Corona beer. Source: Flickr Image.

AB InBev or Anheuser-Busch InBev is a dividend-paying stock and has been paying cash dividends since 2006 according to its website.

Although AB InBev has been paying dividends consecutively for 15 years, its dividend rates have declined considerably in recent years.

Therefore, are AB InBev’s dividends safe?

Should investors be concerned with AB InBev’s declining dividends?

In this article, we will look at factors that are in favor of AB InBev’s dividends.

Apart from favorable factors, we also look at unfavorable factors, including those that may harm and make the dividends unsafe.

On a side note, AB InBev’s stocks are traded in several stock exchanges, including the New York Stock Exchange (NYSE:BUD), Mexican Stock Exchange (MEXBOL:ANB), and Johannesburg Stock Exchange (JSE:ANH), in addition to its main listing on Euronext Brussels (Euronext: ABI).

For AB InBev’s stock listed on the NYSE, the stock is a form of ADR or American Depository Receipt.

According to AB InBev, 1 ADR equals 1 common stock.

Therefore, U.S. investors who have bought AB Inbev’s ADR listed on NYSE (NYSE:BUD), are entitled to the same dividends declared per common stock.

However, U.S. investors will receive the cash dividends in USD instead of in Euro.

Let’s move on!

Table Of Contents

Favorable Factors

A1. Rising Sales Volumes Across All Segments

A2. Steady Regional Revenue Growth

A3. A Profitable Company

A4. A High Margin Business

A5. Solid Cash Flow

A6. Manageable Debt Levels

A7. Comfortable Interest Coverage

A8. Low Dividend Payout Ratio

Unfavorable Factors

B1. Declining Profitability

B2. Declining Margins

B3. High Indebtedness

B4. Poor Capital Return History

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

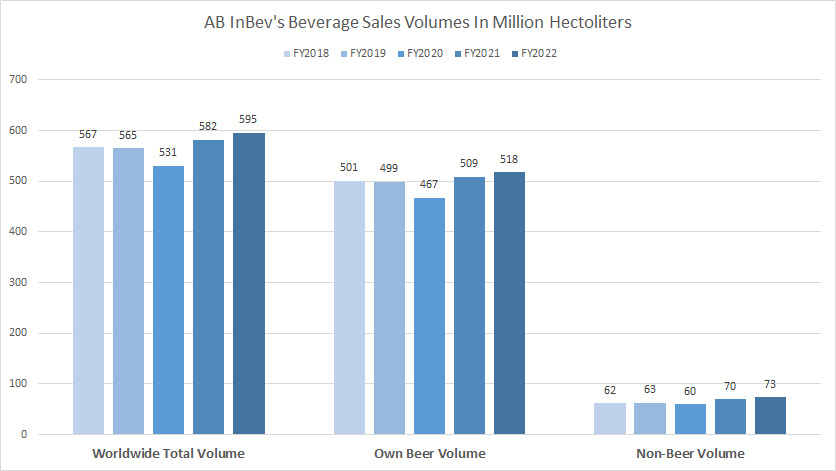

AB InBev’s Rising Sales Volumes Across All Segments

AB InBev beverage sales volume

(click image to enlarge)

While AB InBev’s beverage sales volumes declined in fiscal 2020, they have significantly recovered in post-pandemic periods.

As shown in the chart above, AB InBev’s beverage sales volumes hit record figures as of 2022 across all segments, including the company’s own beer and non-beer volumes.

The increasing sales volumes may drive revenue and therefore, profitability higher.

AB InBev’s dividends will be much safer when beverage sales volumes are rising.

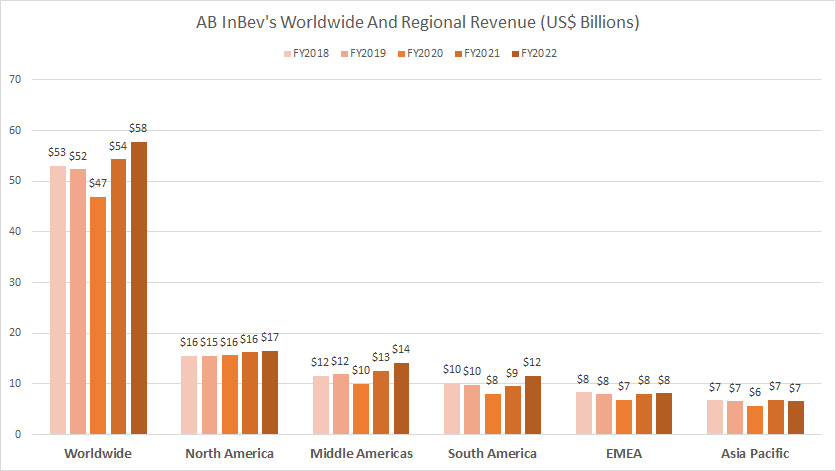

AB InBev’s Steady Regional Revenue Growth

AB InBev worldwide and regional revenue

(click image to enlarge)

As AB InBev’s beverage volumes rise, its revenue also rises.

