A vegan dish. Flickr Image.

This article explores Beyond Meat’s R&D spending and compares it with peers such as Kellogg and Conagra Brands which also work in the same industry and develop packaged-food products.

For your information, Beyond Meat specializes in producing plant-based meat products. Its revenue topped slightly over $300 million in fiscal 2023.

The company’s creative approach to developing the world’s best plant-based meat products does not come without a cost. Reportedly, it spent well over $60 million in research and development in 2022 alone.

Let’s take a look!

Investors interested in Beyond Meat’s advertising spending versus peers may find more information on this page: Beyond Meat advertising expenses versus Kellogg and Conagra.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. How Does Beyond Meat Spend Its Research And Development?

Research and Development Results

Research and Development Growth Rates

B1. Growth Rates Of R&D Spending

With Respect To Revenue

With Respect To Operating Expenses

D1. R&D To Operating Expenses Ratio

Conclusion And Reference

S1. Conclusion

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Research And Development Expenses: Research and development (R&D) expenses refer to the costs associated with the research and development of a company’s products or services.

These are the costs incurred in the process of discovering new knowledge that could lead to the development of new products, processes, or services, or that could lead to the improvement of existing products.

R&D expenses can include various activities such as conceptualizing new products, conducting primary research, developing prototypes, testing, and improving existing products.

These expenses are crucial for companies that aim to innovate and stay competitive in their industry. R&D expenses are often considered an investment in the company’s future, as they can lead to new products and improvements that generate revenue.

How Does Beyond Meat Spend Its Research And Development?

Beyond Meat invests its research and development expenses primarily in creating and improving its plant-based meat substitutes.

Its R&D includes developing new products and refining existing ones to mimic better the taste, texture, and nutritional profile of traditional animal-based meats.

To achieve these goals, the company explores and incorporates different plant-based ingredients, such as peas, mung beans, fava beans, and brown rice.

Research also goes into optimizing the production process to make it more efficient and sustainable.

The aim is to continually enhance the quality and appeal of its products to consumers, while also addressing the environmental and health concerns associated with livestock production.

R&D Spending By Year

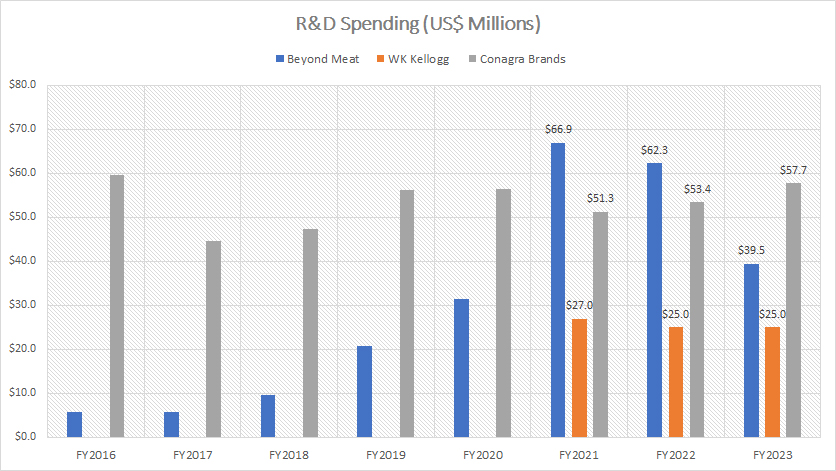

bynd-research-and-development-comparison-with-peers

(click image to expand)

Beyond Meat’s R&D spending surpassed Kellogg and Conagra Brands in the past. However, it reduced significantly in fiscal 2023. In fact, it was cut by as much as 37% in fiscal year 2023 from a year ago.

As of 2023, Beyond Meat’s R&D expenses declined to just $39.5 million compared to $62 million in fiscal year 2022 and $67 million in fiscal year 2021.

In the same period, Kellogg’s R&D spending reached $25 million, while Conagra Brands’ figure topped nearly $60 million.

YoY Growth Rates Of R&D Spending

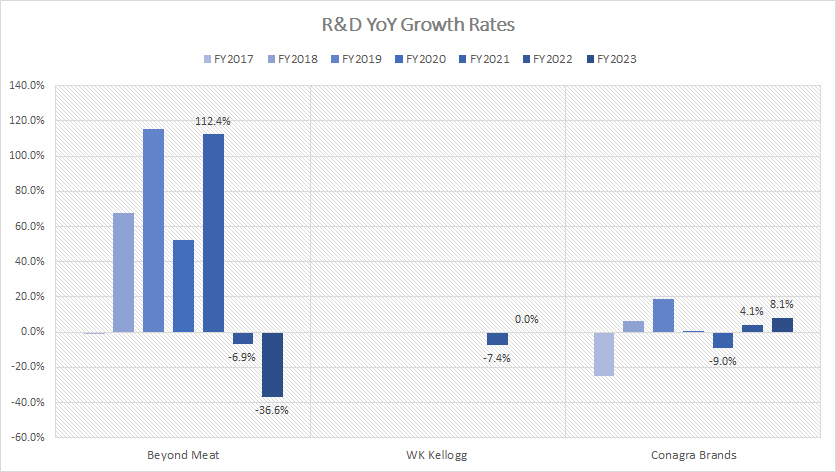

bynd-growth-rates-of-research-and-development-spending

(click image to expand)

In terms of the R&D annual growth rate, Beyond Meat used to lead the pack by a substantial margin. However, things have taken a beating in recent years.

As shown in the chart, Beyond Meat’s R&D spending has begun to dive since 2022. In fiscal year 2022, it decreased by 7% and it further plummeted by another 37% in fiscal 2023.

