Cryptocurrencies to invest. Pexels image.

This article presents the breakdown of Coinbase Global, Inc. (NASDAQ: COIN)’s transaction revenue by crypto assets. Coinbase’s transaction revenue are fees charged on cryptocurrency trades conducted on its platform.

These fees are applied to both buying and selling transactions and vary depending on factors like the transaction amount, payment method, and user type (e.g., retail or institutional).

Bitcoin and Ethereum are the two major cryto currencies traded on Coinbase’s platforms. As of the end of fiscal year 2024, no other crypto assets (except bitcoin and ethereum) individually made up more than 10% of the total transaction revenue, according to the annual report.

For transaction revenue based on user types, such as consumer and institutional, you may refer to this article: Coinbase trading revenue by users: retail and institutional.

For other key statistics of Coinbase Global, you may find more resources on these pages:

- Coinbase transaction volume by segment and crypto asset,

- Coinbase financial health: debt level, payment due, and cash, and

- Coinbase subscription and services revenue analysis.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Why is Coinbase’s trading revenue concentrated mainly on Bitcoin and Ethereum?

Consolidated Results

A1. Transaction Revenue

A2. Percentage Of Transaction Revenue To Total

Revenue Breakdown

B1. Percentage Of Revenue From Bitcoin, Ethereum, and Other Crypto Assets

B2. Revenue From Bitcoin, Ethereum, and Other Crypto Assets

Revenue Growth

C1. YoY Growth Rates Of Revenue From Bitcoin, Ethereum, and Other Crypto Assets

Conclusion And Reference

S1. Insight

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Bitcoin: Bitcoin is a type of digital currency, often referred to as a cryptocurrency, that operates on a decentralized network using blockchain technology.

It was invented in 2008 by an anonymous entity or group using the pseudonym Satoshi Nakamoto and launched in 2009. Key features of Bitcoin include:

-

Decentralization: It is not controlled by any central authority, like a government or bank. Instead, it relies on a peer-to-peer network to process and verify transactions.

-

Blockchain: Bitcoin transactions are recorded on a public ledger called the blockchain, which ensures transparency and security.

-

Limited Supply: There will only ever be 21 million bitcoins in existence, making it scarce and often compared to digital gold.

-

Anonymity: While transactions are public, users are identified only by their wallet addresses, offering a degree of privacy.

Bitcoin is used for a variety of purposes, including investments, online transactions, and as a hedge against inflation in some economies.

Ethereum: Ethereum is a decentralized, open-source blockchain system that enables the creation and execution of smart contracts and decentralized applications (dApps).

It was proposed in 2013 by Vitalik Buterin and went live in 2015. Unlike Bitcoin, which primarily functions as a digital currency, Ethereum is designed to be a programmable blockchain, offering more versatile use cases.

Key aspects of Ethereum include:

-

Ether (ETH): The native cryptocurrency of the Ethereum network, used to pay for transaction fees and computational services (commonly referred to as “gas”).

-

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code. They enable automated, trustless transactions.

-

Decentralized Applications (dApps): Applications built on the Ethereum blockchain that operate without central control.

-

Ethereum Virtual Machine (EVM): A computational engine that executes smart contracts and ensures consensus across the network.

Ethereum’s versatility has made it the foundation for various innovations, including non-fungible tokens (NFTs), decentralized finance (DeFi), and more.

Why is Coinbase’s trading revenue concentrated mainly on Bitcoin and Ethereum?

Coinbase’s trading revenue is primarily concentrated on Bitcoin and Ethereum due to these key reasons:

-

Market Leadership: Bitcoin and Ethereum are the two largest cryptocurrencies by market capitalization, attracting the highest trading volumes.

-

Liquidity: Both assets offer deep liquidity, making them preferable for institutional and retail traders.

-

Price Volatility: Frequent price fluctuations in Bitcoin and Ethereum drive active trading and boost transaction revenue.

-

Broad Adoption: Their widespread acceptance and integration into financial systems make them highly popular trading choices.

