Tata Motors’ Nexon. Flickr Image.

This article presents the vehicle sales volume of Tata Motors Limited (TML).

Tata Motors Limited is a wholly-owned subsidiary of Tata Motors Group, a leading global automobile manufacturing company based in Mumbai, India.

Aside from Tata Motors Limited, Tata Motors Group also wholly owns Jaguar Land Rover (JLR), a UK-based company that was only established after the acquisition in 2008.

That said, the vehicle sales volume presented in this article includes only those from the subsidiary, Tata Motors Limited.

In addition, the vehicle sales volume presented here is based on a wholesale basis obtained from Tata Motors Limited’s monthly car sales reports.

There is a difference between retail-based and wholesale-based vehicle sales.

In simple terms, wholesale-based vehicle sales volume generally correlates with the revenue or sales data presented in the company’s profit and loss statements whereas retail-based vehicle sales volume does not.

The data presented on other websites may not tell you about the nature of the vehicle sales data simply because they have no idea.

Nevertheless, let’s look at the following topics!

Table Of Contents

Consolidated Results

Results By Market Segment

B1. Domestic And Export Sales

B2. Domestic And Export Sales In Percentage

Results By Vehicle Type

C1. Commercial And Passenger Vehicle Sales

C2. Commercial And Passenger Vehicle Sales In Percentage

Results By Vehicle Model

D1. Car, Utility And Commercial Vehicle Sales

D2. Car, Utility And Commercial Vehicle Sales In Percentage

Electric Vehicle Sales Results

E1. EV Sales

E2. EV Sales In Percentage

Summary And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

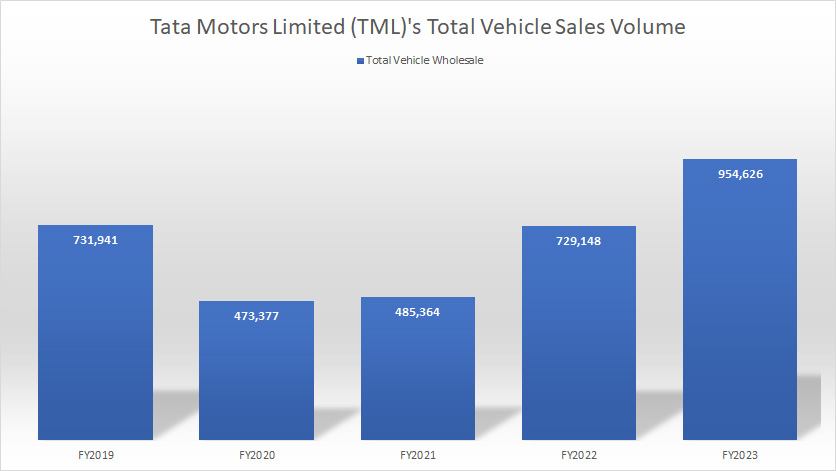

Total Car Sales Volume

Tata Motors total vehicle sales volume

(click image to enlarge)

For total car sales volume, Tata Motors Limited delivered 955,000 vehicles on a wholesale basis as of fiscal 2022, a record high for the company in the past 5 years.

Tata Motors Limited’s FY2023 vehicle sales represent a growth rate of 31% over FY2022.

Despite facing a multitude of problems, including the chip crisis as well as the ongoing COVID-19 challenges, TML continued to deliver excellent sales results.

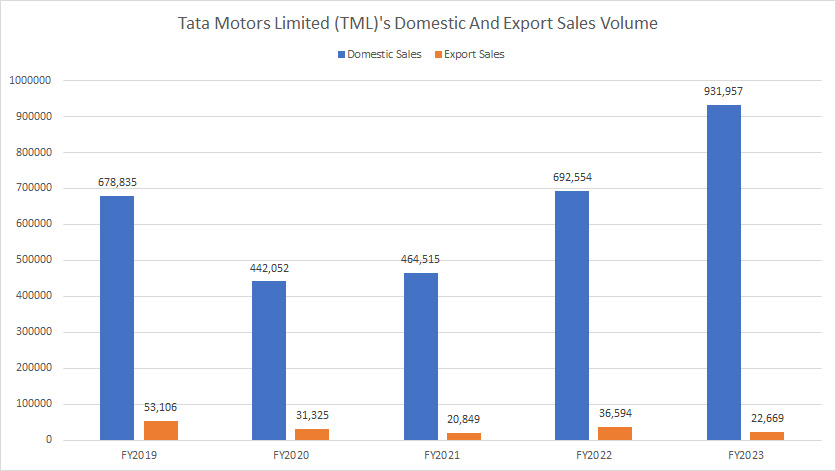

Domestic And Export Sales

Tata Motors domestic and export vehicle sales volume

(click image to enlarge)

Tata Motors Limited’s domestic car sales are much higher than export car sales.

