Euro. Pixabay image.

Stellantis is a multinational automotive company formed in January 2021 by merging Fiat Chrysler Automobiles (FCA) and Peugeot S.A. The company is headquartered in Amsterdam, Netherlands.

It has a strong presence in Europe, operating under several well-known brands such as Peugeot, Citroën, Opel, Vauxhall, Fiat, Alfa Romeo, and Jeep. Stellantis is one of the largest automakers in Europe, with a market share of around 18% in 2023.

The company has a wide range of products, from small city cars to luxury SUVs. It invests heavily in electric and hybrid vehicles to meet the growing demand for sustainable mobility. Overall, Stellantis is a major player in the European automotive industry with a diverse portfolio of brands and a commitment to innovation and sustainability.

This article covers Stellantis’ vehicle sales and market share in Europe, as well as its competitive position in Europe versus its competitors.

Let’s get started!

Investors interested in Stellantis’ vehicle sales and market share in North America may find more information on this page: Stellantis US sales and market share.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Stellantis Business Strategy In Europe

O3. How Stellantis Distributes Its Vehicles In Europe

O4. How Stellantis Provides Financing To Customers In Europe

Consolidated Sales

A1. Vehicle Sales In Enlarged Europe

A2. YoY Growth Rates Of Vehicle Sales In Enlarged Europe

Sales By Region

A3. Vehicle Sales In Europe30

A4. Vehicle Sales In Other Europe

Sales By Country

B1. Vehicle Sales In France, Italy, Germany, UK, And Spain

B2. Percentage Of Vehicle Sales In France, Italy, Germany, UK, And Spain

B3. YoY Growth Rates Of Vehicle Sales In France, Italy, Germany, UK, And Spain

Consolidated Market Share

C1. Market Share In Enlarged Europe

C2. Market Share In Europe30

Market Share By Country

D1. Market Share In France, Italy, Germany, UK, And Spain

Market Share Vs Competitors

E1. Market Share In Europe30 Vs Competitors

E2. Market Share Before The Merger

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Enlarged Europe: Stellantis defines the Enlarged Europe as Europe30 plus Other Europe.

The definition of Europe30 can be found here: Europe30.

Other Europe includes Eurasia (Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Moldova, Russia, Ukraine, Uzbekistan) and other Europe (Albania, Bosnia, Kosovo, Malta, Montenegro, North Macedonia and Serbia).

Basically, Enlarged Europe is defined in the following equation:

Enlarged Europe = Europe30 + Other Europe

Europe 30: Europe 30 includes the 27 members of the European Union excluding Malta and including Iceland, Norway, Switzerland and UK.

Basically, Europe 30 is defined in the following equation:

Europe 30 = Europe 27 (excluding Malta) + Iceland + Norway + Switzerland + UK

Other Europe: According to Stellantis’ 2023 annual report, Other Europe = Eurasia (Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Moldova, Russia, Ukraine, Uzbekistan) and other Europe (Albania, Bosnia, Kosovo, Malta, Montenegro, North Macedonia, Serbia and Ukraine).

New Vehicle Sales: Stellentis defines its new vehicle sales as the sales of vehicles primarily by dealers and distributors or, directly by the company in some cases, to retail customers and fleet customers.

Sales include mass-market and luxury vehicles manufactured at Stellantis’ plants and vehicles manufactured by joint ventures and third-party contract manufacturers and distributed under its brands. Sales figures exclude sales of vehicles that it contracts to manufacture for other OEMs.

While vehicle sales are illustrative of Stellantis’s competitive position and the demand for its vehicles, sales are not directly correlated to net revenues, cost of revenues, or other measures of financial performance in any given period.

For a discussion of Stellantis’ vehicle shipments that directly correlate to its Net revenues, Cost Of revenues, and other financial measures, you may visit this article: Stellantis vehicle wholesale.

Stellantis Business Strategy In Europe

Stellantis’ business strategy in Europe is centered around leveraging its diverse portfolio of brands to meet the needs of a wide range of customers.

The company aims to maintain and grow its market share by offering innovative, sustainable, high-quality products that meet consumers’ evolving needs. Stellantis invests heavily in research and development to stay ahead of the competition and to anticipate changes in consumer preferences and trends.

The company is also focused on expanding its presence in emerging markets and is committed to producing electric and hybrid vehicles to meet the growing demand for sustainable mobility.