-

Strategic Focus: Coinbase capitalizes on the prominence of these cryptocurrencies to optimize its trading revenues.

These factors contribute to Coinbase’s reliance on Bitcoin and Ethereum for a significant portion of its trading income.

Transaction Revenue

Coinbase-trading-revenue-total

(click image to expand)

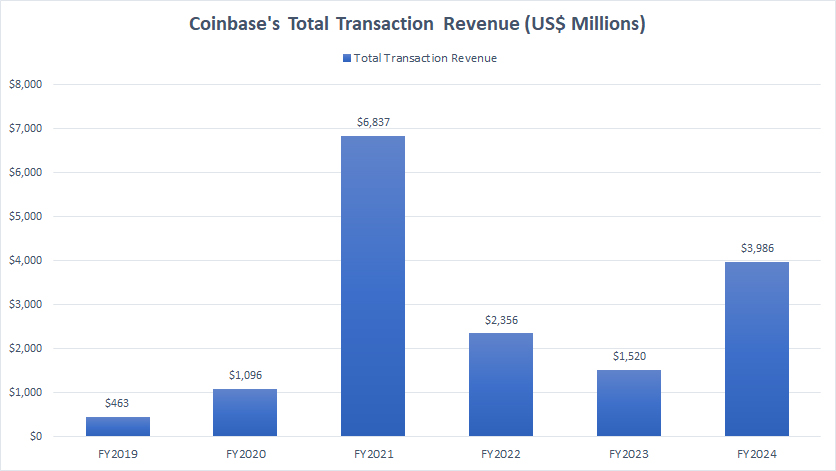

Coinbase achieved remarkable growth in transaction revenue during fiscal year 2024, recording nearly $4 billion. This represents a substantial improvement from the $1.5 billion reported in 2023, signaling a recovery in trading activity and market interest.

This rise follows two challenging years of revenue decline. In fiscal year 2022, Coinbase generated $2.4 billion in transaction revenue, marking a steep 65% decrease from the $6.8 billion earned in 2021. The drop reflected broader industry trends, including reduced trading volumes amidst market uncertainty.

The turnaround in 2024 breaks the downward trajectory observed in the preceding years. This resurgence in transaction revenue highlights Coinbase’s ability to navigate challenging market conditions and adapt to shifting demand. Factors such as increased trading activity in major cryptocurrencies like Bitcoin and Ethereum, alongside broader market recovery, may have driven this renewed growth.

The $4 billion milestone underscores Coinbase’s strengthened position within the cryptocurrency industry as it moves past a period of decline to achieve renewed momentum in transaction-based revenue.

Percentage Of Transaction Revenue To Total

coinbase-transaction-revenue-to-total-revenue-ratio

(click image to expand)

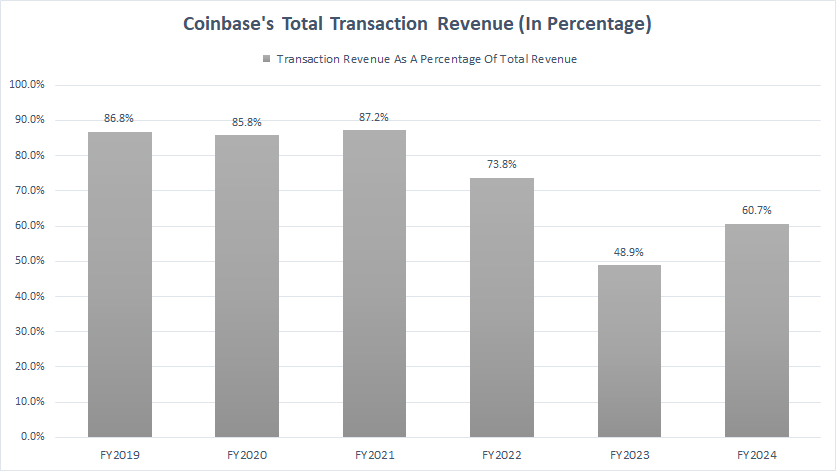

In fiscal year 2024, Coinbase’s transaction revenue constituted 61% of its total revenue, solidifying its position as the company’s primary source of income. This underlines the critical role transaction revenue continues to play in Coinbase’s overall business model.

