Come Monday Morning. Source: Flickr Image

Debt and cash is often a hot topic for most companies.

The reason is that a company that has the least leverage and the most cash will often thrive and prosper.

Therefore, buying a stock of a company that is debt-free and the one which holds more cash than debt is always a no-brainer.

This strategy always works if you can hold the stock for a long period of time.

The stock price of such a company has only one direction to go and that is up.

It’s no exception for social media companies such as Meta, Twitter, Snap, and Pinterest.

For example, I have reaped enormous gains from Meta’s stocks all these years despite the headwinds that it has been facing.

5 years ago, when I found out that Meta was debt-free and the company was literally printing cash, I did not even need to think twice when I bought the company’s stock.

Since then I have never looked back.

As of today, I am still holding Meta’s stock.

That said, in this article, we are going to explore several metrics that relate to social media companies’ debt, cash, and leverage.

We will do a quick comparison to see how these metrics measure up to one another.

Let’s take a look!

Facebook, Twitter, Pinterest And Snap’s Debt And Cash Topics

1. Total Debt

2. Total Liabilities

3. Total Cash On Hand

4. Net Debt

5. Net Liabilities

6. Total Debt To Equity Ratio

7. Total Debt To Assets Ratio

8. Total Liabilities To Equity Ratio

9. Total Liabilities To Assets Ratio

10. Conclusion

11. References and Credits

12. Disclosure

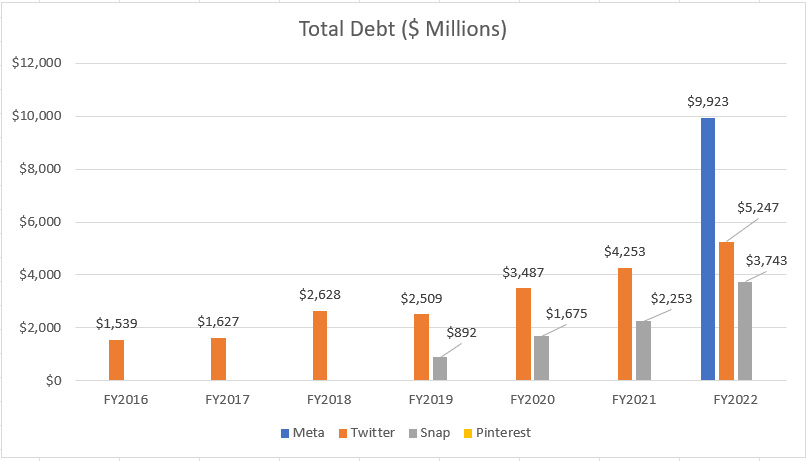

Total Debt

Meta, Twitter, Snap and Pinterest’s total debt

Let’s first look at the total debt of social media companies such as Meta, Twitter, Snap Inc., and Pinterest.

Pinterest has been debt free for the last 7 years.

On the contrary, Twitter and Snapchat’s debt has been on a rise, topping record highs at $5.2 billion and $3.7 billion, respectively, as of 2022.

While Meta had been debt free between 2016 and 2021, it took up a significant amount of debt in 2022, totaling a massive $10 billion.

Therefore, Meta is now having the biggest amount of debt among all social media platforms.

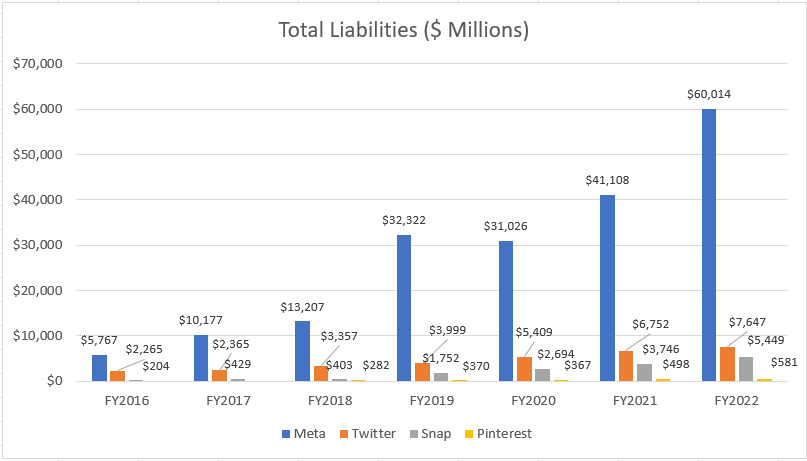

Total Liabilities

Meta, Twitter, Snap and Pinterest’s total liabilities

While most social media companies carry little to no debt, they do have a considerable amount of liabilities.

