Car engine. Pexels Image.

This article presents General Motors’ (NYSE: GM) market share by region, with a specific focus on North America, Asia/Pacific, Middle East & Africa, South America, and Europe. These regions are selected due to their significant vehicle volumes, which play a crucial role in GM’s global sales strategy.

The market share statistics presented are based on GM’s market share results presented in the annual reports, calculated using the company’s total vehicle sales data divided by the industry volumes.

GM’s total vehicle sales data encompasses the company’s retail volumes, fleet sales, and vehicles used by dealers in their businesses.

More information about GM’s total vehicle sales is available here: GM’s total vehicle sales. GM’s method of calculating its market share is shown here: GM’s market share calculation.

Investors looking for other statistics of General Motors may find more resources on these pages:

- GM market share by country: U.S., China, Brazil, U.K., etc.,

- GM global sales and market share, and

- GM revenue breakdown: sales of new and used vehicles, services, etc..

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

- Total Vehicle Sales

- Market Share

- North America

- Asia/Pacific, Middle East, And Africa (AMEA)

- South America

O2. Why is General Motors’ market share in Asia on the decline?

America

A1. Market Share In North America

A2. Market Share In South America

AMEA

Europe

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Total Vehicle Sales: Per the latest annual report, General Motors defines its total vehicle sales as:

- retail sales (i.e., sales to consumers who purchase new vehicles from dealers or distributors);

- fleet sales (i.e., sales to large and small businesses, governments and daily rental car companies); and

- certain vehicles used by dealers in their business.

Total vehicle sales data includes all sales by joint ventures on a total vehicle basis, not based on the percentage ownership interest in the joint venture. Certain joint venture agreements in China allow for the contractual right to report vehicle sales of non-GM trademarked vehicles by those joint ventures, which are included in the total vehicle sales it reports for China.

While total vehicle sales data does not correlate directly to the revenue it recognizes during a particular period, GM believes it is indicative of the underlying demand for its vehicles.

Total vehicle sales data represents management’s good faith estimate based on sales reported by dealers, distributors and joint ventures; commercially available data sources such as registration and insurance data; and internal estimates and forecasts when other data is unavailable.

Market Share: GM’s market share is calculated by dividing the total vehicle sales of a particular country and region with the industry volume in that respective country and region.

Here is the formula:

\[\text{Market Share} = ( \frac{\text{Total Vehicle Sales}}{\text{Industry Volume}} ) \times 100\%\]

North America: North America includes the United States and others.

Asia/Pacific, Middle East, And Africa (AMEA): AMEA includes China and others.

South America: South America includes Brazil and others.

Why is General Motors’ market share in Asia on the decline?

General Motors (GM) has faced a significant decline in its market share in Asia due to several interconnected factors:

- China’s Market Dynamics: China, being the largest automotive market in Asia, has seen a surge in demand for electric vehicles (EVs). Local manufacturers like BYD and NIO, along with Tesla, have captured a significant portion of this market. GM’s EV offerings, while growing, have not been as competitive in terms of price, range, or innovation.

- Strategic Retreats: GM has scaled back its operations in several Asian countries, including India and Indonesia, as part of its global restructuring strategy. This decision, aimed at focusing on profitability, has reduced its presence in key markets.

- Partnership Challenges: In China, GM operates through joint ventures, such as SAIC-GM-Wuling. While these partnerships have been successful in the past, the competitive landscape and evolving consumer preferences have made it harder for GM to maintain its edge.

- Economic and Regulatory Pressures: Trade tensions, fluctuating economic conditions, and stringent environmental regulations in Asia have added to GM’s challenges. These factors have impacted production costs and market accessibility.

- Shift in Consumer Preferences: Asian consumers are increasingly favoring compact, fuel-efficient, and technologically advanced vehicles. GM’s portfolio, traditionally strong in larger vehicles like SUVs and trucks, has struggled to align with these preferences.