The 2024 figure marks a notable increase from the 49% share reported in 2023, reflecting a significant rebound in trading activity. However, this percentage remains lower than the 74% recorded in 2022, illustrating ongoing shifts in revenue composition. These changes indicate that while transaction revenue remains dominant, Coinbase has been exploring diversification in its revenue streams.

Looking at the broader trend, Coinbase’s reliance on transaction revenue has steadily declined over the years. In 2019, transaction revenue made up an overwhelming 87% of total revenue. By 2024, this share had fallen to 61%, highlighting the company’s gradual evolution towards a more balanced revenue mix.

Despite this decline, transaction revenue still stands as the cornerstone of Coinbase’s earnings, underscoring its significance as the company navigates a maturing cryptocurrency market and increasingly competitive landscape.

These trends suggest that Coinbase’s future growth may hinge not only on its ability to sustain transaction revenue but also on the success of efforts to expand other revenue streams, such as subscription services and staking. Such strategic diversification could play a pivotal role in reducing dependency on transaction revenue, particularly in volatile market conditions.

Percentage Of Revenue From Bitcoin, Ethereum, and Other Crypto Assets

Coinbase-transaction-revenue-by-crypto-type-in-percentage

(click image to expand)

Coinbase’s transaction revenue from cyrpto assets consists of two major streams: bitcoin and ethereum. The definition of these crypto assets are available here: bitcoin and ethereum.

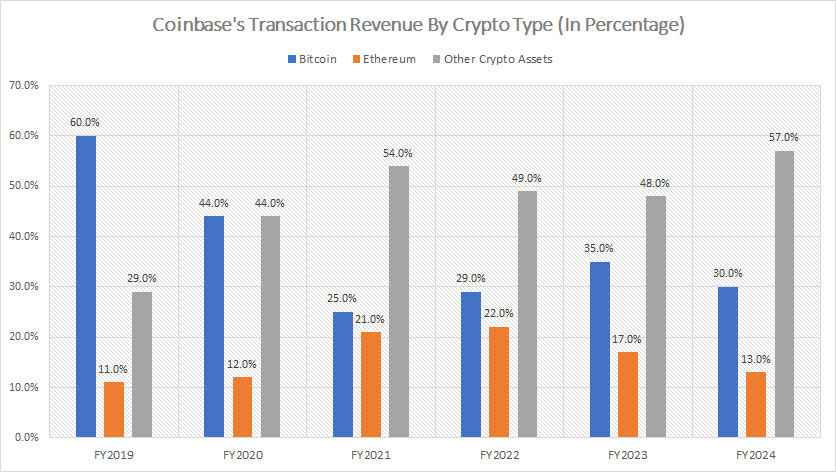

From a percentage standpoint, Bitcoin trading accounted for 30% of Coinbase’s total transaction revenue in fiscal year 2024, while Ethereum trading contributed 13%. Combined, these two leading cryptocurrencies represented 43% of Coinbase’s transaction revenue for the year.

Meanwhile, other crypto assets made up the remaining 57%, marking a dominant share and underscoring their growing importance in the platform’s overall revenue composition.

This shift highlights broader trends in Coinbase’s revenue mix. Bitcoin’s share of transaction revenue peaked at 60% in fiscal year 2019 but has steadily declined since then, reflecting the platform’s gradual reduction in dependence on its flagship cryptocurrency. Similarly, Ethereum’s revenue share reached its high point at 22% in fiscal year 2022 and has also been on a downward trajectory.