On the other hand, the growth rates of R&D spending of Kellogg and Conagra Brands have remained relatively stable. For example, Conagra’s result climbed 8% in fiscal 2023.

R&D To Revenue Ratio

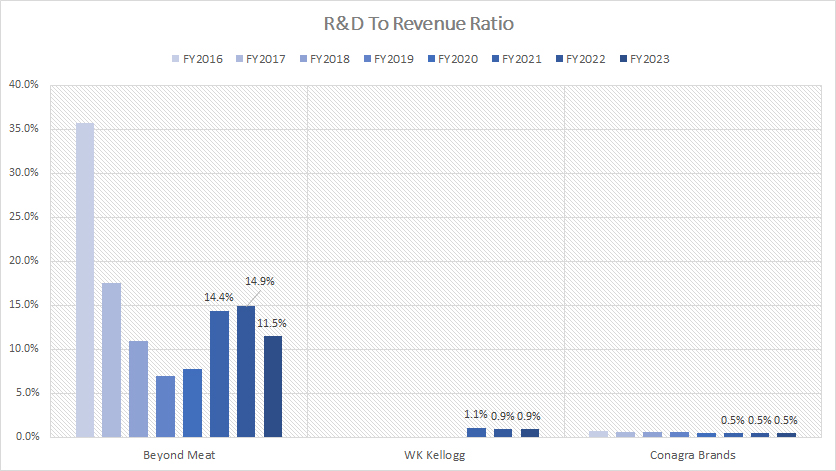

bynd-research-and-development-to-revenue-ratio-comparison-with-peers

(click image to expand)

Among the companies under comparison, Beyond Meat has the highest R&D to revenue ratio, as shown in the chart above. In other words, it has a relatively high research and development budget from the perspective of revenue.

For example, Beyond Meat’s R&D to revenue ratio has consistently clocked above 10% in most fiscal years. Its peers such as Kellogg Company and Conagra Brands have spent less than 1% of their sales on research and development.

Therefore, Beyond Meat takes its research and development to another level and continues to spend quite a considerable amount with respect to revenue despite the various challenges and setbacks that it faces.

For example, Beyond Meat has been having consistent revenue decline in recent years. However, its R&D budget with respect to revenue has remained relatively solid.

R&D To Operating Expenses Ratio

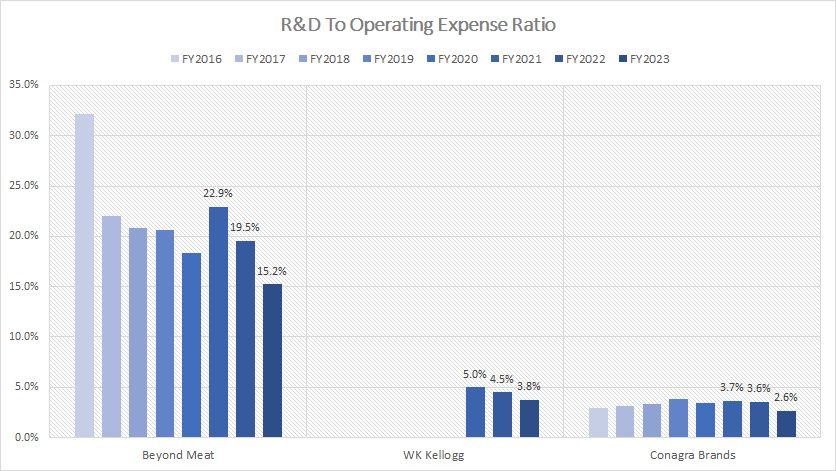

bynd-research-and-development-to-operating-expenses-ratio-comparison-with-peers

(click image to expand)

Again, Beyond Meat leads the pack when it comes to R&D expense with respect to operating expenses. It has the highest ratio among its peers.

As shown in the chart above, Beyond Meat’s R&D to total operating expenses ratio has consistently topped at least 15% in all fiscal years since 2016, while its peers such as Kellogg Company and Conagra Brands have recorded less than 5% each.

The high ratio illustrates that Beyond Meat has considerable high R&D budget with respect to operating expenses.

Although Beyond Meat has been having high R&D budget, we can see that the ratio relative to operating expenses has been on the decline.

As of 2023, Beyond Meat’s R&D budget with respect to operating expenses declined to just 15%, the lowest level ever measured.

Conclusion

Beyond Meat has spent a considerable amount of money on research and development. In fiscal year 2023, it spent $39.5 million on R&D and $62 million in fiscal year 2022.

With respect to revenue, Beyond Meat’s R&D budget soared through the roof and was among the highest versus its peers such as Kellogg and Conagra Brands.

With respect to operating expenses, Beyond Meat also has allocated a considerably large portion of operating expenses on research and development. The ratio came in at 15% in fiscal year 2023.

References and Credits

1. All financial figures presented in this article were obtained and referenced from the respective SEC filings, quarterly and annual reports, earnings releases, investors presentations, etc., which are available in the following links:

(a) Beyond Meat’s Financials and Filings.

(b) Conagra Brands’ Financials and Filings.

(c) Kellogg Company’s Financials and Filings.

2. Featured images in this article are used under the Creative Commons license and sourced from the following websites:

(a) Ella Olsson

(b) Nestlé

Disclosure

References and examples such as tables, charts, and diagrams are constantly reviewed to avoid errors, but we cannot warrant the full correctness of all content.

The content in this article is for informational purposes only and is neither a recommendation nor a piece of financial advice to purchase a stock.

If you find the information in this article helpful, please consider sharing it on social media and also provide a link back to this article from any website so that more articles like this one can be created in the future.

Thank you!