In fiscal 2023, Tata Motors Limited shipped 932,000 vehicles within India while export sales volume came in at only 23,000 units.

Keep in mind that the export sales figures have been on the decline and reached a 5-year low as of fiscal 2023.

On the other hand, Tata Motors Limited’s domestic vehicle volumes continued to grow in the post-pandemic periods and the FY2023 result represents a growth rate of 34% over FY2022.

Also, the company’s sales reported in FY2023 were at a 5-year high and even surpassed the pre-pandemic figures.

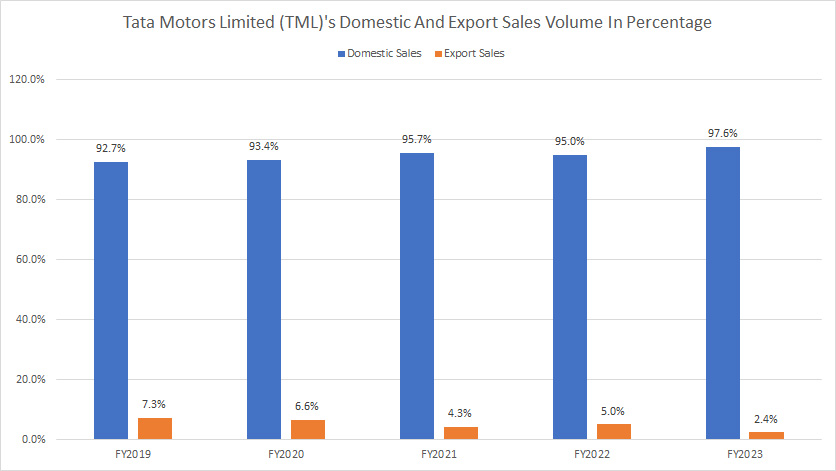

Domestic And Export Sales In Percentage

Tata Motors domestic and export vehicle sales volume in percentage

(click image to enlarge)

From a percentage perspective, Tata Motors Limited’s domestic sales accounted for 98% of the company’s total vehicle volume as of fiscal 2023, the highest figure that has ever been recorded.

Moreover, this ratio has grown significantly since fiscal 2019, illustrating the growing importance of the domestic market to the company.

On the other hand, Tata Motors Limited’s export sales accounted for only 2.4% of the company’s total vehicle volume as of fiscal 2023.

This ratio has been on the decline over the past 5 years and reached a record low as of FY2023.

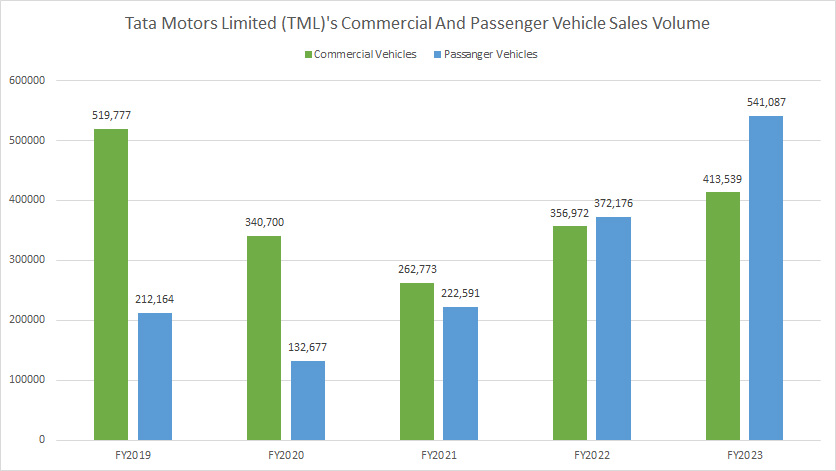

Commercial And Passenger Vehicle Sales

Tata Motors commercial and passenger vehicle sales volume

(click image to enlarge)

Tata Motors Limited’s vehicle sales in the commercial segment include trucks, vans, and buses.

On the other hand, Tata Motors Limited’s vehicle sales in the passenger segment include utility vehicles and sedans.

Tata Motors Limited’s commercial vehicle volume used to be much bigger than its passenger vehicle volume as shown in the chart above.

However, the passenger vehicle volume had surpassed the commercial segment in recent years.

In fact, Tata Motors Limited’s passenger vehicle volume was much higher in fiscal 2023, totaling 541,000 units while that of the commercial vehicle clocked only 413,500 units in the same period.

