Artificial Intelligence. Pexels Images.

This article delves into Nvidia’s revenue by market or product segment. For your information, Nvidia focuses on four large markets where its expertise is critical: Data Center, Gaming, Professional Visualization, and Automotive.

You may find more information about Nvidia’s market segments here: Data Center, Gaming, Professional Visualization, and Automotive.

Investors interested in Nvidia’s’s other key statistics may find more resources on these pages:

- Nvidia revenue and profit margin by segment,

- Nvidia revenue by country: U.S., Singapore, Taiwan, China, and Europe, and

- Nvidia vs Palantir: profit margin comparison.

Let’s get started.

Please use the table of contents to navigate this page.

Table Of Contents

Definitions And Overview

O2. What contributes to Nvidia’s significant revenue growth in the Data Center?

Data Center And Gaming

A1. Revenue From Data Center And Gaming

A2. Percentage Of Revenue From Data Center And Gaming

Professional Visualization, Automotive, And OEM

B1. Revenue From Professional Visualization, Automotive, And OEM

B2. Percentage of Revenue From Professional Visualization, Automotive, And OEM

Revenue Growth

C1. YoY Growth Rates Of Revenue By End Market

Summary And Reference

S1. Summary

S2. References and Credits

S3. Disclosure

Definitions

To help readers understand the content better, the following terms and glossaries have been provided.

Data Center: Nvidia’s Data Center segment is a crucial part of the company’s business, focusing on products and services specifically designed for data center applications.

This segment includes high-performance GPUs and networking solutions essential for accelerating computing in data centers. These products are used in a variety of applications, including cloud computing, big data analytics, artificial intelligence (AI), machine learning, and scientific computing.

Nvidia’s data center solutions are designed to significantly improve processing speed, efficiency, and power consumption, making them ideal for supporting the infrastructure of modern, data-intensive tasks and services.

Gaming: Nvidia’s Gaming segment primarily focuses on designing, developing, and marketing graphics processing units (GPUs) for gaming and PCs.

This segment includes GeForce GPUs for PCs, laptops, and cloud gaming services, designed to deliver high-performance gaming experiences with superior image quality and immersive virtual reality capabilities. It also encompasses gaming consoles, such as the Nintendo Switch, which uses Nvidia technology.

The Gaming segment is central to Nvidia’s business, leveraging the company’s expertise in parallel processing to drive innovations in gaming graphics and artificial intelligence features, enhancing the overall gaming experience for users.

Professional Visualization: Nvidia’s Professional Visualization segment focuses on developing and selling hardware and software solutions that enable professional users to create, visualize, and manage 2D and 3D content.

This includes graphics processing units (GPUs) and related platforms, such as Quadro, NVIDIA RTX, and NVIDIA Omniverse, aimed at professionals in architecture, engineering, medical imaging, digital content creation, and more.

These solutions help render complex designs, simulations, and visualization tasks more efficiently, enhancing productivity and enabling more immersive and detailed visual experiences.

Automotive: Nvidia’s Automotive segment focuses on developing and integrating artificial intelligence (AI) and graphics technologies for the automotive industry. This includes autonomous driving systems, in-vehicle infotainment solutions, and cockpit visualization systems.

Utilizing Nvidia’s expertise in GPU (Graphics Processing Unit) technology, deep learning, and parallel computing, the Automotive segment aims to revolutionize how vehicles are driven, operated, and experienced. Nvidia’s platforms, like DRIVE AGX, enable cars to perceive the world around them, make split-second decisions, and navigate safely, paving the way toward fully autonomous vehicles.

Additionally, Nvidia’s software and services in this segment support the development and deployment of these advanced automotive solutions, ensuring that vehicles become safer and more enjoyable for passengers through advanced entertainment and interactive features.

OEM: Nvidia’s OEM segment refers to the company’s part that deals with original equipment manufacturers.

This segment is responsible for developing and selling products and technologies to OEMs that integrate Nvidia’s graphics processing units (GPUs), system-on-a-chip units (SoCs), and other technologies into their products. These products can range from personal computers, laptops, and servers to gaming consoles and automotive infotainment systems.

The OEM segment allows Nvidia to leverage its advancements in GPU technology across a broad range of consumer and professional electronics, providing the computational power or graphics capabilities these products require.

What contributes to Nvidia’s significant revenue growth in the Data Center?