As seen in the chart above, AB InBev’s worldwide revenue hit a 5-year high of $58 billion USD in fiscal 2022, a growth of 9% over 2018.

AB InBev’s rising worldwide revenue is driven by the growth of revenue across multiple regions in the world, particularly sales from North America, Middle America and South America.

While revenue may not necessarily translate to profitability and subsequently, cash dividends, it is better to have rising revenue than a falling one.

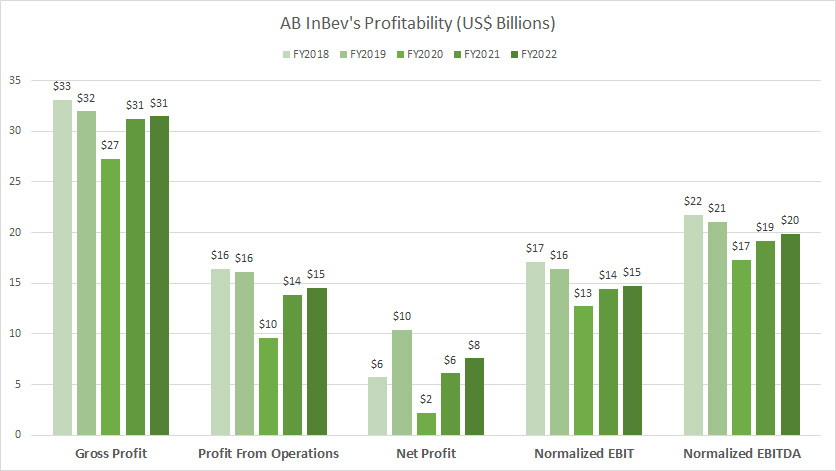

AB InBev Is A Profitable Company

AB InBev profitability

(click image to enlarge)

AB InBev is a profitable company and it still made money during the COVID-19 crisis.

While profitability dropped in fiscal 2020, it recovered quickly in post-pandemic periods, suggesting a seemingly resilient business model.

AB InBev’s profitability in all periods and situations makes the case for a safe and consistent dividend highly probable.

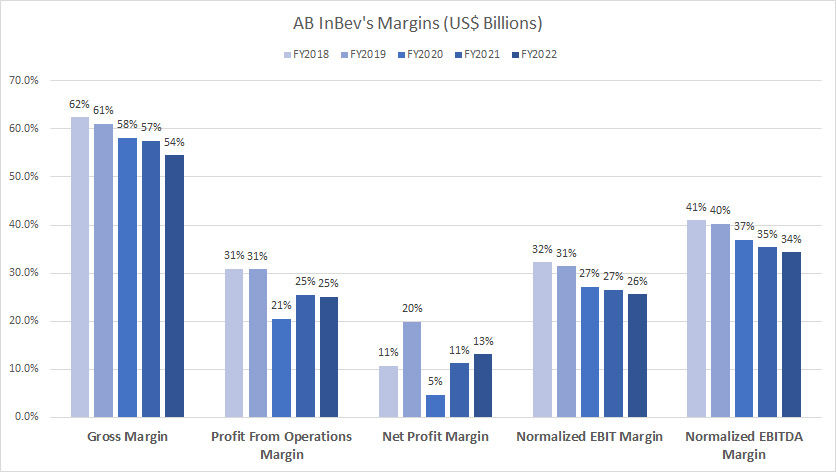

AB InBev Runs A High Margin Business

AB InBev margins

(click image to enlarge)

AB InBev’s margins are undisputedly extraordinary.

For example, AB InBev’s gross margin tops more than 50% while its operating margin grosses more than 20%.

Similarly, AB InBev’s net profit margin averages more than 10%.

Only a few companies can replicate AB InBev’s high-margin business.

In short, AB InBev’s high-margin business definitely helps the dividends.

