Fuel sales. Pexels Images.

This article presents Walmart’s fuel sales revenue, along with the corresponding profit and margin. Notably, all of Walmart’s fuel revenue is exclusively generated through its Sam’s Club segment.

Let’s look at the details!

For other key statistics of Walmart, you may find more resources on these pages:

Revenue

- Revenue by region: U.S. and International,

- Revenue category: net sales and membership & other income,

- Revenue segments: U.S., International, and Sam’s Club

Other Revenue Streams

Profit Margin

- Profit margin by segment: U.S., International, and Sam’s Club,

- Walmart vs Costco: profit margin comparison

Other Statistics

- Capital expenditures by segment,

- Comparable sales by calendar period,

- Global store count and locations breakdown by region,

- revenue per store

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What contributes to the significant growth in Walmart’s fuel revenue?

Sales Revenue

Percentage

B1. Percentage Of Fuel Sales To Net Sales

Profit and Margin

C1. Fuel Profit

C2. Fuel Profit Margin

Summary And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Walmart Fuel Sales: Walmart’s fuel sales refer to the revenue generated from selling gasoline at its retail locations.

Notably, Walmart does not operate standalone fuel stations under its primary brand; instead, all of its fuel revenue comes from Sam’s Club, its membership-based warehouse segment.

Sam’s Club fuel centers often offer discounted gasoline prices to attract customers into its stores. Additionally, Walmart Plus members receive fuel discounts at select Walmart, Murphy, Exxon, and Mobil stations.

Sam’s Club U.S.: Sam’s Club U.S. operates as a membership-only warehouse club with 600 locations across 44 states in the U.S. and Puerto Rico, alongside its online platform, samsclub.com.

Committed to offering a fast and seamless omni-channel experience, Sam’s Club U.S. integrates physical clubs with eCommerce solutions.

Members enjoy convenient services such as curbside pickup for contact-free shopping, the Scan & Go mobile checkout for skipping lines, and the innovative Just Go feature, introduced in fiscal 2025, which enables frictionless exits.

The club provides merchandise across four key categories: Grocery, General merchandise, Health and wellness, and Fuel.

Memberships come with added value, including a spouse/household card at no extra cost. Club members benefit from free curbside pickup for orders of $50 or more, while Plus members enjoy additional perks such as complimentary delivery-from-club, free shipping on $50+ orders, exclusive discounts, convenience features, and early access to shopping before regular hours.

Beginning in fiscal 2023, Sam’s Club U.S. launched a rewards program allowing members to earn Sam’s Cash on purchases, which can be redeemed for cash, used for future purchases, or applied toward membership fees.

Omni-Channel: Omni-channel refers to a strategy in commerce and customer engagement that provides a seamless and integrated experience across all channels, whether they are online, offline, or hybrid. It’s about making every interaction — from browsing products online to visiting a physical store—feel connected and consistent.

For example:

-

In retail, omni-channel could mean a customer can browse products online, reserve an item on a mobile app, and pick it up in-store, all while receiving consistent information and support.

-

In customer service, omni-channel ensures that whether a customer contacts a company via email, chat, phone, or social media, their inquiries and interactions are unified across these platforms.

The key idea is to break down silos between channels and prioritize the customer’s convenience. Businesses that adopt omni-channel approaches often see improved customer satisfaction and loyalty.

What contributes to the significant growth in Walmart’s fuel revenue?

Walmart’s fuel revenue has seen significant growth due to several key factors:

-

Expansion of Fuel Sites:

-

Walmart has aggressively expanded its fuel station footprint, reaching 400 locations by late 2024 and aiming for 450 by the end of 2025.

-

The company is integrating fuel stations into more Supercenter stores, increasing accessibility for customers.

-

-

Increased Market Share & Volume Growth:

-

Walmart’s share of the U.S. gasoline market has doubled over the past seven years.

-

The company has focused on higher throughput, meaning its fuel sites are selling more gallons per location.

-

Walmart’s fuel brand efficiency rating has nearly doubled, indicating stronger performance compared to the national average.

-

-

Competitive Pricing Strategy:

-

Walmart has widened its fuel price discounts over time, offering prices three times lower than they were seven years ago.

-

In 2017, Walmart’s fuel was 6 cents per gallon below market average, but in 2024, the discount increased to 19 cents per gallon.

-

Walmart+ members receive additional fuel savings, further driving customer loyalty.

-

-

Convenience Store Strategy:

-

Walmart is evolving into a major convenience retailer, leveraging fuel stations to attract customers to its stores.