Nvidia’s significant revenue growth in the Data Center segment can be attributed to several key factors:

- Strong Demand for AI Chips: Nvidia’s AI chips, particularly the Blackwell and Hopper 200 products, have seen extraordinary demand. The Blackwell product ramp is the fastest in the company’s history, generating billions in revenue.

- Expansion of AI Infrastructure: Nvidia’s AI infrastructure, including the Spectrum-X ethernet networking platform, has been integral to supporting AI models. The company has been providing its Spectrum-X platform for large data centers, such as the Stargate project, which is a $500 billion joint venture between OpenAI, Oracle, SoftBank, and Abu Dhabi’s MGX.

- Enterprise and AI Workflows: Enterprise revenue has significantly increased, driven by demand for model fine-tuning and AI workflows. Nvidia’s inference demand is accelerating, with Blackwell offering up to 25x higher token throughput and 20x lower cost compared to previous models.

- Strategic Partnerships and Collaborations: Nvidia has formed strategic partnerships with major cloud service providers and consumer internet companies, including Microsoft, Alphabet, Meta, and Tesla. These partnerships have helped integrate Nvidia’s AI technologies into their architectures.

- Innovation and Product Development: Nvidia continues to innovate with new products and technologies. The upcoming Blackwell Ultra chip, expected to be available in the second half of next year, promises new networking, memory, and processors while maintaining the same system architecture as Blackwell.

These factors combined have driven Nvidia’s impressive revenue growth in the Data Center segment, solidifying its leadership in the AI chip market.

Revenue From Data Center And Gaming

Nvidia-revenue-from-data-center-and-gaming

(click image to expand)

The definitions of Nvidia’s Data Center and Gaming markets are available here: Data Center and Gaming.

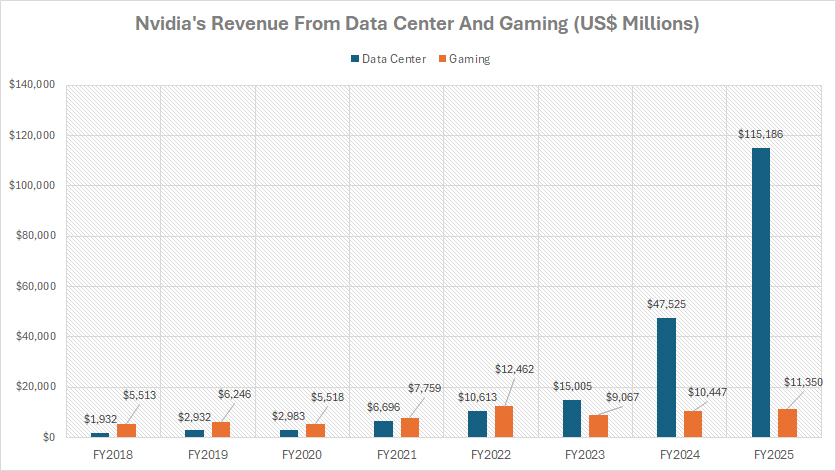

Nvidia’s financial landscape has undergone a significant transformation over the past few years, with the Data Center segment emerging as the primary revenue driver. In fiscal year 2025, Nvidia’s revenue from the Data Center reached an impressive $115.2 billion, showcasing a remarkable 142% increase from the $47.5 billion recorded in fiscal year 2024.

This growth trajectory is even more striking when compared to fiscal year 2023, where Data Center revenue was $15 billion, reflecting a 50% increase from the $10.6 billion earned in fiscal year 2022.

The long-term growth trend is equally noteworthy. From fiscal year 2021 to 2025, Nvidia’s Data Center revenue has multiplied nearly 20 times, underscoring the pivotal role this segment plays in the company’s overall financial performance.

In contrast, the Gaming segment, while not the primary revenue generator, remains a significant contributor. In fiscal year 2025, Nvidia’s Gaming segment revenue was $11.4 billion, making it the second-largest revenue contributor. Although the Gaming market generates substantially less revenue compared to the Data Center, its growth has been steady. Over the past five years, from fiscal year 2021 to 2025, the Gaming segment revenue has increased by 46%.

Historically, Nvidia relied heavily on Gaming revenue for its growth. However, recent periods have seen a dynamic shift, with the Data Center segment rising to dominance. This transition highlights Nvidia’s strategic pivot towards capitalizing on the burgeoning demand for AI and data center technologies.

These trends reflect Nvidia’s strategic evolution, positioning it as a leader in both the Gaming and Data Center markets, while continuously adapting to the shifting technological landscape.