These factors have collectively contributed to GM’s decline in Asia.

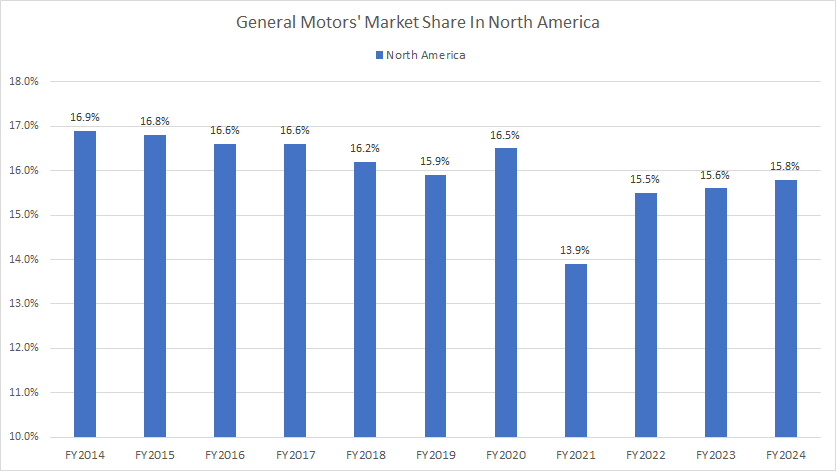

Market Share In North America

GM-market-share-north-america

(click image to expand)

The definition of GM’s market share is available here: market share. GM’s biggest market in North America is the United Staets.

General Motors (GM) reported a market share of nearly 16% in North America for fiscal year 2024, as highlighted in its latest annual report. This marks a steady trend over the past three years, with GM achieving market share of 15.6% in fiscal year 2023 and 15.5% in fiscal year 2022. Such consistency reflects GM’s ability to maintain its strong position in its home market.

One critical point in recent years was GM’s sharp decline in North American market share during fiscal year 2021. Market share plummeted to 14%, significantly below its typical range. This drop was largely influenced by global supply chain disruptions and production challenges caused by the COVID-19 pandemic, which affected the entire automotive industry. However, GM’s recovery in subsequent years has been remarkable, with the company regaining lost ground and reestablishing its presence in North America.

Looking at a broader timeline, from fiscal year 2014 to 2024, GM’s market share in North America experienced a slight but noteworthy decline, falling from 17% to 16% over the decade. This modest erosion could be attributed to increasing competition from other automakers, particularly in the electric vehicle (EV) segment, as well as evolving consumer preferences for innovative and technology-driven models.

Despite these challenges, GM has proven resilient in maintaining a solid foothold in North America. The company’s ongoing efforts to innovate, expand its EV portfolio, and strengthen its production capabilities suggest it is well-positioned to continue competing in the market. This stability underscores GM’s enduring brand strength and adaptability in navigating a highly competitive industry.

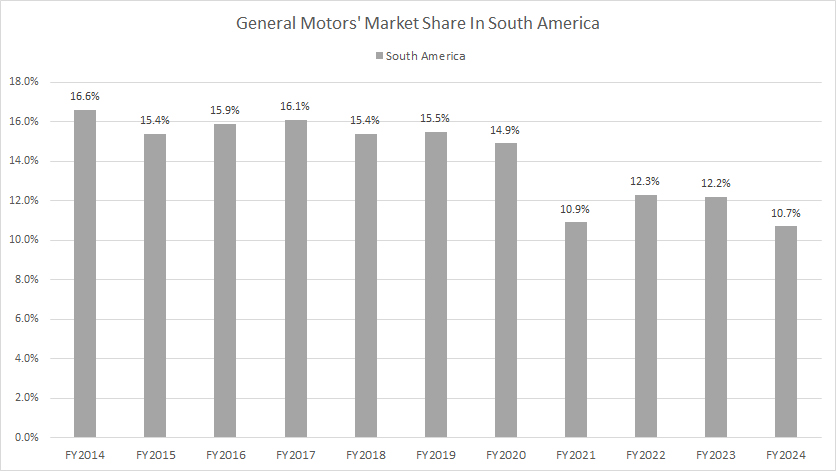

Market Share In South America

GM-market-share-south-america

(click image to expand)

The definition of GM’s market share is available here: market share. GM’s biggest market in South America is Brazil.

