Maserati. Pixabay image.

Stellantis is a global automotive company in South America with a strong presence in Brazil, Argentina, Chile, Colombia, Peru, and Uruguay. The company was formed in January 2021 due to a merger between Fiat Chrysler Automobiles (FCA) and Groupe PSA. Stellantis is now the fourth largest automaker in the world with a portfolio of 14 brands, including Jeep, Fiat, Peugeot, Citroën, Opel, and Vauxhall.

Stellantis has a long history of manufacturing and selling vehicles in South America. The company has 12 production plants in the region, including five in Brazil, three in Argentina, two in Colombia, and one in Chile and Uruguay. These plants produce a wide range of vehicles, from compact cars to heavy-duty trucks and buses, and employ more than 30,000 people in the region.

Stellantis is committed to delivering innovative and sustainable mobility solutions in South America, focusing on reducing emissions and improving fuel efficiency. The company has invested heavily in research and development and has a strong presence in the region’s electric vehicle market. Stellantis also works closely with local suppliers and partners to support the development of the automotive industry in South America.

This article covers Stellantis’ vehicle sales, market share in South America, and its competitive position in this region versus its competitors.

Investors interested in Stellantis’ vehicle sales and market share in North America, Europe, and the MEA region may find more information on these pages: Stellantis North America, Stellantis Europe, and Middle East & Africa.

Let’s get started!

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. Stellantis Business Strategy In South America

O3. Stellantis Vehicle Line-up In South America

O4. How Stellantis Distributes Its Vehicles In South America

O5. How Stellantis Provides Financing To Dealers And Customers In South America

Consolidated Sales

A1. Vehicle Sales In South America

Sales By Country

B1. Vehicle Sales In Brazil, Argentina, And Other South American Countries

B2. Vehicle Sales In Brazil, Argentina, And Other South American Countries In Percentage

Consolidated Market Share

C1. Market Share In South America

C2. Market Share In South America Before The Merger

Market Share By Country

D1. Market Share In Brazil, Argentina, And Other South American Countries

D2. Market Share In Brazil, Argentina, And Other South American Countries Before The Merger

Market Share Vs Competitors

E1. Market Share In Brazil Vs Competitors

E2. Market Share In Brazil Vs Competitors Before The Merger

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

New Vehicle Sales: Stellentis defines its new vehicle sales as the sales of vehicles primarily by dealers and distributors or, directly by the company in some cases, to retail customers and fleet customers.

Sales include mass-market and luxury vehicles manufactured at Stellantis’ plants, manufactured by joint ventures and third-party contract manufacturers, and distributed under its brands. Sales figures exclude sales of vehicles that it contracts to manufacture for other OEMs.

While vehicle sales are illustrative of Stellantis’s competitive position and the demand for its vehicles, sales are not directly correlated to net revenues, cost of revenues, or other measures of financial performance in any given period.

For a discussion of Stellantis’ vehicle shipments that directly correlate to its Net revenues, Cost Of revenues, and other financial measures, you may visit this article: Stellantis Vehicle Wholesale.

Stellantis Business Strategy In South America

Stellantis has a strong presence in South America, operating through brands such as Peugeot, Citroen, Fiat, and Jeep.

In South America, Stellantis focuses on producing and selling vehicles that cater to the needs of local consumers. The company’s business model in this region involves manufacturing vehicles locally to reduce costs and improve competitiveness.

Stellantis also uses a combination of direct sales and dealership networks to distribute its vehicles across South America.

Overall, Stellantis strives to provide high-quality vehicles that offer value for money to customers in South America while maintaining a sustainable and socially responsible approach to business.

Stellantis Vehicle Line-up In South America

Stellantis’ vehicle line-up in South America leverages Fiat’s brand recognition. It offers vehicles in smaller segments, such as the Fiat Argo and the Fiat Mobi, catering to the relatively urban population of countries like Brazil.

In addition, Fiat leads the pickup truck market in Brazil, with the Fiat Strada and the Fiat Toro representing almost half of the market share in the segment. Jeep, also a part of Stellantis, achieved 7.0 percent of the total sales in Brazil and led the SUV segment with 20.0 percent of the market share primarily based on the performance of the Jeep Renegade, the Jeep Compass and the Jeep Commander.

Finally, Peugeot and Citroën, also part of Stellantis, are conquering new consumers and have shown impressive sales growth of 41.5 percent and 37.6 percent, respectively, in 2022 compared to 2021.

How Stellantis Distributes Its Vehicles In South America

Stellantis distributes its vehicles in South America through a network of dealerships.