Also, Stellantis’ European sales are largely weighted to passenger cars, with an estimated 65.0 percent of total vehicle sales in the small car segment (A and B segments) for 2022. This reflects the demand for smaller vehicles due to driving conditions prevalent in many European cities and stringent environmental regulations.

Therefore, Stellantis’ strategy in the European region also revolves around the small sedan segment to meet the demand for smaller vehicles in this region.

Additionally, Stellantis strongly focuses on operational efficiency and cost management to ensure sustainable profitability and long-term success.

How Stellantis Distributes Its Vehicles In Europe

Stellantis sells its vehicles directly to independent and owned dealer entities located in most European markets and fleet customers (including government and rental).

In other markets and in segments where it does not have a substantial presence, it will have agreements with general distributors.

In 2021, Stellantis underwent a transformation process where it terminated its distribution contracts and consulted its networks about future distribution models. This process was initiated to prepare for implementing new distribution schemes, which are set to begin in July 2023.

How Stellantis Provides Financing To Customers In Europe

Stellantis provides financing to European customers through its in-house financing arm, Stellantis Financial Services.

Through Stellantis Financial Services, customers can access various financing options, including loans and leasing, to purchase or lease new and used vehicles.

The financing arm also offers insurance products to customers, such as extended warranties and GAP insurance. Customers can apply for financing online or at Stellantis dealerships, and the financing terms are tailored to their individual needs and creditworthiness.

Stellantis Financial Services operates in several European countries, including France, Germany, Italy, Spain, and the United Kingdom.

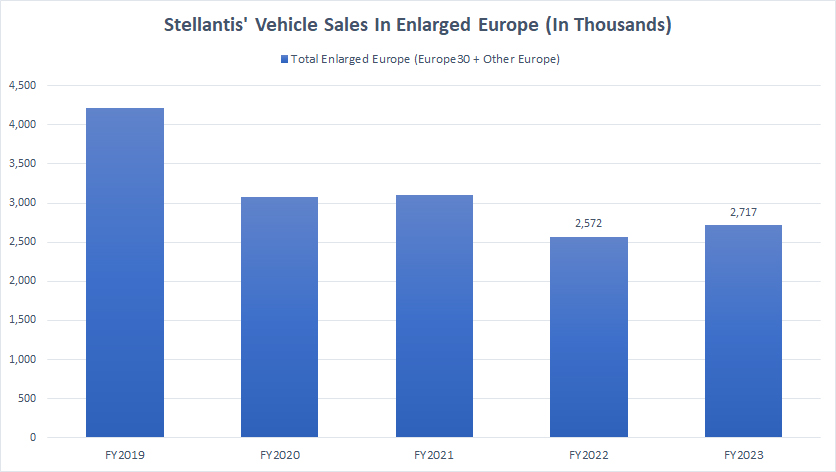

Vehicle Sales In Enlarged Europe

Stellantis-vehicle-sales-in-Enlarged-Europe

(click image to expand)

A definition of Stellantis’ Enlarged Europe and new vehicle sales can be found here: Enlarged Europe and vehicle sales.

Stellantis’ new vehicle sales in Enlarged Europe reached 2.7 million units in fiscal year 2023, up slightly from 2.6 million in 2022, according to its 2023 annual report.

Stellantis used to deliver more than 4.0 million vehicles in Enlarged Europe. For example, the estimated vehicle sales in 2019 exceeded 4 million units, and roughly 3 million vehicles were sold in 2020 and 2021, respectively.

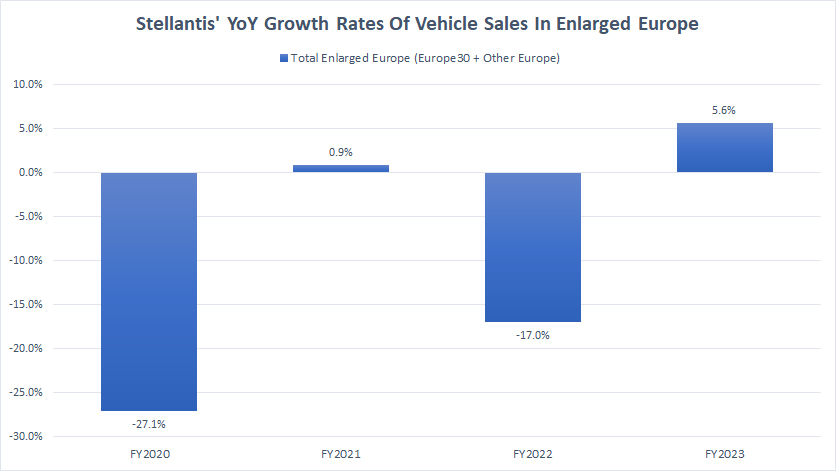

YoY Growth Rates Of Vehicle Sales In Enlarged Europe

Stellantis-yoy-growth-rates-of-vehicle-sales-in-Enlarged-Europe

(click image to expand)