In contrast, transaction revenue from other crypto assets has shown a significant upward trend. From accounting for just 29% of total transaction revenue in 2019, this category reached an unprecedented 57% in fiscal year 2024. This growth illustrates the increasing diversification of trading activity on Coinbase, driven by rising interest in alternative cryptocurrencies as investors explore assets beyond Bitcoin and Ethereum.

The evolving revenue distribution reflects Coinbase’s ability to adapt to shifting market dynamics and cater to the expanding preferences of its user base. By capturing growing trading volumes in alternative crypto assets, Coinbase is not only diversifying its revenue streams but also reducing its reliance on any single cryptocurrency, positioning itself to better navigate the volatile cryptocurrency market in the years to come.

Revenue From Bitcoin, Ethereum, and Other Crypto Assets

Coinbase-transaction-revenue-by-crypto-type-in-money-figures

(click image to expand)

Coinbase’s transaction revenue from cyrpto assets consists of two major streams: bitcoin and ethereum. The definition of these crypto assets are available here: bitcoin and ethereum.

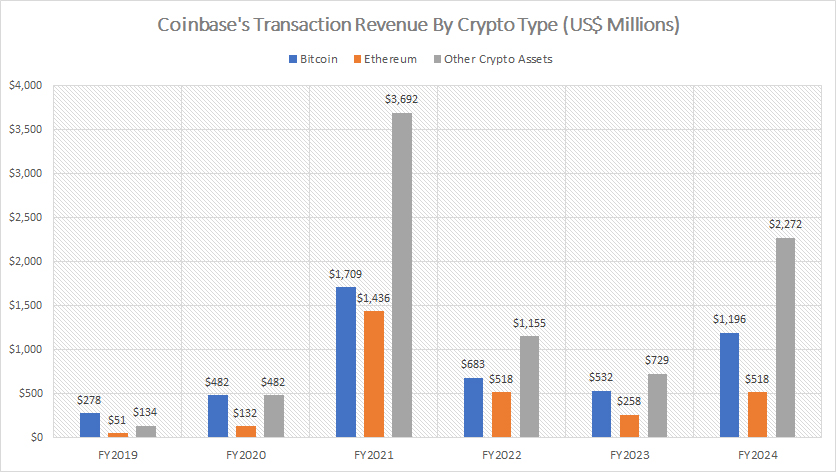

From the perspective of monetary figures, Coinbase’s transaction revenue from Bitcoin and Ethereum saw a marked resurgence in fiscal year 2024, with revenues reaching $1.2 billion and $518 million, respectively. These figures represent significant growth compared to the $532 million in Bitcoin revenue and $258 million in Ethereum revenue reported in 2023.

This recovery underscores the increasing trading activity in these flagship cryptocurrencies, likely driven by heightened investor confidence, market stabilization, and renewed interest in digital assets following a period of volatility.

Even more noteworthy is Coinbase’s performance in transaction revenue from other cryptocurrencies. In 2024, revenue from these alternative crypto assets surged to an impressive $2.3 billion, a sharp rise from the $729 million generated in 2023.

This massive growth signals the expanding influence of non-Bitcoin and non-Ethereum cryptocurrencies within the digital asset ecosystem, as traders explore opportunities in a broader range of assets beyond the two market leaders.

The combined results highlight a dual trend in Coinbase’s revenue strategy: a robust recovery in trading activity for Bitcoin and Ethereum, alongside significant growth in trading volume from alternative cryptocurrencies.

This diversification not only strengthens Coinbase’s position as a leading platform but also reflects the dynamic and evolving nature of the cryptocurrency market. The impressive $2.3 billion from other crypto assets in 2024 further emphasizes the rising importance of these emerging assets in driving Coinbase’s revenue growth.

