Tata Telcoline pickup. Flickr Image.

This article highlights the vehicle sales statistics of Tata Motors, with a specific focus on the company’s vehicle wholesale figures. It is important to note that vehicle wholesale numbers can vary significantly from retail sales. For a detailed definition of vehicle wholesale, please refer to: vehicle wholesale.

In addition to examining global vehicle sales, this article delves into Tata Motors’ sales breakdown by segment and category. Tata Motors is divided into two major subsidiaries: Jaguar Land Rover and Tata. When discussing vehicle sales by category, we analyze the commercial vehicle and passenger vehicle sales of Tata Motors.

Let’s take a look!

Investors looking for other statistics of Tata Motors may find more information on these page: Tata Motors market share, Tata Motors sales by country, and Tata Motors passenger vehicle sales.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

Consolidated Sales

Sales By Segment

B1. Jaguar Land Rover And Tata Sales

B2. Jaguar Land Rover And Tata Sales In Percentage

Sales By Vehicle Type

C1. Commercial And Passenger Vehicle Sales

C2. Commercial And Passenger Vehicle Sales In Percentage

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Vehicle Wholesale: Vehicle wholesale refers to the sale of vehicles by manufacturers to dealerships, distributors, or other businesses that will then sell the vehicles to end consumers.

These transactions typically involve large quantities of vehicles and occur at a wholesale price, which is lower than the retail price paid by consumers.

Key Points:

- Manufacturers to Dealers: Manufacturers sell vehicles in bulk to dealerships or distributors.

- Wholesale Price: The price at which vehicles are sold to these intermediaries is lower than the retail price.

- Not Direct to Consumers: Wholesale transactions do not involve direct sales to the end consumer; instead, the vehicles are sold to businesses that will eventually sell them to consumers.

Vehicle wholesale can differ significantly from retail sales figures, as it tracks the movement of vehicles into the supply chain rather than directly into consumer hands.

Tata Commercial Vehicles: Tata commercial vehicles include small commercial vehicles & pickups (SCV & pickups), medium and heavy commercial vehicles, and intermediate light commercial vehicles and commercial vehicle passenger vehicles (CV passenger vehicles) manufactured under the Tata and Daewoo brands (and excludes vehicles manufactured under the Jaguar Land Rover brand).

Tata Passenger Vehicles: Tata passenger vehicles include passenger vehicles and utility vehicles manufactured under the Tata and Fiat brands (and excludes vehicles manufactured under the Jaguar Land Rover brand).

Jaguar Land Rover: Tata passenger vehicles include vehicles manufactured under the Jaguar Land Rover brand (and excludes vehicles manufactured under the Tata, Fiat, Daewoo and other brands).

In June 2008, Tata Motors acquired the Jaguar Land Rover business from Ford. Jaguar Land Rover is a global automotive business that designs, manufactures, and sells Jaguar luxury sedans, sports cars, luxury performance SUVs, and Land Rover premium all-terrain vehicles, as well as related parts, accessories, and merchandise.

Tata Daewoo: Tata Daewoo Commercial Vehicle Co. Ltd. (known as TDCV) is one of Korea’s leading commercial vehicle manufacturers. Its expansive portfolio of light, medium, and heavy-duty trucks is exported to over 90 countries.

In March 2004, Tata acquired TDCV. TDCV manufactures heavy, medium, and light vehicles, such as cargo trucks, dump trucks, tractor-trailers, and special-purpose vehicle mixers.

Passenger Cars: Tata-branded passenger cars include the Tiago (compact), Tiago EV, and the Altroz (premium) in the hatchback category, and the Tigor, Tigor EV, Xpres T-EV (mid-size) in the sedan

category.

Jaguar-branded passenger cars include the F-TYPE two-seater sports coupe and convertible, the XF sedan, the XE sports saloon, the F-PACE Jaguar’s luxury performance SUV, the Jaguar E-PACE compact SUV, and the Jaguar I-PACE.

Utility Vehicles: Tata-branded utility vehicles include the Harrier, the Nexon, the Nexon (EV), Nexon EV Max, Punch, and Safari.

There are seven car lines under the Land Rover umbrella, encompassing the luxury brands Range Rover, Defender, and Discovery, including the Range Rover, the Range Rover Sport, Range Rover Velar, Range Rover Evoque, Defender, Discovery, and Discovery Sport.

SCV & Pickup: Tata Motors manufactures a variety of small Commercial Vehicles and pickup trucks (less than 3.5 tons).

This includes the Tata Ace, India’s first indigenously developed mini-truck, with a sub-1 ton payload with different fuel options (Diesel, CNG, Gasolene, EV), the Tata Intra (V10, V20, V30, V50) with varying options of payload and the Tata Yodha pickup range with single cab and double cab variants and 4X2 and 4X4 options including the 2-Ton payload variant.

