Tobacco. Flickr Image.

Altria Group (NYSE:MO) is probably one of the best-run companies in the world.

Altria’s businesses involve not only cigarettes but also oral tobacco products as well as wine.

As recent as 2019, the company also has ventured into non-combustible products such as the IQOS and the respective consumables through a licensing agreement with Philip Morris International (PMI).

For your information, Altria is a licensed distributor of PMI’s IQOS and the respective consumables in the U.S.

The tobacco business is highly competitive and requires huge investment as well as time to build up not only the brands but also the distribution network.

Aside from the huge upfront capital requirement, the tobacco and cigarette businesses are difficult to break into due mainly to the tough regulatory environment.

As a result, Altria has a huge moat in these businesses where there are literally no compelling competitors.

For this reason, Altria is a very profitable company and has made tonnes of profits over the years.

With a large profit, Altria has been able to return tonnes of cash to stockholders in the form of stock buybacks and cash dividends.

In this article, we will explore Altria’s profitability from the perspective of several metrics, including the gross profit, operating income, net profit and earnings per share.

Let’s have a look.

Altria Profitability Topics

1. Gross Profit

2. Operating Companies Income (OCI)

3. Operating Income (EBIT)

4. Earnings Before Taxes (EBT)

5. Net Profit

6. Earnings Per Share (EPS)

7. Adjusted Earnings Per Share (Adjusted EPS)

8. Summary

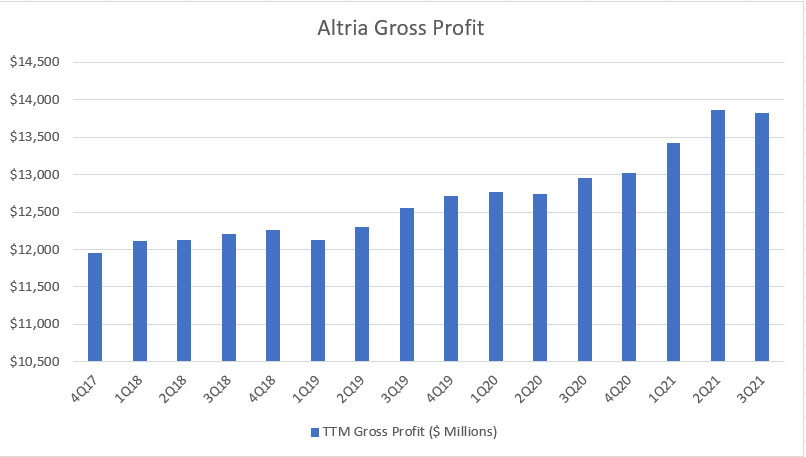

Altria’s Gross Profit

Altria gross profits

When we explore Altria’s profitability, the first thing that we look at will be the gross profit.

The gross profit expresses Altria Group’s consolidated or total profitability after accounting for only costs of goods sold.

Other expenses such as research and development, marketing and administrative costs have yet to be taken into consideration in gross profit.

All told, Altria’s gross profits have been rising steadily in the last 5 years since fiscal 2017 as shown in the chart above.

On a TTM basis, Altria reached a record high in gross profit at $13.8 billion as of fiscal 3Q 2021.

Year over year, Altria’s gross profit grew about 6% in fiscal 3Q 2021.

Since fiscal 2017, Altria has been able to have a steady growth in its gross profits despite the tough business environment and the continuous regulatory crackdown on smoking all these years.

In fiscal 2021, Altria still managed to eke out a significant growth in gross profitability despite the adverse impact of the COVID-19 pandemic on the economy.

To date, Altria’s companies have not experienced any material impact associated with consumers’ movement restriction as the majority of retail stores in which Altria’s products are sold have been deemed as essential by the authorities and will remain open.

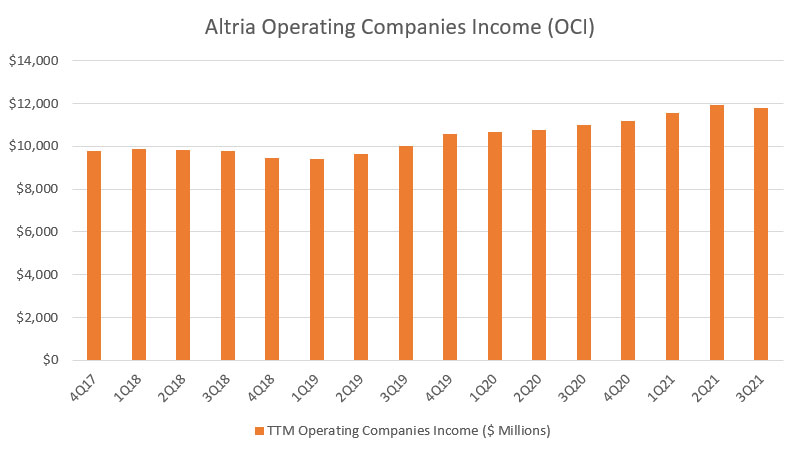

Altria’s Operating Companies Income (OCI)

Altria operating companies income

Altria’s operating companies income or OCI is a metric specifically designed to evaluate the performance and allocation of resources to a business segment by the management.