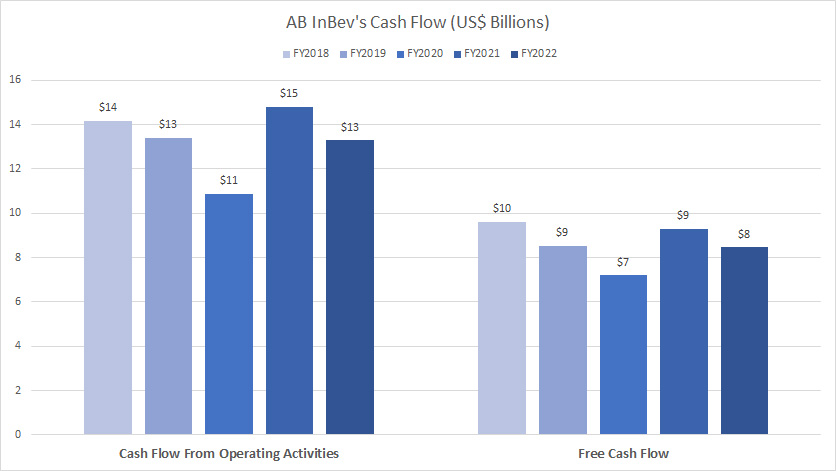

AB InBev’s Solid Cash Flow

AB InBev cash flow

(click image to enlarge)

AB InBev’s strong cash flow generation definitely helps pay the dividends.

As seen in the chart above, AB InBev produces solid cash flow no matter what the situation, be it the COVID-19 pandemic or the high inflationary environment.

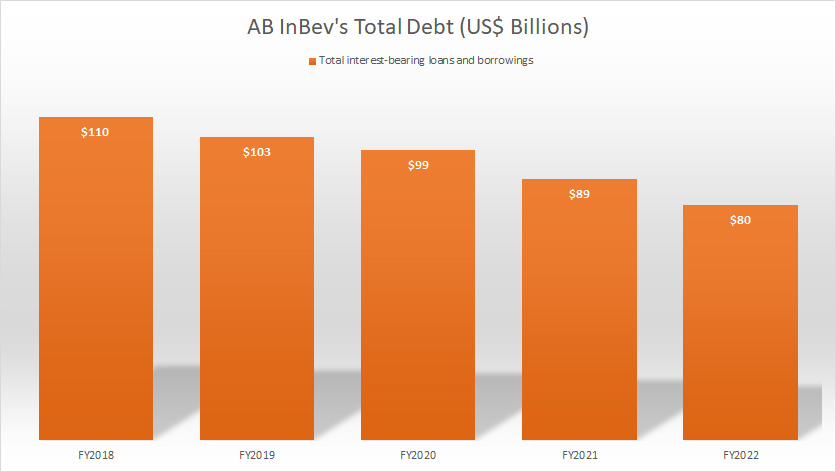

AB InBev’s Manageable Debt Levels

AB InBev debt levels

(click image to enlarge)

While AB InBev’s total debt is on the high side, it is still manageable.

As discussed in this article, AB InBev Debt Vs Cash, the company’s cash alone is capable of repaying its debt in the near term.

As a result, debt should not harm or even stop AB InBev’s cash dividends.

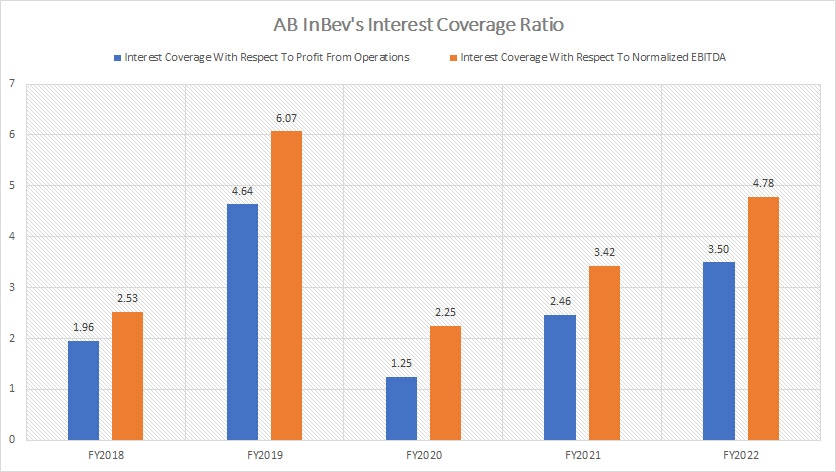

AB InBev’s Comfortable Interest Coverage

AB InBev interest coverage ratio

(click image to enlarge)

While AB InBev carries a decent amount of debt, it is not a threat to the company’s financial health.