General Motors (GM) has experienced a declining market share in South America over the years, as shown in the accompanying graph.

In fiscal year 2024, GM’s market share in the region dropped to 10.7%, the lowest level reported in the past decade. This marks a notable decline compared to fiscal year 2023, when GM held a 12.2% market share, and fiscal year 2022, with a slightly higher share of 12.3%.

A significant dip in GM’s South American market share occurred in 2021, when it fell to 11%. This decline was largely attributed to disruptions caused by the COVID-19 pandemic, including production slowdowns, supply chain challenges, and weakened consumer demand. However, GM demonstrated resilience post-pandemic, recovering some of its lost ground in subsequent years.

Over the long term, spanning from fiscal year 2014 to 2024, GM’s market share in South America has eroded considerably, declining from 16.6% to 10.7%. This ten-year reduction underscores the serious obstacles the company faces in retaining its competitive edge in the region. Key factors contributing to this long-term decline include intensifying competition from local and global automakers, shifting consumer preferences, and economic volatility in South American countries.

Despite these challenges, GM has managed to sustain its presence in South America at a modest level, adapting its strategies to navigate the complexities of this highly competitive market. Its ability to weather these adversities reflects a degree of resilience, even as it contends with evolving market dynamics.

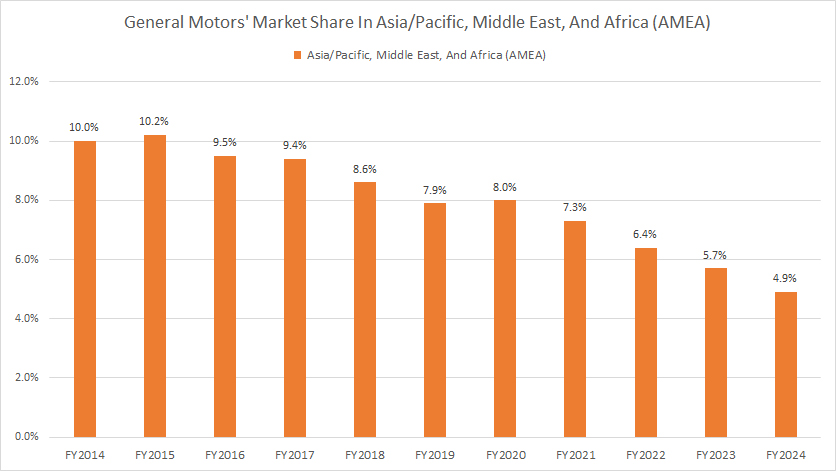

Market Share In AMEA

GM-market-share-amea

(click image to expand)

The definition of GM’s market share is available here: market share. GM’s biggest market in AMEA is China.

In the Asia-Pacific, Middle East, and Africa (AMEA) region, General Motors (GM) has faced a significant and ongoing decline in market share. Over the past decade, GM’s market share has dropped from 10% to just 5% as of fiscal year 2024 — a reduction of more than half.

The primary driver behind this decline is China, historically a key market for GM within the region. GM’s market share in China has faced a parallel erosion due to increased competition from local brands like BYD, NIO, and Great Wall Motors, as well as global competitors like Tesla. The surge in demand for electric vehicles (EVs) has further intensified competition, with GM struggling to match the pace of its rivals in innovation, pricing, and localized product offerings.

Additionally, GM’s performance across other AMEA markets remains challenging. Despite the post-pandemic recovery in global markets, GM has yet to regain momentum in this region. Economic factors, such as fluctuating currencies and inflation, combined with evolving consumer preferences and rising environmental regulations, have made it difficult for the company to stabilize its presence.