For example, Meta’s total liabilities logged $60 billion as of fiscal 2022, a record high and the biggest among Twitter, Snap Inc., and Pinterest.

In contrast, Twitter and Snap’s total liabilities were significantly lower than that of Meta, totaling only $7.6 billion and $5.4 billion, respectively, as of fiscal 2022.

Pinterest has the least liabilities, at only $581 million as of fiscal 2022.

A trend worth talking about is the rising liabilities of most social media companies over the years.

For example, Meta’s total liabilities grew the fastest in 2022, rising 46% over 2021.

Meta’s rising liabilities in 2022 were most likely caused by the $10 billion debt that it issued in the same fiscal year.

Snap Inc is no better than Meta as its total liabilities rose 45% year over year in 2022.

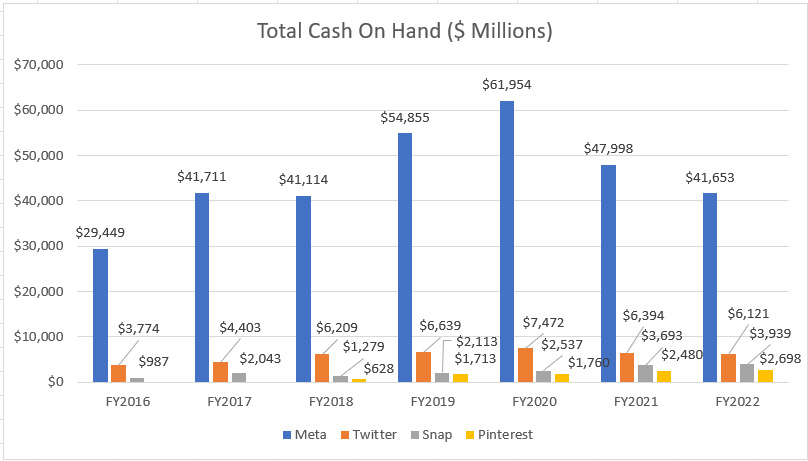

Total Cash On Hand

Meta, Twitter, Snap and Pinterest’s total cash on hand

The total cash on hand is another figure that is as important as the debt and liability figures.

Comparing the cash on hand with the total debt and total liabilities will give us a sense of where these social media companies’ leverages stand.

Looking at the chart, Meta leads again when it comes to total cash on hand.

As of fiscal 2022, Meta’s total cash on hand came in at $42 billion, the biggest amount among all social media companies.

While Meta’s cash position was massive, it had been on a decline, reaching its lowest level as of 2022, a figure that was last seen in 2018.

The cash on hand looks incredibly small for other social media platforms such as Twitter, Pinterest, and Snap when compared with that of Meta.

For example, Twitter and Snapchat’s cash positions totaled $6.1 billion and $3.9 billion, respectively, as of 2022, only about one-sixth the amount of Meta for Twitter, and less than one-tenth the amount of Meta for Snap.

Pinterest’s cash on hand was the least among all social media companies, at only $2.7 billion as of 2022.

A trend worth noting is that not all social media platforms saw their cash position growing between 2016 and 2022.

While their liabilities have been on the rise, it may not be the case for their cash reserves.

Therefore, it does not look good for companies that see their cash position on a decline.