As seen in the chart above, AB InBev is capable of servicing its debt and this applies to all situations, including the COVID crisis.

In fact, AB InBev’s profits are able to cover all debt expenses multiple times.

Again, AB InBev’s cash dividends remain safe and solid considering the high profitability which is more than sufficient to service its indebtedness.

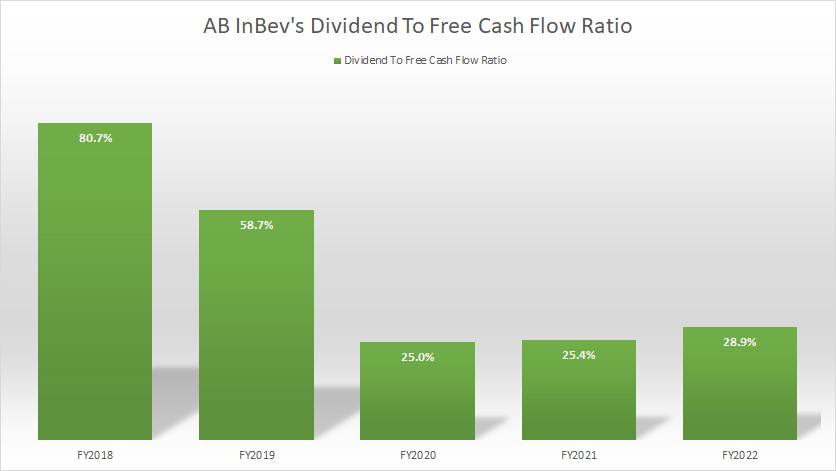

AB InBev’s Low Dividend Payout Ratio

AB InBev dividend to free cash flow ratio

(click image to enlarge)

Although the dividend payout ratio was high prior to 2020, AB InBev has been able to bring the ratio down.

As of fiscal 2022, AB InBev’s dividend to free cash flow ratio measured at only 29%, one of the lowest ratios that have ever been recorded.

AB InBev’s declining dividend payout ratio has primarily been driven by a series of dividend cuts to a level that can be afforded by the company.

While AB InBev has cut dividend rates, the company did so for the benefit of shareholders so that future dividend payments not only are sustainable but also can be balanced out between capital returns and optimum capital structure.

Therefore, AB InBev’s current dividend payments are at a comfortable and safe level for both shareholders and the company and most likely will remain so in the foreseeable future.

AB InBev’s Declining Profitability

AB InBev profitability

(click image to enlarge)

While AB InBev makes money, its profitability has been on a decline as shown in the chart above.

As seen, AB InBev has not been able to replicate the profitability that matches or even exceeds the pre-pandemic results.

Despite the surge in profitability in recent years, the results were still below pre-pandemic levels.

AB InBev’s stagnant or even declining profitability does not bode well for the company’s dividend policy.

It may not totally stop the dividend payments but the company may only be able to maintain the same dividend rates at best as long as it produces mediocre results.

AB InBev’s Declining Margins

AB InBev margins

(click image to enlarge)

Similar to the profitability metrics, AB InBev’s margins from all levels also have been on the decline.

The most obvious one is the company’s gross, normalized EBIT, and EBITDA margins which have continued to deteriorate even in post-pandemic periods.

Despite the rise in revenue and profitability in post-pandemic periods, margins have continued to depress, suggesting that AB InBev may have raised volume at the expense of margins.

To make up for the lower margins, AB InBev needs to boost volume and revenue.

If volume and revenue do not grow higher enough to make up for the lower margins, AB InBev’s profitability will suffer and consequently, the dividends.