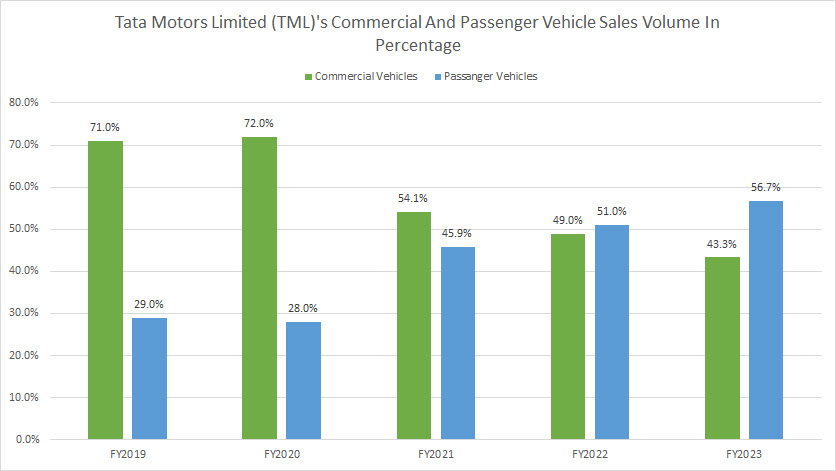

Commercial And Passenger Vehicle Sales In Percentage

Tata Motors commercial and passenger vehicle sales volume in percentage

(click image to enlarge)

In terms of percentage, Tata Motors Limited’s passenger vehicle segment accounted for 57% of the company’s total sales volume as of fiscal 2023, up significantly from fiscal 2021.

This ratio has been on the rise from 29% reported in fiscal 2019 to the 57% reported in fiscal 2023.

On the other hand, the percentage of commercial vehicle sales has decreased from a whopping 71% reported in fiscal 2019 to only 43% as of fiscal 2023, down nearly half over the past 5 years.

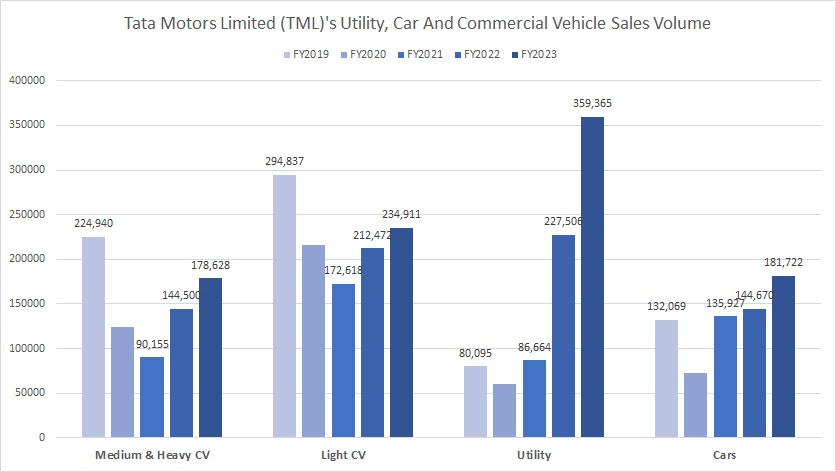

Car, Utility And Commercial Vehicle Sales

Tata Motors utility, car and commercial vehicle sales volume

(click image to enlarge)

Among all vehicle models, Tata Motors Limited’s utility vehicle accounts for the highest sales as of fiscal 2023, topping 359,000 units, up considerably from fiscal 2022.

On the other hand, the sales of medium and heavy commercial vehicles were among the smallest despite having been on the rise over the years.

Tata Motors Limited’s light commercial vehicle sales topped 235,000 units as of fiscal 2023 while passenger cars clocked 182,000 units in the same period.

Among all vehicle models, the sales of utility vehicles grew the fastest, and the sales figures had more than tripled in just 3 years.

Management mentioned that models such as the Nexon, Punch, Harrier, and Safari were among the best-selling SUVs in fiscal 2023.

In short, the sales of all vehicle models have significantly risen from the pandemic lows and some even exceeded the pre-pandemic figures.

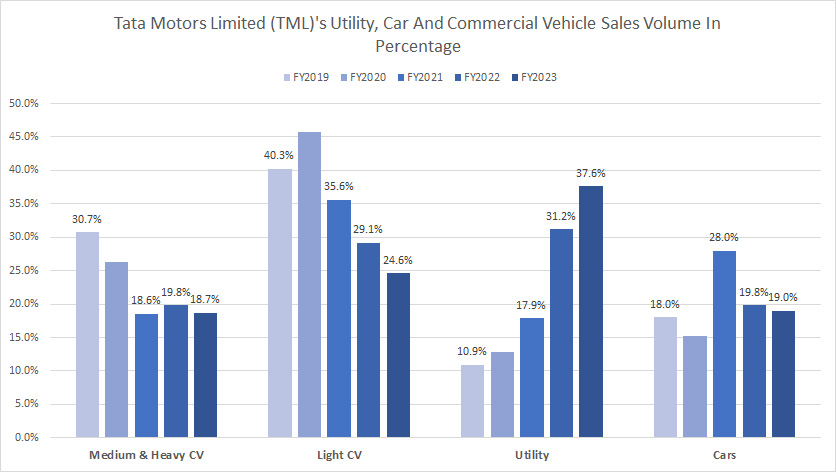

Car, Utility And Commercial Vehicle Sales In Percentage

Tata Motors utility, car and commercial vehicle sales volume in percentage

(click image to enlarge)

As of fiscal 2023, Tata Motors Limited’s sales of utility vehicles accounted for the biggest portion of all vehicle volume, boasting nearly 38%.