Percentage Of Revenue From Data Center And Gaming

Nvidia-percentage-of-revenue-from-data-center-and-gaming

(click image to expand)

The definitions of Nvidia’s Data Center and Gaming markets are available here: Data Center and Gaming.

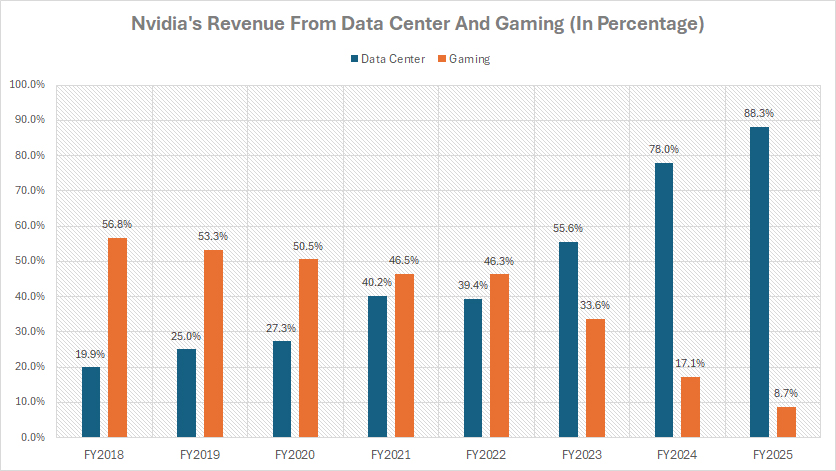

Nvidia’s revenue contribution from sales of products within the Data Center has been unparalleled, totaling a staggering 88% of the total revenue in fiscal year 2025. This figure marks a significant rise from the 78% recorded a year ago and an extraordinary surge from the 20% reported in fiscal year 2018.

On the other hand, Nvidia’s Gaming products revenue contributed just 9% of the total in fiscal year 2025, a far lower figure compared to the 88% share from the Data Center. Together, these two segments accounted for 97% of Nvidia’s total revenue, highlighting their critical role in the company’s financial ecosystem.

Although Nvidia’s Gaming revenue has grown significantly over the years, its overall revenue share has decreased, indicating that revenue growth from other segments, particularly the Data Center, has significantly outpaced the Gaming market.

Since fiscal year 2018, Nvidia’s Gaming revenue share has declined from 57% to just 9% in the latest results, showcasing the diminishing role of this segment and the remarkable rise of the Data Center. This shift underscores Nvidia’s strategic pivot towards harnessing the burgeoning demand for AI and data center technologies.

The transition reflects Nvidia’s ability to adapt to the rapidly evolving technological landscape, positioning the Data Center segment as the primary growth engine. The company’s focus on developing and deploying AI infrastructure, as well as forming strategic partnerships, has played a pivotal role in this dynamic shift.

Ultimately, Nvidia’s financial evolution highlights its strategic foresight and adaptability, ensuring its continued leadership in both the Data Center and Gaming markets while capitalizing on emerging opportunities in the AI and data-driven world.

Revenue From Professional Visualization, Automotive, And OEM

Nvidia-revenue-from-professional-visualization-automotive-and-oem

(click image to expand)

The definitions of Nvidia’s Professional Visualization, Automotive, And OEM markets are available here: Professional Visualization, Automotive, and OEM.

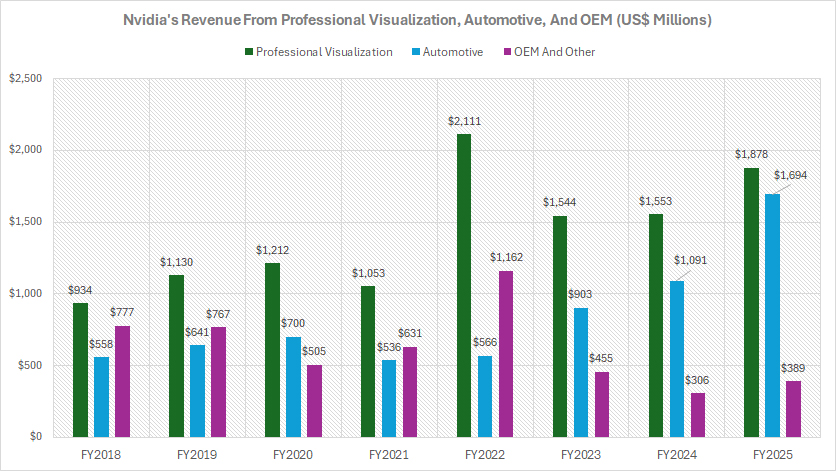

Beyond the dominant Data Center and Gaming markets, Nvidia also generates revenue from its Professional Visualization, Automotive, and OEM markets. However, these segments contribute far less to the company’s overall revenue compared to the Data Center and Gaming markets.