A definition of Stellantis’ Enlarged Europe and new vehicle sales can be found here: Enlarged Europe and vehicle sales.

Stellantis’ new vehicle sales in Enlarged Europe in 2023 grew 5.6% from the previous year versus a decrease of 17% in 2022.

On average, Stellantis’ YoY growth rates in Enlarged Europe has declined by 3.5% annually since 2021.

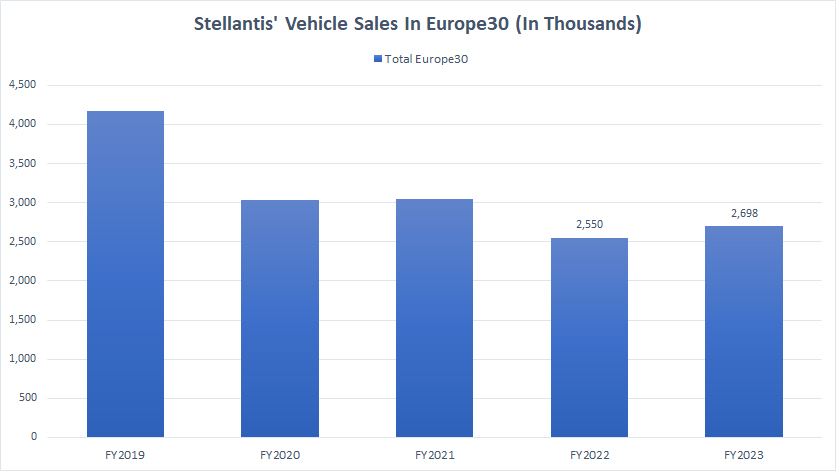

Vehicle Sales In Europe30

Stellantis-vehicle-sales-in-Europe-30

(click image to expand)

A definition of Stellantis’ Europe30 and new vehicle sales can be found here: Europe30 and vehicle sales.

Stellantis’ retail sales in Europe30 topped 2.7 million vehicles in fiscal year 2023, up 6% year-over-year compared to a decrease of 16% in 2022, according to its 2023 annual report.

Stellantis’ vehicle sales in Europe30 in 2019 were estimated at over 4 million units, while roughly 3 million vehicles were sold in 2020 and 2021, respectively, which were much higher than the figure in 2023.

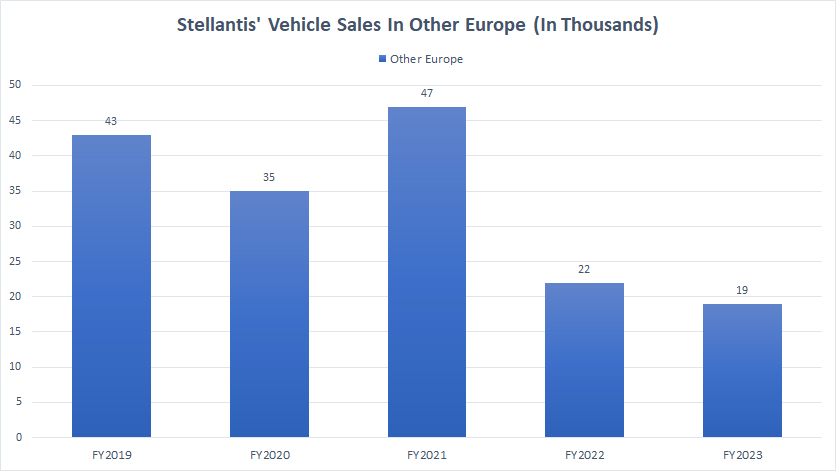

Vehicle Sales In Other Europe

Stellantis-vehicle-sales-in-Other-Europe

(click image to expand)

A definition of Stellantis’ Other Europe and new vehicle sales can be found here: Other Europe and vehicle sales.

