Beer bottles. Pexels Images.

This article presents the profitability of Anheuser-Busch InBev (AB InBev) by segment. AB InBev’s reportable segments consist of five major divisions: North America, Middle Americas, South America, EMEA, Asia Pacific, and Corporate.

The definition of these segments are available here: AB InBev’s segments. We exclude the Corporate segment in this discussion as the profitability of this segment has been negligible.

For other statistics of AB InBev, you may find more resources on these pages:

- AB InBev sales volumes by region,

- AB InBev revenue breakdown and profit margin, and

- AB InBev dividend safety: 4 reasons it is not safe.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What Is Driving The Decline In AB InBev’s Profitability?

Profitability By Segment

A1. Gross Profit In America, EMEA, and Asia Pacific

A2. Operating Profit In America, EMEA, and Asia Pacific

Margins By Segment

B1. Gross Profit Margin In America, EMEA, and Asia Pacific

B2. Operating Profit Margin In America, EMEA, and Asia Pacific

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

North America: ABI’s North American region includes the following countries: United States and Canada.

Middle Americas: ABI’s Middle Americas region includes the following countries: the Caribbean, Colombia, Costa Rica, the Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Panama and Peru.

South America: ABI’s South American region includes the following countries: Argentina, Bolivia, Brazil, Chile, Paraguay and Uruguay.

EMEA: ABI’s EMEA region includes the following countries: Austria, Belgium, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Spain, Switzerland, the United Kingdom, Botswana, Ghana, Lesotho, Mozambique, Namibia, Nigeria, South Africa, Swaziland, Tanzania, Uganda and Zambia and other African, European and Middle East countries.

Asia Pacific: ABI’s Asia Pacific region includes the following countries: China, India, Japan, New Zealand, South Korea, Vietnam and other South Asian and Southeast Asian countries.

What Is Driving The Decline In AB InBev’s Profitability?

Several factors are driving the decline in AB InBev’s profitability and profit margins:

- Decline in Beer Volumes: AB InBev has experienced a significant drop in beer volumes, with total volumes declining by 1.7% in fiscal year 2023 and beer volumes specifically sliding by 2.3% in the same period. This decline in volumes directly impacts revenue and profitability.

- Economic Challenges: Consumers in various markets are facing economic challenges, including a cost of living crisis. This has led to reduced spending on premium beer brands, with consumers opting for cheaper alternatives.

- Consumer Behavior Shifts: There has been a shift in consumer behavior, with many choosing to cut back on drinking or switching to less expensive labels. This trend has been particularly pronounced in emerging markets, where local brands are gaining market share.

- Weather and Seasonal Factors: Cooler and wetter weather in certain regions has negatively impacted sales, as people are less likely to visit pubs and restaurants.

- Increased Competition: The beer market is highly competitive, with both local and international brands vying for market share. This competition puts pressure on pricing and profit margins.

- Regulatory Changes: Stricter drink-driving laws and other regulatory changes in some markets have also affected sales.

- Operational Costs: Rising operational costs, including raw materials and logistics, have squeezed profit margins.

These factors combined have contributed to the decline in AB InBev’s profitability and profit margins. Despite these challenges, AB InBev has managed to outperform some of its peers by focusing on its megabrands and implementing cost-cutting measures.

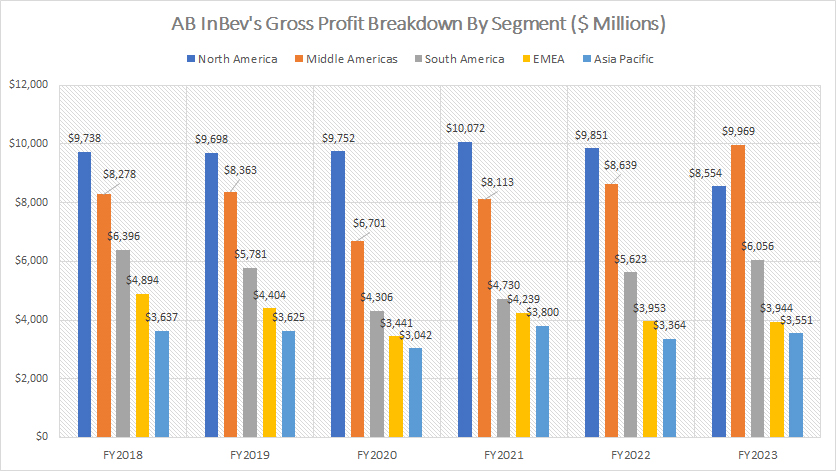

Gross Profit In America, EMEA, and Asia Pacific

ab-inbev-gross-profit-breakdown-by-segment

(click image to expand)

The definitions of ABI’s segments are available here: North America, Middle Americas, South America, EMEA, and Asia Pacific.