In fiscal year 2025, the combined revenue from Professional Visualization, Automotive, and OEM markets totaled less than $5 billion, accounting for only 3% of Nvidia’s total revenue.

Breaking it down further: Nvidia earned $1.9 billion from the Professional Visualization sector in fiscal year 2025. The Automotive market reached sales of $1.7 billion during the same period, while the OEM segment generated $389 million, making it the smallest contributor among the compared markets.

These figures highlight the relatively modest contributions of these segments to Nvidia’s overall financial performance. Despite their smaller revenue streams, these markets still play a strategic role in Nvidia’s diversified portfolio, helping the company tap into different technological advancements and applications beyond AI and gaming.

The Professional Visualization segment primarily serves industries like architecture, design, and media production with high-performance graphics solutions. The Automotive market focuses on advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-vehicle infotainment systems. The OEM segment encompasses a variety of custom and standard products tailored to specific customer requirements.

While the Data Center and Gaming markets dominate Nvidia’s revenue streams, the Professional Visualization, Automotive, and OEM markets contribute to the company’s broader strategy of innovation and market leadership across various high-tech industries. This diversified approach helps Nvidia maintain its competitive edge and capitalize on emerging opportunities in the ever-evolving tech landscape.

Percentage Of Revenue From Professional Visualization, Automotive, And OEM

Nvidia-percentage-of-revenue-from-professional-visualization-automotive-and-oem

(click image to expand)

The definitions of Nvidia’s Professional Visualization, Automotive, And OEM markets are available here: Professional Visualization, Automotive, and OEM.

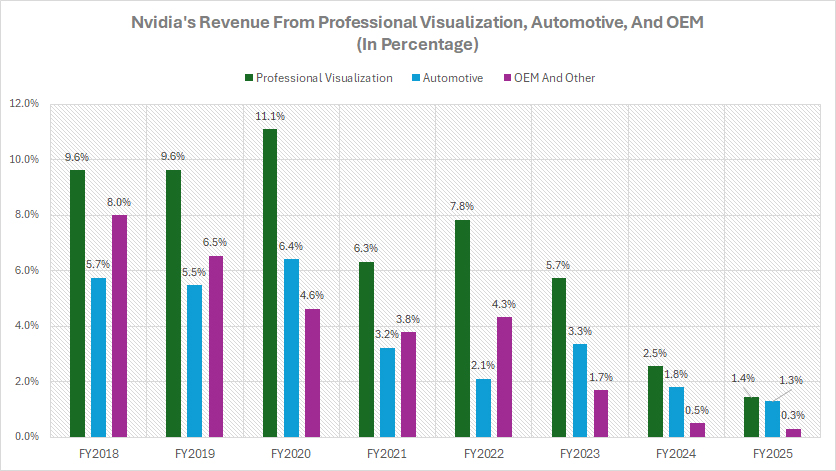

Since fiscal year 2018, Nvidia has experienced a notable shift in its revenue composition, particularly concerning its Professional Visualization, Automotive, and OEM markets. These segments have seen significant declines in their revenue shares, reaching record lows as of fiscal year 2025.

In fiscal year 2025, Nvidia’s revenue share from the Professional Visualization market decreased to a mere 1.4%. The Automotive market contributed 1.3% to the total revenue, and the OEM segment made up only 0.3%. Collectively, these three segments accounted for just 3% of Nvidia’s total revenue in fiscal year 2025.

This marks a stark contrast to fiscal year 2018, when sales of products from the Professional Visualization market contributed a substantial 10% to Nvidia’s total revenue. During the same period, the Automotive market made up 6%, and the OEM market accounted for an impressive 8% of the company’s overall revenue.

The significant decline in revenue shares from these segments highlights the growing dominance of the Data Center and Gaming markets. Despite the diminished contributions from Professional Visualization, Automotive, and OEM markets, Nvidia continues to innovate and maintain a presence in these areas. The company’s strategic pivot towards AI and data center technologies has fueled its rapid growth and market leadership, underscoring the importance of adapting to evolving technological demands.