Stellantis delivered just 19 thousand vehicles in European countries in Other Europe. This figure was slgithly lower than the 22 thousand vehicles sold in 2022 and was massively down from the 47 thousand units sold in 2021.

In fact, Stellantis’ new vehicle sales in countries in Other Europe in 2023 was less than half of the vehicles sold in 2021.

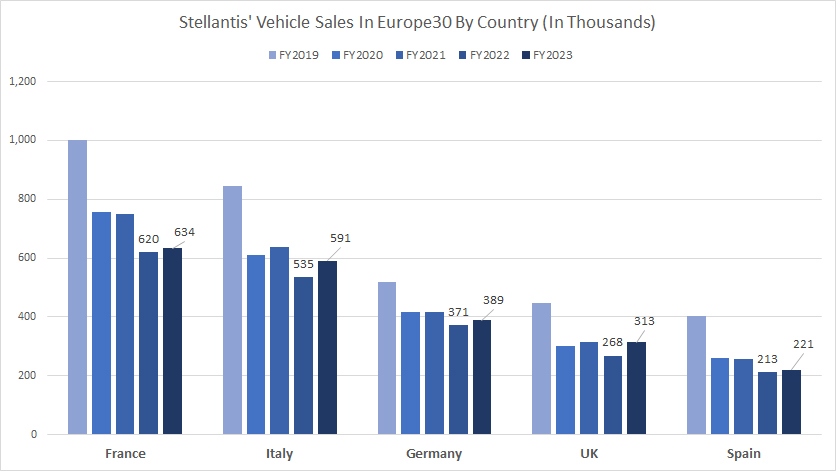

Vehicle Sales In France, Italy, Germany, UK, And Spain

Stellantis-vehicle-sales-in-Europe-30-by-country

(click image to expand)

Stellantis’ biggest market in Europe30 is France, with vehicle sales reaching 634 thousand in fiscal year 2023. The automaker sold 620 thousand vehicles in France in 2022.

Stellantis’ second biggest market in Europe30 is Italy. The company’s retail volume in this country topped slightly over half a million vehicles in fiscal year 2022, and it sold nearly 600 thousand vehicle in Italy in 2023.

Germany contributed about 389,000 vehicles to Stellantis in fiscal 2023 versus 371,000 units in 2022, making this country the third-largest market for the company in Europe.

The UK and Spain were Stellantis’ fourth and fifth largest markets in Europe, contributing sales of about 313,000 and 221,000 vehicles to the company in 2023.

A noticeable trend is that Stellantis vehicle sales increased in most European countries in 2023, following a decrease in sales in 2022 compared to the previous year.

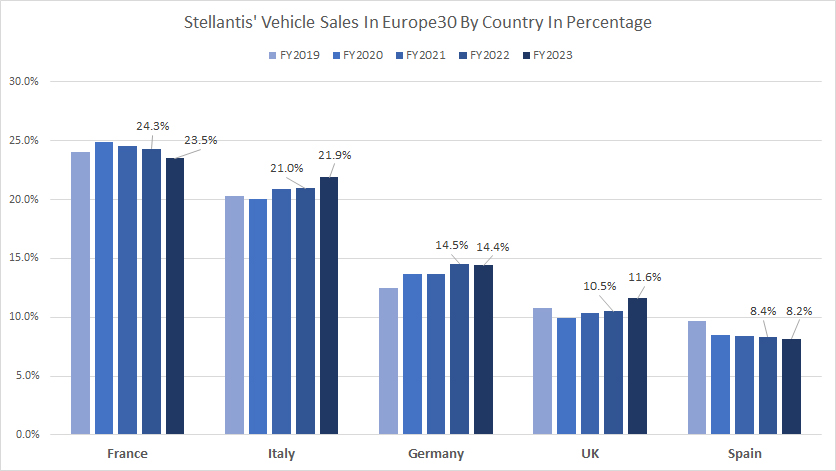

Percentage Of Vehicle Sales In France, Italy, Germany, UK, And Spain

Stellantis-vehicle-sales-in-Europe-30-by-country-in-percentage

(click image to expand)

France contributed about 23.5% of sales to Stellantis in fiscal year 2023, while Italy contributed 22% of sales to the company during the same period. These two countries have contributed the biggest number of vehicle volumes to the company in most fiscal years.

On the other hand, new vehicle sales from Germany made up just 14.4% of Stellantis’ total retail volume in Europe in fiscal year 2023.