North America remains AB InBev’s largest source of profit, as illustrated in the chart above. In this context, AB InBev’s gross profit reached $9.9 billion in fiscal year 2022 and $8.6 billion in fiscal year 2023. On average, AB InBev’s gross profit amounted to $9.5 billion annually between fiscal year 2021 and 2023.

Since fiscal year 2018, AB InBev’s gross profit in North America has remained relatively flat, increasing by just 4% between 2018 and 2021, and peaking at $10.1 billion in 2021. However, since peaking in 2021, the gross profit in North America has been on a decline. In fiscal year 2023, it experienced a considerable decrease.

Despite the significant decline, the North America segment has consistently been the company’s top profit generator. This trend highlights the importance of the North American market to AB InBev’s overall financial performance, even as it faces challenges in other regions.

The Middle Americas segment is AB InBev’s second-largest source of gross profit after North America. In fiscal year 2023, AB InBev’s gross profit in this region surpassed that of the North America segment, reaching a record $10.0 billion — an increase of more than 16% from the previous year. In fiscal year 2022, the gross profit in the Middle Americas segment was $8.6 billion.

Since fiscal year 2018, AB InBev’s gross profit in the Middle Americas has increased by 20%, reaching a record high as of fiscal year 2023. This significant growth highlights the importance of the Middle Americas region to AB InBev’s overall profitability, especially as it surpasses the historically dominant North American segment in recent performance.

South America is AB InBev’s third-largest profit generator. AB InBev’s gross profit in this region has significantly rebounded after bottoming out at $4.3 billion in fiscal year 2020. Since then, gross profit has increased by more than 40%, reaching a new high of $6.1 billion in fiscal year 2023.

In fiscal year 2022, AB InBev produced a gross profit of $5.6 billion in the South America segment. This rebound highlights the region’s growing importance to the company’s overall profitability, demonstrating a strong recovery and sustained growth trajectory.

The EMEA and Asia Pacific regions have remained some of the lowest profit generators for AB InBev. In fiscal year 2023, both regions produced gross profits of $3.9 billion and $3.6 billion, respectively—the lowest figures among all compared regions.

In addition, AB InBev has experienced a significant decline in gross profit in the EMEA segment, which dropped from $4.9 billion in fiscal year 2018 to $3.9 billion in 2023, representing a decline of $1 billion or 20% over six years.

For the Asia Pacific segment, AB InBev’s gross profit has remained relatively flat since fiscal year 2018 but has significantly recovered from a low of $3.0 billion in fiscal year 2020. In this regard, the Asia Pacific segment has seen an increase of $500 million in gross profit, or a rise of 17%, since fiscal year 2020.

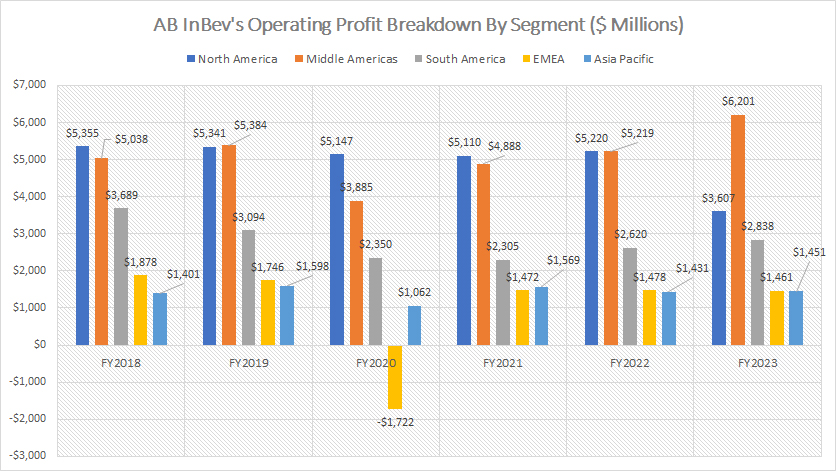

Operating Profit In America, EMEA, and Asia Pacific

ab-inbev-operating-profit-breakdown-by-segment

(click image to expand)

The definitions of ABI’s segments are available here: North America, Middle Americas, South America, EMEA, and Asia Pacific.

Similar to the gross profit discussed earlier, AB InBev’s North America segment has consistently been the largest source of operating profit for the company in most fiscal years. However, in fiscal year 2023, AB InBev’s operating profit from North America tumbled by 30%, dropping to $3.6 billion, a level not seen over the past six years. This significant decline shifted the profit dynamics within the company.