The OCI is a non-GAAP measure that comes after the gross profit and it accounts for marketing, administrative as well as r&d costs that have been excluded from the gross profit.

The OCI is similar to the operating income, but with certain items excluded, and is meant for measuring Altria’s core operating strength before any other non-core items such as interest expenses, earnings from equity investments, gain or loss from financial instruments, etc are taken into considerations.

That said, Altria’s OCI also has been on a rising trend since fiscal 2017 as seen in the chart above.

As of 2021 Q3, Altria’s OCI reached about $11.8 billion on a TTM basis, one of the highest OCIs ever recorded by the company.

Year over year, the 3rd quarter result grew 7%.

On a long-term basis, Altria’s OCI has been on a rising trend.

Over the chart, you may notice that Altria’s OCI grew significantly in fiscal 2020 despite the COVID-19 outbreak.

While Altria is still very far off from being a growth stock, the steady rise in the OCI means a lot to the company and investors.

In this case, the growing OCI represents Altria’s growing operating strength and thus, growing profitability.

In short, Altria’s core businesses are making money and thriving.

Altria’s Operating Income (EBIT)

Altria operating income

As mentioned, the operating income is similar to the OCI.

However, the OCI excludes certain items such as the amortization of intangibles, general corporate expenses, corporate asset impairment and exit costs.

Unlike the OCI, the operating income or earnings before interest and taxes (EBIT) includes these items and is a GAAP measure.

All told, Altria’s operating income is having a similar trend as the previous OCI.

As of 2021 Q3, Altria’s operating income reached one of the highest figures at $11.4 billion on a TTM basis, representing a year-on-year growth rate of 7%.

On a long-term basis, Altria’s operating income has been growing and it has been doing so even during one of the worst outbreaks in the U.S.

The growth of the operating income is an important signal for not only Altria but also the shareholders as it indicates Altria’s strengthening core operation.

In other words, Altria’s core businesses are thriving.

All in all, Altria is making money on the back of its growing core businesses.

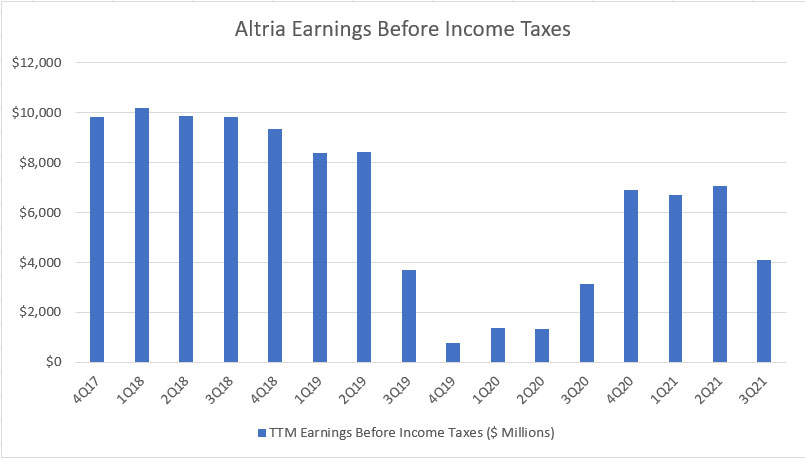

Altria’s Earnings Before Income Taxes (EBT)

Altria earnings before tax

When we take into consideration of Altria’s interest expenses and gains or losses from equity investments as well as gains or losses from financial instruments, Altria has not been doing so well.

As seen in the chart above, Altria’s earnings before income taxes or EBT has been going downhill for the period from fiscal 2017 to 2021.

Altria’s earnings before taxes had been the worst between fiscal 2019 and 2020, with some quarters reaching less than $1 billion on a TTM basis.

Prior to 2020, Altria suffered from one of the worst blunders in the company’s history – investments in JUUL and Cronos.