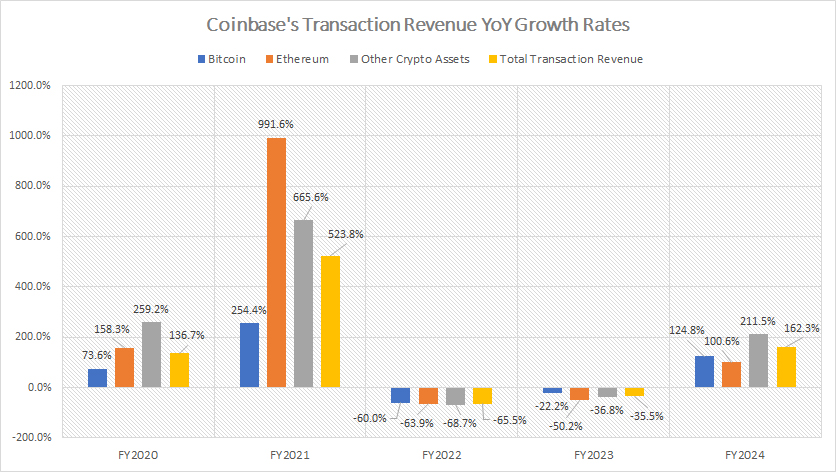

YoY Growth Rates Of Revenue From Bitcoin, Ethereum, and Other Crypto Assets

Coinbase-transaction-revenue-by-crypto-type-yoy-growth-rates

(click image to expand)

Coinbase’s transaction revenue from cyrpto assets consists of two major streams: bitcoin and ethereum. The definition of these crypto assets are available here: bitcoin and ethereum.

Coinbase experienced a substantial recovery in its transaction revenue from Bitcoin, Ethereum, and other cryptocurrencies in fiscal year 2024, following two consecutive years of downturn. This recovery is a testament to the platform’s ability to navigate a volatile market and capitalize on the resurgence of trading activity.

On a consolidated basis, Coinbase’s total transaction revenue surged by 162% in fiscal year 2024, a striking turnaround from the -36% contraction recorded in 2023. The strong rebound underscores a renewed wave of investor activity, likely driven by favorable market conditions and increasing interest in digital assets.

The past three fiscal years reveal a rollercoaster trend for Coinbase’s transaction revenue. In fiscal year 2022, total transaction revenue plummeted by 66% compared to the previous year, reflecting the challenging market environment at that time. However, by 2024, Coinbase had regained momentum, with notable growth across all major cryptocurrency categories.

Analyzing individual assets, Bitcoin transaction revenue showed consistent improvement, growing at an average annual rate of 14% from fiscal year 2022 to 2024. Ethereum’s transaction revenue, in contrast, contracted slightly over the same period, declining at an average annual rate of 4.5%. This divergence reflects differences in market dynamics and trading patterns between the two leading cryptocurrencies.

The standout growth came from Coinbase’s transaction revenue for other cryptocurrencies. From fiscal year 2022 to 2024, revenue from these alternative assets expanded at a robust average annual rate of 35%, underscoring the increasing importance of a diversified portfolio of tradable assets. In comparison, the total transaction revenue grew by 20% annually on average during this period, further highlighting the critical role that non-Bitcoin and non-Ethereum assets play in Coinbase’s recovery and growth.

These trends suggest that Coinbase’s future performance may depend on its ability to maintain strong transaction volumes in Bitcoin and Ethereum, while continuing to capture opportunities in the rapidly growing market for alternative cryptocurrencies. The platform’s resilience and adaptability have positioned it to thrive amidst the evolving landscape of the cryptocurrency industry.

Insight

Essentially, Coinbase is evolving into a more diversified platform. While Bitcoin and Ethereum will likely remain foundational to its revenue, the rapid expansion of alternative crypto assets reflects broader market trends and user preferences.

Coinbase’s ability to balance its portfolio while capitalizing on new growth areas will be critical for sustaining momentum in an increasingly competitive cryptocurrency landscape.

Credits and References

1. All financial figures presented were obtained and referenced from Coinbase Global, Inc.’s annual reports published on the company’s investor relations page: Coinbase Investor Relations.

2. Pixabay images.

Disclosure

We may use artificial intelligence (AI) tools to assist us in writing some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.