Stellantis’ sales in the UK represented only 11.6% of its total volume in Europe in fiscal year 2023, while Spain came in at 8.2% in the same period.

Most European countries have seen their sales contributions steadily increasing over the last three years since 2021. However, France and Spain have experienced a decrease in sales contribution over the last three years.

For example, the sales contribution from France has decreased from nearly 25% in 2021 to 23.5% as of 2023, while Spain’s ratio has decreased from 8.4% to 8.2% during the same period.

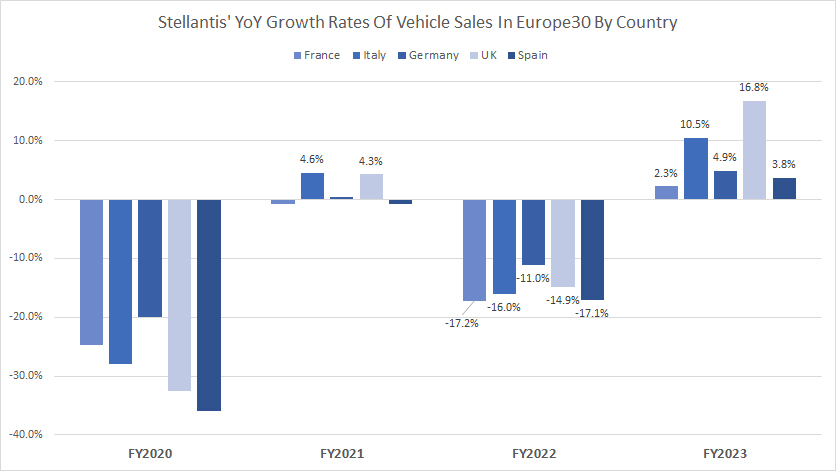

YoY Growth Rates Of Vehicle Sales In France, Italy, Germany, UK, And Spain

Stellantis-yoy-growth-rates-of-vehicle-sales-in-Europe-30-by-country

(click image to expand)

Stellantis only managed to record decent sales growth in most European countries in fiscal year 2023, as depicted in the chart above.

Before 2023, Stellantis has experienced primarily negative sales growth in most European countries. On average, Stellantis’ sales growth in France has measured around -5% annually over the last three years, while the figure for Italy has come in at -0.3% on average during the same period.

Stellantis’ sales in Germany have declined by an average of 2% annually since 2021, while the U.K. has amounted to a growth rate of 2% annually since 2021.

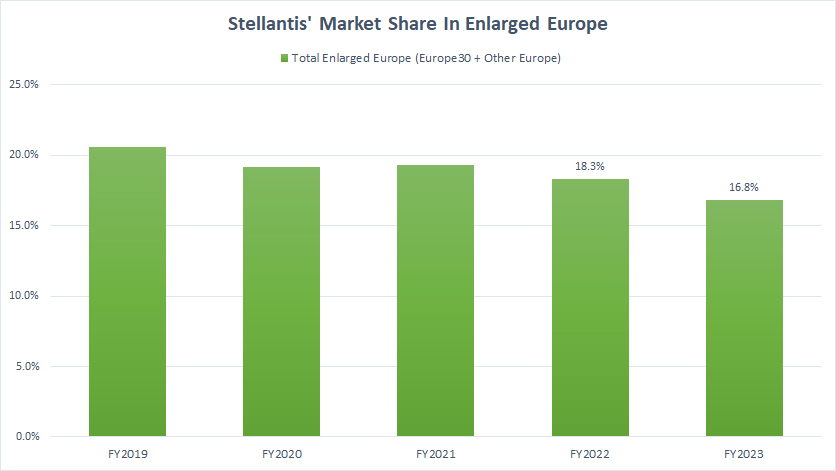

Market Share In Enlarged Europe

Stellantis-market-share-in-Enlarged-Europe

(click image to expand)

Stellantis had a total market share of 16.8% in Enlarged Europe in fiscal year 2023, down slightly from 18.3% in 2022, according to the company’s 2023 annual report.

Since 2019, Stellantis’ market share in Enlarged Europe has been on the decline, reaching slightly below 17% as of 2023, an all-time low in the last five years.