-

The company has introduced walk-in convenience stores at fuel sites, offering low-cost beverages and snacks.

-

Walmart’s fuel centers reinforce its “Save Money. Live Better” brand positioning.

-

-

Inflation & Consumer Behavior:

-

Rising fuel prices have made discounted gas more attractive, driving more customers to Walmart’s fuel stations.

-

Walmart’s ability to offer lower fuel prices has positioned it as a preferred choice for budget-conscious consumers.

-

These factors have collectively driven Walmart’s soaring fuel revenue over the years.

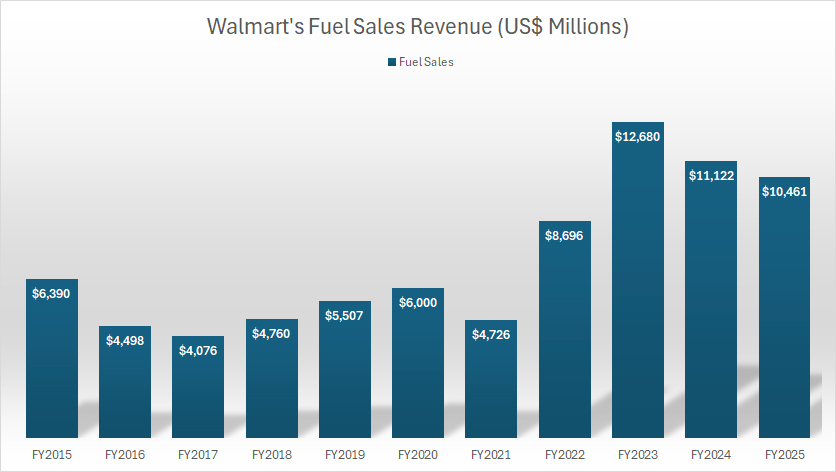

Fuel Sales Revenue

Walmart-fuel-sales-revenue

(click image to expand)

Walmart derives its fuel revenue entirely from Sam’s Club. You may find more information about the segment here: Sam’s Club U.S. For the definition of Walmart’s fuel sales, you may refer to this section: Walmart fuel sales.

Walmart’s fuel sales climbed to $10.5 billion in fiscal year 2025, reflecting a slight decline from $11.1 billion in 2024. The company’s fuel revenue previously peaked at $12.7 billion in fiscal year 2023, marking its highest level.

On average, Walmart sold an annual average of $11.4 billion in fuel revenue between fiscal year 2023 and 2025.

Looking further back, Walmart’s fuel revenue reached $8.7 billion in fiscal year 2022, a substantial increase from $6.4 billion in 2015.

While the recent pullback suggests some stabilization, Walmart’s long-term strategy indicates a continued focus on maintaining its competitive pricing and enhancing fuel-related membership benefits.

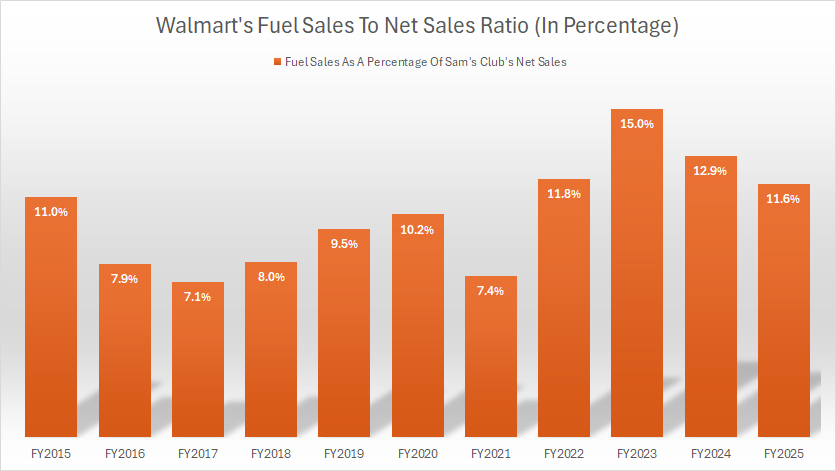

Percentage Of Fuel Sales To Net Sales

Walmart-fuel-sales-to-net-sales-ratio

(click image to expand)

Walmart derives its fuel revenue entirely from Sam’s Club. You may find more information about the segment here: Sam’s Club U.S. For the definition of Walmart’s fuel sales, you may refer to this section: Walmart fuel sales.

The percentage is calculated relative to Sam’s Club’s net sales.