As a result, in fiscal year 2023, the Middle Americas segment’s operating profit significantly surpassed that of North America, reaching a record $6.2 billion, marking a 19% increase from the previous year. This milestone underscores the growing importance of the Middle Americas region to AB InBev’s overall profitability.

On average, over the past three years, AB InBev’s Middle Americas segment has produced an annual operating profit of $5.4 billion, compared to $4.6 billion from the North America segment. This trend highlights the shifting landscape of AB InBev’s profit sources and the critical role of the Middle Americas in the company’s financial performance.

AB InBev’s South America segment has consistently been the third-largest source of profit from operations for the company, mirroring the gross profit generated in this region. In fiscal year 2023, AB InBev achieved $2.8 billion in profit from operations from South America, a slight increase from the $2.6 billion recorded in the previous year. This steady growth highlights the region’s continuing importance to AB InBev’s overall profitability.

The EMEA and Asia Pacific regions have remained some of the lowest sources of profit for AB InBev. In fiscal year 2023, the profit from operations in these regions amounted to $1.5 billion each, highlighting their relatively modest contributions compared to other regions.

On a long-term basis, AB InBev’s profit from operations from the EMEA segment has slightly declined from $1.9 billion to $1.5 billion, while that of the Asia Pacific has remained steady at approximately $1.5 billion per year.

Despite these modest figures, these regions play a critical role in AB InBev’s global strategy. The EMEA region, with its diverse markets, offers potential growth opportunities, especially in emerging markets. The Asia Pacific region, on the other hand, presents a vast consumer base with evolving preferences, offering room for strategic expansion and innovation.

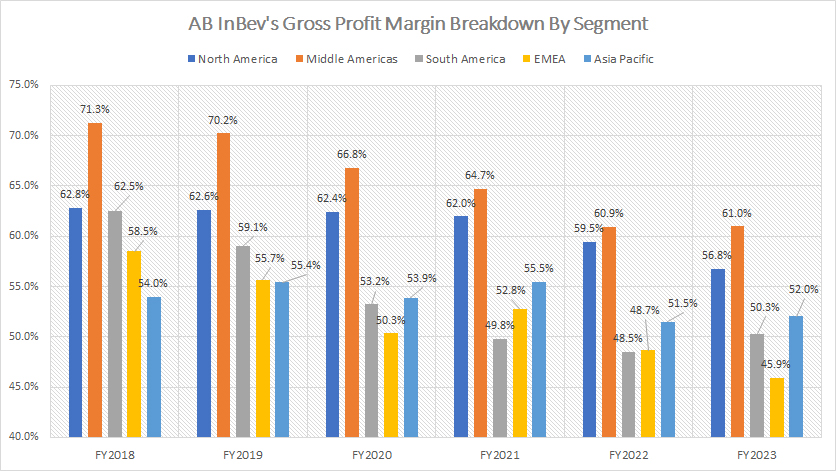

Gross Profit Margin In America, EMEA, and Asia Pacific

ab-inbev-gross-profit-margin-breakdown-by-segment

(click image to expand)

The definitions of ABI’s segments are available here: North America, Middle Americas, South America, EMEA, and Asia Pacific.

Although AB InBev’s North America segment has consistently been the company’s top profit generator, it is not the most profitable segment, as illustrated in the chart above. In this context, the gross margin of AB InBev’s North America segment has consistently been lower than that of the Middle Americas segment.

In fiscal year 2023, the gross profit margin of AB InBev’s North America segment amounted to just 57%, significantly lower than the 61% recorded in the Middle Americas segment.

While AB InBev’s Middle Americas segment has been the most profitable, its gross profit margin has been on the decline. Specifically, the gross profit margin of this region has decreased from 71% in fiscal year 2018 to 61% in fiscal year 2023, reaching a level not seen in the past six years.

A similar trend is observed in the North America region, where the gross profit margin declined from 63% in fiscal year 2018 to 57% in fiscal year 2023. However, the decline in North America is less pronounced compared to that of the Middle Americas region.

These trends highlight the shifting profitability dynamics within AB InBev, emphasizing the need for strategic adjustments to address the declining gross profit margins in key regions.

AB InBev’s South America region has recorded one of the most significant declines in gross margin among all its operating segments. The gross margin dropped from 62.5% in fiscal year 2018 to 50% in fiscal year 2023, highlighting a decrease of over 10 percentage points.

Similarly, AB InBev’s EMEA region experienced a substantial decline in gross profit margin, falling by over 10 percentage points between fiscal year 2018 and 2023. In fiscal year 2023, the EMEA region reported a gross profit margin of just 46%.