MHCV and ILCV: Tata Motors manufactures a variety of MHCVs and ILCVs, which include trucks, tractors, tippers, multi-axle vehicles and pickups with GVWs (including payload) of between 3.5 tons and 55 tons.

Tata Motors also provides fully built solutions for special applications like garbage compactors, containers, tankers, reefers, and diesel bowsers to customers and various government organizations, including solutions related to national defense. In addition, through TDCV, Tata Motors manufactures a wide array of trucks ranging from 215 horsepower to 560 horsepower, including dump trucks, tractor-trailers, mixers, and cargo vehicles.

Tata’s signature product is the Prima range of trucks, which are sold in India and South Korea and exported to several countries in South Asia, the Middle East, and Africa. The SIGNA range of new MHCV trucks launched in 2016 has been extended to several additional tractor and tipper variants.

Similarly, the newest addition to this portfolio—the Ultra range—now spans multiple tonnage points starting from 5-ton Light Commercial Vehicles (“LCV”) to 30-ton tractors.

CV Passenger Vehicles: Tata Motors manufactures a variety of passenger carriers, including buses. Its products include Magic Express, including an electric variant, a passenger variant for commercial transportation developed on the Tata Ace platform, and the Winger.

Tata also offers a range of buses, which includes the Semi Deluxe Starbus Ultra Contract Bus and the new Starbus Ultra. Its range of buses is intended for various uses, including intercity coaches (with air-conditioned and non-air-conditioned luxury variants), school transportation, and ambulances.

Tata also offers various electric buses in different configurations for every application.

Global Vehicle Sales

Tata-Motors-global-vehicle-wholesale

(click image to expand)

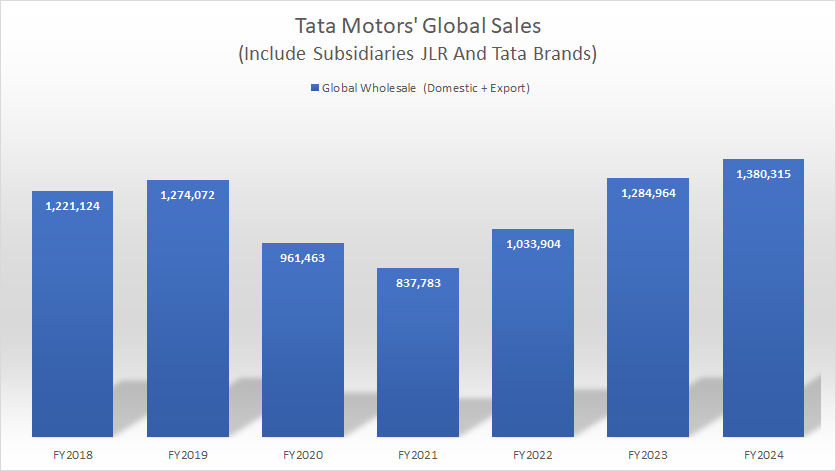

Tata Motors’ global vehicle sales reached 1.38 million units in fiscal year 2024, marking an 8% increase compared to fiscal year 2023 and a 34% rise compared to fiscal year 2022.

Since fiscal year 2021, Tata’s vehicle sales have seen remarkable growth, rising from 838,000 vehicles to 1.38 million units. This represents a 64% increase over a span of three years.

Additionally, Tata’s global sales in fiscal year 2024 significantly surpassed pre-pandemic levels, illustrating a remarkable recovery in the post-pandemic period.

Several major factors have driven the significant improvement in Tata Motors’ vehicle sales. One notable factor is the increase in government infrastructure initiatives. Following the end of the COVID pandemic, government spending on infrastructure projects has surged, boosting demand for Tata’s commercial vehicles.

Another crucial factor driving Tata Motors’ recovery is the global economic rebound in the post-pandemic period. The overall economic recovery has boosted consumer confidence and spending, leading to Tata Motors’ increased vehicle sales.

Jaguar Land Rover And Tata Sales

Tata-Motors-vehicle-wholesale-by-subsidiary

(click image to expand)

You can find the definition of vehicle wholesale here: vehicle wholesale. There is more information about Jaguar Land Rover here: Jaguar Land Rover.