Walmart’s fuel sales reached $10.5 billion in fiscal year 2025, representing 11.6% of Sam’s Club’s total net sales.

This ratio peaked at 15% in fiscal year 2023 before experiencing a gradual decline in recent periods.

Over the long term, the 10-year average stands at 10%, while the 5-year average is 12%, and the 3-year average is 13%.

In short, roughly 13% of Sam’s Club’s net sales were represented by fuel sales on average over the past three years.

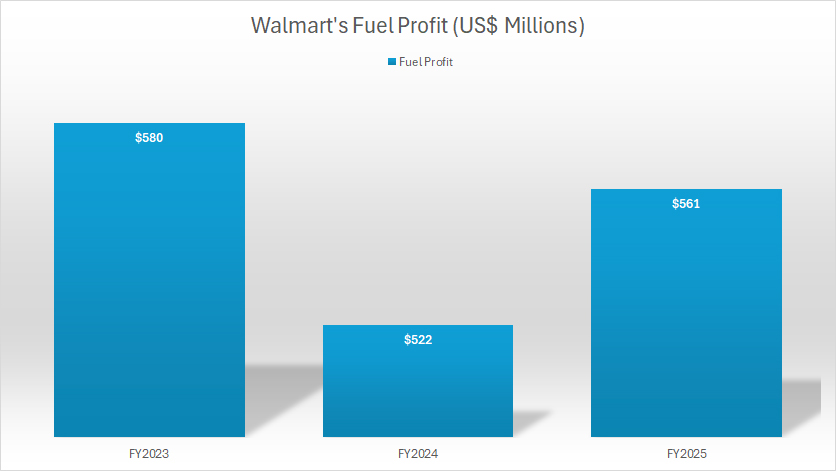

Fuel Profit

Walmart-fuel-profit

(click image to expand)

Walmart derives its fuel revenue entirely from Sam’s Club. You may find more information about the segment here: Sam’s Club U.S. For the definition of Walmart’s fuel sales, you may refer to this section: Walmart fuel sales.

Walmart disclosed its total fuel-related expenses, revealing that its fuel profit reached $561 million in fiscal year 2025, marking a slight increase from $522 million in 2024. In fiscal year 2023, fuel profit was $580 million.

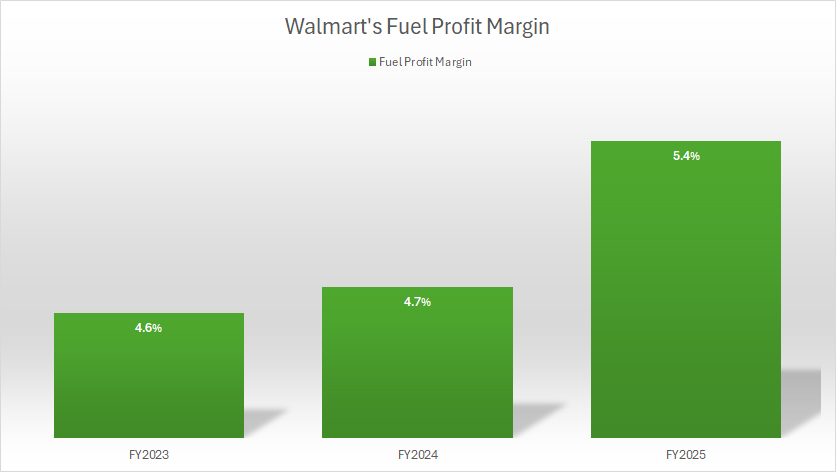

Fuel Profit Margin

Walmart-fuel-margin

(click image to expand)

Walmart derives its fuel revenue entirely from Sam’s Club. You may find more information about the segment here: Sam’s Club U.S. For the definition of Walmart’s fuel sales, you may refer to this section: Walmart fuel sales.

Walmart’s fuel sales profit margin increased to 5.4% in fiscal year 2025, showing a slight improvement from 4.7% in 2024 and 4.6% in 2023.

Insight

Walmart’s fuel business remains a crucial component of its Sam’s Club strategy, offering an important value proposition for members.

The decline from 2023’s peak revenue suggests a stabilization phase, likely influenced by market shifts in fuel pricing and consumer demand.

Competitive pricing continues to be a key advantage, positioning Walmart as a preferred choice for budget-conscious shoppers.

References and Credits

1. All financial figures presented were obtained and referenced from Walmart’s annual reports published on the company’s investor relations page: Walmart Investor Relations.

2. Pexels Images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.