This shift reflects Nvidia’s ability to strategically realign its focus, ensuring sustained growth and relevance in the ever-changing tech landscape. While the Professional Visualization, Automotive, and OEM markets now contribute less to the overall revenue, they remain integral to Nvidia’s diversified approach and long-term innovation strategy.

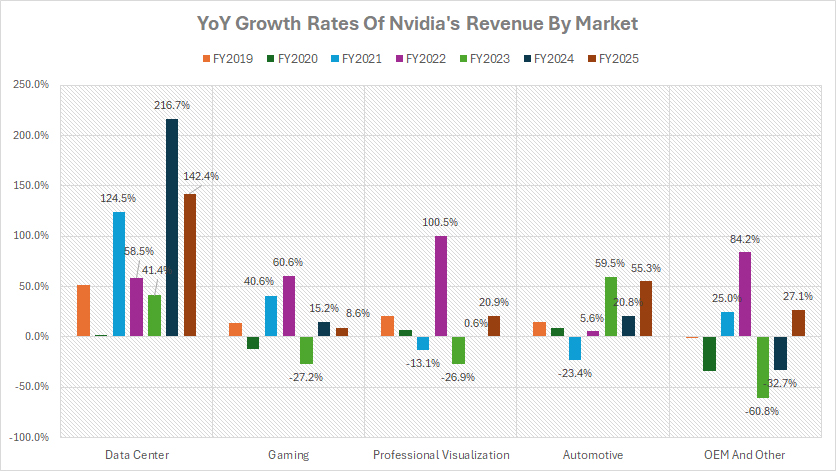

YoY Growth Rates Of Revenue By End Market

Nvidia-growth-rates-of-revenue-by-market

(click image to expand)

The definitions of Nvidia’s markets are available here: Data Center, Gaming, Professional Visualization, Automotive, and OEM.

Among all market segments, Nvidia’s Data Center has shown the most significant growth, averaging an impressive 117% annually over the past five fiscal years. This exceptional growth has solidified the Data Center’s position as the primary revenue driver for the company.

Following the Data Center, Nvidia’s Automotive market has experienced substantial growth, with an average annual growth rate of 24% from fiscal year 2023 to 2025. This growth underscores Nvidia’s expanding footprint in the automotive industry, particularly in advanced driver-assistance systems (ADAS) and autonomous driving technologies.

The Gaming and Professional Visualization markets have faced moderate challenges, with both segments recording slightly lower growth rates in revenue over the past five years. The Gaming market has experienced modest growth of 20% annually, while the Professional Visualization market has seen growth of 16% annually.

The OEM market has experienced the lowest growth, with revenue climbing by only 8% annually from fiscal year 2021 to 2025. This sharp contrast reflects the broader challenges faced by the OEM segment, which includes custom and standard products tailored to specific customer requirements.

Despite the varying performance across different market segments, Nvidia’s overall strategy remains focused on innovation and adapting to evolving technological demands. The company’s ability to pivot towards high-growth areas like the Data Center and Automotive markets demonstrates its resilience and forward-thinking approach.

These trends reflect Nvidia’s strategic priorities, as it continues to navigate the complexities of the tech landscape while leveraging its strengths in AI, data center technologies, and automotive solutions. The diverse performance across market segments underscores the importance of a balanced and adaptive approach to sustaining long-term growth and market leadership.

Conclusion

Nvidia’s financial evolution over the past few years highlights its adaptability and strategic realignment. The rise of the Data Center segment as the primary revenue driver, alongside the growth in the Automotive market, reflects Nvidia’s successful navigation of the rapidly evolving tech landscape. Despite the challenges faced by other segments, Nvidia’s diversified approach and commitment to innovation ensure its continued leadership in the technology sector.

References and Credits

1. All financial figures presented were obtained and referenced from Nvidia’s quarterly and annual reports published on the company’s investor relations page: Nvidia Financial Reports.

2. Nvidia’s product information is referenced and obtained from Nvidia’s website: Nvidia Data Center GPU, Nvidia Gaming GPU, Nvidia RTX, and Nvidia Automotive Solutions.

3. Pexels Images.

Disclosure

We may use the assistance of artificial intelligence (AI) tools to produce some of the text in this article. However, the data is directly obtained from original sources and meticulously cross-checked by our editors multiple times to ensure its accuracy and reliability.

If you find the information in this article helpful, please consider sharing it on social media. Additionally, providing a link back to this article from any website can help us create more content like this in the future.

Thank you for your support and engagement! Your involvement helps us continue to provide high-quality, reliable content.