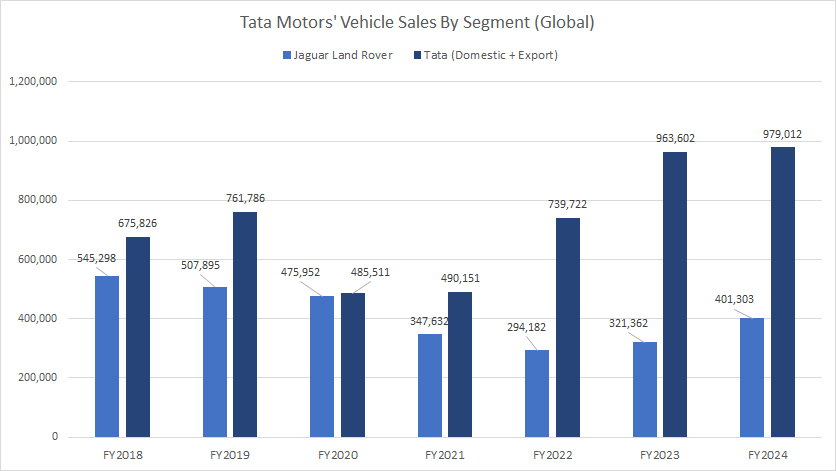

Jaguar Land Rover and Tata are two major subsidiaries of Tata Motors. Tata is subdivided into Tata Commercial and Tata Passenger segments which we will explore in the next section.

It is worth noting that Tata Motors’ division significantly outperformed Jaguar Land Rover in terms of vehicle sales. In fiscal year 2024, Tata Motors’ sales were more than double those of JLR, with Tata delivering 979,000 vehicles compared to JLR’s 401,300 units, as shown in the graph above.

A notable trend is the decline in Jaguar Land Rover (JLR) vehicle sales since fiscal year 2018. JLR’s vehicle sales have dropped from over 545,000 units in fiscal year 2018 to 401,000 units in fiscal year 2024, representing a 36% decrease over six years. Also, the sales decline of JLR has been further worsened by the COVID pandemic.

The encouraging news is that JLR’s global sales are showing a modest recovery in the post-pandemic period. For instance, since fiscal year 2022, JLR’s worldwide vehicle sales have significantly improved, rising from 294,000 units to over 401,000 vehicles in fiscal year 2024.

Similarly, between fiscal year 2022 and 2024, Tata has experienced a recovery, with global vehicle sales increasing from 739,700 units to 979,000 units. However, Tata has seen a much faster growth compared to Jaguar Land Rover in post-pandemic period.

For example, in fiscal year 2024, Tata’s global vehicle sales significantly exceeded pre-pandemic levels, while JLR’s sales remained well below their pre-pandemic highs.

There are more statistics about JLR’s sales here: JLR sales by region, Jaguar sales by model, and Land Rover top-selling cars.

Jaguar Land Rover And Tata Sales In Percentage

Tata-Motors-vehicle-wholesale-by-subsidiary-in-percentage

(click image to expand)

You can find the definition of vehicle wholesale here: vehicle wholesale. There is more information about Jaguar Land Rover here: Jaguar Land Rover.

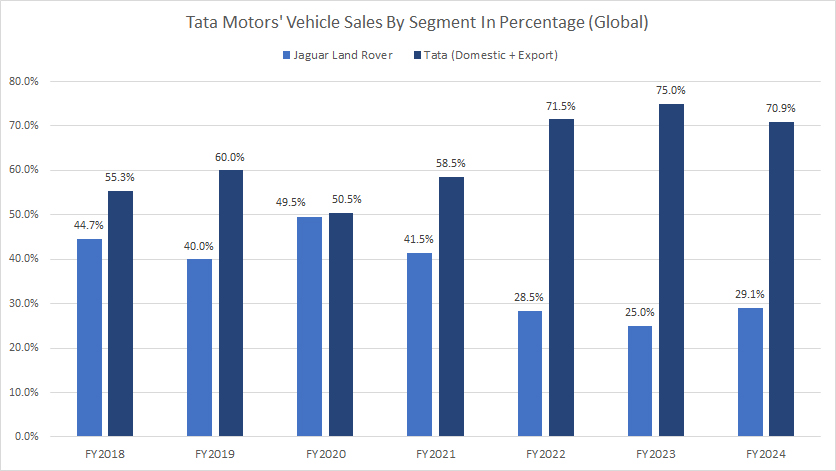

As illustrated in the chart above, the Tata segment has consistently accounted for the majority of Tata Motors’ global wholesale vehicle sales across most fiscal years.

In fiscal year 2024, the Tata segment accounted for approximately 71% of Tata Motors’ global wholesale volume, whereas Jaguar Land Rover contributed just 29%.

A noticeable trend is the significant increase in Tata’s percentage figures over the years, rising from 55% in fiscal year 2018 to 71% in fiscal year 2024. Conversely, Jaguar Land Rover’s (JLR) percentage has decreased from 45% in fiscal year 2018 to 29% in fiscal year 2024.

This shift isn’t surprising, as the Tata subsidiary primarily targets the mainstream vehicle market, while JLR focuses on the luxury segment. In essence, the Tata segment delivers significantly more vehicles than JLR.

Commercial And Passenger Vehicle Sales

Tata-Motors-commercial-and-passenger-vehicle-wholesale

(click image to expand)

The definitions of Tata commercial and passenger vehicles are available here: Tata Commercial Vehicles and Tata Passenger Vehicles.