In contrast, AB InBev’s Asia Pacific segment has performed slightly better than the EMEA segment, with a gross profit margin hovering around 52% in fiscal year 2023. This margin is slightly higher than that of the South America region and significantly higher than that of the EMEA region.

Since fiscal year 2020, AB InBev has consistently generated better gross profit margins in the Asia Pacific segment compared to South America and EMEA. This trend illustrates the relative stability and potential growth opportunities in the Asia Pacific market, despite the challenges faced in other regions.

Overall, AB InBev has experienced better profitability in the Asia Pacific region compared to South America and EMEA, despite generating a much lower gross profit than South America and EMEA, which we saw in this section: gross profit in Asia Pacific.

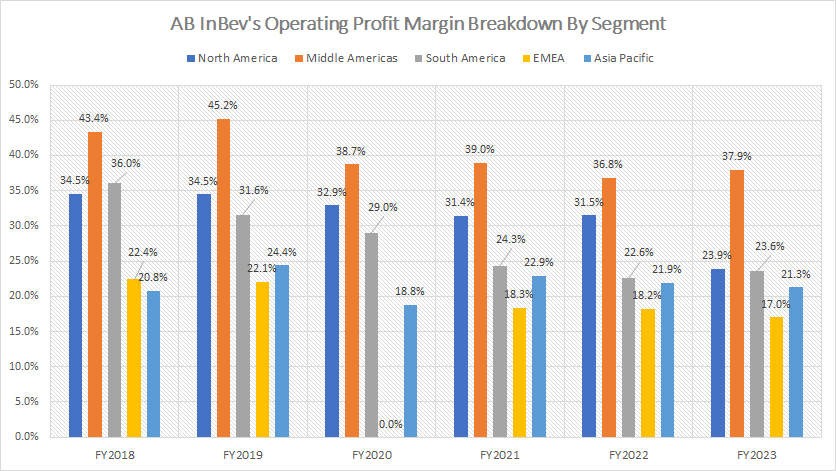

Operating Profit Margin In America, EMEA, and Asia Pacific

ab-inbev-operating-profit-margin-breakdown-by-segment

(click image to expand)

The definitions of ABI’s segments are available here: North America, Middle Americas, South America, EMEA, and Asia Pacific.

From an operating margin standpoint, AB InBev’s Middle Americas segment has consistently outperformed the North America segment, despite generating significantly lower profit from operations in most fiscal years.

In fiscal year 2023, the Middle Americas segment’s operating profit margin stood at 38%, while the North America segment’s operating profit margin was just 24%. On average, over the past three years, the Middle Americas segment has achieved an operating profit margin of 38%, significantly higher than the 29% recorded in the North America region.

Despite the consistent profitability from the Middle Americas and North America regions, their operating profit margins have been on a declining trend, reaching record lows in fiscal year 2023.

These decreasing margins in two of AB InBev’s largest profit sources highlight the challenges the company faces in maintaining profitability amidst rising costs and market pressures. This trend underscores the need for strategic initiatives to enhance operational efficiency and explore new growth opportunities in these critical regions.

Although the South America segment produces lower gross margins than EMEA and Asia Pacific, its operating profit margins are significantly better. For instance, in fiscal year 2023, AB InBev achieved an operating profit margin of 24% in South America, compared to just 17% and 21% in the EMEA and Asia Pacific regions, respectively.

This disparity underscores the operational efficiency and cost management strategies employed by AB InBev in South America, enabling the region to maintain higher profitability despite lower gross margins.

Meanwhile, AB InBev has experienced declining operating margins across all regions. For instance, the operating profit margin in South America has tumbled from 36% to 24% over the past six years. Similarly, the EMEA and Asia Pacific regions have also seen significant declines in their operating profit margins.

Overall, the company’s global operating profit margins have been under pressure, reflecting the combined impact of rising costs, market competition, and economic challenges. The decline in operating margins highlights the necessity for AB InBev to adopt adaptive strategies tailored to the unique market dynamics of each region.

Conclusion

In summary, AB InBev’s financial performance across regions highlights the importance of targeted strategic initiatives. By focusing on improving operational efficiency and addressing regional market challenges, AB InBev can enhance its profitability and maintain a competitive edge in the global market.

These insights underline the necessity for AB InBev to stay agile and responsive to market dynamics, ensuring sustained growth and profitability.

References and Credits

1. All financial figures presented were obtained and referenced from AB InBev’s annual reports published on the company’s investor relations page: AB InBev Financial Results.

2. Pexels Images.

Disclosure

We may utilize the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.