In Brazil and Argentina, the distribution is done through each brand’s dealerships, with some distributors having multiple stores to offer different brands.

Stellantis uses multi-brand importers or dealers in other countries to distribute its vehicles.

How Stellantis Provides Financing To Dealers And Customers In South America

Stellantis provides financing options to its dealers and customers in South America through its 100 percent owned captive finance companies and strategic partnerships with financial institutions.

Stellantis owns three captive finance companies in the region, including Banco Fidis S.A. and FCA Rental Locadora de Automoveis Ltda in Brazil and FCA Compañia Financiera S.A. in Argentina. These companies offer dealer and retail customer financing and rental services.

Stellantis also has two 50 percent owned joint ventures in South America, namely PSA Finance Argentina Compañia Financiera S.A. and Banco PSA Finance Brasil S.A.

In addition to these partnerships, Stellantis has significant commercial agreements with Banco Itaú and Bradesco in Brazil. Through these partnerships, Stellantis provides financing options to retail customers purchasing its branded vehicles.

Vehicle Sales In South America

Stellantis-vehicle-sales-South-America

(click image to expand)

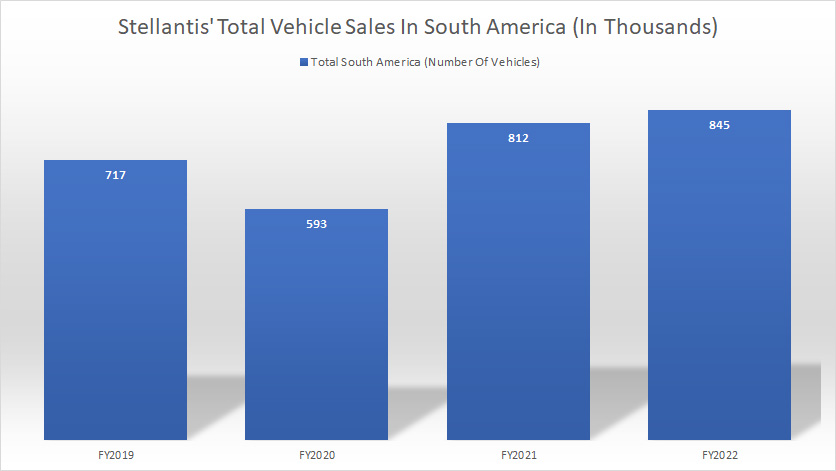

A definition of Stellantis’ vehicle sales is available here: vehicle sales. Stellantis’ total sales in South America reached 845,000 vehicles as of fiscal 2022, up 4% over 2021.

Stellantis has maintained a consistent vehicle volume in South America since 2019, demonstrating its competitive position in this region.

Vehicle Sales In Brazil, Argentina, And Other South American Countries

Stellantis-vehicle-sales-South-America-by-country

(click image to expand)

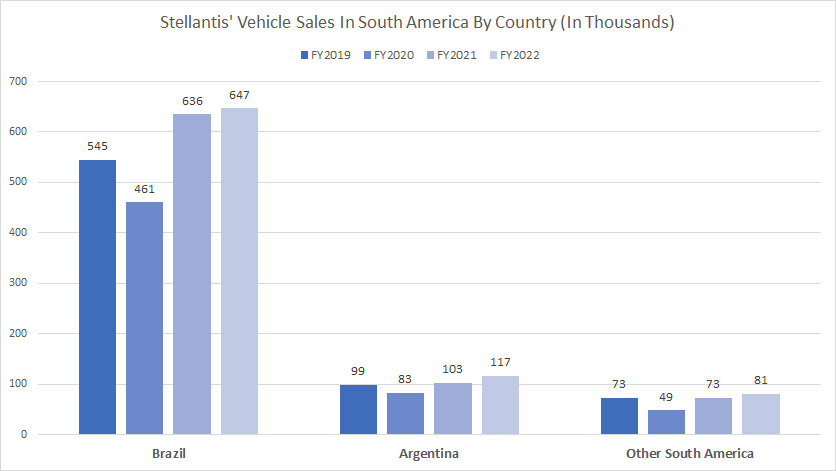

The definitions of Stellantis’ vehicle sales is available here: vehicle sales. Brazil is Stellantis’ biggest market in South America, with vehicle sales reaching 647,000 in fiscal 2022 in this country.

Stellentis sold only 117,000 vehicles in Argentina in 2022, which was a distant second from Brazil. Sales in other South American countries totalled about 81,000 in 2022.

A noticeable trend is that Stellantis’ vehicle sales in most countries in South America have remained relatively solid since 2019, highlighting Stellantis’ solid competitive position in this region.