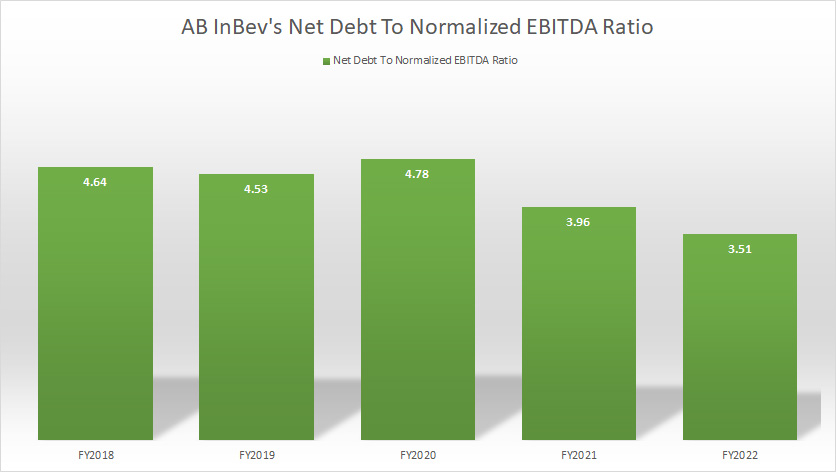

AB InBev’s High Indebtedness

AB InBev net debt to normalized EBITDA ratio

(click image to enlarge)

Despite having a manageable debt level, AB InBev’s indebtedness is still on the high side and it is dragging down capital returns.

In this aspect, AB InBev allocates a large portion of cash to repay debt every year and this practice is expected to continue in the foreseeable future.

AB InBev has stated that it intends to achieve a net debt to normalized EBITDA ratio of 2.0X where the optimal capital structure will be reached.

As of 2022, AB InBev’s net debt to normalized EBITDA ratio was only at 3.51X as shown in the chart above, still a very far off target from the optimum ratio of 2.0X.

Therefore, AB InBev will most likely prioritize debt reduction over capital returns in the foreseeable future.

The practice of paying down debt over dividends may not kill the dividends but will probably restrict a rate rise.

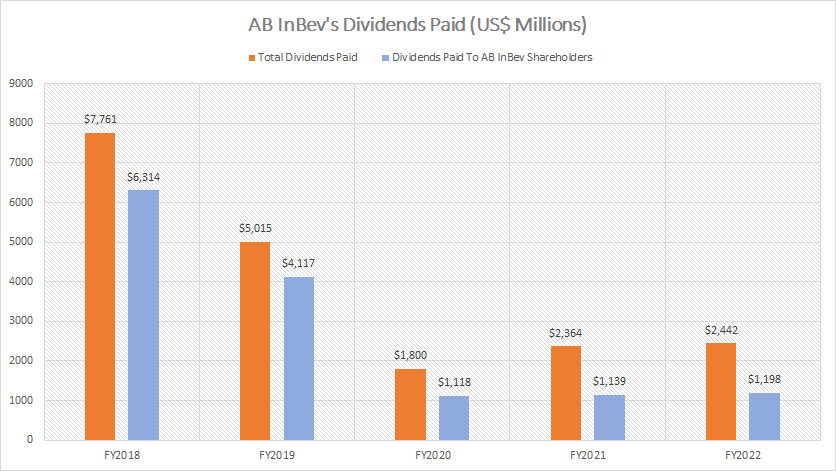

AB InBev’s Poor Capital Return History

AB InBev dividend history

(click image to enlarge)

AB InBev has very poor capital returns for shareholders.

The company pays only dividends and has not bought back any shares since fiscal 2018.

AB InBev’s historical share buyback

| Fiscal Year | Cash Spent On Stock Buybacks |

|---|---|

| 2018 | $0 |

| 2019 | $0 |

| 2020 | $0 |

| 2021 | $0 |

| 2022 | $0 |

| — | — |

| Average | $0 |

While AB InBev pays cash dividends, dividends paid to the company’s shareholders have risen only marginally since 2020, or just 7% in 2 years.

However, since 2018, AB InBev’s total dividends and dividends paid to shareholders have significantly declined, driven by a series of dividend cuts carried out by the company in order to save capital.

In short, AB InBev’s poor capital return history is a put-off for income investors.

The poor history reflects the company’s mediocre performance and unreliable dividend payments.

Conclusion

While there are some unfavorable factors that may harm or threaten AB InBev’s dividend payments, they have not totally killed the dividends.

The good news is that AB InBev was still a dividend-paying stock as of 2023, albeit at a lower rate compared to 5 years ago.

As of the date this article was published, AB InBev’s forward dividend yield totaled about 1.41% based on a stock price of $58 USD and a forward dividend rate of US$0.82 for U.S. investors.

Therefore, it is not the end of the world as investors are still able to get a decent rate if they lock in the stock today.

What do you think?

Please leave your comments below.

References and Credits

1. All financial figures presented in this article were obtained and referenced from AB InBev’s financial reports, earning releases, SEC filings, etc, which are available in AB InBev Investor Relation.

2. Featured images in this article are used under creative commons license and sourced from the following websites: Traveller_40 and renata mascarello.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!