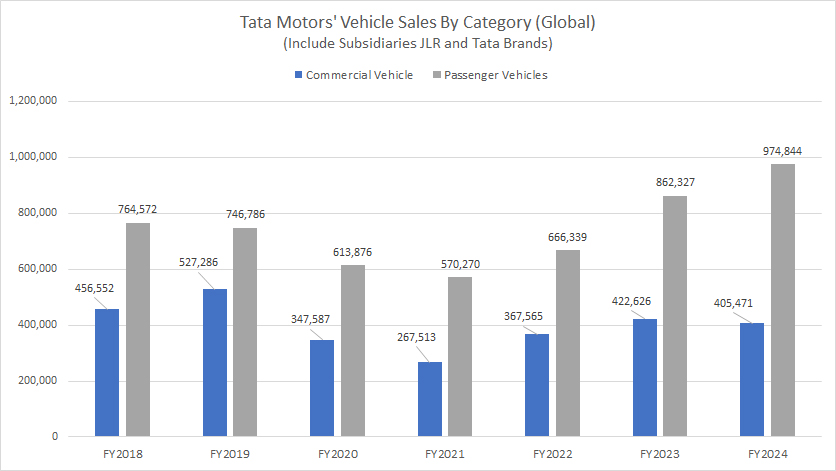

As illustrated in the chart above, Tata Motors sells significantly more passenger vehicles compared to commercial vehicles on a global scale.

In fiscal year 2024, Tata Motors’ passenger vehicle sales reached 974,800 units, significantly outpacing the 405,500 commercial vehicles sold. This means that the sales volume of passenger vehicles is more than double that of commercial vehicles.

Although the sales of both categories of vehicles have significantly recovered post-pandemic, the passenger vehicle segment has experienced a much faster growth rate, substantially outpacing the commercial vehicle category.

For instance, since fiscal year 2021, Tata Motors’ passenger vehicle segment has surged by 71%, markedly exceeding the 51% growth rate observed in the commercial vehicle segment.

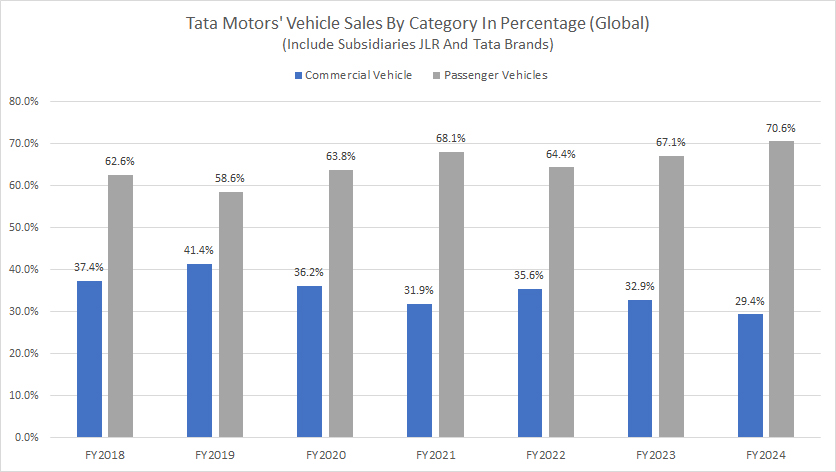

Commercial And Passenger Vehicle Sales In Percentage

Tata-Motors-commercial-and-passenger-vehicle-wholesale-in-percentage

(click image to expand)

The definitions of Tata commercial and passenger vehicles are available here: Tata Commercial Vehicles and Tata Passenger Vehicles.

As illustrated in the chart above, Tata Motors’ passenger vehicle category has consistently accounted for the majority of its worldwide vehicle sales volume.

In fiscal year 2024, the ratio from the passenger vehicle category reached a record figure of 71%, while the commercial vehicle category contributed only 29%.

A significant trend is the steady increase in the sales contribution from Tata Motors’ passenger vehicle category, which has grown from 63% in fiscal year 2018 to 71% in fiscal year 2024.

Conversely, the sales contribution from Tata Motors’ commercial vehicle category has declined from 37% to 29% over the same period.

The significant and rapid rise in the sales contribution from Tata Motors’ passenger vehicle category highlights the faster growth rate in this segment than the commercial vehicle category.

Conclusion

Tata Motors has shown remarkable growth and recovery in its vehicle sales over recent years. These insights underscore Tata Motors’ resilience and strategic growth in the global vehicle market, particularly in the passenger vehicle segment.

Credits And References

1. All financial data presented in this article was obtained and referenced from Tata Motors’ annual reports published in the company’s investors relation page: Tata’s Annual Reports.

2. Flickr Images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!