Vehicle Sales In Brazil, Argentina, And Other South American Countries In Percentage

Stellantis-vehicle-sales-South-America-by-country-in-percentage

(click image to expand)

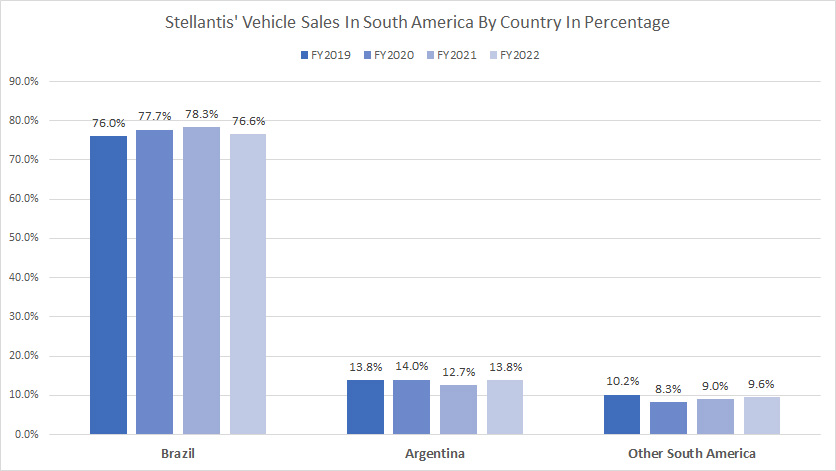

Vehicle sales in Brazil contributed to about 76.7% of Stellantis’s total vehicle volume in fiscal 2022, down slightly from 78.3% in 2021.

On the other hand, Argentina’s sales accounted for only 13.8% of Stellantis’ total vehicle volume in 2022, while other countries in South America formed 9.6%.

The percentage figures in most countries in South America have remained relatively stable over the last several years.

Market Share In South America

Stellantis-market-share-South-America

(click image to expand)

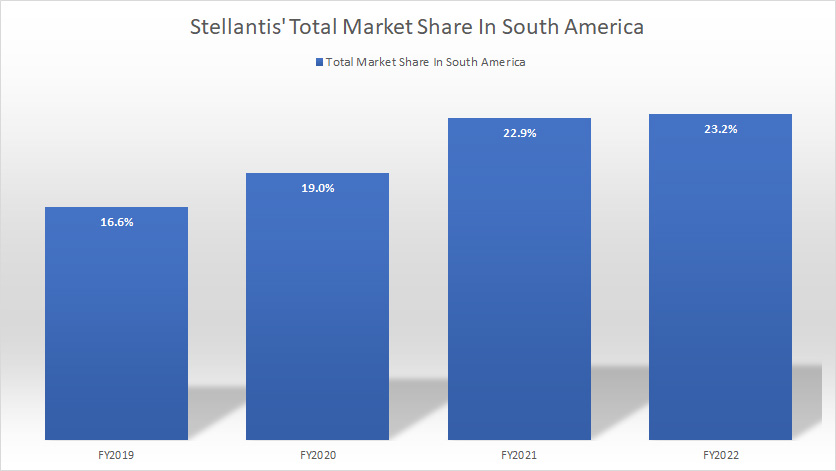

Stellantis achieved a market share of 23.2% in South America in fiscal 2022, up slightly from 22.9% in 2021.

Since 2019, Stellantis’ market share in South America has risen from 16.6% in 2019 to 23.2% in 2022, indicating the company’s increasing competitive position in this region.

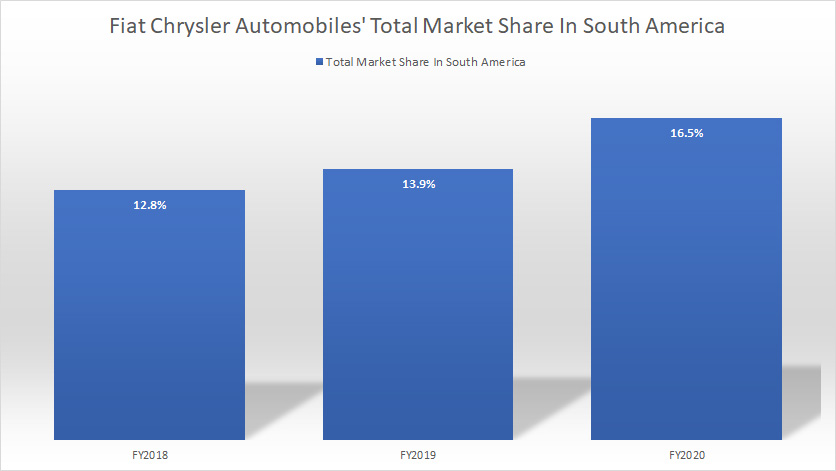

Market Share In South America Before The Merger

FCA-market-share-South-America

(click image to expand)

Before the merger, Stellantis, formerly known as FCA or Fiat Chrysler Automobiles, had a market share of 16.5%, 13.9%, and 12.8% in South America in fiscal years 2020, 2019 and 2018, respectively.