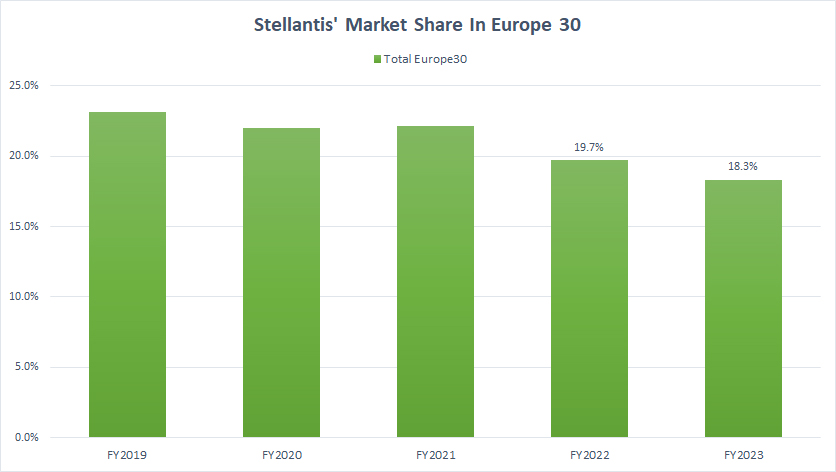

Market Share In Europe30

Stellantis-market-share-in-Europe-30

(click image to expand)

The definition of Stellantis’ Europe30 is available here: Europe30.

Stellantis’s market share in Europe30 topped 18.3% as of fiscal year 2023, down slightly from 19.7% in 2022, according to the company’s 2023 annual report.

Since 2019, Stellantis’s market share in Europe30 has decreased from 23.1% in 2019 to 18.3% as of 2023.

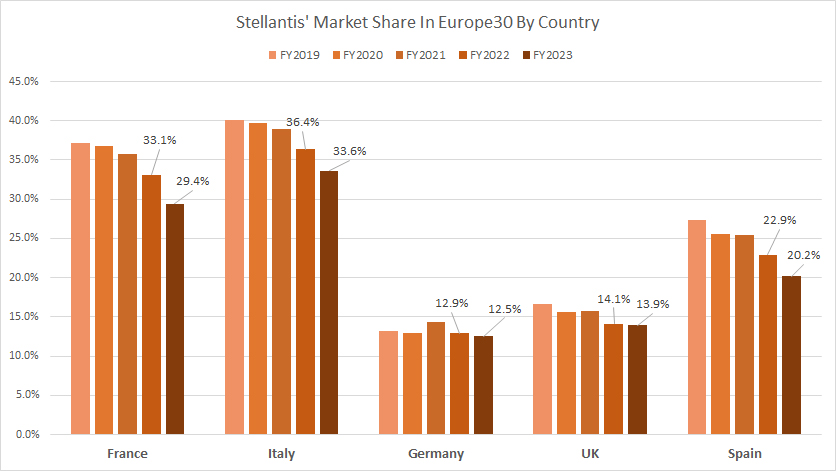

Market Share In France, Italy, Germany, UK, And Spain

Stellantis-market-share-in-Europe-30-by-country

(click image to expand)

The definition of Stellantis’ Europe30 is available here: Europe30.

Stellantis’ market share in Europe30 by country shows that its market share in Italy is among the highest for all countries under comparison. In fiscal year 2023, the market share figure for Italy declined to 33.6% from 36.4% in 2022.

Stellantis registered a market share of 29.4% in France in 2023, the second-highest after Italy although France was the automaker’s biggest market by sales volume in Europe in the same year.

Stellantis had substantial market share in Spain, which reached 20.2% as of 2023. On the other hand, Stellantis’ market share in Germany and the U.K. came in at just 12.5% and 13.9% as of 2023, one of the lowest among all countries under comparison.

A noticeable trend is the decrease in Stellantis’ market share in most European countries since fiscal year 2021. For example, Stellantis’ market share in Italy has considerably decreased from 39% in 2021 to 33.6% as of 2023, while a similar decline is observed in France whose number has decreased from 35.8% to just 29.4% during the same period.