A detailed investigation into Altria’s financials revealed that Altria had incurred impairment charges that spanned multiple quarters in 2019.

Some of the impairment charges were a result of JUUL investments that have cost Altria nearly $10 billion in losses.

Additionally, Altria also suffered losses in Cronos-related financial instruments totaling more than $1 billion in 2019.

As a result, Altria has incurred losses totaling more than $10 billion between 2019 and 2020 which then led to the decline in earnings before taxes.

Fortunately, Altria’s EBT recovered in fiscal 2020 and was seen reaching as much as $6.9 billion in Q4 2020 on a TTM basis.

While Altria’s earnings before taxes were seen rising into fiscal 2021, it suffered significant losses gain in fiscal Q3 2021 as a result of the equity investment in ABI.

Therefore, Altria’s EBT declined to only $4 billion as of fiscal 3Q 2021 from the prior result of $7 billion.

However, Altria’s EBIT still rose 30% from a year ago as of fiscal 3Q 2021 despite recording significant losses from equity investments in ABI.

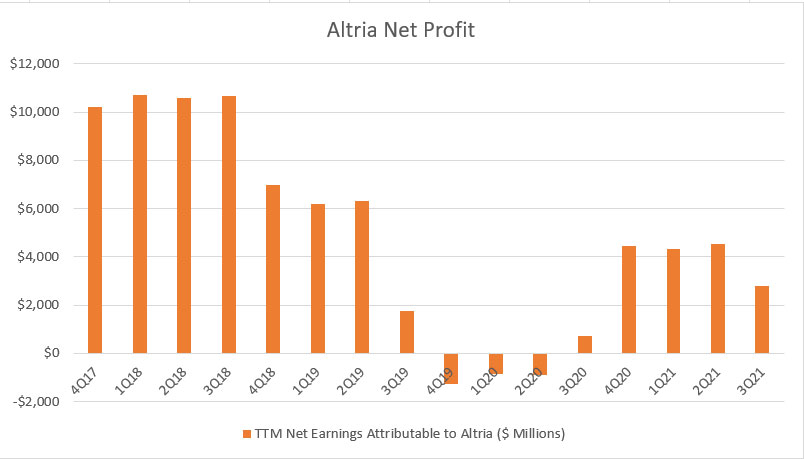

Altria’s Net Profit (EAT)

Altria earnings after tax

The next profitability metric after earnings before tax will be the earnings after-tax or net profit attributable to Altria.

Keep in mind that the EAT is a GAAP measure and is the final profits available to Altria’s common stock shareholders after accounting for all expenses incurred by the company.

The earnings after-tax or net profit should be lower than the earnings before tax after taking into account the taxes that have been incurred.

That said, according to the chart, Altria’s net profit is considerably lower than the earnings before taxes in most results and some of them are even in the negative regions after accounting for taxes.

Similar to the downtrend observed in the EBT, Altria incurred huge losses between fiscal 2019 and 2020 due mainly to the impairment charges related to the company’s JUUL and Cronos investments.

As of fiscal 2021 3Q, Altria’s net profit came in at only $2.8 billion on a TTM basis, more than a 100% jump from the quarter a year ago but was 40% down from the previous quarter.

While Altria’s net profit was significant down in the latest quarter, the fiscal 2021 results had been considerably higher than that in fiscal 2020, suggesting that the company has significantly recovered from huge losses seen in fiscal 2020.

More importantly, Altria’s losses since fiscal 2020 should have already baked in all impairment charges and losses from equity investments.

As a result, Altria should be able to report significantly higher net profits going forward.

Altria’s Earnings Per Share (EPS)

Altria earnings per share

Altria’s earnings per share or EPS is the final profitability metric that expresses the company’s profits on a per-share basis.

The EPS is also one of the most important numbers available to investors and most share prices are valued based on the EPS.

For example, the PE ratio is one of the valuation metrics based entirely on the EPS.

However, the EPS can be manipulated in a way that is referred to as the financial engineering in which the company buys back a considerable number of shares outstanding.

The result will be a smaller number of shares outstanding and hence, a higher EPS.

To rule out the effect of the share buyback, investors may supplement their review of the EPS with other profitability metrics, including the gross profit and operating income.

These profitability metrics rule out not only the share buyback effects but also non-core-related incomes as well as expenses that may distort the realistic profitability nature of a company.

That said, Altria’s earnings per share or EPS have been on a downtrend since fiscal 2017.

Similarly, the declining EPS has been driven largely by Altria’s losses in some of its investments, including JUUL and Cronos.