Of course, Stellantis had a smaller market share in South America before the merger.

After the merger, Stellantis’ market share in the South American region surged to 23.2% and 22.9% in fiscal 2022 and 2021, respectively, as shown here: Stellantis market share.

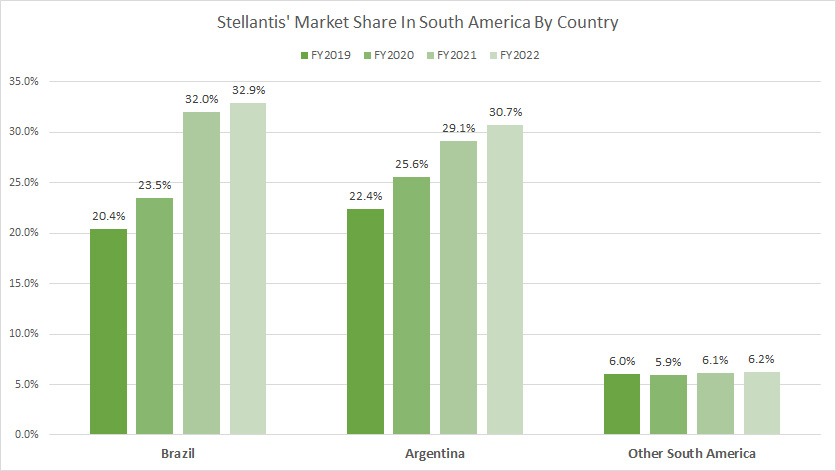

Market Share In Brazil, Argentina, And Other South American Countries

Stellantis-market-share-South-America-by-country

(click image to expand)

Stellantis had a market share of 32.9% in Brazil as of 2022, the highest among all countries in South America within the company’s market.

Stellantis’ market share in Argentina is not far from Brazil’s, coming to 30.7% as of 2022. For the rest of the countries in South America, Stellantis’ market share arrived at 6.2% in 2022.

A noticeable trend is that Stellantis’ market share in Brazil and Argentina has significantly increased since 2019, demonstrating the company’s strong market position in the South American region.

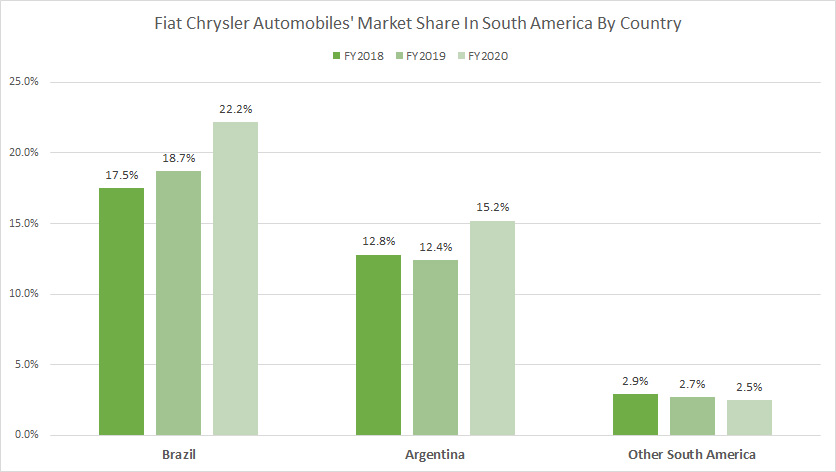

Market Share In Brazil, Argentina, And Other South American Countries Before The Merger

FCA-market-share-South-America-by-country

(click image to expand)

Before the merger in 2021, Stellantis, formerly known as FCA or Fiat Chrysler Automobiles, had a market share of 22.2%, 18.7%, and 17.5% in Brazil in fiscal years 2020, 2019 and 2018, respectively.

Similarly, Stellantis’ market share in Argentina landed at 15.2%, 12.4%, and 12.8% in fiscal years 2020, 2019, and 2018, respectively.

All market share numbers before the merger are apparently lower than those after the merger.

In short, Stellantis had a much higher market share in Brazil and Argentina after the merger.