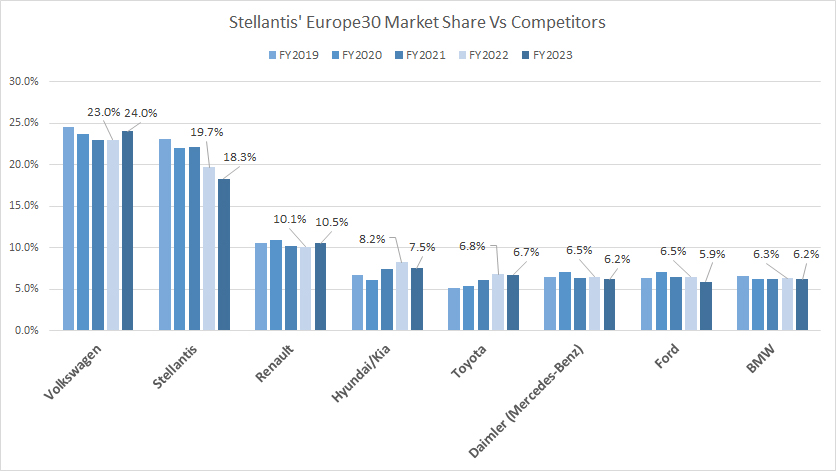

Market Share In Europe30 Vs Competitors

Stellantis-Europe-30-market-share-vs-competitors

(click image to expand)

Stellantis has become the second largest automobile company in Europe30 after the merger in 2021, only behind Volkswagen.

Compared to most competitors in Europe30, Stellantis’ market share in this region has led by a wide margin.

For example, Stellantis’ market share of 18.3% in 2023 was much higher than that of its next closest competitor, Renault, which had a market share of 10.5% in the same year. In this context, Stellantis’ market share was nearly double Renault’s figure.

A noticeable trend is the solid market share of Hyundai/Kia and Toyota in Europe30. Their market shares have remained relatively firm in this region over the last several years.

On the other hand, Stellantis’ market share in Europe30 has significantly decreased since 2021, down from 22% in 2021 to 18.3% as of 2023.

Daimler ((Mercedes-Benz), Ford Motor, and BWM had market shares of 6.2%, 5.9%, and 6.2%, respectively, in Europe as of 2023. Their results were far behind Stellantis.

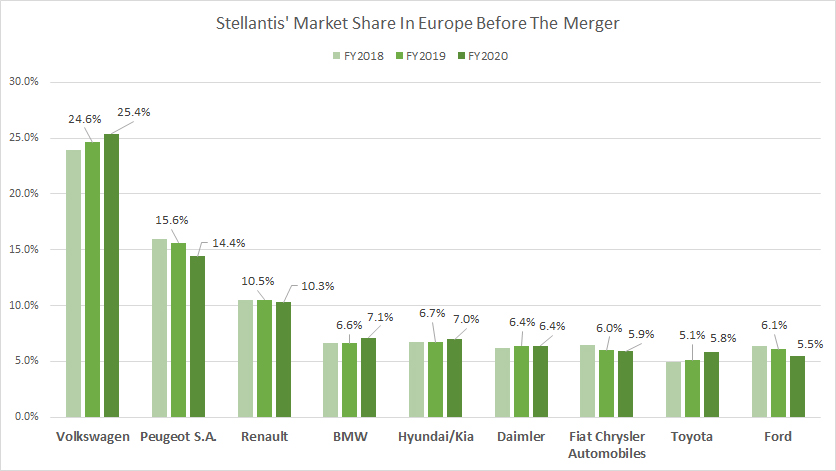

Market Share Before The Merger

Stellantis-market-share-in-Europe-before-the-merger

(click image to expand)

Before the merger of PSA Group (Peugeot S.A) and FCA (Fiat Chrysler Automobiles), Stellantis’s market share in Europe was much smaller.

For example, PSA Group had a market share of just 14.4% in 2020 in Europe, while FCA’s market share in the European region came in at only 5.9% during the same period.

Although PSA Group’s market share in Europe was nowhere near Volkswagen’s market share of 25.4%, it was second only to Volkswagen. Moreover, PSA Group was literally the second-largest automobile company by market share in Europe in that period.

On the other hand, FCA was a much smaller player in Europe as its market share in this region was only 5.9% in fiscal year 2020, the seventh largest in the European continent at that time.

Conclusion

Stellantis’ market share in Europe has risen substantially after the merger, and it was the second-largest automobile company in this region in fiscal year 2023, only behind Volkswagen.

With a strong product portfolio that includes popular models such as the Peugeot 208, the Citroen C3, and the Jeep Renegade, Stellantis is well-positioned to continue growing its regional presence in Europe.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Stellantis’ quarterly and annual reports, SEC filings, investor presentations, press releases, Form-20, etc., which are available in Stellantis Investor Relation.

2. Pixabay images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!