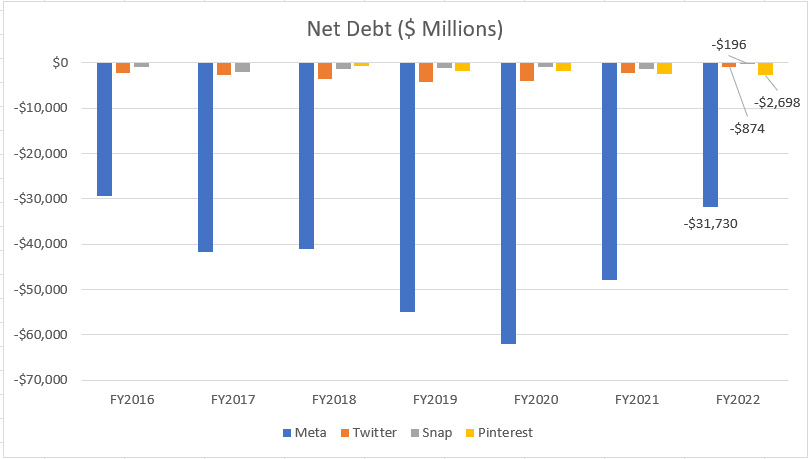

Net Debt

Meta, Twitter, Snap and Pinterest’s net debt

As discussed in prior paragraphs, most social media companies have more cash than debt.

In this section, the chart above reflects the net debt of Meta, Twitter, Snap, and Pinterest after accounting for the cash on hand.

As seen, most social media companies have net debt below the value of zero, indicating a greater amount of cash than debt.

For example, Meta’s net debt totaled -$31 billion while that of Twitter came in at -$874 million as of 2022.

Snap Inc.’s net debt logged $-196 million while Pinterest’s net debt totaled -$2.7 billion as of 2022.

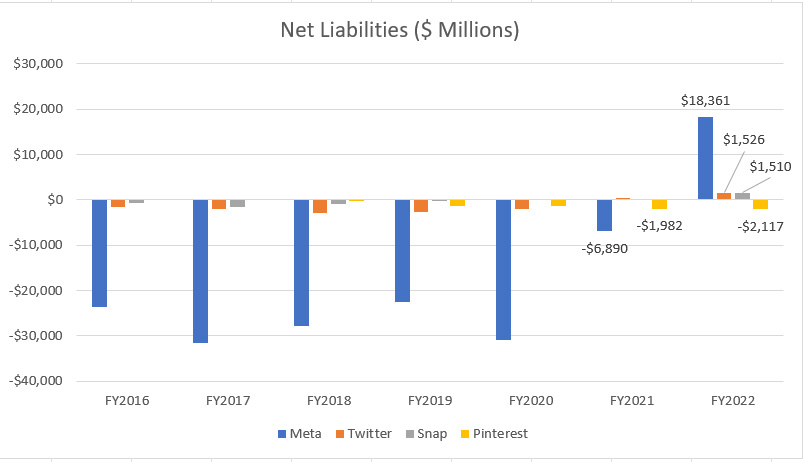

Net Liabilities

Meta, Twitter, Snap and Pinterest’s net liabilities

In terms of net liabilities, all social media companies have net liabilities that clocked at negative values prior to 2022, indicating a greater amount of cash than total liabilities.

However, the trend changed drastically in 2022.

As seen in the chart above, the net liabilities of most social media companies increased significantly in 2022.

A dramatic change was that their respective net liabilities turned from negative to positive, illustrating the surging amount of liabilities in 2022.

For example, Meta’s net liabilities were no longer a net zero and soared to a massive $18 billion as of fiscal 2022.

Similarly, Twitter’s net liabilities reached $1.5 billion while that of Snapchat also totaled the same number as of 2022.

Only Pinterest’s net liabilities were still in negative values, indicating that the company has not taken on extra debt or any other liabilities.

In short, Meta, Twitter, and Snap Inc. have increased their leverages significantly in 2022 compared to prior years.