Over the long term, GM’s market share in the AMEA region demonstrates a continuous and persistent downward trend, with no apparent recovery in sight. The company’s challenges in this region highlight the urgent need for a more tailored strategy to combat competitive pressures and align with regional market demands. Without significant adjustments, GM risks further marginalization in one of the world’s most dynamic and rapidly evolving automotive landscapes.

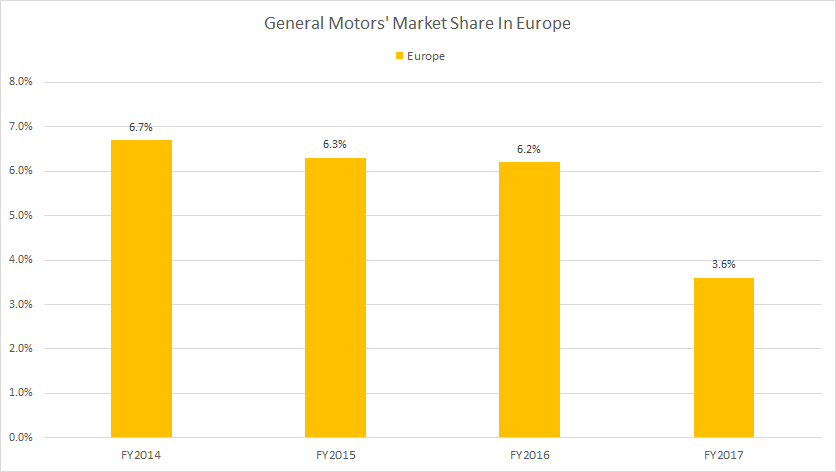

Market Share In Europe

GM-market-share-europe

(click image to expand)

The definition of GM’s market share is available here: market share. GM’s biggest market in Europe was the United Kingdom and Germany.

General Motors (GM) made a strategic decision to exit the European market in 2017 by fully divesting its European subsidiary, including its well-known brands, Opel and Vauxhall, which were sold to the PSA Group (now part of Stellantis). This marked the end of GM’s direct presence in Europe, a region it had been part of for decades.

The last available market share data from 2017 showed GM holding just 3.6% of the European market, a stark decline compared to its 6.2% share in 2016. This nearly 50% drop reflects the challenges GM faced in competing with strong European automakers such as Volkswagen, Renault, and BMW, as well as the increasing prominence of Asian brands in the region.

Historically, GM’s market share in Europe reached a peak of 6.7% in fiscal year 2014. However, this position eroded steadily in subsequent years, driven by several factors:

- Intense Competition: European markets are dominated by regional players who better catered to local consumer preferences, including fuel-efficient, compact vehicles.

- Cost Structures and Losses: GM struggled with high operational costs and recurring losses in Europe, which ultimately prompted the divestiture.

- Shifts in Strategy: GM opted to focus on core markets like North America and China, as well as on developing its electric and autonomous vehicle capabilities, rather than continuing to invest in Europe’s highly competitive landscape.

The decision to exit the European market allowed GM to redirect its resources and attention to other strategic priorities. While this move helped streamline the company’s global operations, it also marked the end of an era in which GM played a significant role in the European automotive sector.

Conclusion

Overall, while GM maintains strength in its core North American market, its performance in other regions highlights the challenges of adapting to local market dynamics and consumer trends. Regions like South America and the AMEA are characterized by declining market shares, and the exit from Europe signals a narrowing geographic footprint.

To sustain long-term growth and relevance, GM must bolster its global strategy, particularly in innovation (e.g., EVs), competitive pricing, and alignment with regional needs. The evolving automotive landscape demands adaptability, which will be critical for GM’s future trajectory.

Credits and References

1. All market share figures presented were obtained and referenced from General Motors’ annual reports published on the company’s investor relations page: GM Financial Reports.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.