-retail-sales-in-Turkey-Italy-Australia-and-France

(click image to expand)

The explanation of Ford’s vehicle retail sales is available here: vehicle retail sales.

Ford derives only modest sales from countries such as Turkey, Italy, Australia, and France. In fiscal year 2024, Ford’s retail volumes in each of these countries were a mere 0.1 million vehicles.

Despite efforts to boost sales, Ford’s performance in these markets has shown little to no improvement over the past decade. The sales figures have remained relatively constant, reflecting the challenges Ford faces in gaining a stronger foothold in these regions.

One significant factor impacting Ford’s retail volumes in Turkey, Italy, Australia, and France is the specific preferences of consumers in these markets.

For instance, consumers in these countries have demonstrated a strong preference for local and European brands, which makes it challenging for Ford to capture a substantial market share.

In addition, competition in these regions significantly impacts Ford’s vehicle sales. The intense rivalry from well-established local and European manufacturers presents a formidable challenge for Ford in securing a substantial market share.

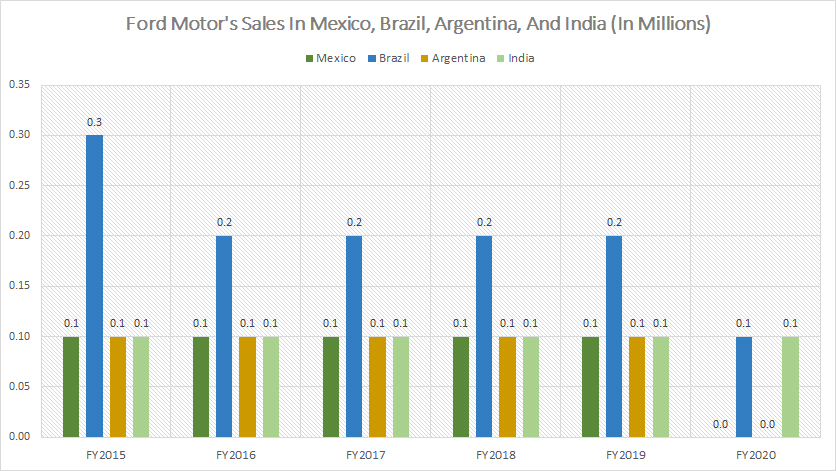

Sales In Mexico, Brazil, Argentina, And India

ford-retail-sales-in-Mexico-Brazil-Argentina-and-India

(click image to expand)

The explanation of Ford’s vehicle retail sales is available here: vehicle retail sales.

Ford has ceased reporting retail sales figures for Mexico, Brazil, Argentina, and India, likely due to poor sales performance in these regions.

For instance, Ford’s last reported vehicle sales in Mexico were in fiscal year 2019, amounting to approximately 0.1 million vehicles. Similarly, the last reported sales figures in Brazil were for fiscal year 2020, also totaling around 0.1 million units.

In Argentina and India, Ford reported similar sales figures. The last reported sales in Argentina were in fiscal year 2019, with 0.1 million units sold. In India, Ford’s final reported sales were in fiscal year 2020, also totaling around 0.1 million vehicles.

The economic instability and fluctuations in Mexico, Brazil, and Argentina are likely significant factors impacting Ford’s vehicle sales in these regions.

The poor economic conditions in these countries have substantially affected consumers’ purchasing power, leading to reduced consumer spending on vehicles.

In summary, Ford has struggled to achieve strong sales performance in most South American countries.

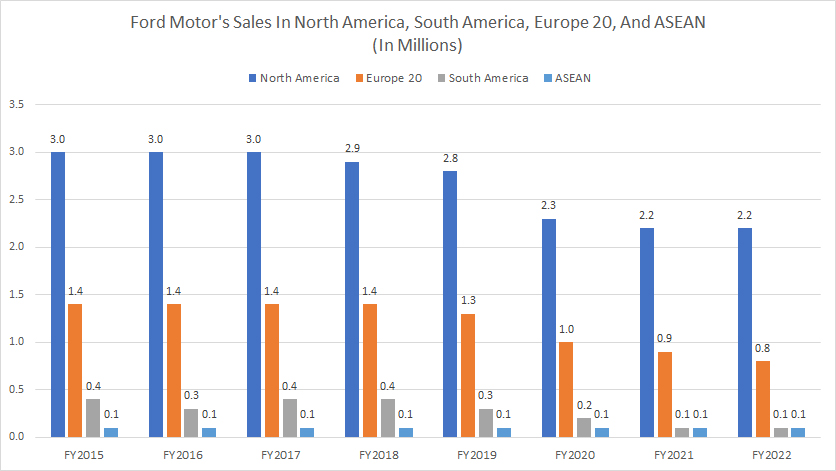

Sales In North America, Europe 20, South America, And ASEAN

Ford vehicle sales by region

(click image to expand)

The definitions of Ford’s vehicle sales and Europe 20 are available here: retail sales and Europe 20.

Ford ceased publishing vehicle sales data by region in its annual reports starting in fiscal year 2023. As shown in the chart above, the company’s vehicle sales are primarily derived from three key regions: North America, Europe 20, and China (not presented in the chart here).

In 2022, Ford’s vehicle sales amounted to approximately 2.2 million units in North America and 0.8 million units in Europe. Together, these two regions accounted for about 75% of Ford’s total retail volume for the year.

When including sales from China, which totaled around 0.5 million vehicles in 2022, the combined percentage increased to 88% of Ford’s total retail volume.

On the other hand, Ford’s smallest markets in terms of vehicle sales were South America and the ASEAN regions, each totaling only 0.1 million vehicles in 2022.

Unfortunately, Ford’s vehicle sales have been declining across most regions since 2015. In North America, sales have dropped by about 27%, from 3.0 million units in 2015 to 2.2 million units in 2022. In Europe, sales have decreased by over 40% since 2015.

Several factors have contributed to Ford’s declining sales, including economic instability, shifting consumer preferences towards electric and hybrid vehicles, intense competition from local and international competitors, and stringent emissions regulations.

Conclusion

In summary, Ford has demonstrated strong performance in North America, with impressive sales figures and market presence. The company has successfully navigated challenges and capitalized on opportunities, resulting in robust sales volumes and a solid market position.

However, the story is quite different in Europe and South America, where Ford has faced significant challenges and underperformed in terms of sales. Economic instability, intense competition, and shifting consumer preferences have all contributed to the automaker’s struggles in these regions. As a result, Ford’s sales in Europe and South American countries have been notably poor.

In China, the situation has been particularly challenging for Ford. The company’s retail volumes have experienced a dramatic decline, plummeting significantly over the past few years. This sharp downturn can be attributed to factors such as the rise of local competitors, changing market dynamics, and evolving consumer preferences. Despite efforts to regain market share, Ford continues to face an uphill battle in China’s highly competitive automotive market.

Overall, while Ford has achieved commendable success in North America, its performance in Europe, South America, and China highlights the need for strategic adjustments and a renewed focus on adapting to local market conditions and consumer preferences.

References and Credits

1. All vehicle sales data presented were obtained and referenced from Ford’s annual reports published on the company’s investor relation page: Ford’s Financial Reports.

2. Pexels Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.