Coming in second was light commercial vehicle whose sales made up 25% of all vehicle volume in fiscal 2023.

Tata Motors Limited’s passenger car sales represent 19% while medium and heavy commercial vehicles also came in at 19% of all vehicle sales.

Among all vehicle models, you can see that the percentage of utility vehicles grew the most in the past 5 years, rising from 11% reported in fiscal 2019 to the new high reported as of fiscal 2023.

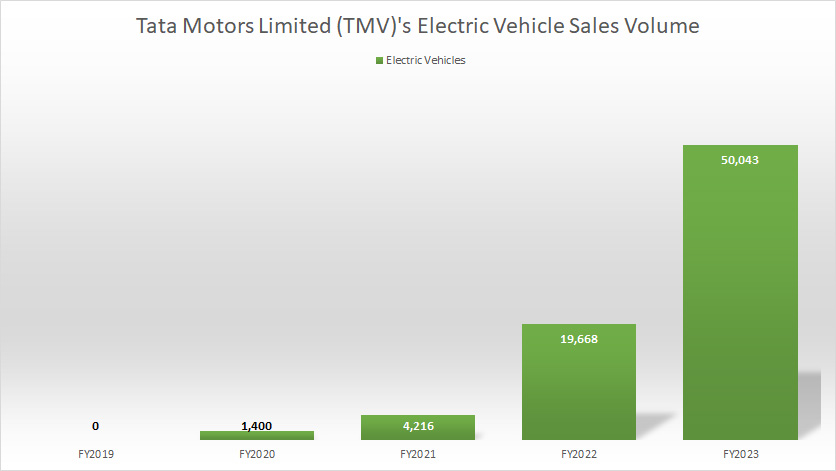

EV Sales Volume

Tata Motors electric vehicle sales volume

(click image to enlarge)

Tata Motors Limited sold 50,000 EVs in fiscal 2023, which was more than double the number in fiscal 2022.

In just 5 years, Tata Motors Limited’s EV sales volume has grown from 0 to 50,000.

The company said that the Nexon EV and Tigor EV have been the best-selling EV models.

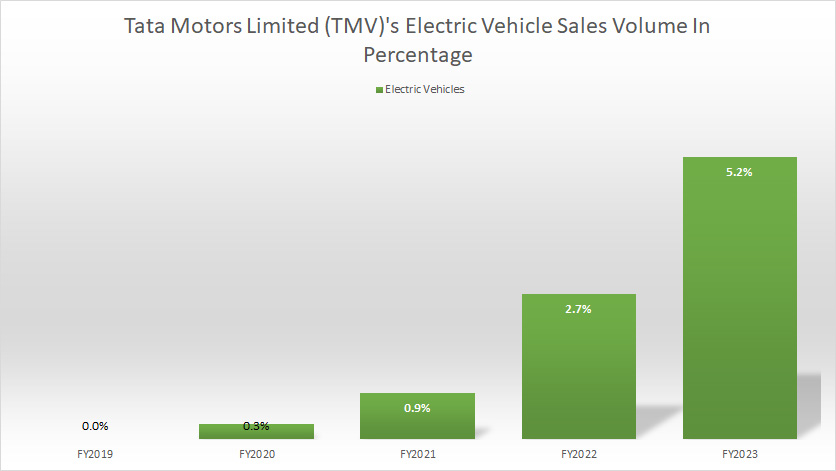

EV Sales Volume In Percentage

Tata Motors EV sales volume in percentage

(click image to enlarge)

As of fiscal 2023, Tata Motors Limited’s EV sales volumes accounted for 5.2% of the company’s total vehicle volume.

While the percentage may look small, the figure has been on the rise since 2019 and reached a record high in fiscal 2023.

Conclusion

To recap, Tata Motors Limited’s vehicle wholesale data is presented in this article, and the wholesale data is slightly different from the retail sales data.

Overall, Tata Motors Limited’s vehicle wholesale in FY2023 was one of the most impressive, with nearly all segments, be it domestic or overseas market, commercial or passenger segment, reporting considerable sales growth.

Credits And References

1. All sales data presented in this article were obtained and referenced from Tata Motors Group’s car sales reports which are available in Tata Investor Relation.

2. Featured images in this article are used under creative commons licenses and sourced from the following websites: Tata and Nexon Concept.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!