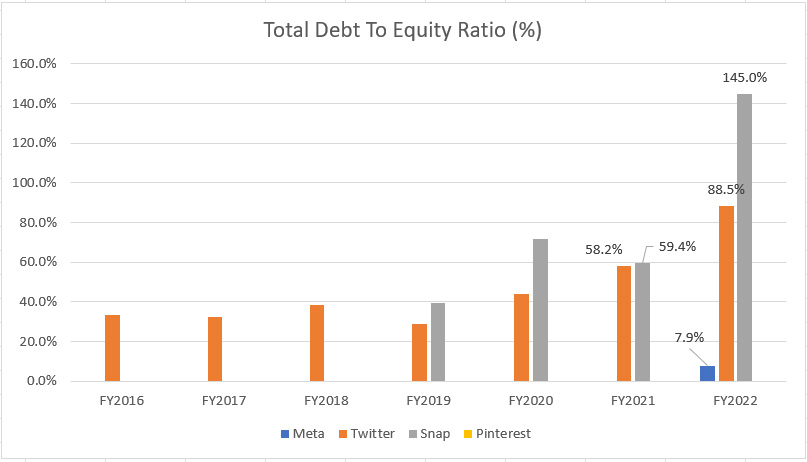

Total Debt To Equity Ratio

Meta, Twitter, Snap and Pinterest’s total debt to equity ratio

From the perspective of debt leverage, Snapchat’s ratio in 2022 topped the chart at 145% of equity, indicating that the company was the most leveraged compared to Meta, Twitter, and Pinterest.

Twitter’s debt leverage ratio in 2022 came in at 89% of equity, second only to Snap Inc.

Meta’s debt-to-equity ratio totaled only 8% in 2022, the lowest among Snapchat and Twitter.

On the other hand, Pinterest’s debt leverage was zero as of 2022 as the company did not carry any debt.

Again, Snap Inc.’s debt leverage in 2022 was the biggest among Meta, Twitter, and Pinterest.

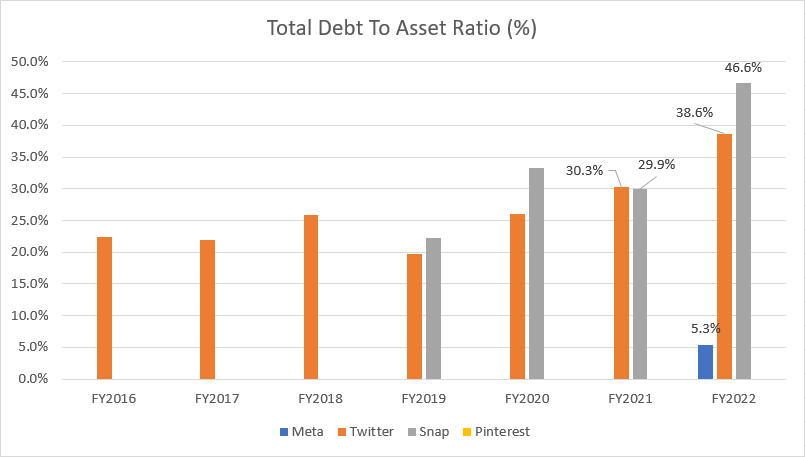

Total Debt To Asset Ratio

Meta, Twitter, Snap and Pinterest’s total debt to asset ratio

From the perspective of assets, Snap Inc. is again at the top of the chart, with its total debt making up about 47% of its asset in 2022.

Twitter’s total debt represents 39% of assets as of 2022.

Meta’s debt-to-asset ratio totaled only 5% as of 2022, the lowest among Twitter and Snap.

Pinterest’s debt-to-asset ratio was zero as of 2022 as the company did not have any debt.

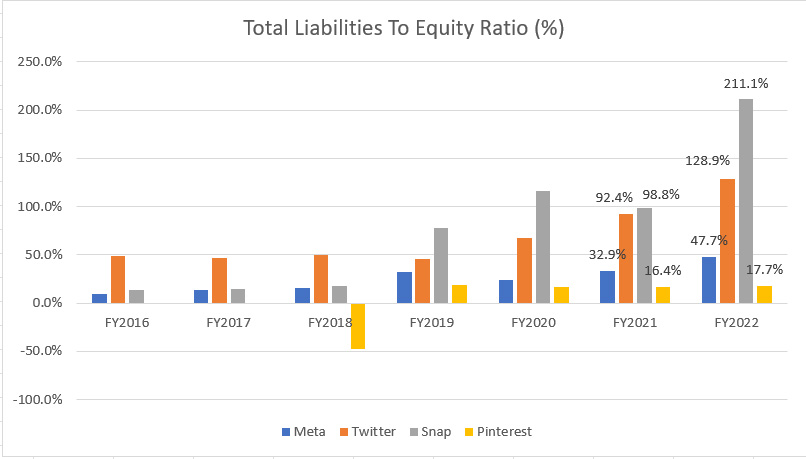

Total Liabilities To Equity Ratio

Meta, Twitter, Snap and Pinterest’s total liabilities to equity ratio

The total liabilities to equity ratio measures total leverage which includes all debt and liabilities owed to 3rd parties with respect to stockholders’ equity.