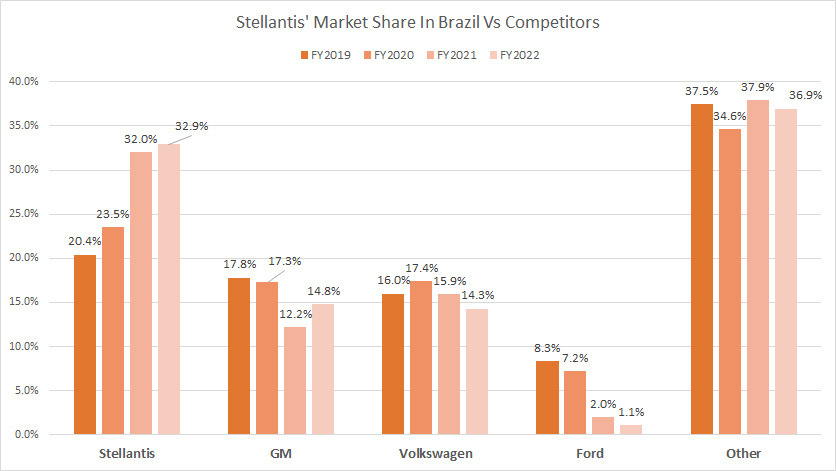

Market Share In Brazil Vs Competitors

Stellantis-market-share-Brazil-vs-competitors

(click image to expand)

Against competitors such as General Motors, Volkswagen, and Ford Motor, Stellantis has a much higher market share in Brazil, its largest market by sales volume.

In fact, Stellantis’ market position in Brazil has been at the top over the last four years, far exceeding General Motors, Volkswagen, and Ford Motors.

For example, GM and Volkswagen’s market share in Brazil ended up at 14.8% and 14.3%, respectively, as of 2022, while Ford Motor’s results were much lower.

Interestingly, none of any Japanese and Korean automakers, such as Toyota and Hyundai/Kia, make the cut as one of the automakers in Brazil with a market position in the top three.

Although Ford’s market share in Brazil came to 8.3% in 2019, it had significantly declined and arrived at only 1.1% as of 2022.

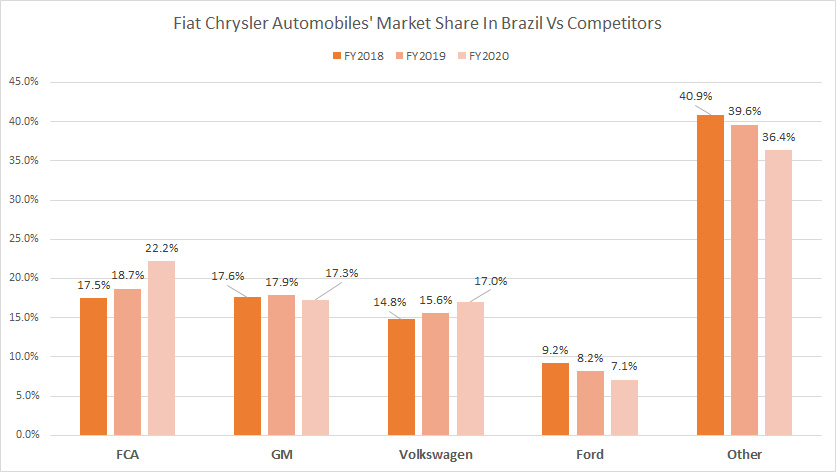

Market Share In Brazil Vs Competitors Before The Merger

FCA-market-share-Brazil-vs-competitors

(click image to expand)

Before the merger, Stellantis, formerly known as FCA, had a much lower market share in Brazil.

Although Stellantis’ market share was much lower before the merger, it was still the top automaker in Brazil with the largest market position.

After the merger, Stellantis’ market position in Brazil has become even larger, far outpacing GM, Volkswagen, and Ford, as shown here: Stellantis’ Brazil market position.

Conclusion

Stellantis’ market share in South America has significantly increased. After the merger, Stellantis has gained an even greater market share in the South American region.

For example, Stellantis was already the biggest automobile company in Brazil by sales volume before the merger. After the merger, Stellantis has become an even bigger automaker with much larger market position in this country.

In contrast, no Japanese or Korean car companies have gained a significant market position in South America.

References and Credits

1. All financial figures presented in this article were obtained and referenced from Stellantis’ quarterly and annual reports, SEC filings, investor presentations, press releases, etc., which are available in Stellantis Investor Relation.

2. Pixabay images.

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the total correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and provide a link to this article from any website so that more articles like this can be created.

Thank you!