As of 2021 Q3, Altria’s EPS stood at $1.48 on a TTM basis, representing more than 100% growth from the quarter a year ago but was down 40% from the prior quarter.

Similar to the net income, Altria’s earnings per share also have recovered quite substantially in fiscal 2021 from the prior year, suggesting the path to recovery is happening.

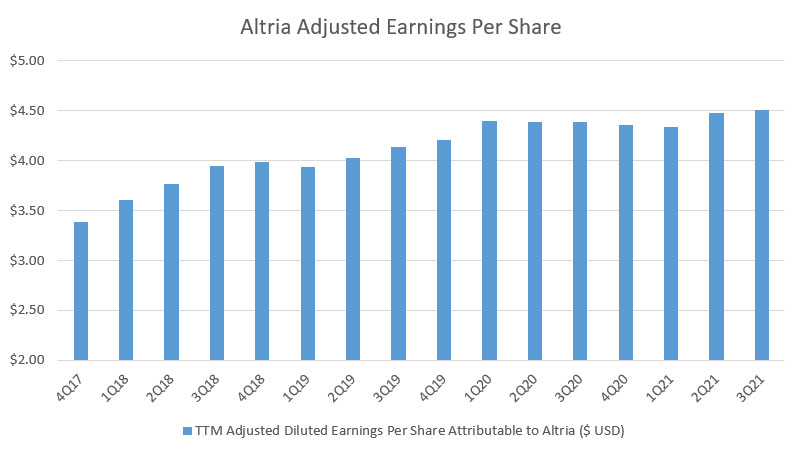

Altria’s Adjusted Earnings Per Share (Adjusted EPS)

Altria adjusted earnings per share

Altria has its own earnings per share metric which are referred to as the adjusted earnings per share.

The adjusted earnings per share or adjusted EPS is a non-GAAP measure calculated by Altria and excludes certain income and expense items in which Altria management believes are not part of the underlying operations.

Altria considers these special items as highly variable, unusual or infrequent, are difficult to predict and can distort the underlying business trends and results.

For this reason, Altria created its own earnings per share or adjusted EPS to rule out the effect of these special items.

Similar to the OCI, Altria’s adjusted EPS is designed to specifically track the core profitability but on a per-share basis.

That said, Altria’s adjusted EPS looks vastly different from the non-adjusted EPS seen in the prior discussion.

For instance, Altria’s adjusted EPS totaled $4.51 on a TTM basis in Q3 2021 compared to the GAAP EPS figure of $1.48 reported in the same quarter.

Additionally, the long-term trend of both charts also looks vastly different.

In this case, the adjusted EPS has been on a rising trend whereas the GAAP figures have been going in the opposite direction.

The rising trend in the adjusted EPS is due mainly to the adjustment made to exclude special items such as the impairment charges and equity investment losses in JUUL, Cronos and ABI.

As a result, Altria’s adjusted EPS has not been distorted by these special items and focuses only on the company’s core profitability.

That said, it is a relief to see Altria’s adjusted EPS growth in the last 5 years since fiscal 2017.

Since fiscal 2017 4Q, Altria’s adjusted EPS have grown more than 30%, indicating that Altria’s core businesses have performed well and are thriving.

Additionally, Altria bases its dividend payout on the adjusted EPS.

In this case, Altria intends to pay out as much as 80% of the adjusted EPS as dividends.

Therefore, Altria’s dividends tend to grow when the adjusted EPS is growing too.

In short, dividend investors who are seeking a rising income from Altria should track the company’s adjusted EPS from time to time.

Summary

In conclusion, Altria’s profitability grew on all metrics, particularly the gross profits, and the operating income, indicating the strengthening of the company’s core businesses.

However, when impairment charges and losses from equity investment were taken into consideration, Altria suffered severely in profitability.

Specifically, Altria’s earnings before tax, net income and EPS have been adversely impacted between fiscal 2019 and 2021.

In those periods, Altria incurred multiple huge impairment charges and losses from equity investment related to JUUL, Cronos and ABI.

However, these profitability metrics recovered substantially by fiscal 2021, suggesting that most losses should have already been accounted for.

Therefore, Altria should be able to report significantly higher profitability going into fiscal 2022.

Credits And References

1. All financial data in this article was obtained and referenced from Altria’s annual and quarterly filings which are available in Altria’s SEC Filings.

2. Featured images in this article are used under creative commons licenses and sourced from the following websites: Mark Herpel and simone.brunozzi.

Top Statistics For Your Reference

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future. Thank you!