The higher the ratio, the more leverage the company has.

According to the chart, Snap Inc. was again the highest leveraged social media company in fiscal 2022, with its total liabilities representing 211% of equity.

At this ratio, Snap’s total leverage was $1.00 dollar of equity to $2.10 dollar of liabilities.

Besides, Snap’s total leverage also has been on the rise year over year, growing to a record high as of 2022.

In contrast, Pinterest’s total leverage was the lowest at only 18% in fiscal 2022 and the leverage ratio has remained relatively unchanged since fiscal 2019.

Meta’s total leverage ratio also grew significantly in 2022 to 48%, the highest ever recorded since 2016.

Similarly, Twitter’s total leverage also has been on a rise between 2016 and 2022, topping 129% as of 2022, second only to Snap Inc.

Again, Snap Inc. was the most leveraged social media company whereas Pinterest is the least leveraged with respect to equity or book value of the company.

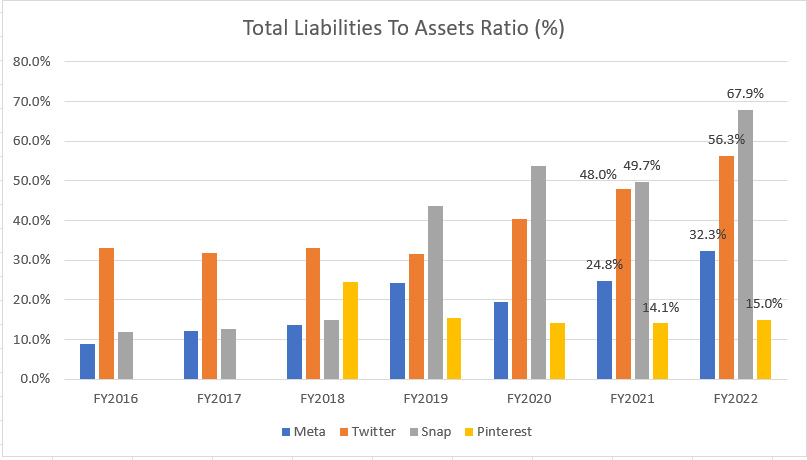

Total Liabilities To Assets Ratio

Meta, Twitter, Snap and Pinterest’s total liabilities to assets ratio

The total liabilities to assets ratio measures the company’s capital structure, whether made up of debt or equity, or both equally.

For example, Snap’s total liabilities to total assets ratio was around 53% in fiscal 2020, meaning that the company’s capital structure was half liabilities and half equity.

As seen in the chart above, Snap’s liabilities-to-asset ratio came in at 68% in 2022, indicating a very high debt structure compared to equity.

At this ratio, Snap’s capital structure in 2022 was mostly represented by liabilities, at 68% of total assets.

In contrast, Pinterest’s capital structure was only 15% liabilities and 85% equity as of fiscal 2022, making it the least leveraged social media company.

Therefore, Pinterest has considerably more equity than liabilities in its balance sheets than most social media platforms have.

Twitter’s capital structure was quite balanced, at 56% liabilities and 44% equity as of 2022, indicating nearly a 1-to-1 liabilities-to-equity ratio.

On the other hand, Meta’s capital structure was mostly represented by equity with a liability-to-asset ratio of 32% in 2022.

Conclusion

To recap, Meta had the biggest amount of debt as of 2022 compared to other social media platforms but its leverage was low.

On the other hand, Snap’s total debt amounted to only $3.7 billion in 2022 but it was the most leveraged among Meta, Twitter, and Pinterest.

Pinterest had zero leverage as of 2022 as the company did not have any debt.

Therefore, Pinterest was the least leveraged among Meta, Snapchat, and Twitter as of 2022.

References and Credits

1. All financial figures in this article were obtained and referenced from financial statements and reports available in the following links:

a) Facebook Investor Relations

b) Pinterest Investor Relations

c) Twitter Investor Relations

d) Snap Investor Relations

2. Featured images in this article are used under Creative Commons License and sourced from the following websites: Come Monday Morning and Cancel the Debt.

Disclosure

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you for the help!